A downwards day remains within the small pattern forming.

Summary: A small pennant pattern may be completing, the target would be about 2,359 (measured rule) or 2,473 (Elliott wave). However, ADX is still extreme in the short term at the daily chart level, and VIX is again behaving strangely today.

Last monthly chart is here.

Last weekly chart is here.

New updates to this analysis are in bold.

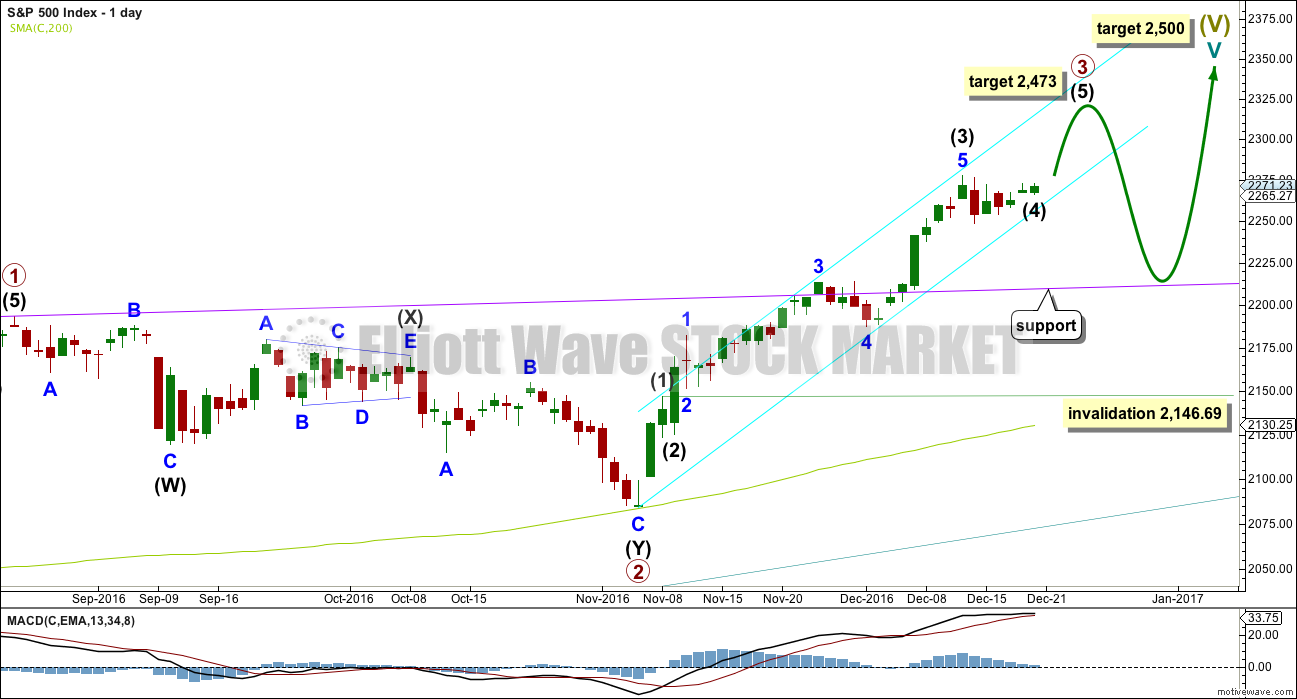

DAILY CHART

Cycle wave V must subdivide as a five wave structure. At 2,500 it would reach equality in length with cycle wave I. This is the most common Fibonacci ratio for a fifth wave for this market, so this target should have a reasonable probability.

Cycle wave V within Super Cycle wave (V) should exhibit internal weakness. At its end, it should exhibit strong multiple divergence at highs.

Within cycle wave V, primary waves 1 and 2 are complete. Primary wave 3 may be over halfway through and is now exhibiting stronger momentum than primary wave 1. It is possible primary wave 3 may fall short of the target and not reach equality in length with primary wave 1.

Within primary wave 3, the correction for intermediate wave (4) looks like it is relatively brief and shallow. Intermediate wave (2) was over very quickly within one day. Intermediate wave (4) may last a little longer and may not move into intermediate wave (1) price territory below 2,146.69. When any and all alternates that allow for intermediate wave (4) to continue have been invalidated, then the invalidation point may be moved up to the start of intermediate wave (5).

At 2,473 primary wave 3 would reach equality in length with primary wave 1. This Fibonacci ratio is chosen for this target calculation because it fits with the higher target at 2,500.

There is already a Fibonacci ratio within primary wave 3. Intermediate wave (3) is 12.49 points short of 2.618 the length of intermediate wave (1). This is a reasonable difference, but as it is less than 10% the length of intermediate wave (3) I will consider it close enough to say there is a Fibonacci ratio here. This means that intermediate wave (5) should not be expected to exhibit a Fibonacci ratio to either of intermediate waves (1) or (3), as the S&P often exhibits Fibonacci ratios between two of its three actionary waves and rarely between all three.

When primary wave 3 is complete, then the following correction for primary wave 4 may last about one to three months and should be a very shallow correction remaining above primary wave 1 price territory. Although primary wave 3 has now moved above the end of primary wave 1, it looks like primary wave 3 needs to move higher to allow enough room for primary wave 4 to unfold.

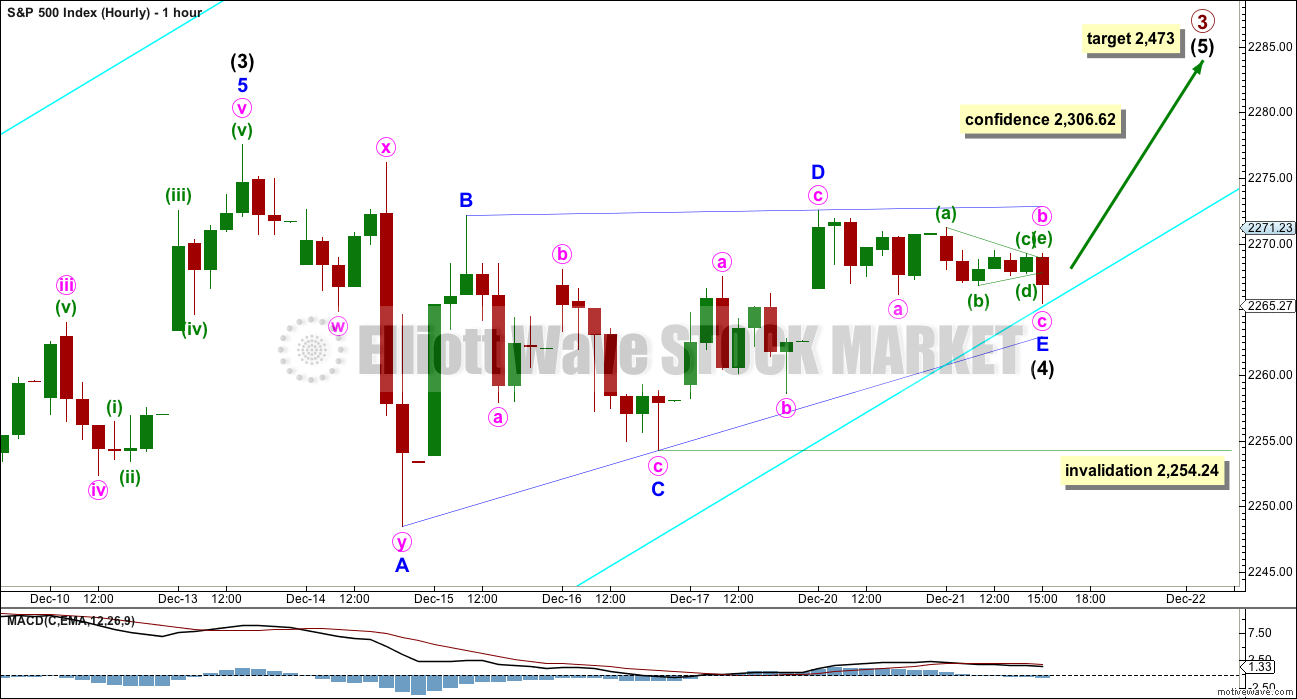

HOURLY CHART

It is possible now that the triangle for intermediate wave (4) is complete as a regular barrier triangle.

For a barrier triangle, the rule regarding where wave D may end states only that the B-D trend line must remain essentially flat. In practice, this means minor wave D may end slightly beyond the end of minor wave B; the B-D trend line here looks flat.

Minor wave E may have ended short of the A-C trend line finding support at the cyan channel. This is drawn the same way on both hourly and daily charts, but because the hourly chart is on an arithmetic scale it sits slightly differently.

The alternate hourly chart below would be discarded above 2,306.62. Above this point confidence should be had that the next wave up is underway.

If this first hourly chart is correct, then it provides some information about how intermediate wave (5) may behave. Fifth waves following barrier triangles are either remarkably short and quick, or very long extensions. The target for primary wave 3 expects a long extension.

Minor wave E of the triangle may not move beyond the end of minor wave C below 2,254.24.

ALTERNATE HOURLY CHART

It is still possible that a flat correction is unfolding for intermediate wave (4).

Within a flat, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,274.62.

The normal range for minor wave B within a flat is from 1 to 1.38 the length of minor wave A giving a range from 2,277.53 to 2,288.58.

When minor wave B is longer than twice the length of minor wave A above 2,306.62, then the idea of a flat correction continuing should be discarded due to a very low probability.

The triangle may be a smaller running contracting triangle for minute wave b within minor wave B. It may be incomplete. Within this smaller triangle, minuette wave (d) may not move reasonably above the end of minuette wave (d) at 2,272.56. Minuette wave (c) may not move below the end of minuette wave (a) at 2,254.24. If price completes a triangle within this range then breaks out upwards, then a larger zigzag may be completing for minor wave B.

Minor wave C downwards would be most likely to make at least a slight new low below the end of minor wave A at 2,248.44 to avoid a truncation.

The risk presented by this wave count is that intermediate wave (4) may not yet be over. After price moves to 2,274.62 or above, price could turn and see a quick sharp drop to complete the correction.

TECHNICAL ANALYSIS

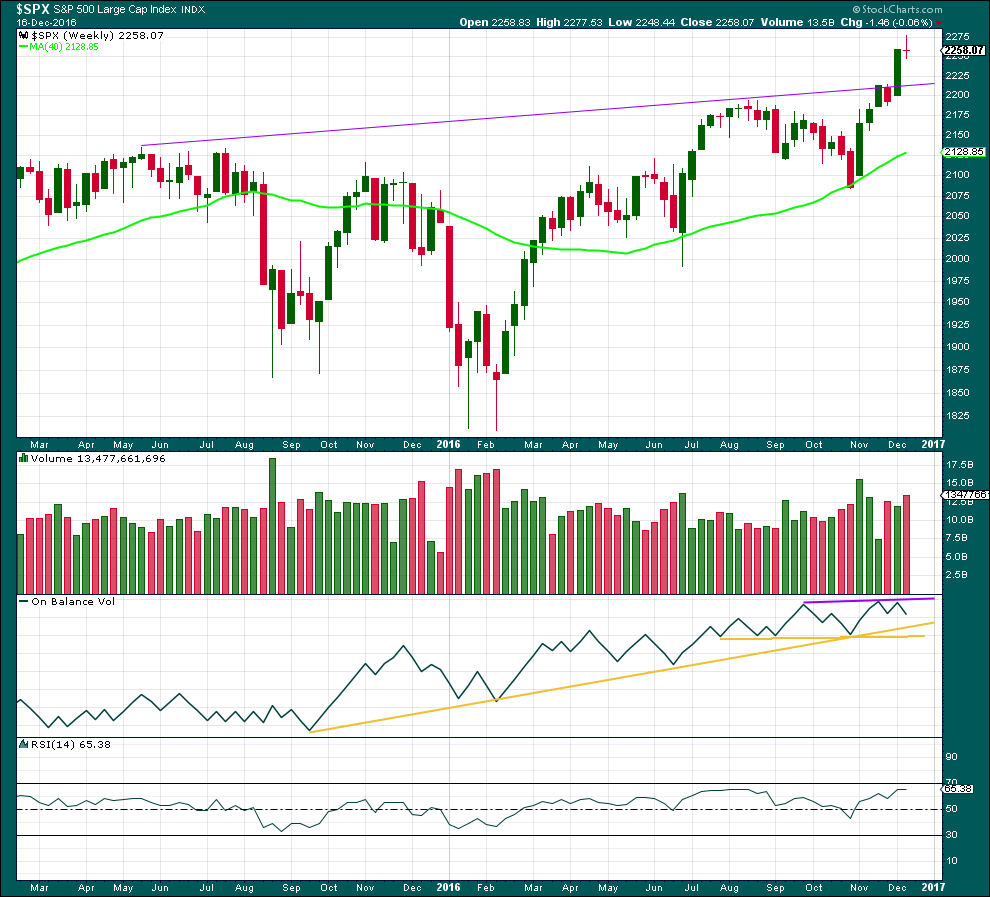

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week completes a small red doji candlestick. This indicates a pause in the trend, and a change from up to neutral.

Last week closes red and comes with an increase of volume, the balance of which was downwards. There was some support for a fall in price at the end of the week. This in conjunction with the doji is slightly bearish, or at least indicating a consolidation here.

On Balance Volume has found resistance again at the purple trend line. It may find support at the first yellow line, which is very long held and offers good technical significance. This may assist to halt a fall in price forcing a consolidation to be shallow.

RSI is still not extreme. There is room for price to continue higher.

The purple trend line on price may also provide support.

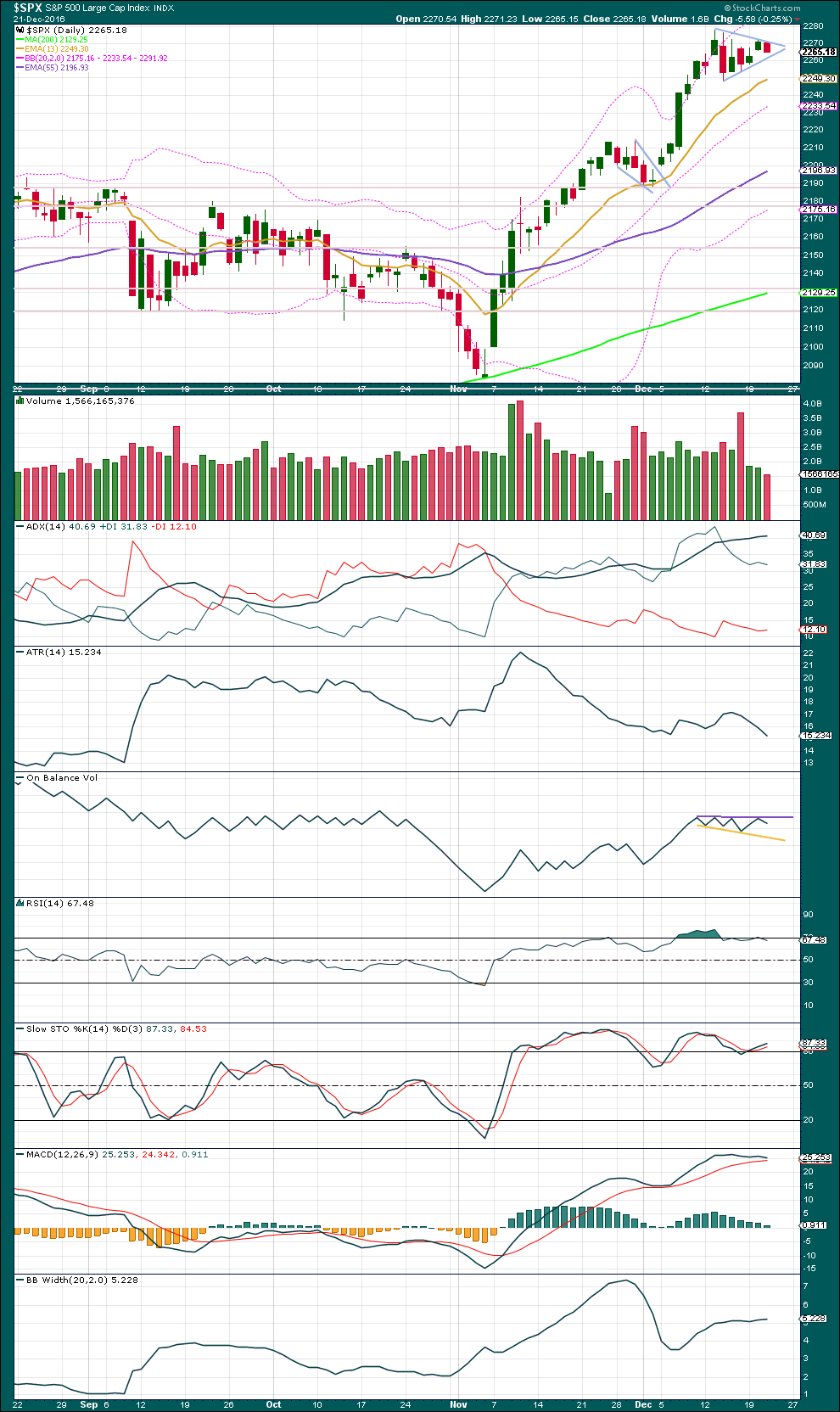

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Yesterday’s gap was a pattern gap, not a breakaway gap. Trend lines about the pennant pattern are adjusted. These are usually fairly reliable continuation patterns. This one is supported by declining volume as price moves sideways. The target using the measured rule is about 2,359.

ADX is comfortably extreme above 35. It is above 40 and the black ADX line is above both the +DX and -DX lines. This trend is extreme; an end should come soon. The small pennant pattern so far has been unable to bring ADX down.

I have spent some time going back over the bull market on the daily chart to March 2009. During this time ADX has reached above 35 nine times:

– In May 2010 during a downwards wave.

– In January 2011 (just above 35). This was followed by a drop of 1.9% over two days.

– In August 2011 during a downwards wave.

– In February 2012: on 8th February ADX reached above 35 then slightly above 40 on 21st February, but price did not find a high until the 29th of February. Price then dropped 2.8% over four days.

– In June 2012 at the end of a downwards wave.

– In August 2012. This was followed by a drop of 3.9% over two days.

– In February 2013: on the 5th of February ADX reached above 35 and continued higher with price to find a high on 19th February when ADX reached almost to 39. Price then dropped 3% over five days.

– In May 2013: on the 22nd of May ADX was almost 40. Price then dropped 7.5% over 23 days.

– In January 2016 during a downwards wave.

Conclusion: A reading of over 35 for ADX is extreme, and a reading over 40 is unusually extreme. However, this is not necessarily useful in pinpointing a trend change nor does it provide useful information on how far price may drop. In other words, it cannot tell us when price will turn nor how far it may fall.

ADX at the daily chart level is sounding a note of caution here. At the weekly chart level though it is not; at that time frame ADX it is bullish.

ATR is declining as price has consolidated for the last five sessions. Bollinger Bands are slightly widening.

Stochastics and RSI are still overbought, but these may remain extreme for reasonable periods of time during a trending market.

On Balance Volume should be watched closely. It has come up to find resistance at the purple trend line. A breakout by OBV may indicate the next direction for price.

The trend is up. All three moving averages are pointing upwards and price is above all three. The small pennant has brought price away from the upper Bollinger Band extreme. There is again room for price to rise.

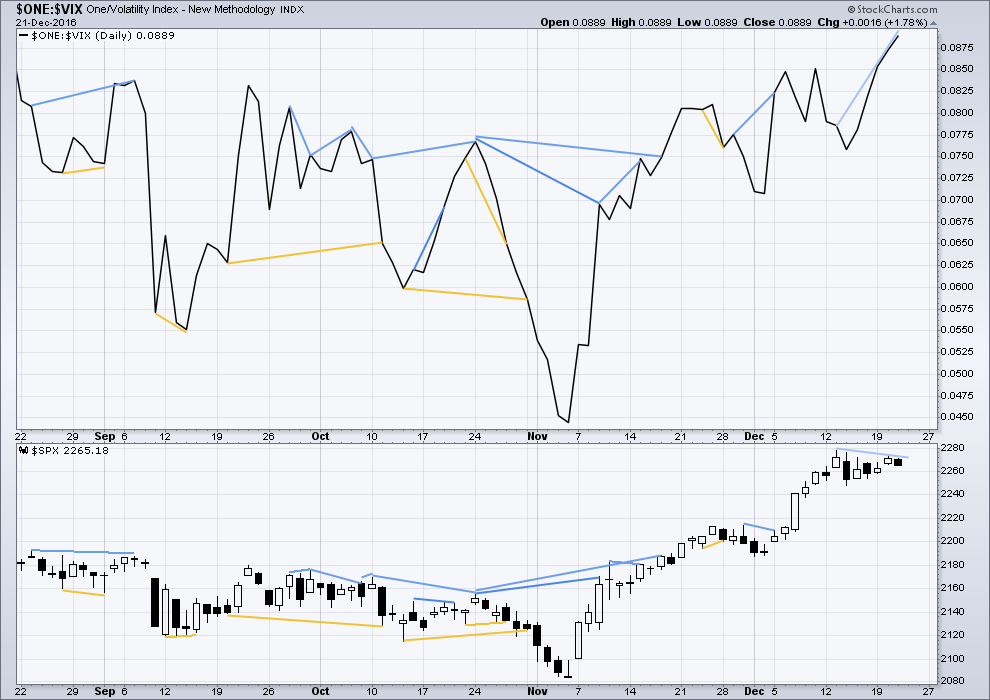

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is mostly working to indicate short term movements spanning one or two days. While this seems to be working more often than not, it is not always working. As with everything in technical analysis, there is nothing that is certain. This is an exercise in probability.

Price moved lower today. This may have resolved the short term bearish divergence noted in yesterday’s analysis.

Inverted VIX increased while price moved lower today. Normally, volatility increases as price moves lower, but today abnormally it declined. This will be interpreted today as bullish. There was something wrong or abnormal about price today, and the fall in price is not supported by an increase in volatility. It is noted that this has happened before fairly recently and in those instances it was not followed by downwards movement and price has keep rising.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

There is longer term divergence between price and the AD line, but like inverted VIX this has proven reasonably recently to be unreliable. It will be given no weight here.

Hidden bearish divergence noted in last analysis may now be resolved by one day of downwards movement. There is now new divergence today between price and the AD line.

DOW THEORY

Major lows within the old bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the bear market from November 2014:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – closed above this point on the 9th of November, 2016.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: The transportations indicate an end to the prior bear market. The transportation index confirms a bull market.

This analysis is published @ 08:43 p.m. EST.

I think that my labelling of the triangle as complete was premature.

So far this still has not met the minimum 0.9 retracement for wave B within a flat, so at this stage I’m struggling to see how a flat could be unfolding.

If the triangle continues for another five sessions it would total a Fibonacci 13. Will it take that long though?

I think so. Was starting to consider that myself today.

I think we’ve either started a trend change down or we are in an ABC wave 4.

I hesitate to add anything since I’m new to Elliott but here goes:

it seems that today’s action bounced off of 2256 at about 12:00 pm. If that holds, then Lara’s requirement for a barrier triangle (whatever that is) is met. And if that’s case, it’s a stronger argument for (4) to be over and (5) to begin.

Is that right?

Can I ask something? What is an “ABC wave 4”? I cannot determine that by looking at Lara’s chart.

thanks…. Lance

Hi Lance 🙂

The barrier triangle as I had it labelled yesterday now does not look right to me. The overshoot to the lower trend line for minor wave E is far too big.

The chart I’ve posted above looks better for a triangle now after todays movement.

An “ABC” wave 4 would be referring to a simple A-B-C correction, rather than a combination W-X-Y or a triangle A-B-C-D-E.

There are short videos on my Education page which explain EW structures.

thanks. the videos are helpful, I have viewed them already.

speaking of video, the video by Ciovacco was very interesting. Thank you to whoever posted it.

L