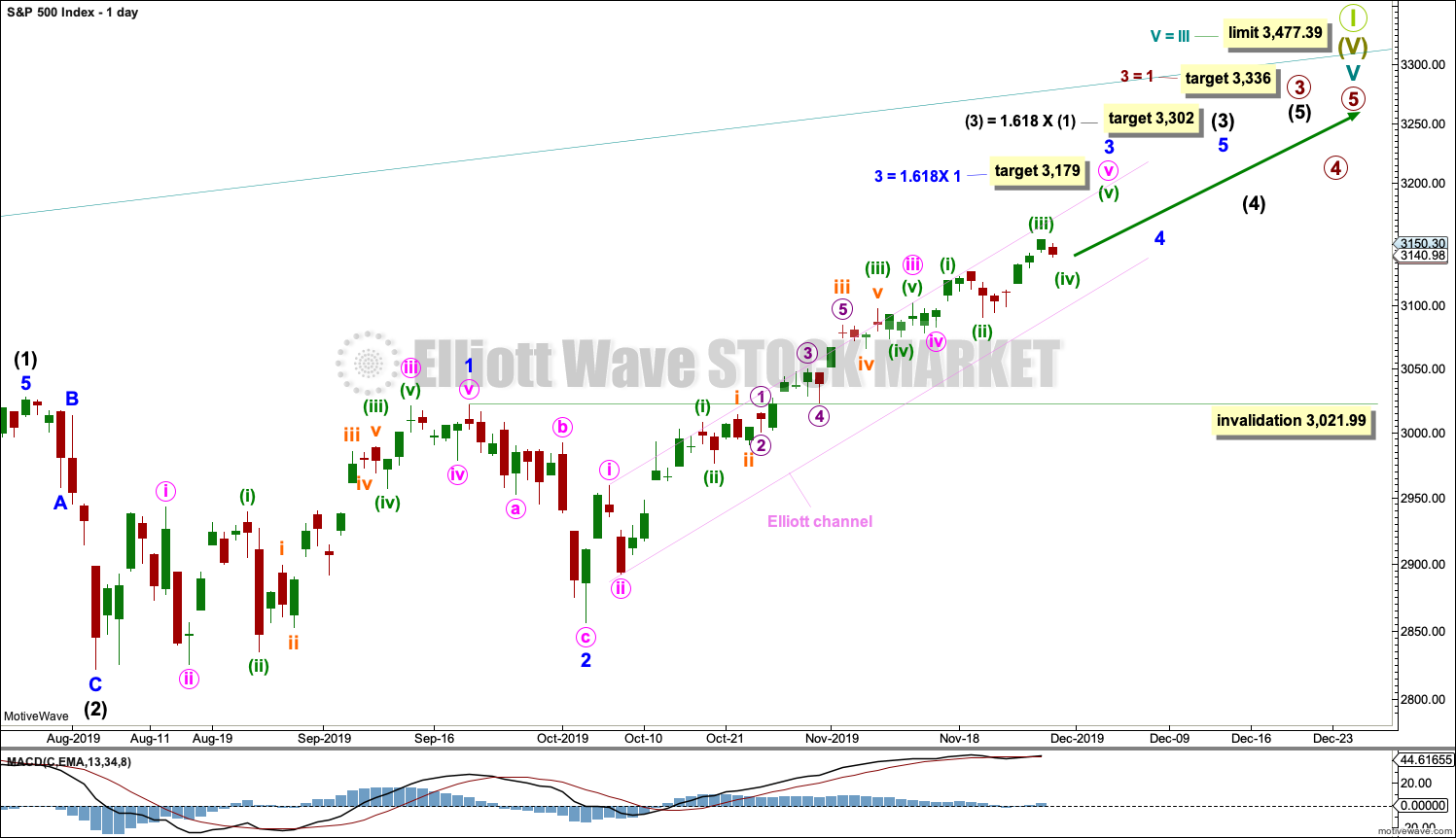

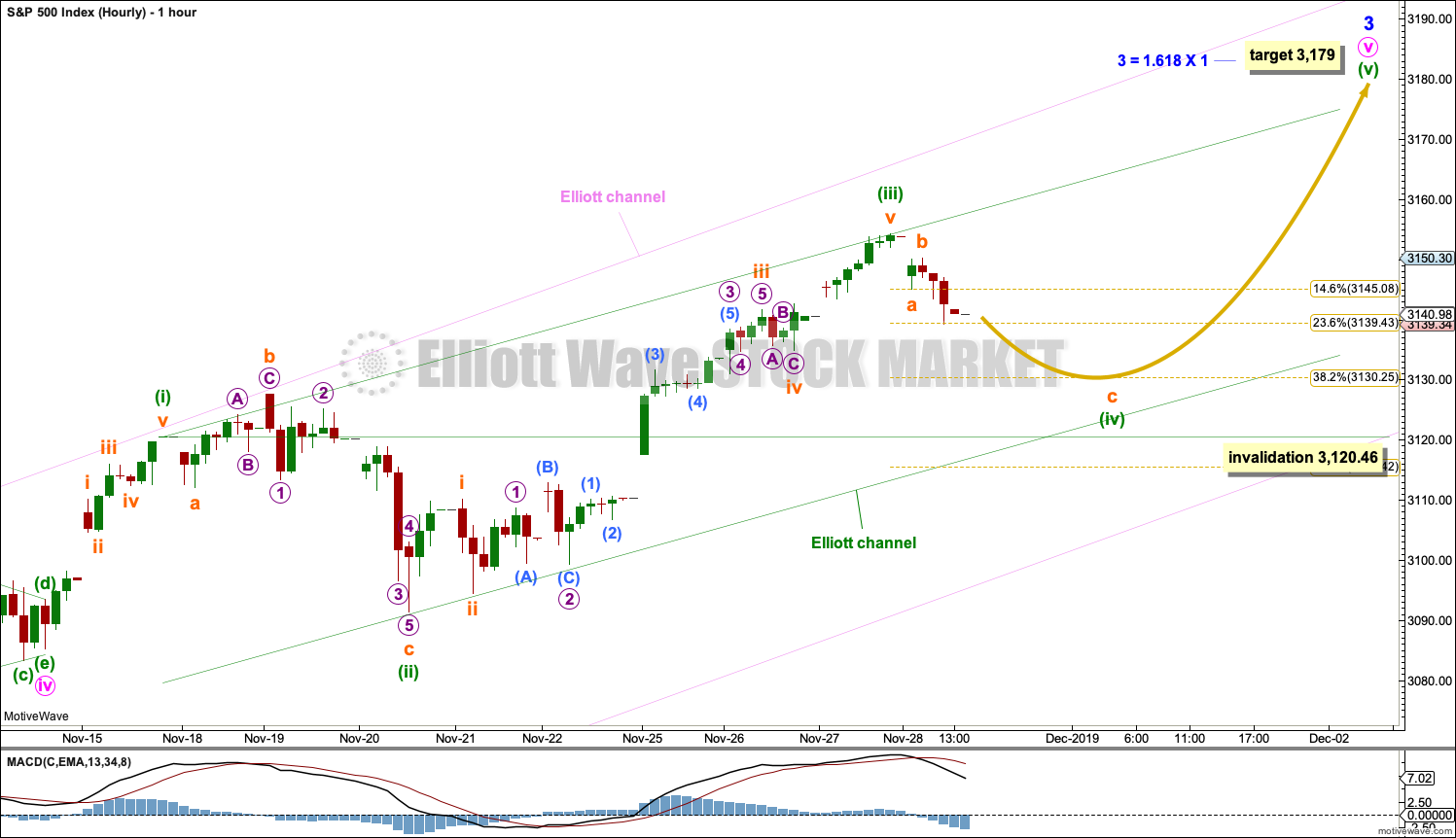

A breach of a small short-term channel early on Friday indicated a small correction had begun. The Elliott wave count at that stage expected a small short-term pullback to continue.

Summary: A very brief and shallow correction may have begun which must remain above 3,120.46. This correction may be over within one to a very few days. The target for it to find support is about 3,130. Thereafter, the upwards trend may resume.

The next target at 3,179 is where minor wave 4 may begin (expect it to be very shallow). Thereafter, the next target is at 3,302 and then 3,336.

Three large pullbacks or consolidations during the next 1-2 years are expected: for minor wave 4, then intermediate (4), and then primary 4. Prior to each of these large corrections beginning, some weakness may begin to be evident.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. An alternative wave count which considered an ending diagonal has been invalidated. While it is possible a diagonal may become an alternate wave count in coming weeks or months, at this stage the structure does not fit.

At this stage, cycle wave V may take another one to two or so years to complete.

The daily chart below will focus on movement from the end of intermediate wave (1) within primary wave 3.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

Within cycle wave V, primary waves 1 and 2 may be complete. Within primary wave 3, intermediate waves (1) and (2) may be complete. Within the middle of intermediate wave (3), no second wave correction may move beyond its start below 2,855.96.

DAILY CHART

All of primary wave 3, intermediate wave (3) and minor wave 3 may only subdivide as impulses.

Minor wave 3 may be underway and may be almost complete. Minor wave 3 now shows an increase in momentum beyond minor wave 1; MACD supports this wave count.

Minor wave 4 may not move into minor wave 1 price territory below 3,021.99.

Intermediate wave (3) must move far enough above the end of intermediate wave (1) to then allow intermediate wave (4) to unfold and remain above intermediate wave (1) price territory. While intermediate wave (3) has now moved beyond the end of intermediate wave (1), meeting a core Elliott wave rule, it still needs to continue higher to give room for intermediate wave (4).

The target for intermediate wave (3) fits with a target calculated for minor wave 3.

Minor wave 2 was a sharp deep pullback, so when it arrives minor wave 4 may be expected to be a very shallow sideways consolidation to exhibit alternation. Minor wave 2 lasted 2 weeks, so minor wave 4 may be about the same duration to have good proportion.

Draw an Elliott channel about minor wave 3 using Elliott’s first technique: draw the first trend line from the end of minute wave i to minute wave iii, then place a parallel copy on the end of minute wave ii. Copy this channel over to the hourly chart. The channel may show where minute wave v finds support and resistance along the way up.

HOURLY CHART

Within minor wave 3, minute wave iv subdivides as a small triangle, and minute wave v may only subdivide as a five wave motive structure, either an impulse or an ending diagonal. Impulses are more common in fifth wave positions and that is what shall be expected unless overlapping suggests a diagonal.

Within minute wave v, minuette waves (i) through to (iii) would be complete.

Minuette wave (ii) was a deep 0.83 expanded flat correction that lasted three sessions. Minuette wave (iv) may be very shallow and may last about three or four sessions to have good proportion. Minuette wave (iv) may be expected to most likely unfold as a zigzag, although it may still be any one of more than 23 Elliott wave corrective structures.

Minuette wave (iv) may not move into minuette wave (i) price territory below 3,120.46.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

Primary wave 5 may be subdividing as either an impulse, in the same way that cycle wave V is seen for the first weekly chart.

TECHNICAL ANALYSIS

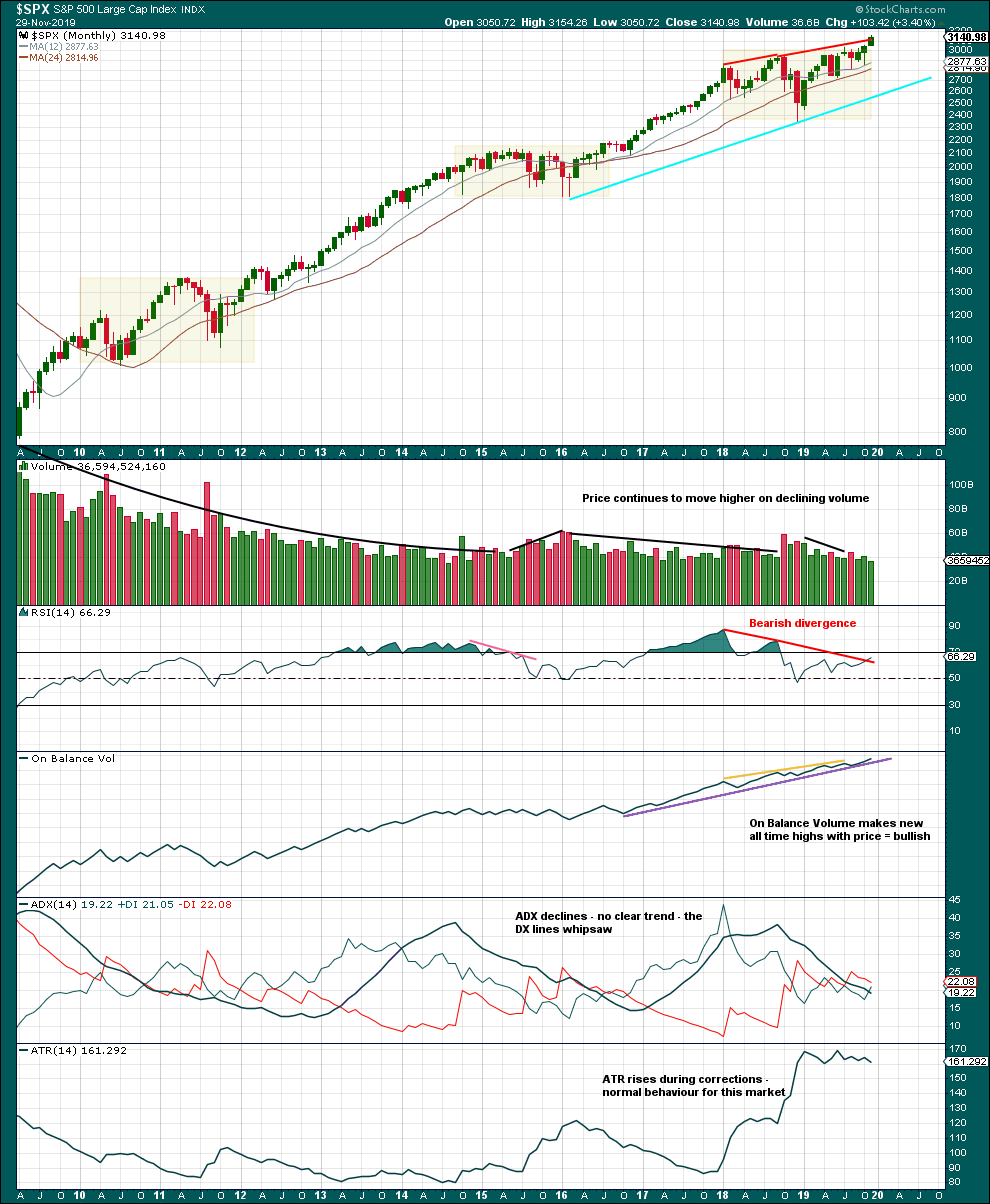

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are three large consolidations noted on this chart, in shaded areas. After a breakout from a multi-month consolidation, it is reasonable to expect a multi month bullish move may result.

This chart very clearly exhibits rising price on declining volume has now persisted for several years. A decline in volume this month, in current market conditions, is not of concern.

On Balance Volume supports the Elliott wave count.

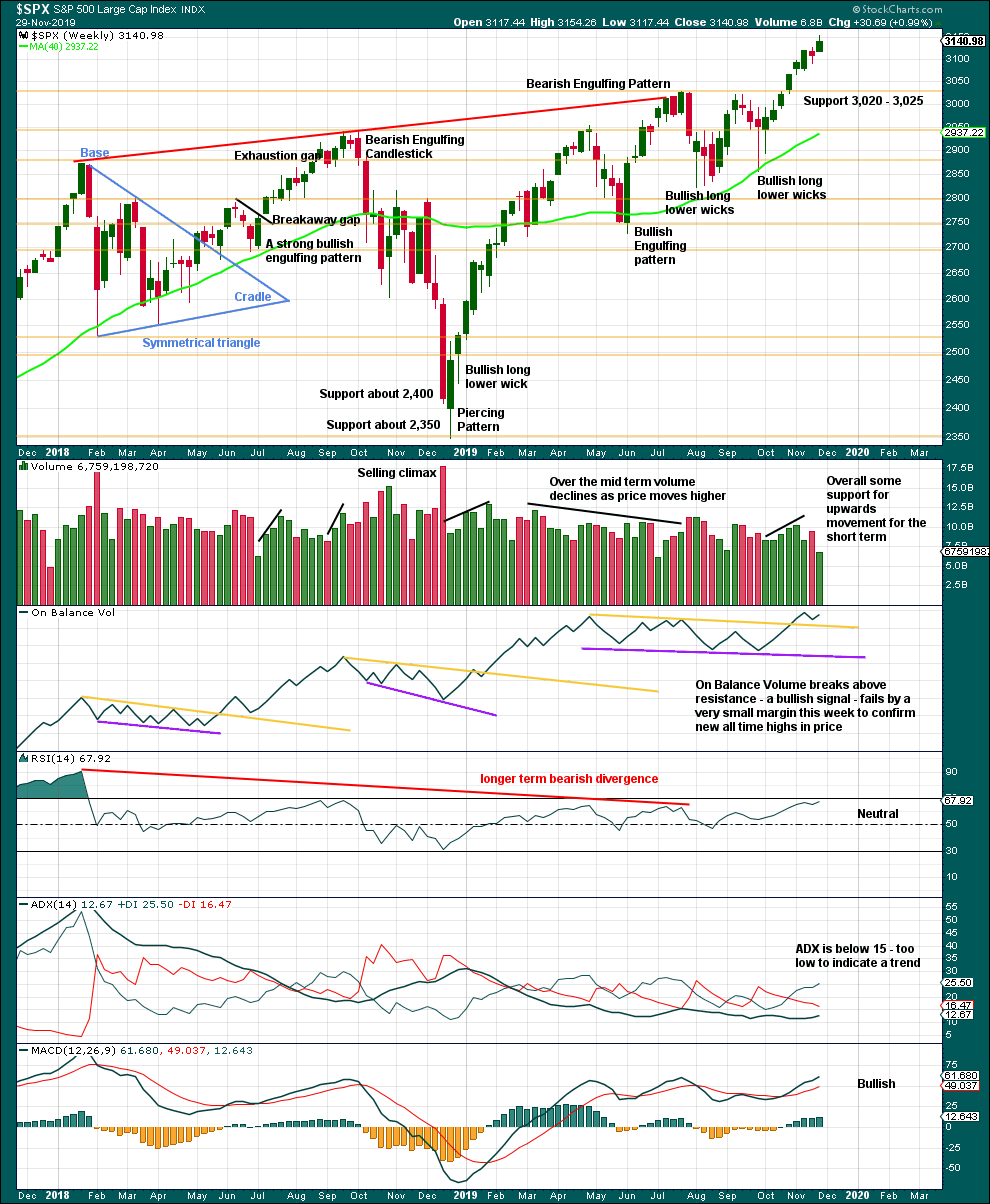

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is very clear that the S&P is in an upwards trend and the bull market is continuing. Price does not move in straight lines; there will be pullbacks and consolidations along the way.

This week is a short week with New York closed for a day and a half for Thanksgiving Day.

A decline in volume this week is acceptable. The failure by On Balance Volume to confirm a new all time high this week is extremely small, and as this is a short week this shall be given no weight.

Overall, this chart supports the Elliott wave count.

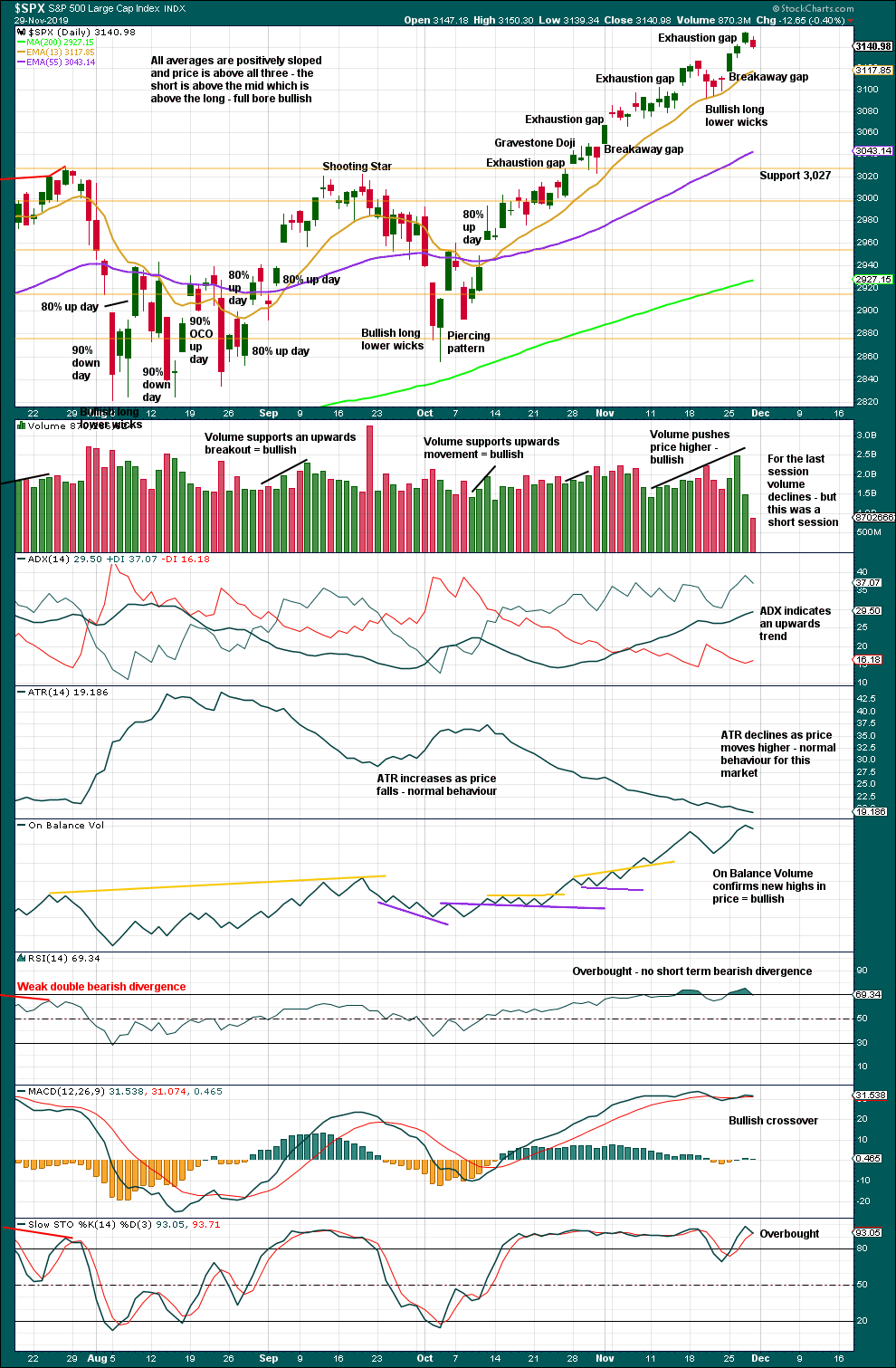

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an upwards trend in place. There will be corrections along the way.

When this market is in a bullish trend, RSI can reach deeply overbought and remain there for some weeks.

Again, the last gap is closed with a new low below 3,142.69. This has happened twice recently and yet it was followed only by a very short-term pullback.

At this stage, there is an upwards trend that is not yet extreme. There is room for this trend to continue. There is zero evidence today that the trend is over. Assume the trend remains the same until proven otherwise.

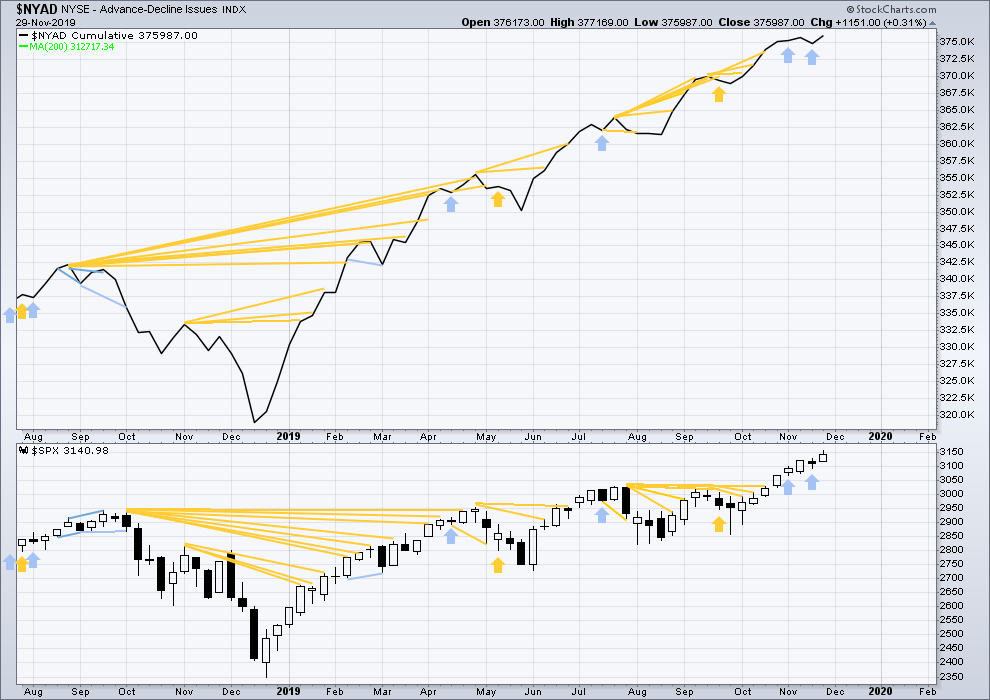

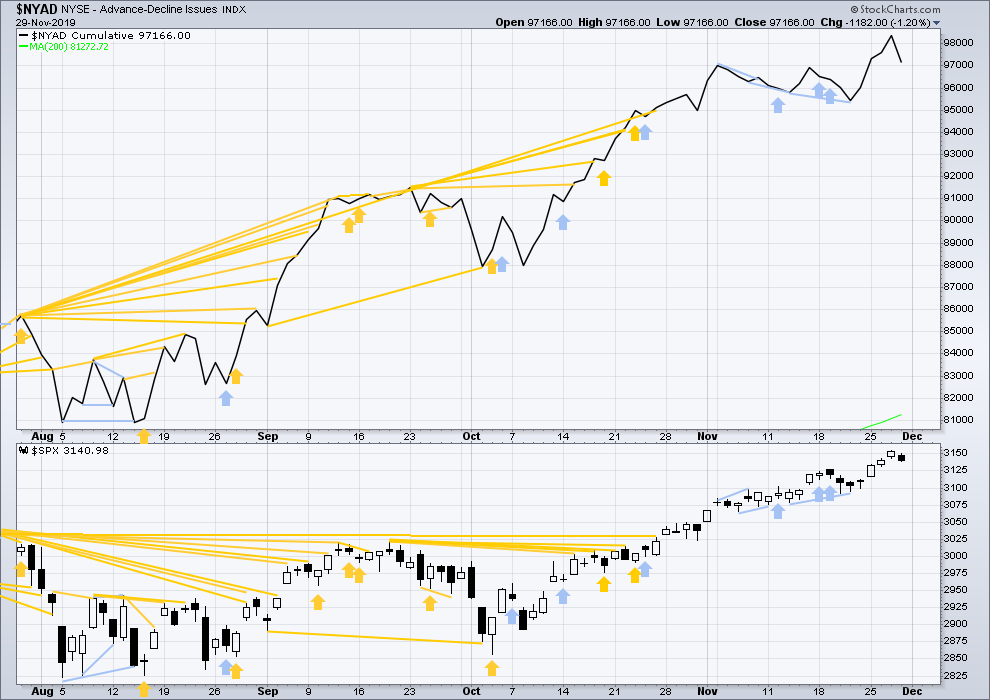

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs last week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid March 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

All of small, mid and large caps have made new swing highs above the prior swing high on the 13th of September, but only large caps have made new all time highs. This upwards movement appears to be mostly driven by large caps, which is a feature of aged bull markets. This bull market at over 10 years duration certainly fits the definition of aged.

Mid and small caps have not yet made new all time highs.

This week both price and the AD line have moved higher. Upwards movement this week from price has support from rising market breadth. This is bullish and supports the Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Both price and the AD line moved lower on Friday. Neither have made new short-term swing lows. There is no new divergence.

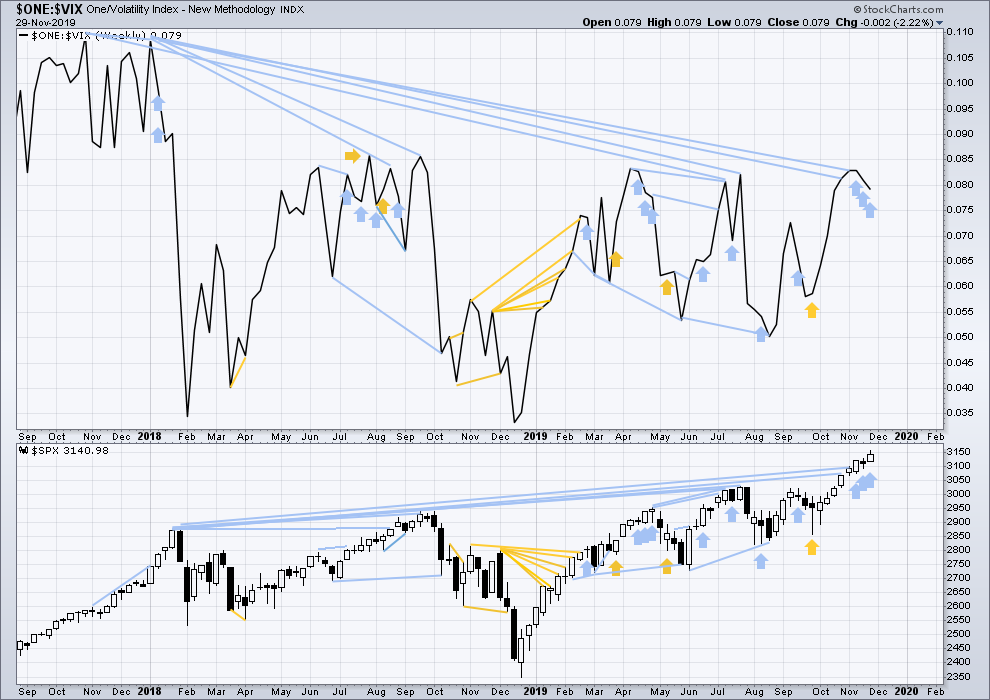

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Price has moved higher for three weeks in a row, but inverted VIX has moved lower. This divergence is now persistent enough to be considered to be sounding a strong warning that there is now reasonable risk to the downside.

The last time this happened was after early January 2018. It was followed by primary wave 4.

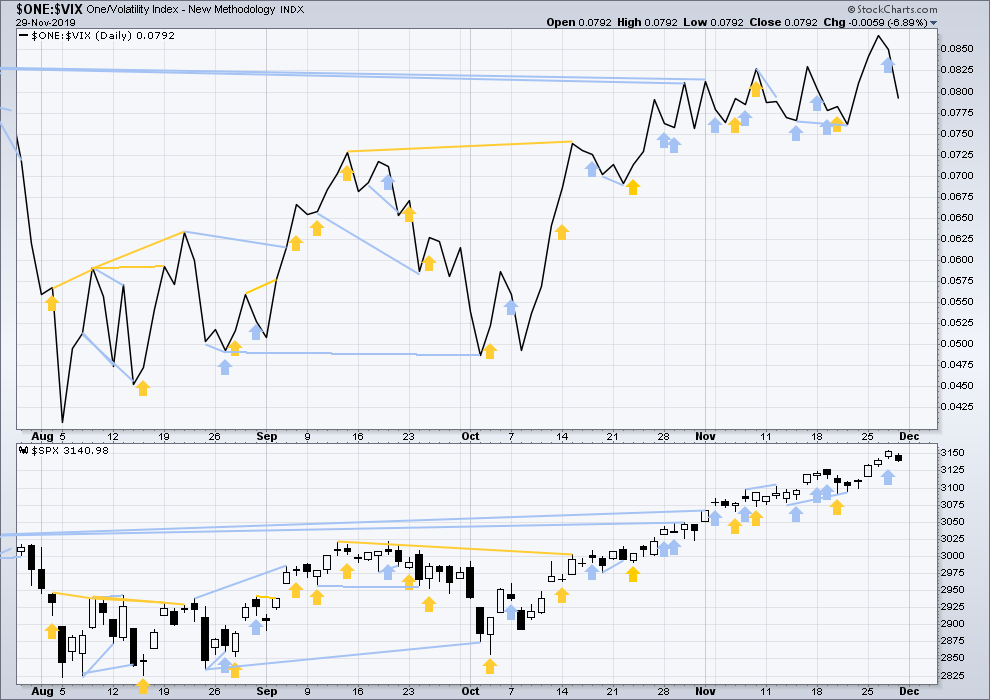

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have moved lower on Friday. Neither have made new short-term swing lows. There is no new divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 10:57 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

I made a little money on my AAPL short 7 days ago (exited late Friday just before it started running back up last Monday). Now it’s doubled topped and initiated another pullback. Buying Jan puts at 270…let the minor 4 proceed! Some AAPL holders are sure to want to take profits I would think.

…and how about an IWM butterfly 157-159.5-161.5 for this Friday. Gotta get me some of that premium decay, it’s fastest the last few days!

/ES (e-mini futures) has shown strong respect to the short term trend line here. Will it hold for the entire correction? Probably not if it’s a minor 4, but maybe if it’s turns out to be a triangle.

Note the big turn right at the overlapped 161.2% extension and the blue dashed Fibonacci projection done almost 3 weeks ago (starting point of the line). Those who don’t consider Fibonacci structure…are lost. It’s the key to the map.

Kevin,

good observation. Actually, if you continue that trendline to the left you will see that it perfectly falls onto support for candles (their wicks) on 05/29/19 and 09/23/19. So it might be a longer term trend line than observed in the beginning.

If it continues to run along this new trendline, it’s a big sign that momentum decelerated and it might take longer to get to minor 5 target, if we are even getting there eventually.

Bull RUT count.

Gooood morning everybody

With the short term hourly chart invalidated I’m going to label minor 3 now complete. Minor 3 has no Fibonacci ratio to minor 1 but it is longer than minor 1.

Minor 2 was a zigzag. So lets expect minor 4 to exhibit alternation and be a triangle, flat or combination. That means it’s A (or W) wave would most likely subdivide as a three, which would most likely be a zigzag.

I’m relabelling the two triangles I had for minute iv and minuette (iv) within minor 3 as just one triangle for minute iv, this has a better look on hourly and daily charts.

After todays invalidation of the short term hourly count I’ll now expect some consolidation or pullback to relieve overbought conditions and set the stage for the next wave up.

The consolidation or pullback will most likely be shallow (relative to minor 3) and last about 2 weeks. Focus will be on identifying when minor 4 may be complete rather than trying to identify what structure is takes before it’s over. I’ll have alternate wave counts for it, but to keep the comprehension of the analysis manageable I’ll only have two or three alternates.

Hi Lara,

is there a gold chart tonight?

Such a sudden breakdown in a kind of minor 4, always makes me suspicious of triangle forming, the biggest leg of a triangle is the first leg A

An excellent point and a real possibility. We’ve seen several triangles recently in the hourly price action, why not another. However, it’s going to look like a zig-zag for a long time (until it doesn’t anymore) if it goes that way. B up, C down…only when a D up start “early” relative to a zigzag with C going down below A would a triangle take shape.

I believe the hourly has invalidated; minuette iv has crossed below the high of minuette i.

Price has also broken out of what I’ve been modeling as the “tightest” channel.

The safe assumption would be that the minor 4 down has started. However, might it be possible we are seeing the REAL minute iv matching the minute ii here? Just a thought.

Here’s the count I’ve been considering (a small but significant delta off Lara’s main hourly), and from this I would say…yes, it would appear the minute v has completed a five wave structure, and minor 4 has begun. Also, the pivot high here supports that thesis, being exactly off a 161.8% extension of a prior swing. SPX loves it’s Fibonacci structure!

Hi Kevin,

thanks for the update. Could you please explain what you mean by “might it be possible we are seeing the REAL minute iv matching the minute ii here?” I thought we are currently in minute V degree. Did you mean minuette (iv) same length as minuette (ii)?

Thank you,

Lev

I try to think about alternatives. What if the minute iii is extended, and there has not BEEN a minute iv yet? In which case, this might be the start of that minute iv. I haven’t tried to really justify such a count with a detailed analysis though. I want to see what our resident expert has to say because she’s almost always right because she does the heavy lifting to validate her count. But for the sure, the hourly as presented over the weekend has to change.

Just a thought – might be completely off, but after today’s correction I noticed that another trend line can be drawn on a daily ES. And if market holds where it is right now and goes slowly back up from here, then top of the cross-over with another long term trend line happens right at 3179.5 where minor 3 should be terminated according to EW analysis.

Everything seems poised for some risk off price action this week: some corrective action in equities, some bullish action in bonds and gold. But right now the overnight market is showing some strength, so…we’ll see! Certainly the 1st half 2019 run in price tells us this move can rock and roll for a long time further with minimal corrective moves. However, I do notice that the average daily bar in this run up is quite a bit smaller than the average daily bars through the same period of 1st half ’19; there were lots of BIG days back then, and we haven’t yet seen any of that.

Dec 20 (expiry of lots of sold premium for me!) can’t come soon enough…I worry a bit about dark news on the china trade deal front that might reverse this market’s fortunes strongly. And am ready to hedge with sold call premium overhead if something like that develops.

Here’s a headline for ya:

73% Chance Stocks Drop In The Next Week

Because the “intermediate optimism index” is at a high and 73% of the time it’s this high going into a week, the week ends up as a down week. Maaaaybe.

Some other quotes from TheoDark:

“All the tracking estimates for Q4 GDP growth will be higher when they are updated. ”

“New home sales were very strong in September and October. This signals the next recession could be 2 years away or longer. “

Amazing how often fundamentals drive the market one way or another as forecast by EW.

Also looks like 5 waves up on an hourly basis on ES.

I put on a hedging/tactical short for Friday in SPY, sold a call spread for 315/317. Trying to squeeze a little juice from around the edges…

I bought this dip, friday 313 calls

May we both profit!

You were right on the money about your worry, Kevin. Today is a good correction day (finally):)

The question is if minuette IV is now invalidated if it ends up below 3120 (its currently way below it).

Weekend #1.

||