Upwards movement continued as the main Elliott wave count expected. All three Elliott wave counts remain valid at the end of the week, but the two alternates now have a very low probability.

Summary: An upwards breakout above 2,940 with support from volume would add confidence in the main wave count. If this happens, then the next target is 3,120. Classic analysis very strongly supports this main wave count, so much so that I have considered discarding alternates, but I shall let price confirm it.

A new low below 2,822.12 would indicate a continuing deeper pullback as fairly likely, as outlined by the alternate wave counts. The first target would then be at 2,663.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

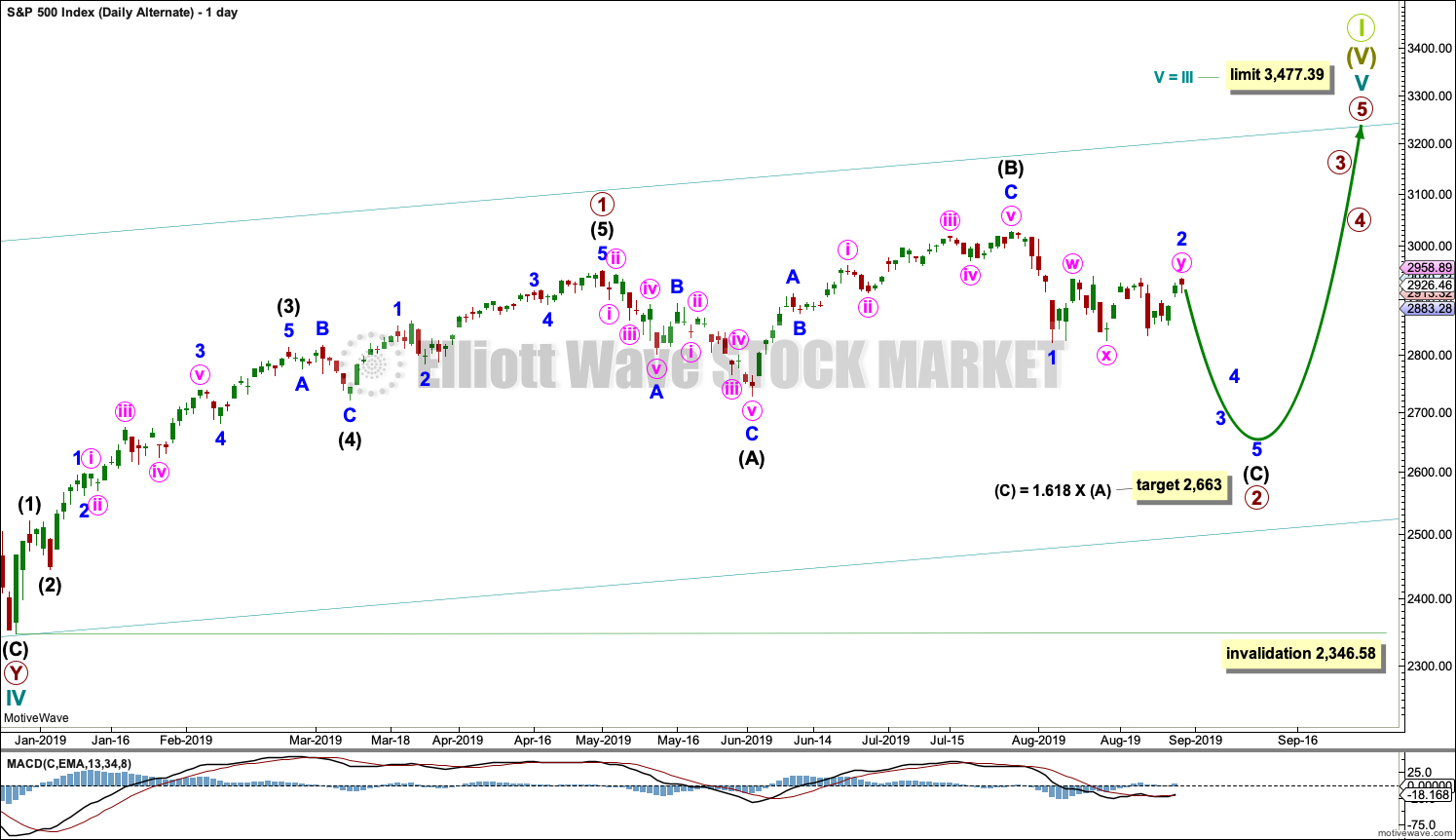

FIRST WAVE COUNT

WEEKLY CHART

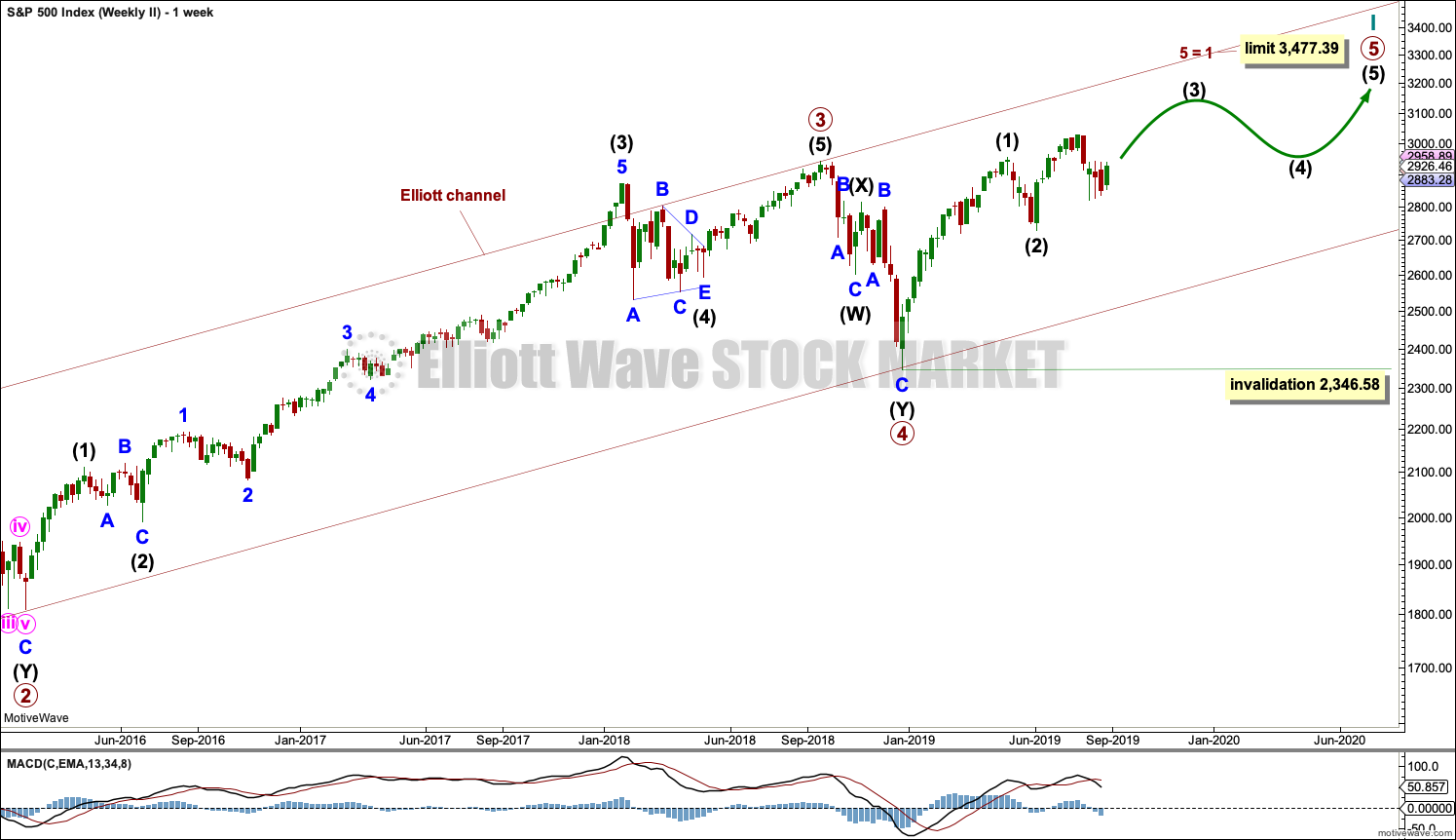

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will now focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

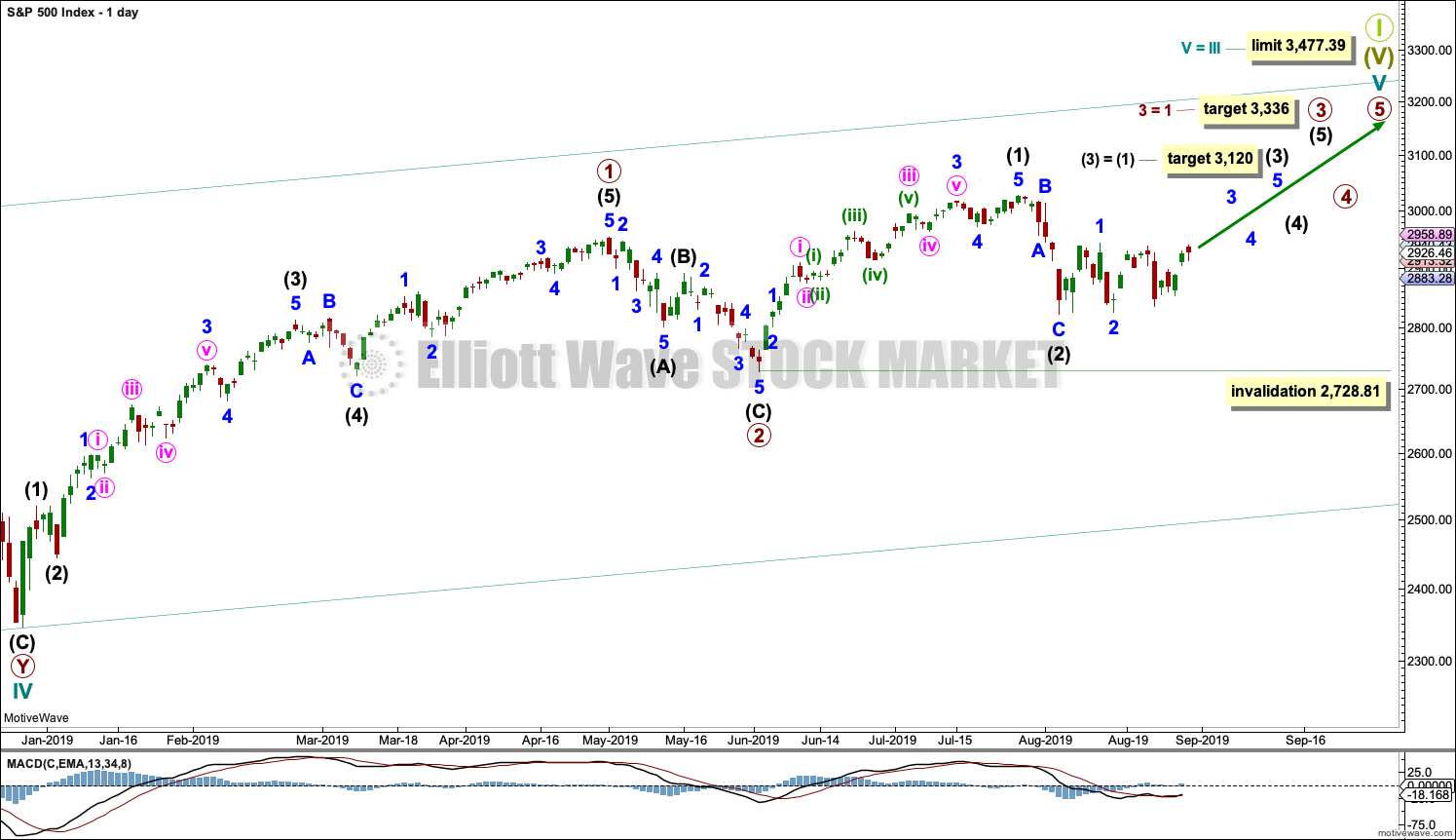

MAIN DAILY CHART

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

It is also possible that intermediate wave (2) may be incomplete and sideways movement of the last 19 sessions may be minor wave B within a zigzag for intermediate wave (2). If intermediate wave (2) continues lower, then it may not move beyond the start of intermediate wave (1) below 2,728.81.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse.

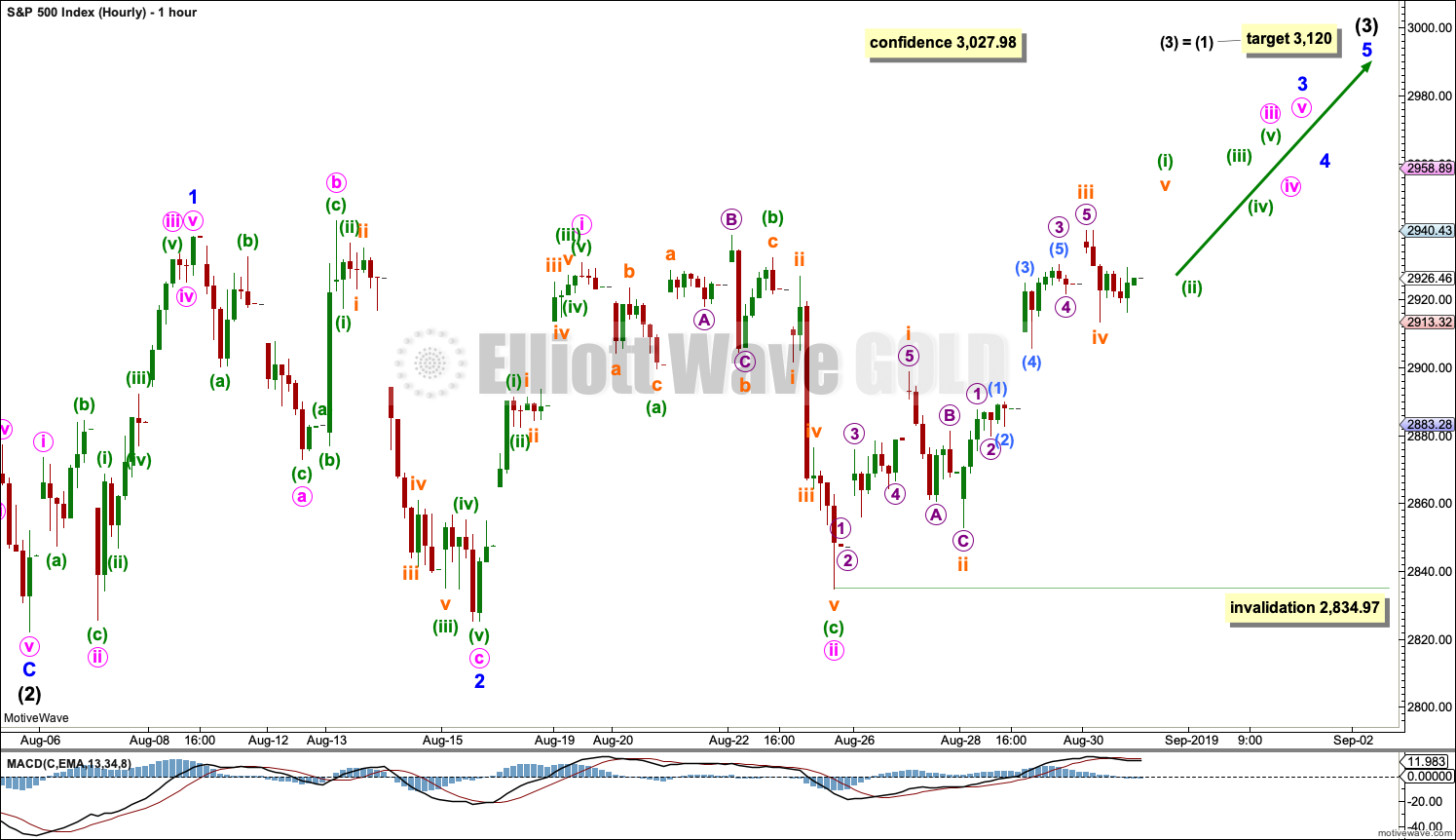

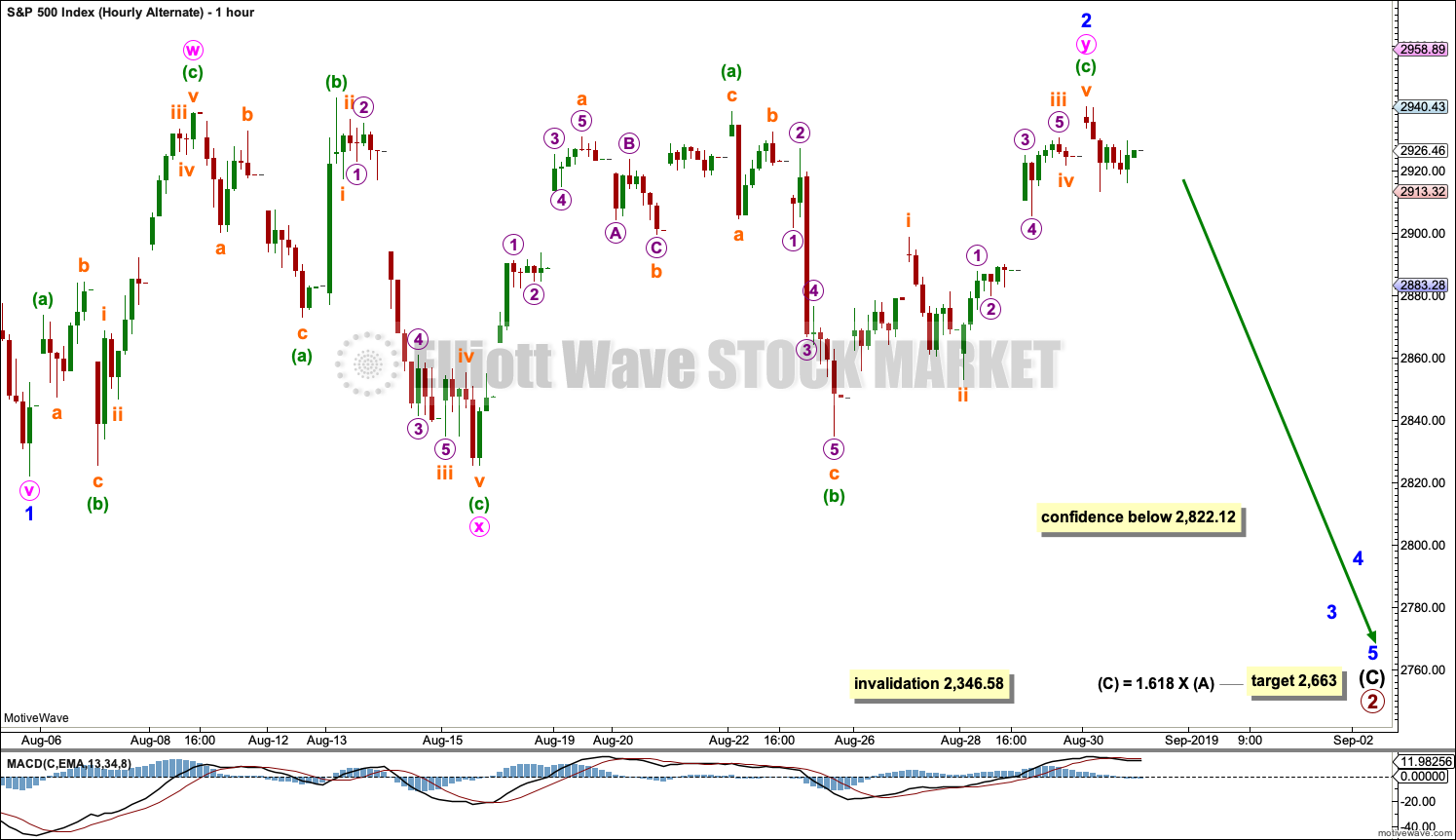

MAIN HOURLY CHART

Intermediate wave (3) may only subdivide as a five wave impulse. Within intermediate wave (3), minor waves 1 and 2 may now be complete. Minor wave 3 may only subdivide as a five wave impulse.

Within minor wave 3, minute waves i and ii may be complete. Within minute wave iii, minuette wave (ii) may not move beyond the start of minuette wave (i) below 2,834.97.

Minute wave iii must move beyond the end of minute wave i. Minute wave iii must move far enough above the end of minute wave i to allow room for minute wave iv to unfold and remain above first wave price territory.

When minuette wave (i) is complete, then another pullback should develop for minuette wave (ii), which may be relatively brief and shallow.

The next wave up for this wave count may then exhibit an increase in momentum as a third wave at five degrees unfolds.

ALTERNATE DAILY CHART

This first alternate wave count considers the possibility that cycle wave V may be unfolding as an impulse.

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary wave 1 only may be complete.

Primary wave 2 may be unfolding as an expanded flat correction. These are reasonably common Elliott wave corrective structures. Flat corrections subdivide 3-3-5. Expanded flats have B waves which are 1.05 or more the length of their A waves. In this example for primary wave 2, intermediate wave (B) is a 1.33 length of intermediate wave (A). The target for intermediate wave (C) expects it to exhibit the most common Fibonacci Ratio to intermediate wave (A) within an expanded flat.

If price reaches the target at 2,663 and keeps falling, then the next target would be the 0.618 Fibonacci Ratio of primary wave 1 at 2,578.66.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

ALTERNATE HOURLY CHART

Intermediate wave (C) must subdivide as a five wave motive structure for this wave count. Minor waves 1 and 2 may be complete within intermediate wave (C).

Minor wave 2 may have ended as a double combination at Friday’s high: zigzag – X – flat. It is also possible that minor wave 2 may not be quite complete: minuette wave (c) within minute wave y may continue a little higher.

Minor wave 2 may not move beyond the start of minor wave 1 above 3,025.86.

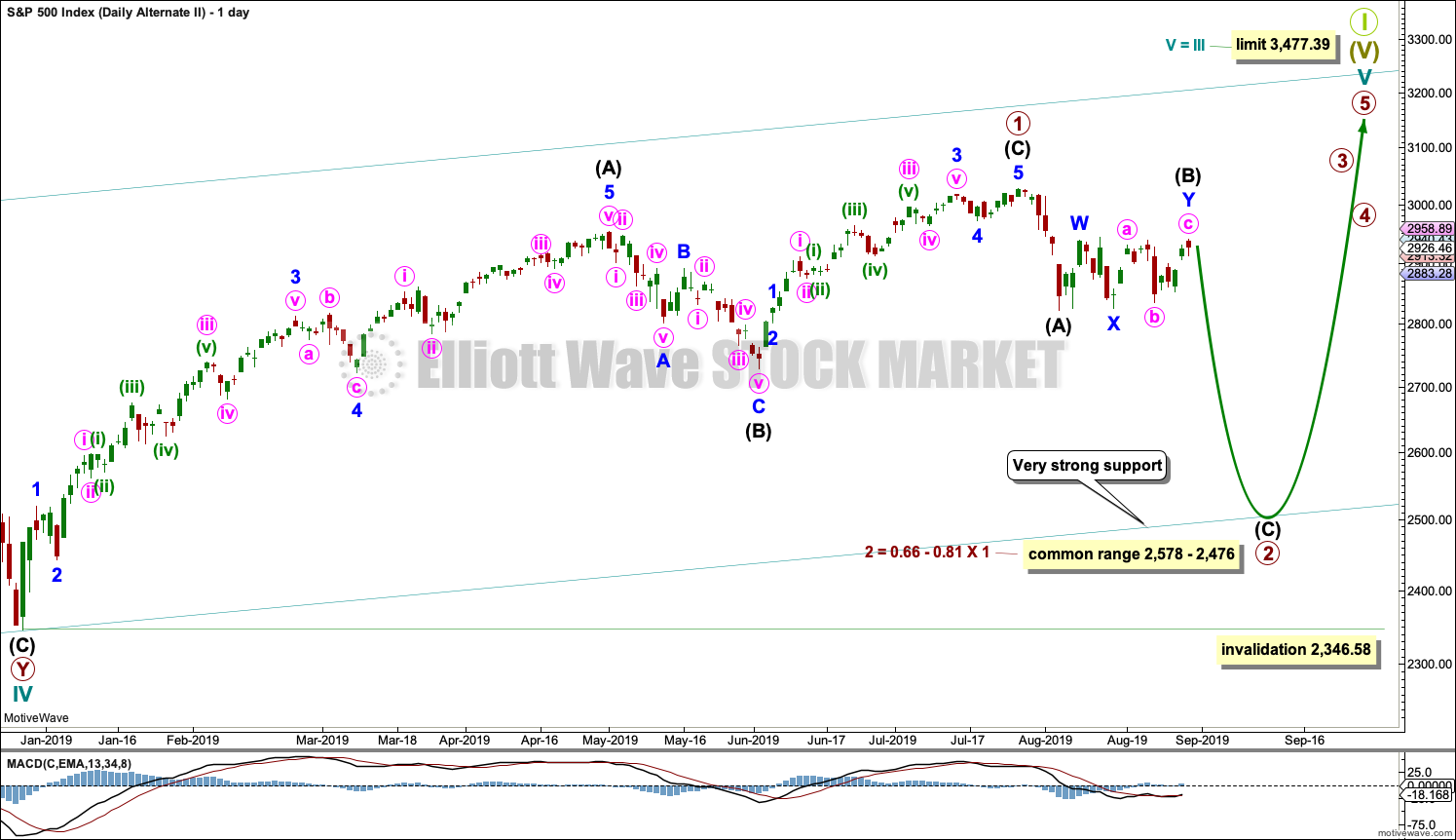

SECOND ALTERNATE DAILY CHART

This second alternate daily chart considers the other structural possibility for cycle wave V, that of an ending diagonal. Ending diagonals in fifth wave positions are not as common as impulses; for this reason, this wave count will remain an alternate until an impulse for cycle wave V is invalidated.

All sub-waves within an ending diagonal must subdivide as zigzags. Primary wave 1 may have been complete as a zigzag at the last all time high on the 26th of July.

Primary wave 2 may be continuing lower as a zigzag. Within the zigzag, intermediate wave (B) may now be a complete double combination.

Within diagonals, sub-waves 2 and 4 are normally very deep, ending within a range of 0.66 to 0.81 the prior wave. This range for primary wave 2 is from 2,578 to 2,476. Primary wave 2 may possibly come as low as the lower edge of the teal channel, which is copied over from the weekly chart.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

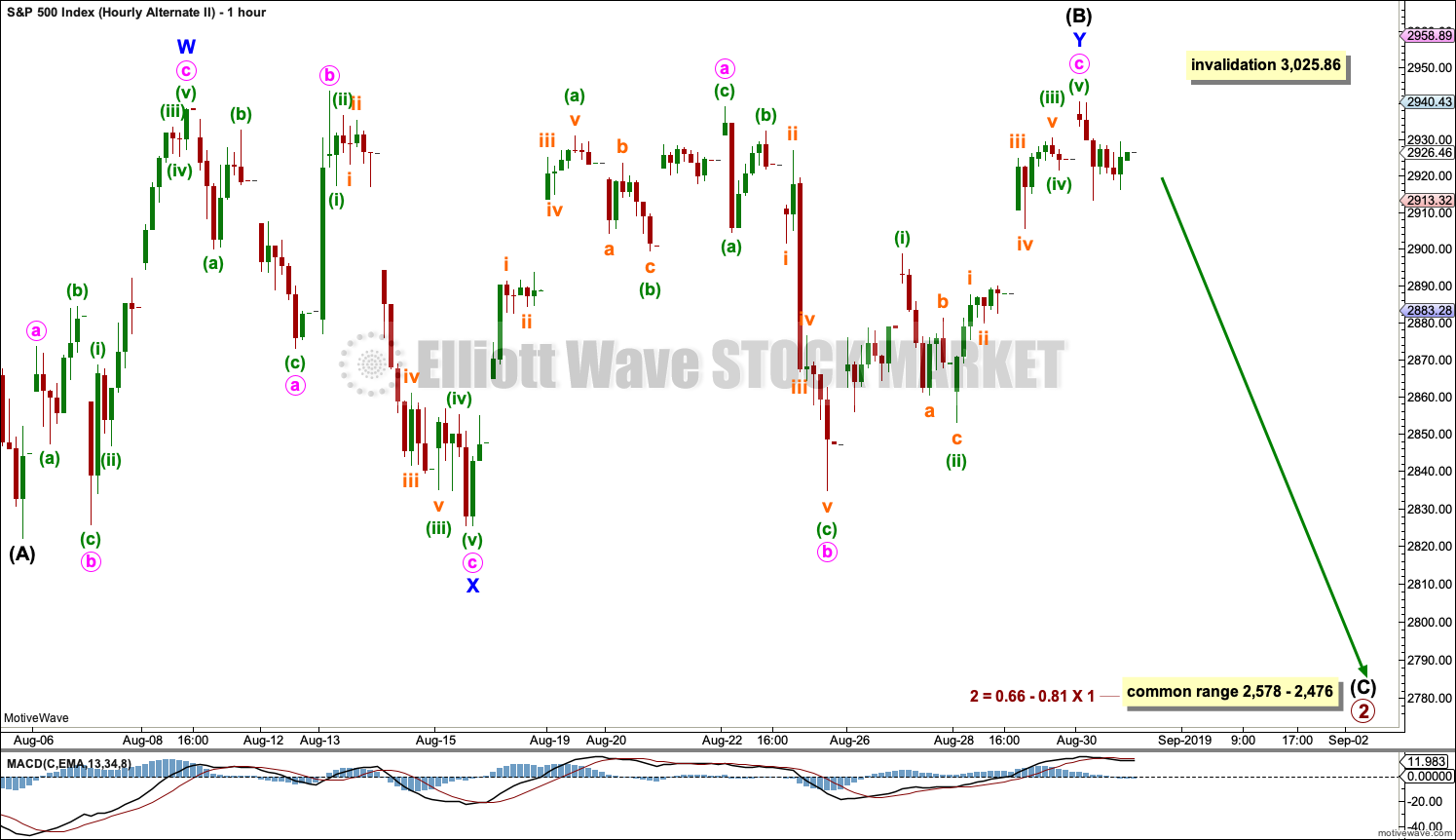

SECOND ALTERNATE HOURLY CHART

Intermediate wave (B) within the zigzag of primary wave 2 may now be a complete double combination: zigzag – X – flat. It is also possible that intermediate wave (B) may continue a little higher: minute wave c within minor wave Y may not be complete.

Intermediate wave (B) may not move beyond the start of intermediate wave (A) above 3,025.86.

Intermediate wave (C) downwards for this wave count should begin here or very soon.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

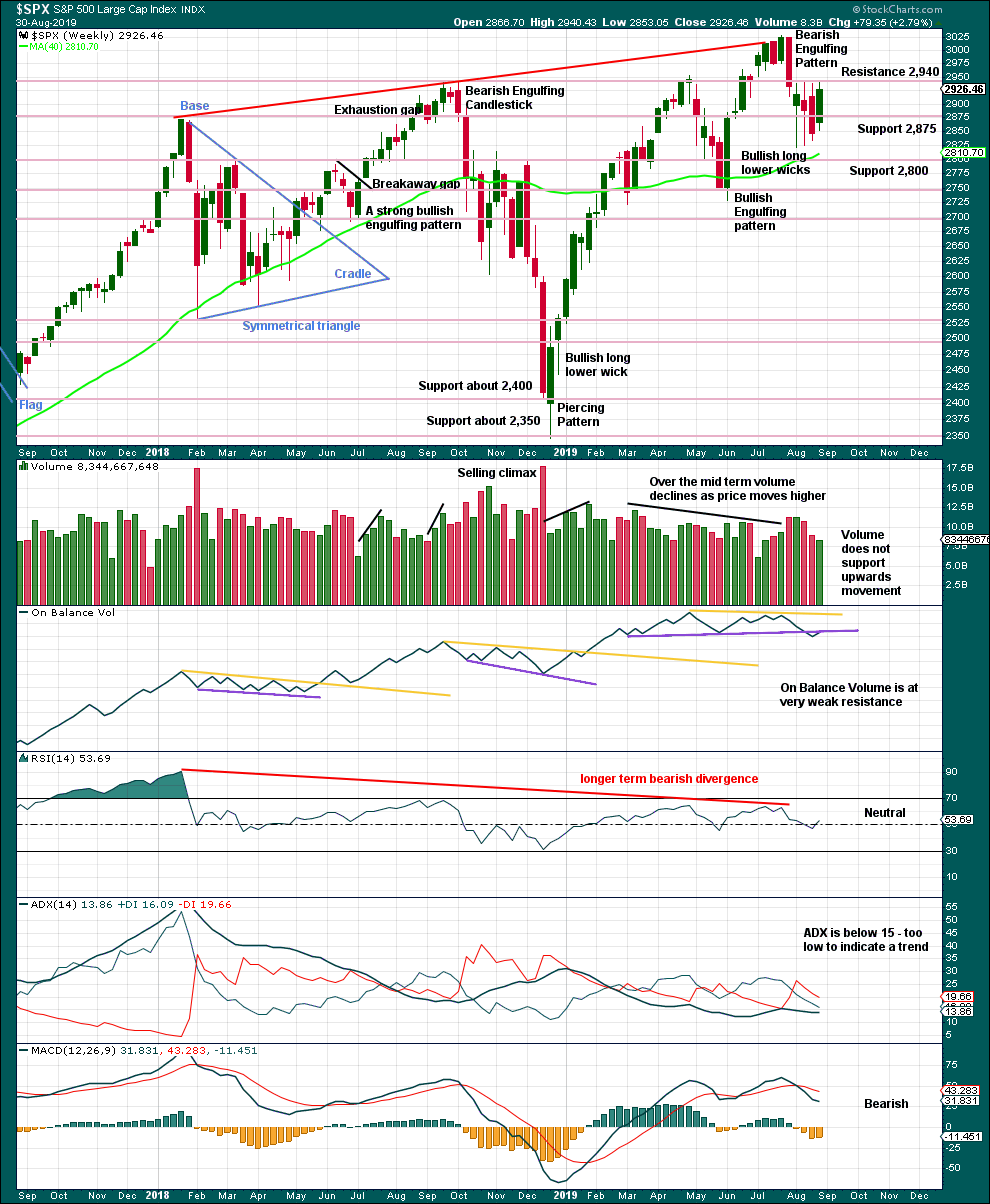

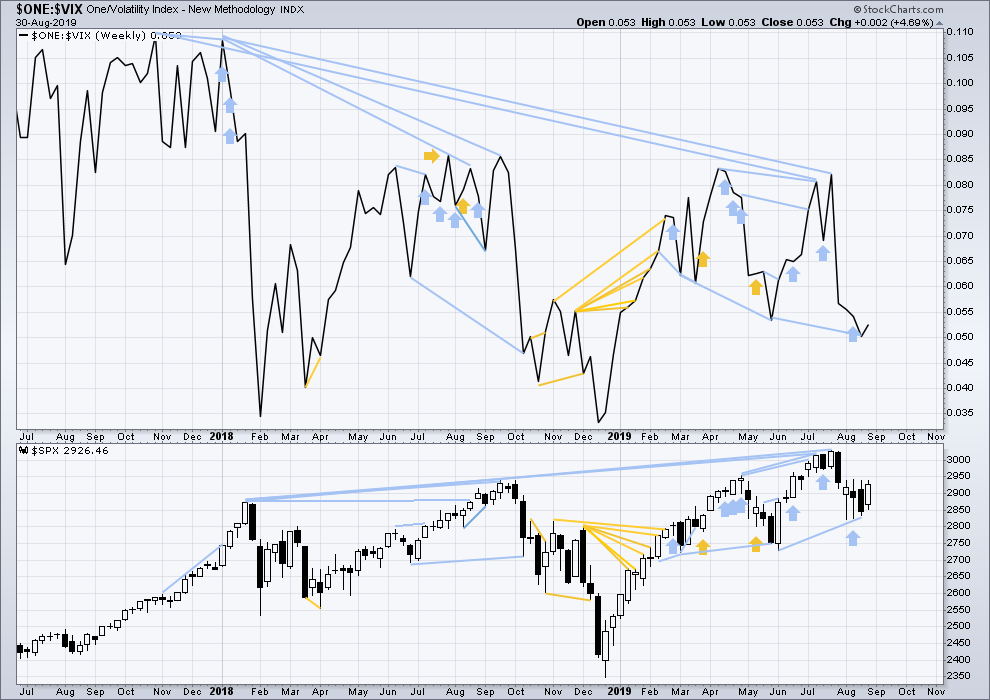

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains range bound with resistance about 2,940 and support about 2,920.

The larger trend is up from the low in December 2018, with a series of higher highs and higher lows. This upwards trend should be assumed to remain while the last swing low at 2,728.81 remains intact.

If On Balance Volume breaks back above the resistance line, then the weak bearish signal would be negated and the line would need to be redrawn.

DAILY CHART

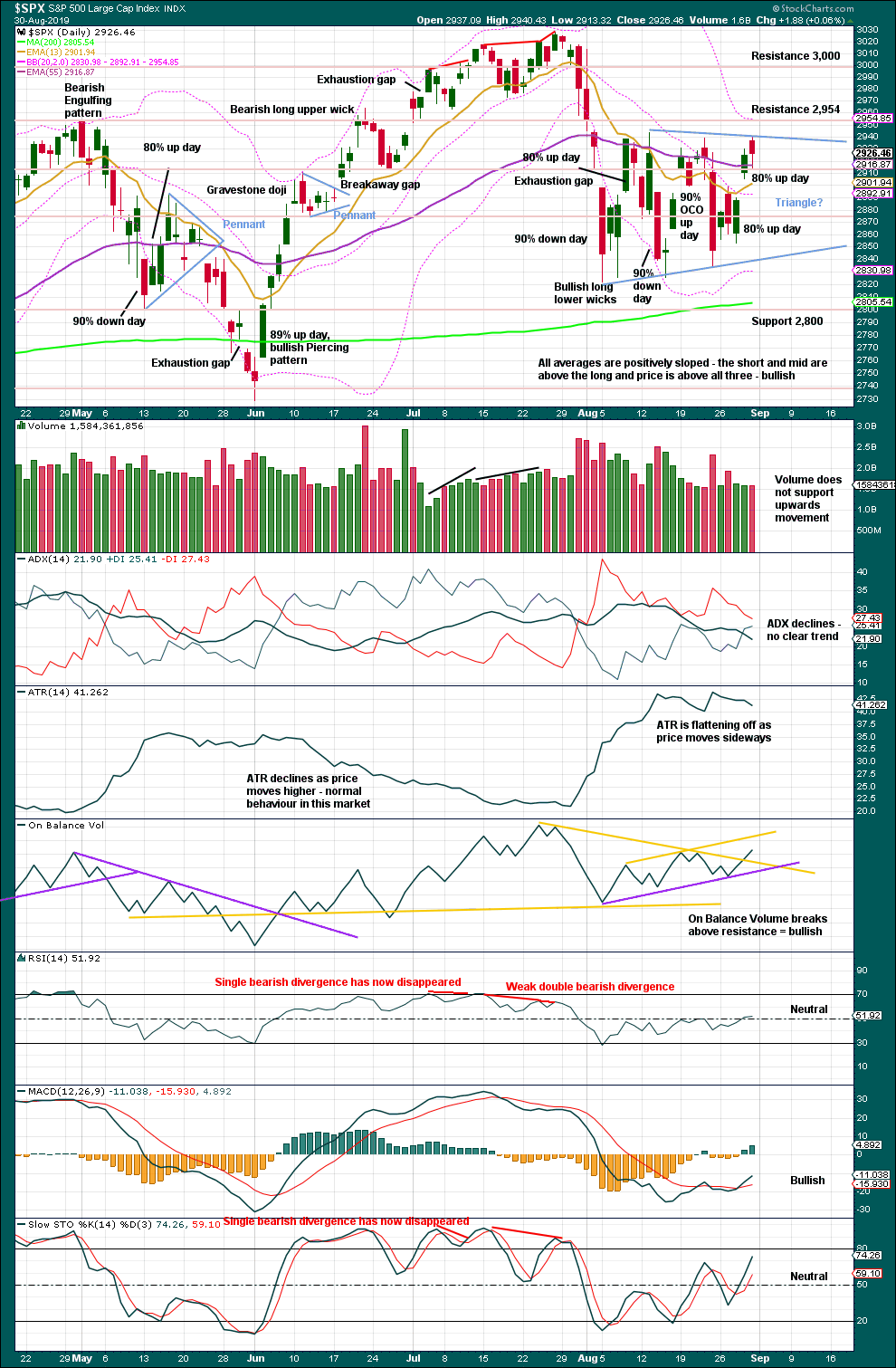

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last low of the 15th of August was preceded immediately by a 90% downward day and followed immediately by a 90% OCO (Operating Companies Only) up day. This is a pattern commonly found at major lows, and it indicates a 180 degree shift in sentiment from bearish to bullish. This favours the main Elliott wave count.

Now the next low of the 23rd of August has been followed by two back to back 80% up days. This too is very bullish and favours the main Elliott wave count.

The classic triangle no longer has a very clear look. The trend lines do not converge at a normal rate. This pattern is weak.

On Balance Volume today gives a clear bullish signal. This supports the main Elliott wave count.

BREADTH – AD LINE

WEEKLY CHART

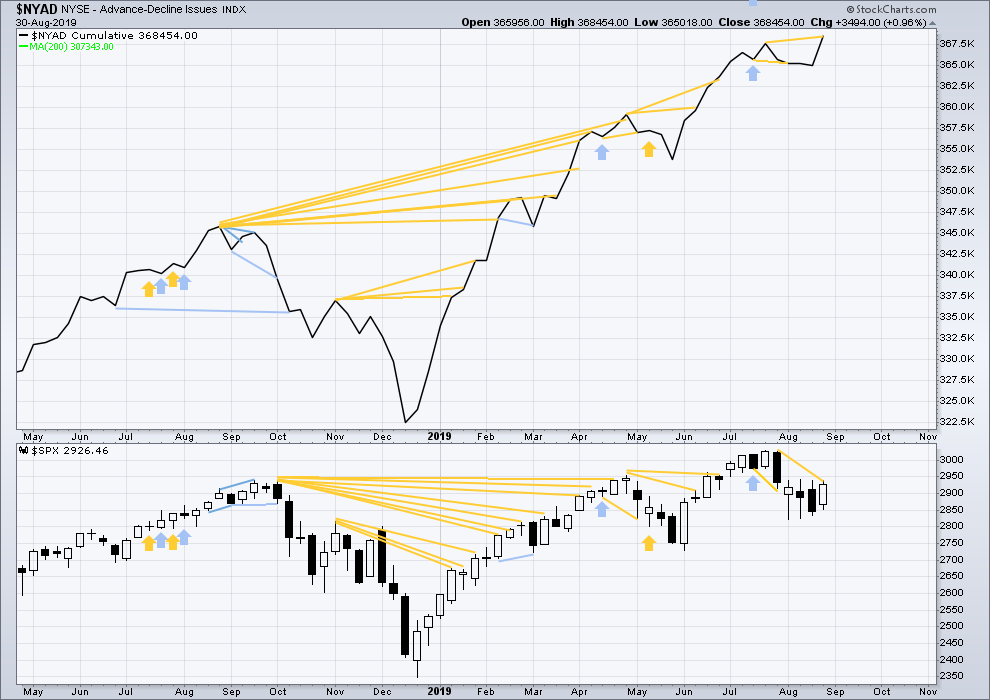

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is the end of December 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

This week both price and the AD line have moved higher.

The AD line makes a new all time high. This is a very bullish signal and very strongly supports the main Elliott wave count.

DAILY CHART

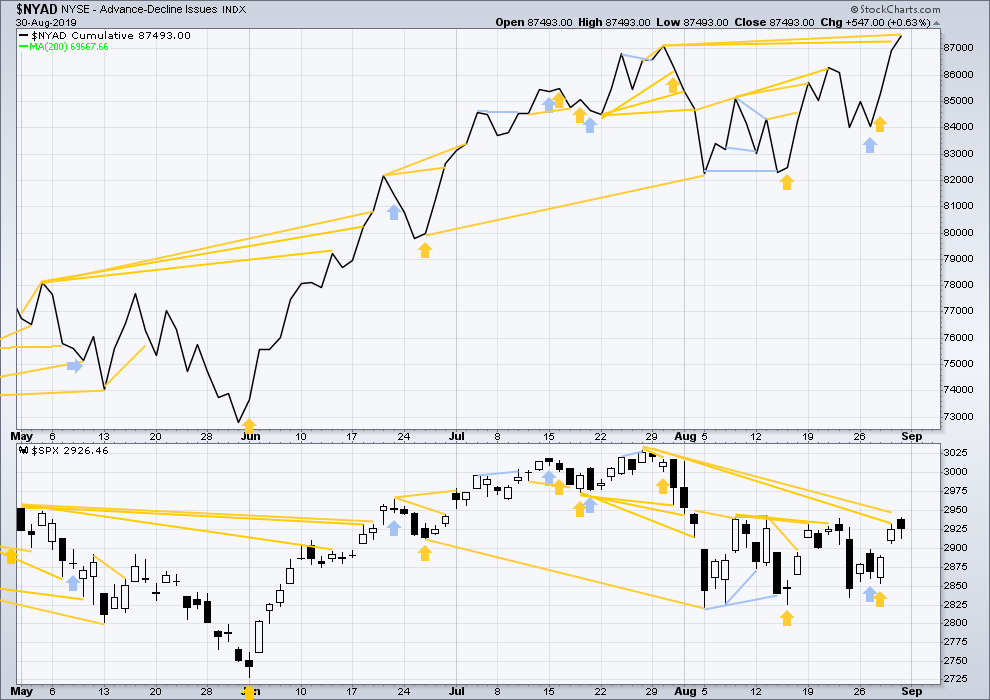

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line makes another new all time high on Friday. This is a very bullish signal and strongly favours the main Elliott wave count.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and nine months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

This week both price and inverted VIX have moved higher. There is no new divergence.

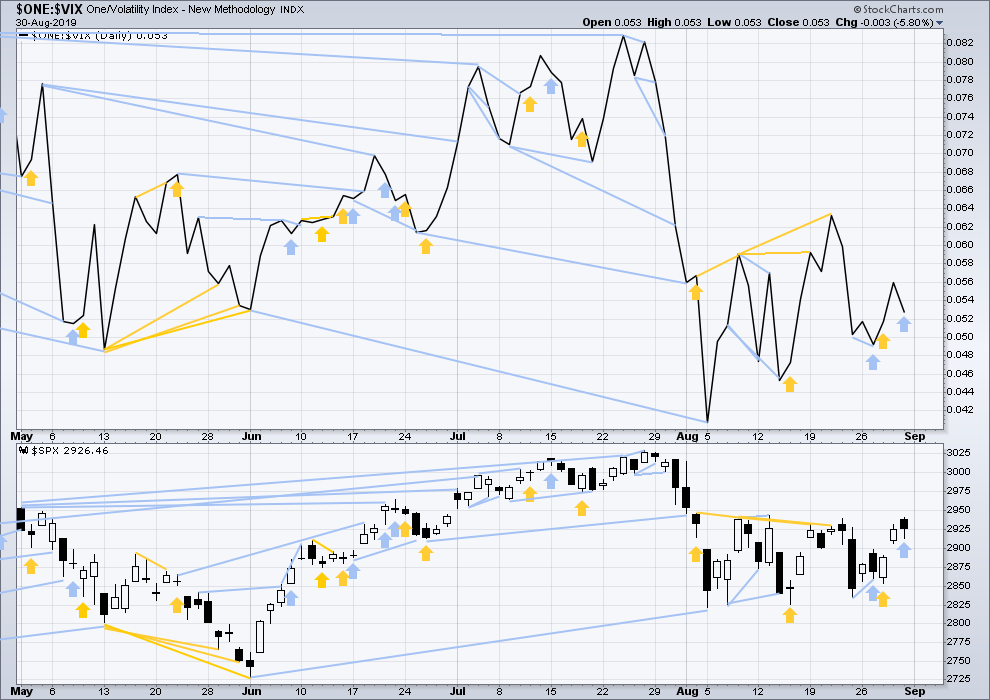

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Price has moved higher on Friday, but inverted VIX has moved lower. This divergence is bearish but shall be given no weight in this analysis as it is contradicted by the AD line.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 10:22 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Main hourly chart updated

We are likely going to see another stab at reclaim of 2900 into the close.

I think the bears are going to fade it…probably overnight…

Have a great evening all!

On the SPX, any new low on the day would trace 5 waves down. A 3 wave corrective rally would be a good opportunity to initiate a short position.

I’m expecting new low towards 2888, then rally into the close

Barring a dump of a few more hundred million before session end, bulls will today loose the fight over the 2900 S/R pivot. Next they have to defend top of the gap below at just above 2890……

This market has a long way to fall.

The complacency in the face of rapidly deteriorating market internals is absolutely stunning. The so-called Commercials appear to be of the same mind. COT data shows they hold even bigger short positions than last fall.

We could see another ramp higher prior, courtesy of all this bullish sentiment…

Days like today really highlight how inane is the theory of efficient markets. Some entity, clearly with very deep pockets, has in the last 48 hours spent literally hundreds of millions in the futures market in a frantic attempt to maintain price above 2900. They are now spending hundreds of millions in the cash session in an attempt to achieve the same objective. Support once broken becomes resistance….at least that used to be true…!

My corresponding view on RUT. Likely target zones for a bottom/turn shown as gray ellipses.

Difficult to draw a viable EW channel with such a protracted second wave and maintain good wave degree proportion imho…

Indeed. Do you have an alternative (“better”) model?

man, with this churn…. all I have is motion sickness

Might I suggest trading RUT (via IWM options) instead of SPX/SPY? It “runs” much more smoothly, presumably by virtue of being 2000 stocks rather than 500. And it is clearly weaker, and thus “better” for short trading these days. Compare the 5 minutes charts today between RUT and SPX, for example. My $0.02, ymmv!

Excellent point

To be honest, I am really stumped about the count. I was originally leaning towards a nested 1,2 off the July highs that got clearly invalidated. I was then thinking tentatively that we had a larger upward second wave correction but that triangle formation posed a problem for a second wave. I am now trying to see if I can get a reasonable “a,b,c” pattern off the August lows and like you, am leaning toward Lara’s alternate…

For better and worse, Thinkorswim doesn’t seem to have a way to create “alternative drawing sets” on charts, so that I can have alternative wave counts I can “apply” and refine. So I have to pick my one, ideally the one I view as most likely. Usually, that’s not too difficult. At this moment, it is.

My conclusion is that the 2nd alternate is the most probable model. Why? First, the general structure here of a move down a bit from an all-time high followed by consolidation in a highly volatile and very wide range reeks of distribution. Second, in terms of wave structure, it reeks of a 2 or B or X wave. Third, both the main and first alternate have time proportionality problems (not violations, just “oddities”) by virtue of having a very long in time 2 wave (down). The second alternative doesn’t have this problem; an ongoing 2 down is very balanced still with the 1 up from the December lows.

There are also seasonal factors that support the two alternates.

My final reason for finding this model more probable is the trend of deteriorating fundamentals and deteriorating drivers of that trend.

That all said, price action tomorrow could completely change my mind! But with price action that supports my thesis I’m going to take a large short position because if correct, the set up is very much here and now. The risk/reward structure is excellent here at the top of the range if/as the price starts to plummet.

Kevin, The ES could be on a totally different count, it’s possible in my view that it opens gap up to 2950 area to complete the green (i) then dump for green (ii) over 2-3 days back to 2875, which is kinda mid & point of control for this range and then we start the strong up move in third… without a gap up or strong Tuesday, Bulls are in trouble

Remember ES made a lower low to 2810 on the last leg down but SPX held it’s low of 2835

Here’s an interesting data point: “when the S&P 500 has fallen in August in this bull market, it has risen an average of 8.6% in the final 4 months of the year.” The writer goes on to state that a trade deal with China is the likely required event to drive such a result this time.

I do believe the likely sequence of events going forward are highly predictable, if you assume the #1 goal is not to change the trade structure with China, but to damage the world economy to drive interest rates down to lower one’s own personal loan payments (a rather large consideration if you are 100’s of millions of $’s in debt and are wholly self-serving). No China trade deal until the December rate cut, then there’s no more runway for a bad world and US economy (which must not crater or incumbents don’t get reelected), so an “instant deal” with China to remove the tariffs, before the end of January 2020. And a fresh bull market in 2020. Just speculating idly on a holi-day. Let’s see what happens…

In /ES, the equivalent of the main hourly is now invalidated. The selling over the weekend has brought the price of the subminuette iv to below the top of subminuette i.

For me, this shifts my view of the most probable model to the alternate. With all that that implies re: trading next week.

I acknowledge that in SPX proper, there may not be an equivalent invalidation if price moves back up before Tuesday’s open. I’ll be watching for that. However, I suspect the handwriting is on the proverbial wall here.

Have a an enjoyable and rest-ful Labor day week-end everyone!

My labors this year have provided much fruit / return. I am quite blessed and quite grateful for that. Oh, BTW, today is my first day qualifying for and a recipient of Medicare in the USA. I will now begin to collect on that for which I have been contributing (through taxes) for 53 years! Actually, when I started contributing Medicare was still a year away from its inception! Wow, I look back and on the one hand it seems like yesterday. On the other hand, it seems like a lifetime ago which must be because it was a lifetime ago.

On this Labor Day weekend, I am grateful saying, “Thank you” to my family, to all my 5+ decades worth of employers, and all the contributors on this forum. Have a good one.

Congrats and enjoy it while it lasts. I’m 5 years younger and effectively in a race to get any return of my contributed money before it’s pilfered.

Well, after a few very busy and very painful (physically) days, I am back at #1 for the weekend. A few days ago, I mentioned it was time for the bulls to put up or shut up. I think they have spoken loudly on Thursday and the week as a whole. We should be in rally mode for the next few months as the A-D line, both daily and weekly, are portending. As of this week’s close, I am back at a 100% long position. Thanks Lara for a great analysis and commentary. Like you, I put a lot of weight on the A-D line new ATH’s.

Have a great weekend all and for our USA members a wonderful Labor Day weekend.

Caught me nappin’ Rodney.

No market on Monday? Oh bummer man.

I like the bullish sentiment. I need to see price rocket out of this sludge to share it. Is there any possibility of a surprise 1/2 pt rate cut in Sept that sends the market into orbit?