Last analysis expected upwards movement from Apple which is what we have seen. The target remains at 518.48 and has not yet been reached. I expect more upwards movement.

Click on the charts below to enlarge.

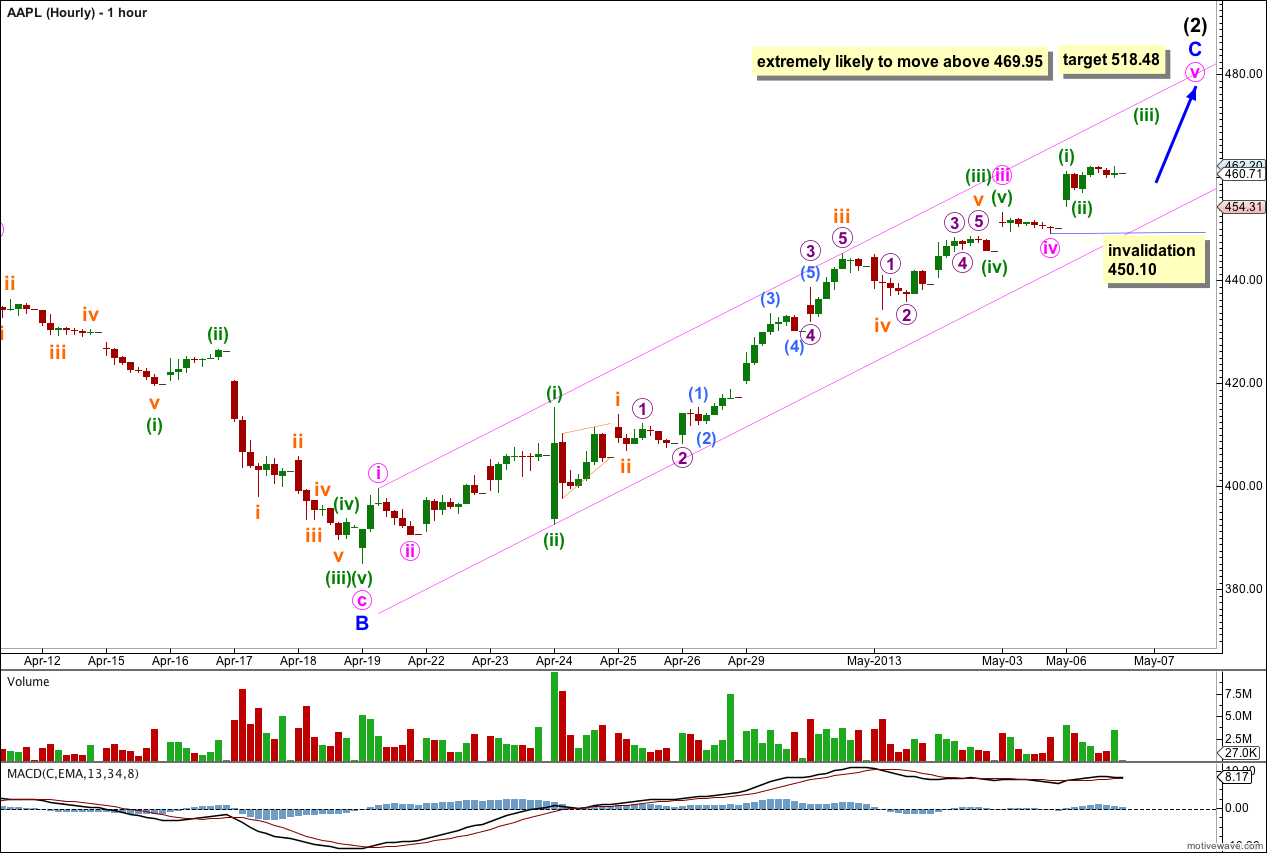

This wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Primary wave 3 is extending. Within primary wave 3 intermediate wave (1) is complete, and intermediate wave (2) is an incomplete flat correction. It is extremely likely that minor wave C within intermediate wave (2) will move above the high of minor wave A at 469.95 to avoid a truncation and a rare running flat.

Within intermediate wave (2) at 518.48 minor wave C would reach 2.618 the length of minor wave A.

At 272 primary wave 3 would reach 1.618 the length of primary wave 1. This long term target is still months away.

Intermediate wave (2) may not move beyond the start of intermediate wave (1). This wave count is invalidated with movement above 594.59.

I have considered various possibilities for this downwards movement from the high labeled primary wave 2. What is most clear is that the middle of primary wave 3 has not yet passed because we have not seen momentum increase beyond that seen for primary wave 1. Primary wave 3 cannot be complete.

A channel drawn about intermediate wave (1) using Elliott’s channeling technique has been clearly breached. This indicates that this impulse is over and the correction to follow it has begun.

Price has passed the short term target at last analysis which was 451.87. Minute wave iii is now likely to be complete at just 1.36 longer than 4.236 the length of minute wave i.

Because there is already a close Fibonacci ratio between minute waves i and iii I would not expect to necessarily see a ratio between minute wave v and either of i or iii. I will leave the target calculated at minor wave degree.

The parallel channel drawn here is a best fit. Draw the upper trend line from the high of minute wave i to the high of subminuette wave iii within minuette wave (iii) within minute wave iii, then place a parallel copy upon the low of minuette wave (ii) within minute wave iii. So far price has remained contained within this channel. I would expect it to continue to remain within this channel while minor wave C completes.

When this channel is clearly breached by downwards movement we shall have a first indication of a trend change.

Within minute wave v minuette wave (ii) may not move beyond the start of minuette wave (i). This wave count is invalidated with movement below 450.10 (prior to the end of minor wave C).

The next wave downwards will be a first wave at minor wave degree.

Intermediate wave (2) may not move beyond the start of intermediate wave (1). This wave count is invalidated with movement above 594.59.

If Wave 1 is 705 to 505, and Wave 3 is 600 to 275…does that put wave 5 down to essentially less value than AAPL has in CASH!??!?

Firstly, using all caps is the equivalent of shouting at someone. It’s rude. Don’t do it here.

Secondly, the fifth wave will end months from now. Apples cash position several months from now may very well be different than it is today. In fact, it would be unlikely to be the same as it is today.

I will not be able to calculate a target for the fifth wave until the fourth wave is over so at this stage I will make no prediction or comment at all on where it may end.