A more time consuming correction was expected to have begun after yesterday’s downwards movement. Downwards movement was expected to continue although it has reached below expected support at 3,081.

Summary: Minor wave 4 may continue for about two weeks or so and may find next support about 3,037. It may be a choppy overlapping consolidation. Thereafter, the upwards trend may resume. The next target is at 3,302 and then 3,336.

Three large pullbacks or consolidations during the next 1-2 years are expected: for minor wave 4, then intermediate (4), and then primary 4. Prior to each of these large corrections beginning, some weakness may begin to be evident.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. An alternative wave count which considered an ending diagonal has been invalidated. While it is possible a diagonal may become an alternate wave count in coming weeks or months, at this stage the structure does not fit.

At this stage, cycle wave V may take another one to two or so years to complete.

The daily chart below will focus on movement from the end of intermediate wave (1) within primary wave 3.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

Within cycle wave V, primary waves 1 and 2 may be complete. Within primary wave 3, intermediate waves (1) and (2) may be complete. Within the middle of intermediate wave (3), no second wave correction may move beyond its start below 2,855.96.

DAILY CHART

All of primary wave 3, intermediate wave (3) and minor wave 3 may only subdivide as impulses.

Minor wave 3 is now complete. Minor wave 3 shows an increase in momentum beyond minor wave 1; MACD supports this wave count.

Minor wave 2 was a sharp deep pullback, so minor wave 4 may be expected to be a very shallow sideways consolidation to exhibit alternation. Minor wave 2 lasted 2 weeks, so minor wave 4 may be about the same duration to have good proportion.

Minor wave 4 may not move into minor wave 1 price territory below 3,021.99.

Intermediate wave (3) must move far enough above the end of intermediate wave (1) to then allow intermediate wave (4) to unfold and remain above intermediate wave (1) price territory. While intermediate wave (3) has now moved beyond the end of intermediate wave (1), meeting a core Elliott wave rule, it still needs to continue higher to give room for intermediate wave (4).

The target for intermediate wave (3) fits with a target calculated for minor wave 3.

Draw an Elliott channel now about intermediate wave (3) using Elliott’s first technique: draw the first trend line from the ends of minor waves 1 to 3, then place a parallel copy on the end of minor wave 2. If it is time consuming enough, then minor wave 4 may find support about the lower edge of this blue channel (although it looks like it may end midway within the channel).

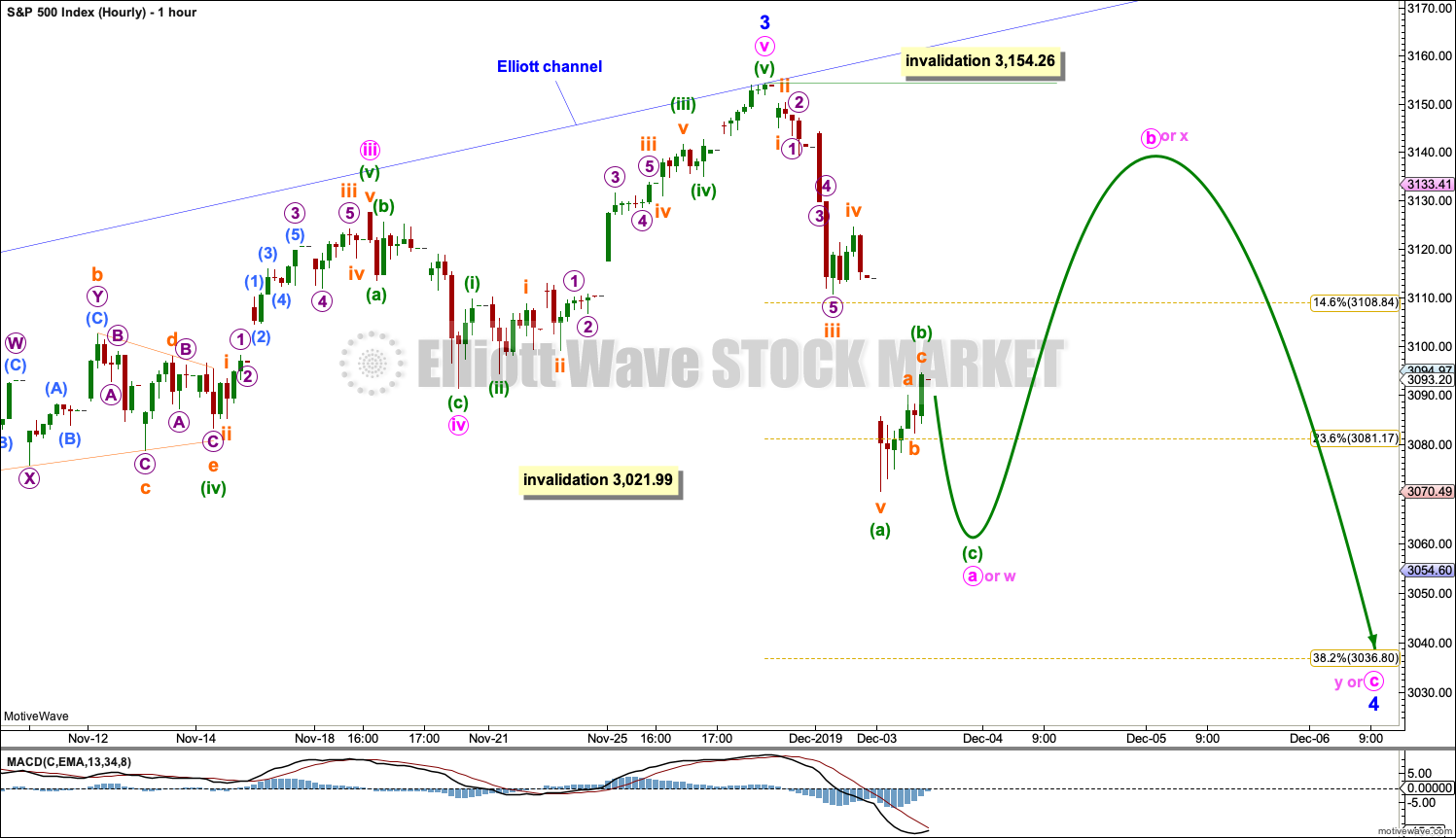

HOURLY CHART

Minor wave 2 was a deep sharp zigzag lasting ten sessions. Given the guideline of alternation, minor wave 4 would least likely subdivide as a zigzag and may more likely subdivide as one of either a triangle, combination or flat correction. Triangles and combinations particularly are usually longer lasting structures than zigzags, so minor wave 4 may last longer than ten sessions.

Minor wave 4 would most likely be shallow. The preferred target for support would be either the 0.146 or 0.236 Fibonacci ratios of minor wave 3. The 0.146 Fibonacci ratio is within the price territory of the fourth wave of one lesser degree; minute wave iv has its range from 3,127.64 to 3,091.41.

All of a triangle, combination and flat correction begin with a three wave structure for minute wave a or w. This is almost always a zigzag. Within the first three wave structure, minuette wave (b) may not move beyond the start of minuette wave (a) above 3,154.26.

Minuette wave (c) may continue to make a new low tomorrow. Thereafter, minute wave b or x may begin. Minute wave b or x may be either a quick sharp bounce, or more likely a very time consuming choppy overlapping movement.

The labelling within minor wave 4 will probably change as it unfolds over the next two weeks or so; alternate wave counts may be required. Focus should not be on identifying exactly which structure it may be and so predicting each small swing within it. Focus should be on identifying when it may be complete. The breakout when minor wave 4 is complete should be upwards; fourth waves are always continuation patterns within the Elliott wave structure one degree higher.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

Primary wave 5 may be subdividing as either an impulse, in the same way that cycle wave V is seen for the first weekly chart.

TECHNICAL ANALYSIS

MONTHLY CHART

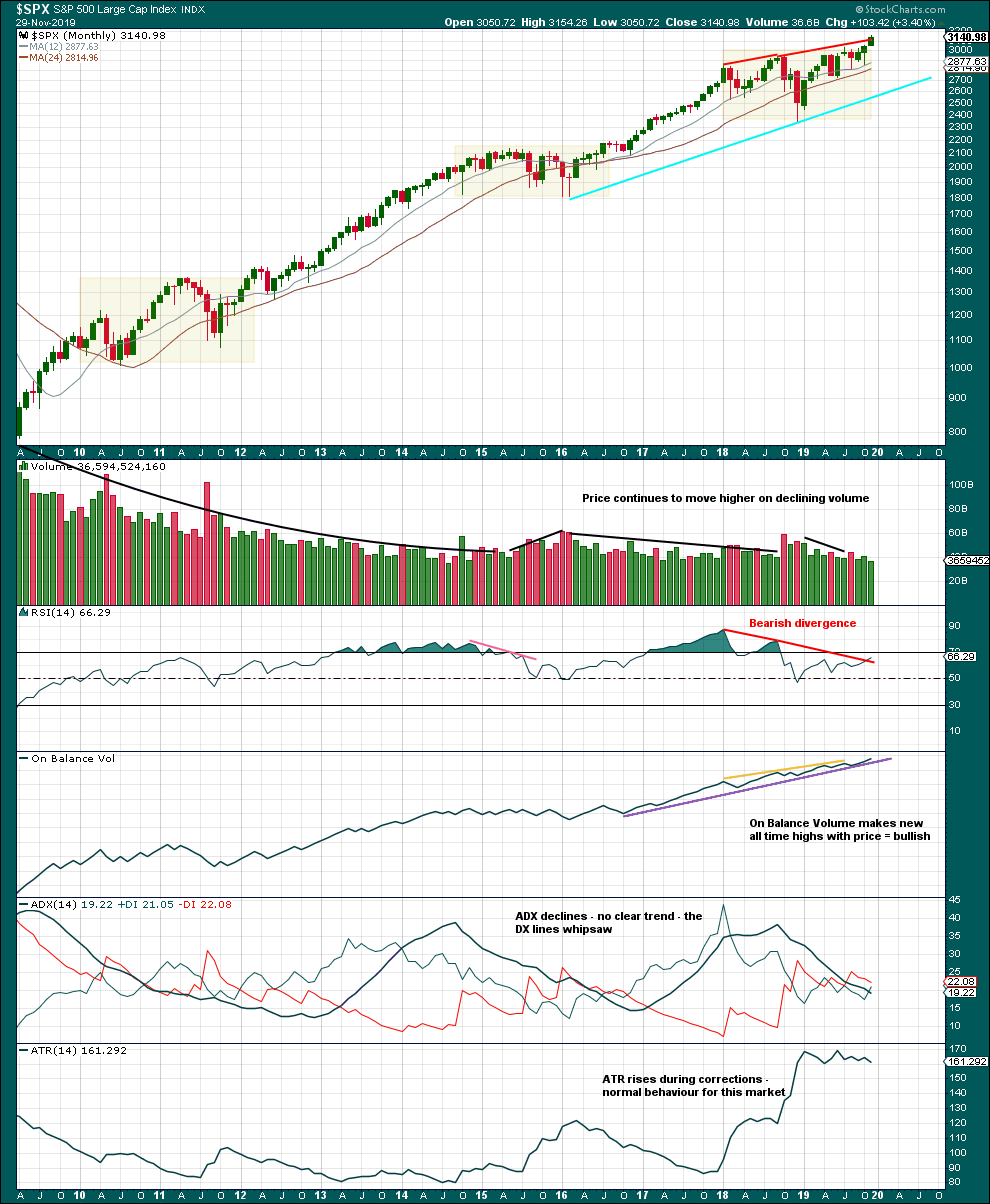

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are three large consolidations noted on this chart, in shaded areas. After a breakout from a multi-month consolidation, it is reasonable to expect a multi month bullish move may result.

This chart very clearly exhibits rising price on declining volume has now persisted for several years. A decline in volume this month, in current market conditions, is not of concern.

On Balance Volume supports the Elliott wave count.

WEEKLY CHART

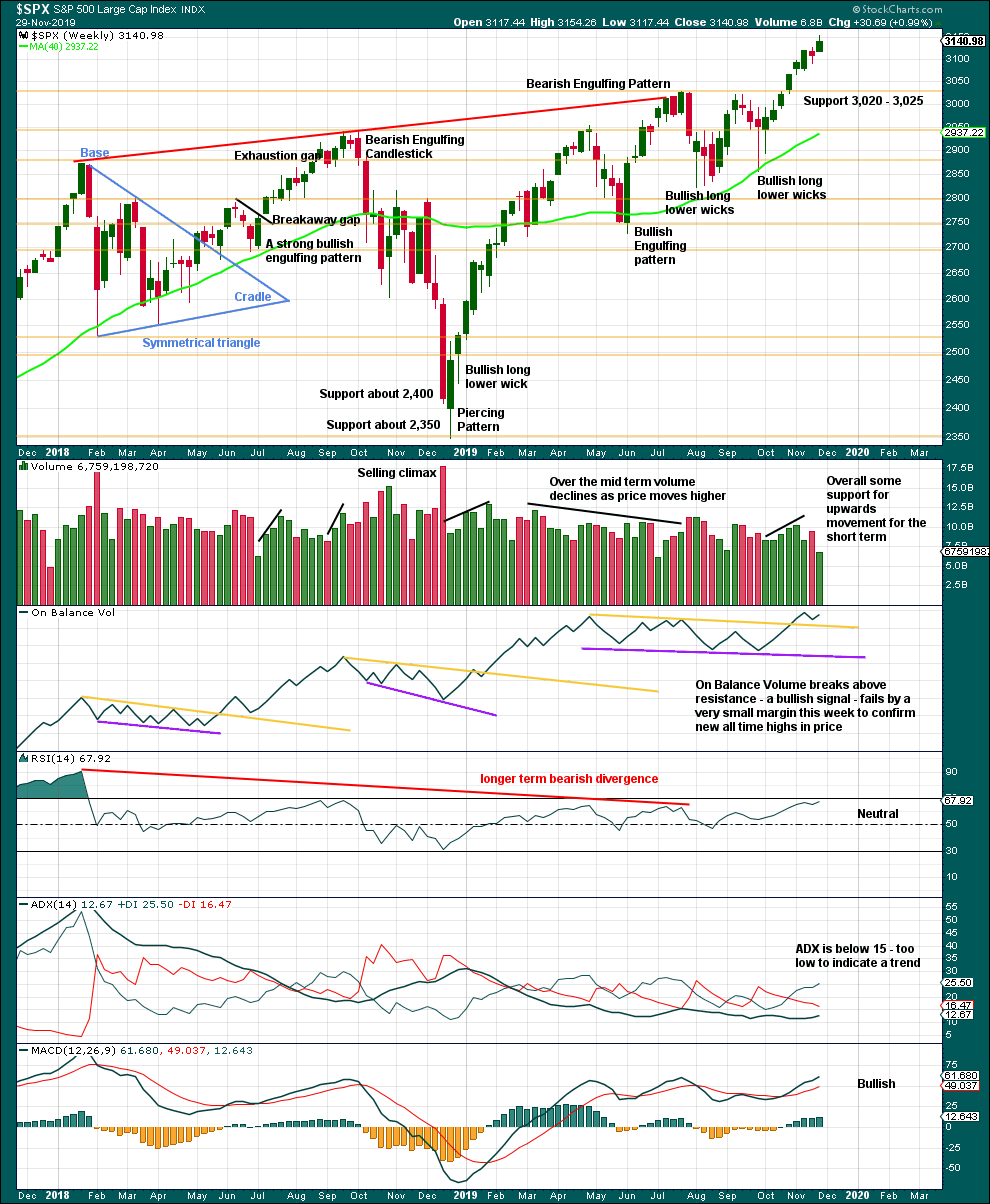

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is very clear that the S&P is in an upwards trend and the bull market is continuing. Price does not move in straight lines; there will be pullbacks and consolidations along the way.

Last week is a short week with New York closed for a day and a half for Thanksgiving Day.

A decline in volume for the last week is acceptable. The failure by On Balance Volume to confirm a new all time high is extremely small, and as this was a short week this shall be given no weight.

Overall, this chart supports the Elliott wave count.

DAILY CHART

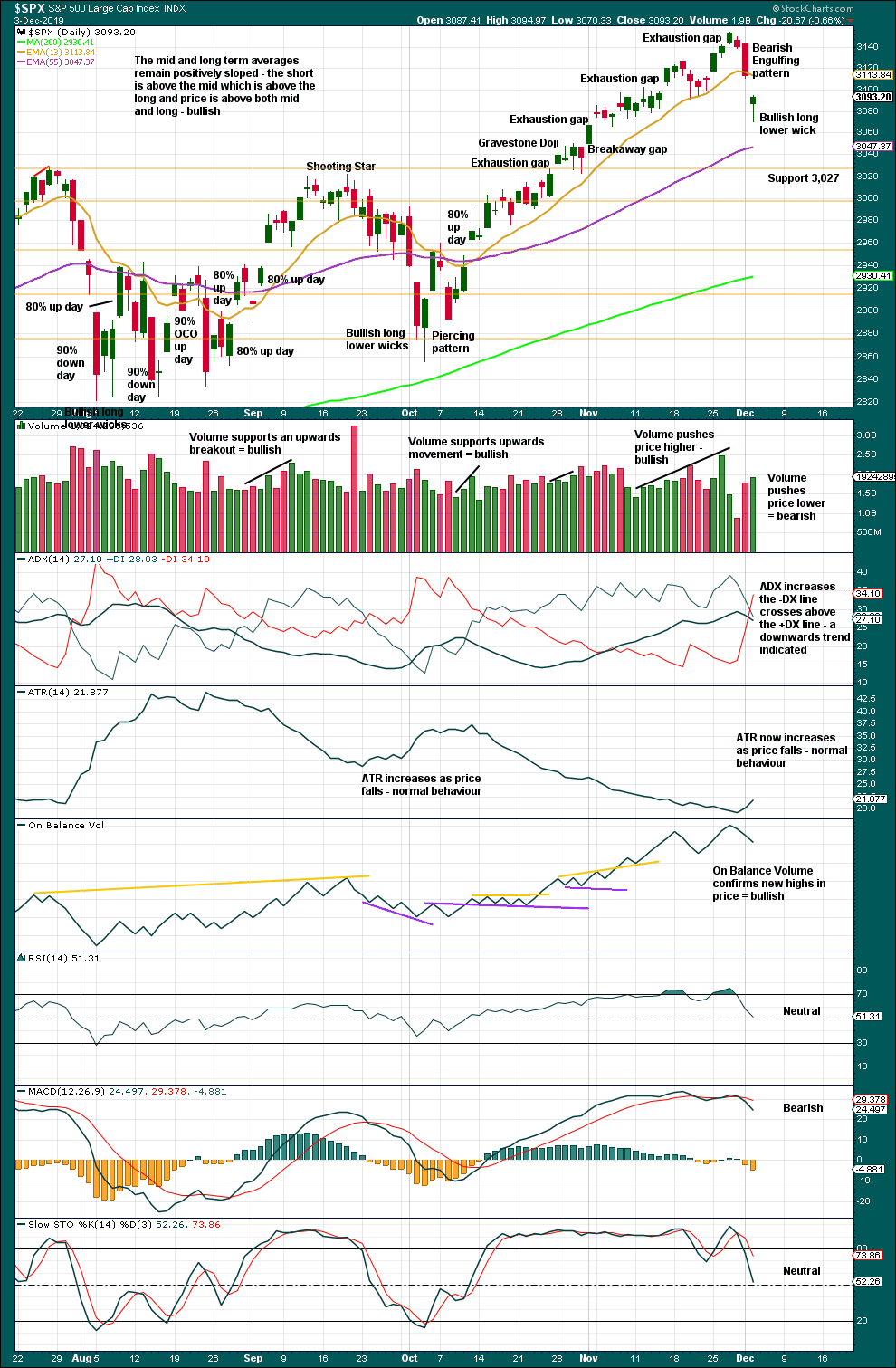

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an upwards trend in place. There will be corrections along the way.

When this market is in a bullish trend, RSI can reach deeply overbought and remain there for some weeks.

The gap downwards today may be a breakaway gap. If it is closed with a new high above 3,110.78, it would then be a pattern gap.

The long lower wick today is bullish, but volume is bearish. Selling lacked intensity today as down volume was 67% of total up/down volume. This looks like a typical although deeper pullback within the ongoing upwards trend.

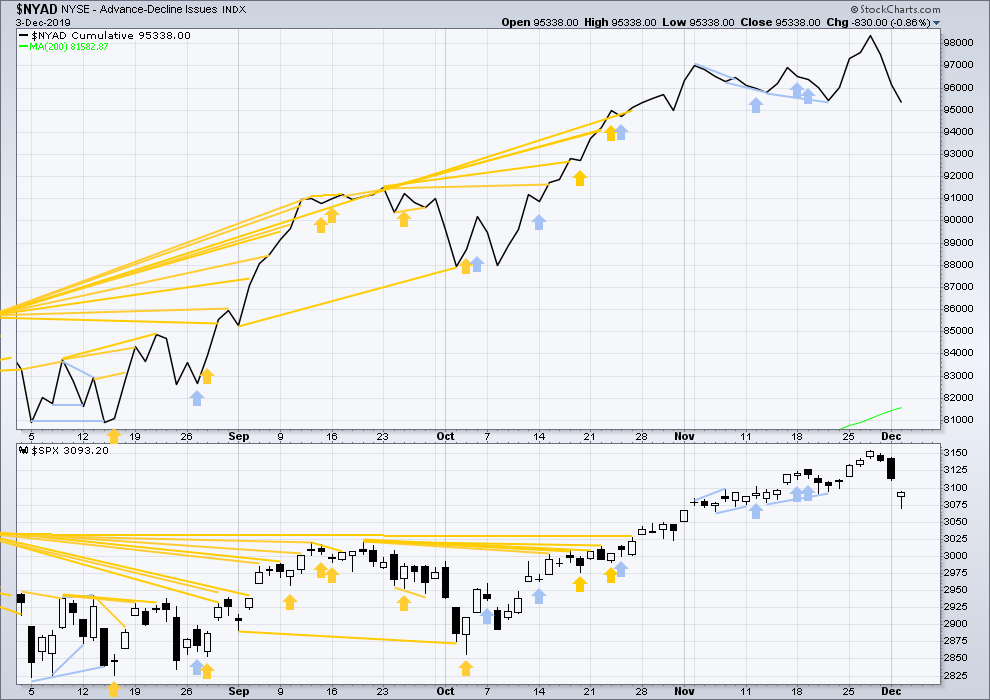

BREADTH – AD LINE

WEEKLY CHART

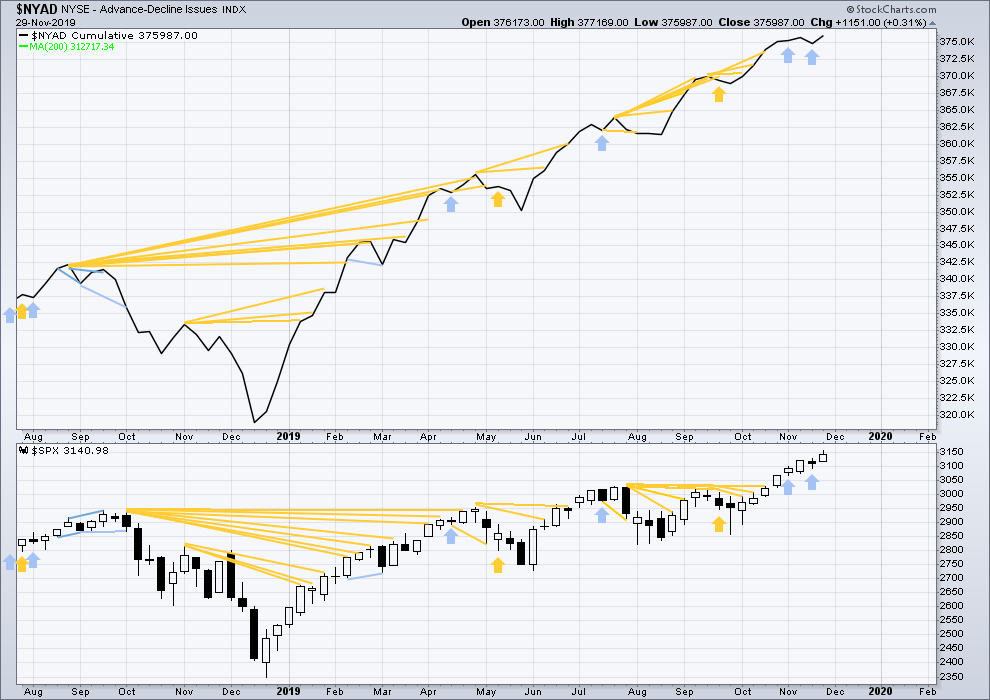

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs last week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid March 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

All of small, mid and large caps have made new swing highs above the prior swing high on the 13th of September, but only large caps have made new all time highs. This upwards movement appears to be mostly driven by large caps, which is a feature of aged bull markets. This bull market at over 10 years duration certainly fits the definition of aged.

Mid and small caps have not yet made new all time highs.

Last week both price and the AD line have moved higher. Upwards movement this week from price has support from rising market breadth. This is bullish and supports the Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Both price and the AD line moved lower again today. Neither have made new short-term swing lows. There is no new divergence.

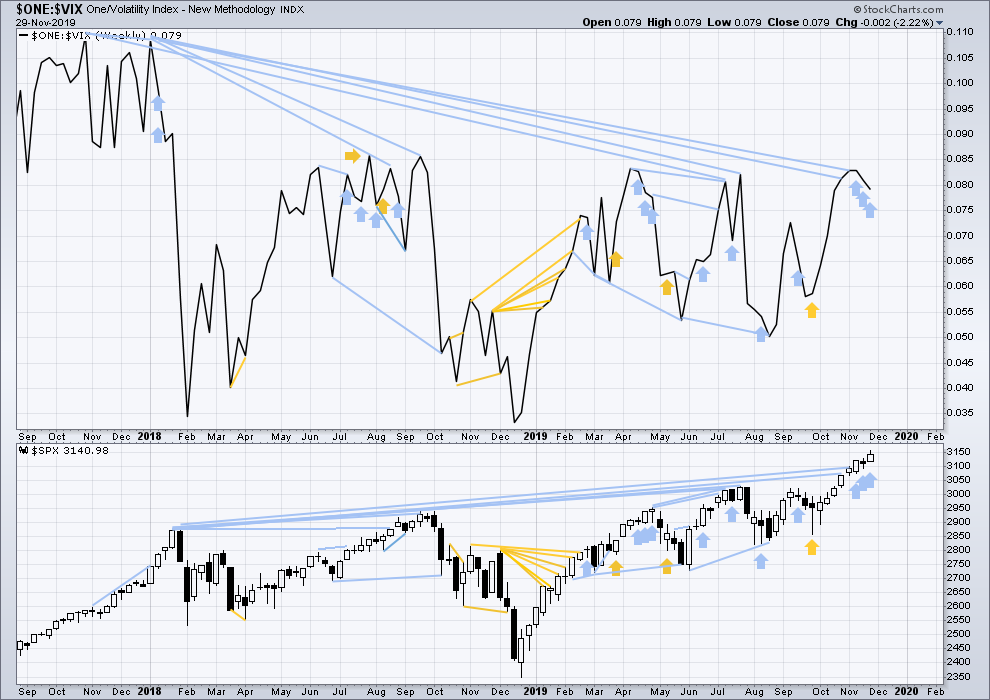

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Price has moved higher for three weeks in a row, but inverted VIX has moved lower. This divergence is now persistent enough to be considered to be sounding a strong warning that there is now reasonable risk to the downside.

The last time this happened was after early January 2018. It was followed by primary wave 4.

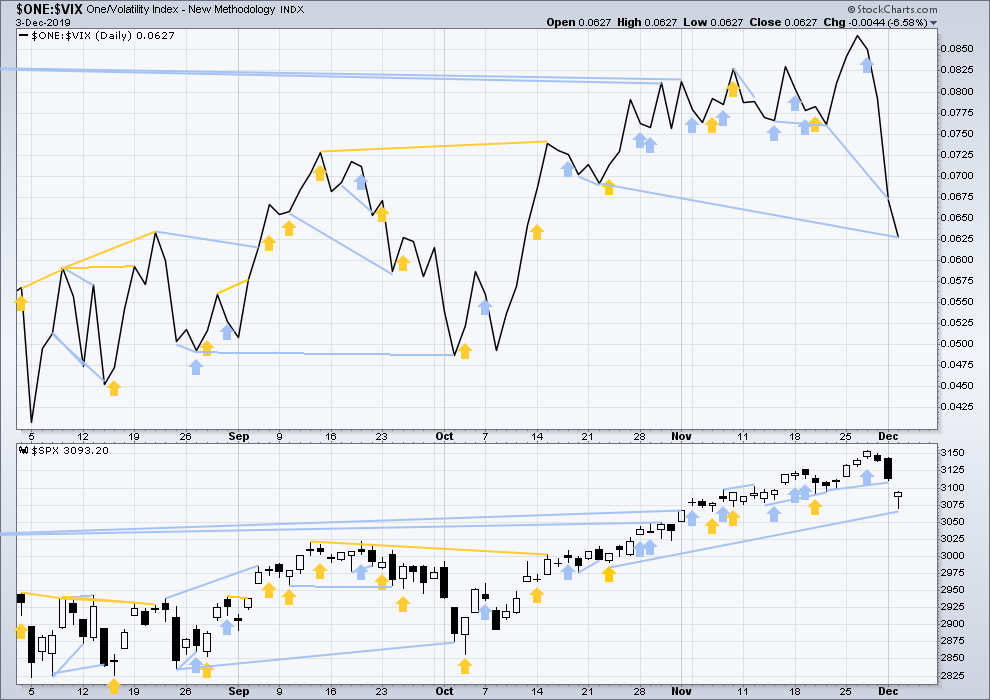

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have moved lower again today. Inverted VIX is falling much faster than price; this divergence is bearish. This divergence is not confirmed today by the AD line, so it is given no weight in this analysis.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 07:24 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

I published BTCUSD analysis yesterday over at Elliott Wave Gold if anyone here is interested.

Hourly chart updated:

I’m labelling minuette (b) incomplete, with a very short subminuette a and a long extended subminuette b, because that fits well. A small final fifth wave may be required to complete this bounce.

Once that’s done, it’s either down to new lows (buy maybe not by much) or continuing sideways in a complicated chop for several days.

This labelling may well change. I can at this time have no reasonable idea on what structure may be unfolding here, there are multiple options for fourth waves.

Everything here looks like the RUT minute 2 is complete already. Maybe it’s a strong B wave up but that’s going to stretch proportionality in the time dimension. On the other hand, RUT recently per this count overall did a massive 2 wave, so maybe this is going to be another long drawn out smaller 2.

Kevin,

That’s what I am thinking as well that minute ii is complete & we are in another minutte (i) up, currently in the iv wave another high then minutte (ii) down… then possibly another 1-2 of some kind and hopefully all with higher lows, so keep an eye… difficult to track as ES and other markets correction will cause RUT to have maybe bigger corrections as well… which should eventually looks like a good test of 1600 level from above

Lara, one “pundit” is publically promoting an EW model that everything since the Dec’18 low is a B wave of a GIANT triangle, and the A wave was the Oct ’18 high to Dec’18 low.

Can you give your quick take on the viability of that?

So for my first weekly chart, cycle IV may be continuing as a big running triangle. If the triangle is contracting then price could continue to find support at the lower edge of the big teal channel.

It’s possible. B would now be 1.36 X A, so within an acceptable range or normal.

So, the EW count fits, it’s an interesting alternate IMO. But… these recent new highs come after strong bullish divergence between price and the AD line, and are confirmed by new highs in On Balance Volume. Apart from some weakness in volume (which has persisted now for years) there is no other evident weakness in this upwards move. It really doesn’t look like a B wave.

Thank you.

The expected ‘b’ wave, whether Minuette or Minute, is progressing nicely. In fact, yesterday’s gap is closed. Remember in a bull (Primary) trend, the surprises will tend to be to the upside even during corrections.

With yesterday’s afternoon rally, the McClellan Oscillator closed just at its lower BB instead of below it. Further, VIX closed inside or above its upper BB. Therefore, we did not get a buy signal which I think fits nicely with the EW count putting us in a ‘b’ wave rally. At the current SPX 3113 we are just above a 50% retrace of the downward movement from 3154 to 3070. The next move should be a ‘c’ wave down to lower lows at which time we will most likely get the buy signal from the McClellan Oscillator and VIX. It would be great to see SPX also close below its lower BB at the same time. That occurrence would give us all three parts of the expected buy signal.

I could play the downside move of the ‘c’ wave for some quick profits. However, since surprises are to the upside and because I hate ‘b’ waves being especially difficult to trade, I will stand aside for the time being. What I am looking for is the end or low point for Minor 4 to take on some additional long positions. Since I am already very heavily invested long in my long term accounts, I will take on smaller positions in my short term account using 3X leveraged vehicles. A move from 3070 (or below) to the next target of 3300 is 7% which means a 3X leveraged position would yield up to 21% in the next six months to a year. A reasonable risk to reward ratio if one uses a stop loss order just below the low mark of the upcoming ‘c’ wave.

Have a great day everyone.

Hi Rodney,

Do you expect minor 4 go only to 3070 and not to 3021 level as Lara was mentioning? Is there any reason why it won’t?

Thank you,

Lev

No, I would not say that. 3070 may be breached to the downside for sure. Lara is repeating that at this point we have no reasonable expectation what form Minor 4 may take. I was using it as an example of what might be an entry point. If Minor 4 turns into a double zig-zag, it can go much lower.

In addition, I stated I don’t like trading these short term moves especially in a ‘b’ wave like now. I want to be patient with any new long positions. I am already long but an opportunity may come along for a good short term trade. I haven’t done that yet. My life and work sometimes controls my schedule from day to day. So I a cannot be assured I can be nimble enough to take on such trades.

I should also state that I look at the McClellan Oscillator, VIX and SPX with respect to their BBs for buy signals. A lot of my short term thinking and strategies are influenced by that.

Rodney,

What would you recommend for leveraged long exposure to SPX for long term (several months or so)?

Lev

Probably the most liquid 3X leveraged ETF on the US markets is UPRO. But these leveraged ETFs are available on the Nasdaq, QQQ, IWM and more. Right now, I am sticking with SPX because I believe the large caps usually lead the market towards the end of a bull market.

Always remember, the 3X leveraged ETFs can go down very fast.

Thanks, Rodney. The reason why I asked is because I read that those 3x ETFs are good for daily trading. And long term gains on SPX might not match performance of those leveraged ETFs. There are examples when SPX gains over time while ETF stays stagnant and even a little down due to fees etc.

That is correct. They are best for shorter term (relatively speaking) trades.

I am traveling tomorrow to Australia for a week. I hear they have a good internet infrastructure there and so all should be well 🙂

I have planned our journey to ensure your analysis tomorrow should be published in good time. If it is not then the reason may be out of my control.

Lara,

You are so good to your subscribers. Thank you. I hope you have a great time in Australia. Stay away from the fires. I also hope you take some time for a holiday this year. Not only do you deserve it (as you truncated your Christmas vacation last year for the sake of your members) but it is also good for the body and good for the soul. Take care.

Thanks Rodney. I’ve been cutting work to a minimum from time to time to stay fresh and happy, so there’s little to no chance of any burnout on this end.

If I get sunshine and waves in Australia then my soul will be restored, we have had so little surf here in Coromandel for many months now, since our Autumn began.

We’re off to visit a good friend north of Brisbane, way north of the fires. At least, for now.

Snap!

Crackle

POP!!

Snap Crackle Pop!

Now that is one I have not seen before. Every day has the potential to teach us something new. Thanks you all.