Last analysis expected upwards movement from AAPL. Price has moved slightly higher, but mostly sideways.

The fourth wave that I expected was over in last analysis looks like it is continuing further sideways as a contracting triangle. It is nearly complete.

If the triangle remains valid then there would be a high probability that this wave count is correct. At that stage I would expect a sharp upwards thrust about $27 in length.

Click on the charts below to enlarge.

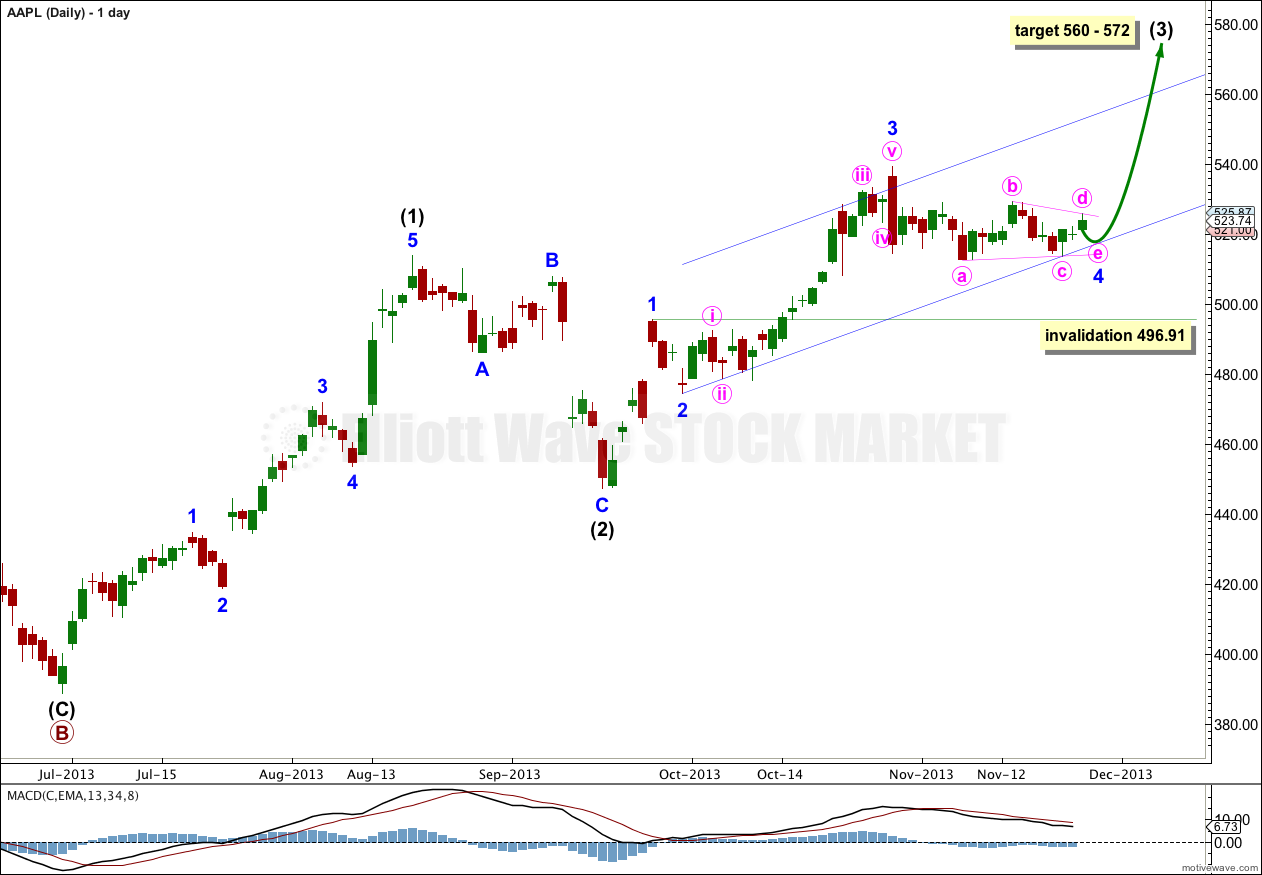

The daily chart shows the structure of primary wave C upwards within a larger upwards correction for a cycle wave b zigzag.

Within primary wave C so far intermediate waves (1) and (2) are complete. Intermediate wave (3) is an incomplete impulse.

Within intermediate wave (3) minor wave 3 has no Fibonacci ratio to minor wave 1.

I have redrawn the channel about intermediate wave (3) again this week using Elliott’s second channeling technique. Draw the first trend line from the lows of minor waves 2 to 4, then place a parallel copy upon the high of minor wave 3. As minor wave 4 finishes redraw the channel. I will expect minor wave 5 to end midway within this channel, or about the upper edge.

Minor wave 4 is an incomplete contracting triangle. The final e wave downwards needs to complete. Minor wave 4 may not move into minor wave 1 price territory. This wave count is invalidated with movement below 496.91.

At 572 intermediate wave (3) would reach equality in length with intermediate wave (1). At 560 minor wave 5 would reach equality in length with minor wave 1. I am aware that this target zone is rather large, and so as we get closer to the end I will try to narrow it down when I can add to it at a third wave degree.

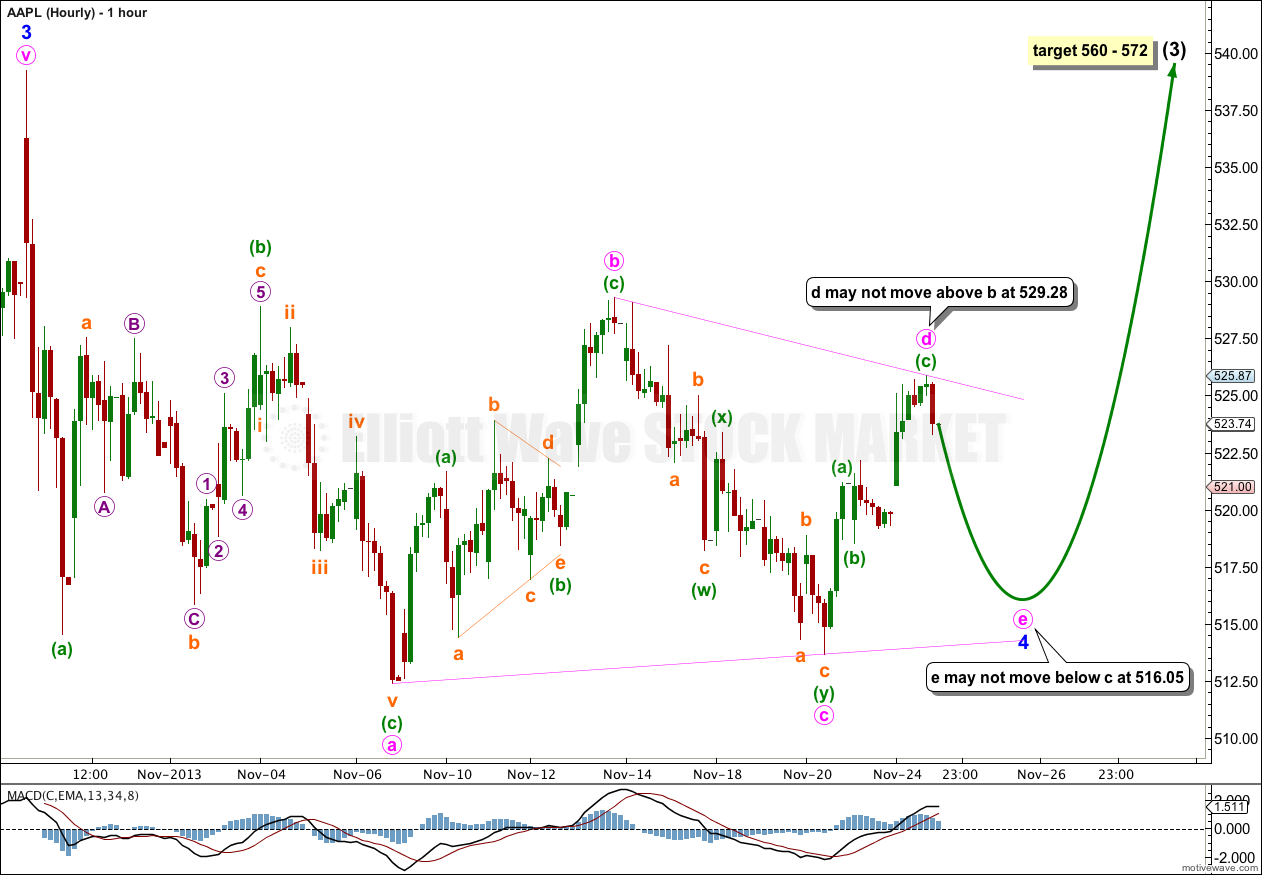

This hourly chart shows all of the structure of minor wave 4. For the triangle to remain valid any further upwards movement of minute wave d may not move beyond the end of minute wave b at 529.28, and the final wave down for minute wave e may not move below the end of minute wave c at 516.05.

If the triangle remains valid then the next wave upwards for minor wave 5 may travel a length about equal to the widest part of the triangle, which was $26.87.

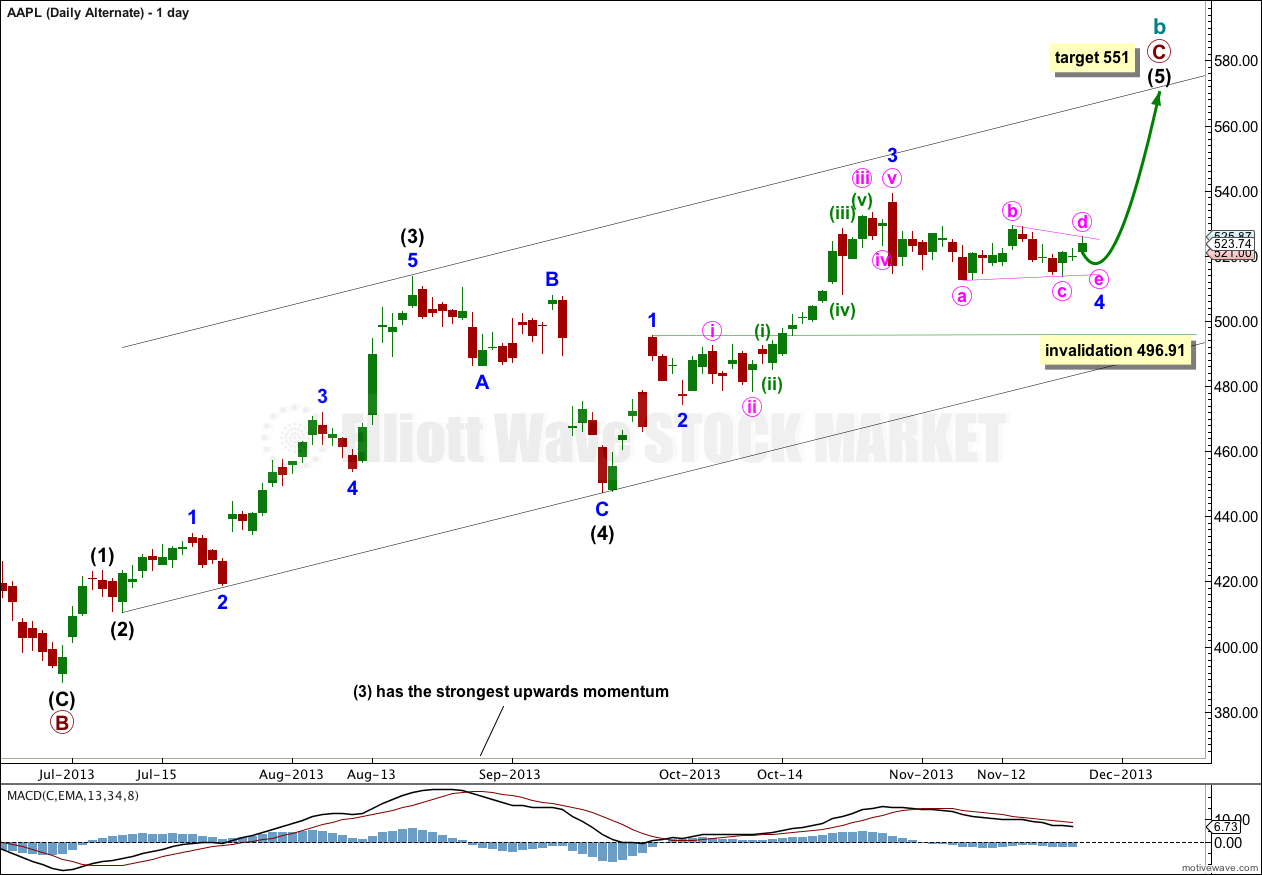

Alternate Daily Wave Count.

Although the main wave count has a good overall look and fit, this alternate must be considered because the main wave count does not agree with MACD.

The strongest momentum should be within a third wave. This alternate looks at the possibility that intermediate waves (3) and (4) are over.

This alternate has a problem of proportion: intermediate wave (4) is much bigger in duration than intermediate wave (2) which gives this wave count the wrong look.

At 551 intermediate wave (5) would reach equality in length with intermediate wave (3).

Apart from a differently calculated target this alternate does not diverge with the main wave count at this stage, and the expected direction is the same.

They will diverge in the future and at that stage I will use confirmation / invalidation points to determine which wave count is correct.

Hi Lara-

Any quick update on AAPL now that it shot higher today and did not complete e wave.

No.

Hi Lara-

Any quick update on AAPL with the invalidation this morning? Target still looks good.