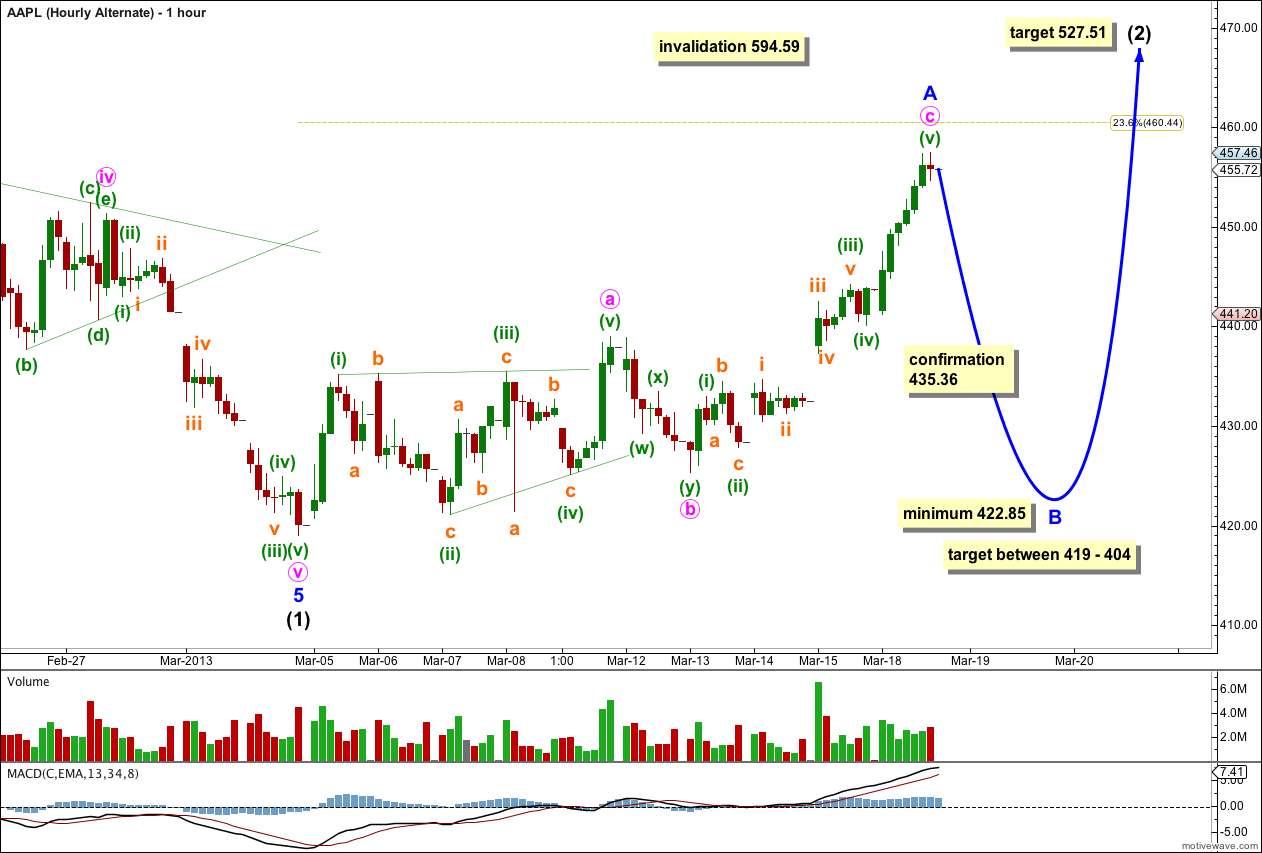

With movement above the invalidation point on the hourly chart and above the parallel channel on the daily chart, I have changed the wave count at intermediate degree.

Upwards movement is not a low degree second wave correction. I have it at intermediate wave degree. This means we would expect upwards movement for Apple for a few weeks yet.

Click on the charts below to enlarge.

This main wave count expects a five wave impulse for a cycle degree wave a is unfolding to the downside. Within the impulse primary waves 1 and 2 are complete. Within primary wave 3 intermediate wave (1) is a complete five wave structure and intermediate wave (2) may have just begun.

I would expect at this early stage for intermediate wave (2) to be relatively deep reaching to about 527.51 the 0.618 Fibonacci ratio of intermediate wave (1).

A parallel channel drawn using Elliott’s channeling technique about intermediate wave (1) is clearly breached by two upward candlesticks. This is trend channel confirmation that for now the downwards movement is over and a new upwards trend has begun.

Within intermediate wave (1) minor wave 3 is just 2.29 longer than 1.618 the length of minor wave 1, and minor wave 5 has no Fibonacci ratio to either of minor waves 1 or 3. Minor wave 2 is a relatively shallow double combination correction, and minor wave 4 is a shallow zigzag.

Intermediate wave (2) may not move beyond the start of intermediate wave (1). This main daily wave count is invalidated with movement above 594.59. If price moves above this point then we may use the alternate wave count below.

At 272 primary wave 3 would reach 1.618 the length of primary wave 1.

Within intermediate wave (2) minor wave A is unlikely to be complete.

Minor wave A is most likely to subdivide as a five wave structure because intermediate wave (2) is most likely to be a zigzag.

Within minor wave A minute wave i subdivides as a leading contracting diagonal. Minute wave ii is a deep double zigzag correction.

Minute wave iii is just 0.28 short of 1.618 the length of minute wave i.

Ratios within minute wave iii are: minuette wave (iii) has no Fibonacci ratio to minuette wave (i), and minuette wave (v) is just 0.98 longer than equality with minuette wave (iii).

Because minute wave ii was a deep correction we may expect minute wave iv to be shallow, about 0.382 of minute wave iii at 445.20. Minute wave iv is most likely to be a flat, zigzag or triangle. It may last one or two sessions. Thereafter, minute wave v should make a new high above the high labeled minute wave iii.

Minute wave iv may not move into minute wave i price territory. This wave count is invalidated with movement below 435.36.

When minor wave A is a complete five upwards then minor wave B must subdivide into a three wave structure downwards. Minor wave B may not move beyond the start of minor wave A. At that stage this main hourly wave count is invalidated with movement below 419.

If this main hourly wave count is invalidated with downwards movement then intermediate wave (2) may not be a zigzag and may be unfolding as a flat correction. We would then use the alternate hourly wave count below.

If price moves below 435.36 then intermediate wave (2) may be unfolding as a flat correction. Within a flat minor wave A subdivides into a three wave zigzag. Minor wave B must also subdivide into a three, most likely a zigzag. Minor wave B within a flat must reach 90% the length of minor wave A which is at 422.85.

The most common length of minor wave B in relation to minor wave A within a flat would be 100% to 138% the length of minor wave A at 419 to 404.

Minor wave B may make a new low below the start of minor wave A.

Thereafter, minor wave C is extremely likely to make a new high above the high of minor wave A to avoid a truncation and a rare running flat.

Alternate Daily Wave Count.

If the main daily wave count is invalidated with upwards movement above 594.59 then this alternate would be confirmed.

If cycle wave a is subdividing into a three wave structure then within it primary wave A may be a complete zigzag. Cycle wave a may be unfolding as a flat correction.

Within primary wave A intermediate waves (A) and (C) have no Fibonacci ratio to each other.

The parallel channel drawn here using Elliott’s technique about a correction is clearly breached by upwards movement. The downwards zigzag is over and an upwards trend has begun.

Primary wave B must subdivide into a three wave structure, most likely a zigzag.

If cycle wave a is a flat correction then primary wave B must reach at least 90% the length of primary wave A at 676.46.

Primary wave B may make a new high above 705.07. Primary wave B should last about six months.

Hi Lara,

For your leading diagonal labeling, shouldn’t it be 5-3-5-3-5 ?

No, not necessarily.

“Waves 1, 3 and 5 of a leading diagonal usually subdivide into zigzags but sometimes appear to be impulses” – Elliott Wave Principle, 10th edition, Frost and Prechter, page 88.

So we would expect them to be more likely to be zigzags.