Upwards movement continues as the main Elliott wave count expects.

The very bearish alternate Elliott wave count remains viable.

Summary: The target is 2,338 for the short term and 2,382 for a longer term trade. In the short term, a small correction for minute iv may unfold sideways Monday / Tuesday. Price should find strong support about 2,300 now. The invalidation point is moved up today to 2,285.38. A new high above 2,334.58 would eliminate a very bearish alternate and provide confidence in this upwards trend. The trend has support from breadth, but not good support so far from volume.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

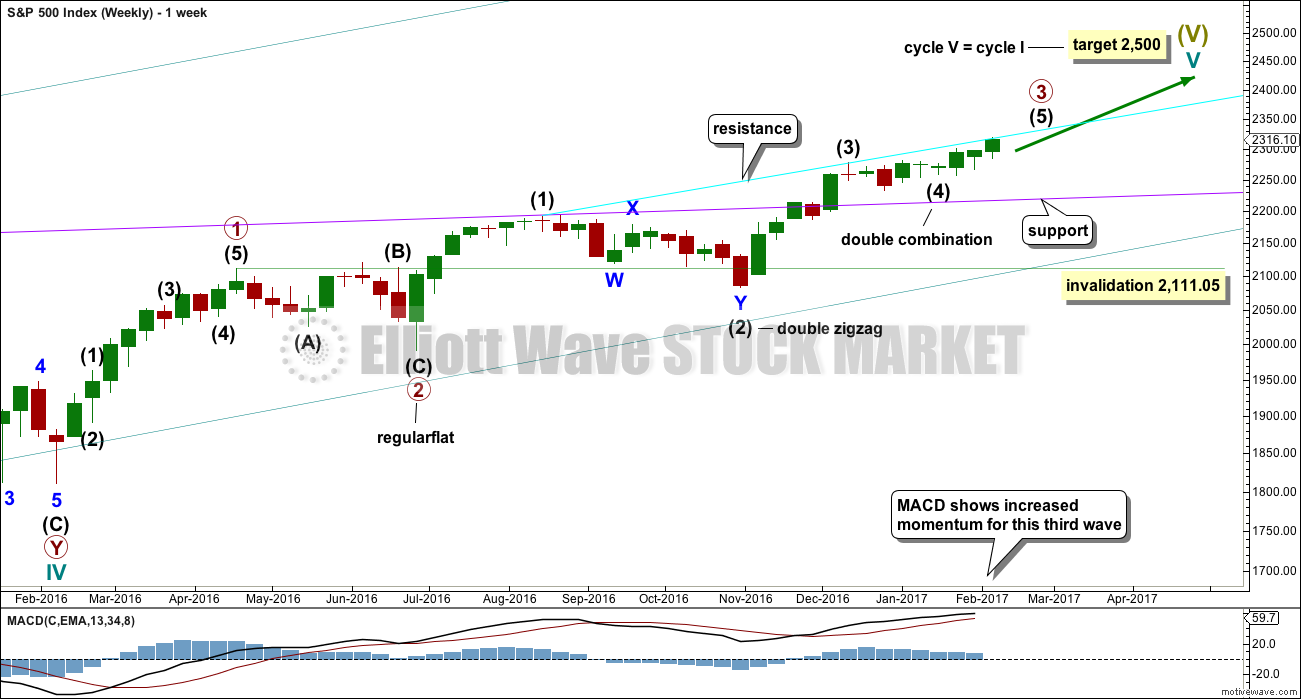

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V is an incomplete structure. Within cycle wave V, primary wave 3 may be relatively close to completion.

When primary wave 3 is complete, then the following correction for primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 2 was a flat correction lasting 47 days (not a Fibonacci number). Primary wave 4 may be expected to most likely be a zigzag, but it may also be a triangle if its structure exhibits alternation. If it is a zigzag, it may be more brief than primary wave 2, so a Fibonacci 21 sessions may be the initial expectation. If it is a triangle, then it may be a Fibonacci 34 or 55 sessions.

Primary wave 3 at this stage though is incomplete and may continue to move price higher.

DAILY CHART

It is possible that intermediate wave (4) is a complete combination: zigzag – X – flat. It would have been even in duration with intermediate wave (3), both lasting 26 days.

Intermediate wave (3) is shorter than intermediate wave (1). One of the core Elliott wave rules states a third wave may never be the shortest wave, so this limits intermediate wave (5) to no longer than equality in length with intermediate wave (3) at 2,450.76.

Minor wave 3 has now moved beyond the end of minor wave 1, meeting the rule. Within minor wave 3, no second wave correction may move beyond the start of its first wave below 2,267.21.

Intermediate wave (5) has so far lasted fourteen days. It may be expected to be shorter both in length and duration compared to intermediate wave (3). At this stage, an expectation of a Fibonacci 21 days total for intermediate wave (5) looks reasonable, so it may now continue for another seven days or sessions. This is starting to look a bit too brief now though. It may continue to total a Fibonacci 34 sessions.

Price has now broken above the cyan resistance line. This line may now offer support.

The proportion here between intermediate waves (2) and (4) is acceptable. There is alternation. Both are labelled W-X-Y, but double zigzags are quite different structures to double combinations.

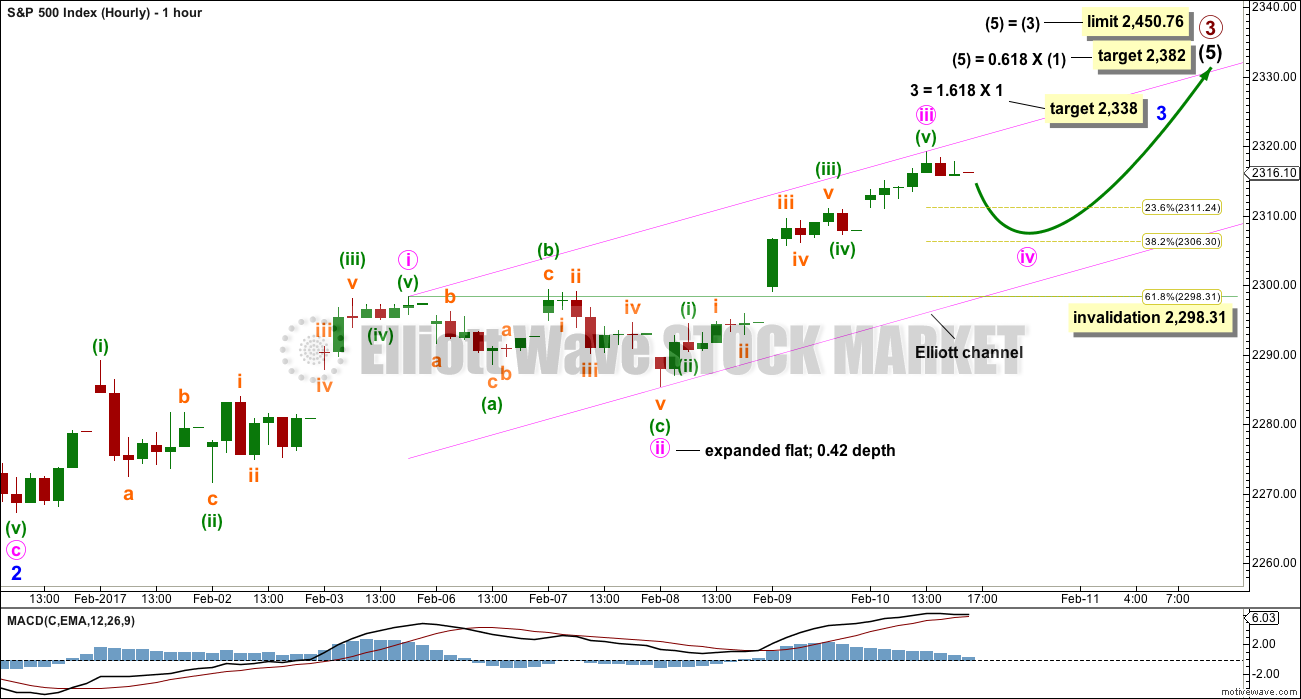

HOURLY CHART

Intermediate wave (5) must subdivide as a five wave structure, either an impulse or an ending diagonal. At this stage, it is not possible to eliminate either option.

Within intermediate wave (5), minor waves 1 and 2 may be complete.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute waves i through to iii may now be complete. Minute wave iii has shown an increase in upwards momentum. Minute wave iii is 2.75 points longer than equality in length with minute wave i.

Minute wave iv may now unfold. It may not move into minute wave i price territory below 2,298.31.

The channel is now redrawn using Elliott’s technique. If minute wave iv is deep, it may find support at the lower edge.

Minute wave ii was a relatively time consuming expanded flat correction. Minute wave iv may be expected to most likely be a zigzag, given the guideline of alternation, and would most likely end within the price territory of the fourth wave of one lesser degree, which is minuette wave (iv) price territory from 2,311.08 to 2,307.35. If minute wave iv does not unfold as a zigzag, then it may be a triangle or combination.

If minute wave iv ends close to the 0.382 Fibonacci ratio, it would look typical and exhibit some alternation in depth with minute wave ii.

Minute wave iv may be expected to show up on the daily chart as at least one red daily candlestick or doji. It may last up to about three or four days, but at this stage it may be expected to be more brief than minute wave ii.

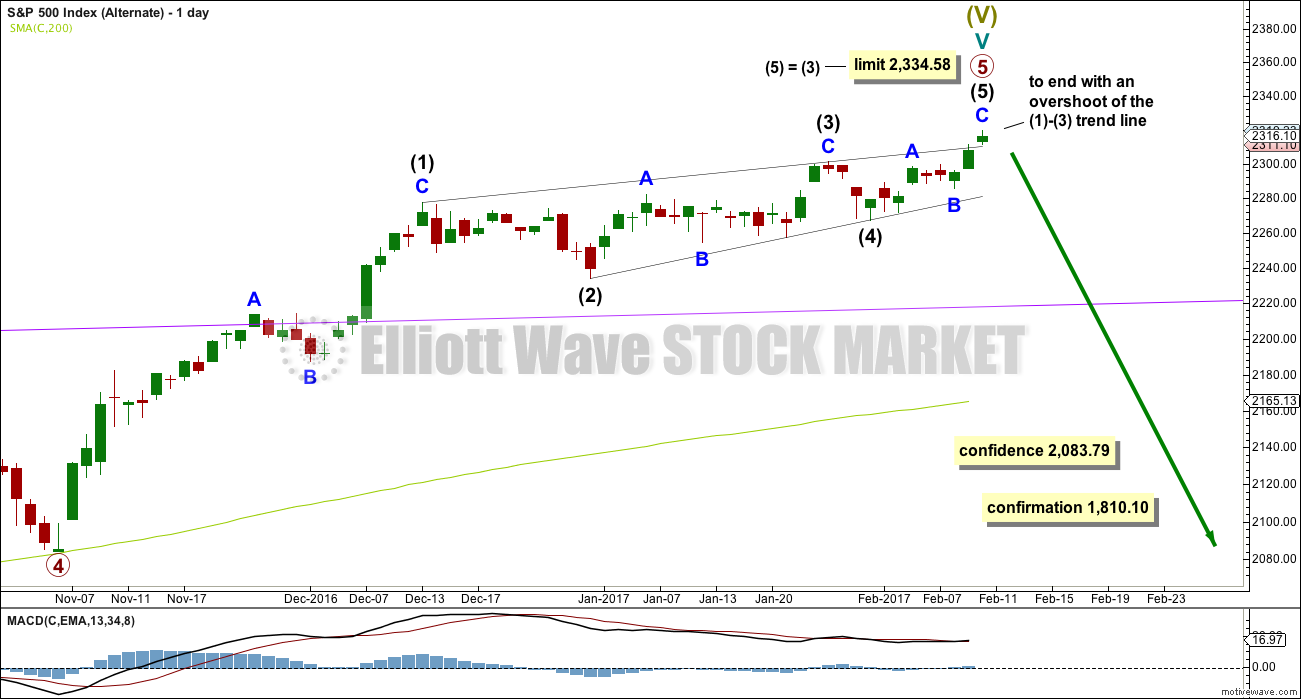

ALTERNATE ELLIOTT WAVE COUNT

DAILY CHART

I will publish alternate ideas from time to time in response to members queries or concerns.

It does look suspiciously like an ending contracting diagonal may be underway and very close to completion.

Current upwards movement (which began on the 4th of November, 2016) must be a fifth wave for it to be an ending diagonal. That means that primary waves 1 through to 4 may be complete.

The only way for this to work and meet all Elliott wave rules is to see primary waves 1 and 2 over very quickly. This makes primary wave 3 longer than primary wave 1, so that the core rule stating a third wave may not be the shortest is met. (To see the entire detail of primary waves 1 through to 4 see last analysis here).

Ending contracting diagonals must have subwaves that all subdivide as zigzags. They normally end with a small overshoot of the 1-3 trend line.

Price has now made a new all time high and slightly overshot the (1)-(3) trend line. This wave count now expects an imminent reversal and a huge bear market to begin here.

This wave count has some support from long term classic analysis at the monthly chart level, but it is not supported by Lowry’s analysis. At this time, Lowry’s do not see normal conditions for a major market top in place.

This wave count has a very low probability. It requires confidence below 2,083.79.

TECHNICAL ANALYSIS

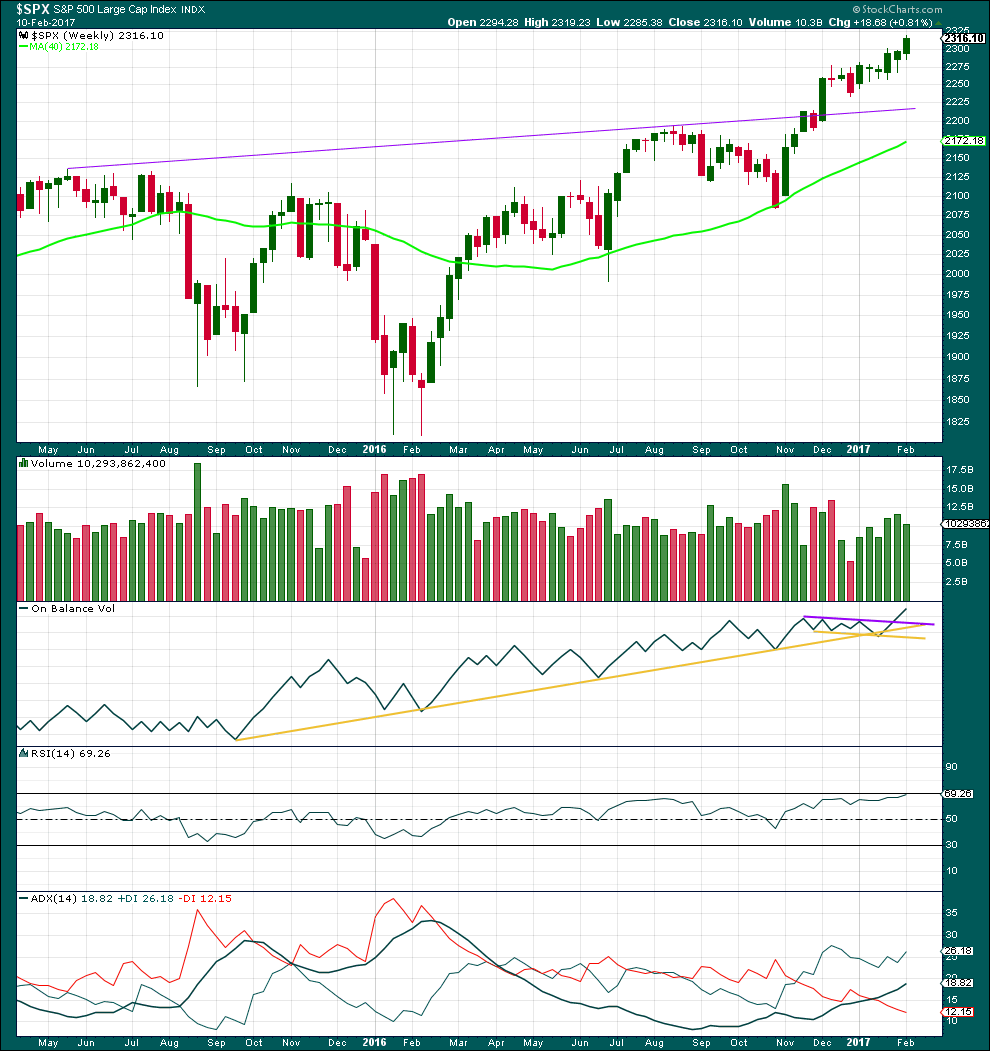

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Overall, price is moving higher on increasing volume. This week sees a decline in volume from last week, but volume is still stronger than the first three weeks of upwards movement.

On Balance Volume gave a bullish signal with a break above the purple resistance line. This line may now offer support and assist to halt any fall in price from being too deep.

RSI is not yet overbought at the weekly chart level. There is room for price to rise further.

ADX indicates an upwards trend, and ADX has a long way to go before it becomes extreme.

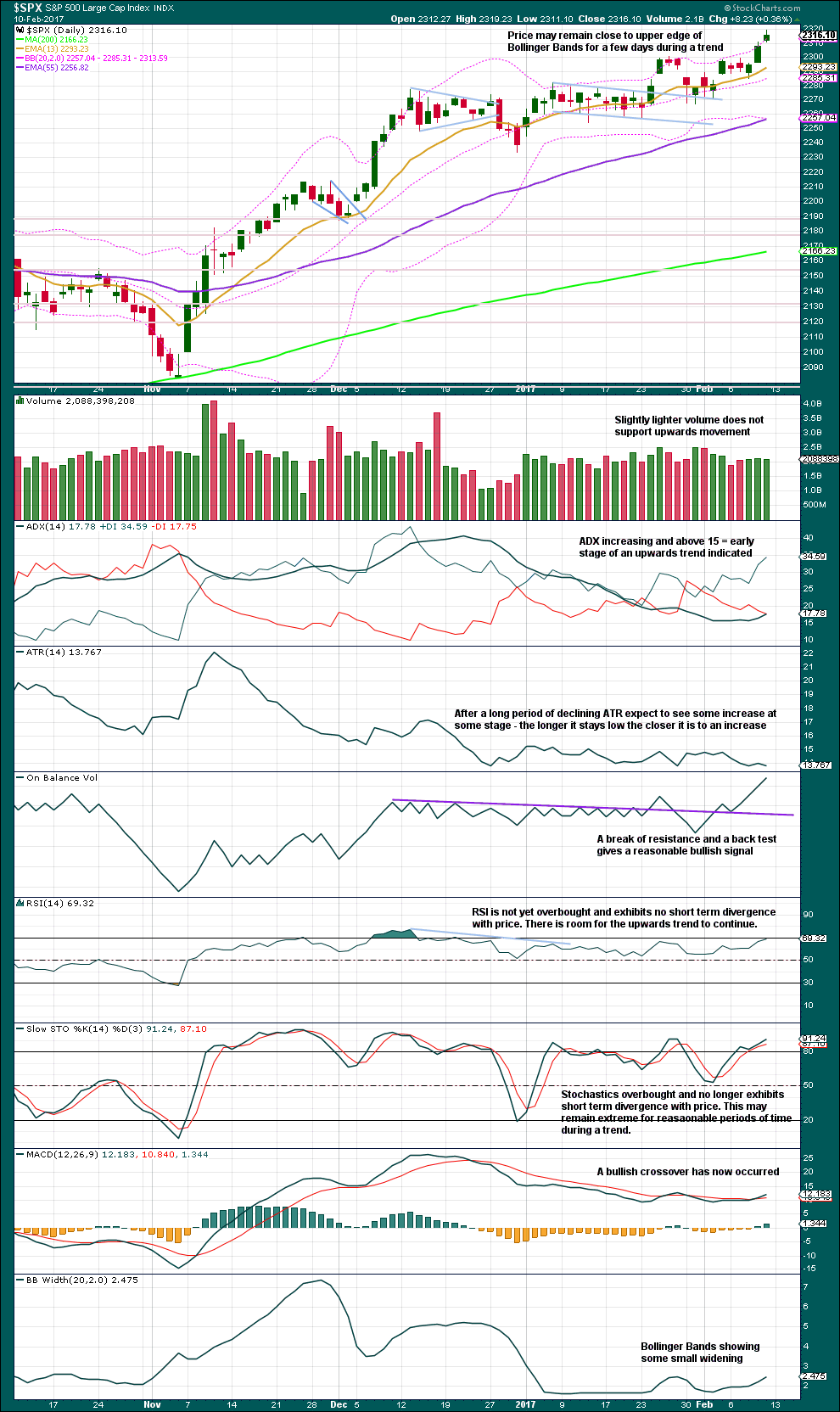

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Data for volume for Thursday’s session has changed retrospectively. Thursday’s session saw a small increase in volume. Now Friday sees a slight decline. The decline is only very slight, so I will not be expecting a pullback here.

Price is closing now for two days in a row at the upper edge of Bollinger Bands. Note that price closed above the upper edge of Bollinger Bands for five days in a row, from the 7th of December, 2016, to the 13th of December, 2016, within the last trend for the S&P on this chart. It is possible that this situation may occur again.

The last three daily candlesticks complete a stalled pattern. This is a reversal pattern. If it works, it may be followed by a pullback or a sideways consolidation about here.

The remainder of commentary is on the chart. Overall, the picture remains bullish. Any pullbacks may find support now about 2,300 and the 13 day moving average.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is mostly working to indicate short term movements spanning one or two days. While this seems to be working more often than not, it is not always working. As with everything in technical analysis, there is nothing that is certain. This is an exercise in probability.

There is still short / mid term hidden bearish divergence today between the new high from price and a lower high from inverted VIX. This indicates underlying weakness in price. This divergence persists now for two days. It may disappear, or it may be followed by one or two days of downwards movement.

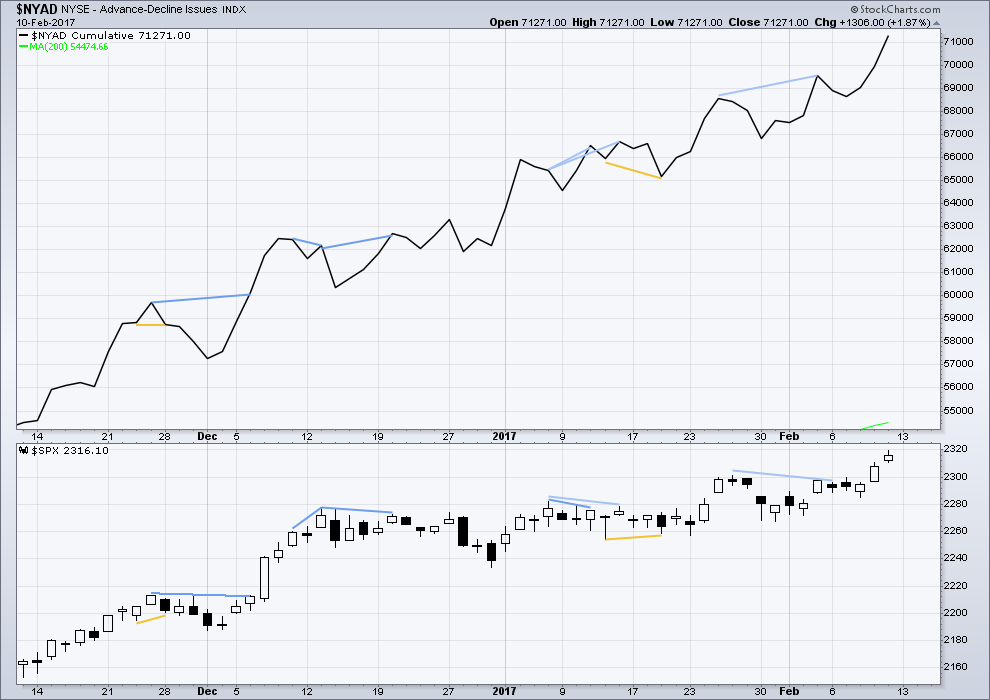

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is no short nor mid term divergence today between price and the AD line. The rise in price to a new high today was accompanied by a corresponding new high in the AD line. The rise in price has support from a rise in market breadth. Lowry’s OCO AD line also shows new highs along with price. Normally, before the end of a bull market the OCO AD line and the regular AD line should show divergence with price for about 4-6 months. With no divergence, this market has support from breadth.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq have made new all time highs in December of 2016. This confirms a bull market continues.

This analysis is published @ 9:16 p.m. EST on 11th February, 2017.

Daily S&P: We’ve left a trail of 3 open gaps in the past 8 days. Exhaustion gaps? There were really 4 technical gaps, but I’m conservatively counting only the “open windows”.

I’ve added some labels for them to the TA chart today.

Targets still the same. Minute iii extending, minuette (v) within it now looks extended.

Corrections are proving so far to be very brief and shallow, with the exception of the very first second wave of minor 2.

This market looks oddly thin and gappy on the daily chart (no autocorrect, not happy!). It looks like an equity, no longer like an index.

Still, price keeps on going up and so to make money we go with it. That’s the general idea.

I’ve moved my stop up to the EW invalidation point to protect a little profit. I’m starting to see some extreme readings on the hourly chart, but no divergence yet with highs. So I’ll hold my long position until one of three things happens:

1. My target is hit and it automatically closes for a nice profit. I’m using the target for intermediate (5) at 2,382.

2. Price moves below the upper cyan support line on the daily chart. If that’s breached then something else may be happening, a multi week deeper pullback maybe so I wouldn’t want to be long then.

3. Extreme readings (I’m using some indicators on the hourly chart) followed by at least double divergence at new highs on the hourly chart.

Lara, may I ask what your S&P trading vehicle is?: SPY, UPRO, options, futures?

My broker CMC markets (NZ based) only offer CFD’s.

I’m trading CFD’s on the spot market for the S&P500.

I’ve never traded options or futures, time is too difficult to figure with any accuracy. Price is hard enough 🙂

Lara,

Good morning. Are you doing your Happy Dance yet?

Good morning Rodney! Yes, I am! Super Happy Morning Dance 🙂

I have profitable positions on the S&P, NZDUSD, and EURUSD. My Gold position is only very slightly underwater now.

Three out of four is pretty good I reckon

I did consider closing my S&P position, but decided to hold on for the targets.

Still going to hold on I think.

Must an ED be a fifth wave at all degrees?

Nope. And if price turns down hard right here then my first idea would be to move everything in cycle V down one degree, only primary 1 may be complete.

Primary 2 should find support at the lower edge of the teal Elliott channel which is drawn about all of cycle V.

If that trend line is breached then the probability of a huge bear market would increase.

Great and appreciated analysis Lara! Got a couple more tubes for you this morning 😉 we had 3-4ft a frames with offshore winds today!

Oh wow! Nice size. 3-4 ft is my limit on my huge longboard 🙂

Our swell has died here now, time to rest the noodle arms.

When there’s no surf I try to do yoga nearly every day so that when the waves come again I’m fully fit and ready for it

Awesome you got great surf. Best feeling ever, isn’t it!

Thanks, and yes great surf heals all. Looks like the southern hemi is waking up for you guys, with another swell for Friday!!! I’ve been a yogi freak since I was 20, so 14 years, and do it everyday. Swimming and cross-training do well too.