Upwards movement was expected to resume. The session has closed as an outside day with a strong finish and a green daily candlestick.

Summary: The upwards trend may now resume to new all time highs. Downside risk is at 2,931 for the short term.

The next target is 3,120. Classic analysis very strongly supports this main wave count.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

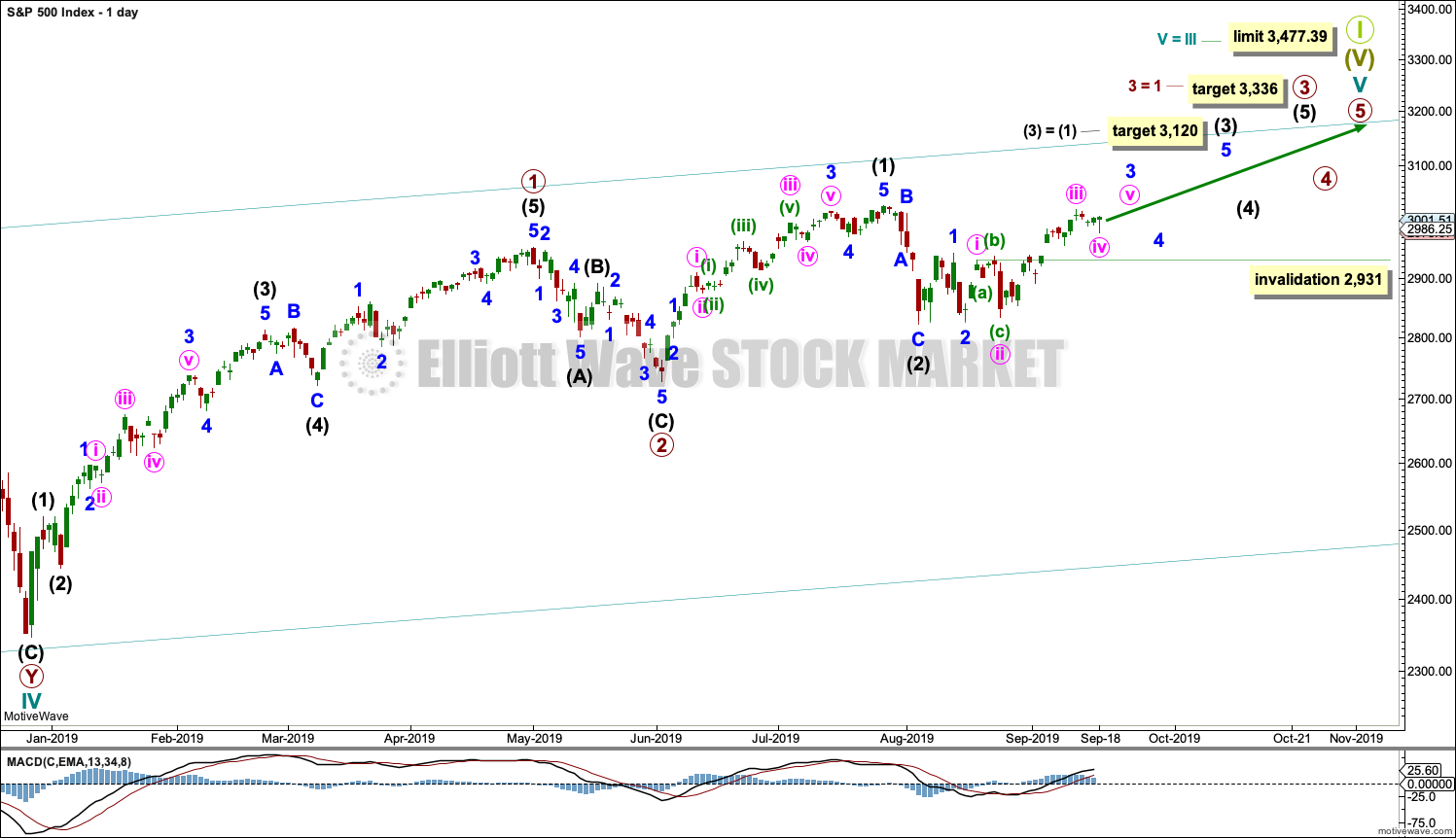

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

MAIN DAILY CHART

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse.

Within intermediate wave (3), minor waves 1 and 2 may be complete. Within minor wave 3, minute waves i through to iii may be complete. Minute wave iv may not move into minute wave i price territory below 2,931. If this wave count is invalidated in the short term, then the alternate below may increase in probability.

All of primary wave 3, intermediate wave (3), minor wave 3 and minute wave iii may only subdivide as impulses.

Intermediate wave (3) must move far enough above the end of intermediate wave (1) to then allow intermediate wave (4) to unfold and remain above intermediate wave (1) price territory.

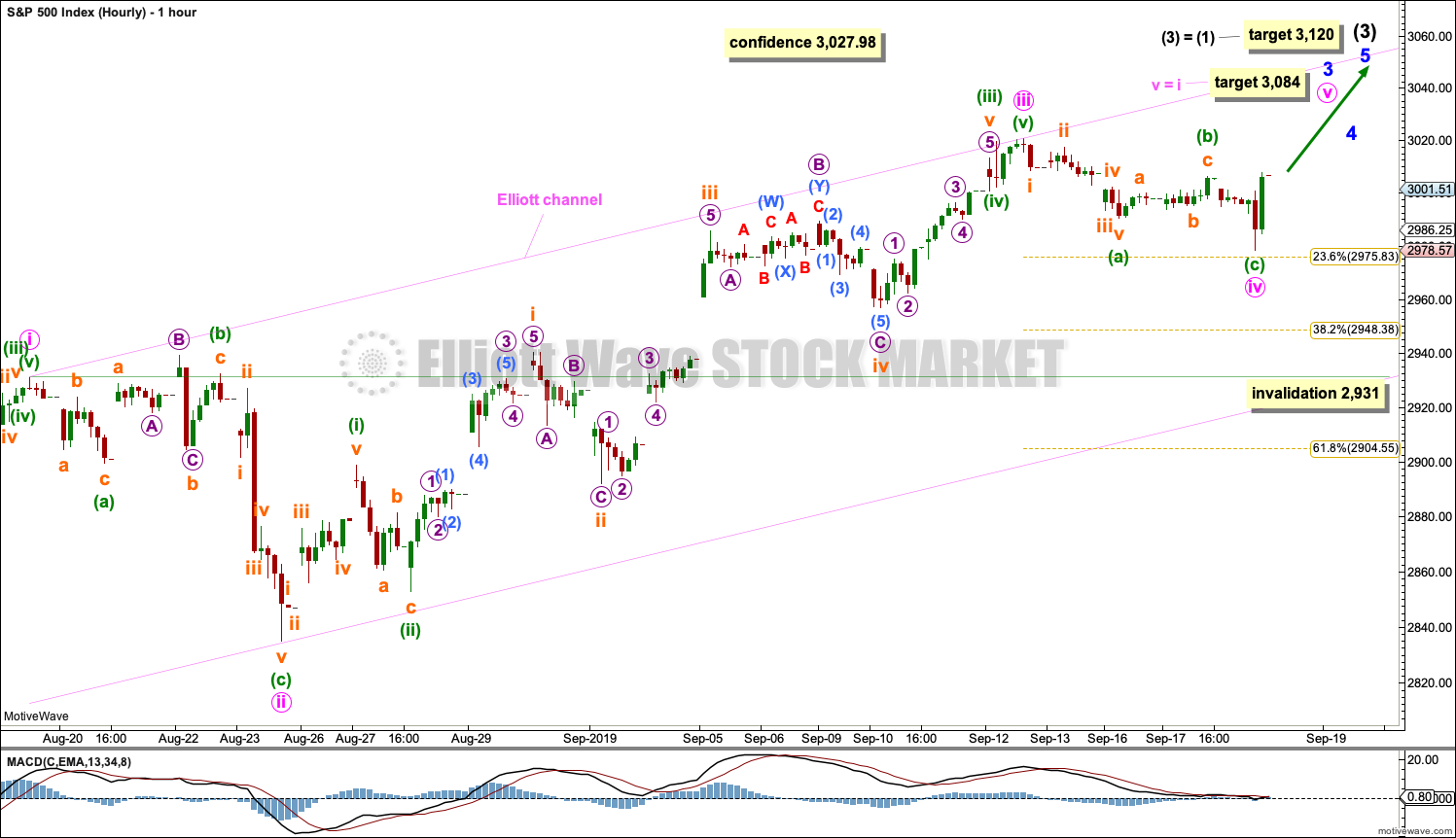

HOURLY CHART

The degree of labelling for the current pullback is moved up one degree. This may be minute wave iv.

Minute wave ii was a deep 0.91 flat correction lasting four sessions. Minute wave iv may be complete as a shallow 0.23 zigzag also lasting four sessions. This wave count has good proportion and alternation.

At target is calculated for minute wave v to exhibit the most common Fibonacci Ratio to minute wave i.

If minute wave iv continues further, it may not move into minute wave i price territory below 2,931.

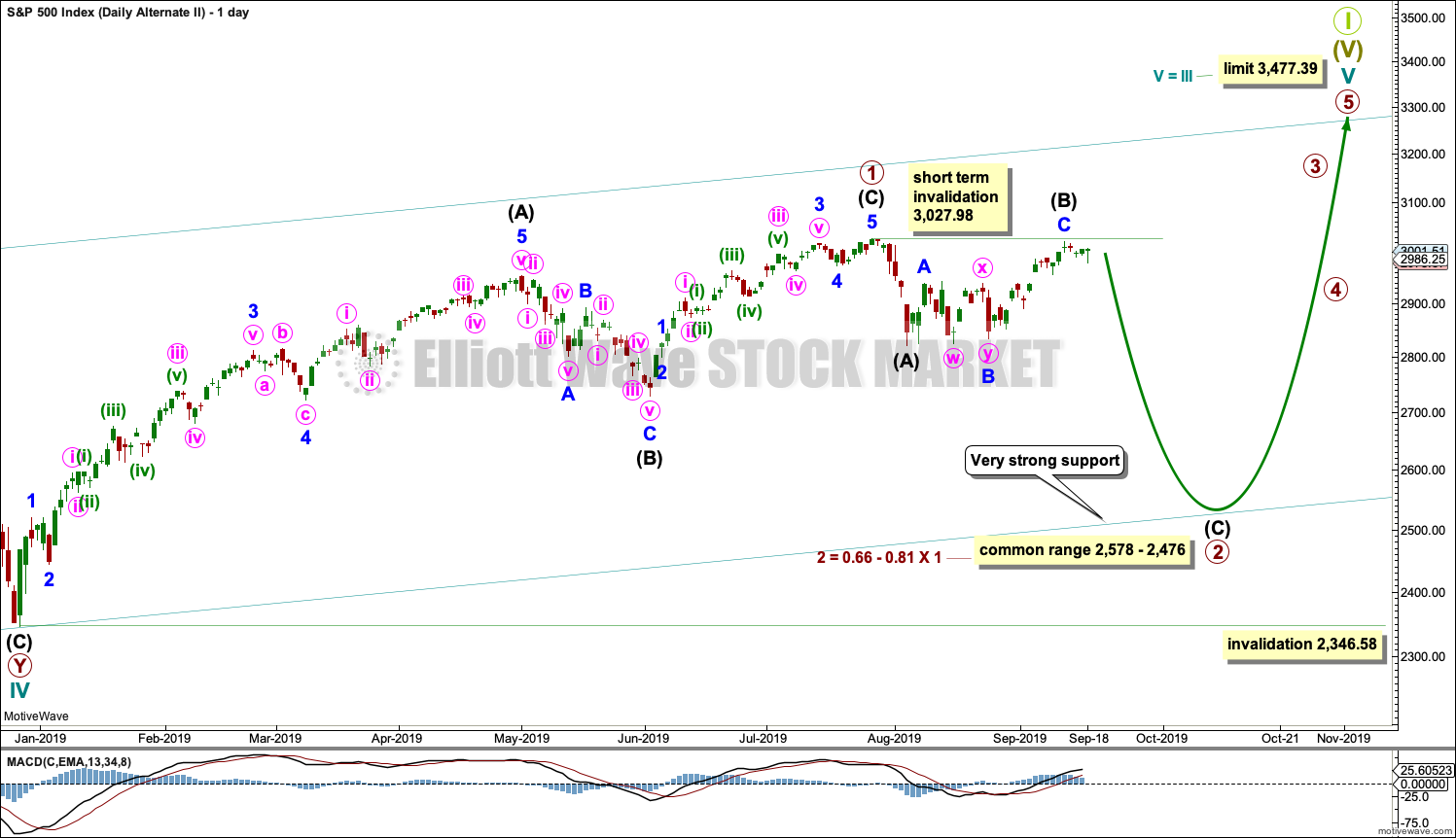

ALTERNATE DAILY CHART

This alternate wave count has been published before. It will be published again today as a reminder that alternates do currently exist

This alternate wave count is still judged to have a low probability because it does not currently have support from classic technical analysis.

The main wave count expects cycle wave V to unfold as the more common impulse. This alternate wave count looks at the less likely possibility that cycle wave V may unfold as an ending diagonal.

All sub-waves within ending diagonals must subdivide as zigzags. The second and fourth waves of diagonals are commonly very deep, correcting to between 0.66 and 0.81 the prior wave.

Within the zigzag of primary wave 2, intermediate wave (B) may not move beyond the start of intermediate wave (A) above 3,027.98.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

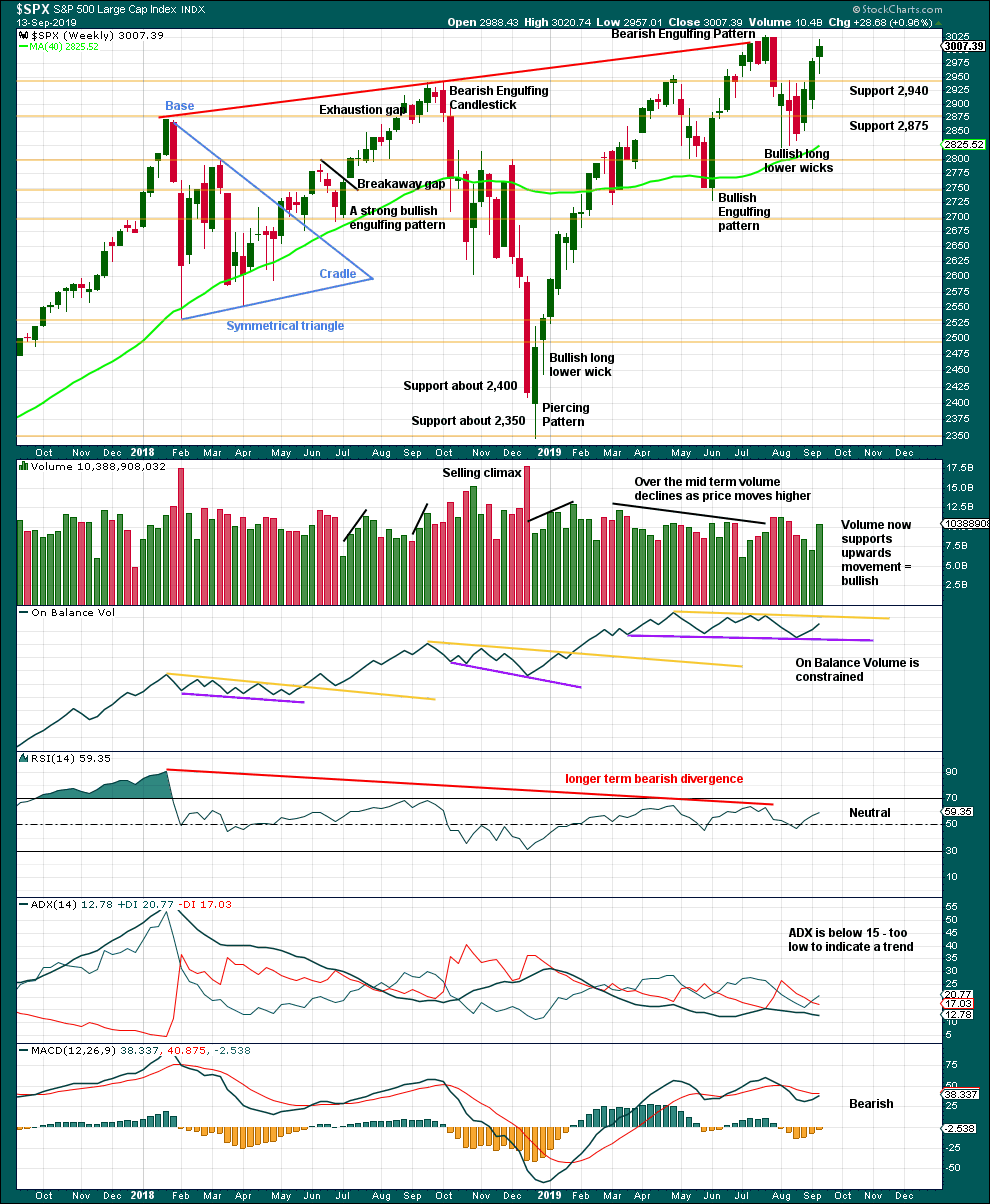

Click chart to enlarge. Chart courtesy of StockCharts.com.

A long lower wick and good support from volume for an upwards week strongly suggests more upwards movement directly ahead.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a series of higher highs and higher lows since the 5th of August. Strength in 90% up days and back to back 80% up days off lows indicate the lows may be sustainable.

Support at 3,000 has not yet been breached on a closing basis, so it remains intact. Another close near the high for the session with a very long lower wick suggests more upwards movement ahead.

The target from the triangle is at 3,060, which has still not been met and remains valid.

BREADTH – AD LINE

WEEKLY CHART

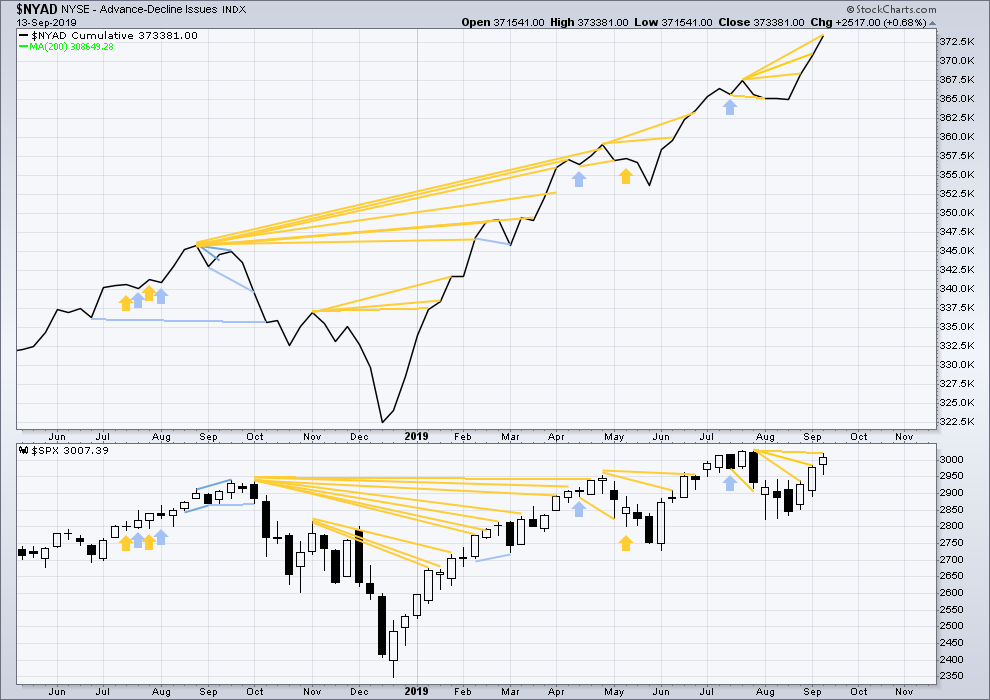

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid January 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Again, last week both price and the AD line have moved higher.

The AD line makes a new all time high. This is a very bullish signal and very strongly supports the Elliott wave count.

Small caps have made a new swing high above the prior high of the end of July, but mid and large caps have not yet done so. This upwards movement of the last three weeks appears to be led by small caps. Because small caps are usually the first to exhibit deterioration in the later stages of a bull market, some strength in small caps at this stage indicates a healthy bull market with further to run.

DAILY CHART

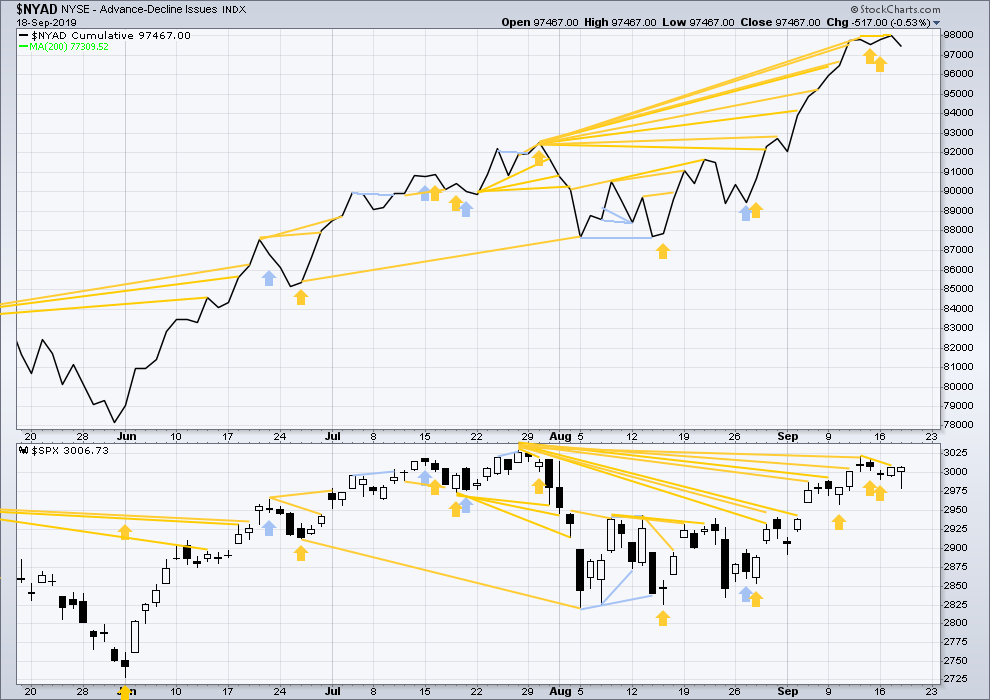

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today price has completed an outside day and the AD line has declined. Both price and the AD line may have made new lows below the low two sessions prior, but the AD line is weaker than price. There is no new short-term divergence.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

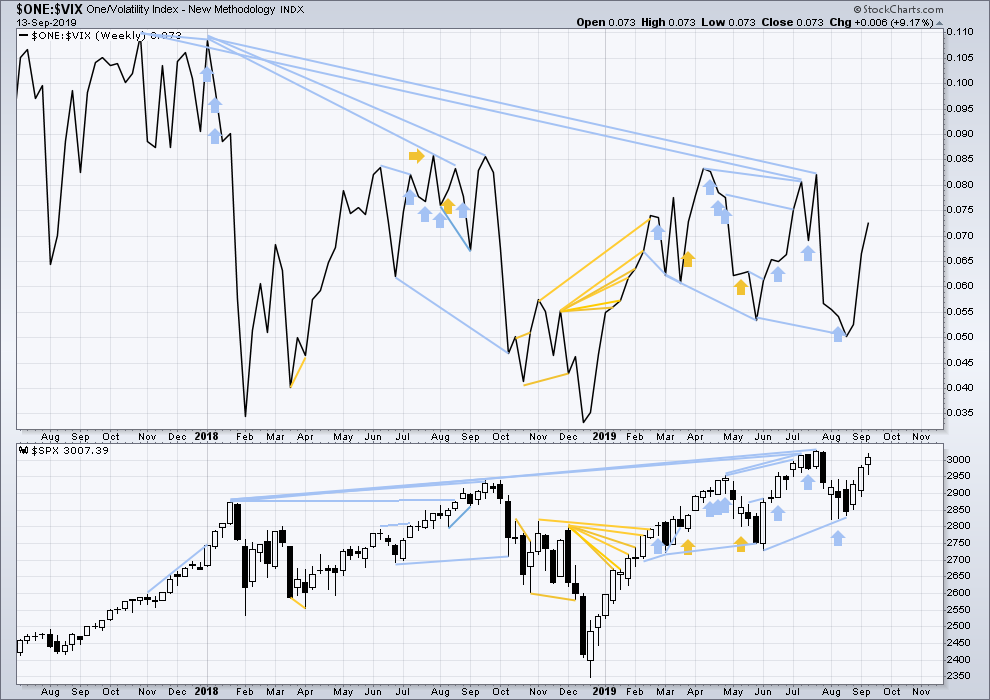

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and ten months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

Again, last week both price and inverted VIX have moved higher. There is no new divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Price has completed an outside day and inverted VIX has increased. There is no new short-term divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 10:09 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

Minor 3 could be over, but it would look better if it moves higher to the target. This is because it’s near the end of intermediate (3) and that needs to move above the end of intermediate (1) far enough to allow room for intermediate (4) to unfold and remain above intermediate (1) price territory.

For those newer members, I hope that makes sense. I’ll go over how this works in the end of week video in a bit of detail to make it as clear as possible.

If my labelling on this chart is wrong it may be one degree too high.

RUT hourly, up to date. Corrections and alternatives, please!

hhmm maybe that minuette iv isn’t over…

Market a bit disappointing today after what seemed like a bullish day yesterday. I think it might be the Repo ordeal, which is turning out to be a QE in of itself. 50 billion on Tuesday, 80 billion yesterday, and another 75 billion today. And I hear they’ll need another one tomorrow…

That doesn’t sound good!

But maybe it has nothing to do with that… who knows.

there is huge options interest in SPX (18000!!) for tomorrow at 3000. Between selling today and a high potential gap down tomorrow…expect price to “get there” by tomorrows open. Those SPX options settle at the opening price of all the stocks in SP500 (which is determined only after each executes its first trade; the opening price of SPX is NOT the settlement price, because that will at least temporarily use prior day’s closing price). It’s complicated, there’s a good article on the mess called “Settlement prices can be unsettling” you can search for if interested.

got my RUT profit for the AM, looking to rebuy

You and me both brother. Sweet run! The pull back here is sitting right on the 21-23% retrace level at the moment. Glad to see you’ve come over the “RUT side”, so to speak yuck yuck!

I’ll take my first bite at the 38%

Anyone know why SPX monthly options are shown expiring today 9/19 instead of tomorrow, 9/20? Do they really expire at the close TODAY ? I mean, that’s what 9/19 implies but…really? On Thursday?

Maybe its because tomorrow is dividend payout?

Not sure…

SPX monthly are a bit odd. Your last chance to trade this months SPX options is the close TODAY. However, settlement (cash) is based on the OPENING price tomorrow morning. This is quite different from SPY options, which close end of day tomorrow. Then with SPY options you have dividend considerations; if you are short SPY calls at close tomorrow, you get dinged for the dividend payout. No dividend issues with SPX options.

The settlement of SPX options and SPX futures tomorrow is on the opening SQ of the SPX. SQ, for special quotation, is the computation of the value of the index using the opening value of its components.

It is very different than the value displayed on CNBC at 9:30am, as the value published uses the closing value for the stocks that have delayed opening (which is why you usually see the price gradually reach fair value in a few seconds as stocks open). For the SQ, you wait for all stocks to be trading, and you compute the value of SPX using the opening value of each stocks and the proper weight in the index. The SQ is usually published late morning.

There is no globex tonight for future maturing tomorrow, so all positions must be squared by 4:15pm tonight, or they will cash settle tomorrow.

While the SPX is approaching a new ATH, I am noting that IWM has still not broken out of its seven month trading range well below its ATH over one year ago! If SPX makes new ATH’s and IWM does not break above the 158-159 then we may be looking at the completion of the bull cycle from March 2009. I have seen more than one EW / TA analyst call for a top in the market around 3050 SPX and October.

On the other hand, I recently read a forecast from Ted Aguhob of WaveGenius calling for a move in the SPX to a minimum of 3250-3300 in this current wave up. He states that if this level is exceeded, we are on our way to SPX 3900-4000.

My point is that I will be very cautious as we climb from 3030 upwards and I will be watching how the other indexes are performing for clues to our direction. Of course, Lara’s wave count is my #1 source and norm for such clues. Thanks Lara for all the excellent effort and products.

I don’t think RUT’s relative weakness in the spring/summer is a matter of significant concern. There was a period when interest rates were going to go UP, then a ton of uncertainty about interest rate direction and RUT is super interest sensitive. Now obviously it is clear rates are going down, and RUT for several weeks has been leading, not lagging. The fact it’s “behind” due to poorer performance in the past doesn’t concern me. Maybe I’m missing something, but that’s how I view it. Also, I appreciate Lara’s assessment that RUT’s current strength is bullish overall because nominally in a very late stage bull market RUT weakens before the big caps.

I guess I am looking at a longer term view. Tops are a process more often than not. A rounded top is not rare. And yes, the small caps like RUT often lead, even in making their top long before the large cap stocks. So, if and when RUT makes a new ATH, I will look at that as some confirming data as to the ongoing bullish market. However, I certainly would like to see it go much higher and negate the possible rounded top. SPX is struggling in a possible ending diagonal that ari mentions. But it may move quickly above 3100-3150 which would help negate this possible pattern. I would love to see that happen.

I guess I am just trying to be cautious looking for and pointing out possible derailment scenarios.

Some traders also talking about a megaphone top formation. The top of the trend line at the very least should provide some resistance, maybe that’s where Minor 4 will start (bullish count).

Not fair, but first 🙂

There is an interim bulletin published today over at Invysis.com

I’m adding another stock to the StockWatch.

2nd to Lara… I’ll take it!

Asleep at the switch third. Or…am I second? We need to consult the rule book on this.

I did. You are third. However, this sort of mad grab at fame by the publisher is only allowed once per month. Should this limit be violated, the publisher shall be banned from being #1 until the start of a new moon.

🙂

But… I make the rules so….