Downwards movement was expected as most likely for the session, but it was allowed that price could continue higher.

Price remains below the invalidation point.

Summary: In the short term, it looks like upwards movement is not quite over. But this upwards wave is very weak and should be expected to still end sooner rather than later, and it is likely to make at least a slight new high above 2,111.05. The next wave down may be surprisingly strong.

Last published monthly charts are here.

New updates to this analysis are in bold.

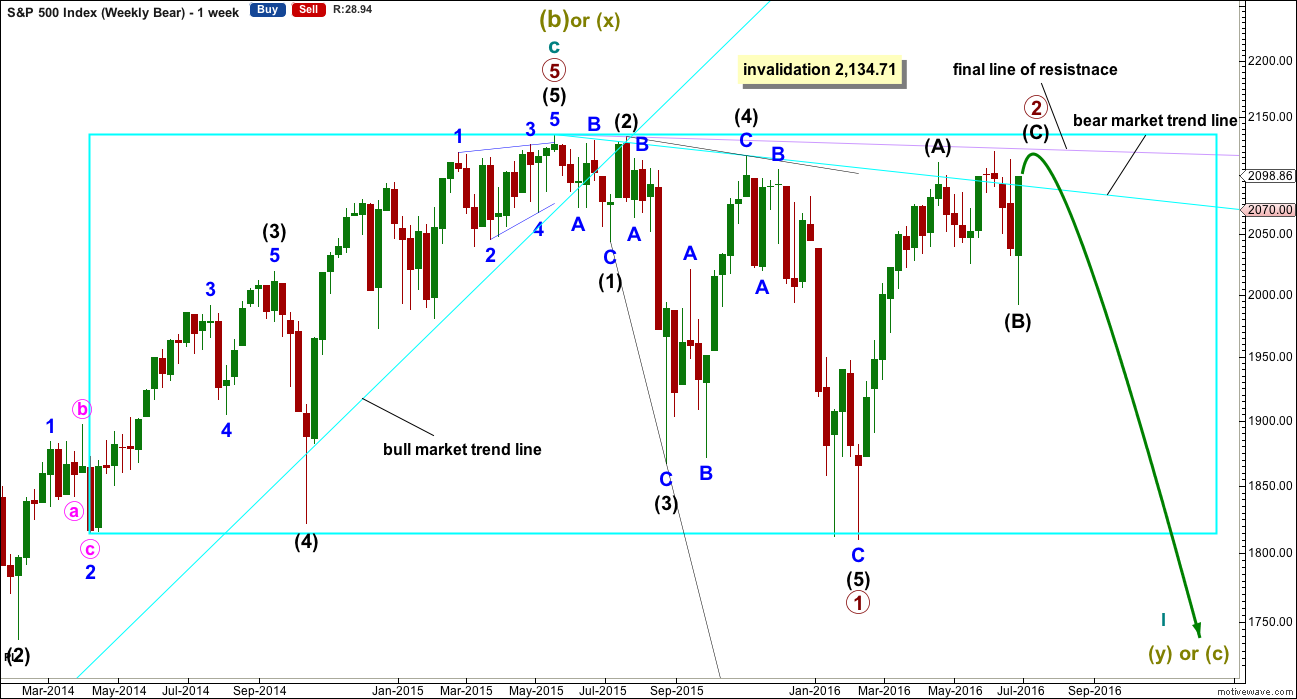

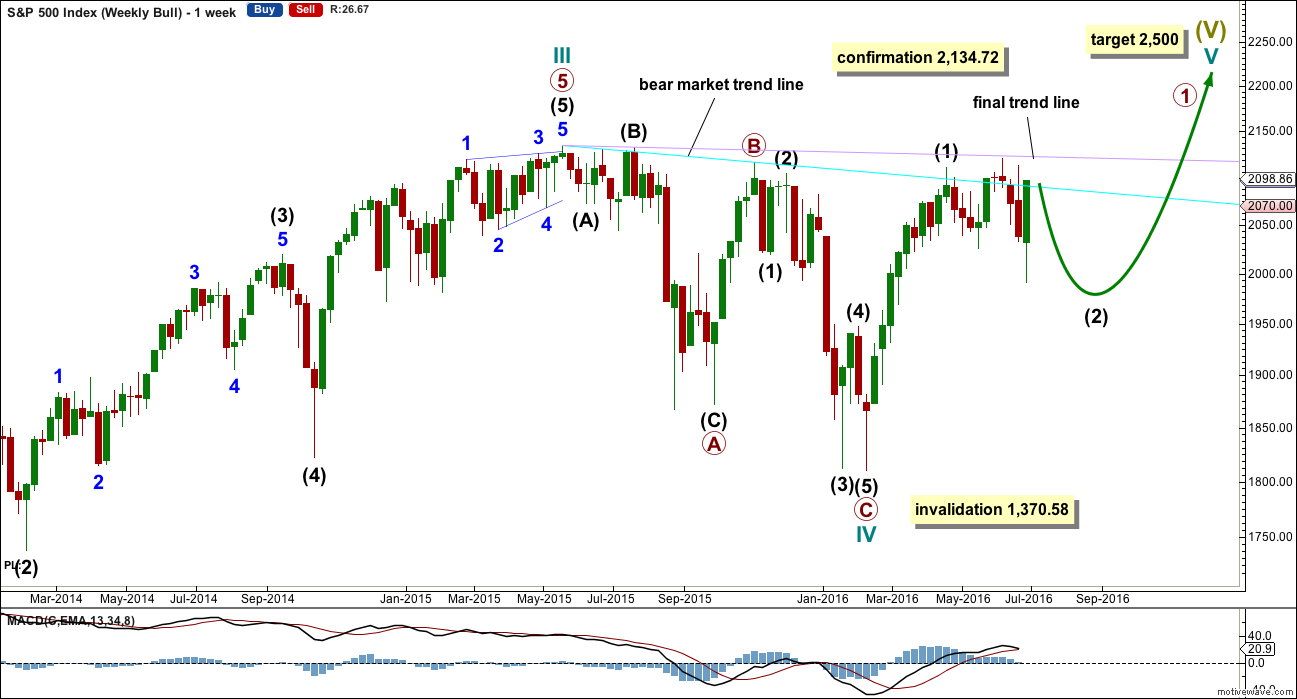

BEAR ELLIOTT WAVE COUNT

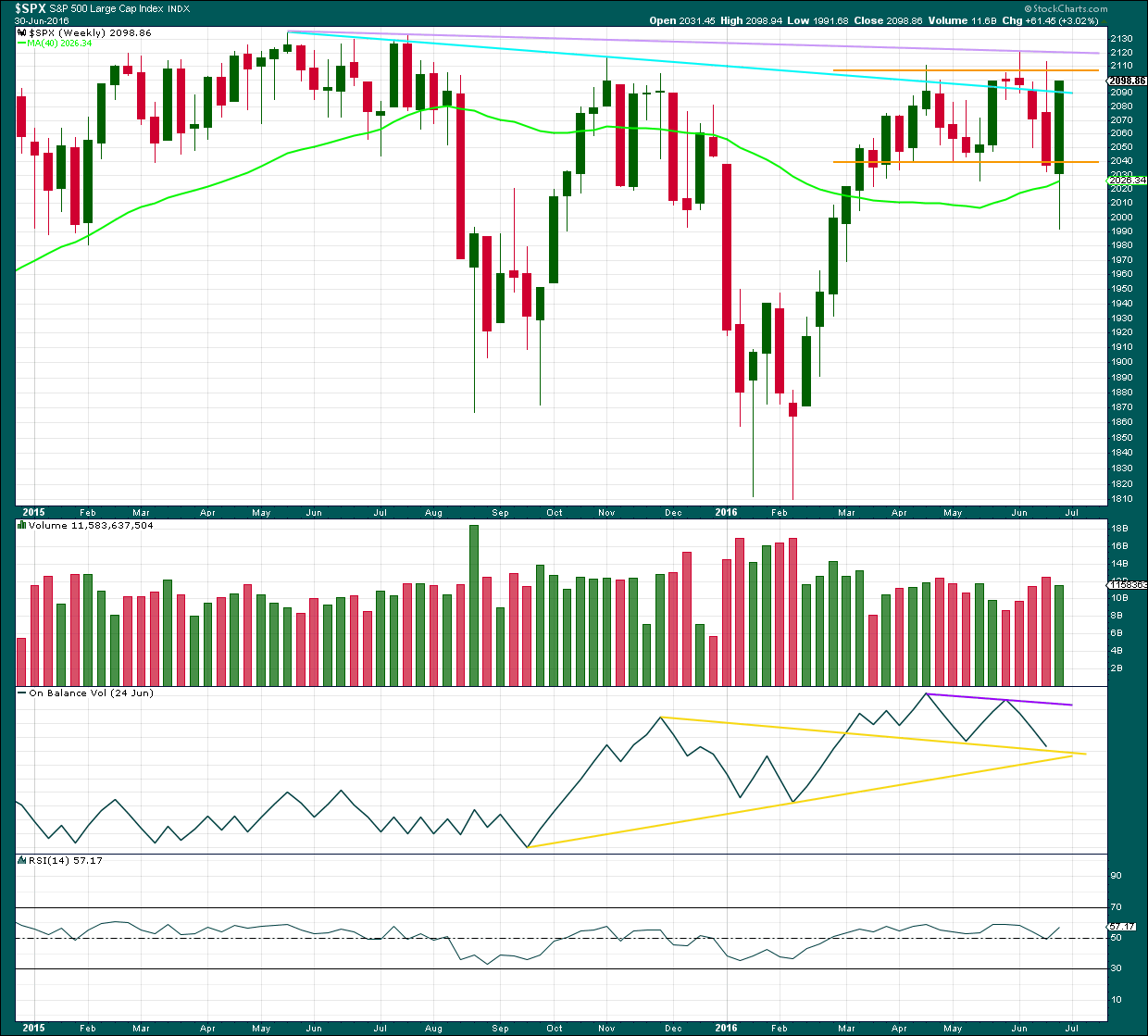

WEEKLY CHART

The box is added to the weekly chart. Price has been range bound for months. A breakout will eventually happen. The S&P often forms slow rounding tops, and this looks like what is happening here at a monthly / weekly time frame.

Primary wave 1 is seen as complete as a leading expanding diagonal. Primary wave 2 would be expected to be complete very soon indeed.

Leading diagonals are not rare, but they are not very common either. Leading diagonals are more often contracting than expanding. This wave count does not rely on a rare structure, but leading expanding diagonals are not common structures either.

Leading diagonals require sub waves 2 and 4 to be zigzags. Sub waves 1, 3 and 5 are most commonly zigzags but sometimes may appear to be impulses. In this case all subdivisions fit perfectly as zigzags and look like threes on the weekly and daily charts. There are no truncations and no rare structures in this wave count.

The fourth wave must overlap first wave price territory within a diagonal. It may not move beyond the end of the second wave.

Leading diagonals in first wave positions are often followed by very deep second wave corrections. Primary wave 2 would be the most common structure for a second wave, a zigzag, and fits the description of very deep. It may not move beyond the start of primary wave 1 above 2,134.72.

So far it looks like price is finding resistance at the lilac trend line. Price has not managed to break above it. If price continues higher tomorrow, then look for upwards movement to end again if it comes up to the lilac trend line. This line may be a better guide for when and where upwards movement may end than any target which could be calculated.

I still have two daily charts. The first main wave count is new. It has better proportions today.

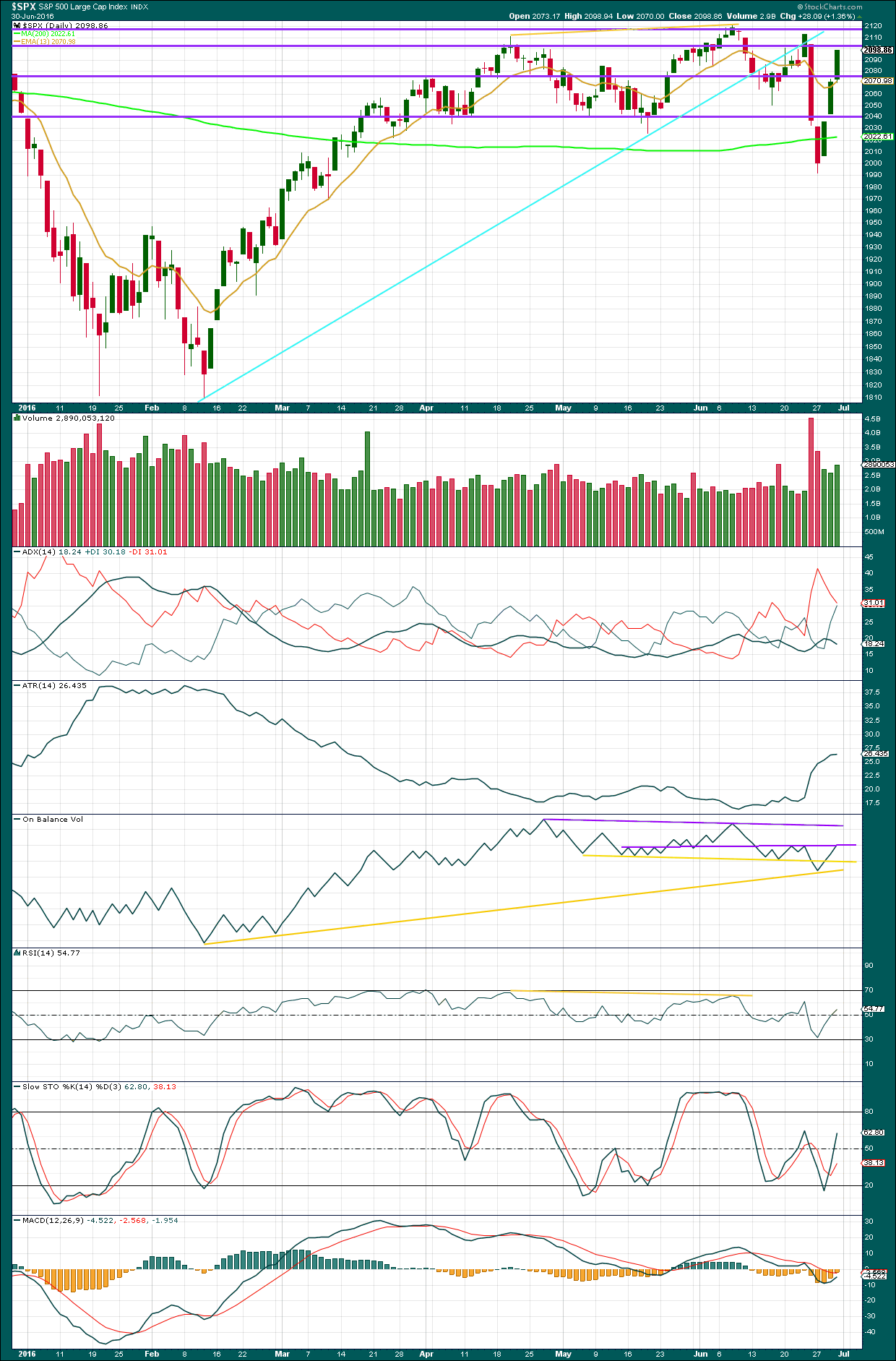

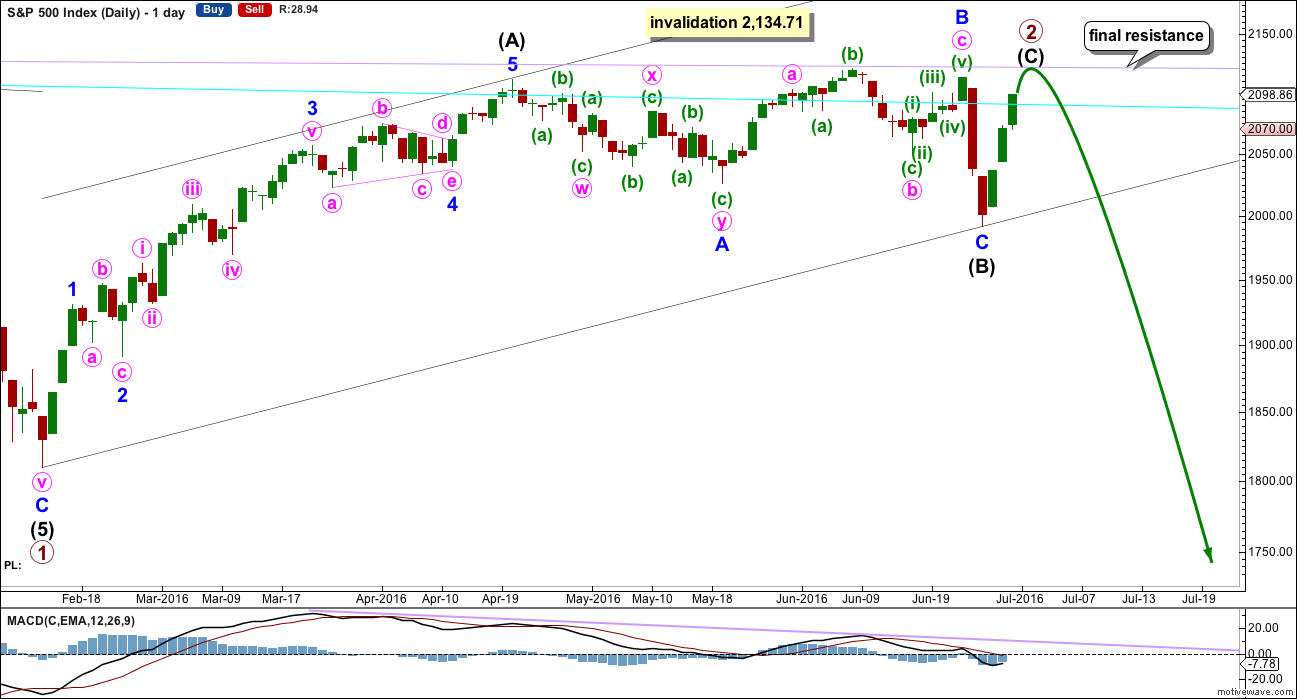

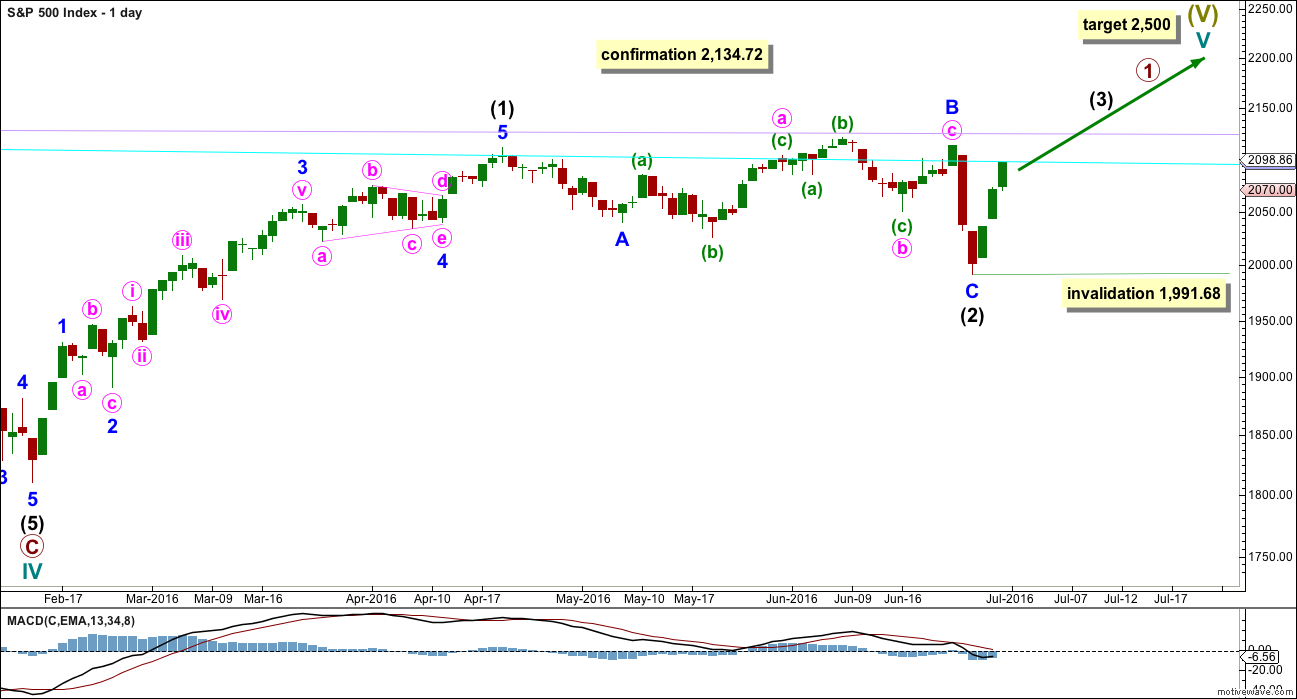

DAILY CHART

Primary wave 2 may be an almost complete zigzag.

Intermediate wave (B) may have been over at the last low as a regular flat correction. Minor wave B within it is a 1.02 length of minor wave A, shorter than the 1.05 requirement for an expanded flat but longer than the minimum requirement of 0.9. There is no Fibonacci ratio between minor waves A and C; minor wave C is shorter than 1.618 the length of minor wave A and was not truncated.

Intermediate wave (C) would be likely to end at least slightly above the end of intermediate wave (A) at 2,111.05 to avoid a truncation.

This wave count has better proportions now than the last main wave count (now an alternate) and the alternate presented yesterday (not published today). Intermediate wave (C) may be over in a few days. This is more acceptable for a C wave within a zigzag than it would be for a second wave within a new trend. Overall, primary wave 2 would have lasted months as a primary degree wave should. This proportion looks about right.

The cyan line has been overshot a few times. It continues to provide some resistance and then support after price breaks above it. The lilac line has been tested only twice, last time at the high of 8th of June. If price comes up to it again, then it should be expected to offer very strong resistance, and that should be where upwards movement ends if a bear market is intact.

When the end of primary wave 2 is known, then a target may be calculated for primary wave 3 down. That cannot be done yet. The expectation would be for primary wave 3 to be either 535 or 850 point in length, with the longer length more likely as primary wave 2 is very deep.

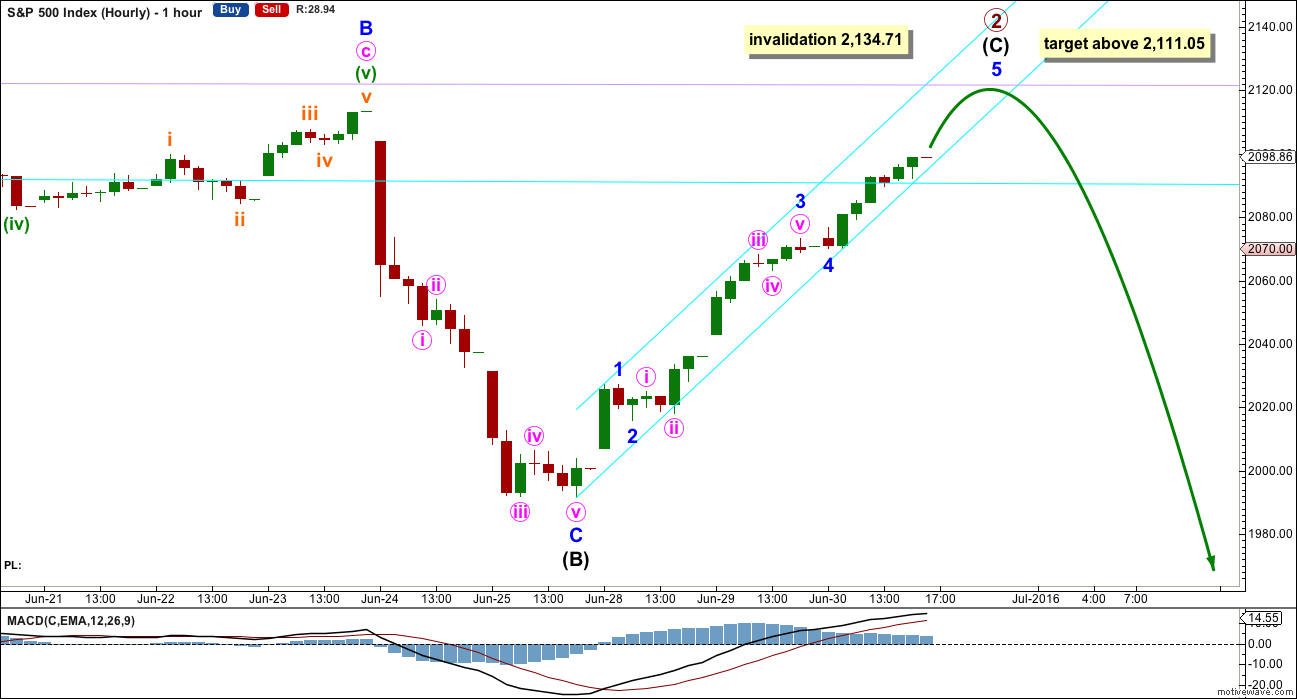

HOURLY CHART

So far upwards movement sits within a very narrow channel. The earliest indication that it may be over would be a breach of this channel to the downside.

Minor wave 3 is just 0.11 points short of 1.618 the length of minor wave 1. Minor wave 5 would reach equality with minor wave 3 at 2,127. This target looks to be too high though because it would require the lilac line to be overshot and that line should provide very strong resistance.

The best way to see when and where upwards movement ends would be to use trend lines in this instance. Expect price to keep rising while price remains within the cyan channel; this is supported today by volume. If price touches the lilac line, then expect upwards movement to end there.

If the cyan trend line is breached, then expect a trend change and the start of a primary degree third wave down.

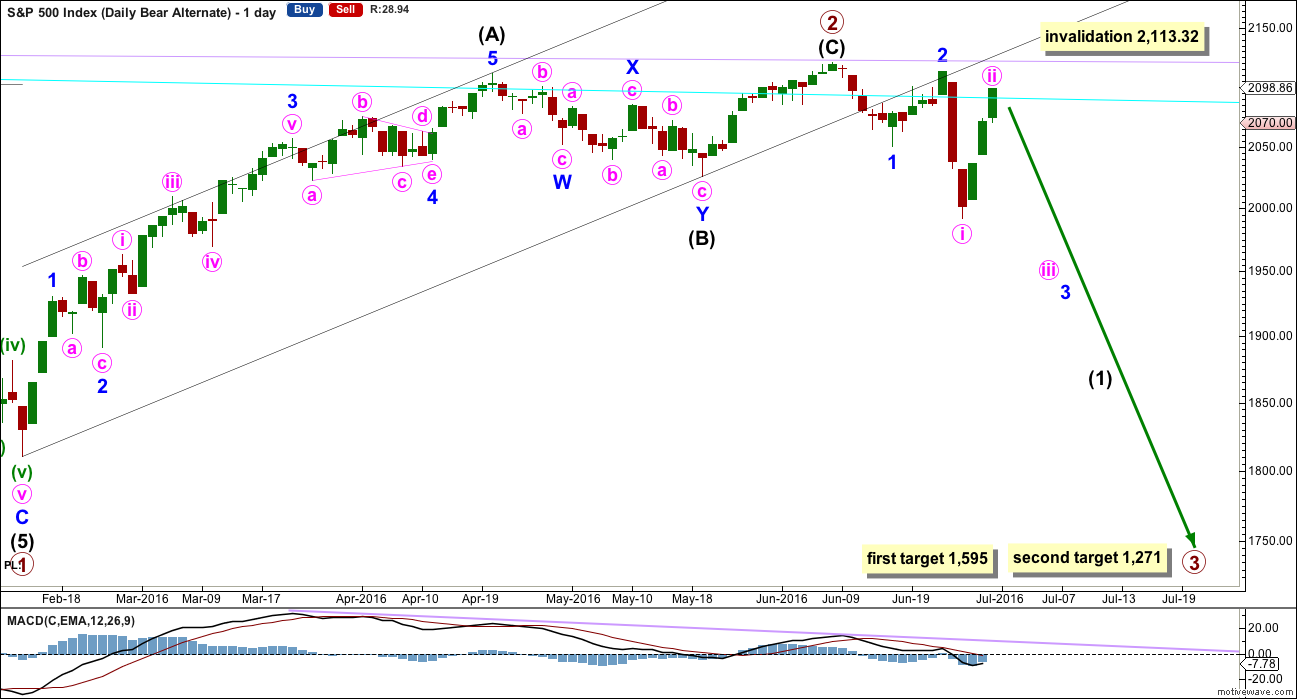

ALTERNATE DAILY CHART

This was the main wave count up to yesterday. It is now relegated to a less likely alternate and will remain possible while price remains below 2,113.32. It is possible that upwards movement could end above 2,111.05 and below 2,113.32 which would leave both wave counts valid.

If primary wave 2 was over earlier on 8th of June, then primary wave 3 has begun. At 1,595 primary wave 3 would reach 1.618 the length of primary wave 1. At 1,271 it would reach 2.618 the length of primary wave 1.

Within primary wave 3, now intermediate wave (1) would most likely be incomplete. The middle of it would be extending, now with two overlapping first and second waves.

Minute wave ii may not move beyond the start of minute wave i above 2,113.32.

The problem today is the size and depth of minute wave ii. If price continues higher tomorrow as expected, then it would be out of proportion with minute wave i and this part of the wave count would start to have a slightly odd look.

BULL ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave IV is seen as a complete flat correction. Within cycle wave IV, primary wave C is still seen as a five wave impulse.

Intermediate wave (3) has a strong three wave look to it on the weekly and daily charts. For the S&P, a large wave like this one at intermediate degree should look like an impulse at higher time frames. The three wave look substantially reduces the probability of this wave count. Subdivisions have been checked on the hourly chart, which will fit.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV may be a complete shallow 0.19 regular flat correction, exhibiting some alternation with cycle wave II and lasting nine months. Cycle wave IV would be grossly disproportionate to cycle wave II, and would have to move substantially out of a trend channel on the monthly chart, for it to continue further sideways as a double flat, triangle or combination. For this reason, although it is possible, it looks less likely that cycle wave IV would continue further. It should be over at the low as labelled.

At 2,500 cycle wave V would reach equality in length with cycle wave I.

Price has now broken a little above the bear market trend line. This line is drawn from the all time high at 2,134.72 to the swing high labelled primary wave B at 2,116.48 on November 2015. This line is drawn using the approach outlined by Magee in the classic “Technical Analysis of Stock Trends”. To use it correctly we should assume that a bear market remains intact until this line is breached by a close of 3% or more of market value. Now that the line is breached, the price point at which it is breached is calculated about 2,093.58. 3% of market value above this line would be 2,156.38, which would be above the all time high and the confirmation point.

This wave count requires price confirmation with a new all time high above 2,134.72.

While price has not made a new high, while it remains below the final trend line (lilac) and while technical indicators point to weakness in upwards movement, this very bullish wave count comes with a strong caveat. I still do not have confidence in it. It is produced as an alternate, because all possibilities must be considered. Price managed to keep making new highs for years on light and declining volume, so it is possible that this pattern may continue to new all time highs for cycle wave V.

The invalidation point will remain on the weekly chart at 1,370.58. Cycle wave IV may not move into cycle wave I price territory.

This invalidation point allows for the possibility that cycle wave IV may not be complete and may continue sideways for another one to two years as a double flat or double combination. Because both double flats and double combinations are both sideways movements, a new low substantially below the end of primary wave C at 1,810.10 should see this wave count discarded on the basis of a very low probability long before price makes a new low below 1,370.58.

DAILY CHART

Intermediate wave (2) may be over, so intermediate wave (3) upwards may be underway. Within intermediate wave (3), no second wave correction may move beyond the start of its first wave below 1,991.68.

Intermediate wave (2) now has better proportion in terms of duration to intermediate wave (1), but it is still more shallow than the first second wave within a new bull trend normally is. Here, it would be only 0.40 the length of intermediate wave (1).

This wave count absolutely requires a new all time high before any confidence may be had in it.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week closes with a very strong Bullish Engulfing candlestick pattern, but there are two problems with this. This candlestick pattern comes within a trading range. Candlestick patterns during consolidations are not reliable reversal signals. It also comes with a decline in volume. It could be interpreted as bullish, but for more confidence that it is bullish a breakout above resistance (orange lines) on a day with increased volume should be seen.

The long lower wick of this candlestick is also bullish.

Price is back well within the range delineated by orange lines, with resistance about 2,107 and support about 2,040. During this period, it is still a downwards week which has strongest volume (ignoring the week with the options expiry date). This suggests a downwards breakout is more likely than upwards.

On Balance Volume is still constrained below the purple line and above the yellow line. A breakout by OBV may precede a breakout by price.

There is no divergence between price and RSI at this time to indicate weakness either way.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Three days of upwards movement completes an Advancing White Soldiers candlestick pattern. Today comes with some increase in volume. Although the third candlestick has a real body that is smaller than the first two, it is not substantially smaller. It is large enough for this pattern to be a bullish pattern and not small enough to indicate a Stalled pattern and a reversal at this stage.

However, volume for the last three days remains much lighter than the two prior downwards days. The fall in price was well supported by volume, and now the rise in price does not have as much support from volume. This indicates more selling pressure than buying; it still looks like this upwards wave is a bear market rally. The volume profile overall remains bearish.

Price should be coming with an increase in volume for a rise in price to be sustainable to new all time highs. Each time price gets closer to the all time high it shows weakness, and so far each time the rise has ended as a bear market rally. While weakness remains, it would be reasonable to expect that this will be another deep rally that will be eventually repelled, before a new all time high.

ADX no longer indicates a trend is in place. The -DX line is very close to the +DX line. If they cross over, it would indicate a possible trend change. This is a lagging indicator as it is based on a 14 day average.

ATR is still overall increasing after a long period of decline and then flattening off. The last few days has seen price begin to move in a wider range, but today ATR is showing some curving off from its steepness. The rise in price is coming slower than the prior fall in price. Again, this may be interpreted as some weakness, particularly if it persists.

On Balance Volume today has come up to touch the first purple line. This may offer resistance, but it has been breached before yet OBV turned back down to fall below it. It offers only some technical significance. A break above would be a weak bullish signal. For a clearer bullish signal from OBV, the upper purple line should be breached. To the downside, a clear bearish signal would be a break below the lower yellow line. Unfortunately, at this time these trend lines are too far away for OBV to be a leading indicator.

RSI has returned to neutral. There is room for price to rise or fall. There is no current divergence between price and RSI to indicate weakness either way.

Stochastics does not indicate any divergence either and is also close to neutral.

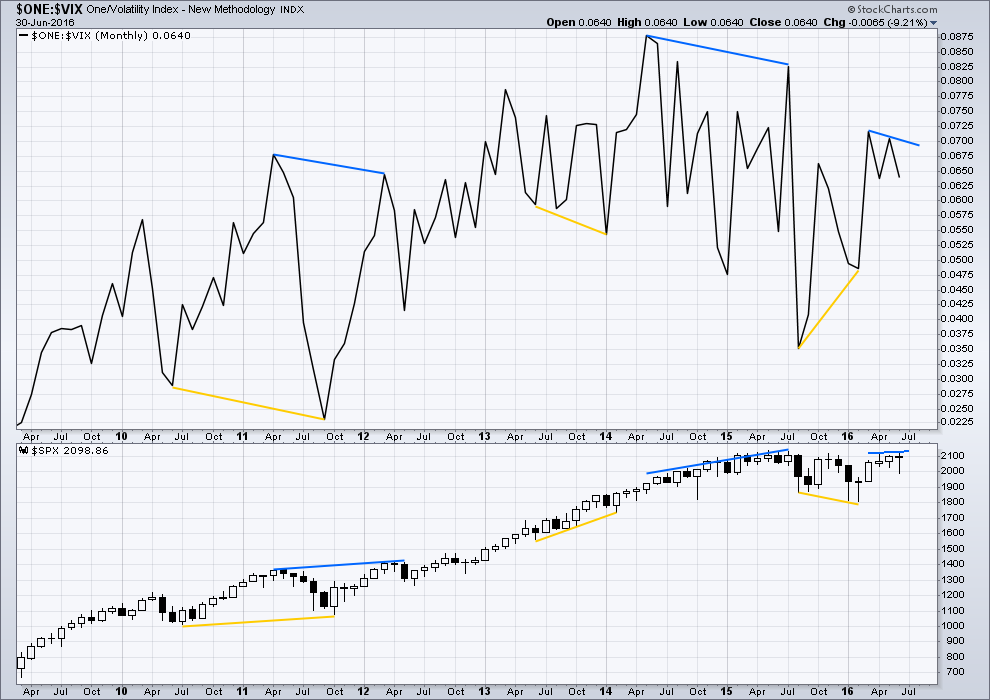

VOLATILITY – INVERTED VIX MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Several instances of large divergence between price and VIX (inverted) are noted here. Blue is bearish divergence and yellow is bullish divergence (rather than red and green, for our colour blind members).

Volatility declines as inverted VIX rises, which is normal for a bull market. Volatility increases as inverted VIX declines, which is normal for a bear market. Each time there is strong multi month divergence between price and VIX, it was followed by a strong movement from price: bearish divergence was followed by a fall in price and bullish divergence was followed by a rise in price.

There is still current multi month divergence between price and VIX: from the high in April 2016 price has made new highs but VIX has failed so far to follow with new highs. This regular bearish divergence still indicates weakness in price.

VOLATILITY – INVERTED VIX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an instance of longer term possible hidden bullish divergence noted here between price and inverted VIX with longer yellow lines. From the low of 24th February, volatility has strongly increased yet this has not yet translated into corresponding lows for price. This bullish divergence may now be resolved by some upwards movement from price over the last two days.

There is today a new instance of hidden bearish divergence between VIX (inverted) and price. As price moved higher over the last three days inverted VIX also moved higher, which indicates volatility has declined. This is normal and should be expected. What is not normal here though is the decline in volatility is stronger than where it was for 23rd June. This indicates weakness in upwards movement from price.

There was an earlier instance of short term hidden bearish divergence between VIX and price, shown here by short blue lines on both from 27th of May to 3rd of June. That was followed by some downwards movement, but it did not happen immediately. Price limped along upwards in a very small range for three days before turning. It is entirely possible that this may happen again. This current divergence indicates weakness and should be taken very seriously, but it cannot tell us that price must turn here.

While I would not give much weight to divergence between price and many oscillators, such as Stochastics, I will give weight to divergence between price and VIX. Analysis of the monthly chart for the last year and a half shows it to be fairly reliable.

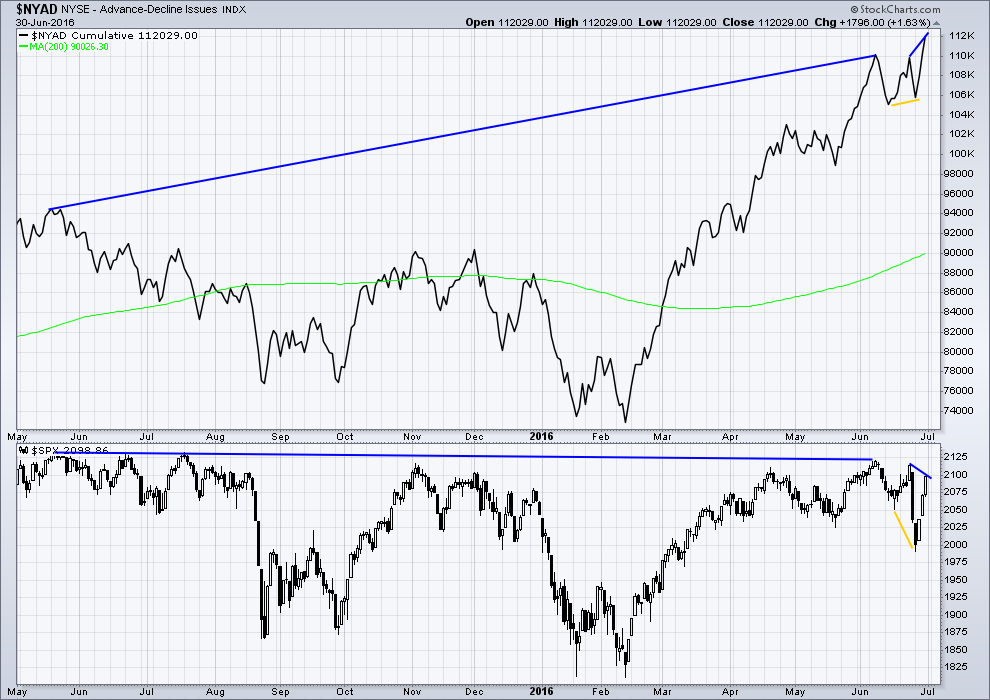

BREADTH – ADVANCE DECLINE LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the AD line increasing, this indicates the number of advancing stocks exceeds the number of declining stocks. This indicates that there is breadth to prior upwards movement.

Taking a look at the bigger picture, the AD line is making substantial new highs but price so far has not. While market breadth is increasing beyond the point it was at in May 2015, this has not translated (yet) into a corresponding rise in price. Price is weak. This is hidden bearish divergence. (long blue lines)

There is divergence between price and the AD line indicated by short yellow lines. Price made new lows but the AD line failed to make corresponding new lows. This indicates some weakness to downwards movement from price. There is less breadth to downwards movement this time. This divergence is bullish and also supports the hourly Elliott wave count. Upwards movement over the last three days may be enough to resolve this bullish divergence.

The AD line has now made a new high above its prior high of 23rd of June yet price has not made a corresponding new high (short blue lines). This divergence now is bearish. It indicates that price is weak.

DOW THEORY

The last major lows within the bull market are noted below. Both the industrials and transportation indicies have closed below these price points on a daily closing basis; original Dow Theory has confirmed a bear market. By adding in the S&P500 and Nasdaq a modified Dow Theory has not confirmed a new bear market.

Within the new bear market, major highs are noted. For original Dow Theory to confirm the end of the current bear market and the start of a new bull market, the transportation index needs to confirm. It has not done so yet.

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd Nobember, 2015) – has now closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – has not closed above this point yet.

It is a reasonable conclusion that the indices are currently in a bear market. The trend remains the same until proven otherwise. Dow Theory is one of the oldest and simplest of all technical analysis methods. It is often accused of being late because it requires huge price movements to confirm a change from bull to bear. In this instance, it is interesting that so many analysts remain bullish while Dow Theory has confirmed a bear market. It is my personal opinion that Dow Theory should not be accused of being late as it seems to be ignored when it does not give the conclusion so many analysts want to see.

This analysis is published @ 09:53 p.m. EST.

Bored? Here is the remedy, 15 minutes of unabashedly bearish video by Tim Knight, the creator of prophet charts, now included as a charting program in ThinkorSwim.

His short presentation consists of the most minimal of charts with just trend lines and fibs. Beautiful. Nice dry delivery is a nice break from the usual talking heads.

Hosted on Tastytrade.com a very cool options site / platform created by Tom Sosnoff, the creator of ThinkorSwim who sold it to TDA. They feature all day live programming and a research team to make some sense out of the real science of options. Stream able on TOS. BTW Tim mentions July 4th as the day things go all pear shaped in the markets, referring to a chart posted most likely by Northman Trader aka Northy.

https://www.tastytrade.com/tt/shows/trading-the-close-with-tim-knight/episodes/trading-the-close-with-tim-knight-07-01-2016

Thanks for the link David. I like it. Simple trend lines, always use them for trading.

He’s got some good ones in there.

And yeah… I was bored 🙂

also, FWIW I’ve got a similar trend line on EURUSD, I’m looking to enter short this weekend or Monday there. Should be a good trade.

I’m glad you enjoyed it! I try to catch it everyday. Tim also has a website, wonderfully named the “slope of hope”. I am sure that expression rings a bell 🙂

Have a great holiday everyone!

Yes. Good watch. Tnx!

I have Ranted here before that Equity Prices are Extremely overvalued.

I always have based my view on Market Capitalization of a company (# of shares outstanding or also fully diluted X Market Price) to Revenue. My valuation looks at the actual value the market is placing on the company for the Revenue it produces. That this measure will always revert back to the mean. In Bull markets stocks trade above & well above this mean (Bubble)… In real bear markets, before it over, this metric will always move below and well below it’s mean (Depression/Deflationary Period).

Here is an article that lends some support to my view… but is using a Price to Sales Ratio. Which also will always revert back to it’s mean or below in real bear markets. P/S is a very good counter to the Earnings Per Share Engineering that has been going on the last several years through the stock buy back wave because sales per share is part of the formula. It’s a good read with some charts.

http://davidstockmanscontracorner.com/price-to-sales-ratio-another-nail-in-the-coffin/

Joseph,

I completely agree! See Q-Ratio graph.

“The Q Ratio is a popular method of estimating the fair value of the stock market developed by Nobel Laureate James Tobin. It’s a fairly simple concept, but laborious to calculate. The Q Ratio is the total price of the market divided by the replacement cost of all its companies. ”

http://www.advisorperspectives.com/dshort/updates/Q-Ratio-and-Market-Valuation

Jim

http://www.valuewalk.com/2016/07/brexit-crash-stocks/

Lets hope he’s right…

Prechter at EWI issued an interim EWT report today calling a top in bond prices and a low in yields. It is somewhat ironic that it comes on the day of the first major bond default from Puerto Rico, which will be the first of many. I don’t often agree with Bob’s EW counts but I think he is right on this one. I jumped the gun early by about a week and a half and am underwater in my TBT bull spread but I gave myself plenty of time for the trade to play out. I entered 1/4 position and will be adding another quarter next week, and the final half when I am back to break even on the trade. I think the story of the stock market will be written by action in the bond market. If Bob is right, and I think he is, the tale is about to be told. 🙂

ps Joe, you still think Prechter is early?

Charts on that interim report look convincing…

I’m not an EWI subscriber Vern, so haven’t seen Prechters take, but two completely independent traders i know and highly respect (lets just say being on the other side of their trades a usually isn’t good position) both agree that bonds are for the woodshed. A “generational top” one called it.

Vern, Just keep in mind last time Bob issued a full report (not just an interim r) on the Top in Bond prices and the Low in Yields… there was a protracted delay of 3 to 9 months… off the top of my head.

I have that full report saved on my laptop but don’t have the time now to research the delay (date of report to spike in yields). But I will, when I have some down time this weekend.

My view is that Sub 2.00% on 30 Year US Treasury will occur before it’s all said & done. That will occur along with the initial big decline in stock prices/ break below 1800.

However, High Yield Bond Yields (Junk Bonds & non-senior corporate bonds) will move higher/spike higher 1st and more defaults are paid any attention to. US Treasury Notes & Bonds will be the 1st choice in safe haven trade… at least for an initial period of time.

EWT – Special Report Dated June 6, 2012 yes 2012

Major Top in the Bond Market:

Bond Yields are Poised to Begin Rising on the way to Deflationary Credit Crisis.

Maybe someone can compare UST 30 & 10 Yr. yields on this date to when this started to spike higher. I have to go out.

We are still waiting for what this report said then. Although there was a tease within 3 to 9 months off the top of my head.

June 6th 2012

10Yr UST —- 1.66% Yield

30 Yr UST — 2.73% Yield

July 25th 2012

10Yr UST —- 1.43% Yield

30 Yr UST — 2.46% Yield

August 31st 2012

10Yr UST —- 1.57% Yield

30 Yr UST — 2.68% Yield

September 14th 2012

10Yr UST —- 1.88% Yield

30 Yr UST — 3.09% Yield – 1st material spike and then more flat trading.

December 31st 2012

10Yr UST —- 1.78% Yield

30 Yr UST — 2.95% Yield

May 2nd 2013

10Yr UST —- 1.66% Yield

30 Yr UST — 2.82% Yield Then after this THE REAL SPIKE UP… So it Took more than 1 Year!

August 21st 2013

10Yr UST —- 2.87% Yield

30 Yr UST — 3.90% Yield

December 31st 2013

10Yr UST —- 3.04% Yield

30 Yr UST — 3.96% Yield This was THE PEAK!

NOW:

July 1st 2016

10Yr UST —- 1.46% Yield

30 Yr UST — 2.24% Yield

Price action following UVXY 1 for 5 reverse split May 20, 2015. Good time to sell premium.

The last two UVXY reverse splits were on 5/20/2015, and 1/24/2014. The splits were 1 for 4 in 2014 and, 1 for 5 in 2015. The current UVXY price is therefore inflated by a factor of 20. Put another way, it would be trading for less than 1.00 today without the splits. This is the kind of subterfuge the issuers engage in to hide the ridiculous non-linearity and decay of the derivative. VIX does not display the same weird symptoms and this is why this instrument should really be avoided by the vast majority of traders who don’t understand what a trap it can be for those who hold on to to more than a few days at at time. In 2014 the split came just ahead of a nice run to the upside and it was worth holding . In 2015 there was mostly sideways action at the inflated price with nothing but premium decay for anyone who bought as opposed to sold options on it. If the current bearish wave count turns out to be correct, we should see a substantial run higher prior to the coming split on July 25, so that split should be a moot point for anyone trading it. If it is a third wave down, the date of the split should be just about the right time to short it. Posting charts of price action after the last two reverse splits.

Well, at least that shows UVXY price can still pop (overall market can go lower) during the split process. We’re only 36 point from ATH on SPX, so not much room for it to pop higher to invalidate the bear count…

UVXY 1 for 5 split coming 7/25

http://finance.yahoo.com/news/proshares-announces-etf-share-splits-201000848.html

In my experience, this means we are very likely to go quite a bit higher. As soon as the split is done the shares should be shorted. I will be exiting all my positions prior to the split. I expect the price of the shares to continue to fall the next few weeks prior to the split.

Thanks for the heads up Barry. That announcement is like issuing a license to short it and I expect quite a few people will. if we are about to start a third impulse down it should get really interesting for enthusiastic short sellers. The reverse split in January 2014 was just ahead of a spike higher. The timing of this announcement is interesting, though I expected it once price went and stayed below 10. I would not be surprised if the issuers themselves are short sellers…

Can we put too much weight to the price action in the last hour of trading today since it is a long weekend and most traders left at half day – etc.

I would put little weight on the whole day TBH, for that reason.

Nice to see some selling into the close for once!

There is a doji or hanging man on each of the monthly charts, at the end of a major uptrend too: Nasdaq, OEX, SPX, RUT, DJ, DAX and the granddaddy NYSE.

Bearish ladder top top candlestick pattern, as posted yesterday, can still be in play on the daily SPX. It begins with a three white soldier type pattern. The ladder top is a five candlestick pattern, 1/2 confirmation will be an open on Tuesday below the real body of the ending daily candlestick today. Other confirmation then will be a close on Wednesday below the low of Tuesday, of course that’s getting in late but would confirm the down. Still a bearish daily candle today!

Have a great weekend everyone!

Well, been flat on the SP500 since 27th and not liking the action last couple days (getting harder to see as corrective), but nothing I see makes me want to get long in the least. Everyone have great weekend…bye.

laura you are the right hand of god

I really like the wave 2 bottom count for stocks.. the gift from brexit..

the pull back will tell it all.. this sure looks like wave 3 up (1) almost complete

sure hope gold plays catch-up ..fast (yes mom I have stops)

LOL I’ve been called many things, but the right hand of God? Not so sure about that one…. I think God may have something to say about it 🙂

Very good you have your stops in. Also, don’t forget, only invest 3-5% of equity on any one trade. Lara’s Second Rule of risk management.

Could have been a small leading diagonal off the highs and now a small 2 wave zz.

Phillip’s other cycle date was 7/4. So that means it’s either today or Tuesday if those dates are still good.

A bit to go yet till the close, but look at the daily candlestick! Do I hear a roar, like a bear?

Love that daily Candle. Rejection at trendline too. Shaping up to be picture perfect.

Now maybe a slow rounding top?

if it touches the bottom of the 15/20min trendline now looks like it would hit your 2,111ish target.

Lara, does it look like we need one more poke over 2111 yet?

I really would think so….

But here’s the problem. I now have three ideas for the daily chart; the two presented in this analysis and one more which up until today (?) was also published.

The main count here is my preferred count because I think it has the “right look”. It needs intermediate (C) to move above 2,111.05 to avoid a truncation.

The alternate here doesn’t need that, and in fact if price turned here then the alternate would look better than if it continues higher.

The other idea (not published here today, maybe I should publish them all!) could also see a turn before 2,111.05 and that would look better….

I don’t want to just publish absolutely everything, that leads sometimes to paralysis by over analysis.

But it is a conundrum.

I’ll let VIX, volume and other technicals guide me. Today VIX has its third day in a row of divergence with the S&P. That’s a really strong warning that price is turning here, or VERY soon indeed.

I do think that this may be another good entry for a short, and I’m considering jumping in myself. The question is, where to put a stop? Gotta give this market some room to move.

I have to consider also that you have 401k deposits all lumped in here. Yesterday for people paid on 15/30th, today for people paid on 1/16th, and today for people paid bi-weekly on Friday. Add to that the low holiday volume that will likely continue into Tuesday, and I am expecting us to float around up here until maybe Wednesday.

Maybe the high could be in and price will turn oh so slowly, go down just a little then another second wave correction… to essentially drift sideways in a narrow range for a few days…

We’ve seen that before.

Final Post… You all Have a Great Weekend.

SPX Volume way behind yesterday at this time… now at 299.877 Million

Bye Joe

I am outta here folk; nothing much to see. Going into the week end holding 179.5 DIA calls expiring next week and July 15 SPY bullish put spread as hedges against my mid and long term short positions. Have a great week-end everyone!

Bye Verne

Selling DIA 179.00 calls for small loss at 0.38. Market listless. Banksters must have left…

They’re off to the Hamptons for July 4th weekend 🙂

Those DIA 179 calls down to 0.33 so it looks as if the banksters are taking a break.

Are we done?

Or is this the pause that refreshes?

I am expecting them to keep pumping until and unless UVXY fills that 9.43 open gap from yesterday.

Yet another five down, three up that seems to get arrested by you- know- who….this is totally nuts! 🙂

Just saw comments about my posting yesterday of the Royal Canadian (bearish Cypher pattern). I actually posted it the day before too, but with more comment yesterday. Esignal system scans for these patterns automatically, so many people would have seen it too. I don’t have Esignal, but saw the pattern nonetheless. Just like the monthly candlestick hangman/doji on the SPX; I spent the time looking for such. The Cypher pattern is based on Fibonacci numbers/ratios and also fits in with Pascal’s triangle.

I am deadly serious when it comes to trading, posting TA, posting EW having upwards of a hundred e-minis in one trade, not something I would joke about posting TA, especially where others may be considering it. Should have left out attempt at jokes in that post itself I guess.

The Fork system works too, one would just draw another parallel fork up higher at the same distance apart from the others. But as in EW there are always numerous targets.

I will never post any kind of TA which I’m not considering, not taking seriously.

Peter

thanks Peter for sharing it!

Ditto. Thanks. I also use forks with regularity. But I defer to another I know who is pretty expert on them. Thanks again Peter for spending the time to see that Royal Canadian.

I suggest not using forks with regularity, it keeps insulin levels spiked ,leading to fat storing. Intermittent fasting works well. So put those forks down.

That is why I defer to the expert forkers. I am just a neo-forker. Wasn’t that the title of a movie, “Meet the Forkers”?

close,, Meet the Fockers. can we put a fork in this market yet?,, sheesh

I greatly appreciate your posts. I actually also enjoyed your humor and I didn’t doubt the TA was legit, in a few clicks got some education on the subject. thanks

Thank you Peter. I’m sure that if anyone doubted you 5 seconds with Google would have showed them you weren’t kidding about the Royal Canadian 🙂 I didn’t doubt.

But I do think Doc’s warning about forks should be heeded 🙂 Insulin levels and all that. Live longer and prosper!

Making a day trade on DIA 179.00 calls expiring today. Filled at 0.50 per contract. Looking to sell at 0.75

Ladies And Gentleman, the trend has left the channel (on a 15 min chart)

That and a trendline reversal, I have doubled my short position.

SPX is notorious for clambering back into those breached channels. If a kiss of the underside not reversed immediately I would be careful…!

These banksters are nothing if not predictable…

Here comes the run at DJI 18,000.00

If the cannot do it on a low volume day like today they are lamer than I thought…out of bullets perhaps? 🙂

Caution…. I do think this is probably going to turn out to be a good entry point for the next wave down…. but as Verne says, S&P doesn’t play nicely with trend channels. Especially narrow steep ones like this.

Someone really should take it off to training school and teach it the rules of the game. It keeps breaking them!

Well I was stopped out with a big loss today. I’m certainly going to let the wave come to me next time! Those b*****d banksters. Is all this legal? It seems to border on the criminal if you ask me.

To ensure we cover the global markets, I told Griz to invite his buddy Rambo.

I love photos of bears. They are magnificent animals and extremely intelligent.

Here is my strategy, just covered my Sept. e-mini shorts here picking up on average 5 basis points. So now I’ll use those points as my stop loss for the next time I short. If I get stopped out I lost nothing, net.

Keeping all the put options for the longer haul.

UVXY got quite close to my assignment break-even price of around 8.50 if it remains under 10.00 on July 15. I will sitting on whole heap O’ Unicorns….!!! 🙂

A UVXY close back above 10 significantly reduces the likelihood of the dreaded Reverse Split.

I expect the banksters to show up any second though…I don’t think they have left for the Hamptons just yet… 🙂

5 wave impulses down are meaningless lately

Verne– about UVXY reverse split?

Is it a straight 1 for 2 or 1 for 10 or……..is split used as a scam for UVXY management to skim huge profit out of UVXY thereby reducing value to UVXY shareholders?

In other words, what is potential downside to UVXY shareholders?

I think they rsplit to bring up to $50 per share.

Thats what other 3X EFT’s do

Last time was a four for one and it is definitely a scam to allow them to rake in fatter option premiums and enjoy greater decay. If we are indeed close to a top it won’t matter as much this time though…

Somebody call Winthorpe !please

LMAO…

Lara – is there any way you can justify a final strong wave 5 up yet to occur?

I can’t, but pretty sure this market can.

It can spring surprises on us when we’re least expecting. So manage risk!

“The market can remain irrational longer than you can remain solvent”

But on a more serious note, I think it’s unlikely. This move up is weak. There’s divergence now today with VIX three days running, that’s usually a pretty reliable indicator of a trend change and I haven’t seen it persist for longer than three days.

So this is quite likely to be it.

DJI 18,000.00 has been rejected today. It will be interesting to see if the bulls press the case on very low volume. A close above along with SPX 2100 and I may have to pick up a few additional calls…..it would almost certainly prompt a knee-jerk spurt of buying at next week’s open….

UVXY trying to perk up but is has been tanking into the close so not too convincing so far. It needs to fill a few gaps to get my attention….

Art Cashin (Director of floor operations of NY stock exchange for UBS Financial) brought up a very interesting point today: there are “strong” rumors that the Chinese strategic petroleum reserves are getting full. That will put pressure on oil prices as early as next week as demand for oil might decrease by “hundreds of thousands of barrels daily.”

And that folks, might very well be the trigger that will take the markets down… Lara’s oil analysis is also looking for prices to go down, possibly to sub 30 again…

There’s your silver lining of the day… for us bears 🙂

One of my favorite indicators that I use, just went negative today for the first time since Tuesday 3pm EST on the ES 5 minute chart (exchange hours).

So why I shorted this market while the short term trend was up and this indicator was positive is beyond me…..sheez. 🙁

TBH, I am surprised that the MMs have not already unleashed their typical whiplash of traders they have been executing lately. The have rarely let the market trend strongly in one direction or another without some kind of reversal of late, typically after three days or so. Profits not taken quickly in this market have been of late liable to evaporation.

I am now expecting DJI will close above 18,000.00 once again. Amazing!

I see that ES was so envious of SPX reclaiming 2100, that ES had to go right ahead and do the very same…

So to celebrate i went right ahead and shorted ES at 2096, with a stop at 2102…

Risking 6 and expecting 24 on this trade

what is ES?

ES is basically SPX futures. ES quotes 24hr as opposed to the cash index, which observes RTH. I’m currently using SEP contract.

Technically, my broker calls it US 500 , but it’s effectively ES as that’s where the price is derived from.

I also get quoted a continuous contract SPX, but rather annoying incur charges for holding positions in instrument overnight.

ES/US500 SEP contract has a slightly bigger spread, but no premium for holding overnight, hence my instrument of choice as I’m a swing/position trader.

Well well well! Lynch has now slightly adjusted her comments to that she “Fully Expects” to accept the lead investigator’s recommendation. How’s that for lawyer speak really meaning exactly nothing?!

I am still holding a few hedging calls I would really like to roll and take some off the table today. I may have to hold into the week-end against my mid and longer term shorts. Who knows how high the banksters can pump this baby…

Rejection at the trendline for the alternate?

Think or swim is a great trading platform!

It is 🙂 I love the charting software 🙂

Jon, I have to ask… if that is thinkorswim… how do you post a chart to this board? I can’t figure it out and I have tried.

I love the software also.

Go to the Menu in the top right corner and hit “Take Screen Shot” (Its under the little box that says “Investools”

Save the file somewhere on your hard drive:) When you reply/add a message here there should be a big gray button that says “Choose File”…

Locate your chart and upload and it should automatically show in the message:)

Great Thank You

I just bought 1000 contracts of FAZ August 37.50 strike calls and got filled at limit of 2.50 per contract. Bid/ask was 2.25/2.90

We should be heading back to the Feb highs around 68 sometime in the next few weeks.

Interesting it is one of the few inverse funds printing green today.

Is the Unicorn just pawing the ground and snorting or is he really on the move? 🙂

Any speculation as to exactly what Slick Willy told AG Lynch during that little get-together?

That was a level of stupidity and hubris rarely seen even in those who imagine themselves above any kind of law or restraint. 🙂

It just shows how above the law the Clinton’s believe they are. They can get away with anything and still get elected to the office of President.

It amazes me how this was the best the Democratic party could run out there for President.

What is funny is how the whole thing went down. Lynch is claiming the He “stopped by” but witnesses say she actually left her private jet and went to his. It sounds to me like it was a summons, and she went to receive her marching orders. It tells you that the level of corruption now extends to the FBI and others in the JD or she would never have bleated that commitment to go with the recommendations of the FBI and senior JD official investigating the matte if the outcome was not already determined. Truly sickening!

I think they wanted to disqualify her so she would be forced to recuse herself. I understand she wasn’t going to roll over so what better way to get someone sympathetic?

Is she really THAT stupid? If that is what Clinton intended, it must mean the fix is in with the FBI and others in the JD. My understanding was that FBI Director Comey wants an indictment and Lynch was the only person who could stop it from happening. Taking her out by compromising her seems a bigger risk to me.

Unless Slick want to make sure they put Hillary away!!!! 🙂

If that is true… then Slick will be walking around with TWO Black Eye’s.

That will be the tell.

Maybe three! 🙂 🙂 🙂

One eye may get cut off.

ROFL!!!!

That just makes my point… It shows how they always manipulate the landscape to their own benefit and shows how above the law the Clinton’s always believe they are.

Guys, that little get together between Lynch and Clinton didn’t change anything. The fix has been in on the Clinton email saga from the beginning for one simple reason–the fact that the President himself knew about her use of a private email server. There will be no prosecution because he would be the first witness she would call to the stand if she were prosecuted and “everyone” in Washington knows this. Hillary fired that shot across the bow long ago when she publicly said that”everyone” in Washington knew about her use of the server–she was referring to Obama. She won’t be prosecuted because it would provoke a constitutional crisis. She has known this from the beginning and its why she has been so confident about the outcome–its not just hubris.

Another rare but significant reversal clue is a green UVXY close after a new 52 week low. I have seen it happen only once or twice….a close of yet another gap down from this morning would be a great start..

hi lara nasdac and the s &p look very strong there a lot of demand I like sure that this market will continue to clime what you think lara ???????

Looks like ending diagonal forming on 5min chart

My problem with the smaller time frame wave patterns is that they so often end up being invalidated, so what are normally reliable patterns end up not being very reliable. No doubt a byproduct of the unprecedented and unrelenting attempts to keep the markets aloft…

I am fairly certain the markets will continue their march higher in the short term and we are still a few days at the very least from any conclusive resolution WRT short term direction. Not much to see here today I’m afraid. Should be a quiet rest of the day as we inch higher into the close.

After 1PM, this will be a snooze fest.

It’s when you don’t expect a move that a move happens. 🙂

SPX looking pretty interesting atm… still hard to fight the stimulus though.

Hard to believe sometimes but the market doesn’t go up or down forever.

As we have yet to see a pull back in the daily chart, there will be one. I’m actually hoping we hit our target without pulling back on the daily with much-much lighter volume.

The entire world has gone stark raving mad it would appear. How is it possible that the market is completely ignoring the seismic event of the PR bond default? Price discovery mechanisms in financial markets are completely broken. Before the close today I will be adding a few more FAZ 2017 calls to my ledger. Hard to believe what we are actually seeing.

I had a Rant about that this morning… I need to chill! Unbelievable that no network is spending any time talking about this.

But what Default are you talking about? I only saw a blurb about a Debt Moratorium.

It’s still too early for a Johnny Walker Black on the rocks.

It really makes one’s head spin. I cannot help but wonder how exactly the unraveling will begin. Slow, torturous bleed, and death of a thousand cuts? Or a sudden, swift and complete beheading?

This won’t be the key world event by any means, but the Austrian Supreme Court overturned the Presidential election. The good conservative guy lost by ~30,000 votes….he challenged it as there were some “funny business votes”. Court found over ~78,000 votes they didn’t know where they came from/whose they were. Point is a new election is being held and the conservative guy should win: and close the Austrian border to immigrants. The guy is for freedom for the Austrian people – just like Brexit voters declared. Europe is wising up.

Frankly I was astonished that they did not steal the Brexit vote. I suspect the margin of leavers’ win was so huge as to render any attempt to rig the results wholly untenable.

Another new 52 week low in UVXY at 8.82. We are seeing some SPX consolidation above the 2100 pivot and that usually means a run higher. When a reclaim of the pivot is not immediately challenged the odds that we will see a run as much as 3% beyond it greatly increases. Today’s close will be quite revealing.

Everyone will be gone in NYC by 1PM Today if they did not already take this Friday off!

CNBC about to wheel out Tom Lee… the perma-bull to tout “ATH’s in 2nd half of the year.”

It would be ironic (and interesting) if some kind of announcement or event occurs while most folk are away…

A new 52 week low in UVXY @8.87. My guess is that we are going to see more of these over the next few trading days as the major top completes. Hopefully we will see some signs of divergence to give a clue the conclusion of the upward move. I expect us to make a 99% retracement of primary wave one.

beginning to short e-minis here; loading up on OEX put options Jul 22nd, Jul 29th strikes.

Huge weekly wick for the SKEW on the Bollinger Band. Should make Verne very happy! Very bearish going forward.

Yep! I am waiting for a decisive turn in the Unicorn. There are two gaps I want to see filled before I commit…. 🙂

Considering the evident resourcefulness of the banksters, I may even revert to my more conservative signal of a second green close after a new 52 week low. We could go higher….

From Tom McClellan

June 30, 2016

The panic over the surprise outcome in the British referendum over leaving the European Union brought about a fairly rare market event: a 10-1 down volume day. That means the amount of share volume in the stocks that were down that day (down volume) exceeded the up volume by more than a factor of 10.

We have only had 8 of these 10-1 down volume days in the past year, all associated with exhaustive selloffs. I say “associated with”, because the day of the 10-1 down volume reading is not always the final bottom day, and indeed that was the case this time. We saw the 10-1 down volume on Friday, June 24, but then stock prices declined for another day on Monday, June 27, before starting the big rebound.

So the key point to take away is that these events are markers of an exhaustive short term bottom, but not necessarily the signal that the bottom is all done happening.

10-1 down volume days can also be precursors of deeper trouble, and more volatility a few weeks later. We saw a pair of these days back in July 2015, ahead of the bigger problems that hit the market in late August 2015. Those July 10-1 down volume days did correctly say that a short term bottom was at hand, but the recovery was short-lived. A similar message came in December 2015, when a 10-1 down volume day marked a meaningful short term bottom, but hinted at trouble that arrived in January 2016.

full article here:

http://www.mcoscillator.com/learning_center/weekly_chart/brexit_vote_brings_a_10-1_down_volume_day/

We have to understand that it was critical for the banksters to furiously bid this market back up the way they did. The people who got caught in that 600 point draw down last Friday will by now have forgotten that startling event. Confidence in CB prowess has been firmly restored. If the banksters can buy us back from a 600 point down day, why not a 6000 down day? You get the idea.

The current absence of any fear whatsoever in the market speaks to how firmly entrenched that mindset has become . I think it is incredibly bearish for the market. The uncertainty is “when”, not “if”…

I am starting to think from a sentiment point of view, we be may actually just now looking at a P2 top. The action in UVXY I believe conclusively rules out a minute degree correction.

An SPX close above 2100 means I leave upside hedges in place.

That was my thinking too…. but I won’t accept a truncation easily.

Fyi – real good chance won’t have the volume to pull the market down until wed, when all the gangsters are back.

Phillip,

I am seriously considering joining the cycle analysis website because I was so impressed with the 6/23 call. Before I do, I was hoping you would share your personal experience with them. Have they been very accurate in the past…say 80%? TIA

after a trial subscription to Elliott Wave STOCK MARKET, determined that Lara’s analysis is superior…subscribed for six months…

I hope you’re right as they now have as their primary count the start of a minor 3rd wave up within an intermediate 5th wave up.

Joe,

You are so right about the 30 year Treasury and bond market. These dwarf the equity markets and when they implode it will be a massive crushing of all financial markets and instruments globally. Most people just don’t understand what is happening and what is coming.

On top of it all, we now have 11+ TRILLION dollars of negative interest rate instruments world wide. Who in their right mind is buying these instruments which guarantee a loss, a negative return? Unbelievable.

Here’s the real question, with all this money going into the bond markets, where is all the buying in the equity markets coming from?

This has been one of the craziest markets I have ever experienced. In the past, when we got a flight to quality, the equities markets would sell off. This move here has been massive. 100+ point run in the ES in 3 1/2 days.

I’ve been stopped out twice, sitting on the sidelines now because I refuse to fight the tape anymore, but can’t bring myself to get long either because of the action in the bond market… Sheez, standing aside is an option too I guess, but fully kicking myself in the butt for not catching a piece of this massive long move in the ES,

Don’t feel badly Quang. The ferocity of this move up caught all of us by surprise even though we were expecting a bounce. The size of the Brexit sell-off really did look like the start of a major move to the downside. It is a good reminder that you can never underestimate the banksters. No one could have possibly imagined after that move down on Friday we would be back above 2100 a week later. I am still holding a very light compliment of upside hedges but I think this market is becoming a very scary place to play….

Rodney, I agree most people don’t get it and see it.

The people that do get it… don’t talk about it. By not talking about it they are participating in the BIG CON.

I don’t yet know if I can sand watching this today… so I will say this now, you all have a Great Weekend!

I will be watching two things to day – whether SPX trades above the 2100 pivot, and whether or not UVXY closes Thursday’s open gap down. If the first happens and the second does not, I will be out of all short term trades and neutral for the foreseeable future. If the first happens and the second does as well with a higher close, I stand pat. It could take several more days for the market to make its intention clear. A great time for SOH as any I have seen recently. Have a great trading day everyone!

Very low volume day ahead of us. Easy for manipulation ahead of a holiday. With massive central bank support, it seems this market is unable to fall under its own weight.

It is going to be very difficult for UVXY to fill Thursday’s opening gap. It’s top mark is 11.48 almost $2 higher. This is especially true if the market is just grinding up slowly.

But it sure would be a sign of strong accumulation of UVXY if both those conditions are met.

That should have been $11.28 for the top of Thursday’s opening gap. Sorry

I agree. I already exited my short term trades today and will be on the sidelines until we have greater clarity.

2.191% Yield is a New All Time Historical Low for the 30 Year US Treasury Bond just recently hit this AM. That blew through 2.25% ATClosingL and 2.20% ATIntraDL.

That is an Extreme!

Back to sleep.

2.188% Yield is a another New All Time Historical Low for the 30 Year US Treasury Bond just recently hit this AM.

Wow… It will go Sub 2.00% IMO. The question now is how far under 2.00%?

Something is about to Blow UP! What though?

Puerto Rico just did, but nobody seems to be noticing!

Nobody seems to care about that… certainly not the business press and other media. People seem to think this has no impact whatsoever!

To me this is the start of the series of Dominoes that have now fallen.

Everyone should take notice!

I wonder what it will take for people to take notice of all that has gone on and going on???

A $2 Billion DEFAULT and nothing… not one word of default mentioned anywhere!

How is that possible?

Because like everything else in this world they are changing the narrative… changing the language to hide from the masses what has actually occurred!

Puerto Rico Declares a Debt Moratorium… is the headline.

The masses don’t pay attention because they don’t know what that means!

What The F _ _ _ is a Debt Moratorium… Well it’s a F_ _ King DEFAULT.

Say what it is… Don’t make up some BS name for it!

It’s a DEFAULT!!!!!!!!! A DEFAULT!

On the main hourly chart, why are you looking for minor wave 5 to have equality with minor wave 3 instead of minor wave 1?

Because if minor 5 = minor 1 then intermediate (C) would be truncated. The target would be 2,105.45, below the end of intermediate (A) at 2,111.05.

I don’t think a target calculation is the best way to see when this upwards move ends though. Because minor 3 = 1.618 X minor 1, minor 5 is less likely to exhibit a ratio to either 3 or 1.

The lilac trend line would be a better point.

THX

Hi all,

question: from the wave notation chart – minor waves are said to take ‘weeks’, minute waves ‘days’ etc. but then looking at an hourly chart a minor degree wave may only be an hour or two. I’m trying to understand how this works out.

thank you

with flexibility

I start at the monthly chart level and get the cycle degree looking right, then move to lower time frames.

Because waves extend and are different lengths in price, they’re also different lengths in time. Which is why the time for each degree is a rough guideline.

When a new wave begins this is one of the hardest things to get right. The degree has to be changed up or down after the wave forms better and becomes clearer.

Good article & Summary of where we are fundamentally …. I should have written it.

“The robo-machines and perma-bulls are at it again, delivering another volumeless dead-cat bounce in a market that has churned sideways for 600 days now.

That’s right. The S&P 500 first crossed the 2060 threshold around mid-November of 2014, and has made upwards of 40 attempts to rally since then—-all of which have failed to be sustained.”

http://www.zerohedge.com/news/2016-06-30/curse-wealth-effects-central-banking

The last time we had three strong candles as we have just seen the last three days was on February 12, 16, and 17 with Feb 15 being a market holiday. In both cases they came after a strong market decline; back in February it was the end of primary one according to the current EWI labels, and now at the end of a minor C of an intermediate B wave, or end of a minute one of minor three. The size of the candles is quite striking and may be an indication that something more that a minute degree correction is underway. While I agree that new a ATH are unlikely, those three candles in Feb kicked of a fairly substantial move to the upside. The one big difference is that UVXY was nowhere near 52 week lows at the time and in fact had made a multi-month high at the Feb low the previous session on Feb 11. It was nowhere near a multi month high at the recent low, and in fact UVXY has already printed a new 52 week low a mere three trading sessions after the recent low so once again I think a very powerful is signal being sent. It appears that crowd expectation of a near and mid-term market decline is virtually zero. Everyone is expecting this market to keep climbing for some time to come…

I totally agree Vern. Everybody I have heard or read is expecting a new ATH with the resumption of the seven year bull market. They also expect new profits in their 401k and IRA accounts. Hold at all cost. Keep buying every month.

If we tank in the month of July, it will surprise most of the world.

Still not extreme yet on CNN’s Fear & Greed index.

Another one or two days up yet… and maybe it’ll get there?

Very strange market. Somehow the manic run up makes the market seem more fragile, not stronger. I could see this market flipping the cards and heading straight down. Definitely something going on, probably including a ton of stimulus, as the UK said it would double down efforts to stabilize the market. This run up that erases all loses in a few days can’t help but embolden the bulls who are getting used to gaining their percent a day. These bullish extremes can’t help but feel very bearish to me, and I think a resolution to the downside is near…

Yes David I could not agree more. There is an unnerving sense of desperation and panic about the recent run-up, moves one does not normally see in a genuine bull market. I do not think it is only short-covering, to which many attribute this type of bull market rally, I think we are seeing massive cash injections into the market by central banks globally, not just the FED, and yes I even would not be surprised if they are buying not only their own markets but other nations as well. Carney admitted some 300 billion poured into the FTSE and they were crowing about how it recovered all of its pre-Brexit losses. The central banks are determined to keep markets inflated. The persistently low volume is a great clue that this is what is taking place. The worrisome thing is that this has been going on for quite some time and many of us thought this market would have imploded long ago based on global economic realities. The Brexit plunge may be hinting that it is going to take some sort of exogenous shock to jolt the market to reality, and that the impact will be immense. I suspect we are looking at a long, frustrating, and slow grind yet higher. Futures not indicating Thursday’s gap down open will be filled, so the waiting and scalping game continues…

Gap down open for UVXY that is….

Oh man… somehow I have no doubt we’re about to head south here soon, but I just can’t believe we’re up here again after such a big downfall. One thing this market has shown over and over again is resilience to break down. But it also can’t move beyond 2100 much.

This week reminds me soooo much of last week. Last Thursday we were in the same type of price action at end of the day. If the remain vote would have won, we prob would be at ATH’s right now. But we have no big news to rapidly turn the markets around, or so it seems.

However, it feels like July might be similar to January… a long, grind down. We’ll see… Price just doesn’t seem to belong way up here. We’re less than 50 ticks from SPX ATH!!!

Unreal…

850 points for Primary Wave 3 sounds great to me. It also sounds appropriate for a Primary Wave 3.

Hi!

Whoo hoo!

Whoo hoo!

Whoo hoo!

I don’t even shout this out in the wilderness where no one can hear. So this is a very intimate moment for me.

(Let’s see if doc can find a joke to fit this.)

Oh, and by the way Lara, thanks a lot for your analysis and commentary. Helps immensely.

Oh, and a second by the way, I did not read the posts from today during the day. It was really peaceful. However, I did read through all the posts, all 180+, after the market closed today. I cannot believe you do this every day, Lara. I admit, I only briefed some.

Rodney, Im crushed,, you yelled it out in Caribbean accent like Verne? Being a fellow Nowhereian I would expect the woo hoo to come out of you, not whoo hoo..and you too Lara? I’m crushed mon.

It’s okay Doc, don’t be crushed. Have another sip of the kool-aid… it’ll all be okay 🙂