The Elliott wave target remains the same. Classic analysis supports the Elliott wave count.

Summary: Some weakness is now beginning to be evident. If the next target at 3,179 is wrong, it may be too high. There is weakness in volume and breadth. However, On Balance Volume remains very bullish.

The next target at 3,179 is where minor wave 4 may begin (expect it to be very shallow). Thereafter, the next target is at 3,302 and then 3,336.

Three large pullbacks or consolidations during the next few months are expected: for minor wave 4, then intermediate (4), and then primary 4. Prior to each of these large corrections beginning, some weakness may begin to be evident.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

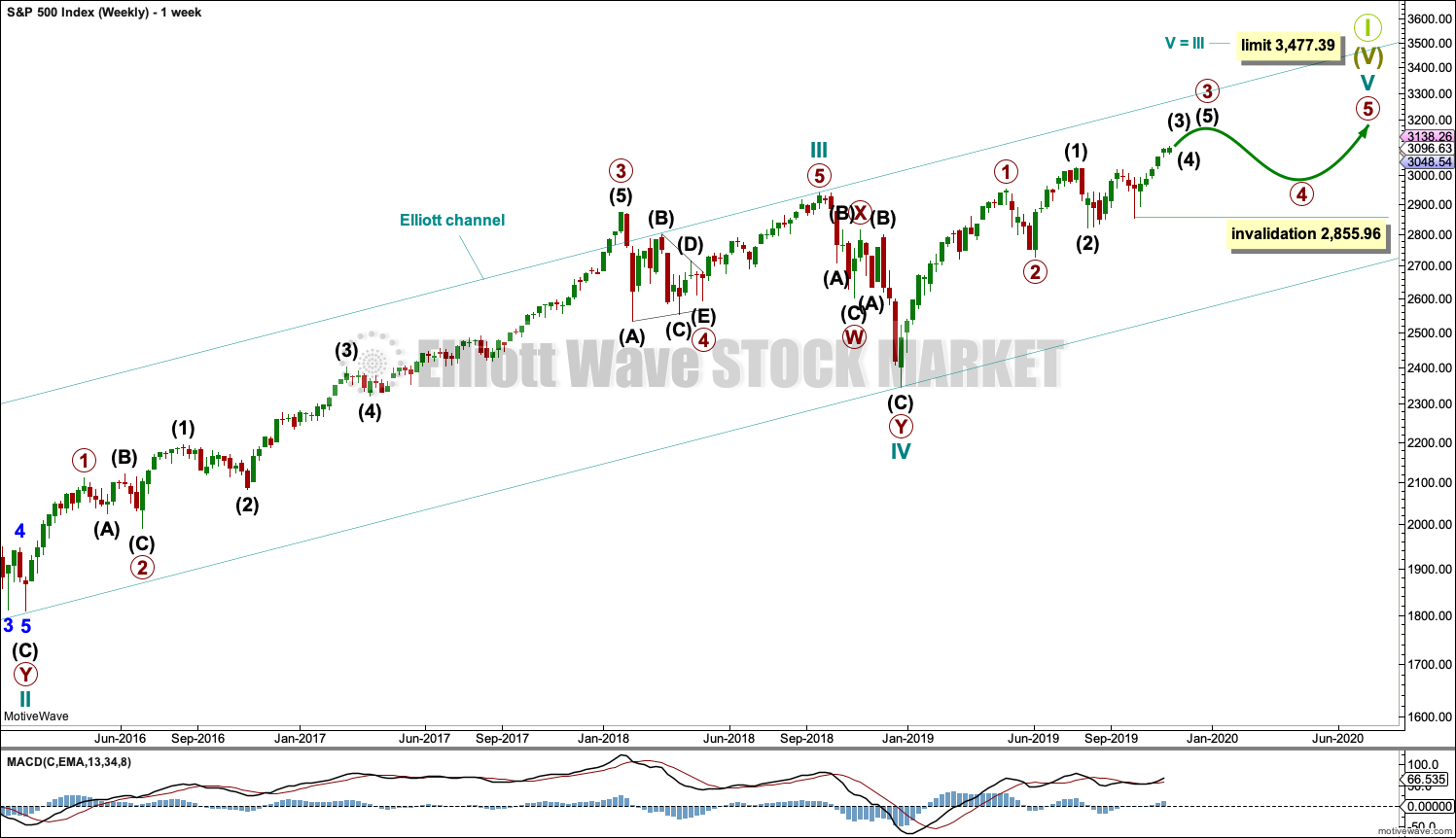

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. An alternate wave count, which looked at the possibility of a diagonal unfolding, has been invalidated with a new all time high.

The daily chart below will focus on movement from the end of intermediate wave (1) within primary wave 3.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

Within cycle wave V, primary waves 1 and 2 may be complete. Within primary wave 3, intermediate waves (1) and (2) may be complete. Within the middle of intermediate wave (3), no second wave correction may move beyond its start below 2,855.96.

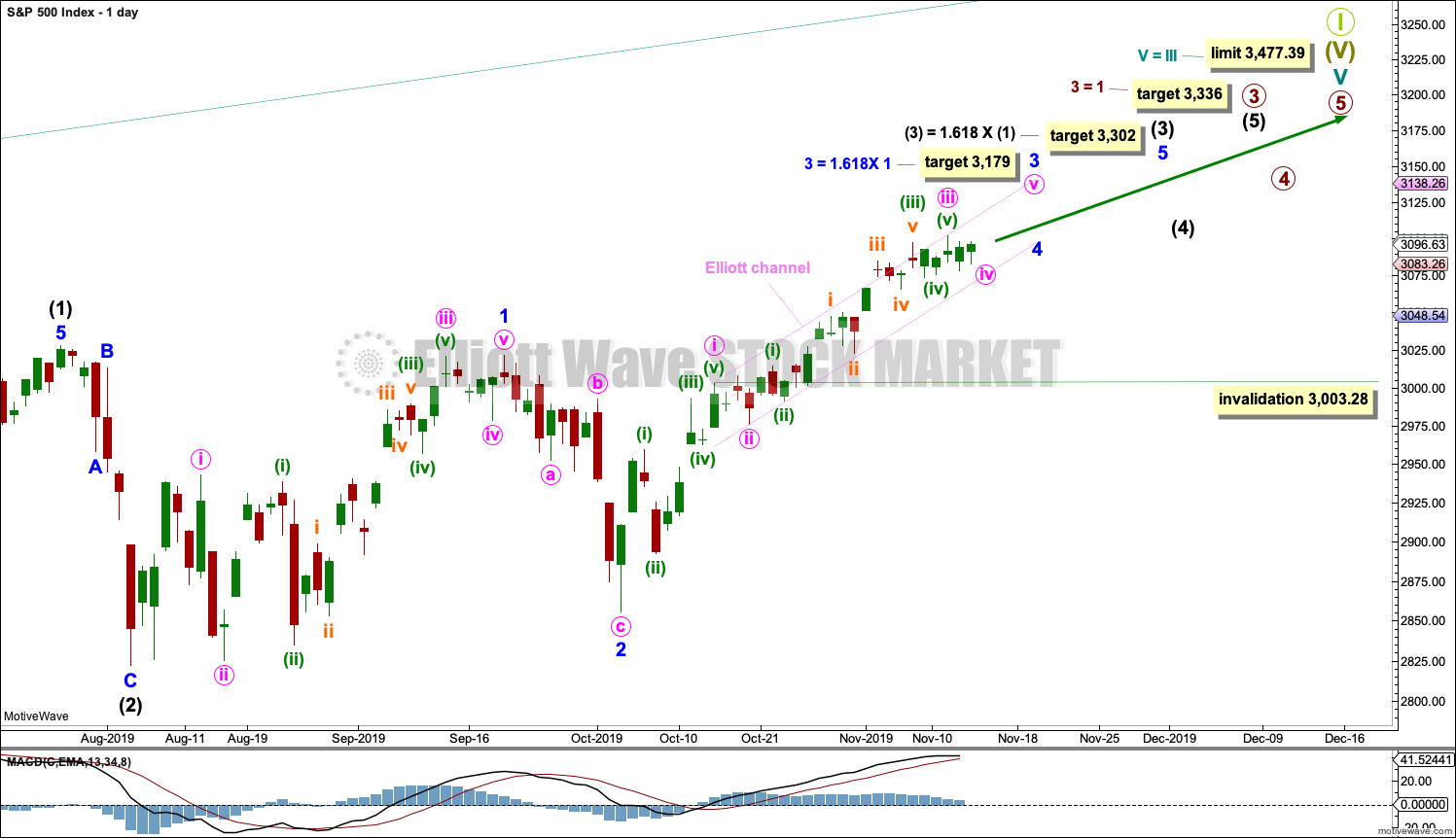

DAILY CHART

All of primary wave 3, intermediate wave (3) and minor wave 3 may only subdivide as impulses.

Minor wave 3 may be underway and may have passed through its middle. Minor wave 3 now shows an increase in momentum beyond minor wave 1; MACD supports this wave count. Within minor wave 3, minute wave iv may not move into minute wave i price territory below 3,003.28.

Intermediate wave (3) must move far enough above the end of intermediate wave (1) to then allow intermediate wave (4) to unfold and remain above intermediate wave (1) price territory. While intermediate wave (3) has now moved beyond the end of intermediate wave (1), meeting a core Elliott wave rule, it still needs to continue higher to give room for intermediate wave (4).

The target for intermediate wave (3) fits with a target calculated for minor wave 3.

Minor wave 2 was a sharp deep pullback, so when it arrives minor wave 4 may be expected to be a very shallow sideways consolidation to exhibit alternation. Minor wave 2 lasted 2 weeks, so minor wave 4 may be about the same duration to have good proportion.

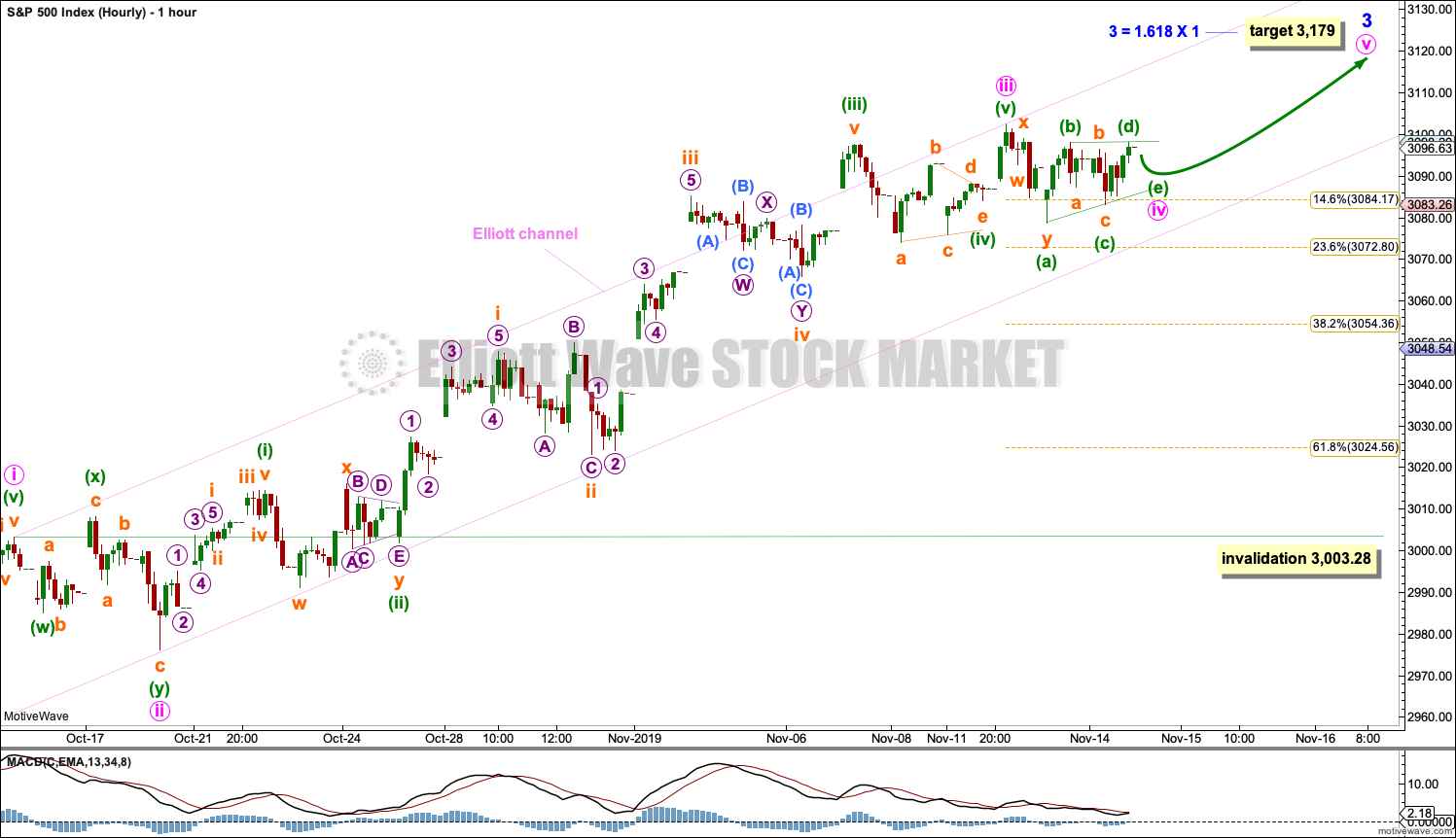

HOURLY CHART

There are multiple ways now to label upwards movement from the end of minor wave 2.

It is possible that minor wave 3 is incomplete. Within it, minute wave iii may be complete.

Minute wave ii was a shallow 0.18 double zigzag or flat correction. Minute wave iv may exhibit alternation as a combination or triangle. Minute wave iv would be likely to find support about the lower edge of the Elliott channel.

Minute wave iv may be almost complete as a barrier triangle. Within the triangle, the B-D trend line looks essentially flat to the eye; minuette wave (d) is very slightly beyond the end of minuette wave (b) by 0.14 points. If minuette wave (d) continues any higher, then the triangle would be invalid and minute wave iv should then be expected to be over.

Minute wave iv may not move into minute wave i price territory below 3,003.28.

Draw a trend channel about minor wave 3: draw the first trend line from the end of minute wave i to minute wave iii, then place a parallel copy on the end of minute wave ii. So far minute wave iv remains contained within the channel.

When this channel is breached by downwards or sideways movement, then that may be taken as an indication that minor wave 3 may be over and a multi-week consolidation for minor wave 4 may have arrived.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

Primary wave 5 may be subdividing as either an impulse, in the same way that cycle wave V is seen for the first weekly chart.

TECHNICAL ANALYSIS

WEEKLY CHART

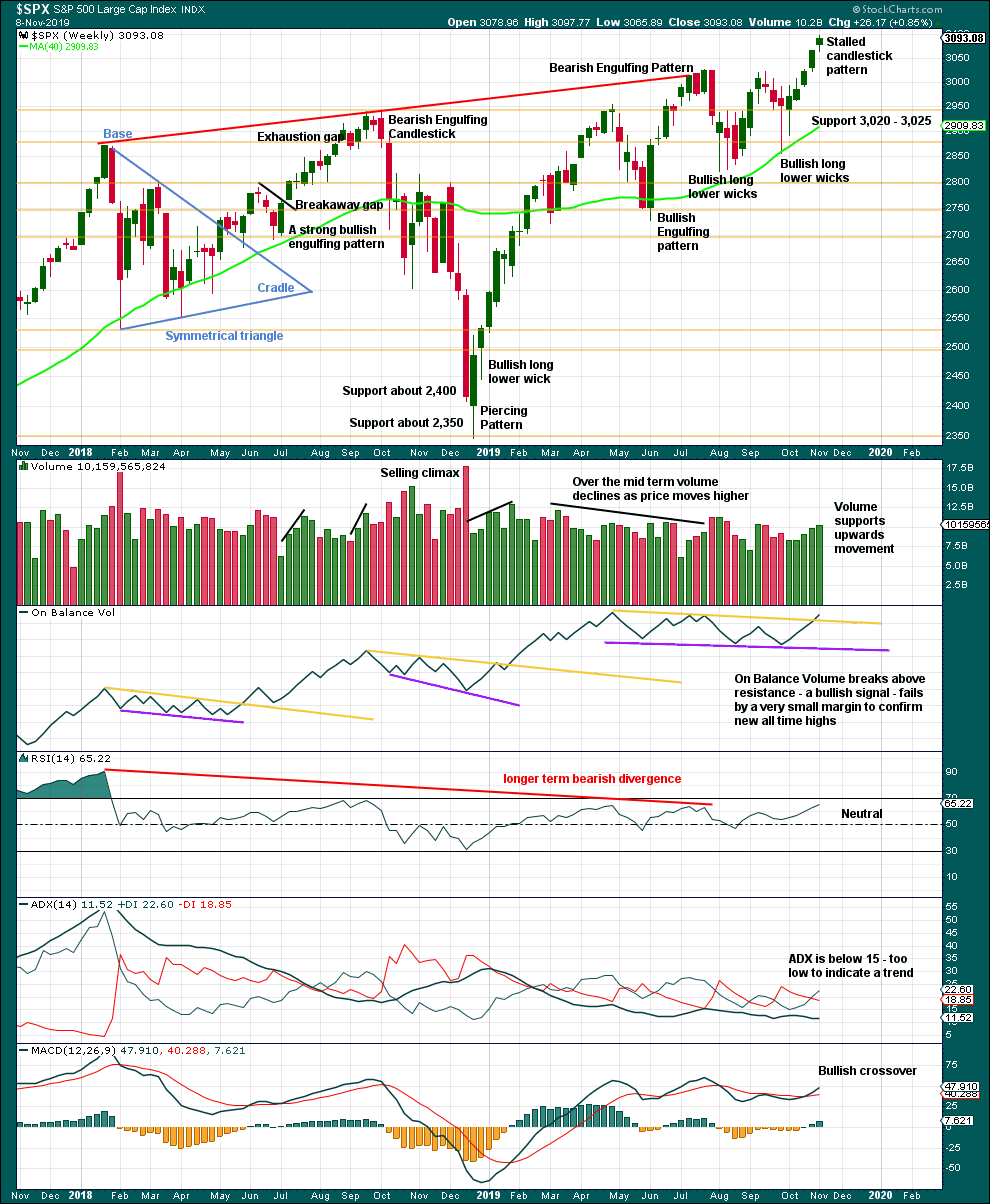

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is very clear that the S&P is in an upwards trend and the bull market is continuing. Price does not move in straight lines; there will be pullbacks and consolidations along the way.

Now that resistance has been overcome, expect a possible release of energy and any surprises should be to the upside. Corrections are normal and to be expected; they may be more short term in nature at this stage.

Last week again price overall has support from rising volume. A smaller real body for this last weekly candlestick completes a Stalled candlestick pattern, but volume undermines the bearishness of this pattern and it shall be given little weight in this analysis for that reason.

The divergence between price and On Balance Volume is extremely small; On Balance Volume is off its prior high by only the smallest of margins. This is not replicated at the monthly or daily time frames, so it shall be given no weight in this analysis.

DAILY CHART

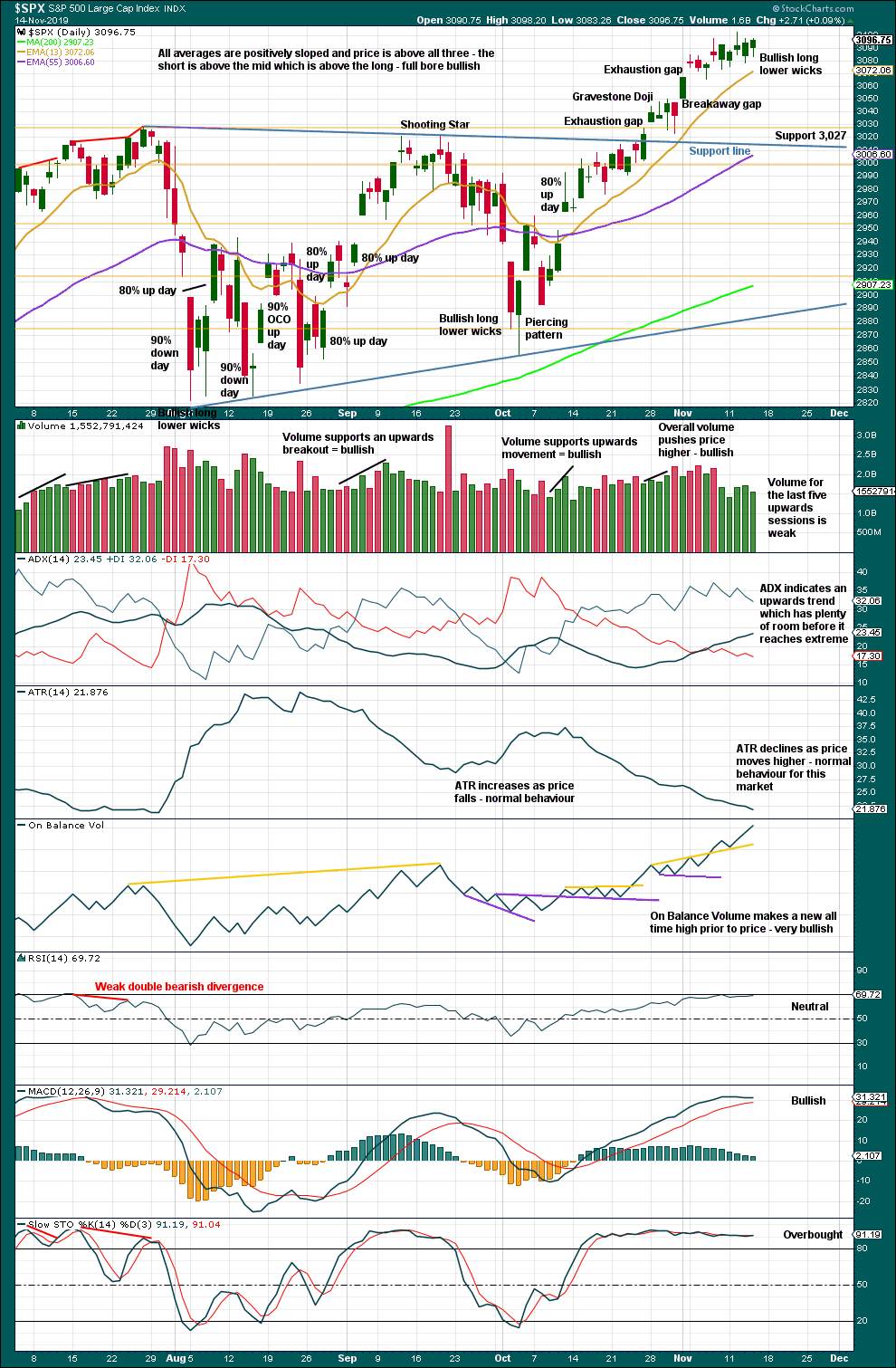

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an upwards trend in place. There will be corrections along the way.

Volume remains weak, but On Balance Volume is very bullish.

Overall, this chart remains very bullish and supports the Elliott wave count.

The breakaway gap remains open, which may provide support at 3,046.90 for any deeper pullbacks.

BREADTH – AD LINE

WEEKLY CHART

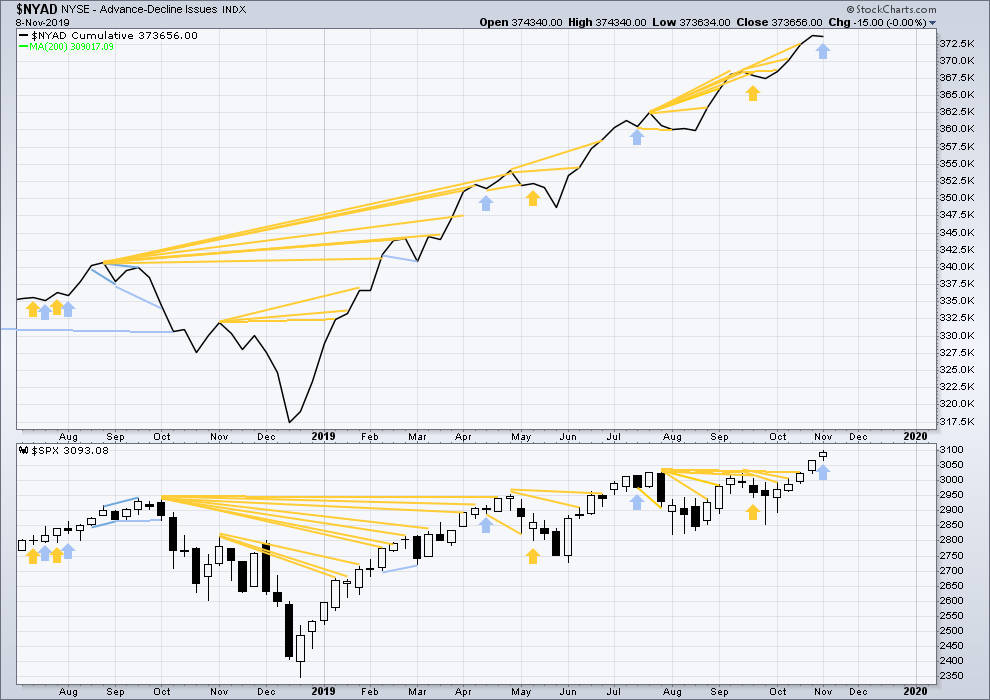

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs last week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is beginning March 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

All of small, mid and large caps have made new swing highs above the prior swing high on the 13th of September, but only large caps have made new all time highs. This upwards movement appears to be mostly driven by large caps, which is a feature of aged bull markets. This bull market at over 10 years duration certainly fits the definition of aged.

Mid and small caps have not yet made new all time highs.

Last week price moves higher, but the AD line has declined very slightly. Upwards movement last week does not have support from rising market breadth, but this divergence is very slight. This may be an early warning of a more time consuming consolidation which may come in the next one to few weeks.

DAILY CHART

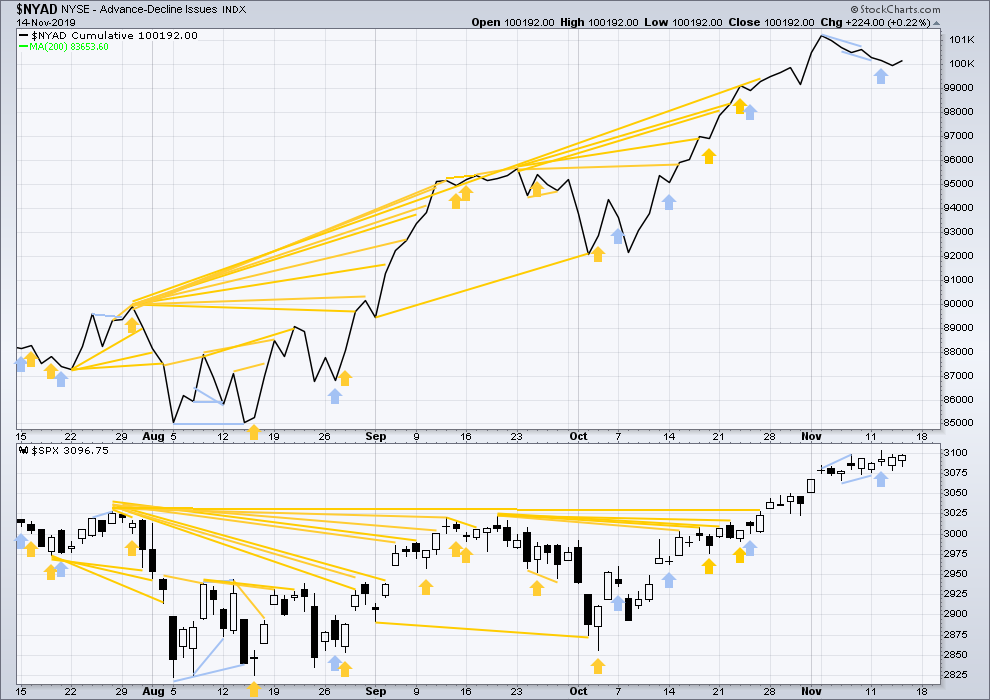

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Both price and the AD line have moved higher today. Neither have made new all time highs. There is no new divergence.

VOLATILITY – INVERTED VIX CHART

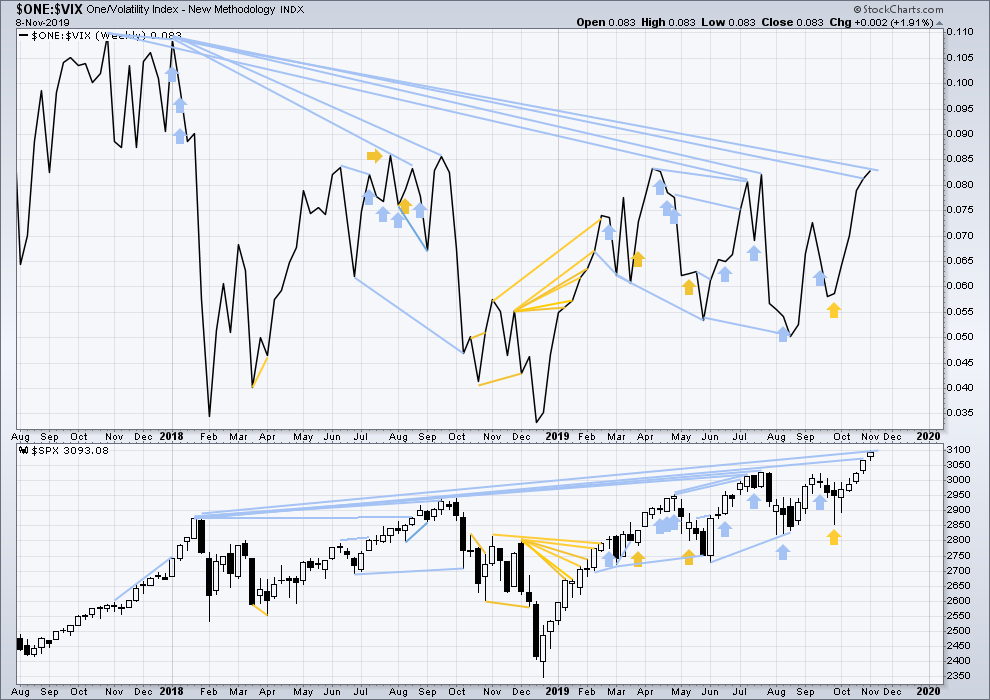

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Last week both price and inverted VIX have moved higher. Price has made new highs, but inverted VIX has not. Long and mid-term divergence remains, but short-term divergence has now disappeared.

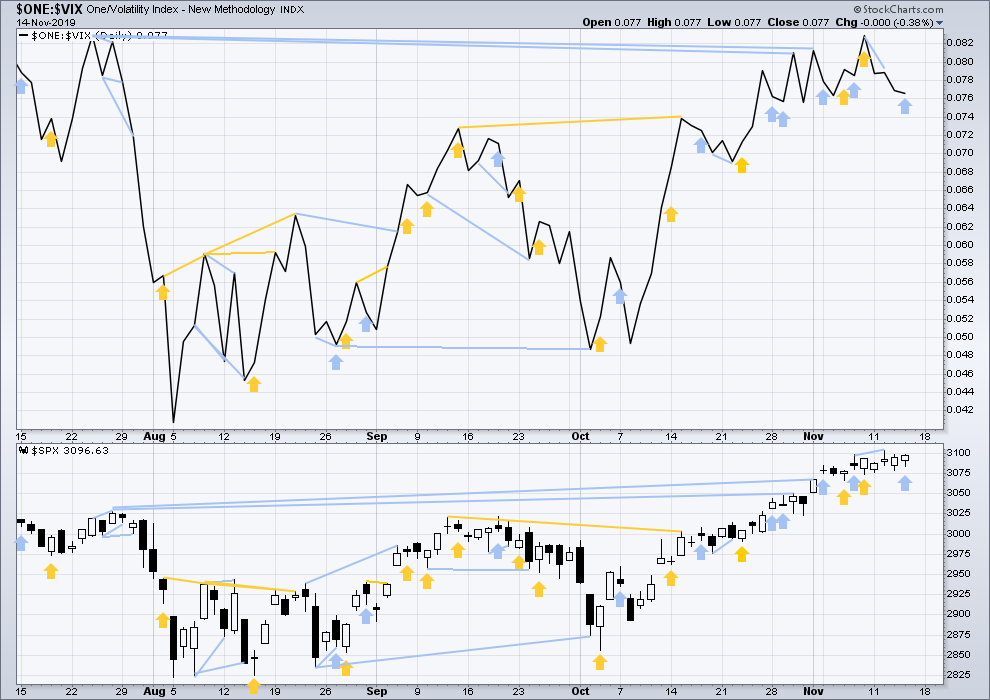

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today price has moved higher, but inverted VIX has moved lower. This divergence is bearish for the short term.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 05:55 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Well, so much for the weakness that looked to be developing. What a day! Onwards and upwards to the target.

I have minute iv as a small triangle, but I shall spend a little time on the 5 minute chart to check subdivisions before next analysis is published.

Kevin,

I think the RUT is still in minute ii and need another low in 1560-1570 before the breakout from this multimonth range..

What is your expectations as SPX YM and NQ all have broken out to new highs… thanks as always

You certainly may be correct; it’s still a bit arbitrary at this point in time how to label the RUT move up overall. But this action has broken out of the base channel of the move (to the down side), this indicating (not proving) to me that it’s a high degree wave. So for now I’m calling it minor 2. It’s sufficient from a time perspective, but it’s very shallow as a minor 2. So we’ll see.

My expectations are highly in line with Lara’s model. I am very bullish in general (I suspect we get overall 6-24 months of bullish action going forward here). But I also expect the corrections Lara refers, including some kind of SPX minor 2 that might be of some significant size.

Here’s my EW view of RUT. If you have a different view, perhaps you could provide a chart? I’m very interested in alternatives.

From what I can see three hours before the close, breadth looks quite positive today. The A-D Line should resume its advance.

Have a great weekend everybody.

Kevin, It looks to me like we have the gap an go day you so longed for. Get it? Longed for!

I am printing green on all my accounts and loving it all the way.

Longed for it…yuck yuck!!!

I’m loving it too Rodney. I’m in about 15 different long positions, SPX and RUT and a variety of stocks, all either sold put bull spreads of bought call bull spreads. Yea, a lot of green and $’s moving from “that column” over to “that column”. Until the cash register is rung and all risk is off the table…the game is still afoot! Most of mine expire mid December. I’m taking ones that get to 80% or so of max possible profit, and reinvesting afresh.

You watch the Monday night game? I like Wilson’s summary: “the craziest game I’ve ever played in!”. Looking forward to the rematch when the 9r’s hopefully have all their weapons healthy. The result may be quite different!

I did watch the game. I agree when the 49rs are fully healthy, they are the better team. But in football who can remain healthy?

Speaking of football and health, my right shoulder, 2nd to receive a replacement, has now surpassed the left. In both I have great range of motion and no more pain in the joint itself. Hooray! The strength of the muscles will take another 6-12 months until they are 100%. But I am very pleased and now planning some mountain wilderness excursions for next year.

That’s really excellent to hear Rodney. I was wondering how your shoulders were getting on… and it’s been a while since you’ve been able to get out into your wilderness so that shall be most excellent when you can do so again 🙂

Awesome. Health is always #1!

BTW, I don’t consider today the kind of day I was talking about (hoping for soon). For that, I’m looking for one of those massive up days, 1.5% at least, ideally over 2%, on relatively huge volume. Money surging into the market. Nyet!! But I suspect it will come.

The other day I mentioned that the McClellan Oscillator had a ‘buy’ signal set up by closing beneath / outside of its lower BB. When this happens the next close inside / above the lower BB is a buy signal. After three consecutive closes below the lower BB, yesterday $NYMO closed above its lower BB triggering the buy signal.

Its swing low was -22.77. I would have preferred to see it close below -40 as a swing low because it is a very reliable signal at that point. But this situation is sufficient to support the idea that the equity indices have much more upside left to go.

they say “hate the players but not the game”.

remind me to become powerful one day, then cook up a scheme where I can manipulate +1% price swings in the indices through casual electronic innuendos and manifest the mysterious, ethereal powers that validate/invalidate elliot wave theory! champagne and mai tai’s for everyone on that day.

Let me suggest that the action yesterday gave a strong signal that this was likely today. Here’s the chart showing what I mean: a perfect triangle in SPX with a break out to the upside before the close.

I was referring to kudlow comments about the brokered trade deal that ignited s&p futures over night. I’m always amazed how a bit of news comes in to move the markets around the areas of wave validation

Lara a question: what you have marked as minuette 2 of minute 1 is the largest corrective price action of this entire swing up so far. What is your take on that possibly being the minute 2, and price continues now in an extended minute 3. Next up soon would then be a minute 4. Thanks.

ps: overnight up strongly! Should be opening at new ATH. I will post my latest projections for current swing completion targets in /ES.

Fibonacci extensions of prior swings (with the %’s) and Fibonacci fitted projections (the blue lines; each starts at the date I did that projection). It’s just a matter of letting the market reveal which level/zone it will be. I left two recent lower projections on there just because; normally I scrub those along the way as they get invalidated.

It’s entirely possible. I can chart it and it looks okay.

There are multiple ways to label this upwards wave now. But at the end of the day it doesn’t matter so much until we get to the end of minor 3. Along the way up no matter how its labelled, corrections may continue to be brief and shallow.

I’m going to believe in the bigger bull…after I see one or more 1.5-2%+ days on high volume, a sign money is finally starting to surge back in. Right now the buying pressure is outweighing selling, but only by a little and we haven’t had a really strong gap and go day since forever. If this thing is going to go secular bull for 6 months+, we need to detect some tidal shift in money flow into the market. Not yet, but be ready. Maybe after the minor 2?

Hi everyone,

I’ve posted on 11/14 the idea that the entire move from November 7 to November 14 on the SPX could be wave (iv)-green.

What is iii-circled-pink on the hourly chart could only be wave b-orange of (iv)-green, and wave (iv)-green has just terminated today (11/14).

This count would only require a wave (v)-green up to finish wave iii-circled-pink.

I like this count because the SPX does not seem ready for a 100+ points rise, but also because of the level of the VIX. The VIX is much too low for the beginning of a serious leg up, and I would anticipate:

A quick wave (v)-green to new but marginal ATH, to finish iii-circled-pink, and then a larger wave iv-circled-pink to develop, with much needed rise of VIX to the >15 area (the quick wave (v)-green has probably started today).

I’m sorry, I can’t follow this without a chart. I can’t see a chart posted in this analysis for 14th November.