Last analysis of AAPL on 4th March, expected more downwards movement in a three wave structure. Price has moved sideways. This is wave B of the three wave structure.

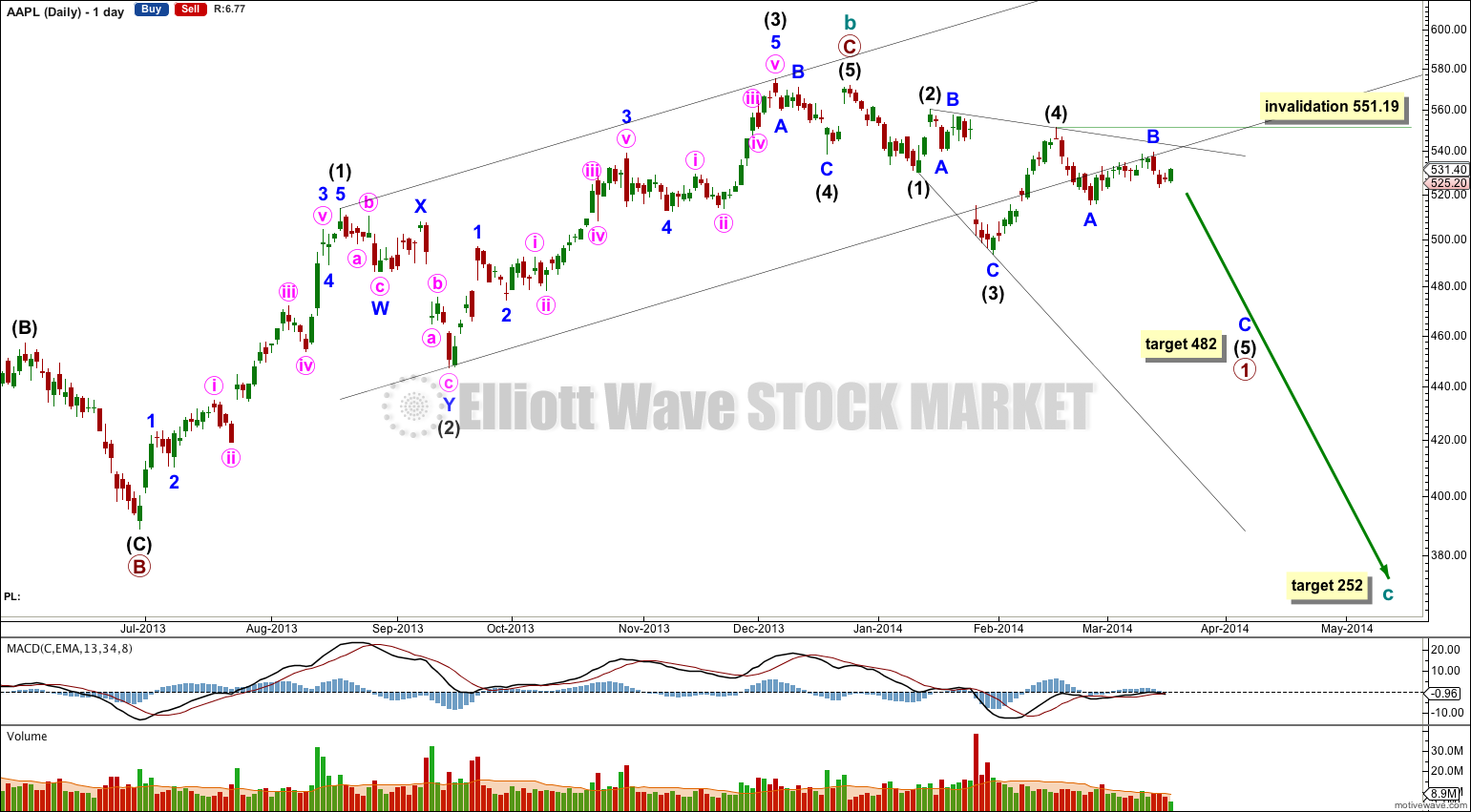

Within the bigger picture this wave count sees AAPL in a super cycle zigzag correction which is just over two thirds completed.

Within the zigzag cycle wave b ended at 571.88 with a small truncation in the final fifth wave up.

At this stage I expect a big leading expanding diagonal is unfolding for a first wave at primary degree.

Within the leading diagonal intermediate wave (2) is a 72% correction of intermediate wave (1), and intermediate wave (4) is a 86% correction of intermediate wave (3).

I would expect intermediate wave (5) to be longer than intermediate wave (3) and to reach down to 484.54 or below. At 482 minor wave C within intermediate wave (5) would reach 1.618 the length of minor wave A.

I had expected (two weeks ago) this target should be met in about three weeks. Downwards movement is very slow and so the target may be yet another few weeks away.

Within intermediate wave (5) no second wave nor B wave may move beyond the start of the first or A wave. This wave count is invalidated with movement above 551.19.

At 252 cycle wave c would reach equality in length with cycle wave a. This target is about one year away.

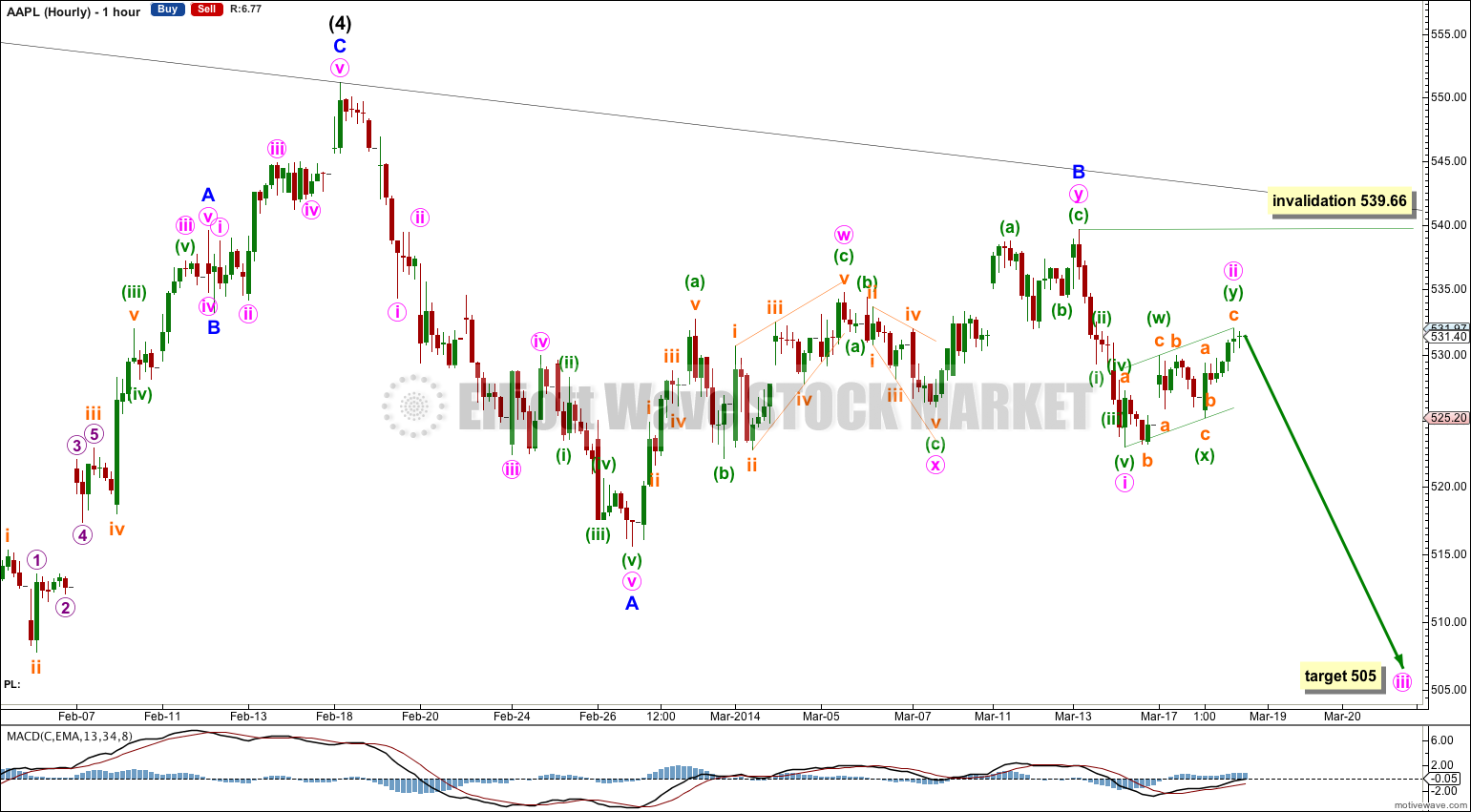

Within intermediate wave (5) so far minor waves A and B are most likely complete.

Within minor wave C minute wave i and now ii also are most likely complete. If minute wave ii moves higher it may not move beyond the start of wave i above 539.66.

At 505 minute wave iii would reach 1.618 the length of minute wave i.

When the small green parallel channel about minute wave ii is clearly breached with downwards movement then I would have confidence that minute wave iii has begun.

Lara, I think it’s time for an AAPL update now that it’s up 8% after hrs. I’m curious what you come up with since I recently saw a count that predicted this move up which is obviously a third wave. I checked subdivisions of this count and all seemed to fit quite well.

Finally breaking to the downside, Lara? Volume on most of the upswing was pretty low. Do you have a target to get to pre earnings?

Thanks as always!

There was a pretty big volume spike on 21st March which was a down day. Because it was a down day it could possibly be an indication that a breakout will be down.

No target yet, sorry. I won’t be able to calculate a target for this one for you until close to the end. Use the lower aqua blue trend line for now.

Where is the aqua blue trend line? Is it on a chart from a different date?

I’m so sorry. I answered the comment in Disquis admin… and didn’t take appropriate notice of which analysis the comment was on.

I’ll update AAPL analysis this week and provide a target for you than.

Thanks!

Hi Lara,

Have your views changed on appl? Hasn’t really gone anywhere.

Lara-

Are you onboard with Minor B completing today at $540.50? Nasdaq getting murdered last 2 days with the exception of Apple? I’m assuming you won’t get bullish until it breaks above the trendline of the expanding diagonal.

Yes, yes and yes 🙂

AAPL should find resistance at that trend line.

The new low on Nasdaq is unconfirmed, in that DJIA, DJT and SPX didn’t make new lows. But… it looks pretty strong doesn’t it!

We definitely need a bullish wave count after today’s price action. Could we be breaking out of a int wave 4 triangle to complete int 5 of primary C?

That does not work on the daily chart, no triangle of intermediate degree size is forming.

But a triangle may be forming on the hourly chart, which would explain this choppy sideways movement quite nicely. Except it’s not supported by MACD…

But this will be an alternate idea today.

Dear Lara,

AAPL is trading in a wedge – higher lows, lower highs on the 60-min chart. The BBs on the daily chart are getting tighter. A big move is coming! The question is, which way? The price keeps getting rejected on the declining trend line on the daily chart, but I think there will be breakout next week. In case there is a breakout to the upside, what is the alternative “bullish” wave count?

At this stage… I don’t have an alternate for AAPL. I can see one idea but I haven’t charted it yet.

Hi Lara,

I was wondering if you had a chance to chart the alternative (bullish) wave count for AAPL. It looks like it want to go higher (probably until the earnings are announced on Apr 21).

Thanks!

No, not yet.