Downwards movement was expected from the Elliott wave count and supported by classic technical analysis. Divergence with price and VIX and the AD line indicated price was likely to move lower today.

Summary: Some downwards movement to find support at the lilac / purple trend line is expected, about 2,211. If this target is wrong, it may be a little too low. Use the trend line as a preference. If this correction ends in a total Fibonacci 34 sessions, it may end on the 1st of February. Thereafter, the bull market should resume.

This bull market is strong and healthy. Use this correction as another opportunity to join the trend.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

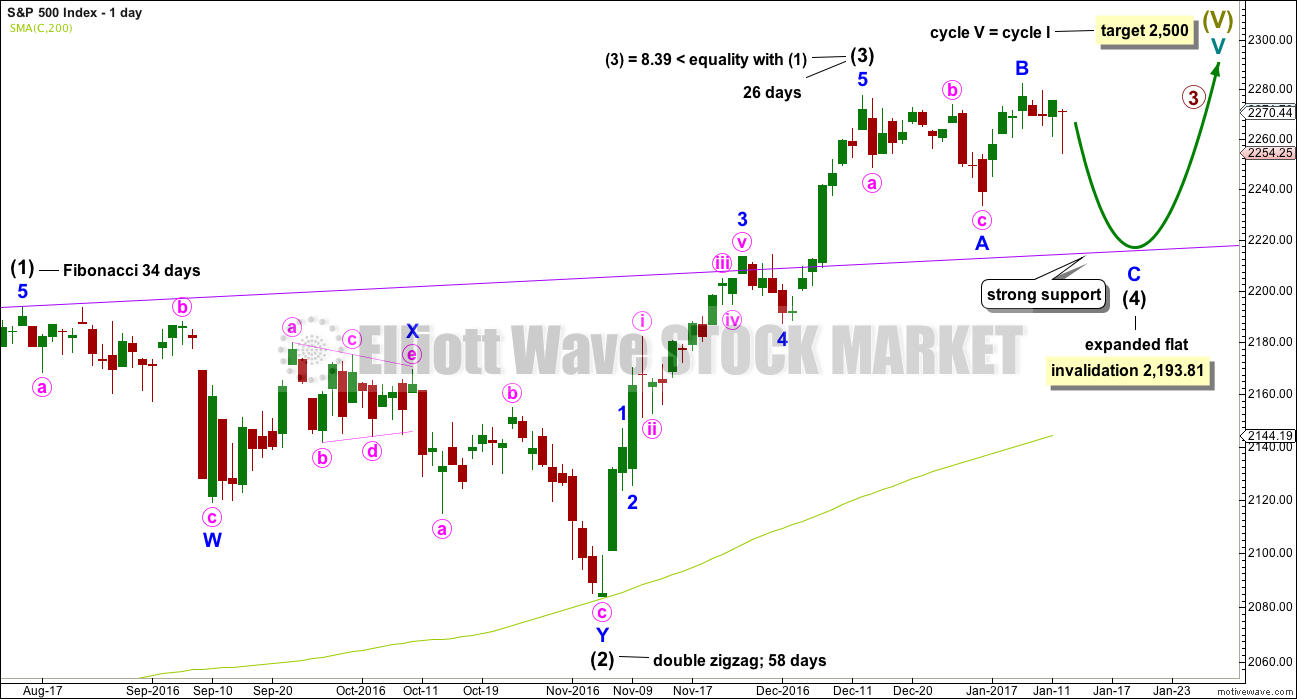

DAILY CHART

Intermediate wave (4) is exhibiting alternation with intermediate wave (2). Intermediate wave (2) is a double zigzag and intermediate wave (4) is an incomplete expanded flat.

Along the way up to the final target at 2,500 a more time consuming fourth wave correction for primary wave 4 would be expected for this wave count.

The purple trend line is the most important piece of technical analysis on all charts. Draw it carefully from prior all time highs of 2,134.28 on the 21st of May, 2015, to 2,193.81 on the 15th of August, 2016. Extend it out. Daily charts are on a semi log scale.

The correction for intermediate wave (4) should end if price comes down to touch the purple trend line.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81.

At this stage, intermediate wave (4) has lasted 20 sessions. With the very slow rate of this correction it may now be possible for it to continue for another 14 sessions to total a Fibonacci 34. This would see it end on the 1st of February.

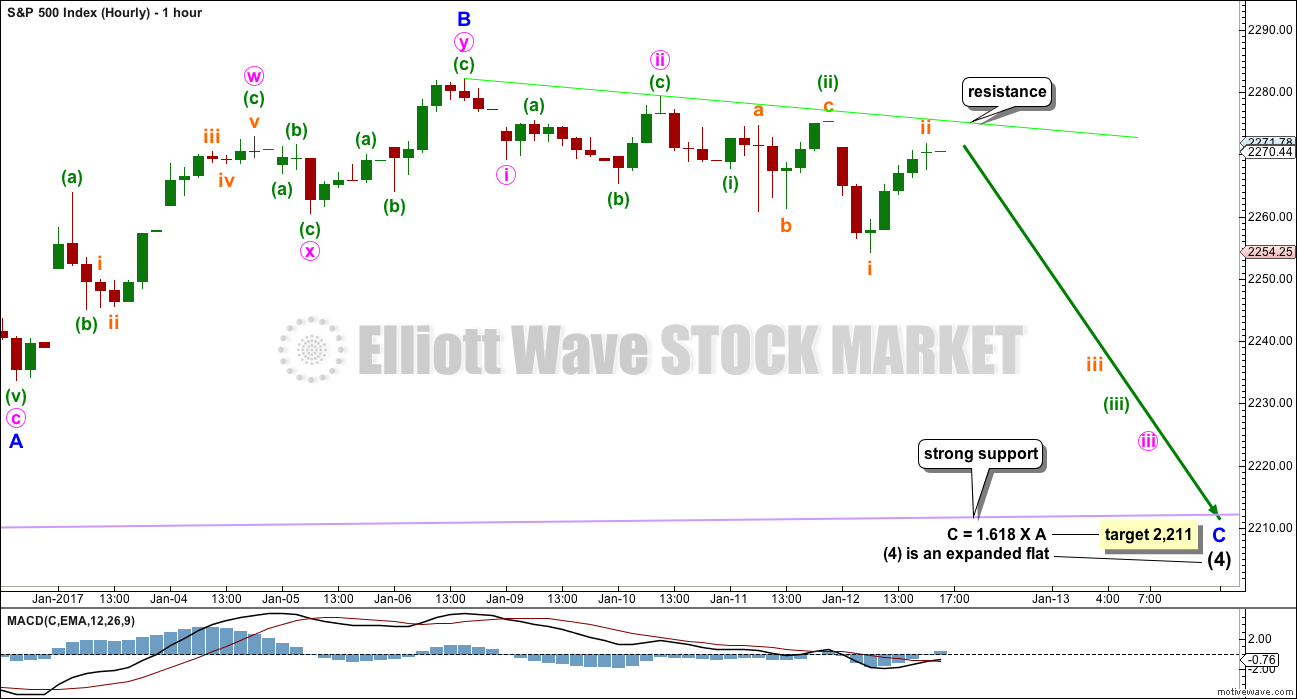

HOURLY CHART

If the target calculated is wrong, it may be too low. Price may find strong support just above the target at the purple trend line. This line is copied over carefully from daily and weekly charts, which are both on semi log scales. This hourly chart is on an arithmetic scale, meaning the line will sit slightly differently. Both should be watched carefully.

Minor wave C must complete as a five wave structure. It is extremely likely to make at least a slight new low below the end of minor wave A at 2,233.62 to avoid a truncation and a very rare running flat.

The tentative green resistance line has been tested now four times, so it has slightly better technical significance today. Confidence may be had in this line.

This wave count now expects to see an increase in downwards momentum and an increase in volatility as a small third wave down unfolds over the next few days.

TECHNICAL ANALYSIS

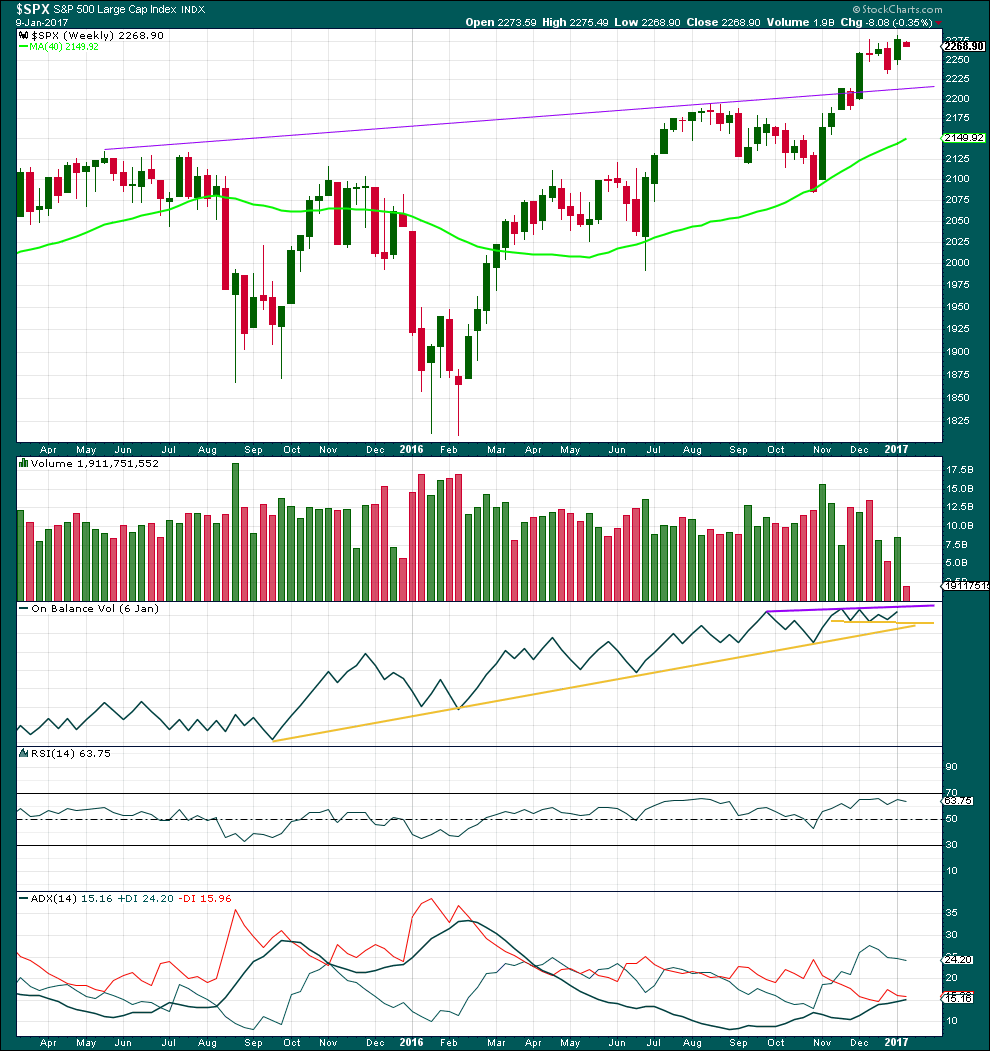

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last three complete weeks show lighter volume than the three weeks prior. This makes sense as a consolidation. Volume has an upwards bias and makes sense if the larger trend is still up.

On Balance Volume is still constrained below resistance and above support.

RSI is not extreme and still in bullish territory.

ADX indicates a new trend; it is above 15 and rising. The trend is up.

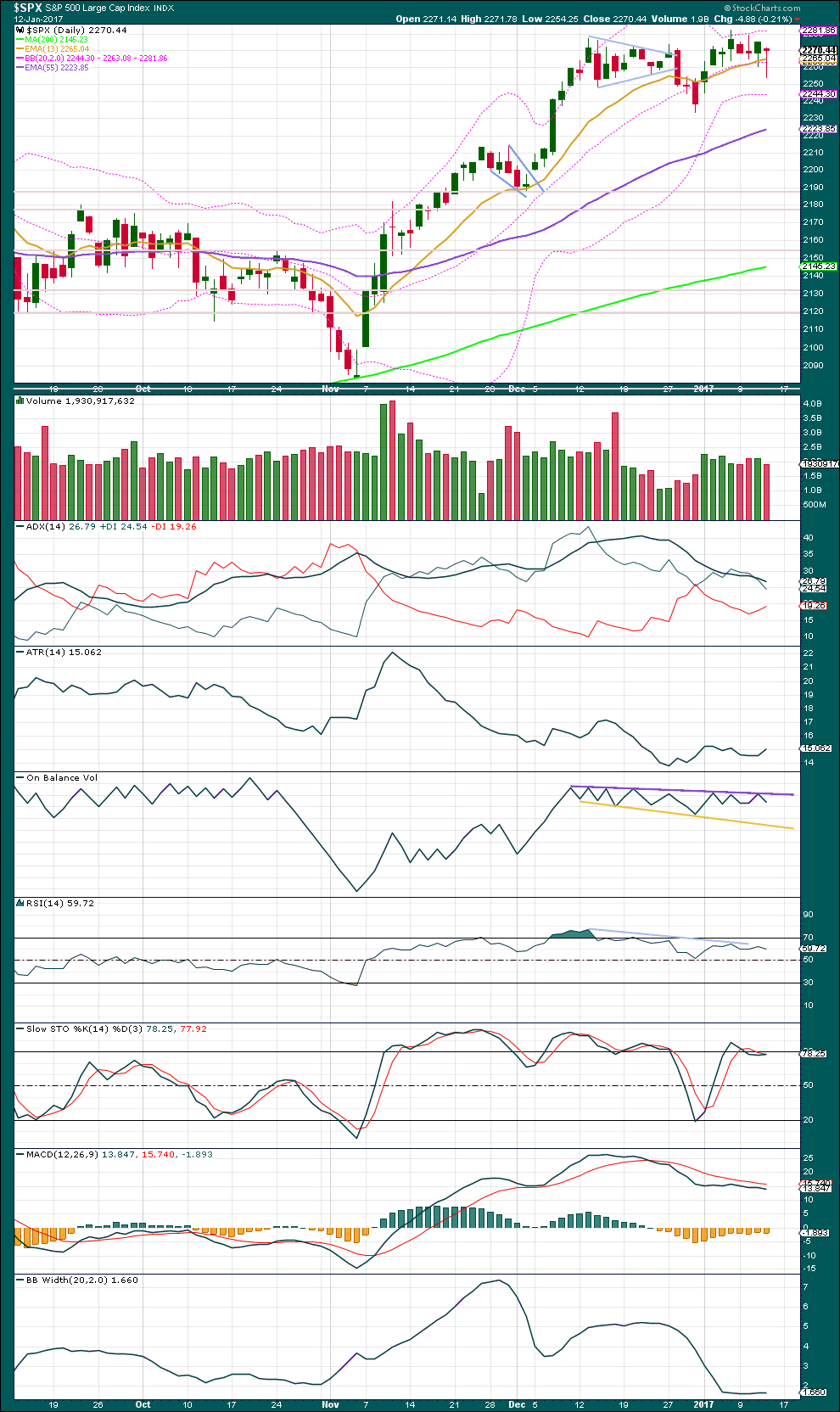

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Two days of downwards movement comes with lighter volume for the second day. The fall in price today did not have much support from volume; the market fell today mostly of its own weight. The balance of volume today was downwards. This gives slight cause for concern over the short term expectation from the Elliott wave count.

The long lower wicks of the last two daily candlesticks also gives some cause for concern; these wicks are bullish.

ADX is declining, indicating the market is consolidating and not trending. No trend change has been indicated as the +DX line remains above the -DX line.

ATR is flat as price moves overall sideways, typical of a consolidation for this market.

On Balance Volume today found resistance and moved down from the purple trend line. This line has very strong technical significance now: it is reasonably long held, has been tested now eight times, and has a very shallow slope. Expect it to continue to provide resistance. A break by OBV above this line would be a strong bullish signal. The yellow support line allows for a reasonable amount of downwards movement as it is some distance away.

Price and RSI exhibited divergence at the last high supporting the Elliott wave count. The end of B waves should exhibit weakness. B waves are suckers.

Divergence at the last high was also exhibited by Stochastics and MACD offering further support for the Elliott wave count.

Bollinger Bands remain tightly contracted as price moves mostly sideways. Look out for volatility to return to this market shortly.

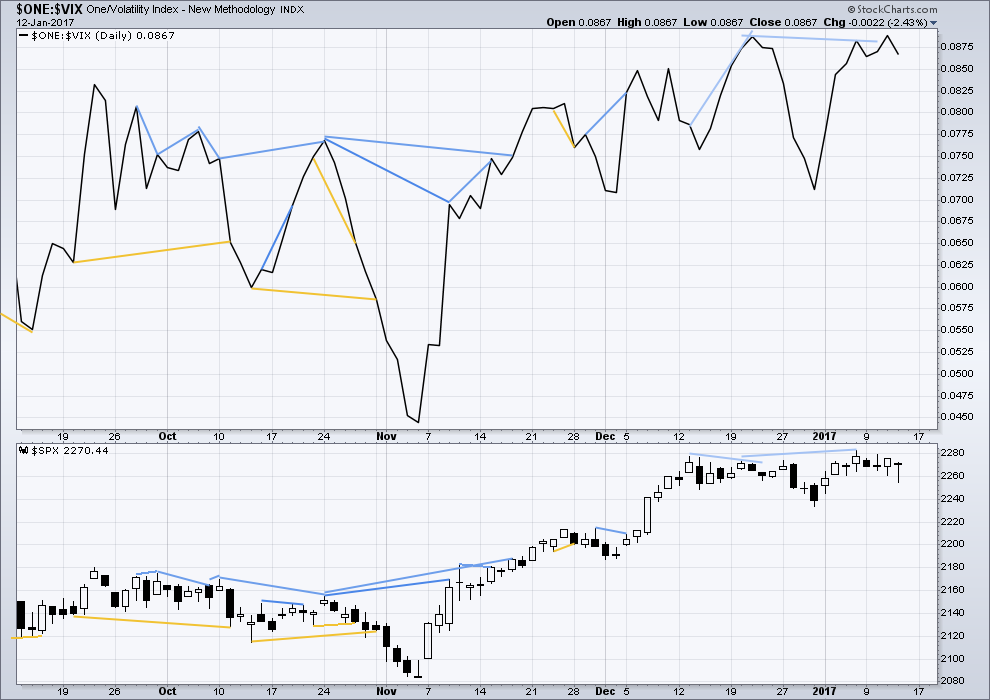

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is mostly working to indicate short term movements spanning one or two days. While this seems to be working more often than not, it is not always working. As with everything in technical analysis, there is nothing that is certain. This is an exercise in probability.

Single day divergence noted in yesterday’s analysis between price and inverted VIX has now been followed by one day of downwards movement. It may now be resolved, or it may be followed by another day of downwards movement.

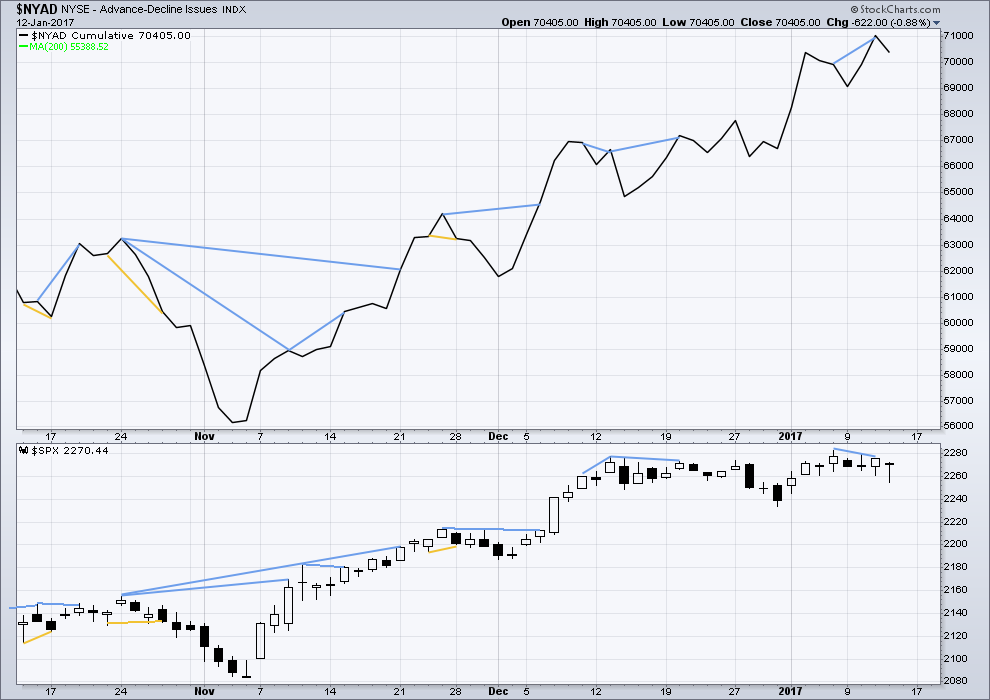

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

Short term divergence noted in yesterday’s analysis between price and the AD line has now been followed by one day of downwards movement. It may now be resolved, or it may still be followed by one more day of downwards movement.

I subscribe to Lowry’s On Demand service to keep a track of the health of the market in terms of market breadth. They conclude that this bull market is strong and healthy, and is likely to continue for at least three or four months, if not substantially longer.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq have made new all time highs in December of 2016. This confirms a bull market continues.

This analysis is published @ 08:43 p.m. EST.

The invalidation point should be at 2,282.1. As long as price remains below this point then intermediate wave (4) should be continuing.

Instead of three overlapping first and second waves, it now looks like only one first and second wave complete.

Thanks Lara.

If we close in the red on SPX today after the gap up open, then Monday could be a strong down day because the bulls could not even keep a one day rally going.

Markets closed on Monday. Have a good long weekend everyone!!!

It’s closed green. But it’s a pathetic range and the upper wick is bearish. It looks like a typical small range day within a consolidation, which fits the wave count fairly nicely.

45 minutes into the trading day and SPX stands at 2277. The upwards movement has violated the second wave highs on the hourly count. The count will need to change. In addition, we have exceeded the green resistance trendline shown on Lara’s hourly count chart.

good point, Rodney. Question for Lara: you wrote that “the tentative green resistance line has been tested now four times, so it has slightly better technical significance today. Confidence may be had in this line.”

What does “confidence may be had in this line” mean? Is it a ceiling (which has been poked through) or does it become a floor (after it has been punctured and climbed onto)?

It means the line was expected to hold.

But I was wrong.

Lara, do you think the stock market can go down at the same time the dollar is rising? This would probably push gold down as well.

The dollar made a new low 12th January. For that wave count minute iv is continuing lower now; minuette (c) looks like a three now, it needs to be a five.

So both may now be going down.

But the inverse correlation between the S&P500 and USD Index is not persistent.