A green daily candlestick was expected for Friday, which is exactly what happened.

Summary: Expect now a multi week to multi month pullback has begun. The target zone for it to end is about 2,400 to 2,322.

Expect downwards movement from here to now start to show an increase in momentum. The short term target is at 2,390.

Look for a red daily candlestick for Monday. Next week may be when price moves very strongly lower.

If choosing to trade this correction, remember to always use a stop and invest only 1-5% of equity on any one trade. Less experienced members should reduce equity to only 1-3%.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

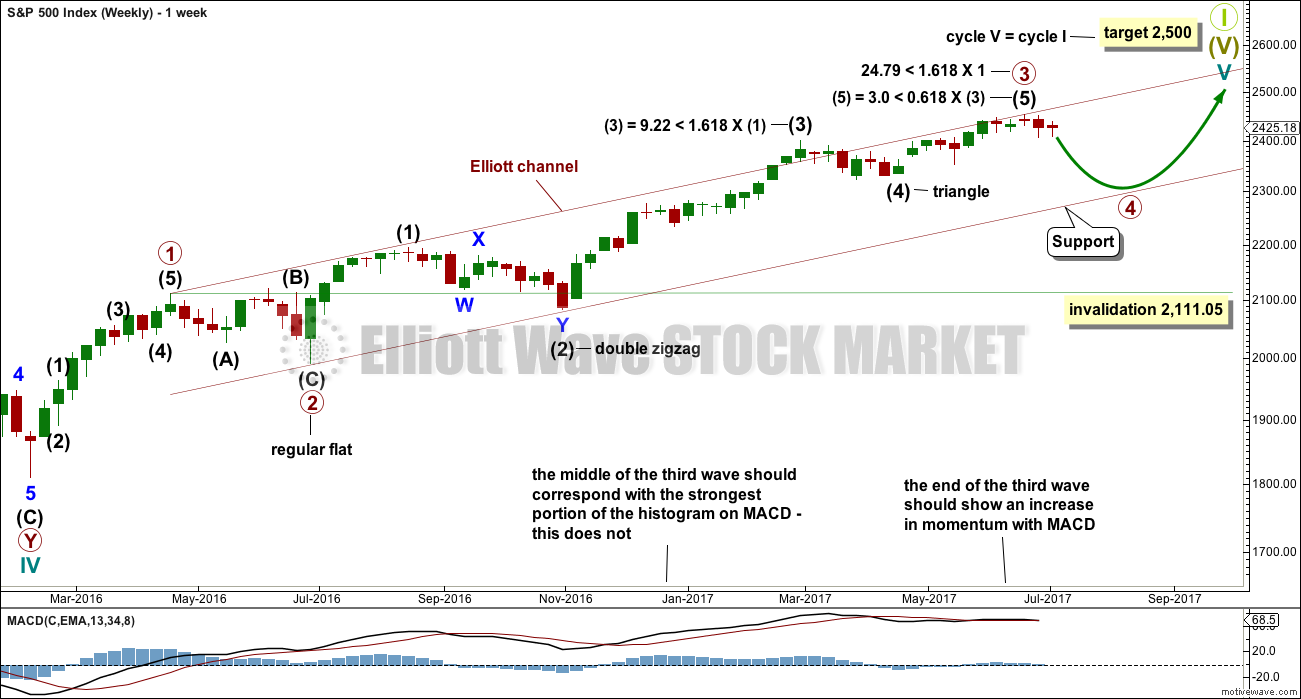

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Price has indicated that this should be the main wave count.

Primary wave 4 may now be underway.

Primary wave 2 was a regular flat correction that lasted 10 weeks. Given the guideline of alternation, primary wave 4 may most likely be a single or multiple zigzag or a triangle and may last about a Fibonacci eight or thirteen weeks, so that the wave count has good proportion and the right look. So far it has lasted only one week. This is far too brief to be considered complete or even close to complete.

Primary wave 4 may end within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its range from 2,400.98 to 2,322.35.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

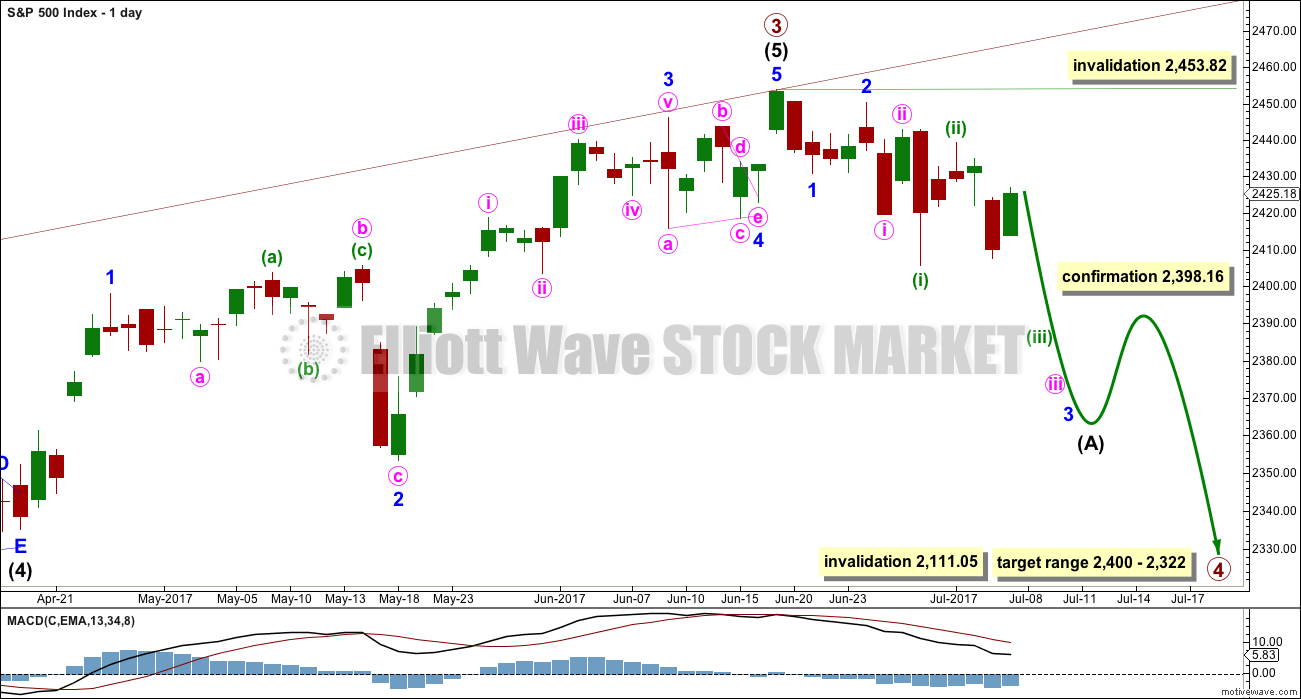

DAILY CHART

If primary wave 4 unfolds as the more common single or multiple zigzag, then it should begin with a five down at the daily chart level. This is incomplete.

If minor wave 2 is not over, and if it continues any higher (as per the alternate hourly wave count below), then it may not move beyond the start of minor wave 1 above 2,453.82.

When intermediate wave (A) is complete, then intermediate wave (B) should unfold higher or sideways for at least two weeks.

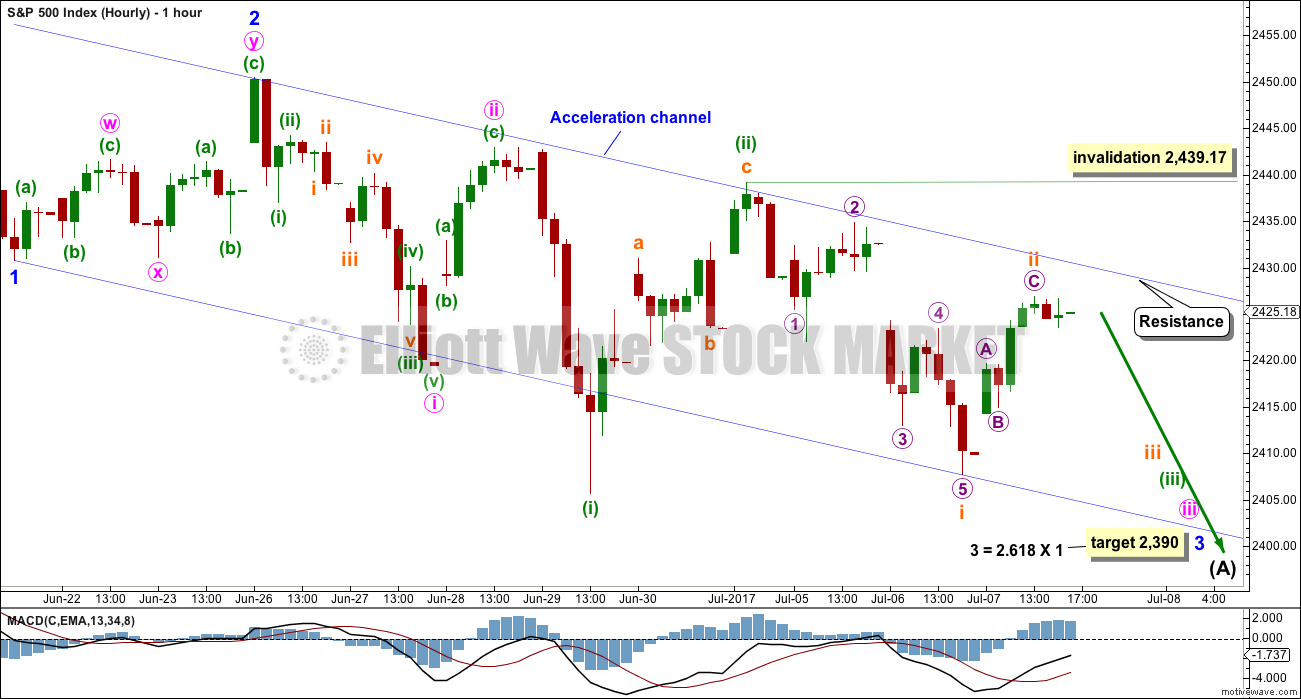

HOURLY CHART

Draw the acceleration channel from the end of minor wave 1 to the last low, then place a parallel copy on the end of minor wave 2. The upper edge should provide resistance along the way down. Keep redrawing the channel as price moves lower. When minor wave 3 is complete, then it will be an Elliott channel that shows where minor wave 4 may find resistance.

There are now four first and second waves complete.

Labelling within subminuette wave i is changed. It may have been over at the last low. The bounce for Friday may be one degree higher than previously labelled. Subminuette wave ii may not move beyond the start of subminuette wave i above 2,439.17.

This wave count expects now to see a strong increase in downwards momentum early next week as the middle of a third wave passes. Fourth wave corrections should be shallow and must remain below their corresponding first wave’s territory.

At 2,392 minute wave iii would reach 1.618 the length of minute wave i.

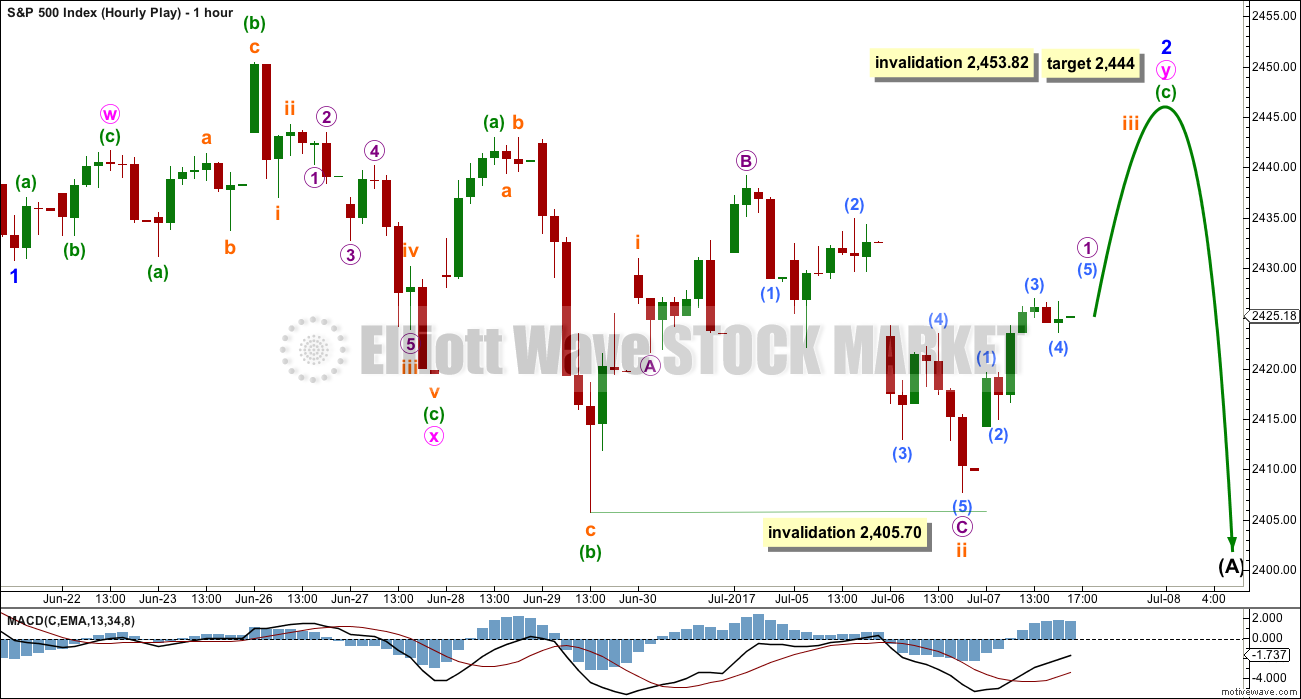

ALTERNATE HOURLY CHART

This wave count is now starting to look ridiculous, because the correction of subminuette wave ii is far too large now for this wave count to have the right look. Subminuette wave ii may not move beyond the start of subminuette wave i below 2,405.70.

There is a convention within Elliott wave that when wave B of a potential expanded flat reaches more than twice the length of wave A, the idea of a flat continuing should be discarded based upon a very low probability. That idea may also be useful in thinking about combinations. When wave X within a combination reaches more than twice the length of wave W (or Y), the idea of a combination continuing should be discarded. Here, minute wave x is 2.04 times the length of minute wave w.

This wave count has a very low probability, but at this stage it is the best alternate that I can find at the hourly chart level.

Minor wave 2 may not move beyond the start of minor wave 1 above 2,453.82.

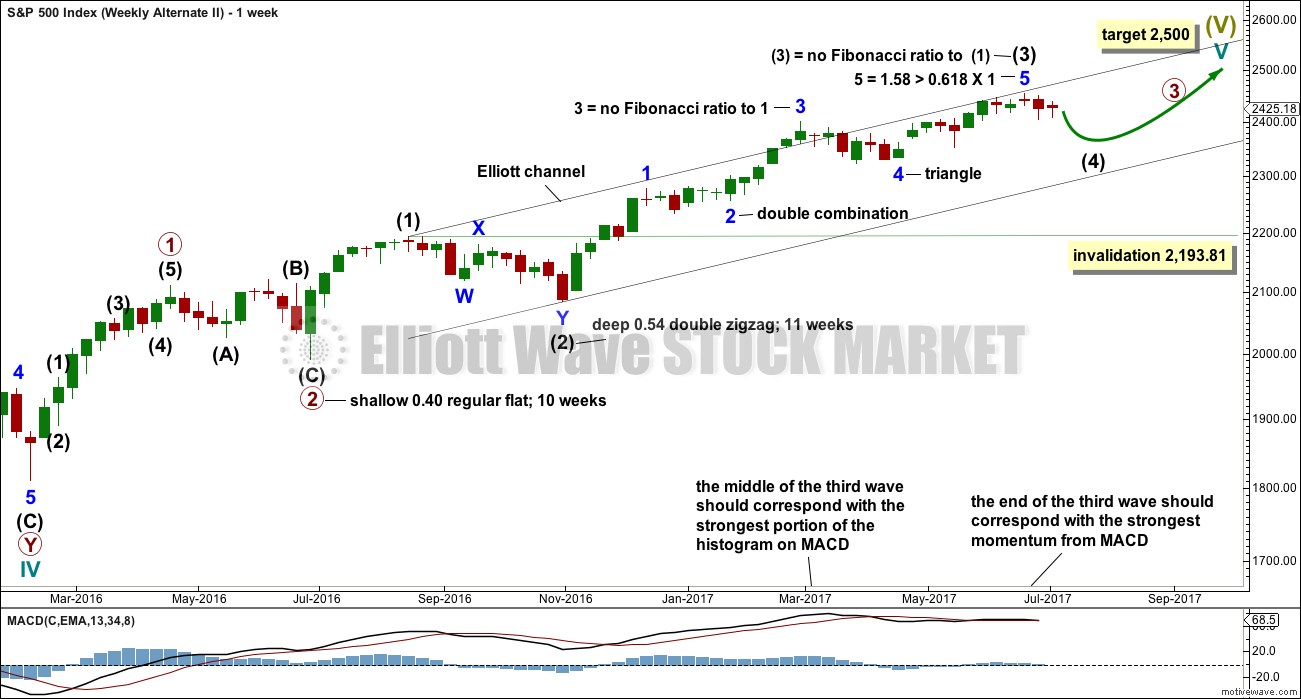

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This idea is new. This alternate wave count allows for an even longer more drawn out end to cycle wave V. It may not end until next year.

The current correction may be one degree lower, intermediate wave (4), which may not move into intermediate wave (1) price territory below 2,193.81.

Intermediate wave (2) lasted 11 weeks. Intermediate wave (4) should be in proportion to intermediate wave (2) for the wave count to have the right look. So far intermediate wave (4) has only lasted one week and is now beginning its second. It is far too early to say it could be complete. At its end, it may total a Fibonacci eight or 13 weeks.

TECHNICAL ANALYSIS

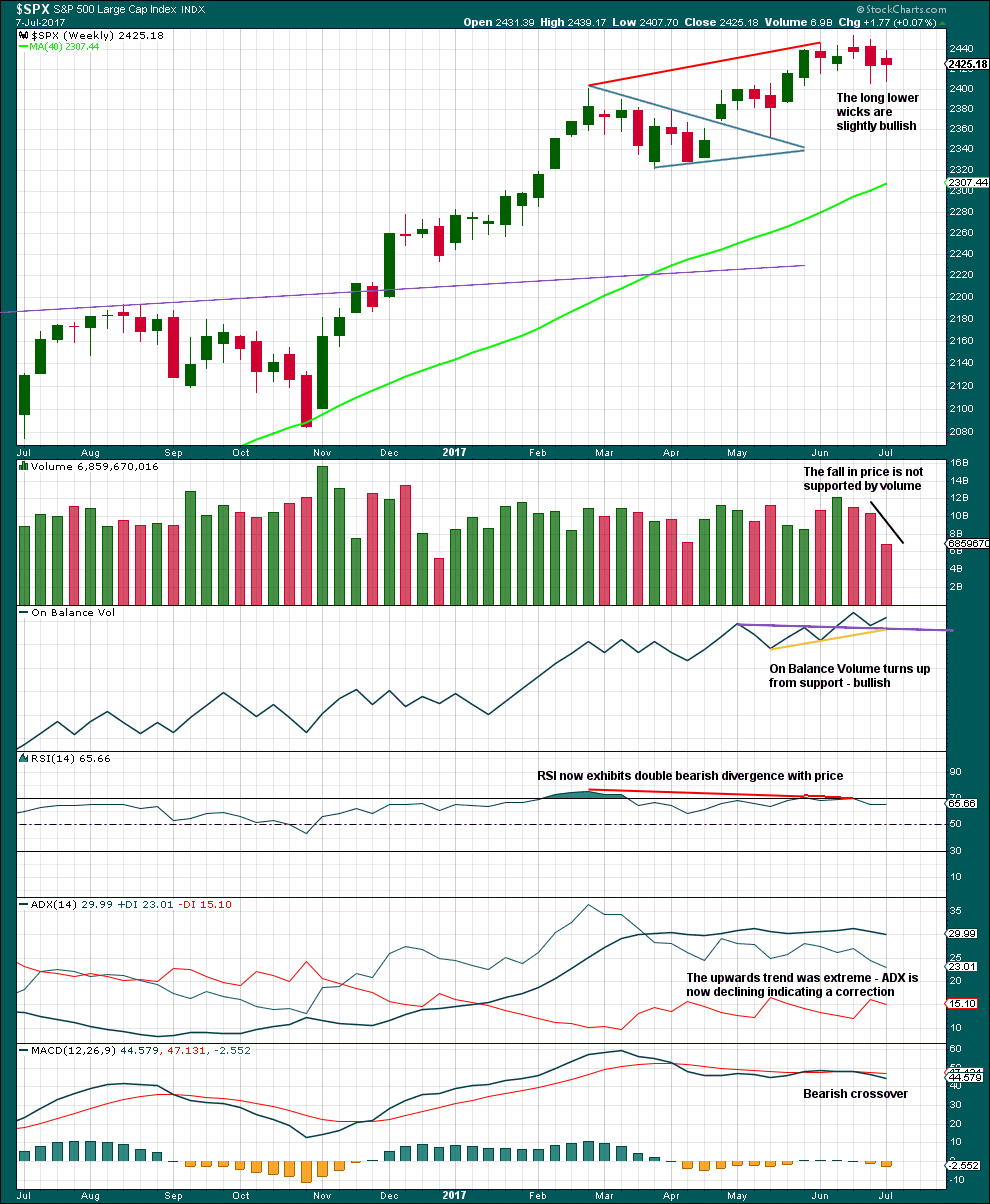

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume, candlesticks and On Balance Volume are bullish. This does not support the main Elliott wave count.

ADX, RSI and MACD still are bearish, and point to lower prices in the next few weeks.

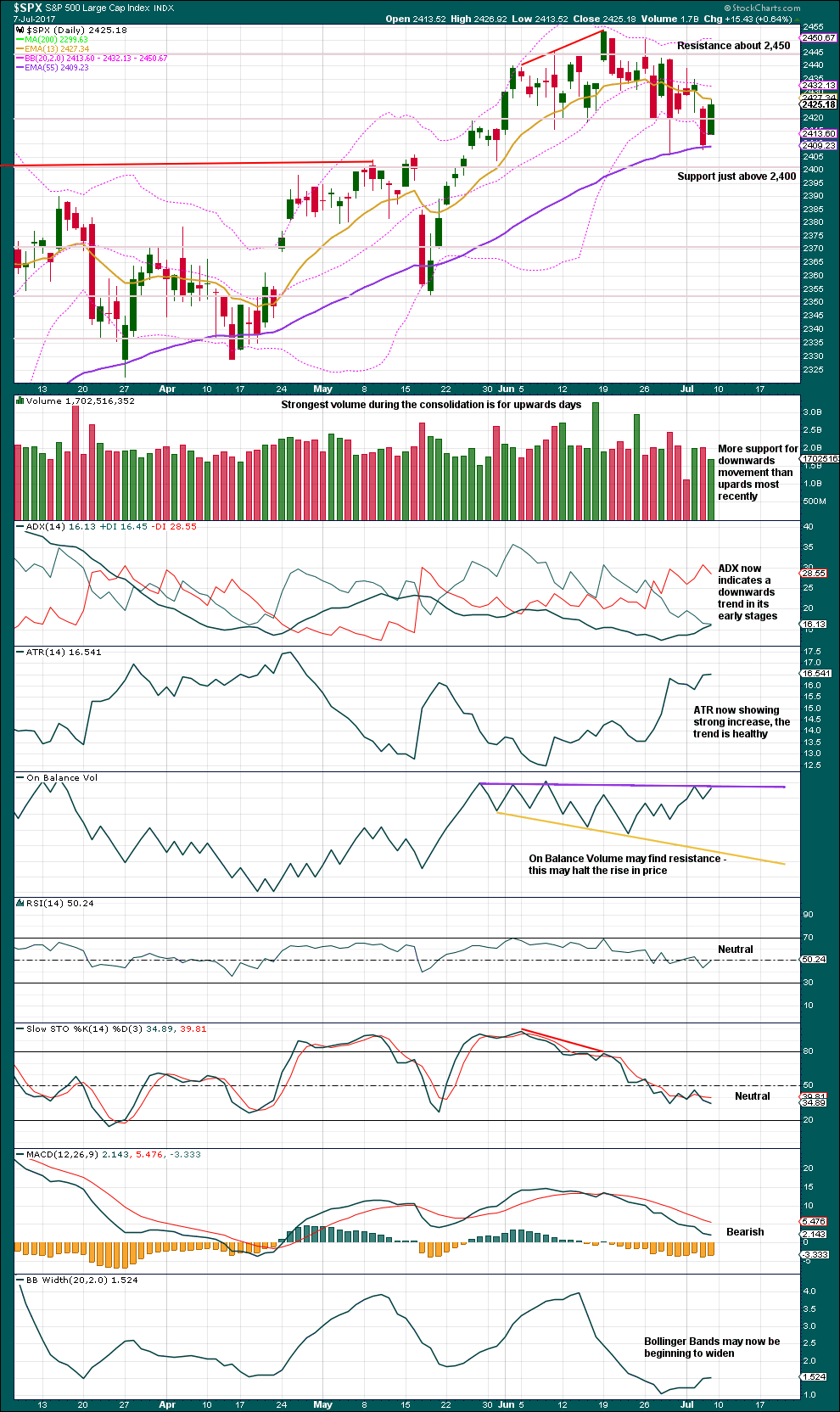

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

2,420 is no longer providing either support or resistance. Final support is just above 2,400.

While weekly volume is bullish, short term daily volume is more bearish.

ADX, ATR, MACD and On Balance Volume are bearish.

The only bullishness in this chart is strong volume for the days of 16th June and 23rd June.

This daily chart is more bearish than the weekly chart.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Hidden bullish divergence noted after Thursday’s session has been followed by an upwards day for Friday. It may be resolved here, or it may need one more upwards day before it is resolved.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

Hidden bullish divergence noted after Thursday’s session has now been followed by an upwards day for Friday. It may now be resolved here, or it may need one more upwards day to resolve it.

The mid caps and small caps have made new all time highs along with recent last all time high for large caps. The rise in price is seen across the range of the market, so it has internal strength.

While the market has moved sideways for about a month now, it has been accompanied by new highs in market breadth and improving underlying health as measured by Lowry’s buying power and selling pressure. This sideways correction should be expected to be a normal consolidation within an ongoing healthy bull market.

Historically, almost every bear market is preceded by at least 4-6 months of divergence with price and market breadth. There is no divergence at all at this time. This strongly suggests this old bull market has at least 4-6 months to continue, and very possibly longer.

DOW THEORY

The DJT today has finally made a new all time high. This confirms a continuation of the bull market.

Nasdaq still has not made a new all time high. Modified Dow Theory (adding in technology as a barometer of our modern economy) indicates some weakness at this time within the bull market, but there is zero indication that it is over.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 02:57 a.m. EST on 9th July, 2017.

Breaking out of channel??

…. and then back in.

Guess I shouldn’t be surprised. At this point, it feels like a game.

IKR

This sideways chop since the 9th of June is…. very challenging. And I’m being very polite here with that wording.

Another new alternate and another video showing the thinking process coming up today.

This is taking a bit of time trying to work out what on earth if could be.

There is a real stare-down taking place in this cagey market. I think smart traders are in SOH mode at the moment. I am getting ready to just unload a bucket-full of credit spreads and let the time decay work in my favor while Mr Market makes up his cagey mind. No point in trying to force the issue until we get some confirmation.

My worry about these sideways consolidations is that they have of late been breaking out upwards…I guess we will see soon enough.

I am absolutely intrigued by the nested 1,2 waves. Over the years it seems as if every time we have seen a similar set up the market surprises and does somthing unexpected. Will this time be different? Here’s to a merry quartet of thirds!

I’m nervous for that very reason.

We have seen it begin… then unfold as a third wave.

But yeah, we have seen it possibly begin… and then not unfold as expected.

I was thinking in particular about the set-ups that involve third waves at multiple degrees. While we have indeed seen many third waves down, it seems as if the ones where we were expecting a multiplet of thirds always end up doing something different. Maybe it’s just me…. 🙂