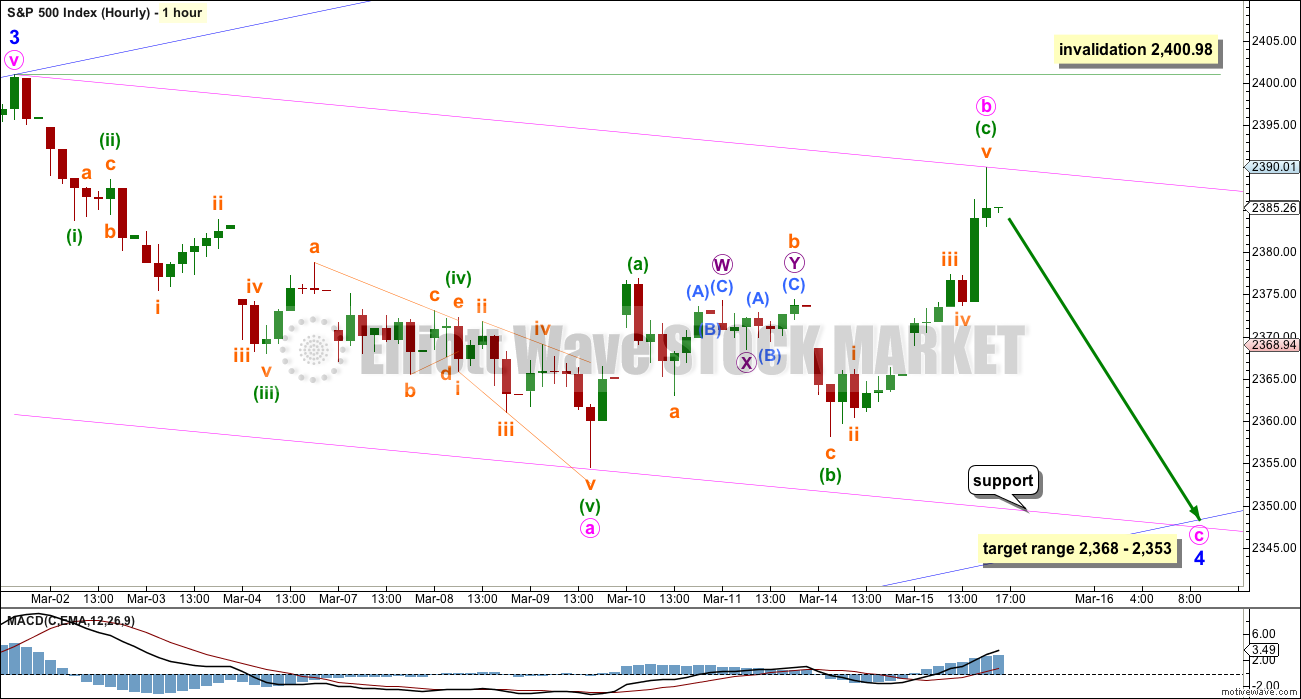

A very short term target expected some upwards movement for one or two days to a target zone at 2,380 to 2,383. Price moved higher as expected for Wednesday’s session, reaching 2,390.01.

Summary: A deeper pullback looks very likely now to have arrived. It may last at least another three days and possibly a few weeks longer. Target zones are either 2,368 – 2,353 or 2,282 – 2,234. A new low below 2,277.53 would indicate the lower target range should be used.

Downwards movement for three days to find support at the blue channel on the daily and hourly charts, and the pink channel on the hourly chart, is now expected as most likely.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

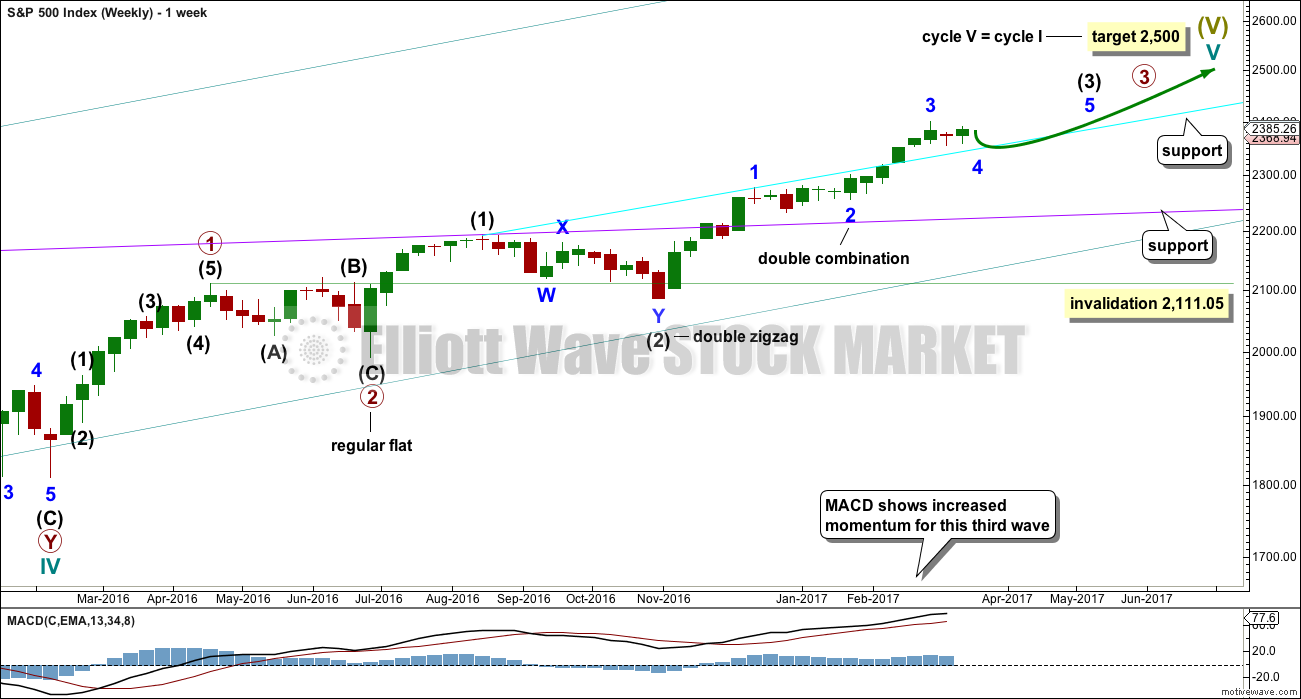

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V is an incomplete structure. Within cycle wave V, primary wave 3 may be incomplete or it may be complete (alternate wave count below).

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

As price moves lower look for support at each of the longer term trend lines drawn here across previous all time highs. Next support at the cyan line may be met soon.

The main and alternate wave counts in yesterday’s analysis are today swapped over. Price behaviour does not look like a larger primary degree correction. So far it looks more like a shallow minor degree correction.

DAILY CHART

All subdivisions are seen in exactly the same way for both daily wave counts, only here the degree of labelling within intermediate wave (3) is moved down one degree.

This wave count expects the current correction is minor wave 4, which may not move into minor wave 1 price territory below 2,277.53. A new low below this point would confirm the correction could not be minor wave 4 and that would provide confidence it should be primary wave 4.

Minor wave 4 may last about 26 days if it is even in duration with minor waves 1, 2 and 3. That would give the wave count good proportions and the right look. So far minor wave 4 has lasted only 10 days, so it may continue for another 16 if it is even in duration with minor waves 1, 2 and 3. However, zigzags are usually quicker structures than combinations. If minor wave 4 is unfolding as a zigzag (which looks likely and would give perfect alternation), then it may complete in a total Fibonacci 13 days, so it may end now in another 3 days.

At this stage, it is looking like this wave count may be more likely than the alternate wave count. A correction at minor degree for minor wave 4 should look similar in range and strength to minor wave 2, which so far it does.

Minor wave 4 may end within the price territory of the fourth wave of one lesser degree about 2,368 to 2,353.

This wave count now expects choppy overlapping movement to find support at the wider blue Elliott channel.

HOURLY CHART

Minor wave 4 looks still like an incomplete zigzag. Within it minute wave b now looks like a complete zigzag.

Use the pink and blue channels to show where minor wave 4 is most likely to end. Expect price to find support at both lower edges.

The target zone of 2,368 to 2,353 is the price territory of the fourth wave of one lesser degree (minute wave iv within minor wave 3 is seen on the daily chart).

The long upper wick on the hourly candlestick at the high for the session looks bearish for the short term.

If this wave count is invalidated with a new high above 2,400.98, then my labelling of minor wave 4 would be wrong. It could possibly be over or it could be continuing sideways as a flat or combination.

At its end, if this wave count is correct, minor wave 4 may offer a good entry point to join the upwards trend.

Always remember my two Golden Rules:

1. Always use a stop.

2. Do not invest more than 1-5% of equity on any one trade.

ALTERNATE DAILY CHART

The subdivisions of upwards movement from the end of intermediate wave (2) are seen in the same way for both wave counts. The degree of labelling here is moved up one degree, so it is possible that primary wave 3 could be over.

Primary wave 2 was a flat correction lasting 47 days (not a Fibonacci number). Primary wave 4 may be expected to most likely be a zigzag, but it may also be a triangle if its structure exhibits alternation. If it is a zigzag, it may be more brief than primary wave 2, so a Fibonacci 21 sessions may be the initial expectation. If it is a triangle, then it may be a Fibonacci 34 or 55 sessions.

Intermediate wave (3) is shorter than intermediate wave (1). One of the core Elliott wave rules states a third wave may never be the shortest wave, so this limits intermediate wave (5) to no longer than equality in length with intermediate wave (3). If intermediate wave (5) is now over, then this rule is met.

Minor wave 3 has no Fibonacci ratio to minor wave 1. If minor wave 5 is now over, then it is 4.14 points longer than equality in length with minor wave 3.

Intermediate wave (5) may have ended in 27 days, just one longer than intermediate waves (3) and (4). This gives the wave count good proportions.

The proportion here between intermediate waves (2) and (4) is acceptable. There is alternation. Both are labelled W-X-Y, but double zigzags are quite different structures to double combinations.

The following correction for primary wave 4 should be a multi week pullback, and it may not move into primary wave 1 price territory below 2,111.05.

TECHNICAL ANALYSIS

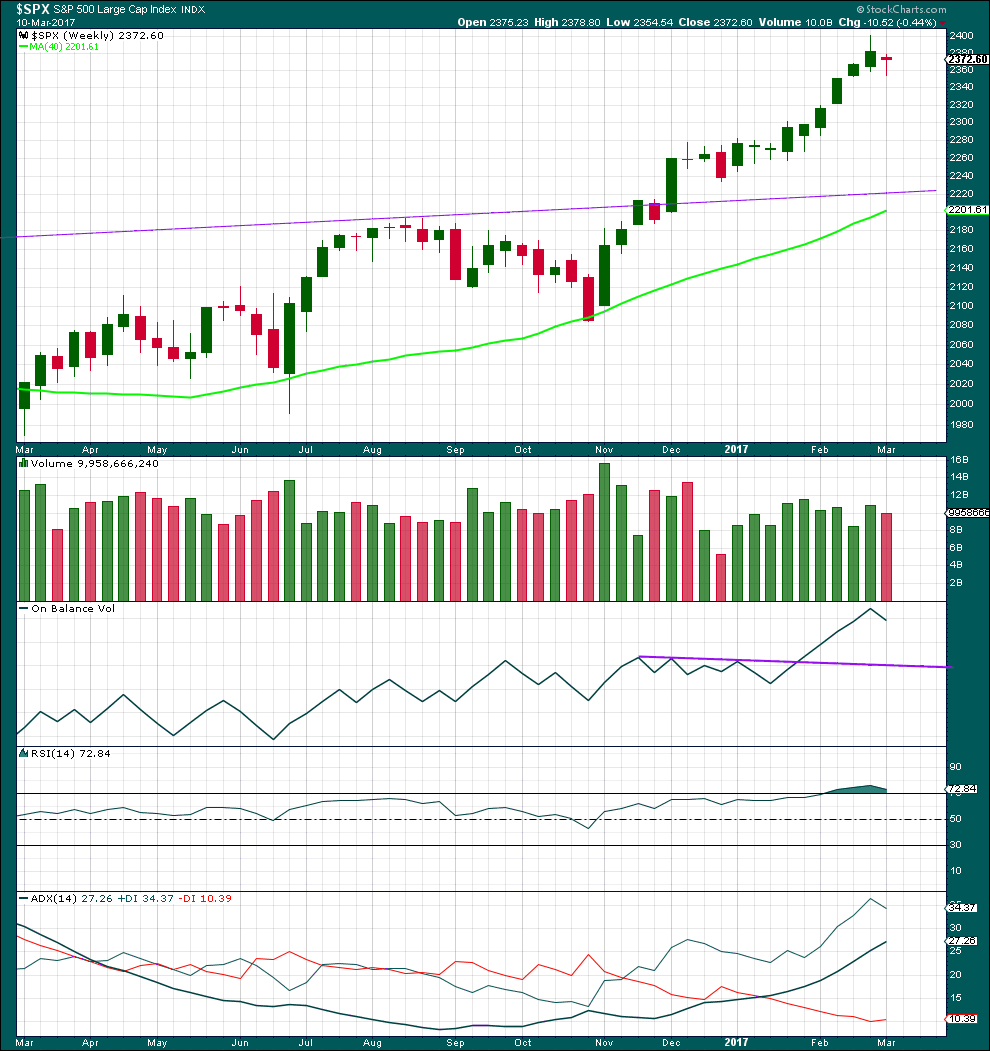

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week completes a red doji, which moved price lower, after nine green weekly candlesticks in a row. The trend has changed from up to neutral. Volume is lighter this week and the fall in price is not supported by volume. This looks like a pause within a trend and not a new trend.

There is a long way for On Balance Volume to go to find support.

RSI may now return from oversold.

ADX did not reach extreme. There is room for the trend to continue further.

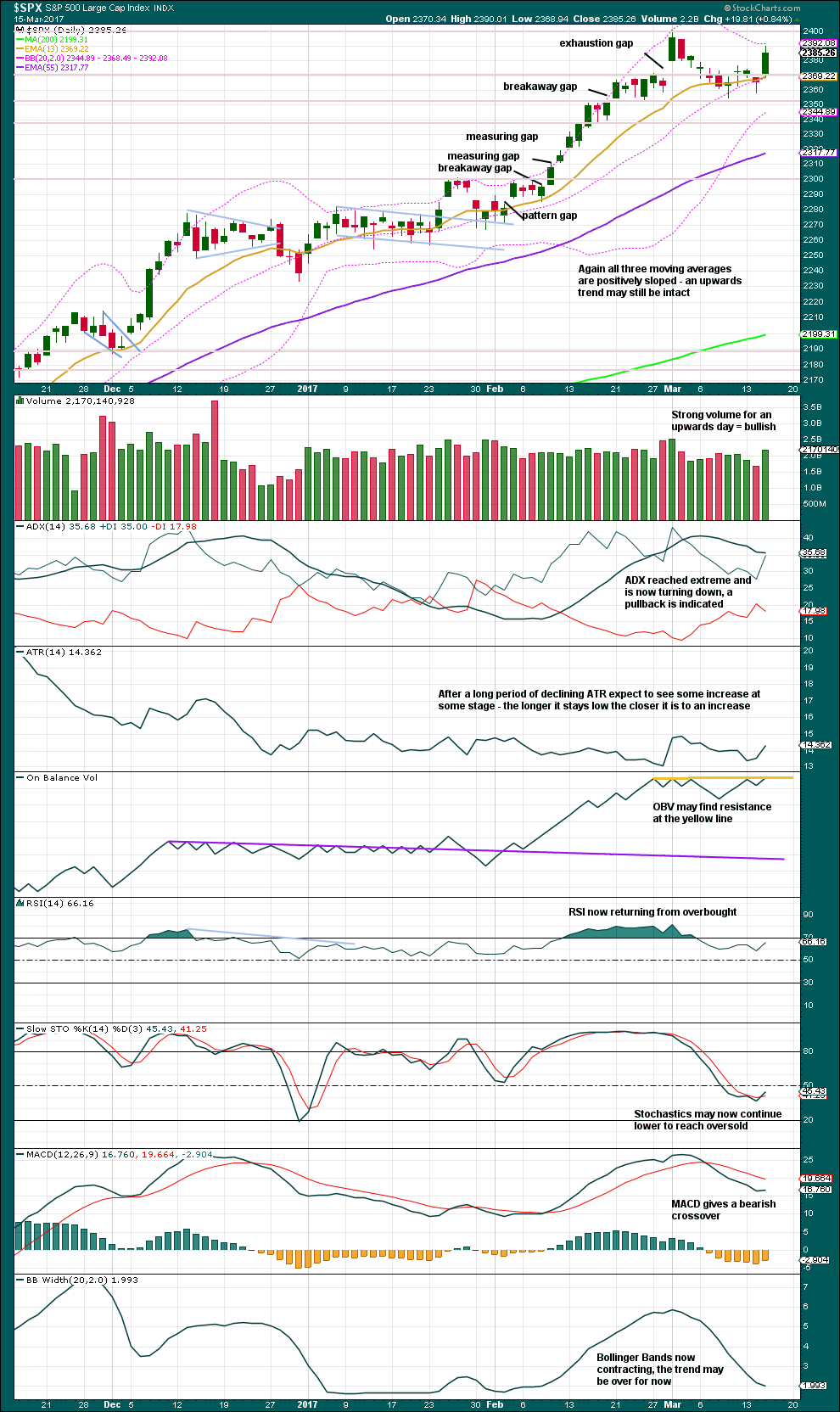

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is still range bound with resistance about 2,400 and support about 2,355. So far, during this period, it is the upwards day for today which has strongest volume suggesting an upwards breakout is more likely.

Today saw price move reasonably strongly higher with a good increase in volume. Price reached the upper edge of Bollinger Bands during the session, which may offer resistance.

ADX remains extreme. This consolidation of the last ten days has not yet been able to pull it down from above 35 and above both directional lines. It is reasonable to conclude that the consolidation is most likely to continue so that ADX can be pulled back.

On Balance Volume is at resistance. It may assist here to halt the rise in price today.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Bearish divergence and bullish divergence spanning a few short days used to be a fairly reliable indicator of the next one or two days direction for price; normally, bearish divergence would be followed by one or two days of downwards movement and vice versa for bullish divergence.

However, what once worked does not necessarily have to continue to work. Markets and market conditions change. We have to be flexible and change with them.

Recent unusual, and sometimes very strong, single day divergence between price and inverted VIX is noted with arrows on the price chart. Members can see that this is not proving useful in predicting the next direction for price.

Divergence will be continued to be noted, particularly when it is strong, but at this time it will be given little weight in this analysis. If it proves to again begin to work fairly consistently, then it will again be given weight.

There is short term bearish divergence today between price and inverted VIX: price has made a new high, but VIX has not made a corresponding new high. There was not a corresponding decline in volatility today while price moved higher and this indicates weakness today in price.

This divergence is noted, but although it does support the Elliott wave count it will be given no weight as it has proven unreliable lately.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

The rise in price has support from a rise in market breadth. Lowry’s OCO AD line also shows new highs along with price. Normally, before the end of a bull market the OCO AD line and the regular AD line should show divergence with price for about 4-6 months. With no divergence, this market has support from breadth.

No new divergence is noted today between price and the AD line.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq continue to make new all time highs. This confirms a bull market continues.

This analysis is published @ 08:19 p.m. EST.

Hourly chart updated:

So far so good. Lets see if minor 4 can complete in just two more days to total a Fibonacci 13. At this stage that’s starting to look a bit optimistic.

Adding SPY 237.50 puts expiring @ 0.60. Target 100%

Move back above 2382.72 negates 1,2 impulse down. Hard stop at 2382.73

We need to take out 2377.18 before the close if we are in a C down…I would not be surprised to see the impulse complete before the close or even early in the a.m if that is what we have…

ES looks like it has put in a double bottom so some doubt about an impulse down underway…not stopped out yet but expect I will be probably in after hours trading. Until manana…! 🙂

Below 2373.75 and we have a five down three up…

Correction…2377.05…

2,376.86? The high I have labelled minuette (a) within minute b

Nasdaq came within 0.31 points of a new high and retreated….weird…

Possible. We rallied right up to resistance at the underside of a broken trendline so today’s price action should be probative.

Top O’ the morning!

2400 today ?

Foist? 🙂