Downwards movement was not expected, but with no confirmation that the upwards trend had resumed it was allowed for.

Summary: A little more downwards movement to 1,989 may complete this correction. A breach of the channel on the hourly chart is still required before the resumption of the upwards trend can be relied upon. If price breaks below 1,972.56 the target for more downwards movement is 1,921.

Click on charts to enlarge.

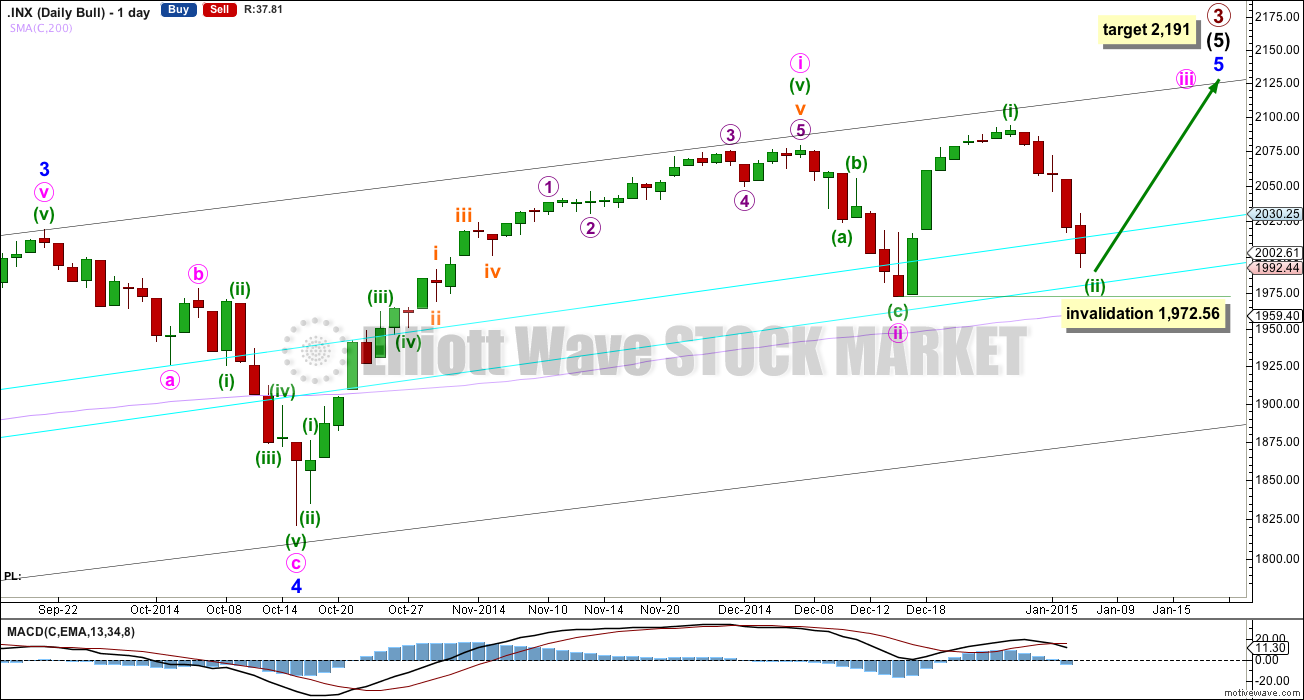

Bull Wave Count

I will favor neither the bull or bear wave count. Both are viable and both expect this current upwards impulse may again be close to complete.

To see a weekly chart with subdivisions and how to draw trend lines and channels click here.

Upwards movement from the low at 666.79 subdivides as an incomplete 5-3-5. For the bull wave count this is seen as primary waves 1-2-3.

Within intermediate wave (5) minor wave 2 is an expanded flat and minor wave 4 is a zigzag. Minor wave 3 is 14.29 points longer than 1.618 the length of minor wave 1.

At intermediate degree there is also a very close relationship between intermediate waves (3) and (1): intermediate wave (3) is just 0.76 points less than 2.618 the length of intermediate wave (1).

The aqua blue trend lines are traditional technical analysis trend lines. These lines are long held, repeatedly tested, and shallow enough to be highly technically significant. When the lower of these double trend lines is breached by a close of 3% or more of market value that should indicate a trend change. It does not indicate what degree the trend change should be though. It looks like minute wave ii may have ended just short of the lower aqua blue trend line, which gives the wave count a typical look.

I have pulled the upper trend line down a little today to touch the low of minute wave a within minor wave 4. This may be a better position for recent movement.

There is still triple technical divergence between MACD and price at the weekly chart level.

Minute wave i lasted seven weeks, 36 days, which is two days longer than a Fibonacci 34. Minute wave iii may be even in duration to minute wave i. This would see it continue for a further 21 trading days.

Minute wave iii may show its subdivisions clearly on the daily chart. Recent downwards movement looks like a second wave correction which may not move beyond the start of minuette wave (i) below 1,972.56.

At 2,191 primary wave 3 would reach 1.618 the length of primary wave 1. This would expect that minor wave 5 is either an ending contracting diagonal (minute wave i would be seen as a zigzag, which is possible) or within minor wave 5 minute wave iii will be shorter than minute wave i, and minute wave v will be shorter still. Both these scenarios are possible. Or the target is wrong.

If 1,972.56 is breached the second alternate would be confirmed.

Main Count Hourly Chart

Minuette wave (ii) is moving lower. At this stage on the five minute chart it looks incomplete. At 1,989 subminuette wave c would reach 6.854 the length of subminuette wave a, and micro wave 5 would reach equality in length with micro wave 1.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,972.56.

Draw a channel about subminuette wave c using Elliott’s second technique: draw the first trend line from the highs labelled micro waves 2 to 4, then place a parallel copy on the low labelled micro wave 3. I would expect micro wave 5 to end mid way within this channel. When this channel is clearly breached with upwards movement that shall provide confirmation that minuette wave (ii) is over and minuette wave (iii) has begun.

When this second wave correction is finally over the next movement for the S&P should be a third wave within a third wave upwards.

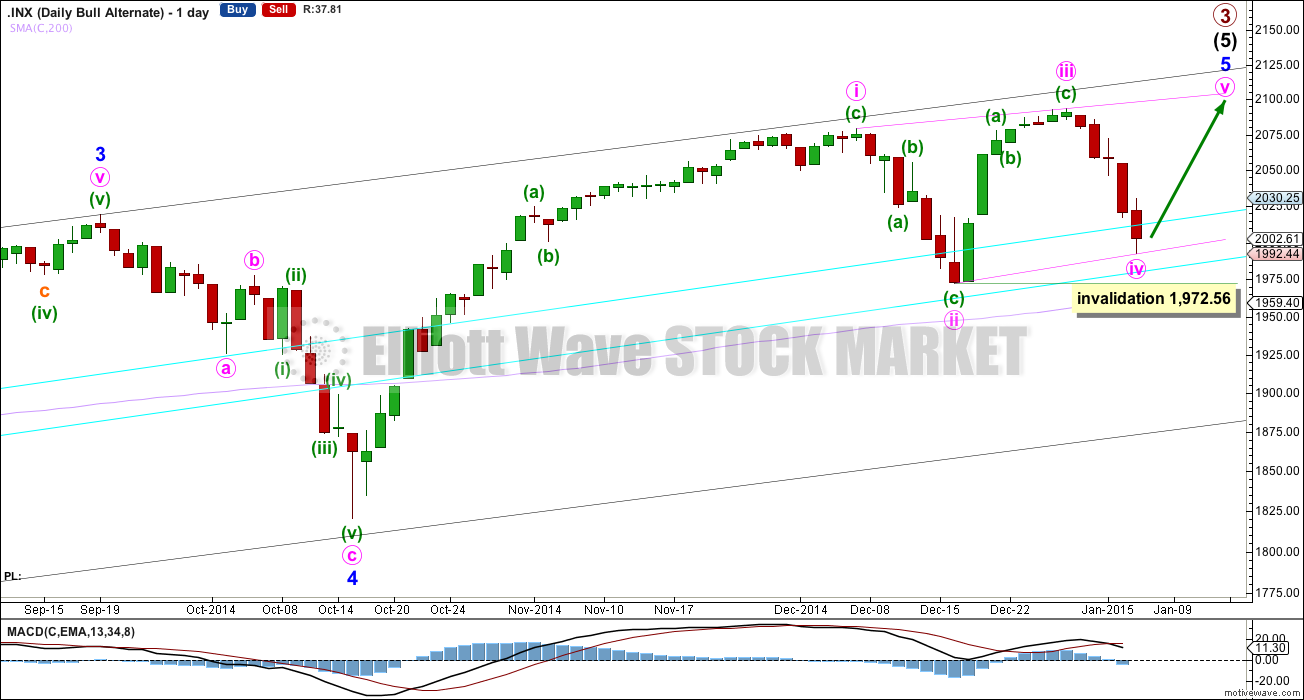

Alternate Bull Wave Count

Alternatively, minor wave 5 may be an ending contracting diagonal. Within an ending diagonal all sub waves must be zigzags, and the fourth wave must overlap back into first wave price territory.

Within this diagonal minute wave ii is only .41 of minute wave i, and minute wave iv is now .84 of minute wave iii. Within diagonals the normal depth of second and fourth waves is between 0.66 to 0.81. Minute wave ii is very shallow, and now minute wave iv is a little deeper than normal.

If minute wave iv moves any lower it may not move beyond the end of minute wave ii at 1,972.56.

This alternate may see a swift end to primary wave 3, which may not exhibit a Fibonacci ratio to primary wave 1. The final fifth wave of the diagonal would be very likely to end with a very small overshoot of the upper i-iii diagonal trend line.

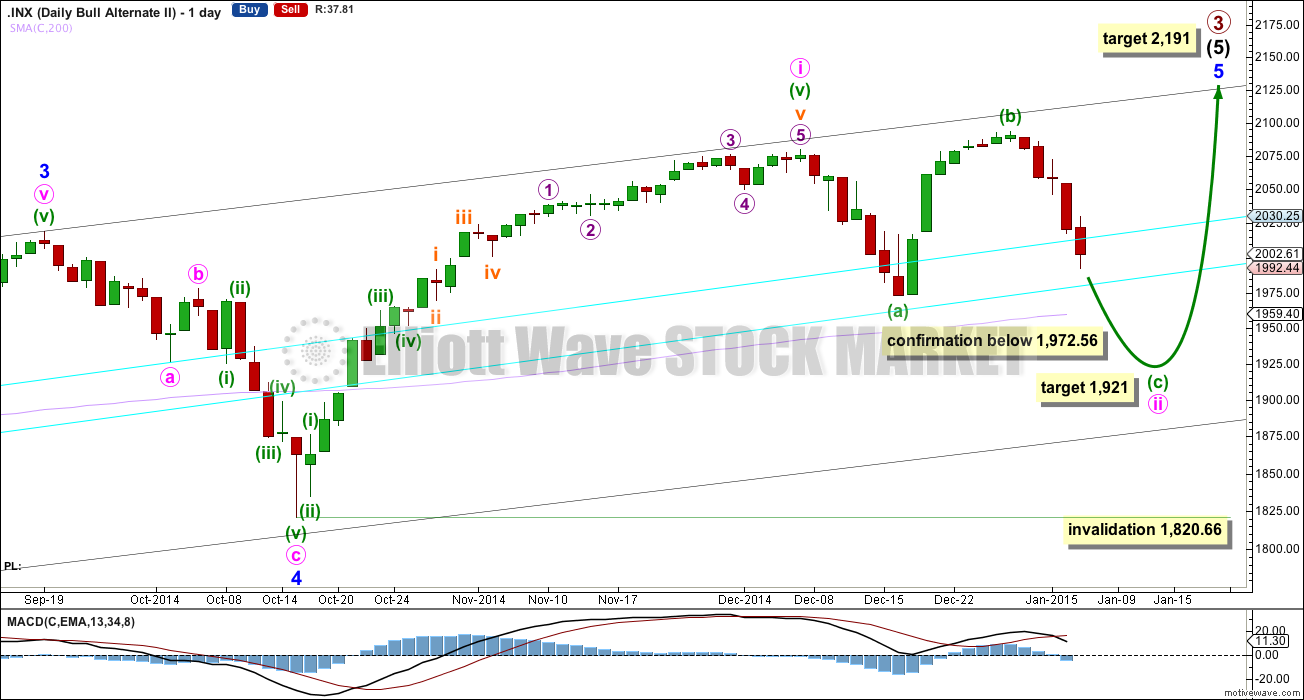

Second Alternate Bull Wave Count

It is possible that this downwards movement is a continuation of minute wave ii as an expanded flat correction. Within it minuette wave (b) is a 113% correction of minuette wave (a). At 1,921 minuette wave (c) would reach 1.618 the length of minuette wave (a). This would see the lower aqua blue trend line again breached, which would be acceptable as long as price does not close below it by 3% or more of market value.

Minute wave ii may not move beyond the start of minute wave i below 1,820.66.

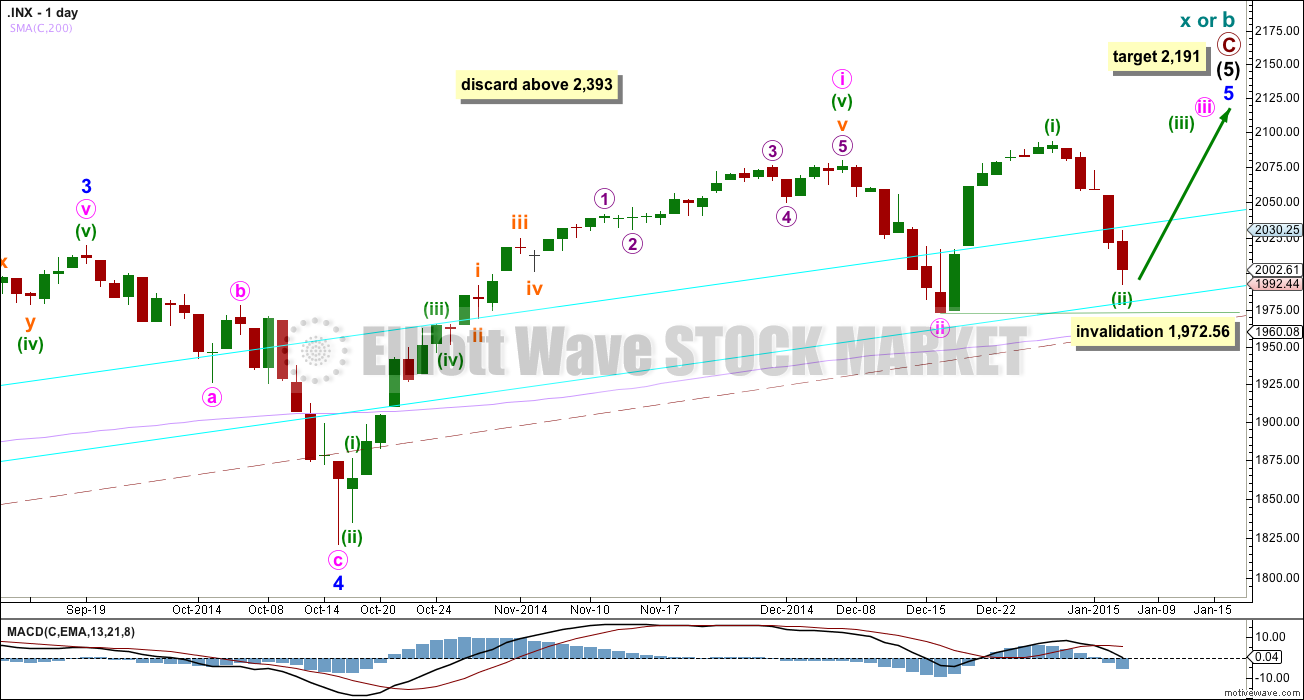

Bear Wave Count

This bear wave count differs from the bull wave count at the monthly chart level and at super cycle wave degree. To see the historic picture go here.

The subdivisions within primary waves A-B-C are seen in absolutely exactly the same way as primary waves 1-2-3 for the bull wave count.

At cycle degree wave b is over the maximum common length of 138% the length of cycle wave a, at 165% the length of cycle wave a. At 2,393 cycle wave b would be twice the length of cycle wave a and at that point this bear wave count should be discarded.

While we have no confirmation of this wave count we should assume the trend remains the same, upwards. This wave count requires confirmation before I have confidence in it.

This analysis is published about 07:45 p.m. EST.