A new low below 2,728.81 has indicated a deeper pullback to end about the lower edge of a multi-year trend channel.

Summary: Downwards movement has now retraced just over 20% of market value (high to low). This now meets the technical definition of a bear market. However, it came after no divergence between price and market breadth at the last all time high, so statistically this bear market is more likely to be shallow.

Downwards movement over the last four weeks is expected to most likely be a deep pullback, which has precedent in this secular bull market that began in 2009.

This deep pullback may end at the lower edge of the teal multi-year trend channel. Instructions on how to draw it are slightly different for the new wave count and are given below.

The biggest picture, Grand Super Cycle analysis, is here.

ELLIOTT WAVE COUNTS

MAIN WAVE COUNT

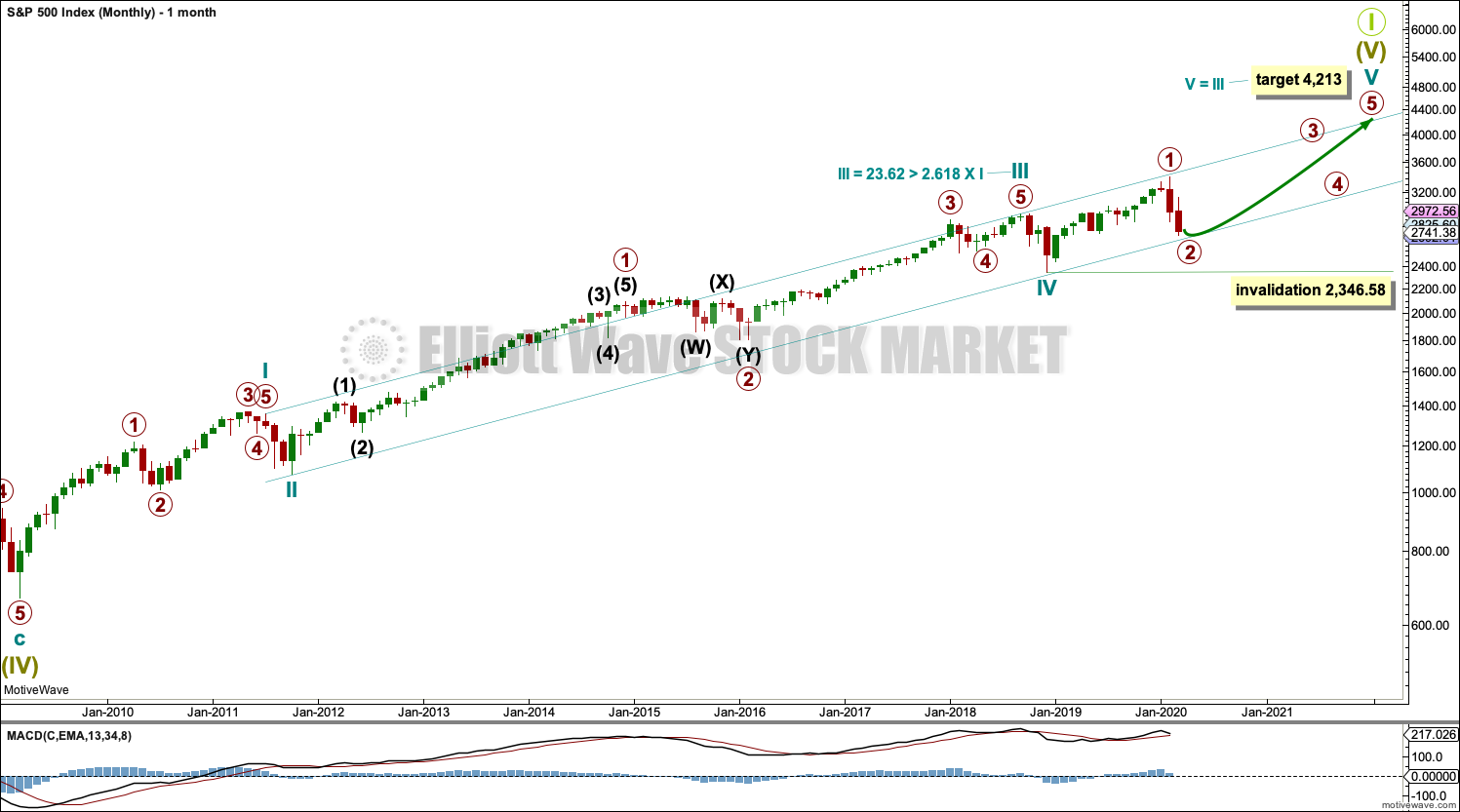

MONTHLY CHART

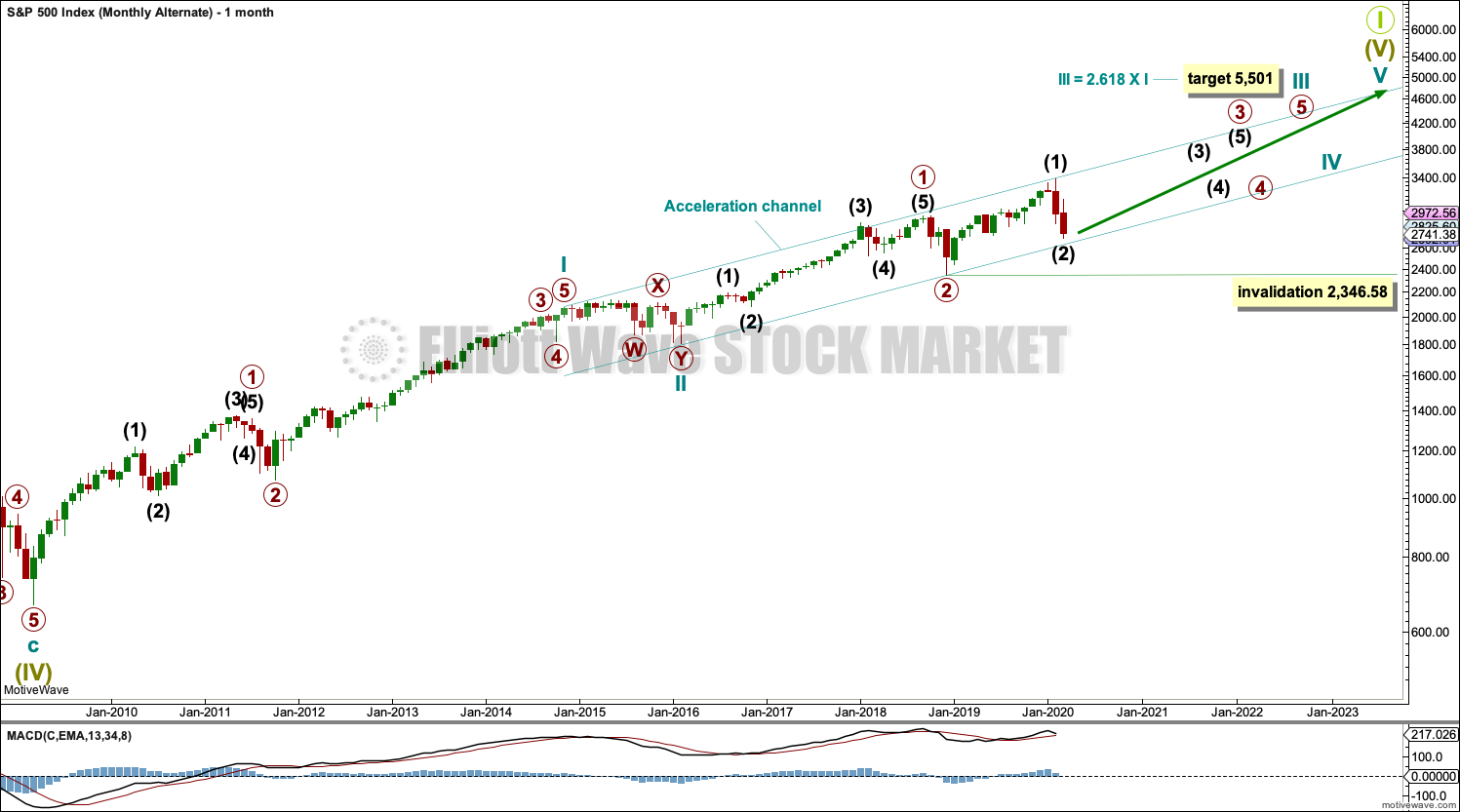

An impulse may be incomplete. The impulse is labelled Super Cycle wave (V). Within Super Cycle wave (V), cycle waves I through to IV may be complete. There is a Fibonacci ratio between cycle waves I and III. Cycle wave V may be incomplete.

Cycle wave I was not extended. Cycle wave III was extended. Two of the three actionary waves within an impulse may extend, so cycle wave V may be also extending.

Draw the Elliott channel now from the following dates and price points: the first trend line from the end of cycle wave I at 1,356.48 (July 7, 2011) to the end of cycle wave III at 2,940.91 (September 21, 2018), then place a parallel copy on the end of cycle wave II at 1,074.77 (October 4, 2011). The lower edge may provide support while cycle wave V is incomplete.

This wave count agrees with Lowry’s analysis.

WEEKLY CHART

Cycle wave V may be unfolding as an impulse. Within the impulse, only primary wave 1 may be over at the last high.

Primary wave 1 is seen as an impulse. Within primary wave 1, there is poor proportion between the corrections of intermediate waves (2) and (4) and minor waves 2 and 4. This gives the wave count a forced look, but it is valid. The S&P does not always exhibit good proportion, so a little flexibility in the right look is sometimes required.

Primary wave 2 may be unfolding as a zigzag. It may find strong support about the lower edge of the multi-year teal trend channel.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

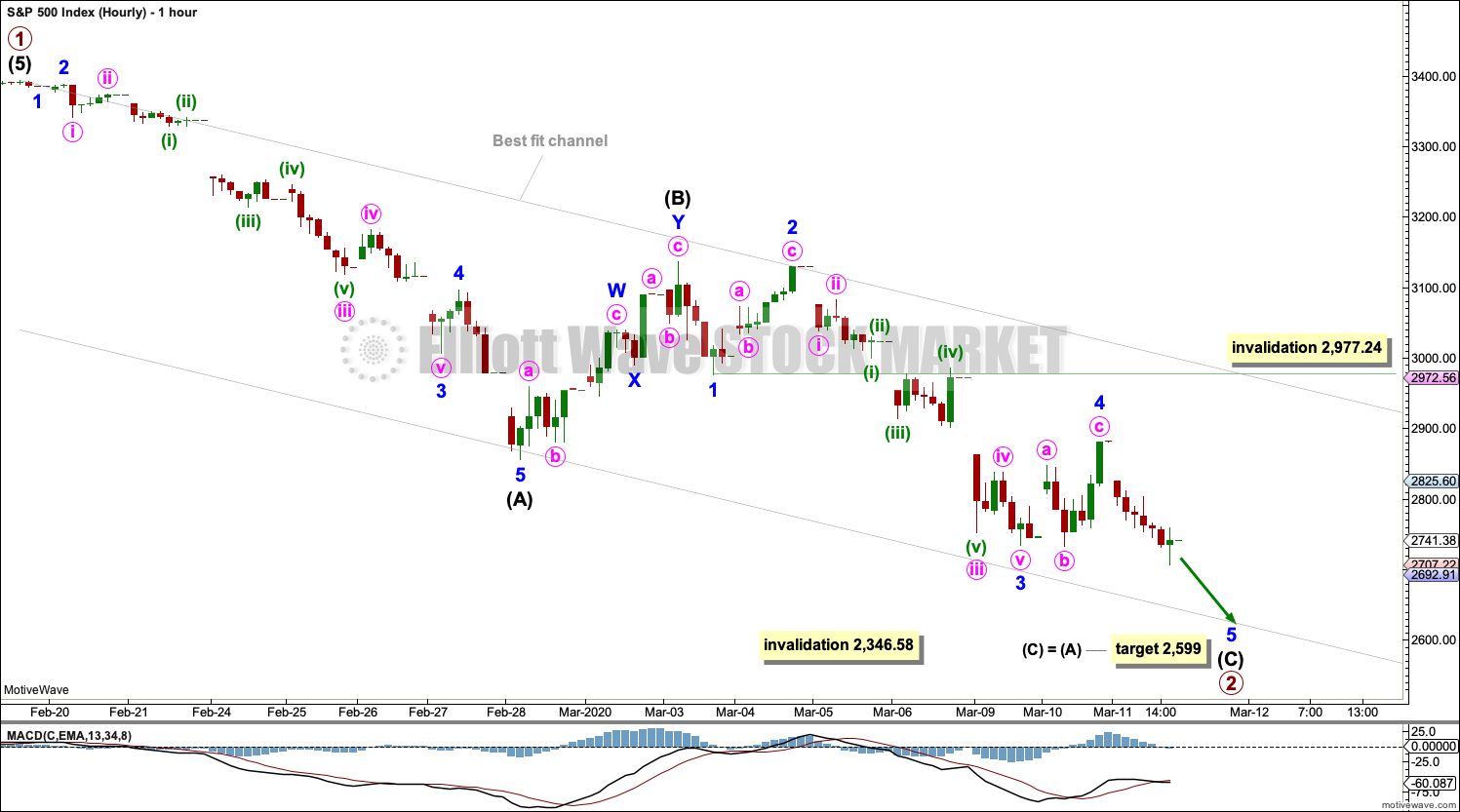

DAILY CHART

This wave count allows for more downwards movement here. Primary wave 2 may not end until price comes down again to test the lower edge of the teal channel.

Primary wave 2 may be subdividing as a zigzag; this is the most common Elliott wave structure for a second wave. Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

It is possible that primary wave 2 could be over at today’s low, but it is also possible it may continue further to test the teal trend channel.

HOURLY CHART

Primary wave 2 may be incomplete. A target is calculated that may be a little too low. It would require an overshoot of the lower edge of the teal channel. The lower edge of the channel may be a better guide to where primary wave 2 may end.

Intermediate wave (C) must subdivide as a five wave structure; it may be an almost complete impulse. Within the impulse, minor wave 4 may not move into minor wave 1 price territory above 2,977.24.

FIRST ALTERNATE WAVE COUNT

MONTHLY CHART

It is also possible that there may be a series of three overlapping first and second waves for this bull market. This wave count would be very bullish once intermediate wave (2) is over.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 2,346.58.

SECOND ALTERNATE WAVE COUNT

MONTHLY CHART

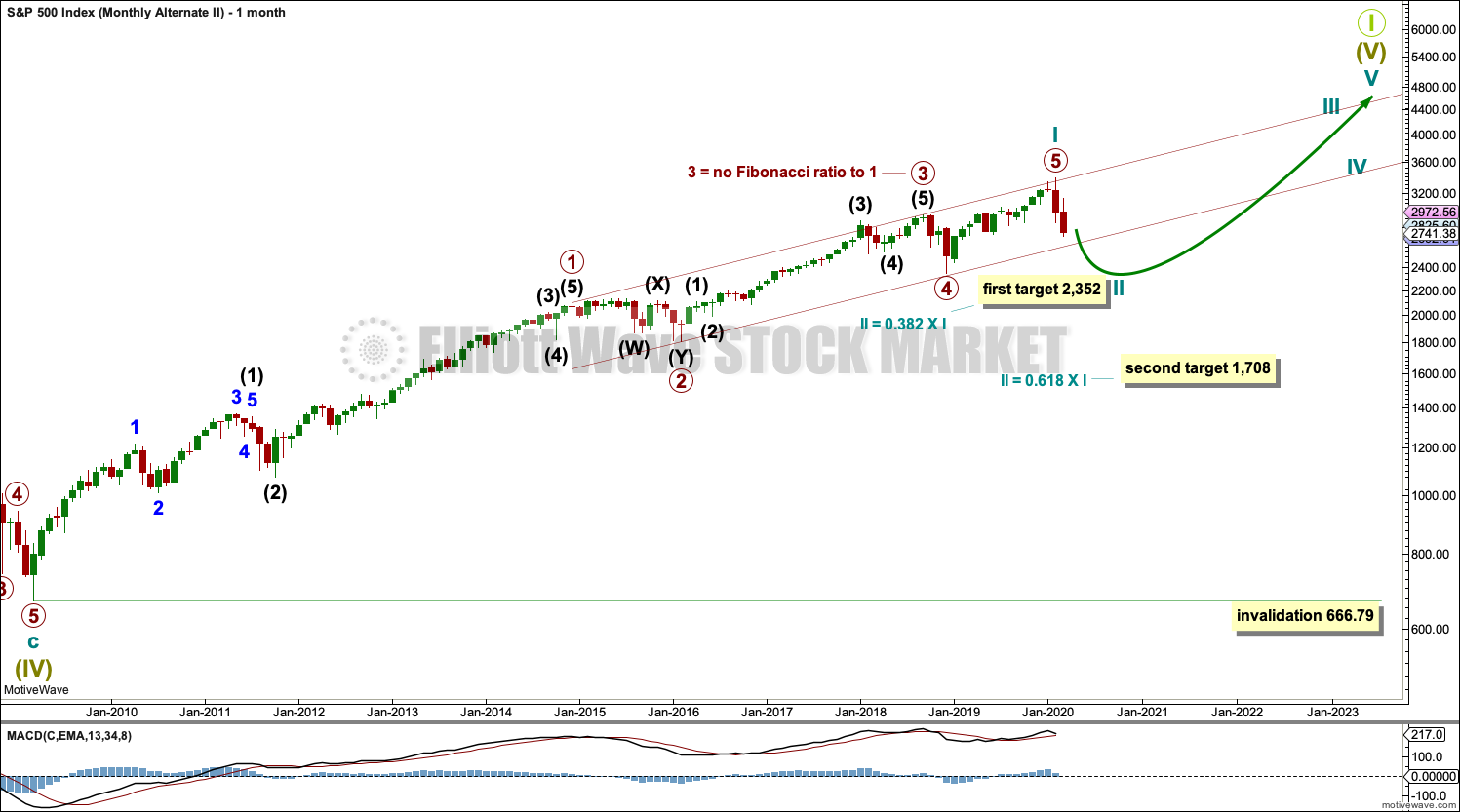

It is also possible that an impulse is complete and the bull market is over, but this does not have support from Lowry’s analysis. For this reason, this wave count must be judged to have the lowest probability.

If the channel is breached by a full daily candlestick below and not touching the lower edge, then this would become the main wave count.

If the bull market is over and a bear market has begun, it has come after no divergence at the last all time high between price and the AD line as a measure of market breadth. Statistically this indicates the bear market to follow would most likely be relatively shallow. The 0.382 Fibonacci ratio would be a preferred target. The 0.236 Fibonacci ratio at 2,750.01 has already been passed.

The second target at the 0.618 Fibonacci ratio would have a low probability.

Although this wave count has the lowest probability in terms of classic technical analysis, it does have the best fitting Elliott trend channel.

TECHNICAL ANALYSIS

WEEKLY CHART

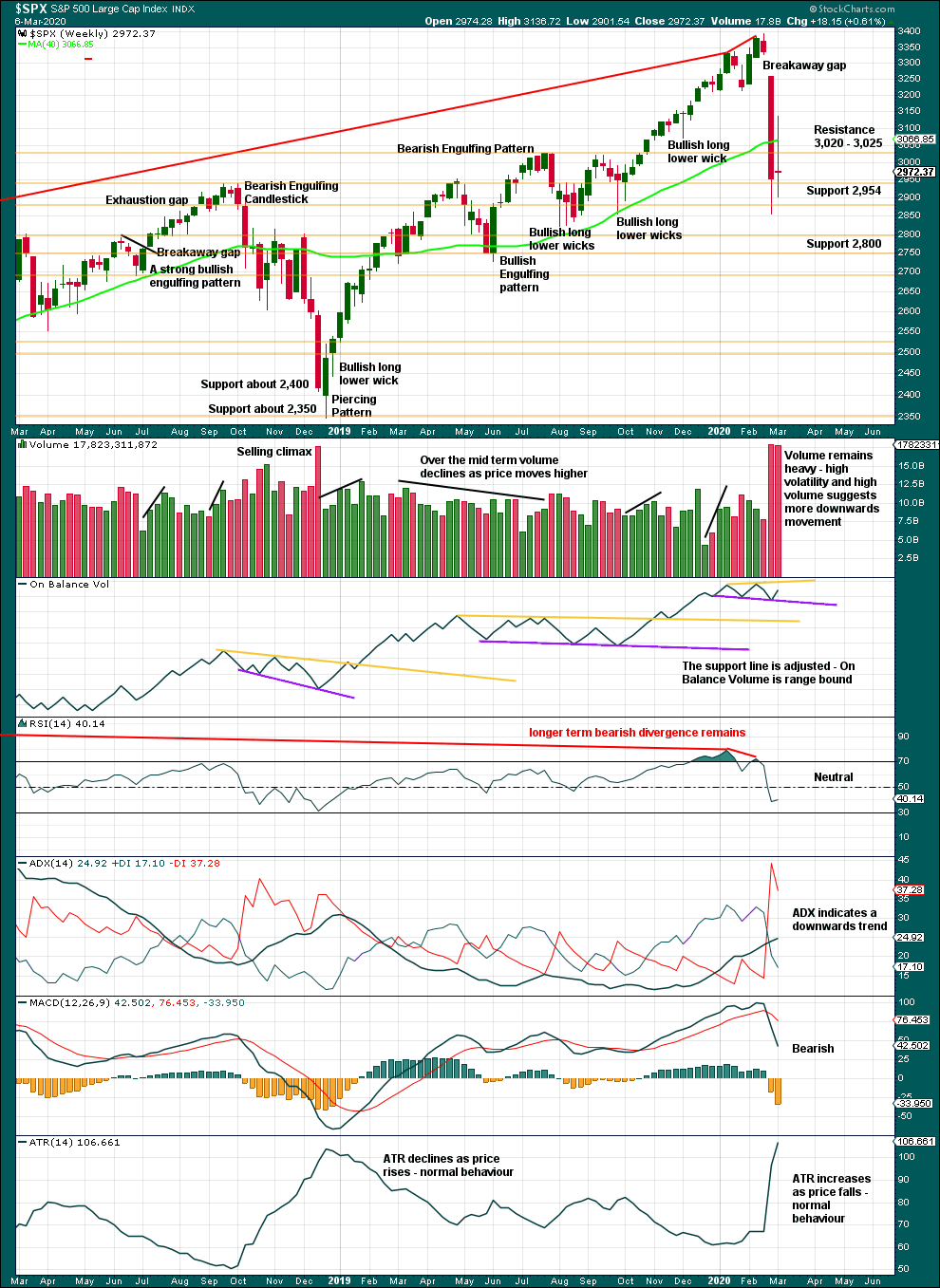

Click chart to enlarge. Chart courtesy of StockCharts.com.

A 19.4% drop in price (high to low) so far has precedent within the larger bull market. It does not necessarily mean the secular bull market must be over.

At the weekly chart level, conditions are not yet oversold; this pullback may be expected to continue further.

A long legged doji last week represents a pause, a balance of bulls and bears. This is not a reversal pattern; doji appear within trends or consolidations.

DAILY CHART

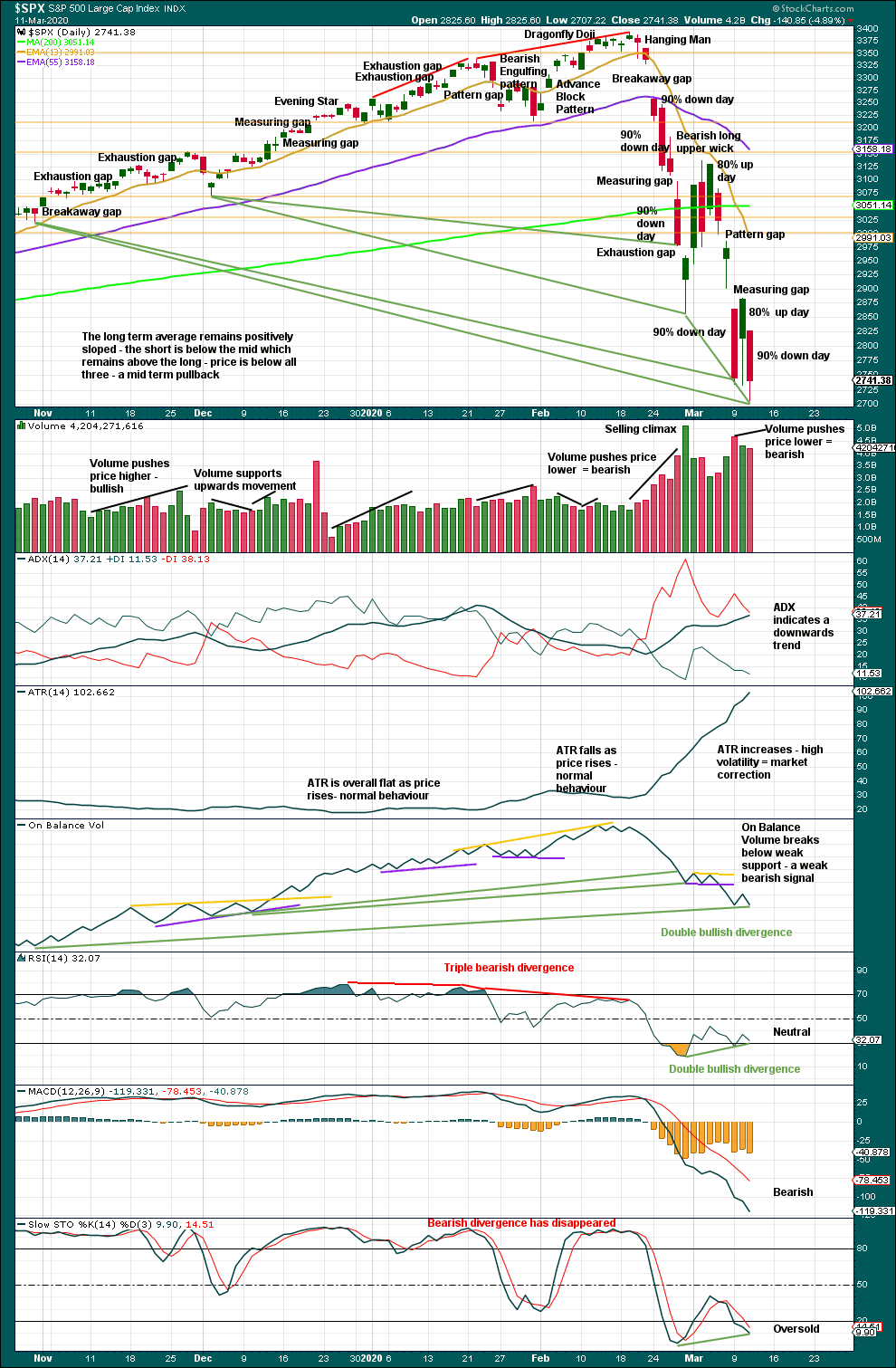

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are now five 90% downwards days in this strong downwards movement.

The following indicators now suggest a low may be in place here or very soon indeed:

– RSI reached deeply oversold and now exhibits short-term bullish divergence with price.

– Stochastics reached oversold and now exhibits short-term bullish divergence with price.

– On Balance Volume continues to exhibit bullish divergence with price.

The following indications will be looked for to provide confidence that a low is in place:

– A 90% upwards day.

– Two back to back 80% upwards days.

– A bullish candlestick reversal pattern.

Next support is in a zone from 2,600 to 2,550.

BREADTH – AD LINE

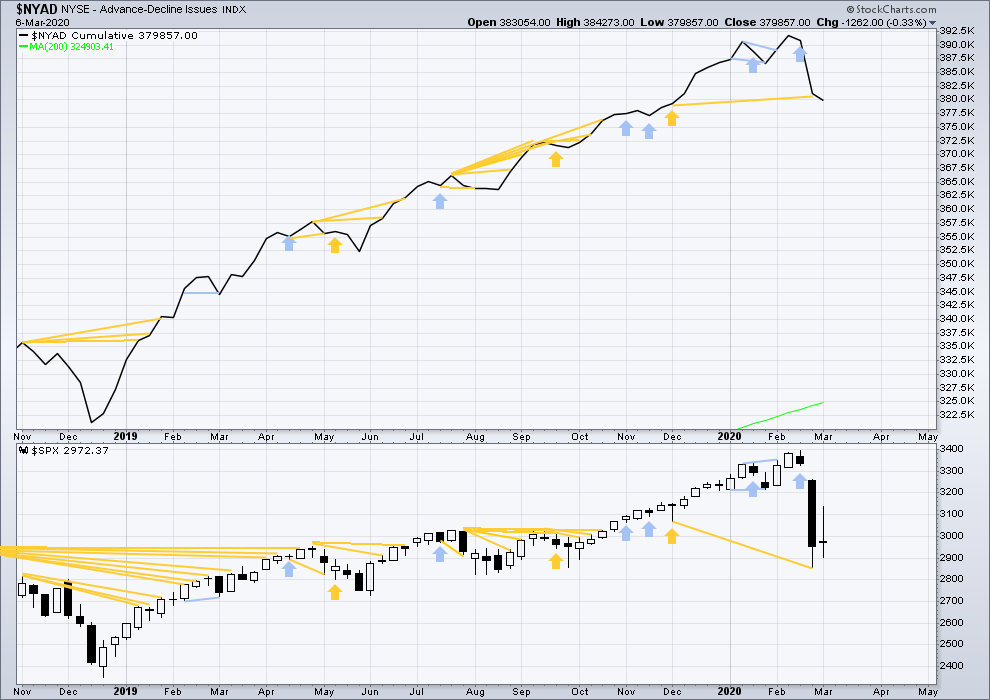

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs with last all time highs from price, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid June 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week price has moved sideways and the AD line has slightly declined. This is very slight bearish divergence.

Large caps all time high: 3,393.52 on 19th February 2020.

Mid caps all time high: 2,109.43 on 20th February 2020.

Small caps all time high: 1,100.58 on 27th August 2018.

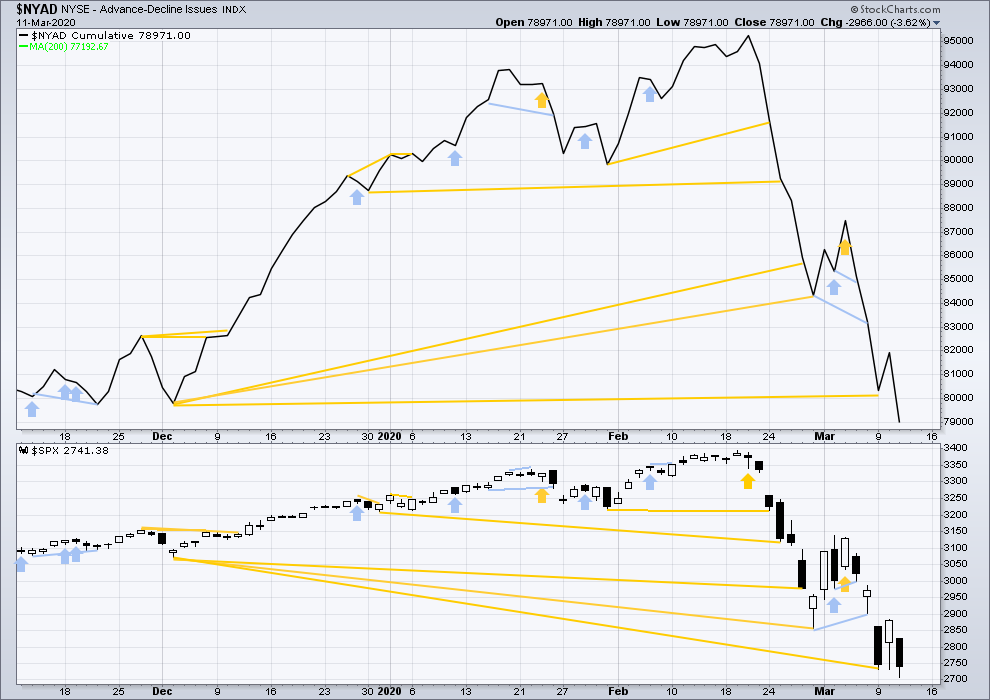

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Both price and the AD line have moved lower today. Short-term bullish divergence has disappeared, but there is still mid-term bullish divergence. Price has made new lows below August 5, 2019, but the AD line has not (not shown on this chart, best viewed on the weekly chart). Price continues to fall faster than breadth.

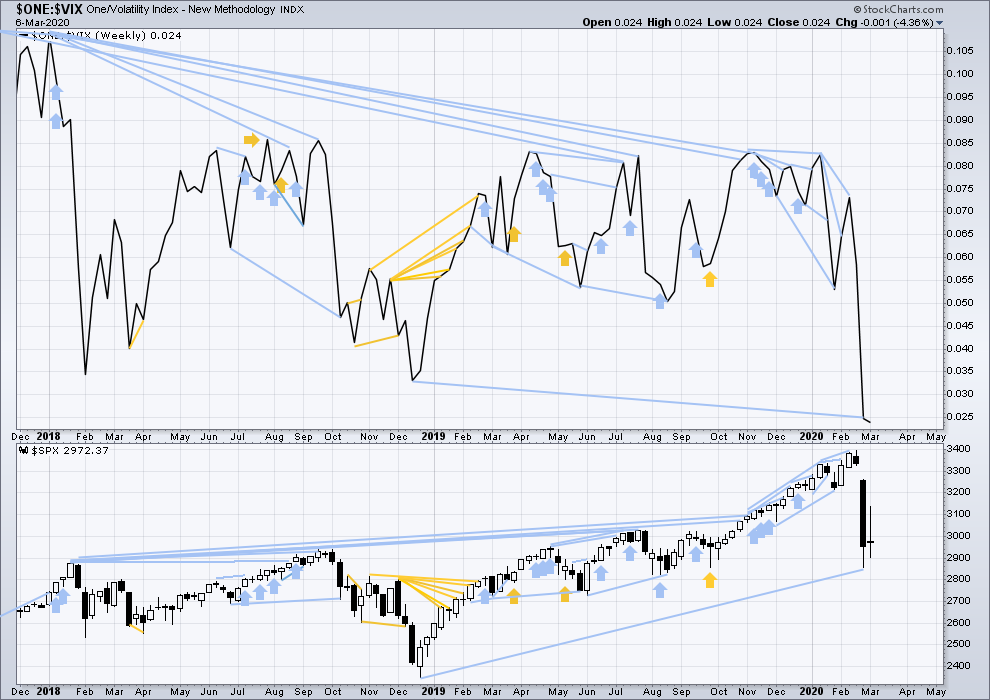

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Last week price has moved sideways and inverted VIX has moved slightly lower. This divergence is bearish for the short term.

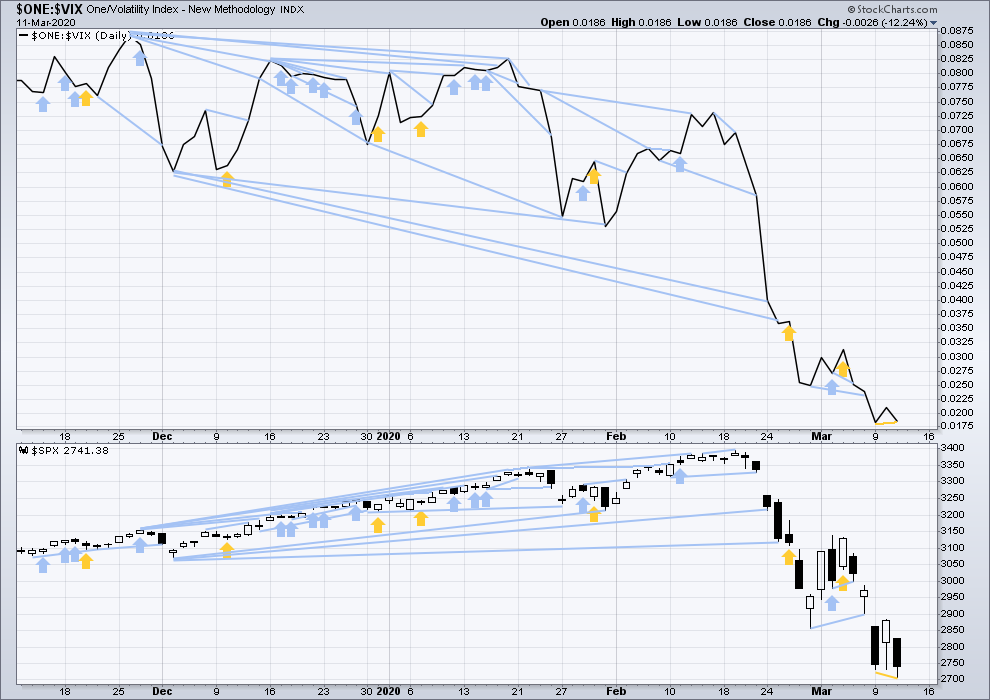

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have moved lower today. Price has made a new short-term low below the low two sessions prior, but inverted VIX has not. This divergence is bullish for the short term, but it is weak and not confirmed by similar short-term divergence between price and the AD line, so it shall be given no weight in this analysis.

DOW THEORY

Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Dow Theory would confirm a bear market if the following lows are made on a closing basis:

DJIA: 21,712.53

DJT: 8,636.79 – a close below this point has been made on March 9, 2020.

S&P500: 2,346.58

Nasdaq: 7,292.22

Published @ 06:19 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

possible second emergency fed cut?

might want to be careful to the short side here. a big fed cut could goose this thing up pretty hard. I’m mostly in cash now except an open IWM ‘fly (unbalanced; my profit stays the same with more downward price acton) with a peak up at 126 (at 113 now), expiring Mar 20. not pressing my luck right now; I’d love to see a correction up Thur/Fri and and chance to short it large again.

“when in doubt, the safest position is cash…and patience!”

note that gold did it’s nominal thing in a market collapse: it got hammered to (and gold miners, destroyed). it’s not a safe haven!

… in a liquidity crisis gold is worthless, in a insolvency event gold is priceless

Being sold to meet margin calls…

Not sure if we are in a liquidity crisis yet. The Fed has injected 1T$ in the repo market today, and the reaction was happiness for exactly 1 15-minute bar chart.

I was looking at the graph of the Dow Jones in 1918-1919 vs. the deaths of the Spanish flu (from Wikipedia). It was a very different situation back then… much more bearish and volatile in 2020. There was no leverage back then, which explains…

I’m hoping 2346 remains intact. Bear markets are not fun (from a real life perspective, not a trading one), and that would open up a big one.

Kevin – Russian CB is offloading gold to shore up cash positions while they Fight Saudi on Oil front.

Looking like they want to hold the last move down until the close….typical…! lol!

ED, one last lower low …. ?!?!?!

Maybe some march 20 SPY 270 for 4.5?

Deployed massive bull AND bear credit spreads…way out of the money of course, but sporting fat juicy premiums nontheless.

All expiring tomorrow.

Is this legal??!!

This market is a spread trader’s dream…!!! 😀

Which strikes/premiums did you pick Verne? Trying to learn from the best!

Tomorrow should give some clarity about purely directional trades for the near term. A failure to “get up off the mat” by Mr. Market would be quite a big red flag for near time price action. Never seen anything like this past two weeks and I don’t think anyone has either. It was unprecedented.

Some of you folk who have been around awhile have heard me going on ad nauseam about what the banksters were doing to financial market for years and probably thought I was nuts.

Did you see how Mr Marker reacted to their multi-trillion dollar jaw-boning?

I think they are toast! It was inevitable, imho…

A reaction should be expected at December 2018 lows…even if only momentary.

There is a a boat-load of premium in options expiring tomorrow.

Some enterprising trader (not recommended for novices!) is going to raid that kitty…! 🙂

Also five up in vol instruments with spinning top developing.

Good news is a bounce could be near.

Bad news (for bulls, that is) is that that is all it may be…

We have five down on the daily. If we are in extended third we still need a four and five down…wactching VIX for lower high to confirm…

Verne, I see the 5, but wonder if I’m miss reading the 4th moving into the 1st wave territory? If so, I guess that would lend weight to the possibility of an extended 3rd?

Yep! 🙂

Sorry, I was looking a degree higher. I see your five. Thanks.

yahooooooooooooo……

That was one KING COBRA! 🙂

I’ll second that emotion!!

And add that I cannot day trade this market today. Too crazy volatile for me. Took my positional shorts for exceptional (for me) daily profits, carefully rebuilding them for more over coming days, but intra-day…no.

If we end up above 2575 today, then it is a very good sign as it is exactly 76.4% retracement from 2018 low to the peak. It also matches Lara’s multi-year teal as she mentioned. Today/tomorrow I believe are critical to see if we are in full blown bear market/recession or just a correction.

Just a thought – let me know how probable it is: current wave is wave 4 in super Cycle when wave 2 was previous recession of 2008. And the bull market of 2009-2020 was a wave 3. Meaning that as Lara mentioned, this recession/bear market (wave 4) should be shallow compared to wave 2 (recession of 2008). Is it a valid thought at all?

I guess it’s possible… I have the big correction beginning April 2000 and ending in March 2009 (8.9 years) as a fourth wave counterpart to the huge correction beginning 1929 begin wave 2. They have pretty good proportion.

CV new daily infection rate showing clear signs of the early stages of exponential growth.

Yep!

The big channel on my monthly charts is well overshot today. Not properly breached yet, that requires a full daily candlestick below and not touching.

This would indicate the second monthly wave count may now be more likely.

Here’s a daily chart for it.

Here’s an hourly chart for it.

Great analysis these past two weeks. Hope all is well in Panama.

Ditto ditto. Nice to have intraday updates too for guidance!

Rodney – I love your comments. I wish we could give Points on the comments 🙂

You are too kind. Thanks for the smile you gave me today. I needed that as my sister 1 year older died this morning. So thanks again.

My condolences, Rodney

OMG! I’m so sorry for your loss Rodney…

sorry to hear that Rod…

I am so very sorry to hear that Rodney. Sending you a virtual Big Hug

Thanks to all of you. If I may comment here, look at the targets given by Lara. The targets provide a great deal of information including confidence points.

I am sorry, Lara, I cannot accept the hug because we now have a three or four people in my County that have tested positive for Covid-19. But just the offer and idea is comforting. Thanks.

LOL

True. No more shaking hands or hugging.

Lara,

The Main (bullish) is still valid until we breach of 2346 and probably more likely if we close around 2640 or higher…is that correct?

Correct. It remains valid, but with the breach of a multi year trend channel the probability has declined.

Condolences Rod on the passing of your sister….

I am also sending you a huge virtual “bear” hug… (smile)

Virtual hugs are A-OK! 🙂

It would be nice to see a long tail on that candle to lend weight to a possible impending reversal…still time before the close…. 🙂

updated /ES view. Broke below the channel, as suspected it might. Turned for the moment off a key 162%. Maybe retests the underside of the channel? The behavior then could be quite telling. I continue to see my blue dash line Fibonacci fitted targets as valid. Hence…a lot more down coming, sooner or after a “channel fill” bounce.

Many wondered about my thoughts on going long at SPX 2600. That idea was not followed this morning. I am not long and will not consider going long until we get reversal signals,, probably much lower. Good health to you all.

The latest advertising email from EWI implies that Precter is calling this the start of GSC wave II. I don’t subscribe so I can’t read the details. I’m not surprised, he’s a very bearish guy all the time!

Yep.

My updated RUT view…

The big channel on my monthly charts is being breached strongly today.

If todays candlestick closes fully below that channel and not touching it, with a downwards day, the second alternate monthly wave count may become the main wave count. Target would be 2,353 as most likely, with the next likely target below that 1,708.

SPX stabilizing, but RUT just…keeps…falling….

-8.8% now.

Anyone a Gann theorist? I’ve been getting Jeff Cooper updates recently, and he’s pointing to multiple long (90, 45, 20) year cycles that all lined up for Q1 2020 as an epic top. Fascinating stuff, sometime I’m going to have to dig into that. Here’s a snippet from new morning report this morning:

“As I’ve warned since last fall, cycles were due to exert their downside influence in a big way. Markets play out in natural cyclic divisions of a circle (cycle) of 360 degrees.

For example, the Crash of 1929 was precisely 60 degrees in years from 1869 where a crash occurred that started The Long Depression lasting a decade.

60 years from 1929 was 1989 which saw the top and crash of the Japanese market which was followed by a bear market in 1990 in the U.S.

90 years from late 1929 is late 2019 and 150 years from 1869.

Let’s take a closer look at these two cycles and their relevance in time.

60 years is 720 MONTHS or 2 cycles of 360 in months.

150 years is 1800 months, which ties to an opposition of 180 degrees.

That the inflection of these two cycles is exerting its downside influence is powerfully validated by the quickest, most severe drop off an all-time high in history.

In terms of pattern, we warned in December that a false breakout spike to new all-time highs in the SPX could mirror the false breakout in January 1973.

Importantly, the false breakout in 1973 was followed by the worst downturn economically since the Great Depression and a 2 year bear market into December 1974.

In other words, 45 years (half the 90 Year Cycle) after the 1929 peak saw the bear market low in 1974.

Taking that same duration in days GIVES THE FIRST QUARTER OF 2020.

Of course the first quarter of 2020 is the anniversary of 20 Year Cycle which marked the Bubble Top in 2000.”

The “degrees” he talking about are on this crazy Gann wheel with a vast array of #’s on it. I have no idea at this point how it’s all derived. Sounds like voodoo but so does EW to the uninitiated. Interesting!

NYSE, DJI, RUT all below 2018 lows…

Potent quote for while we wait…

“Do not use the words “Bullish” or “Bearish.” These words fix a firm market-direction in the mind for an extended period of time. Instead, use “Upward Trend” and “Downward Trend” when asked the direction you think the market is headed. Simply say: “The line of least resistance is either upward or downward at this time.” – Jesse Livermore

A third down underway at several degrees in all likelihood. This implies a fourth and fifth down yet to come to complete the first wave down. We may have an extended third…

I agree, this appears both structurally and momentum wise to me to be wave i of a 3 of a 3, with all that that implies, assuming motive-impulsive action down off the ATH. But I want to see Lara’s work on it in the context of everything off the ATH being an impulsive motive wave before being confident in that.

BTW I have a 162% extension at 2480 that might hold this this morning.

Also BTW ain’t no question but RUT is motive impulsive down!

“Goodbyyyye, bull market channel…” (to the tune of “Yellow Brick Road”)

and now it’s “your circuit’s dead there’s wrong, can you hear me Major Market? Can you hear me Major Market? Can you heeeeeeaaaaarrrrr……???”

Lol!! Took my SPX/SPY shorts, holding my RUT/RTY shorts. A pleasant morning for the dark side.

RUT is down from the top over 27% to date…

Kevin – I read that you have a website. If correct share details if possible.

Link is on sidebar

Yes, it’s specktrading dot com but not much in the way of updates since this market started tanking. Too busy trading!!! Hope you find some value there nonetheless, thanks for looking. Rishi if you don’t have a copy of my book and are interested, send me an email to zinc1024 at that gmail place, and I’ll send you a PDF copy. This offer is open to ALL members here btw; just send a request. I didn’t write it to make money. I wrote it to tell people what I do (for better and worse, lol!!).

NBA season suspended indefinitely, NHL, MLB to follow soon… significant economic impact. Expect break of lower teal line and a new analysis cause market decided to change path based on events. I would love to see what the bear case scenario indicates for market.

Based on price action in ES, downside target for break from coil should be hit in cas h session tomorrow.

Here is the problem for the bulls:

We now have a clear five down off the ATHs……

Ooh find that hard to believe Verne. With a bit of imagination it may be a 5. But at the moment, unless we get a lot more downside, on daily and weekly charts from the ATHs, it’s still a clear 3 down.

I agree Peter H – it is not determined yet – could be interpreted both ways

Falling knife !!!!!!!!!!!

Just realized – while it’s a falling knife, there is perfect order of its falling. On daily ES you can clearly see downtrend channel. I’m not sure why I didn’t look at it before. All those fake uptrends and breaks on hourly were not really fake- they were just a part of this major daily downtrend channel.

You mean this channel…

Note the bounce after hitting the first target zone. Now it’s on the second and the lower channel line…probably another bounce here. I may be scooping up short profits quickly in the morning on naked puts, anticipating such a bounce, but not in my sold calls spreads, at least not those expiring next Friday. Too much premium decay value to be collected over the next 7 days.

Obviously, this would imply a bounce tomorrow in the day session. “Probably…”

But note: RUT is NOT tracking to such a well defined channel. It keeps breakout out of it’s channel to the down side!! Much weaker. Quite possible /ES starts to act similarly here. The pace of the developments seems to be increasing. Now the NBA has “suspended” the season…

Yes, Kevin. I agree – while it’s easy to say that bounce might be coming, what is also possible is for the market to find another lower level support parallel line below and just expanding the width of the channel. So there are probabilities that it might bounce, but definitely not a certainty. We’ll see what happens.

I have the same channel 🙂

Lara,

If the bear market scenario does materialize, you said in your comments you expect it to be shallow based on the lack of divergence between breadth and price at the top. Yet it appears to me the bear market scenario you laid out would mean a very significant downturn after wave II of the bear market correct? Also, can you comment on how your bear market scenario plays into the Super Cycle count you have been updating?

The second monthly alternate outlines a much more bearish scenario. Targets are still relatively shallow at 0.382 of cycle wave I.

I don’t think the appreciation of the economic impact is accurately reflected in the markets. The peak of coronavirus is expected around May 2020 with 96 million infection, 46 million hospitalization and fatalities estimated approx 500,000. These are purely based on studies out of China and Germany but US has its own flavour of health issues I.e.obesity, blood pressure, diabetes. These might influence the numbers. Hospitals to run out of spare capacity early May 2020. This will only sink in the markets once it is seen Happening.

Three up in ES off the lows so far. I think we see another wave down and a low in the a.m. tomorrow.

(from the hourly chart of the main count)

I feel wave 4 blue may still be ongoing. There was lack of upside follow up after market yesterday, and there is lack of downside follow up after market today. This tells me the market is rangy, and may still be in the wave 4 correction. Possibly a wave C of 4 to 2950/3000?

Good trading friend of mine with his own personal “system” expects a BIG up day tomorrow. Many times his calls are spot on, sometimes not…

It would not surprise me at all. We have bullish double divergence on RSI, on-balance volume, and NYMO.

Wow. A lot to digest in today’s analysis. Lara is never stuck on one idea allowing price and other indicators to guide her. Right now I plan to start accummulating long positions between 2650 and 2600. If we get a 90% up day or two consecutive 80% up days from here, I will be looking to get long.

2600 seems like a no brainer for a long with a nice and tidy stop just below. Could be a great risk/reward trade.

I’m confused – how do you know it is going to stop at 2600? I can tell you that it can go to 2550 and way lower if it wants to and situation is getting out of control. Great risk/reward relative to what?

Laura’s teal channel plus two extensions all land at around 2600.

The upside is quite significant and a stop can be placed not too far below so the risk associated with the reward is good in my opinion.

If I get stopped out it was worth the risk for the potential upside reward

I think we all should have taken a clue from buffet. He mentioned 50% correction…I personally expect 1900.

I get all that but trading isn’t my full time job so where I see a good swing opportunity with a good risk/ reward I take it.

I rely on few factors like “theories” of waves which are not always precise because their design has many outcomes.

My stop loss is very tight and if the theory provides a bounce then great. If not, I am aware of the risk and feel the reward justifies the minimal risk for what I can afford in my portfolio and the gains I’ve accumulated. I’m not saying I’m right, I am just saying it’s a swing I am prepared to take.

By all means, take the trades that are comfortable to you with the proper risk management. I am taking a small one that I’m comfortable taking because it’s small and minimal risk. And still hasn’t even hit the entry buy in.

Well, it’s an nice roundie, but other than that I’m not sure why it would be a no brainer in a market with one of the strongest downtrends in history. Zero chance I’ll go long just because price is sitting on top of 2600. I’ve got a pretty large set of short positions on and am quite pleased with this action tonight. Let me suggest that as long as it’s inside this wide down channel, it might be best to be very cautious re: any long plays. I made one a day ago at the close; error!!!!

He was dead wrong on this one!!! I’ve tried to tell him “your system is effective in normal markets…this is NOT a normal market!!!”.