Last Elliott wave analysis of AAPL expected price to move lower which is what has happened.

I have taken a closer look at the corrective structure and considered several possibilities. Today, I have two alternate wave counts for you.

In the short term both wave counts expect more downwards movement, most likely to a low below 435. Thereafter, each wave count expects upwards movement and the differentiating point is at 505.75.

Click on the charts below to enlarge.

Monthly Chart.

From 1982 to September 2012 Apple saw a significant rise. This looks like a nice impulse structure.

The drop from September 2012 to the current date is significant and may be a correction at super cycle degree.

When we use Elliott’s channeling technique to draw a channel about this impulse for super cycle wave (I) the last monthly candlestick clearly breaches the channel. This indicates that the new downwards trend may be a large correction of the upwards trend from the 1980s.

The channel is drawn first with a trend line from the highs of cycle waves I to III, then a parallel copy is placed upon the low of cycle wave II.

Both the main and alternate wave counts below follow on from this monthly wave count.

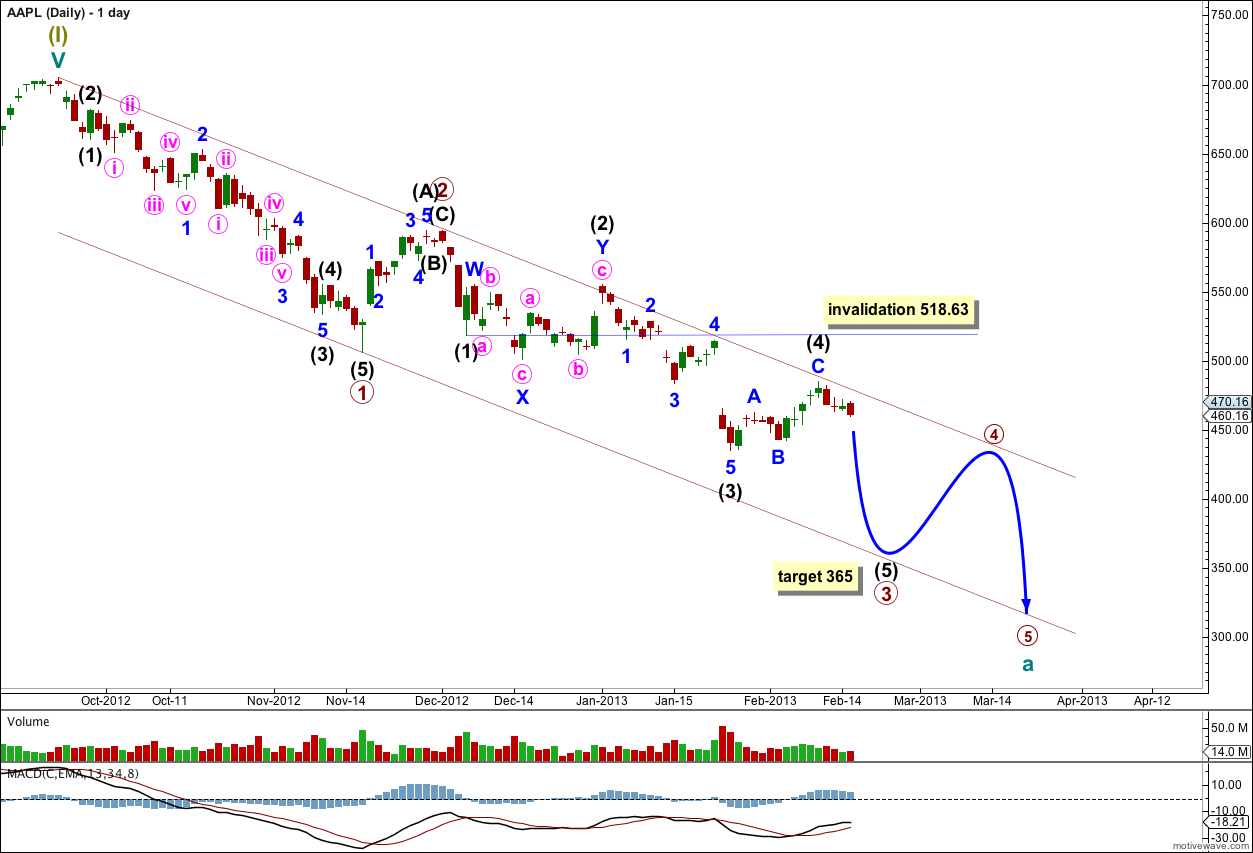

Main Wave Count.

This main wave count looks at the possibility that super cycle wave (II) is unfolding as a zigzag. Because this is the most common structure for a second wave this is the main wave count with a slightly higher probability.

If super cycle wave (II) is unfolding as a zigzag then cycle wave a must subdivide into a five wave structure. So far this cannot be a leading diagonal and must be an impulse.

Within the impulse of cycle wave a wave 4 at primary degree may not move into primary wave 1 price territory. This main wave count is invalidated with movement above 505.75 (prior to the completion of primary waves 3, 4 and 5).

When cycle wave a is complete then cycle wave b upwards must subdivide as a three. Cycle wave b may not move beyond the start of cycle wave a. At that stage this wave count would be invalidated with movement above 705.07. This main wave count sees a high in place for AAPL.

Cycle wave b may find resistance about the lower edge of the parallel channel drawn about the impulse of super cycle wave (I) (see the monthly chart for this channel).

Within cycle wave a primary waves 1 and 2 may be complete and primary wave 3 may be incomplete. However, this wave count does not agree with MACD in that the strongest momentum is within primary wave 1 and not intermediate wave (3) within primary wave 3. This may be remedied if the degree of labeling within primary wave 3 is moved down one degree. If momentum to the downside increases I would expect primary wave 3 is extending, and the strongest momentum may be yet to come.

At 365 intermediate wave (5) would reach equality with intermediate wave (3).

When primary wave 3 is complete then the channel may be redrawn. The first trend line is drawn from the low of primary wave 1 to wherever primary wave 3 ends, then a parallel copy is placed upon the high of primary wave 2. We may expect primary wave 4 to end about the upper edge of the channel.

Within primary wave 3 intermediate wave (4) may not move into intermediate wave (1) price territory. This wave count is invalidated with movement above 518.63.

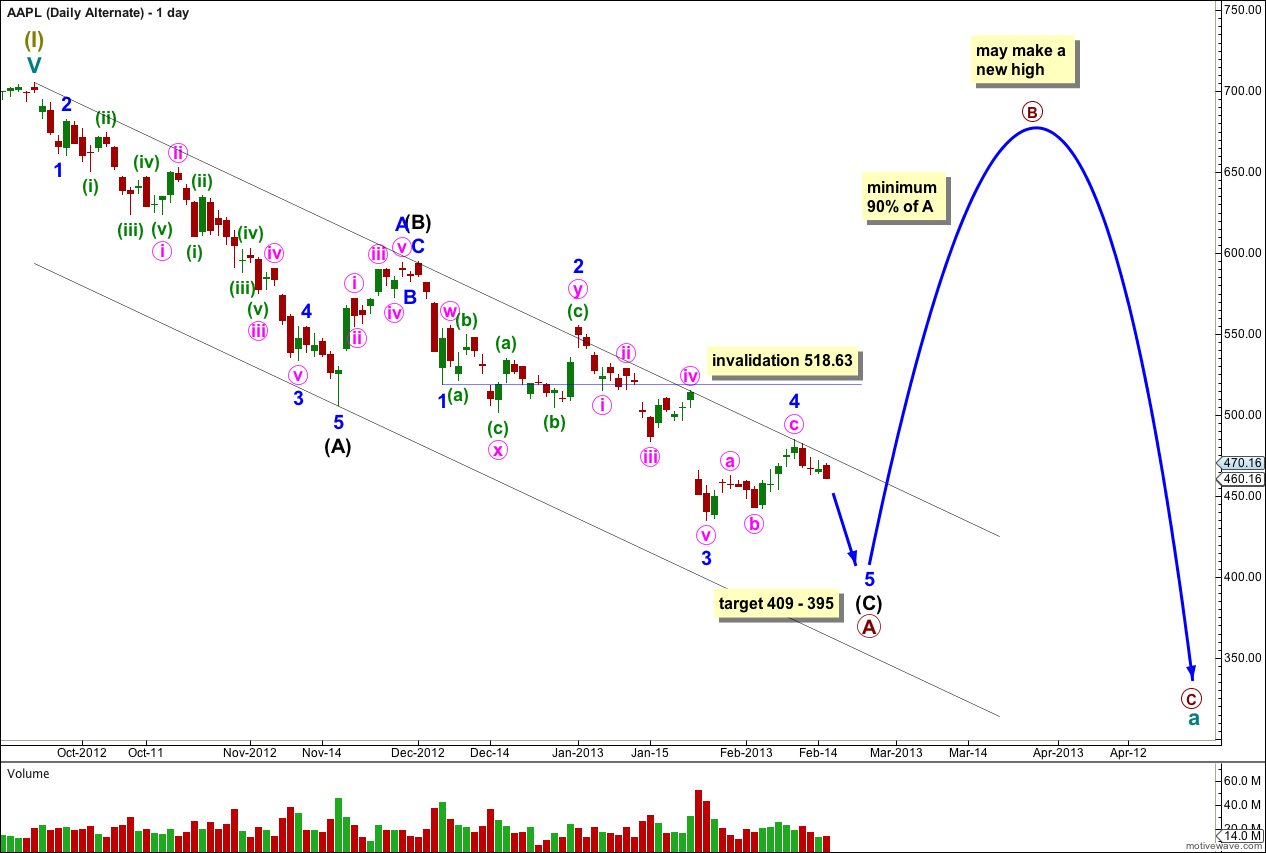

Alternate Wave Count.

This alternate wave count looks at the possibility that super cycle wave (II) may be unfolding as a flat correction. Within it cycle wave a may itself be unfolding as a flat, a three wave structure.

Within cycle wave a primary wave A may be unfolding as a zigzag. If the current downwards wave which began at the high labeled intermediate wave (B) at 594.59 is not extending then the lack of momentum would be explained nicely by this wave count; intermediate wave (C) does not have to have a greater momentum than intermediate wave (A).

At 409 minor wave 5 would reach equality in length with minor wave 1.

At 395 intermediate wave (C) would reach equality in length with intermediate wave (A).

When primary wave A is complete then primary wave B must reach at least 90% the length of primary wave A, and may make a new high. At that stage if price moves above 505.75 the main wave count above would be invalidated and this alternate would be confirmed. If that happens then we will know that price must continue to rise to the point where primary wave B equals 90% of primary wave A at minimum.

Within downwards movement of primary wave A intermediate waves (A) and (B) are complete. Intermediate wave (C) is close to completion.

I have used Elliott’s channeling technique for a correction. The first trend line is drawn from the start of intermediate wave (A) to the end of intermediate wave (B), then a parallel copy is placed upon the end of intermediate wave (A). We may expect intermediate wave (C) to end either mid way within the channel, or maybe about the lower edge. When the channel is breached by subsequent upwards movement we shall have trend channel confirmation that primary wave A was a three and it is over, and primary wave B should then be underway.

In the short term if minor wave 4 continues further it may not move into minor wave 1 price territory. This wave count is invalidated with movement above 518.63.