Upwards movement was expected for Friday’s session.

A small green doji completes an inside day, which mostly fits expectations.

Summary: The main wave count now expects upwards movement here for a fifth wave to end a third wave. The target is at 2,226 – 2,227. This bull market is ageing, but it still shows some signs of strength and is not done yet. Corrections present an opportunity to enter the trend.

Last monthly chart for the main wave count is here.

Last weekly chart is here.

New updates to this analysis are in bold.

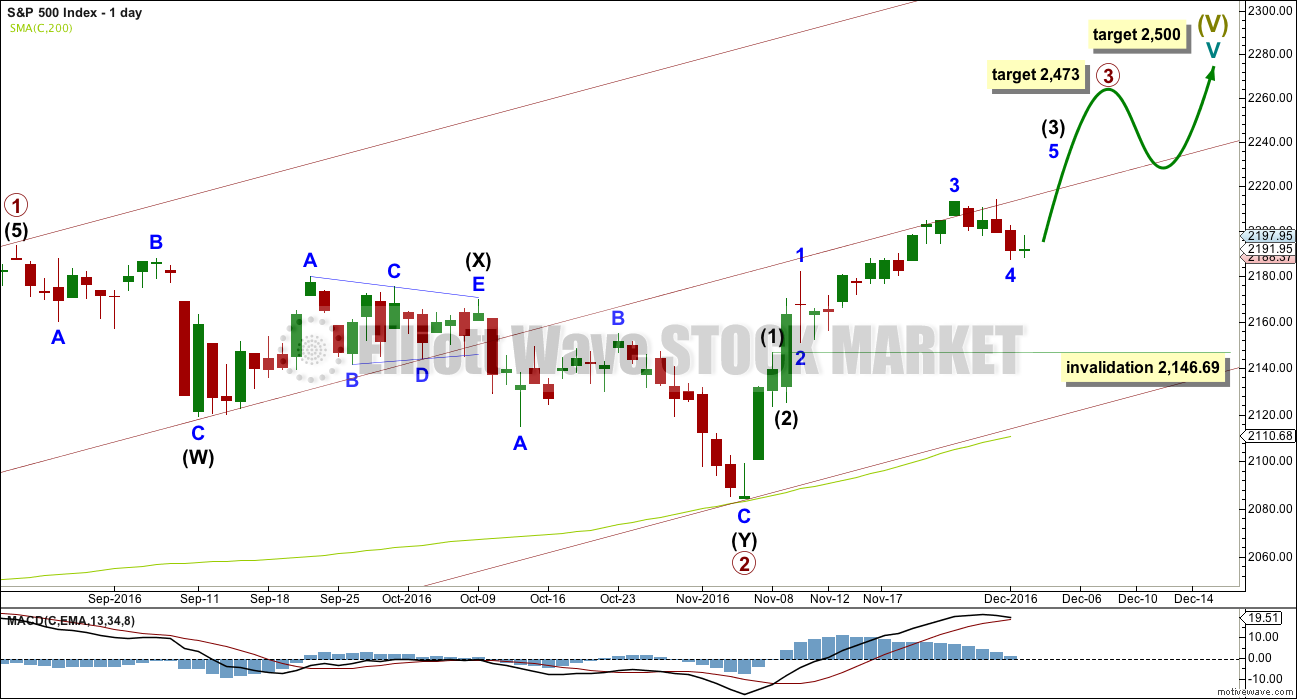

MAIN WAVE COUNT

DAILY CHART

Cycle wave V must subdivide as a five wave structure. At 2,500 it would reach equality in length with cycle wave I. This is the most common Fibonacci ratio for a fifth wave for this market, so this target should have a reasonable probability.

Cycle wave V within Super Cycle wave (V) should exhibit internal weakness. At its end, it should exhibit strong multiple divergence at highs.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may be over halfway through and is so far exhibiting weaker momentum than primary wave 1, which fits with the larger picture of expected weakness for this fifth wave at cycle degree. It is possible primary wave 3 may fall short of the target and not reach equality in length with primary wave 1.

Within primary wave 3, the upcoming correction for intermediate wave (4) should be relatively brief and shallow. Intermediate wave (1) was over very quickly within one day. Intermediate wave (4) may last a little longer, perhaps two or three days, and may not move into intermediate wave (1) price territory below 2,146.69.

At 2,473 primary wave 3 would reach equality in length with primary wave 1. This Fibonacci ratio is chosen for this target calculation because it fits with the higher target at 2,500.

When primary wave 3 is complete, then the following correction for primary wave 4 may last about one to three months and should be a very shallow correction remaining above primary wave 1 price territory.

The maroon channel is redrawn as a base channel about primary waves 1 and 2. Draw the first trend line from the start of primary wave 1 at the low of 1,810.10 on the 11th of February, 2016, then place a parallel copy on the high of primary wave 1. Add a mid line, which has shown about where price has been finding support and resistance.

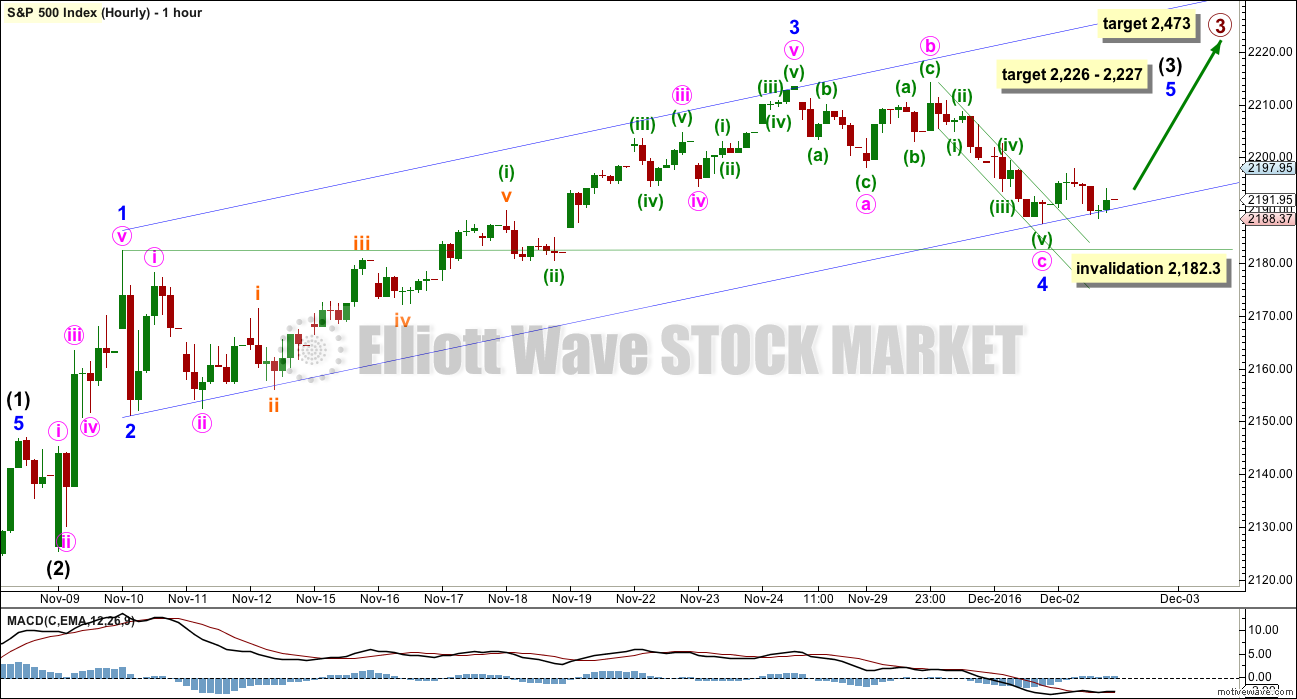

HOURLY CHART

At 2,227 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Now within intermediate wave (3), at 2,226 minor wave 5 would reach 0.618 the length of minor wave 3. This gives a 1 point target zone calculated at two degrees.

This wave count sees the middle of a third wave particularly weak; this is not common. The larger context of a fifth wave at cycle and Super Cycle degrees may see persistent unusual weakness though, so this wave count is possible.

Price has breached the upper edge of the small green channel about minute wave c, so it looks like minor wave 4 may now be complete. However, this channel does not hold good technical significance because it is steep and short held. It must be accepted that the breach increases the probability that minor wave 4 is over, but it is still possible that price may continue sideways.

If minor wave 4 does continue sideways as a double flat or combination, then it would become grossly disproportionate to minor wave 2. This also means that it is very likely minor wave 4 is over now.

When there is a small five up on the hourly chart, then the invalidation point may be moved up to the end of minor wave 4. The invalidation point must be left as it is while there is not yet a five up complete.

Minor wave 4 may not move into minor wave 1 price territory below 2,182.30.

The wider blue channel is redrawn using Elliott’s second technique. Draw the first trend line from the ends of minor waves 2 to 4, then place a parallel copy on the end of minor wave 3. If minor wave 4 is over, then along the way up within minor wave 5 corrections should find support at the lower edge of this channel.

However, the S&P does not always work well with trend channels. Sometimes the S&P breaches channels and then continues in the prior direction. A breach of the lower edge of this channel would be a warning of a possible trend change, but it would not be a strong warning.

The S&P often forms slow rounded tops. When it does this the many subdivisions make analysis difficult. Only when support is breached by movement that is clearly downwards and not sideways would it be an indication of a deeper pullback.

Minor wave 5 may end about mid way within the channel. It must subdivide as a five wave structure. It may last about one or two weeks.

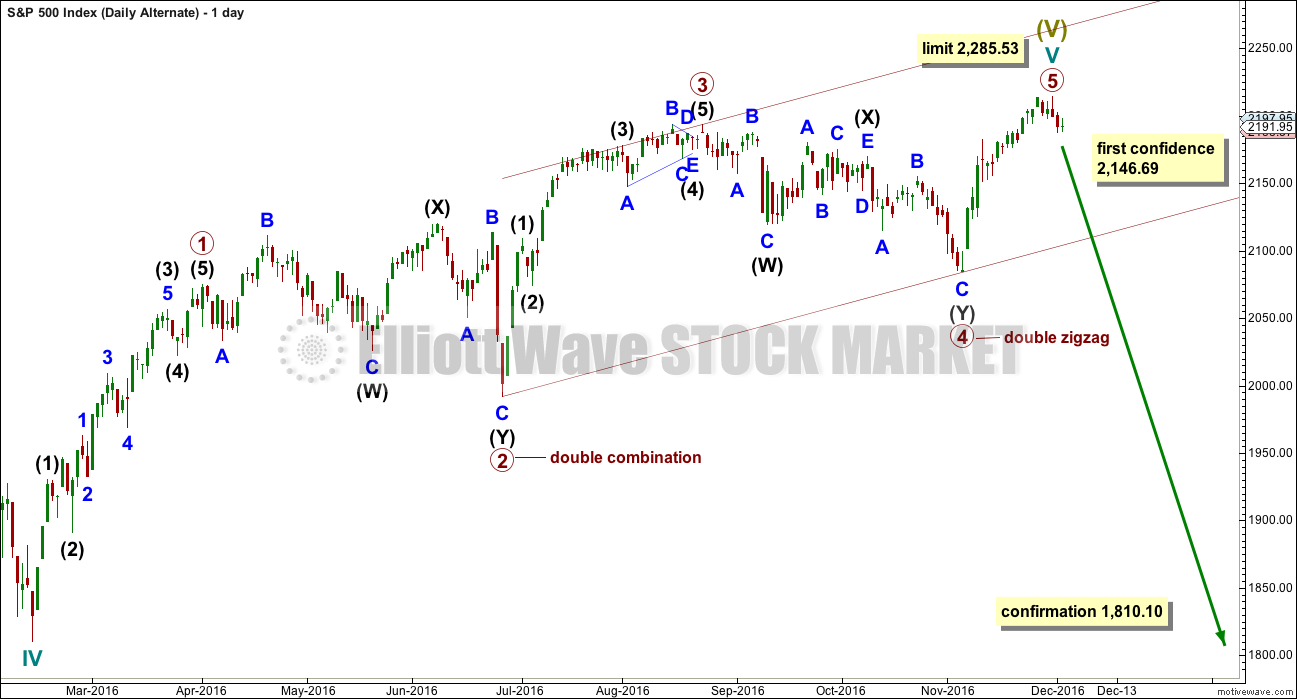

ALTERNATE WAVE COUNT

DAILY CHART

There is a wave count that fits for the Dow Industrials that sees an imminent trend change. It relies upon an ending diagonal, but that idea will not fit well for the S&P.

What if an impulse upwards is now complete? The large corrections labelled primary waves 2 and 4 do look like they should be labelled at the same degree as each other, so that gives this wave count the right look.

Primary wave 4 ends within primary wave 2 price territory, but it does not overlap primary wave 1. Primary wave 1 has its high at 2,057 and primary wave 4 has its low at 2,083.79. The rule is met.

There is alternation between the double combination of primary wave 2 and the double zigzag of primary wave 4. Even though both are labelled as multiples W-X-Y, these are different structures belonging to different groups of corrective structures.

Primary wave 3 is shorter than primary wave 1. This limits primary wave 5 to no longer than equality with primary wave 3 at 2,285.53.

The equivalent wave count for DJIA expects an end now to upwards movement and the start of a large bear market. Only for that reason will this alternate for the S&P also expect a reversal here.

This wave count has good proportions. Primary wave 1 lasted a Fibonacci 34 days, primary wave 2 lasted 60 days, primary wave 3 lasted 40 days, and primary wave 4 lasted 52 days. Primary wave 5 may be more brief than primary wave 3. If primary wave 5 is over now as labelled, then it may have ended in 18 sessions so with no Fibonacci duration.

If there has been a substantial multi generational trend change last week, then price should be falling with strength. The fact that it is not must reduce the probability of this wave count. This wave count remains technically viable, it is a warning of a potential fall in price, but it does not have support from classic technical analysis this week.

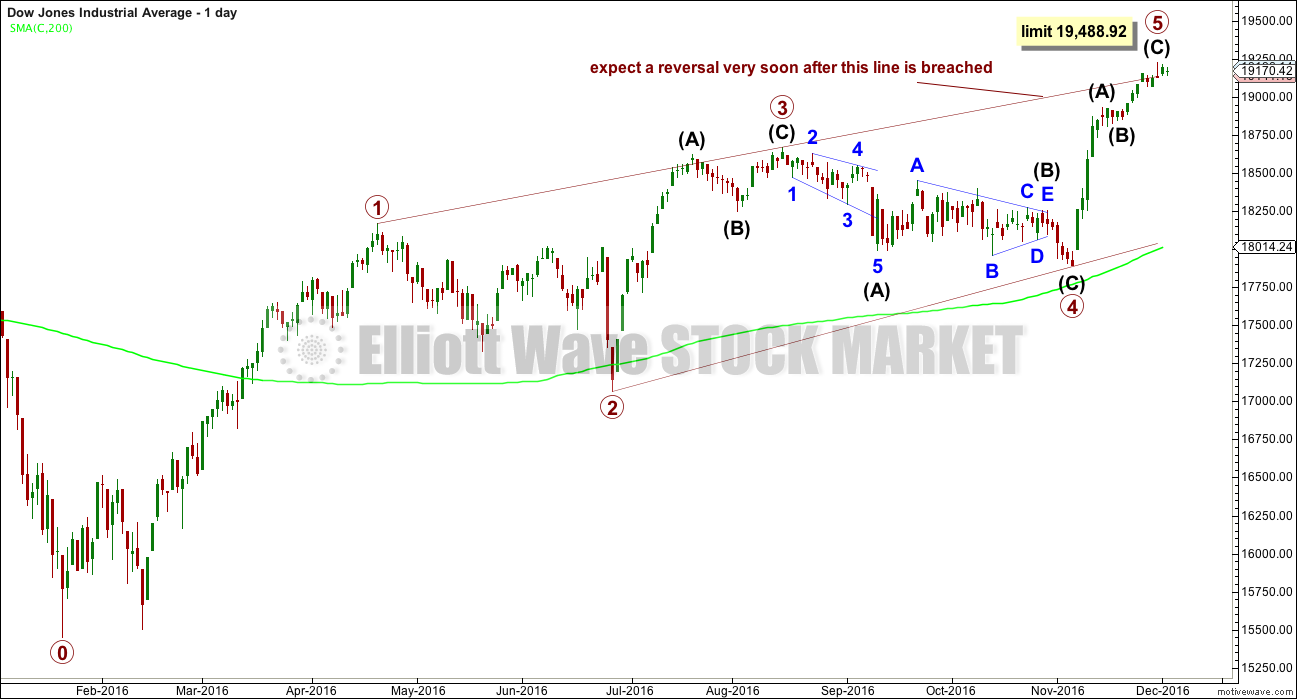

DOW JONES INDUSTRIALS

DAILY CHART

An ending contracting diagonal may be complete for the DJIA. This fits into the same picture as the alternate wave count for the S&P; both see a final fifth wave coming to an end very soon.

The 1-3 trend line is now overshot. Contracting diagonals normally end very quickly after this line is overshot, and it can be surprising how small the overshoot is. This wave count expects a very strong reversal.

The gravestone doji has now been followed by a green daily candlestick and now a small doji. This is not the start of a strong fall because price is not behaving as expected from this wave count. The probability of this wave count has reduced.

The reversal is usually swift and strong when ending diagonals are complete.

The diagonal is contracting, so the final fifth wave is limited to no longer than equality in length with primary wave 3 at 19,488.92.

TECHNICAL ANALYSIS

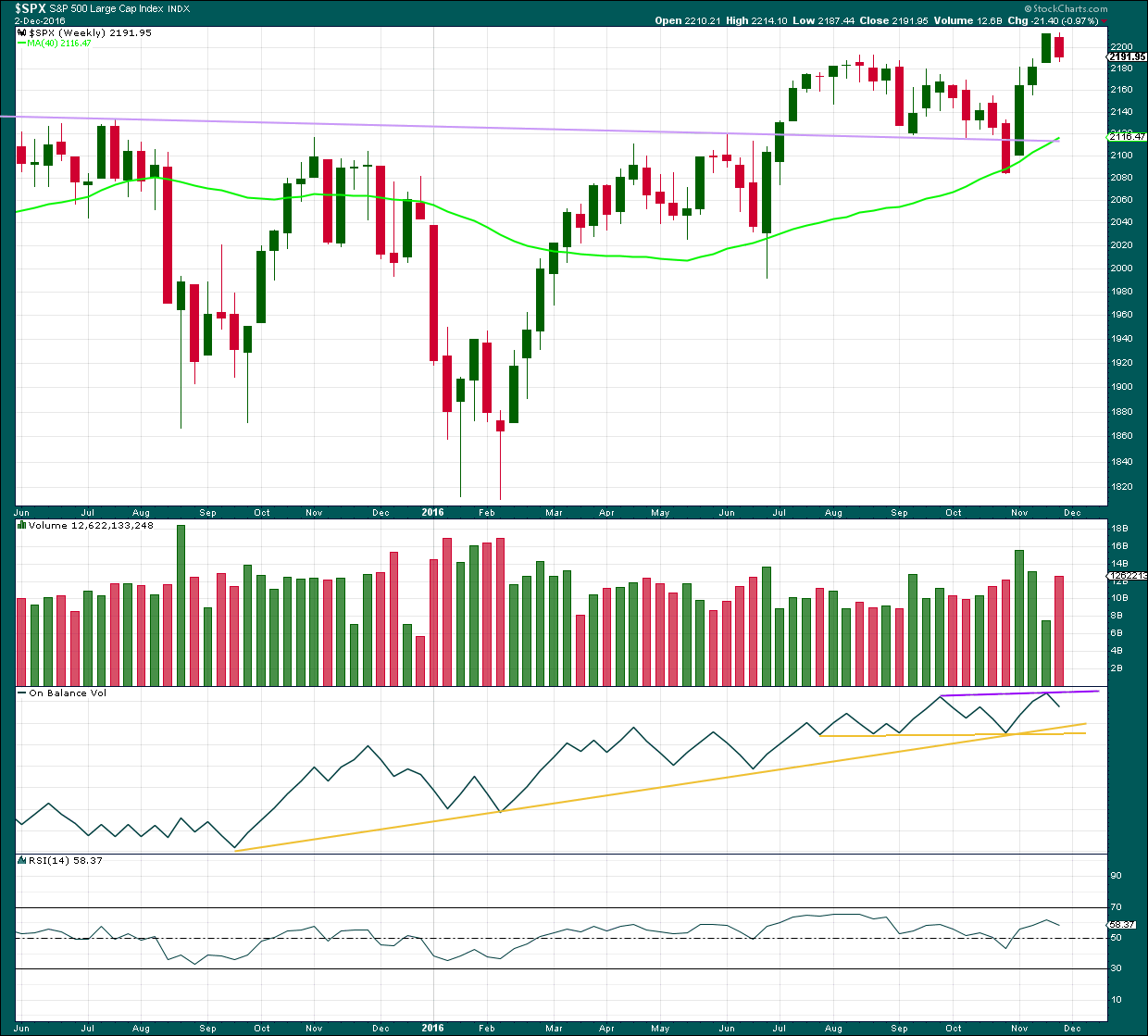

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price moved overall upwards this week with a higher high (slightly) and a higher low. But the week closed with a red candlestick.

On Balance Volume this week moved lower. With stronger volume this week, the balance of it was downwards. The fall in price this week was supported by volume.

If price falls further next week, then the support lines for OBV may assist to hold the fall, at least temporarily.

If OBV breaks above the purple resistance line, that would offer a weak bullish signal.

RSI is not extreme. There is room for price to rise. There is mid term divergence with price and RSI for the new high this week and the high in August. This indicates weakness, but this is expected from the Elliott wave count.

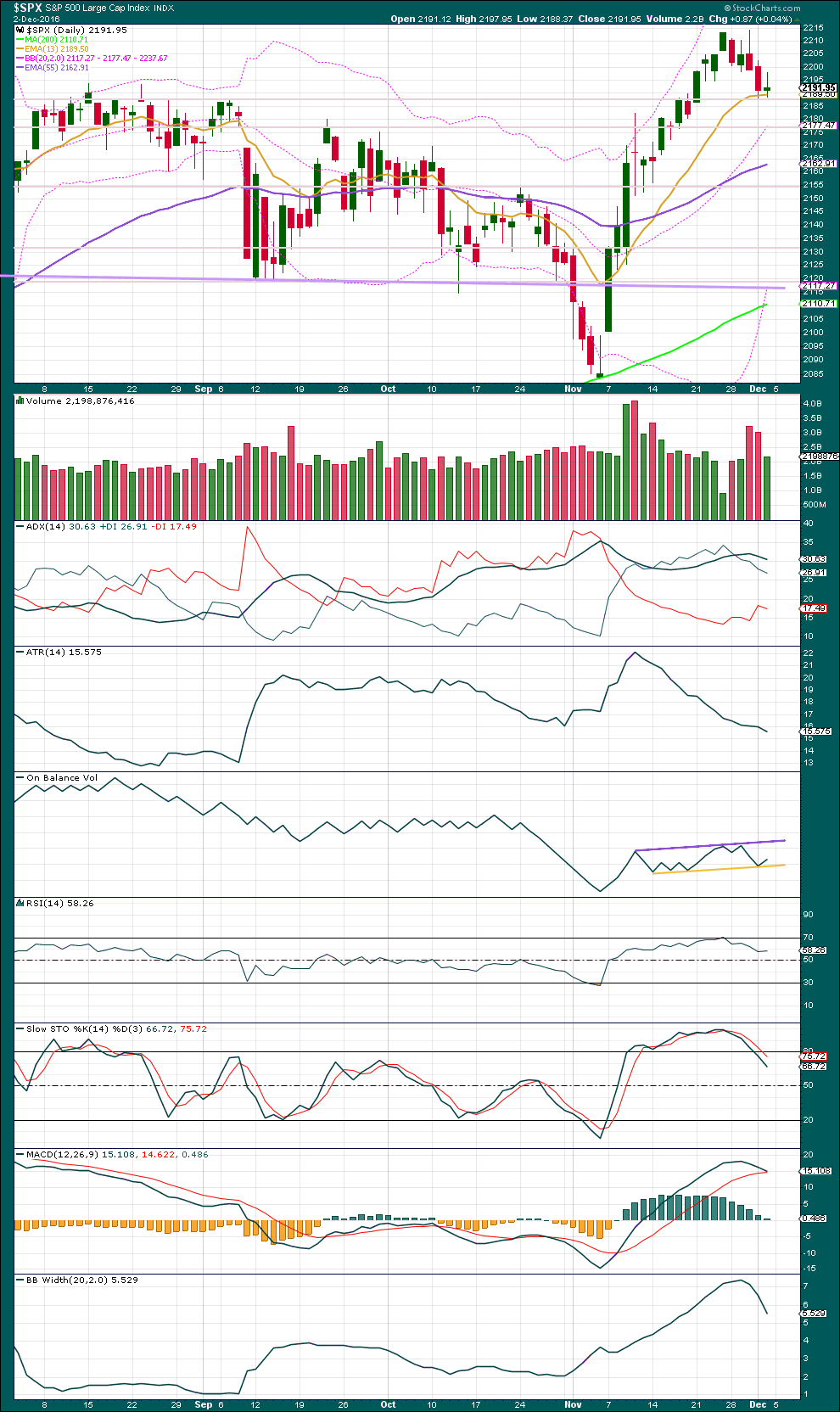

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small inside day completes a small doji or possibly a spinning top (the real body may be slightly too large to be considered a doji). However, the message is the same: the short term trend may have moved from down to neutral.

Price is finding support at the horizontal line at 2,187 and the Fibonacci 13 day moving average.

Price is above all three moving averages. The short term Fibonacci 13 day average is above the mid term Fibonacci 55 day average, and both are above the long term 200 day average. All three are still pointing upwards. At this stage, assume the trend remains up.

ADX is now pointing downwards indicating no clear trend currently, and bringing it back down from close to extreme. There is again room for the trend to continue further.

ATR is declining, indicating the market is not trending; or if it is, that there is something wrong with the trend. Each day bulls were able to push price higher by smaller and smaller amounts. Again, weakness is expected from the Elliott wave count and this fits expectations.

Bollinger Bands are now contracting.

The message is that currently the market is consolidating, and that is what is expected for this last week as a small minor degree correction unfolded. But the larger trend remains upwards.

For Friday MACD may be getting ready to cross over, but it has not done so yet. This is not yet a bearish signal. MACD will be watched closely next week.

The pullback this week has brought Stocahstics and RSI back down from extreme. There is again room for price to rise.

On Balance Volume has bounced up again from the yellow line, strengthening this line. This gives a bullish signal and supports the Elliott wave count. This line has been tested four times now, so it has some reasonable technical significance. Some resistance may be seen when OBV reaches the purple line. If it turns down and breaches the yellow line, that would offer a bearish signal.

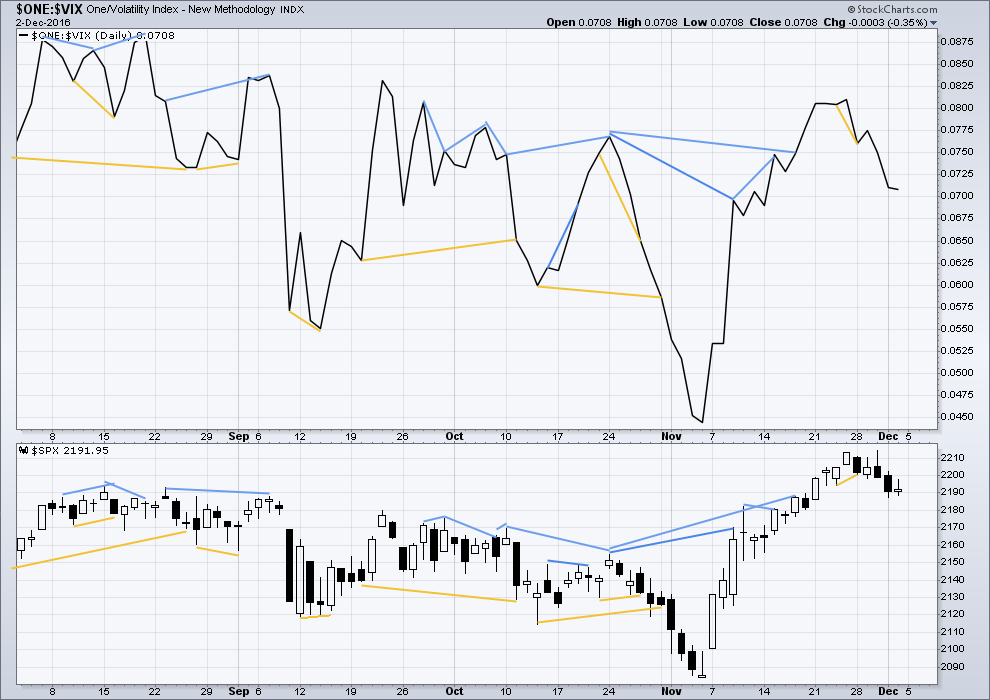

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is again working to indicate short term movements spanning one or two days. While this seems to be working more often than not, it is not always working. As with everything in technical analysis, there is nothing that is certain. This is an exercise in probability.

There looks like some single day divergence between price and inverted VIX: price moved higher to complete a green doji, and during the session On Balance Volume indicates there was some support for upwards movement from volume, but inverted VIX has moved lower. Volatility increased during the session, and this divergence may be read as bearish giving small cause for concern over the Elliott wave count for Monday and Tuesday.

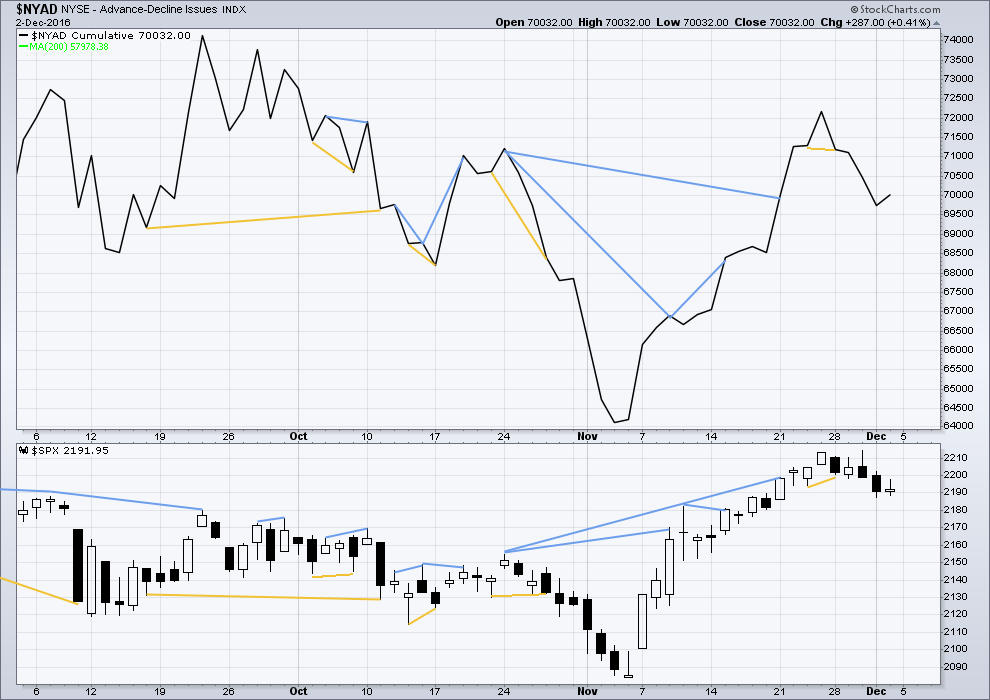

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

There is longer term divergence between price and the AD line, but like inverted VIX this has proven reasonably recently to be unreliable. It will be given no weight here.

Breadth improved during Friday’s session supporting the overall rise in price. There is no short term divergence noted here between price and the AD line.

Lowry’s Operating Companies Only (OCO) AD line also shows support from market breadth. There is some strength to this bull market at this stage even as it ages. This supports the Elliott wave count, which sees a third wave up underway.

DOW THEORY

Major lows within the old bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the bear market from November 2014:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – closed above this point on the 9th of November, 2016.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: The transportations indicate an end to the prior bear market. The transportation index confirms a bull market.

This analysis is published @ 06:22 p.m. EST on 3rd December, 2016.

Looks looks like DJI and SPX trading places so far are printing gravestone dojis go. 🙂

Any guesses on how low we are going on the next correction?

I was initially thinking the 50 dma but that is too far away for the current count.

Well well well! Where are the erstwhile banksters? Are they really going to allow that opening gap to be filled??! C’mon dudes, buy some futures will ya?

I guess they must be getting a bit tired from all that propping! 😀

I think they should be exhausted by now Verne.

That gap looks like a pattern gap, so yeah, it’s likely to be filled.

Complacency in the markets becoming even more extreme. Despite obvious weakness in equity price action VIX continues to head South. Market participants apparently blissfully unaware of the thin-ness of the ice on which they are merrily skating.

In the next week or two after this next fourth wave correction we are going to probably see a 50% haircut in UVXY during the final wave up. I think it will probably go down to around 8.00 or so and I would not be surprised to see VIX also make a new multi-year low. I know what I am going to be doing when that happens. Howzabout youse guys? 🙂

DJI looking to print yet another gravestone doji, or perhaps a regular one. The banksters had better get (or should I say STAY ?) busy if they want to keep the party going!

One of the reasons I like buying option contracts for a buck is that you have a nice and easy visual confirmation of whether you are right or wrong about the trade. The mental stop is very easy to visualize without actually placing it in the market. For example, a 20% stop loss means you sell ’em at 0.80 cents plain and simple, no need to think (or drink!) 😀

A fill of the closing gap at around 115.50 from Friday’s close greatly increases the chance of a take-out of the November 4 lows in very short order.

Filled at 1.00 even on beautiful bankster spike up. Thanks guys! 🙂

Buying Dec 16 expiration 166 triple Q puts for limit price of 1.00 per contract. Stop at today’s high of 117.06

Triple Qs coming up to test 21 day EMA. Should tag it just at about 117.20 at which point I will re-enter short positions via Dec 23 115.50 puts for limit price of a buck.

Yep. Definitely bankster co-ordinated buying on this spike up out of the triangle. Same feint going on in the European markets. I would not chase it. Note the pathetic volume.

This move is probably terminal ahead of at the very least a minor correction before the final move up to complete this long-in-the-tooth bull run. NDX will most likely again lead the way down so I am watching it closely.

Reloading mid term volatility calls. Buying Dec 23 UVXY 11 strike calls for 0.92 per contract.

It seems the lower the volume, the easier it is for them to cause the spikes. Looking forward to a “real” market, whenever that might return. I fear the public is going to get really really really blindsided pretty soon, as the panic purchasing when the market is only down a few points highlights the fear of said “Banksters”.

The ED for DJI remains vialble until and unless it breaks around 19,450 The spike up today was what I was hoping we would get last week but price just ambled along the top of the 1-3 trend-line. This qualifies as a genuine throw-over and if the ED is indeed in play, a swift move back below the 1-3 trendline should shortly follow.

All the ingredients are there…..

Ingredients is an interesting word. Kinda reminds me of watching my daughters happily baking cookies…Yum! 🙂

Quick question, has anyone kept track of the number of times futures broke support/pivots only to have a parabolic upside rip? Since March, I’ve seen the pattern somewhat synchronized with the open of the FTSE, close of Nikkei, and middle of the US futures session. Last night again, futures broke 2180, out of a downside triangle, followed by a parabolic move from 2am-4am. I’m guessing the response is the “Banksters”, but this has become so egregious I wonder if all the money managers would get spooked. Nice to here you caught some waves Lara! We had some chest-high tradeswell over the weekend that provided some nice reprieve from the markets.

Just another Con Job by the Banksters!

They are incorrigible. I wonder when these international criminals are going to inform the poor folk in Italy that they are on the hook for the hundreds of billions in bad loans on the books of their country’s banks. Rumor has it that Renzi is crazy like a fox, and will use the coming chaos to issue a “I told you so” and engineer his political rehabilitation. Amazing!

I think the Vaffanculo Party in Italy is going to win out in this next phase.

As always Lara, nicely done. It sure has been a pleasure to be part of this site this last year. Your commentary and analysis are quite helpful. Thank you. I hope you are having a great weekend.

🙂 Thank you Rodney

I’m having a blast this weekend. I’m in Auckland, and I saw Cold Play Saturday night. They put on a great show.

I even managed a quick surf Saturday morning

Cool. Or should I say Cold! good band.