Price remains range bound and all three Elliott wave counts remain valid.

Summary: An upwards breakout above 2,940 with support from volume would add confidence in the main wave count. If this happens, then the next target is 3,120. Today an 80% up day now supports this view.

A new low below 2,822.12 would indicate a continuing deeper pullback as fairly likely, as outlined by the alternate wave counts. The first target would then be at 2,663.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

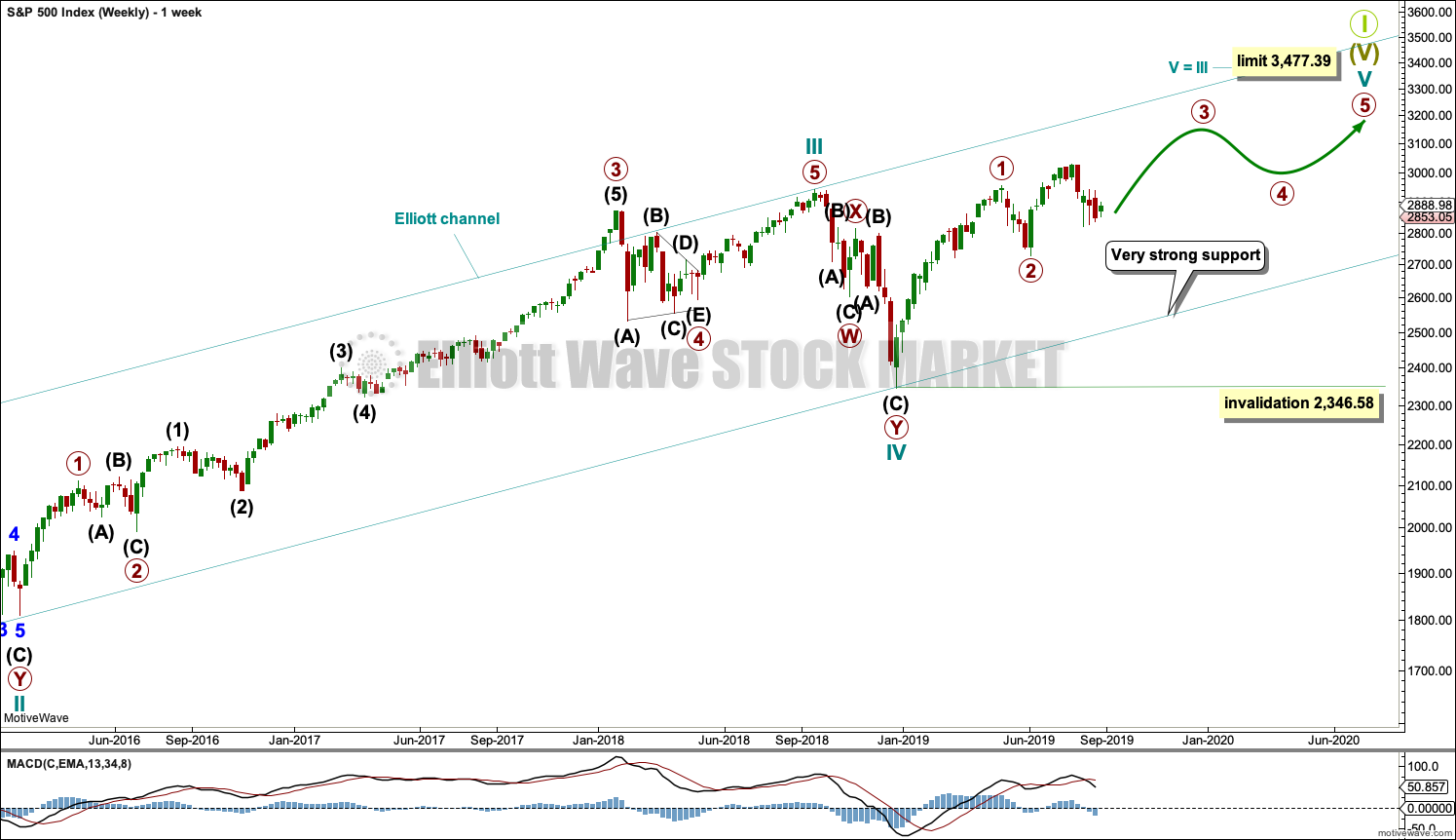

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will now focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

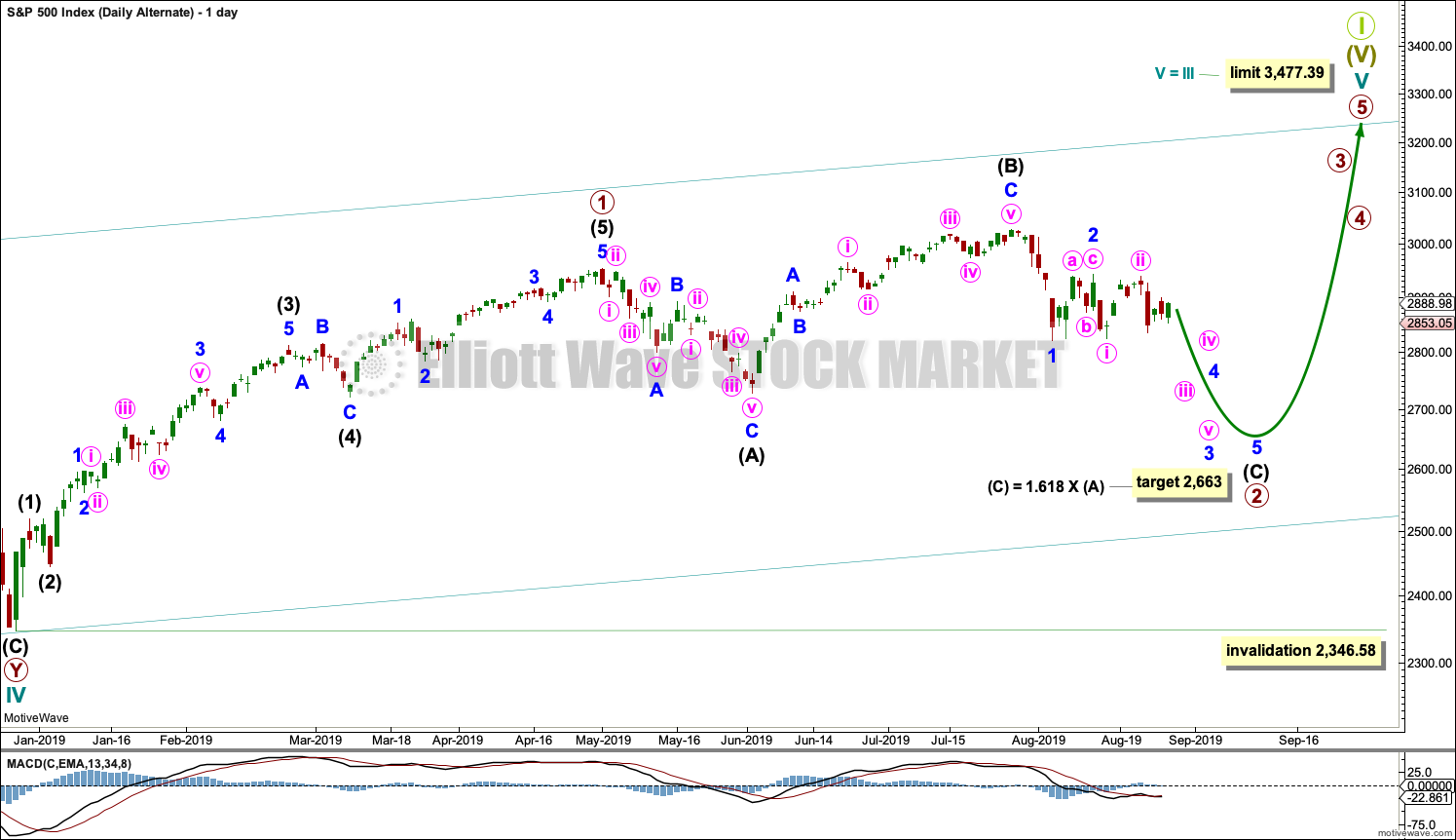

MAIN DAILY CHART

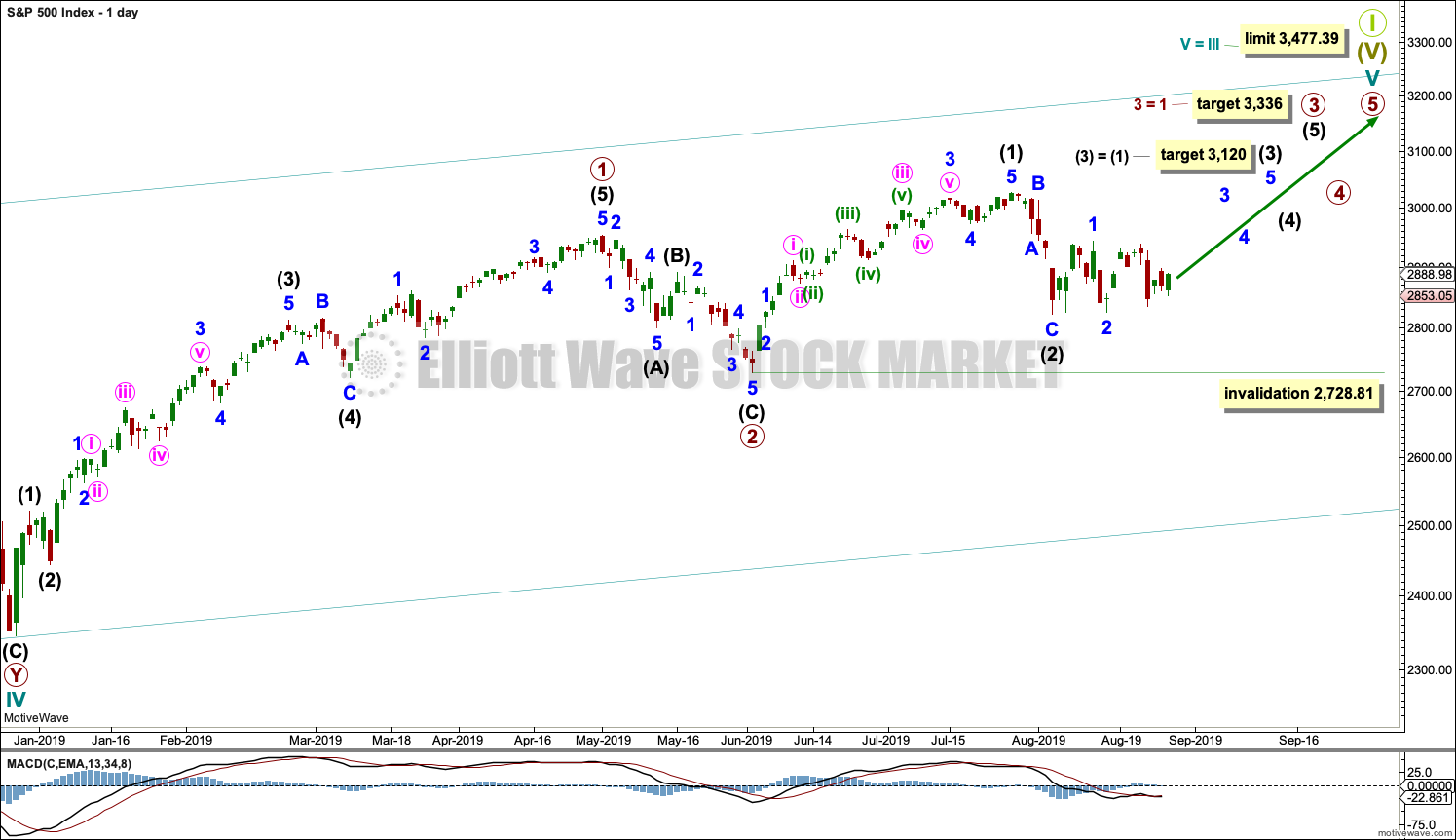

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

It is also possible that intermediate wave (2) may be incomplete and sideways movement of the last 16 sessions may be minor wave B within a zigzag for intermediate wave (2). If intermediate wave (2) continues lower, then it may not move beyond the start of intermediate wave (1) below 2,728.81.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse.

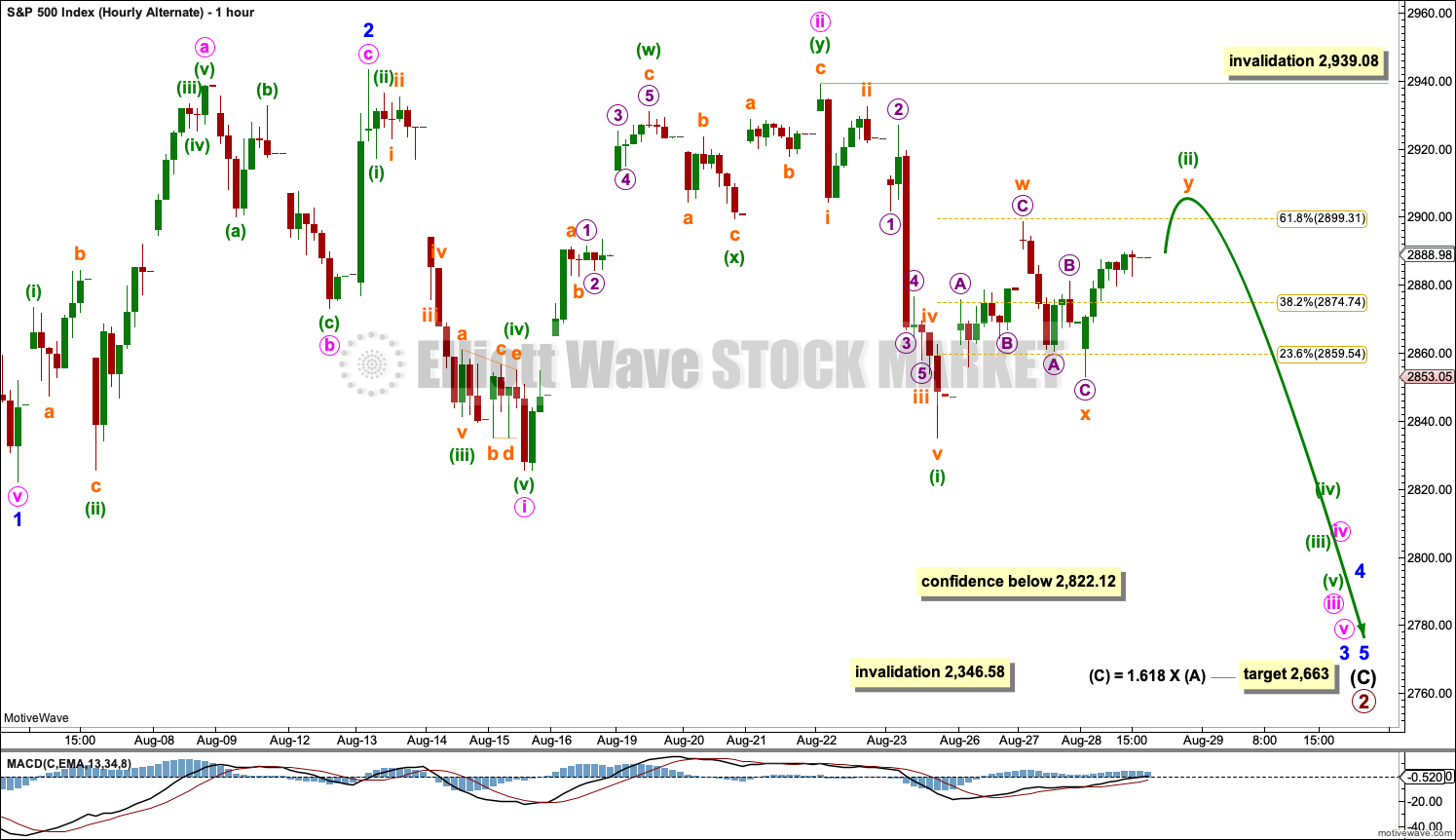

MAIN HOURLY CHART

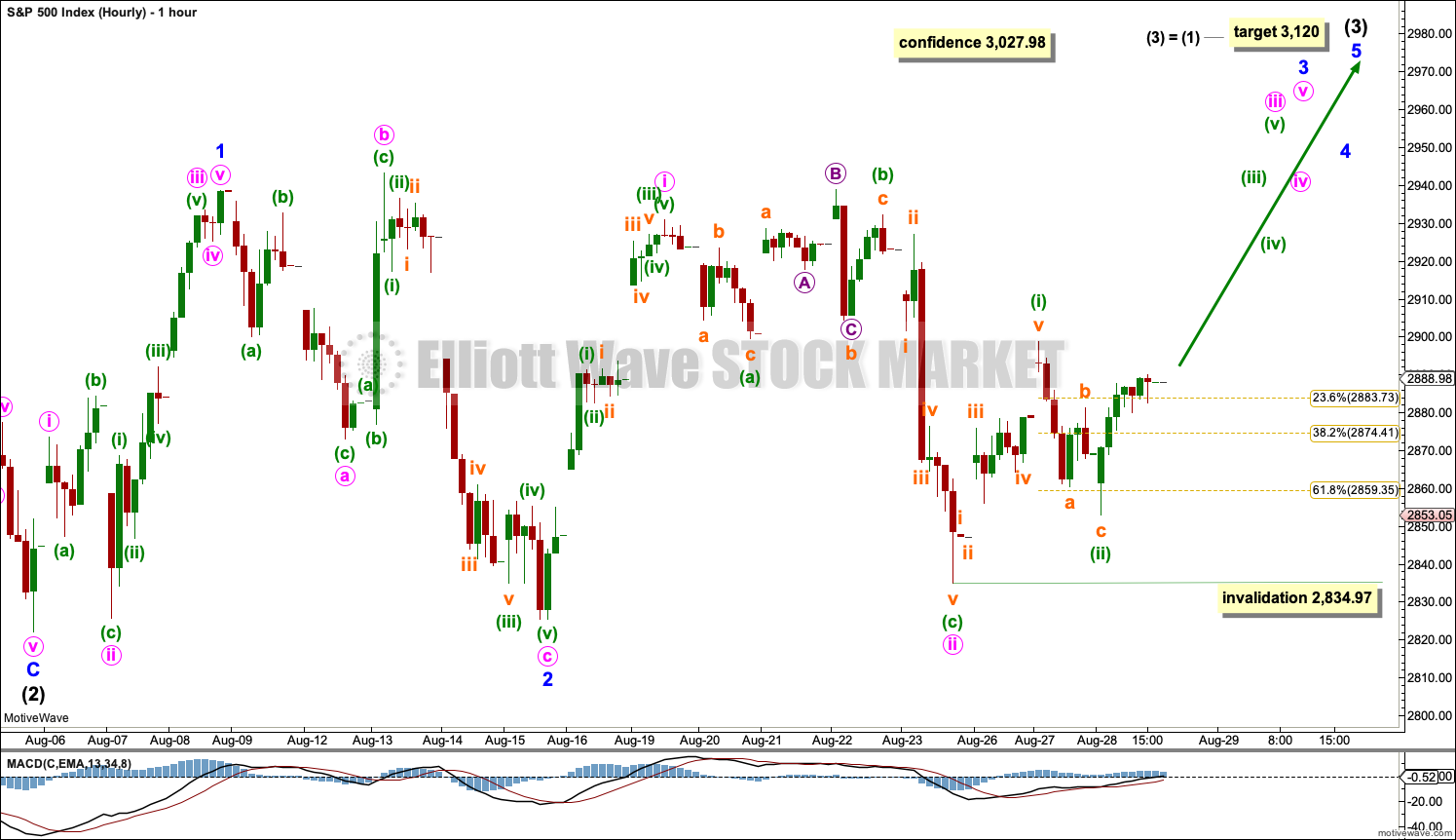

Intermediate wave (3) may only subdivide as a five wave impulse. Within intermediate wave (3), minor waves 1 and 2 may now be complete. Minor wave 3 may only subdivide as a five wave impulse.

Within minor wave 3, minute waves i and ii may be complete. Within minute wave iii, minuette wave (ii) may not move beyond the start of minuette wave (i) below 2,834.97.

Minute wave iii must move beyond the end of minute wave i. Minute wave iii must move far enough above the end of minute wave i to allow room for minute wave iv to unfold and remain above first wave price territory.

The next wave up for this wave count may then exhibit an increase in momentum as a third wave at five degrees unfolds.

ALTERNATE DAILY CHART

This first alternate wave count considers the possibility that cycle wave V may be unfolding as an impulse.

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary wave 1 only may be complete.

Primary wave 2 may be unfolding as an expanded flat correction. These are reasonably common Elliott wave corrective structures. Flat corrections subdivide 3-3-5. Expanded flats have B waves which are 1.05 or more the length of their A waves. In this example for primary wave 2, intermediate wave (B) is a 1.33 length of intermediate wave (A). The target for intermediate wave (C) expects it to exhibit the most common Fibonacci Ratio to intermediate wave (A) within an expanded flat.

If price reaches the target at 2,663 and keeps falling, then the next target would be the 0.618 Fibonacci Ratio of primary wave 1 at 2,578.66.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

ALTERNATE HOURLY CHART

Intermediate wave (C) must subdivide as a five wave motive structure for this wave count. Minor waves 1 and 2 may be complete within intermediate wave (C).

Minor wave 3 may only subdivide as an impulse. Minute waves i and ii may be complete within minor wave 3.

Minute wave iii may only subdivide as an impulse. Minuette wave (ii) may not move into minuette wave (i) price territory above 2,939.08.

When minuette wave (ii) may be complete, then this wave count expects a third wave down at three degrees to begin.

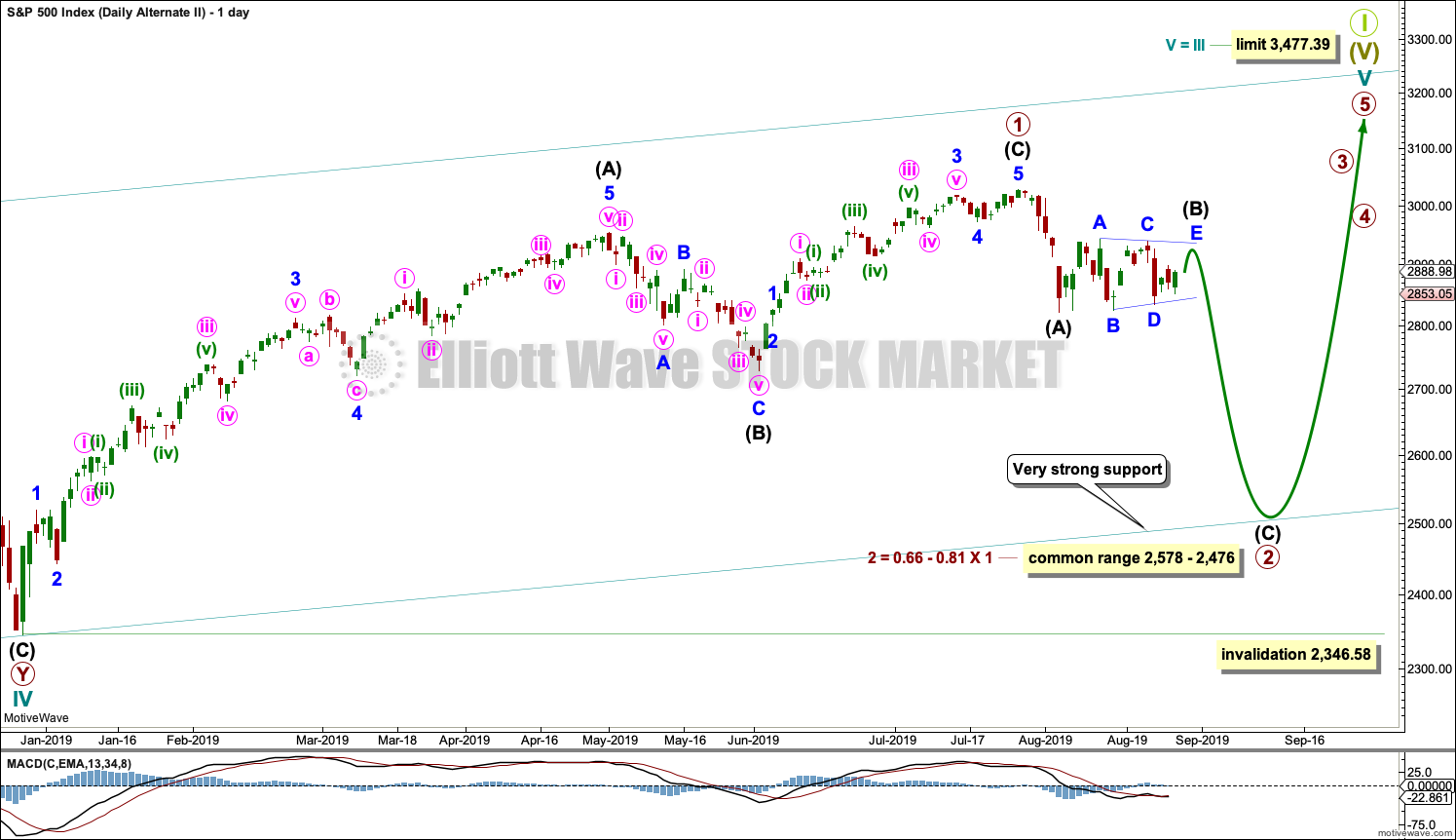

SECOND ALTERNATE DAILY CHART

This second alternate daily chart considers the other structural possibility for cycle wave V, that of an ending diagonal. Ending diagonals in fifth wave positions are not as common as impulses; for this reason, this wave count will remain an alternate until an impulse for cycle wave V is invalidated.

All sub-waves within an ending diagonal must subdivide as zigzags. Primary wave 1 may have been complete as a zigzag at the last all time high on the 26th of July.

Primary wave 2 may be continuing lower as a zigzag. Within the zigzag, intermediate wave (B) may be completing as a sideways triangle.

Within diagonals, sub-waves 2 and 4 are normally very deep, ending within a range of 0.66 to 0.81 the prior wave. This range for primary wave 2 is from 2,578 to 2,476. Primary wave 2 may possibly come as low as the lower edge of the teal channel, which is copied over from the weekly chart.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

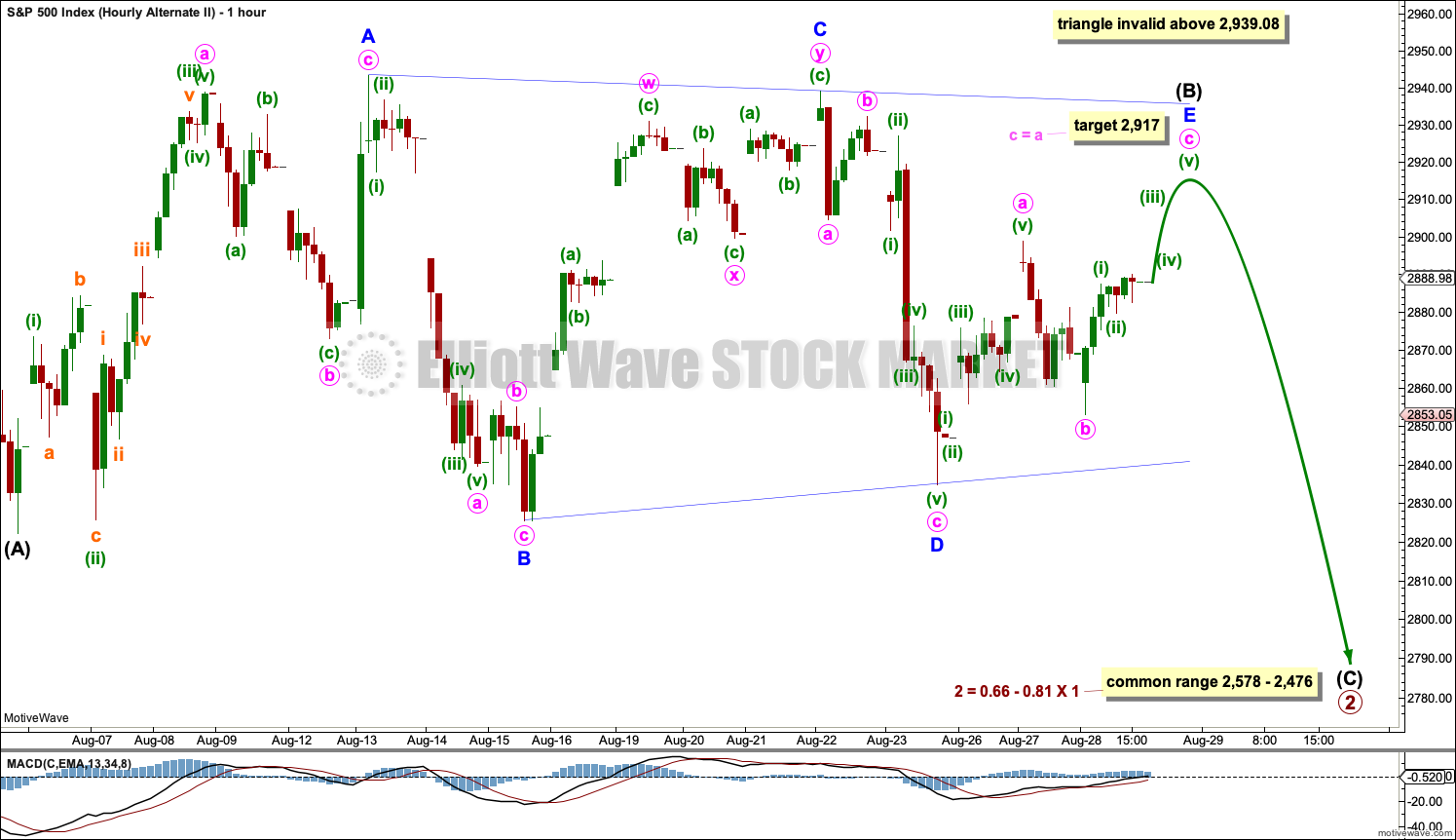

SECOND ALTERNATE HOURLY CHART

Within the zigzag of primary wave 2, intermediate wave (B) may be subdividing as a regular contracting triangle. Only the final sub-wave of minor wave E may be needed to complete.

Minor wave E should subdivide as a single zigzag and would most likely fall short of the upper A-C trend line. Minor wave E may not move beyond the end of minor wave C above 2,939.08. The target is now re-calculated for minor wave E to end that would see it fall a little short of the A-C trend line and expects a common Fibonacci Ratio between minute waves a and c within it.

If the triangle is invalidated with a new high by any amount at any time frame above 2,939.08, then intermediate wave (B) may be completing as a double combination: zigzag – X – flat. A new high above 2,939.08 does not invalidate this wave count.

When the triangle is complete, then intermediate wave (C) downwards should begin.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

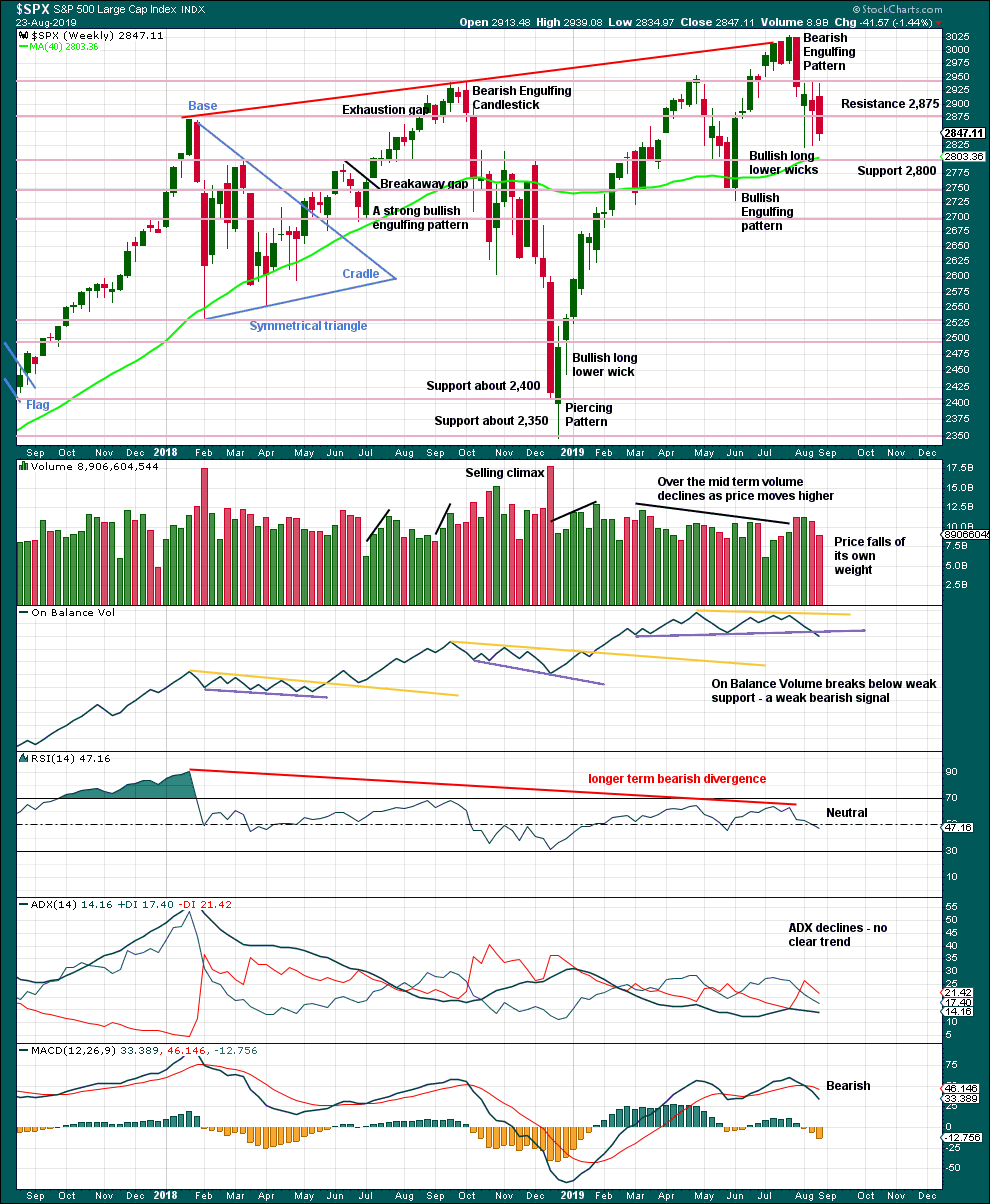

WEEKLY CHART

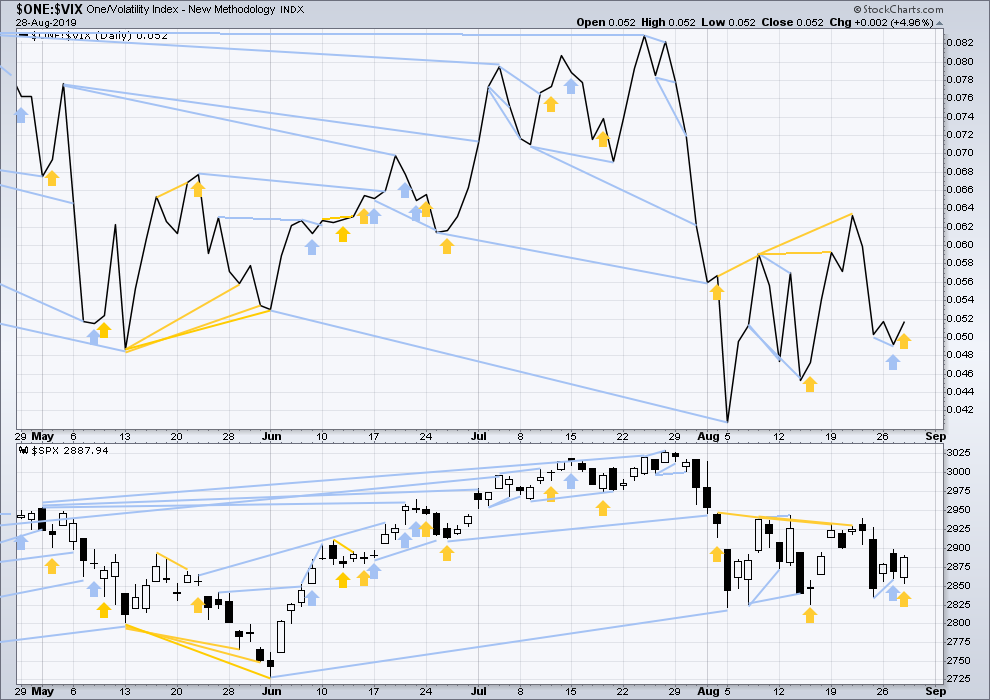

Click chart to enlarge. Chart courtesy of StockCharts.com.

Currently, price is range bound with resistance about 2,945 and support about 2,920.

The larger trend is up from the low in December 2018, with a series of higher highs and higher lows. This upwards trend should be assumed to remain while the last swing low at 2,728.81 remains intact.

The signal from On Balance Volume favours the alternate daily Elliott wave counts.

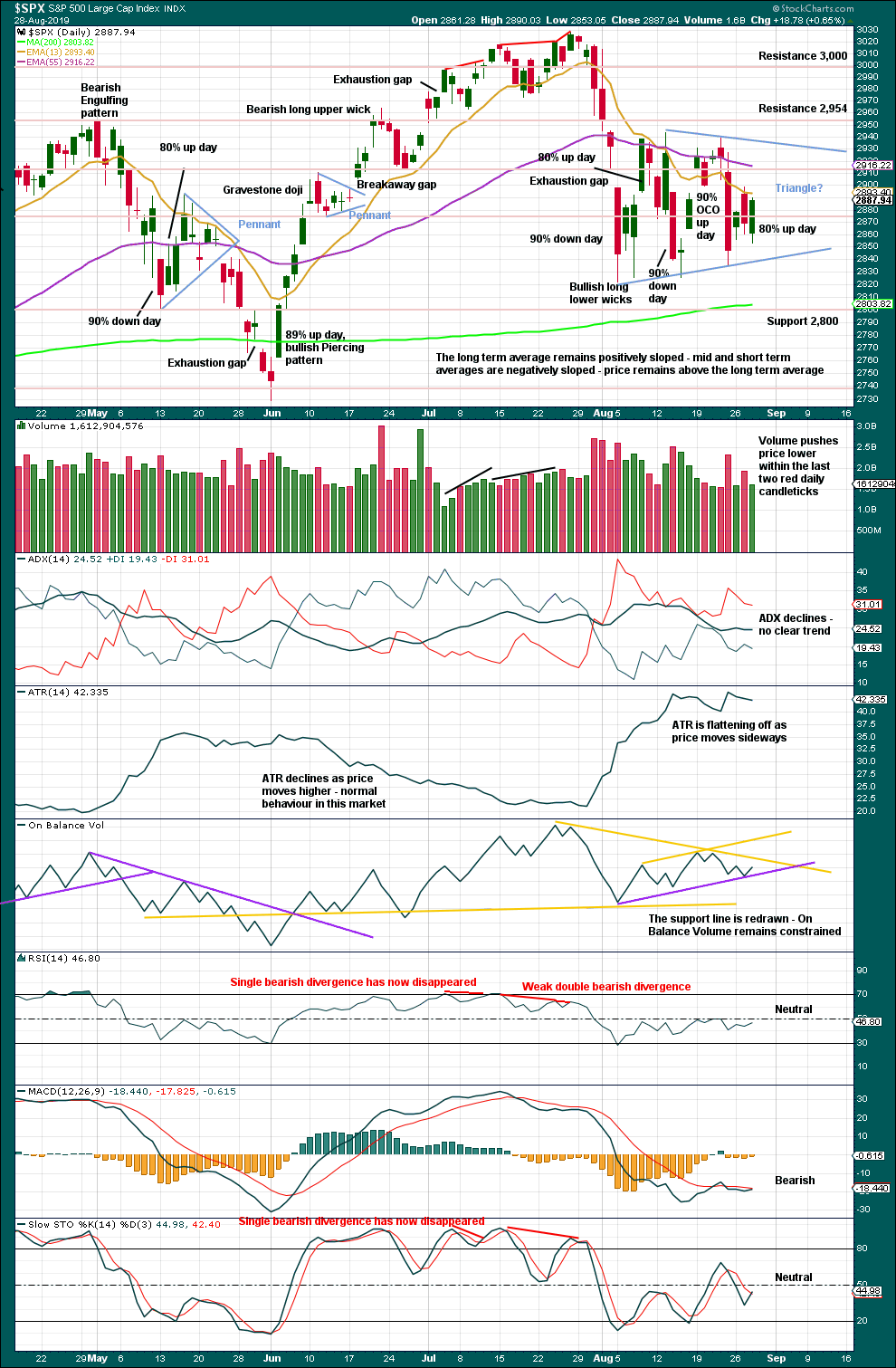

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last low of the 15th of August was preceded immediately by a 90% downward day and followed immediately by a 90% OCO (Operating Companies Only) up day. This is a pattern commonly found at major lows, and it indicates a 180 degree shift in sentiment from bearish to bullish. This favours the main Elliott wave count.

Today some strength in upwards movement within this last session as an 80% upwards day now offers some support to the view that a sustainable low may be in place.

A classic triangle may be completing. Classic triangles have an important difference to Elliott wave triangles. While Elliott wave triangles are always continuation patterns, classic triangles may be either continuation or reversal patterns. A breakout either above or below the triangle trend lines is required before the next direction can be known. At that stage, a target using the triangle width added to the breakout point may be calculated.

The bearish signal given by On Balance Volume yesterday is now negated and the support line is redrawn; it was again breached, so it no longer had technical significance.

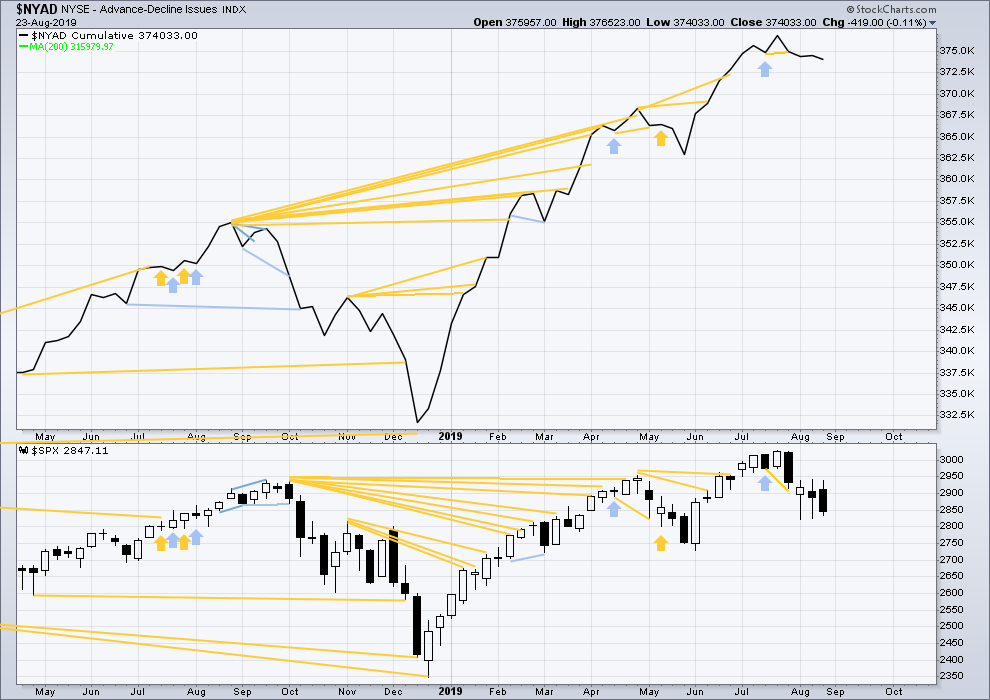

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again recently, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid November 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week price moved sideways with a red candlestick and the balance of volume downwards. The AD line has slightly declined. There is no new short-term divergence.

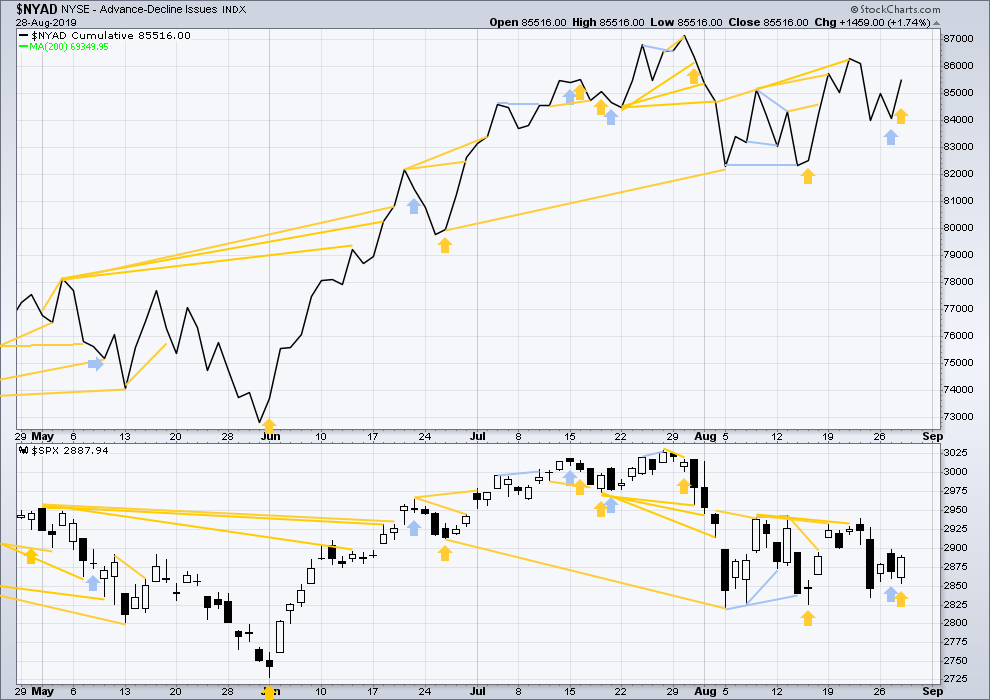

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line has made another new high above the prior high of the 13th of August, but price has not. This divergence is bullish and still supports the main Elliott wave count.

Bearish divergence noted in yesterday’s analysis has now been followed by a downwards day: a lower low and a lower high, although the session closed green.

Today price has moved lower, but the AD line has moved higher. Upwards movement within this session has support from increasing market breadth. This divergence is bullish and supports the main Elliott wave count..

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and nine months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

Last week price moved lower within the week. Inverted VIX has made a new swing low below the prior low of the week of the 28th of May, but price has not. This divergence is bearish and supports the alternate Elliott wave counts; but because it is not confirmed by the AD line, it is given little weight in this analysis. Note that this happened recently with prior divergence between swing lows, which was shortly after followed by upwards movement to the last all time high.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX made a new high above the prior high of the 13th of August, but price has not. This divergence is still bullish and confirms the bullish signal from the AD line. This supports the main Elliott wave count.

Bearish divergence noted in yesterday’s analysis has now been followed by downwards movement.

Today price moved lower, but inverted VIX has moved higher. Upwards movement within this session has support from a corresponding decline in VIX. This divergence is bullish and confirms the signal given today from the AD line, so it shall be given a little weight in this analysis.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 07:16 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

main hourly updated

second alternate hourly updated

Another 80%+ day, back to back

Back to last Thursdays level… lol

That’s one 90% OCO up day and now two 80% up days back to back.

Probability fairly strongly favours a sustainable low in place.

Thanks Lara.

You are the best.

August will be a substantially down month for SPX.

Since 1981, August has been down 15 times. And EVERY SINGLE TIME SPX was up from it’s closing August price at year end. 15 out of 15.

Data from theodark at theotrade web site.

15 out of 15 times.

Go time ? Or is this the 4…..

Let’s not forget that Lara’s HIGHEST PROBABILITY CALL is for bullish price movement here (and quite a bit of it, actually). All markets up over 1% today, and very strong A/D levels. “Climbing the wall of worry.” If the twitter feed stays sufficiently silent, the main may very well be the one next week.

Gap and go in all the major markets…

Lots of stock breaking upward strongly off recent bases. Lots of down trend lines getting busted.

Very high A/D across all markets.

Oil very strong.

A highest probability wave count that calls for strong upward action in general over the next several weeks.

The bear case here is fading fast IMO. Of course a wild tweet could change that in a nano-second, just like last Thursday. Powell spoke, all was well…then WHAM!!! But…you can’t trade on that. Just another risk factor.

I’m getting longer via various stock positions. Posting stock set ups on my “Alerts” page, specktrading dot com. INTC and AVGO and on the small cap side, BLDR today.

Hi Rod. Just noticed your comment about H.O.

I think the required conditions are the number of NYSE stocks simultaneously making new highs and lows (greater than 2.8%) plus a negative M.O.

In thinking about the H.O., it makes one wonder if what it exposes is an attempt to drive weak markets higher with concentrated stock purchases. Sounds like a good potential study!

From Investing Answers (& others):

https://investinganswers.com/dictionary/h/hindenburg-omen

————————————————————————————-

The Hindenburg Omen is triggered when three complex conditions are met:

1) The number of new daily 52-week highs and lows on the NYSE is more than 2.2% of all securities traded that day. However, new 52-week highs cannot be more than twice the number of new 52-week lows. This condition is mandatory.

2) The 10-week moving average of the NYSE Index is rising.

3) The McClellan Oscillator, an overbought/oversold indicator, is negative.

———————————————————————————————

As of a couple of weeks ago, the NYSE 10 week moving average has been declining. Thus, the second criterion is not met.

The H.O. strikes me as similar to perma-bear pundits, who “get famous” by making the big bearish market call. Over and over again until…it’s the RIGHT call, and then they use that as their claim to great fame. “I called the bear market!”. Never mind they called it six other times that didn’t turn out. To put it simply…I put zero stock in the H.O. Sure, sometimes the different market measures align that way. And once in awhile, soon after that happens, there’s sharp downward movement. And many times not. It’s not a reliable indicator. My $0.02. I’ll accept that it’s a reasonable “heads up, pay attention” indicator. But that’s pretty good advice anytime you have $ at risk in the market.

McClelland Oscillator was fractionally positive on Wednesday and was the only condition not met for a third observation for a THIRD confirmed H.O.

Three confirmed on the clock is a historic first. Be careful out there…

Triangle B wave or triple zig zag second wave both right on target. Move back up to former S/R 2900-2920 area absolutely classic and was exactly what I hoped to see…!

There really should be no doubt about what comes next…charts are clear… 🙂

Yes, and…charts don’t predict the the future (nothing does). The market internals today are very strong and very bullish, so far. But perhaps this is just holiday weekend bullishness and from a chart perspective “another test of the top of the range”. Perhaps. But an announcement for example of renewed China/US trade talks over the weekend could have this market soaring early next week. The future is not pre-written in the charts. A/D today most markets running about 8-1….

Got it. #1

Put up or shut up time for the bulls.

The bears must take control or they loose the match.

#2 says…trying to trade this market is like getting caught in the washing machine after getting pitched on a late drop in. Fuhgeddahboudit! Churning. So far.

Good move catching that long yesterday 🙂 I’ve gotta learn not to have tunnel vision…

I’m shorting this move approaching 2925. There should be formidable resistance around there… Heavy volume right on or around SPY 292.50.

Just waiting for signs of reversal.