A small pullback was expected to unfold here or shortly. An upwards day closes red, with a long upper wick on the candlestick. This looks like a small pullback may have begun at the end of this session.

Summary: If a small pullback remains above 2,376.98, then expect it is likely to be brief and shallow. Use it as an opportunity to join the upwards trend. If it moves below 2,376.98, then it may be deeper, ending about 2,365.

A new low below 2,344.51 would indicate the upwards breakout was false and a deeper pullback should continue.

Always use a stop and do not invest more than 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

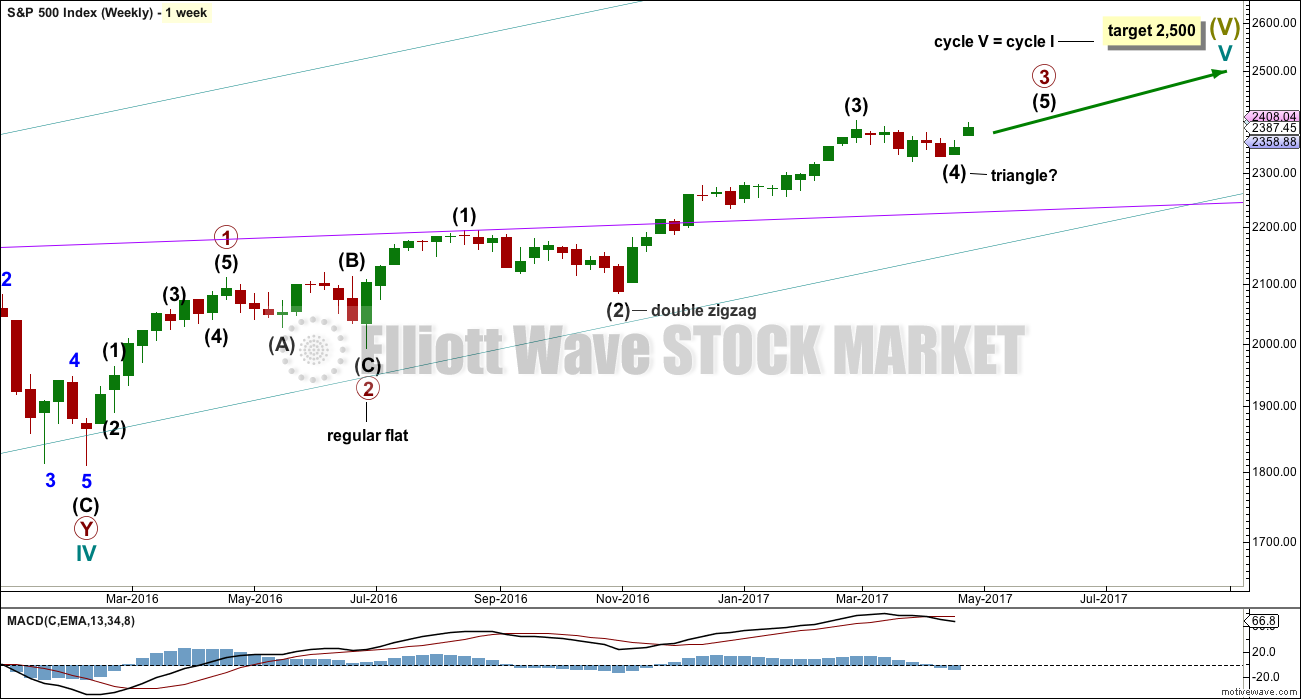

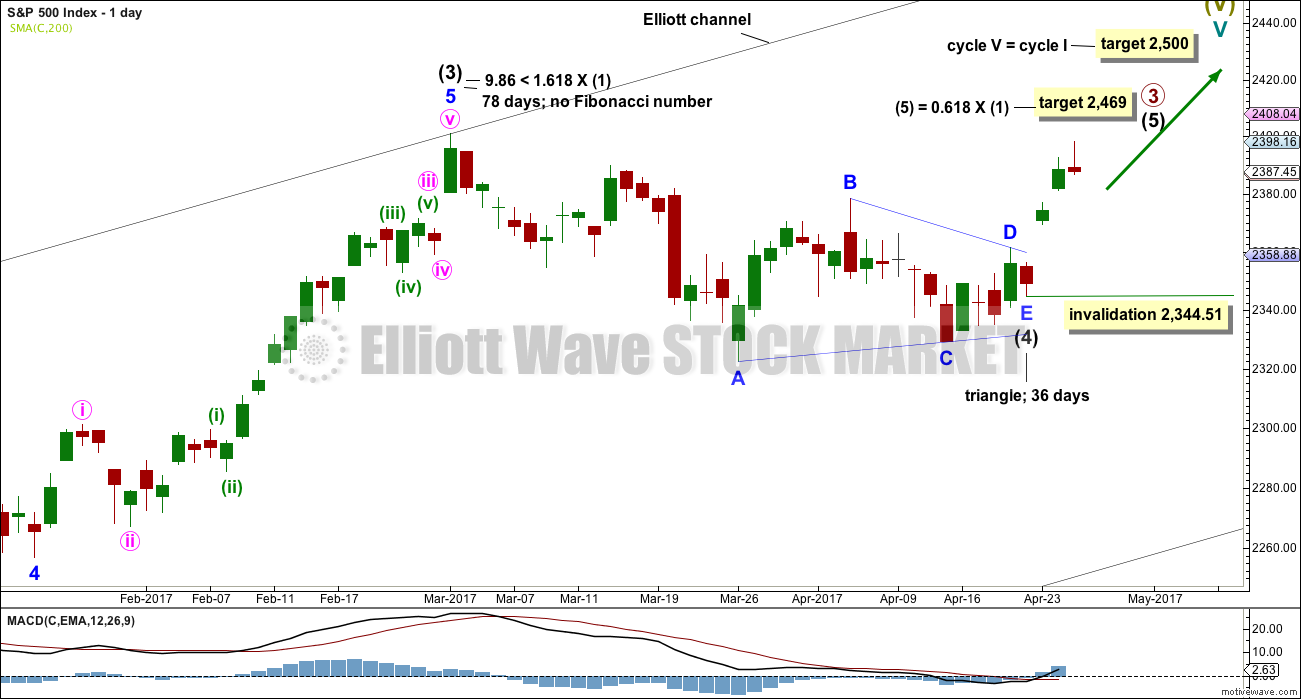

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the middle of primary wave 3 a stretched out extension, which is the most typical scenario for this market.

Primary wave 3 may be incomplete. A target is now calculated for it on the daily chart.

There is alternation within primary wave 3 impulse, between the double zigzag of intermediate wave (2) and the possible triangle of intermediate wave (4).

When primary wave 3 is a complete impulse, then a large correction would be expected for primary wave 4. This may be shallow.

Thereafter, primary wave 5 may be expected to be relatively short, ending about the final target at 2,500.

DAILY CHART

Primary wave (4) may be a complete regular contracting triangle. It may have come to a surprisingly swift end with a very brief E wave.

There is already a Fibonacci ratio between intermediate waves (3) and (1). This makes it a little less likely that intermediate wave (5) will exhibit a Fibonacci ratio to either of intermediate waves (1) or (3); the S&P often exhibits a Fibonacci ratio between two of its three actionary waves but does not between all three.

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,344.51.

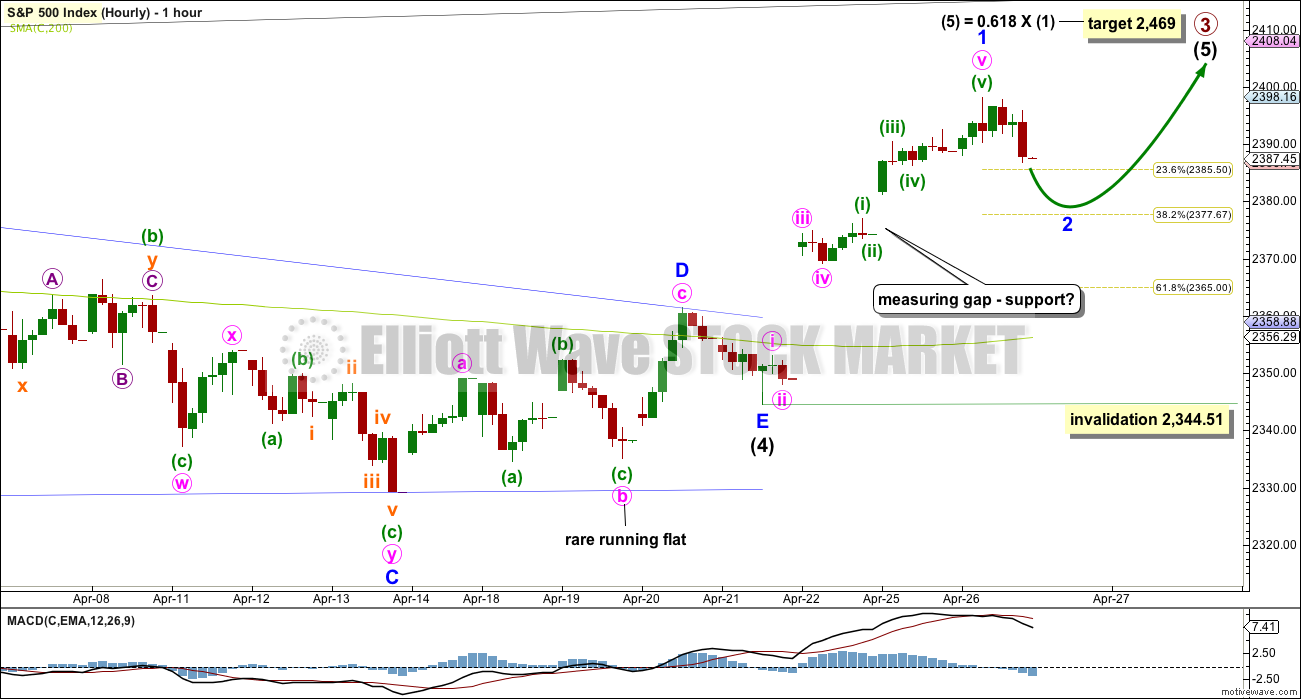

HOURLY CHART

The triangle may have come to a surprisingly quick end. Triangles normally take their time, so this quick end does slightly reduce the probability of this first wave count. The rare running flat within minor wave D also slightly reduces the probability. For these reasons an alternate is provided below.

If the triangle is over, then the next wave up has begun. A five up may be complete. A three down should follow.

If the last gap is correctly named as a measuring gap, then it may not be filled; the lower edge may provide support. If this is the case, then minor wave 2 may be a relatively shallow correction ending close to the 0.382 Fibonacci ratio. Within a new trend for this market, the early second wave corrections are often surprisingly brief and shallow.

Minor wave 2 may be over tomorrow.

If price closes the gap, then use the 0.618 Fibonacci ratio as the next target for minor wave 2.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,344.51.

If price does make a new low below 2,344.51, then the alternate below shall be used.

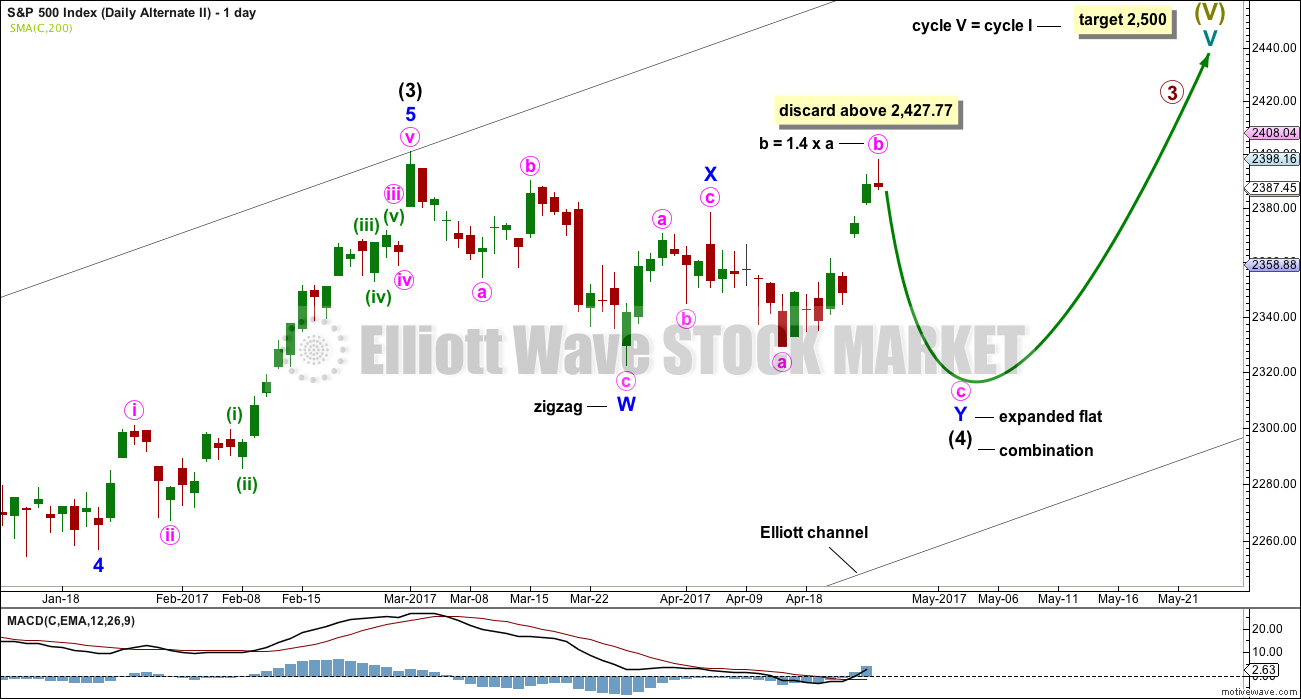

ALTERNATE DAILY CHART

What if intermediate wave (4) was not a complete triangle but is still unfolding as a double combination?

Double combinations are very common structures. This would still provide perfect alternation in structure with the double zigzag of intermediate wave (2). Although double zigzags and double combinations are both labelled W-X-Y, they are very different structures and belong to different groups of corrections.

The purpose of combinations is the same as triangles, to take up time and move price sideways. Intermediate wave (2) lasted 58 days. So far intermediate wave (4) has lasted 38 days. If it continues for another two or three weeks, it would still have excellent proportion with intermediate wave (2).

Although this wave count actually has a better look than the main wave count, it does not have support today from classic technical analysis. For this reason it will be published as an alternate with a lower probability.

ALTERNATE HOURLY CHART

The problem of the running flat seen on the main hourly chart is here resolved.

The second structure of the combination may be an expanded flat labelled minor wave Y. There is no rule regarding the maximum length of B waves within flats, but there is an Elliott wave convention that states when the potential B wave reaches twice the length of the A wave the idea of a flat should be discarded based upon a very low probability. That price point would be at 2,427.77.

The most common Fibonacci ratio is used to calculate a target for minute wave c. If minute wave b moves higher, then this target must be moved correspondingly higher.

A best fit channel is used to contain minute wave b. If this channel is breached by downwards movement, it would be indicating that minute wave b is over and minute wave c is then underway.

TECHNICAL ANALYSIS

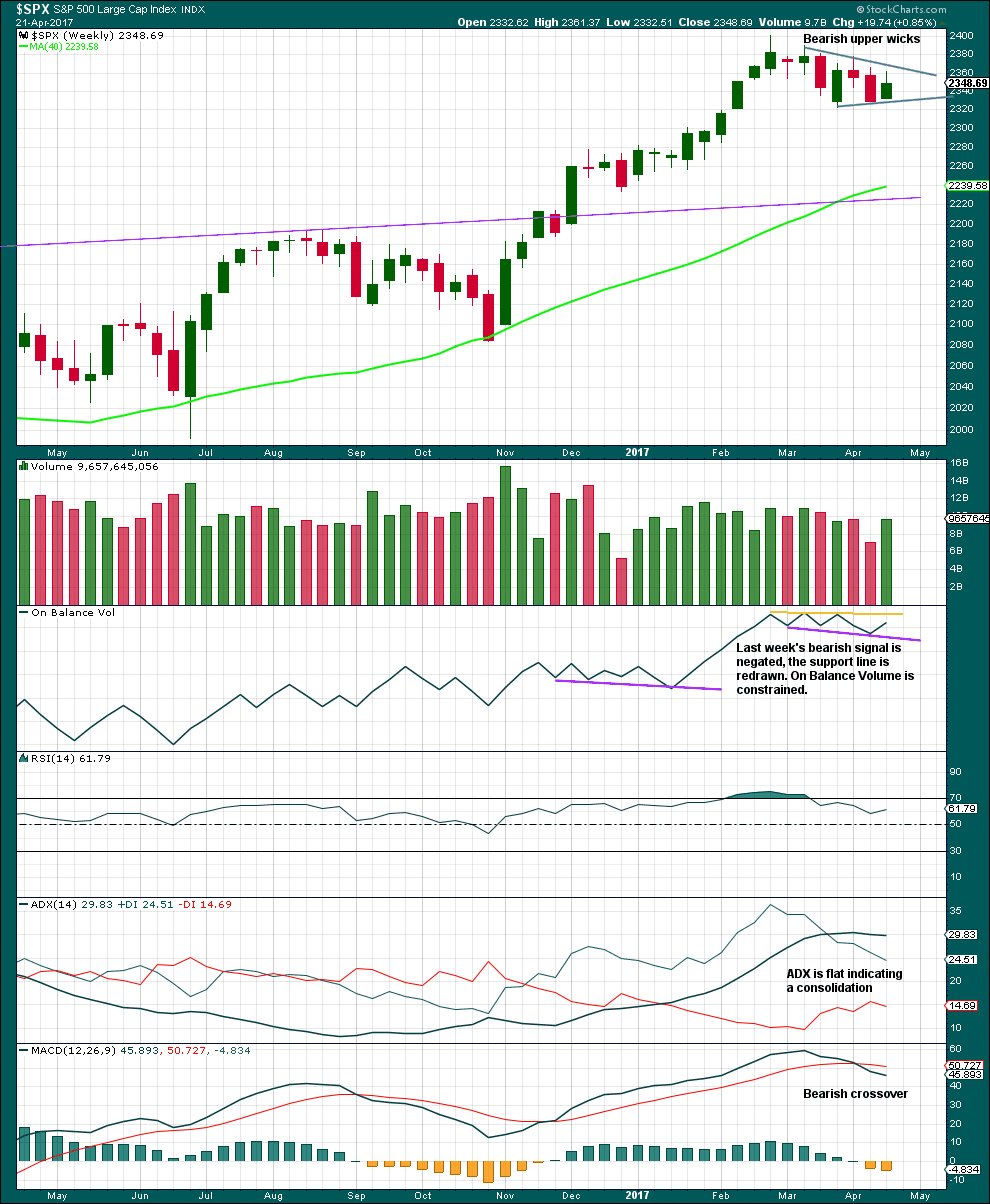

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week has stronger volume, but the bearish wicks of the last two candlesticks indicate more downwards movement.

On Balance Volume is constrained between support and resistance.

ADX indicates a consolidation. This supports the triangle.

RSI is neutral and MACD is bearish.

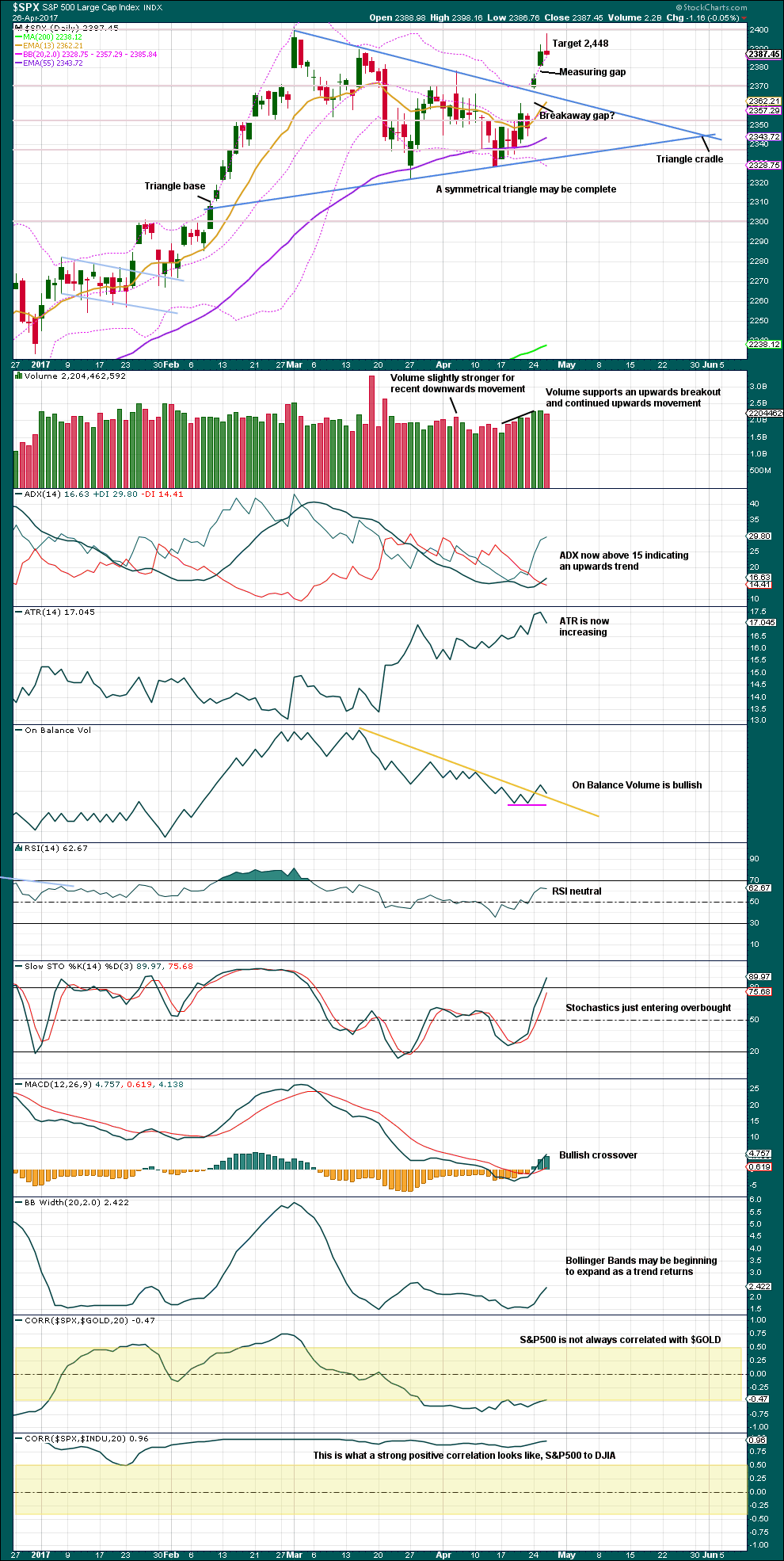

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Although price moved higher today, the balance of volume during the session is downwards and the candlestick closed red. A decline in volume did not support downwards movement during the session. The long upper wick is bearish.

The possible breakout from the symmetrical triangle looks to have come about 64% of the distance from base to cradle. Highest percentage performance following triangle breakouts come from breakouts generally around 60%-70% of this distance.

Volume, ATR, ADX, On Balance Volume, MACD, and Bollinger Bands are still bullish today.

Price has closed above the upper edge of Bollinger Bands. This does not mean that tomorrow price must return to within Bollinger Bands. Price may remain extreme for several days when this market is in a strong trend.

The target is calculated from adding the vertical difference between the initial upper and lower triangle reversal points (78.73 points) to the breakout point, taken at today’s low.

Throwbacks to support after an upwards breakout from a symmetrical triangle occur only 37% of the time, so it would not be wise to expect price to show a deep pullback here. Look out for corrections to be brief and shallow. Each correction would offer an opportunity to join the upwards trend.

Use gaps for trailing stops on long positions. Stops may now be set at the lower edge of the measuring gap. If this is a measuring gap and not an exhaustion gap, then it may not be filled for some time.

Always use a stop. Do not invest more than 1-5% of equity on any one trade.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

It is noted that there are now six multi day instances of bullish divergence between price and inverted VIX, and all have been followed so far by at least one upwards day if not more. This signal seems to again be working more often than not. It will again be given some weight in analysis.

There is no new divergence today between price and inverted VIX.

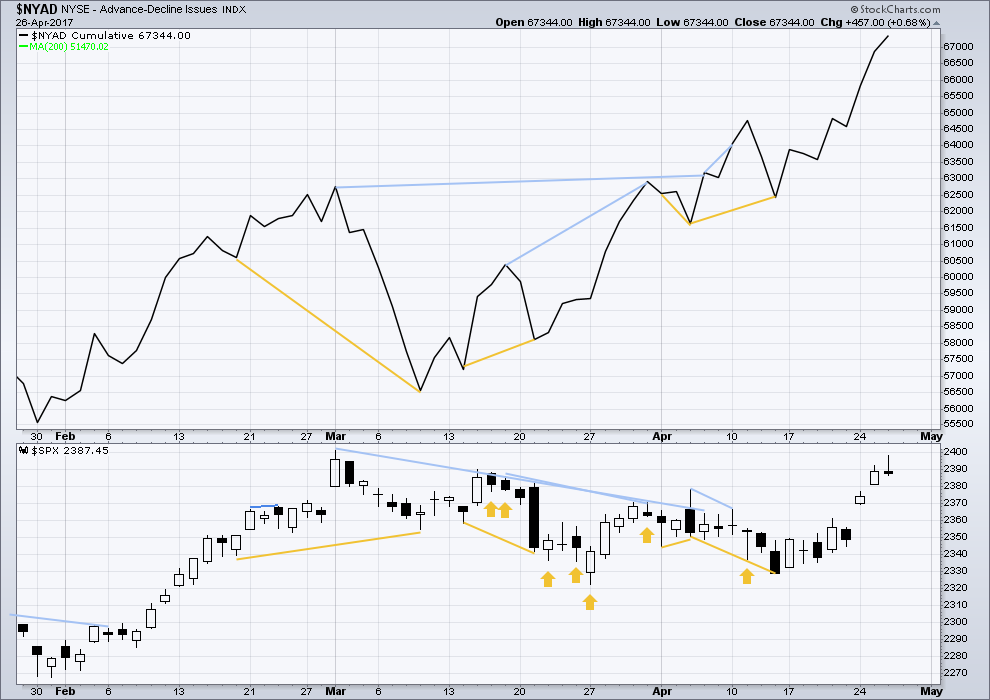

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

The rise in price has support from a rise in market breadth. Lowry’s measures of market breadth do not at this stage warn of an impending end to this bull market. They show an internally healthy bull market that should continue for at least 4-6 months.

No new divergence is noted today between price and the AD line. There is still longer term bearish divergence, but this has not proven reliable lately, so it will not be considered.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq continue to make new all time highs. This confirms a bull market continues.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 10:00 p.m. EST.

Main hourly chart updated:

So far the gap isn’t closed, it’s support. If it’s correctly identified as a measuring gap then this support should hold. Minor 2 may be done.

Wierd! Hanging men and hammers (more precisely “hammer- like”, since some at top of price ranges) appearing in succession everywhere!

Wassup with dat??!! 🙂

A pause in the trend. Giving us a possible opportunity to enter.

Yep! I agree. Looks very much like consolidation to me. Picked up a few DIA 210 calls as I think we head higher from here. (Now watch us get an island reversal tomorrow lol!)

hey,, guess what,,, times 3

Trifecta 🙂