Another upwards day with price closing within a trading range leaves all three Elliott wave counts valid. However, classic technical analysis strongly supports the main Elliott wave count.

Summary: An upwards breakout above 2,940 with support from volume would add confidence in the main wave count. If this happens, then the next target is 3,120. Classic analysis very strongly supports this main wave count.

A new low below 2,822.12 would indicate a continuing deeper pullback as fairly likely, as outlined by the alternate wave counts. The first target would then be at 2,663.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

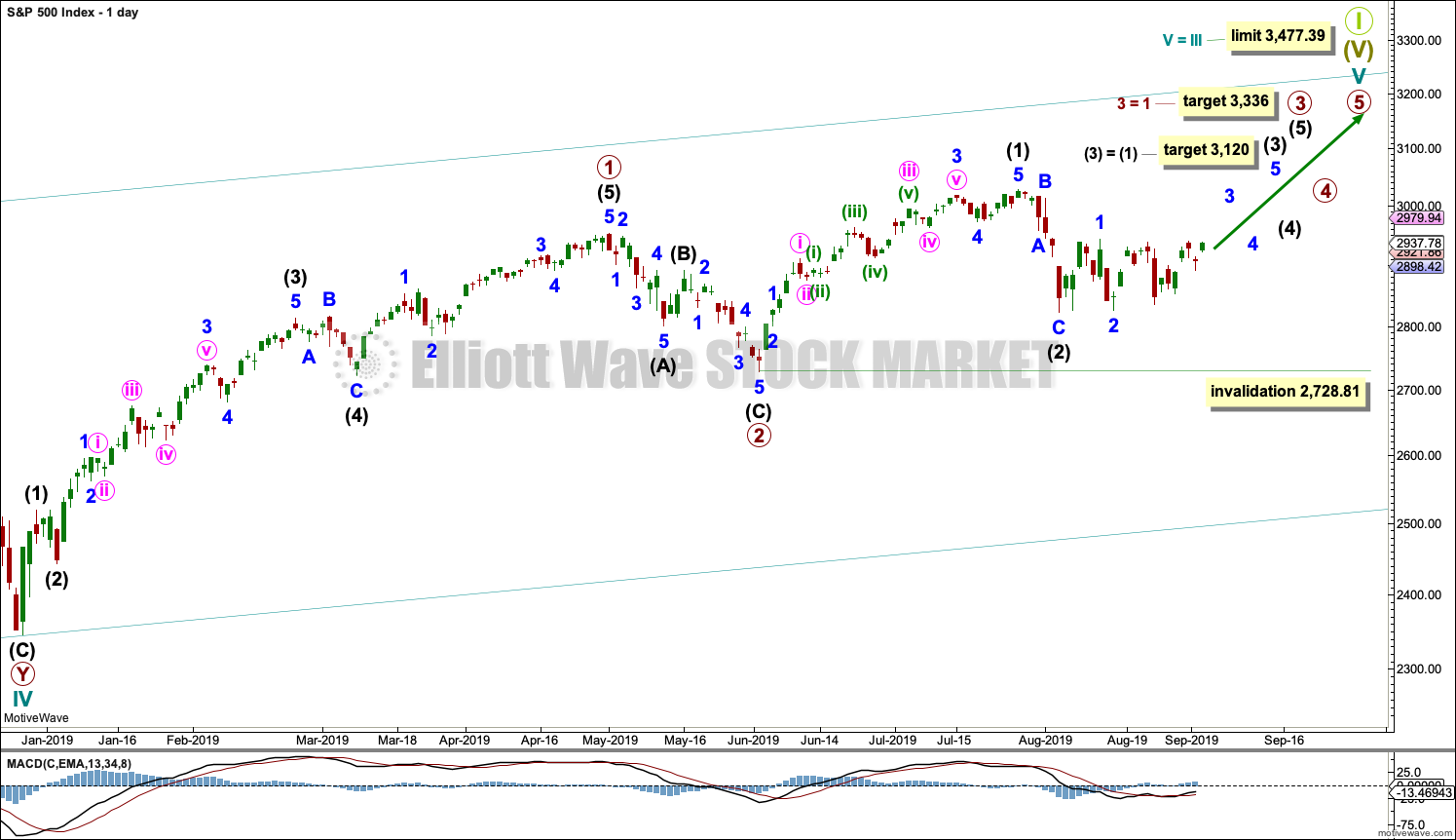

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will now focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

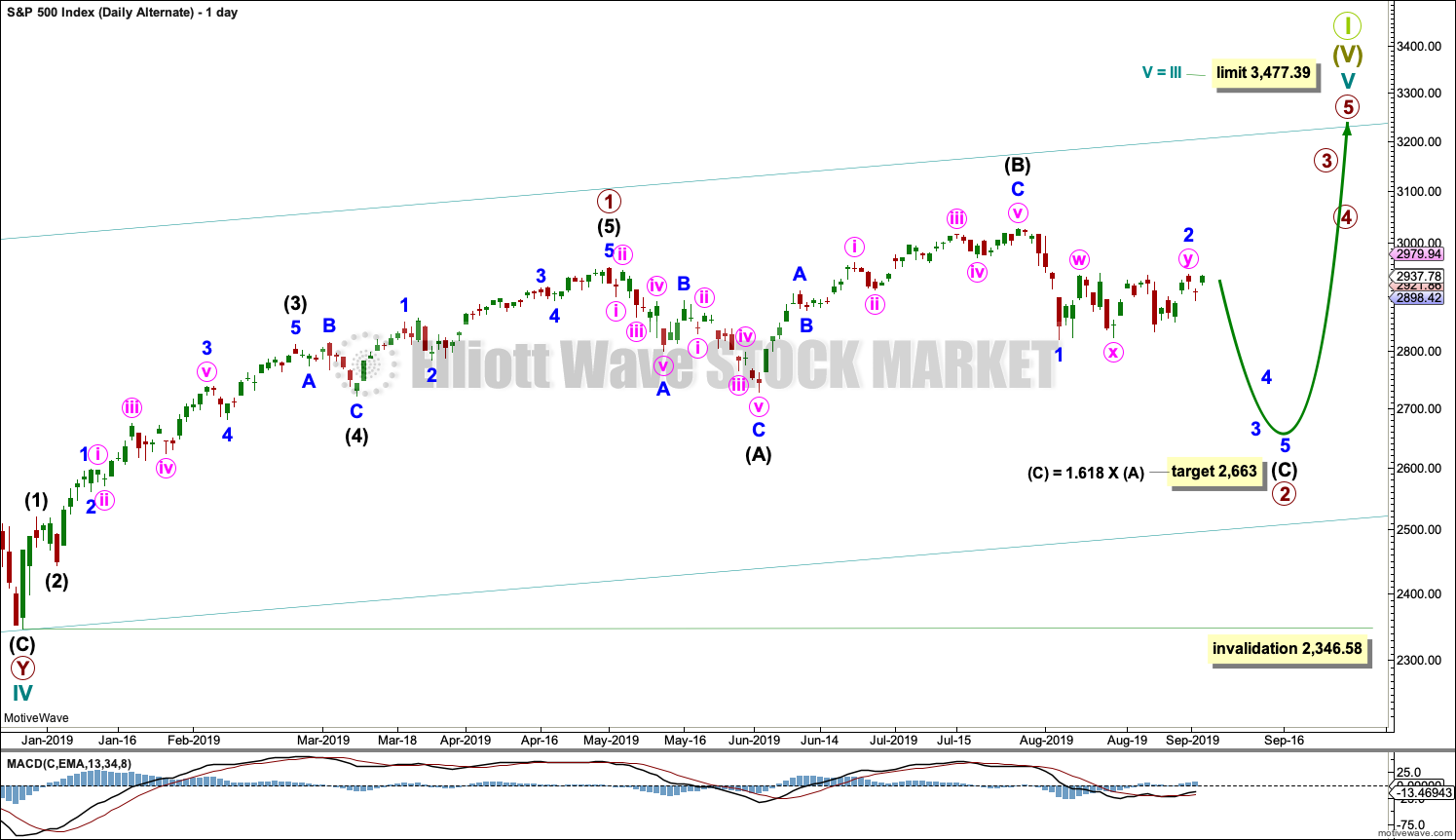

MAIN DAILY CHART

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

It is also possible that intermediate wave (2) may be incomplete and sideways movement of the last 21 sessions may be minor wave B within a zigzag for intermediate wave (2). If intermediate wave (2) continues lower, then it may not move beyond the start of intermediate wave (1) below 2,728.81.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse.

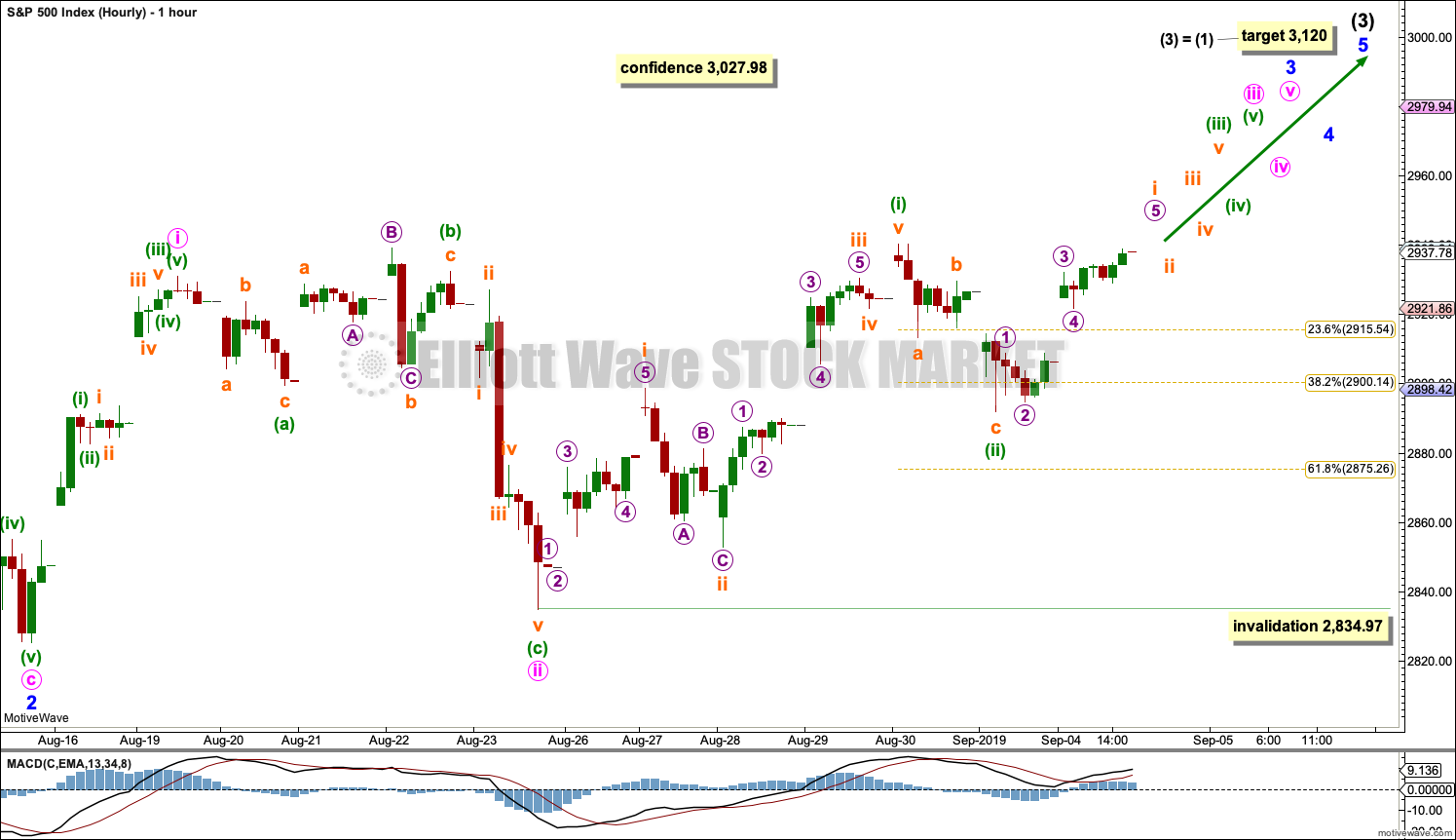

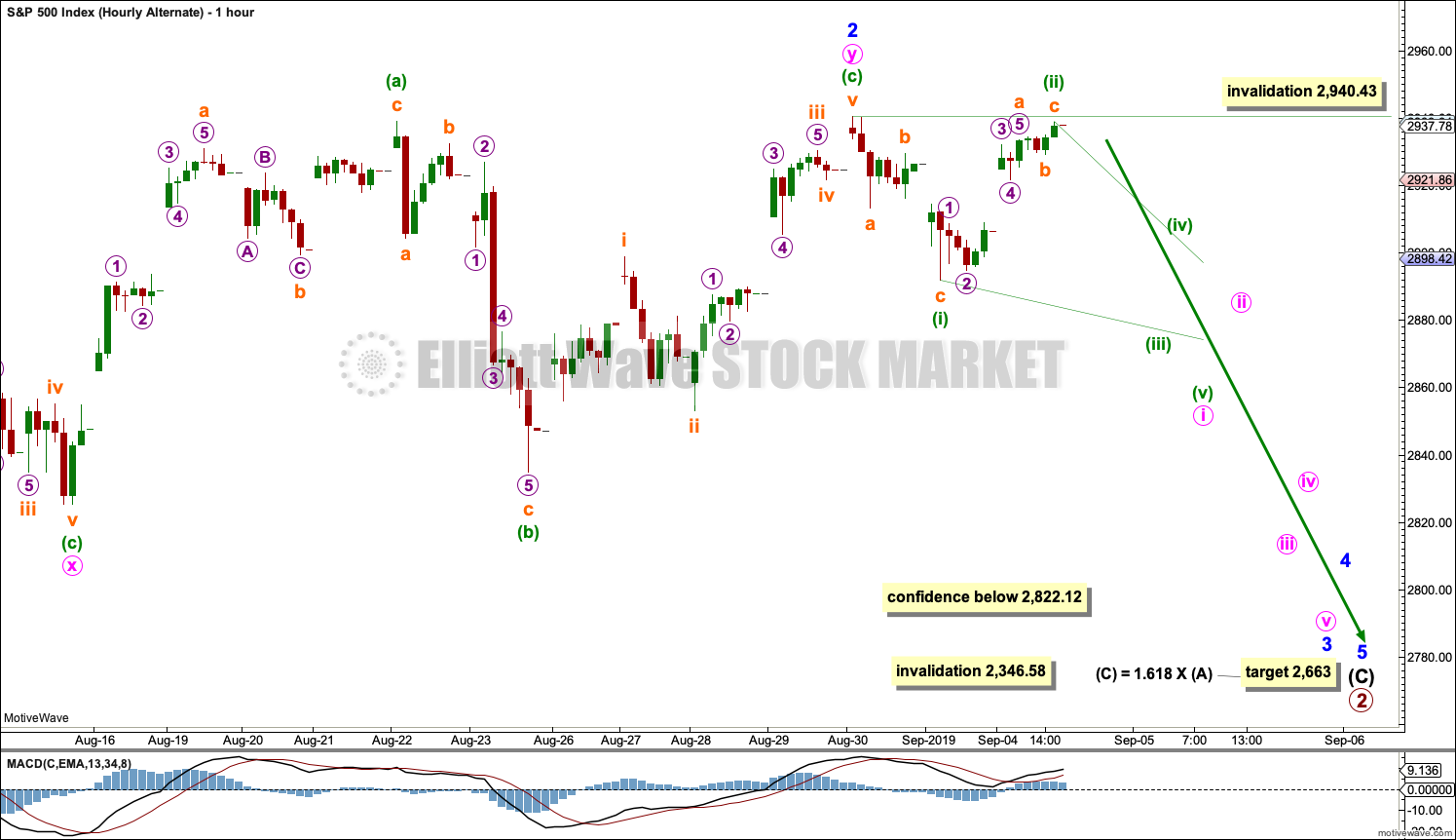

MAIN HOURLY CHART

Intermediate wave (3) may only subdivide as a five wave impulse. Within intermediate wave (3), minor waves 1 and 2 may now be complete. Minor wave 3 may only subdivide as a five wave impulse.

Within minor wave 3, minute waves i and ii may be complete. Within minute wave iii, minuette wave (ii) may not move beyond the start of minuette wave (i) below 2,834.97. For the very short term, a little more confidence may be had in this wave count now that price has today made a new high above 2,913.32.

Minute wave iii must move beyond the end of minute wave i. Minute wave iii must move far enough above the end of minute wave i to allow room for minute wave iv to unfold and remain above first wave price territory.

The next wave up for this wave count may then exhibit an increase in momentum as a third wave at five degrees unfolds.

ALTERNATE DAILY CHART

This first alternate wave count considers the possibility that cycle wave V may be unfolding as an impulse.

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary wave 1 only may be complete.

Primary wave 2 may be unfolding as an expanded flat correction. These are reasonably common Elliott wave corrective structures. Flat corrections subdivide 3-3-5. Expanded flats have B waves which are 1.05 or more the length of their A waves. In this example for primary wave 2, intermediate wave (B) is a 1.33 length of intermediate wave (A). The target for intermediate wave (C) expects it to exhibit the most common Fibonacci Ratio to intermediate wave (A) within an expanded flat.

If price reaches the target at 2,663 and keeps falling, then the next target would be the 0.618 Fibonacci Ratio of primary wave 1 at 2,578.66.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

ALTERNATE HOURLY CHART

Intermediate wave (C) must subdivide as a five wave motive structure for this wave count. Minor waves 1 and 2 may be complete within intermediate wave (C).

Minor wave 2 may have ended as a double combination: zigzag – X – flat.

Minor wave 3 may have begun and may only subdivide as an impulse. Minute wave i within minor wave 3 may be incomplete and may be unfolding as a leading diagonal. The first wave down from the high labelled minor wave 2 now subdivides as a three; leading diagonals may have sub-waves 1, 3 and 5 which subdivide as zigzags.

First waves most commonly subdivide as impulses. Leading diagonals are not rare structures, but they are uncommon. The probability of this wave count today is reduced.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 2,940.43.

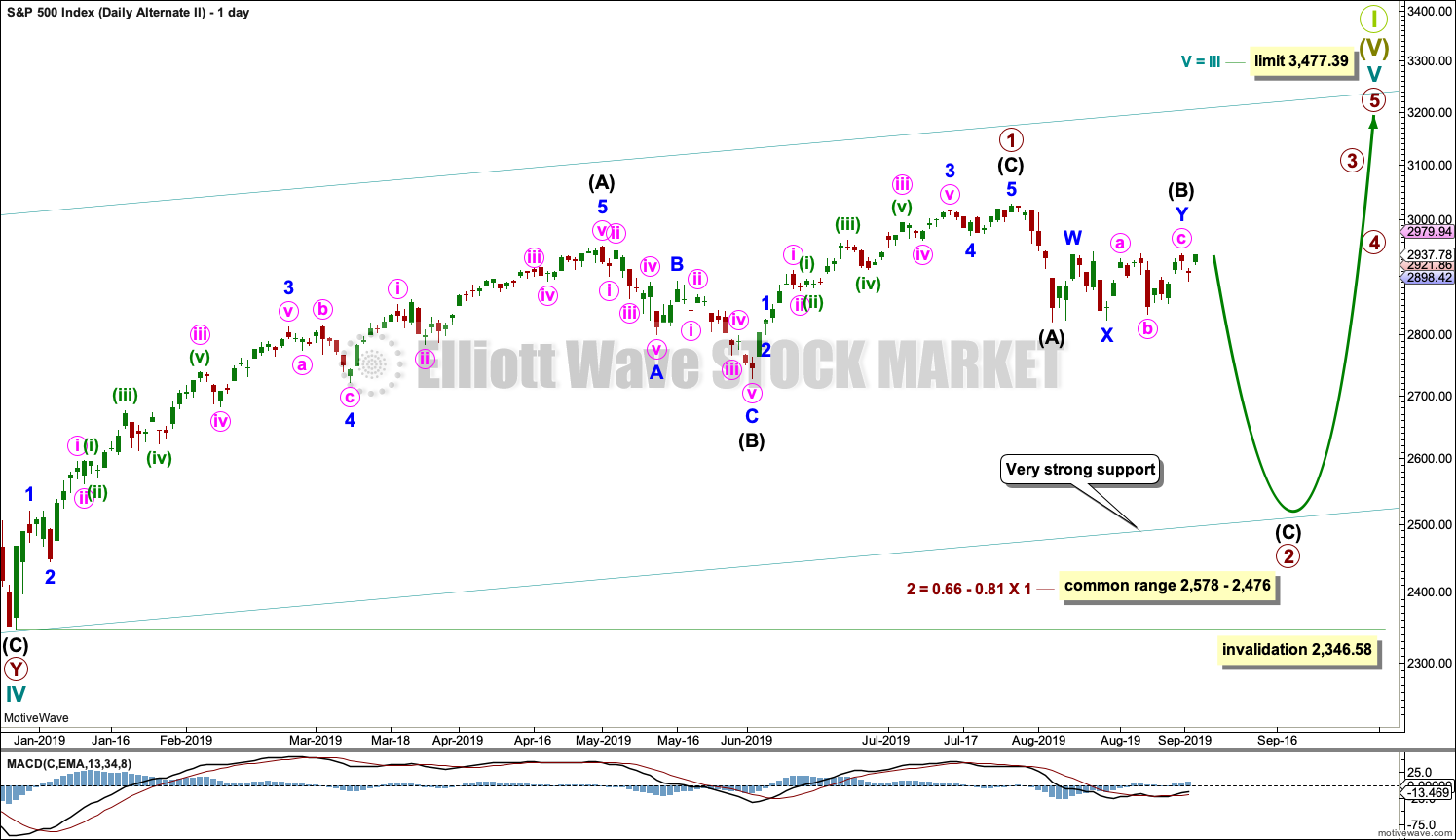

SECOND ALTERNATE DAILY CHART

This second alternate daily chart considers the other structural possibility for cycle wave V, that of an ending diagonal. Ending diagonals in fifth wave positions are not as common as impulses; for this reason, this wave count will remain an alternate until an impulse for cycle wave V is invalidated.

All sub-waves within an ending diagonal must subdivide as zigzags. Primary wave 1 may have been complete as a zigzag at the last all time high on the 26th of July.

Primary wave 2 may be continuing lower as a zigzag. Within the zigzag, intermediate wave (B) may now be a complete double combination.

Within diagonals, sub-waves 2 and 4 are normally very deep, ending within a range of 0.66 to 0.81 the prior wave. This range for primary wave 2 is from 2,578 to 2,476. Primary wave 2 may possibly come as low as the lower edge of the teal channel, which is copied over from the weekly chart.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

The probability of this second alternate wave count today is judged to be too low for an hourly chart to be warranted.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

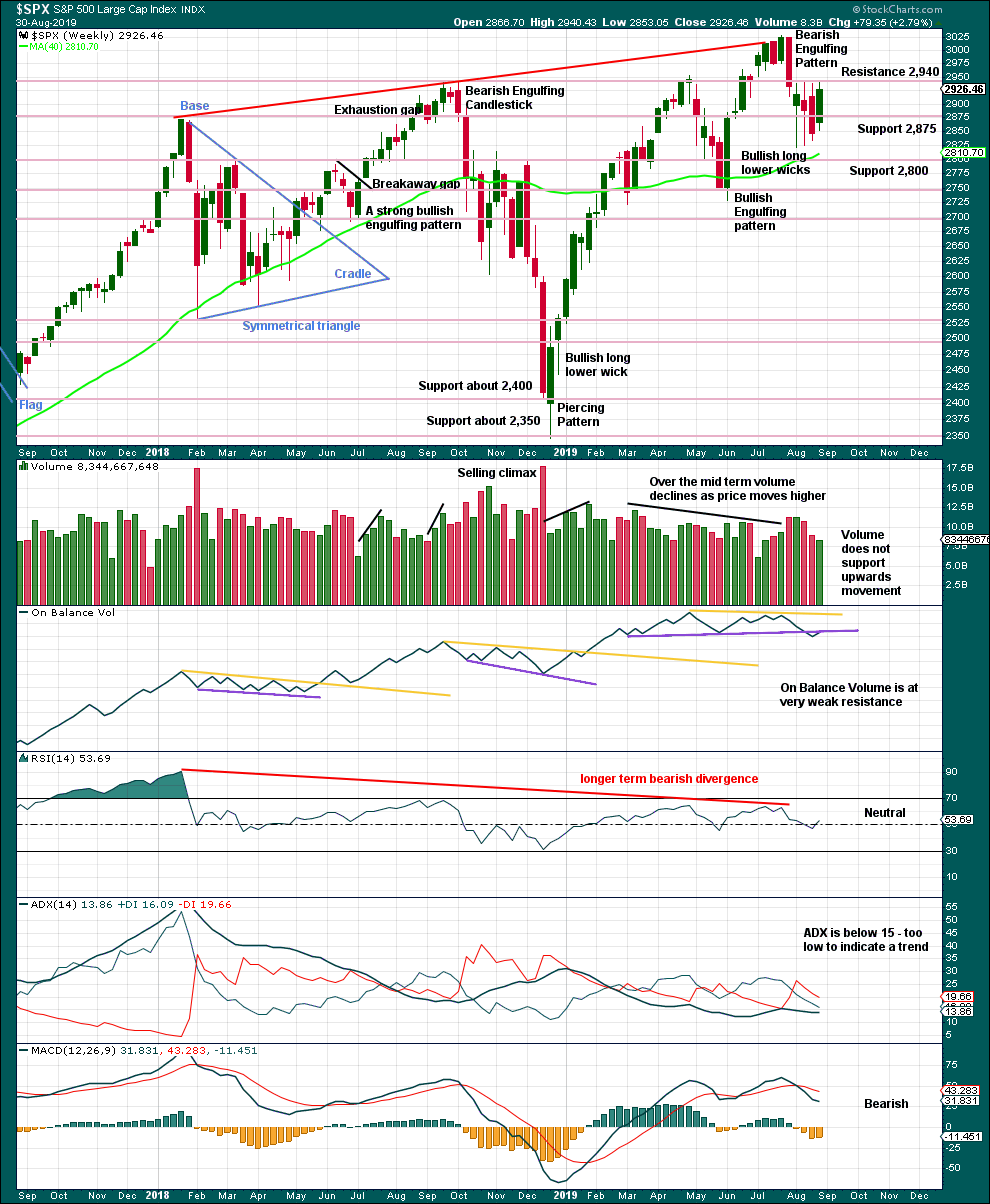

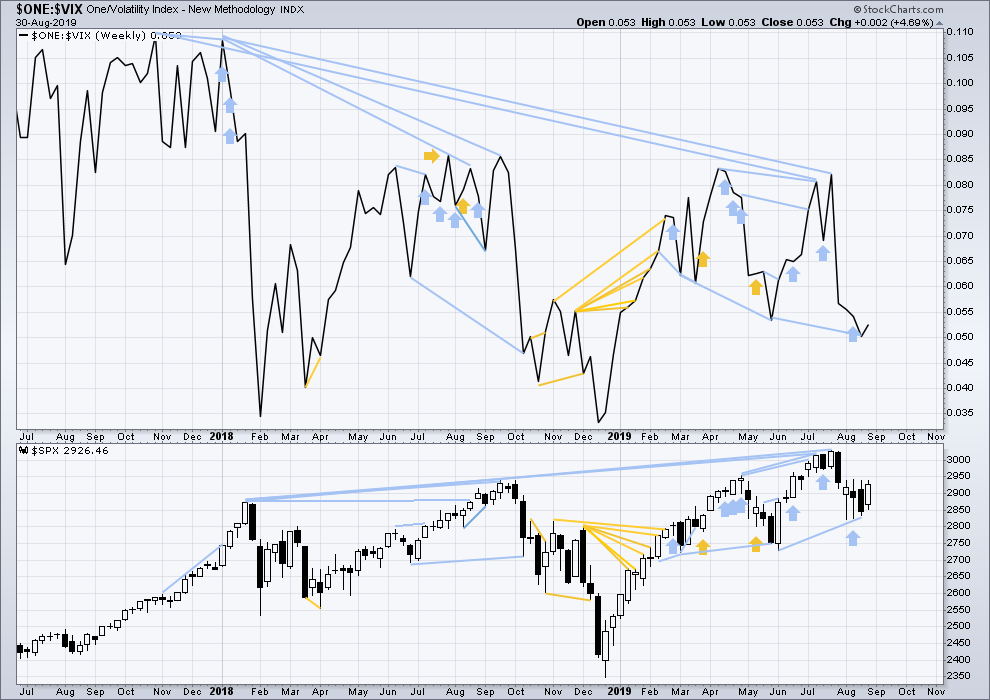

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains range bound with resistance about 2,940 and support about 2,920.

The larger trend is up from the low in December 2018, with a series of higher highs and higher lows. This upwards trend should be assumed to remain while the last swing low at 2,728.81 remains intact.

If On Balance Volume breaks back above the resistance line, then the weak bearish signal would be negated and the line would need to be redrawn.

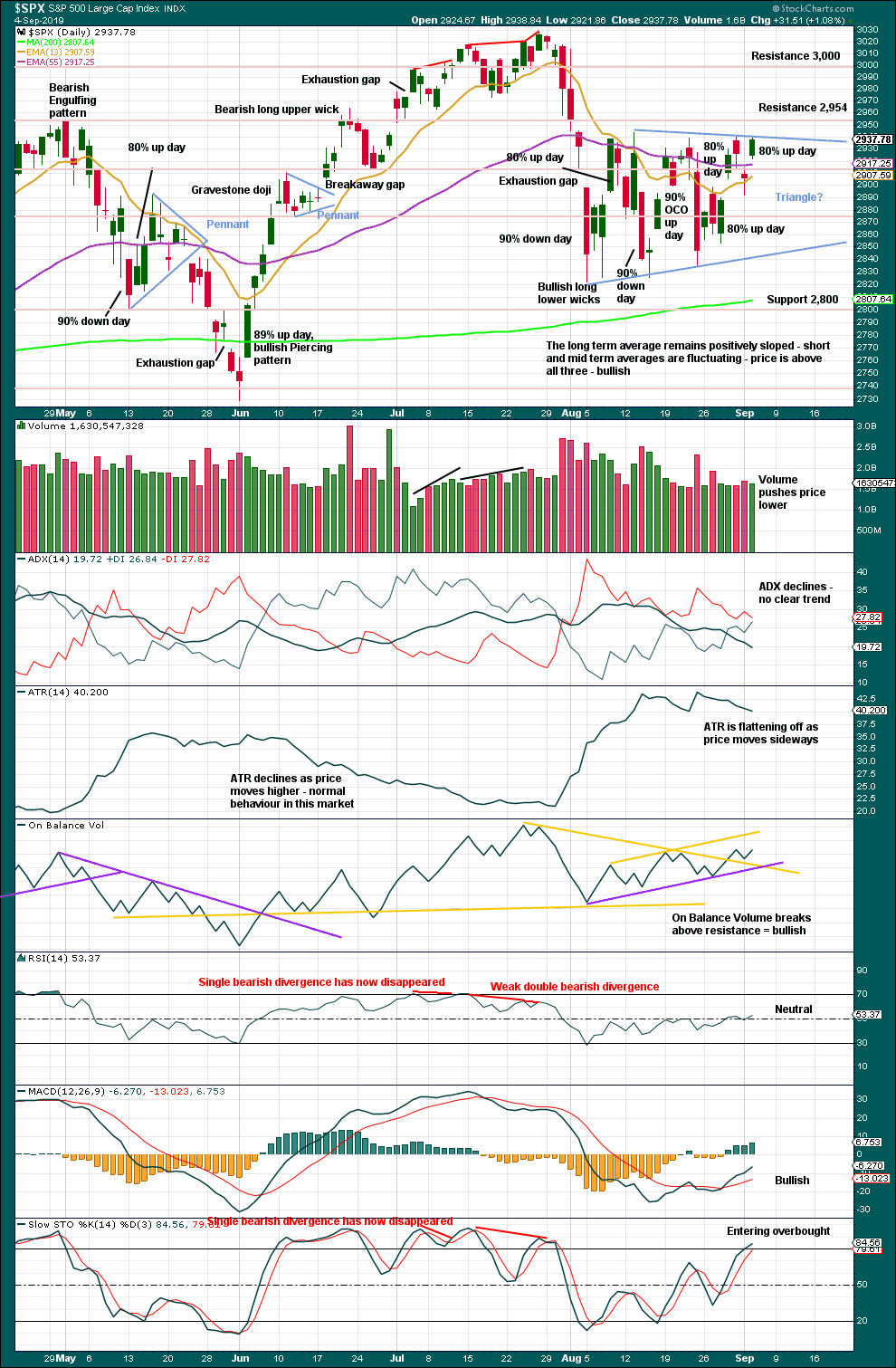

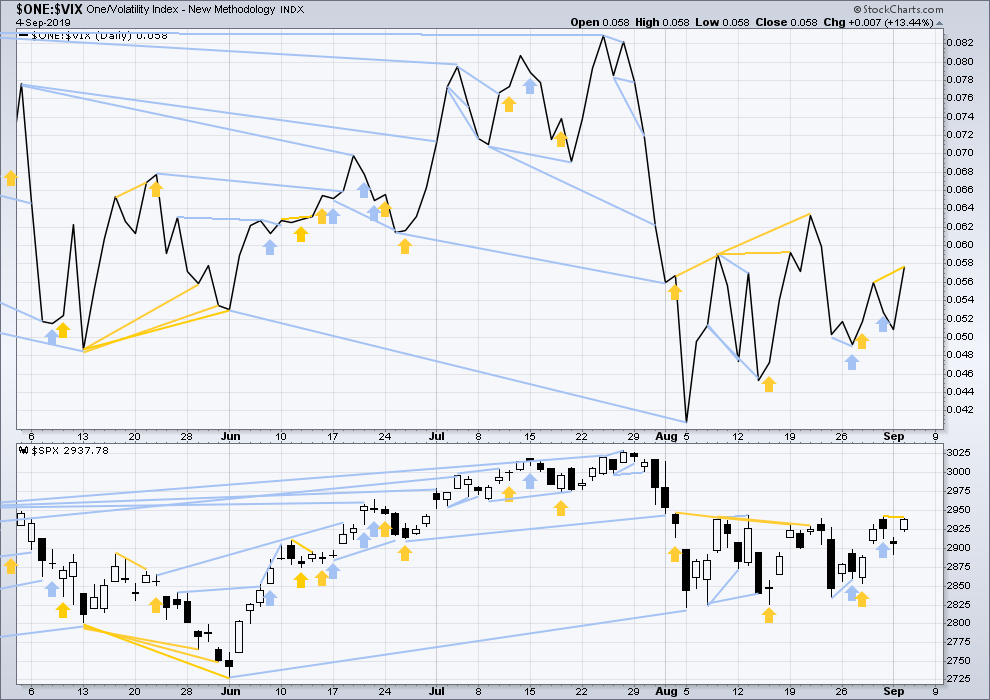

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last low of the 15th of August was preceded immediately by a 90% downward day and followed immediately by a 90% OCO (Operating Companies Only) up day. This is a pattern commonly found at major lows, and it indicates a 180 degree shift in sentiment from bearish to bullish. This favours the main Elliott wave count.

Now the next low of the 23rd of August has been followed by two back to back 80% up days. This too is very bullish and favours the main Elliott wave count. Today another 80% upwards day adds confidence to a bullish outlook.

The classic triangle no longer has a very clear look. The trend lines do not converge at a normal rate. This pattern is weak.

On Balance Volume gives a clear bullish signal. This supports the main Elliott wave count.

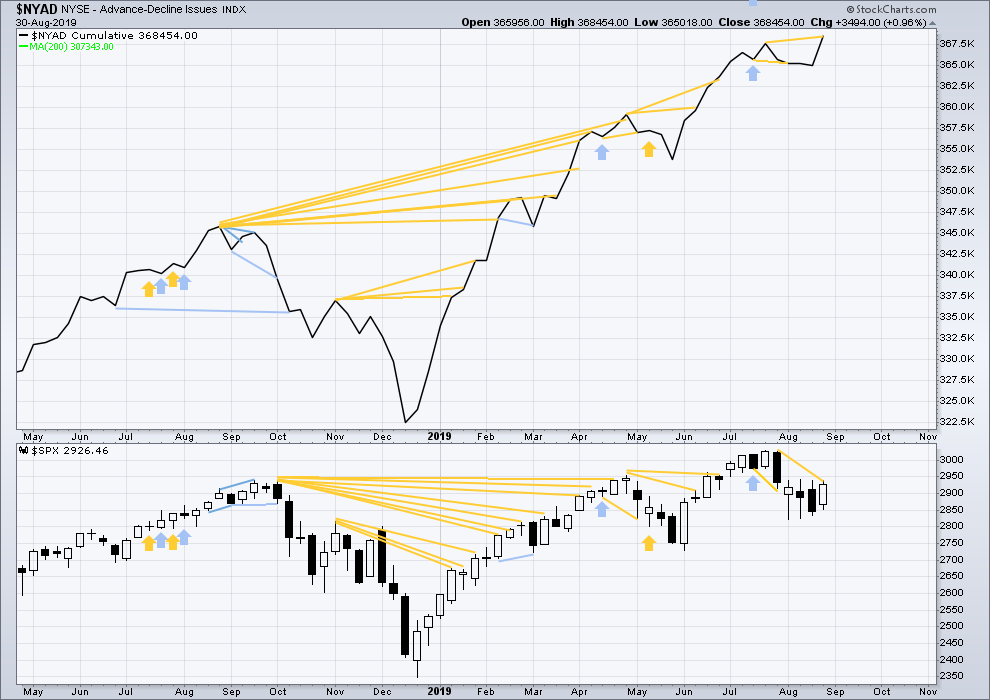

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is the beginning of January 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week both price and the AD line have moved higher.

The AD line makes a new all time high. This is a very bullish signal and very strongly supports the main Elliott wave count.

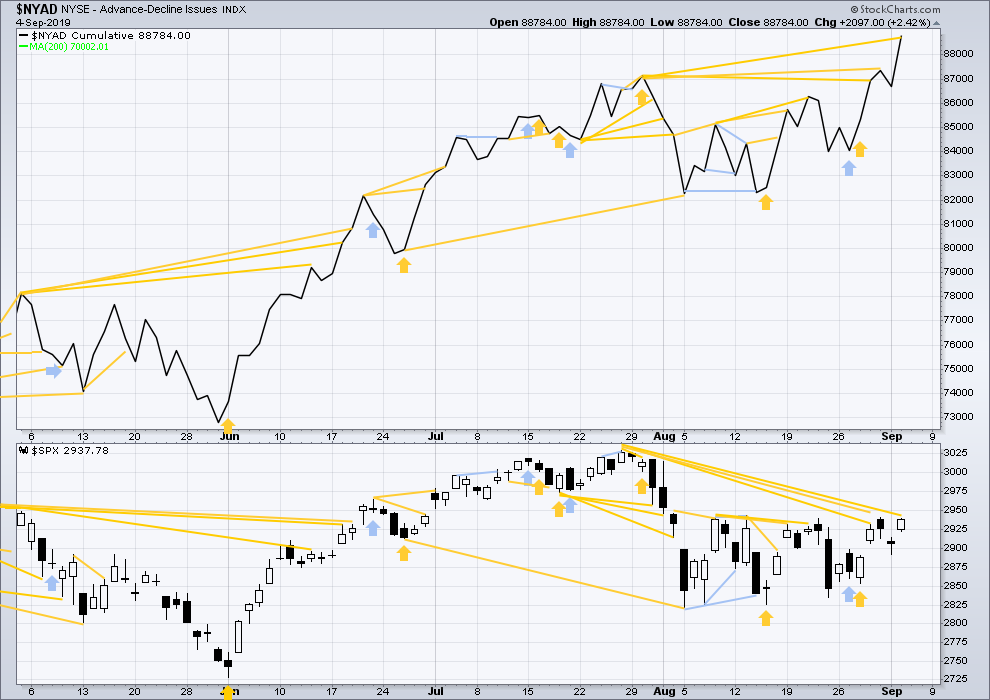

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line makes another new all all time high today. This is a very bullish signal and strongly favours the main Elliott wave count.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and nine months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

Last week both price and inverted VIX have moved higher. There is no new divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today both inverted VIX and price have moved higher. Inverted VIX has made a new short-term swing high, but price has not yet by a small margin. This divergence is bullish and confirms bullishness in the AD line today.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 10:10 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

I’ve got oil (/CL) turning sharply off my upper volatility band at the daily and hourly tf’s. Shooting star candle on daily. Smells strongly of a down day in oil tomorrow, and with that I would expect a sideways/down day in SPX and others. SPX right up against key 76-78% fibonacci level of intermediate 2 down; a very likely place for it to initiate some consolidating action. And if it breaks up, expect a fast run up to 3000. Which may happen overnight…again. I don’t have figures but I believe overnight action as a % of total has been extraordinary over the last month.

With an upwards breakout from the consolidation of the last three weeks, I’m today going to discard the alternate wave counts.

The middle of a third wave looks likely to be ahead of us.

Great work Lara. You stuck in through thick and thin !

Thanks halpin.

It’s just data. Particularly breadth. I trust in the data.

Sold half my gold yesterday, now it put in a tail candle on the 4 hour chart… rebuy

I’m seeing gold doing a larger iv down here myself. GLD to perhaps 21-23% retrace zone around 139.5. I am waiting for that as a long set up…and considering (vaguely) a fly in this pullback zone to charge this market for the right to go sideways/down.

My updated RUT view. I will get long when I see the minuette iv in play now indicate completion.

I’m still waiting for the call by Chris Vermeulen: August 19th massive market plunging events were suppose to unfold around then… What happened???

🙂

Weeeee!!!!

Oh, yee doubters. Oh, right, that included me…

Well, my board is nice and green today, and a reasonable pile in the “cashed” column too. I hope no one’s caught the wrong way.

The real moral is…trade against Lara’s main at your peril.

Ditto!!!!!! I didn’t doubt and got long last week because of the AD line new highs. A lot more upside to go.

Fomo 5th wave ? Wow. Glad I close my shorts. Thanks Lara!

I bet you are glad Peter. I think fear of missing out will start with new ATH’s around 3040 which will drive us over 3100 SPX. Until then, short covering could be massive. Bearish sentiment has been very high.

You’re welcome Peter.

Glad to see members profiting on this breakout. Nice to be able to be positioned before the breakout. What was resistance may now become support about 2,945 and so if your entry is below that point, it could be good for some time yet.

ES up strong. Looks like the main count may be it.

Awe. I thought I had it but before I posted, Curtis had slipped into the #1 spot.

Time to visit the volume profile, to get a clue of where this thing is likely to end up…

Could have a massive +3% short squeeze up day tomorrow…

All the appearance of 3000+, here we come. That would be a +2% day. And maybe it even opens close to there? Gonna be interesting, no doubt about it.

Here’s the volume profile on /ES (hourly with overnight data) where all the overnight action actually is. Price is sitting in a massive volume hole at the moment. That is NOT going to last if it’s still around there tomorrow. It’s going “down” one side or the other.