Another very small range day with price closing within a consolidation zone leaves the Elliott wave analysis the same.

Summary: Conditions are still suggesting a sustainable low may be in place. The next target is 3,120.

A new low below 2,822.12 would indicate a continuing deeper pullback. The first target would then be at 2,663.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will now focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

MAIN DAILY CHART

There is enough support from classic technical analysis to consider this the main wave count.

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse. Within the impulse of intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 2,822.12.

MAIN HOURLY CHART

Intermediate wave (3) may only subdivide as a five wave impulse. Within intermediate wave (3), minor waves 1 and 2 may now be complete. Minor wave 3 may only subdivide as a five wave impulse. Within minor wave 3, minute wave ii may not move beyond the start of minute wave i below 2,825.51.

Minute wave iii must move beyond the end of minute wave i. Minute wave iii must move far enough above the end of minute wave i to allow room for minute wave iv to unfold and remain above first wave price territory.

Minute wave ii may have been relatively brief and shallow; this would follow a reasonably common pattern for this market. It is also possible that the degree of labelling within minute wave ii may be one degree too high; it may continue sideways as a flat, combination or double flat correction.

ALTERNATE DAILY CHART

This first alternate wave count considers the possibility that cycle wave V may be unfolding as an impulse.

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary wave 1 only may be complete.

Primary wave 2 may be unfolding as an expanded flat correction. These are reasonably common Elliott wave corrective structures. Flat corrections subdivide 3-3-5. Expanded flats have B waves which are 1.05 or more the length of their A waves. In this example for primary wave 2, intermediate wave (B) is a 1.33 length of intermediate wave (A). The target for intermediate wave (C) expects it to exhibit the most common Fibonacci Ratio to intermediate wave (A) within an expanded flat.

If price reaches the target at 2,663 and keeps falling, then the next target would be the 0.618 Fibonacci Ratio of primary wave 1 at 2,578.66.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

SECOND ALTERNATE DAILY CHART

This second alternate daily chart considers the other structural possibility for cycle wave V, that of an ending diagonal.

All sub-waves within an ending diagonal must subdivide as zigzags. Primary wave 1 may have been complete as a zigzag at the last all time high on the 26th of July.

Primary wave 2 may be continuing lower as a zigzag. Within the zigzag, intermediate wave (B) may be completing as a sideways triangle.

Within diagonals, sub-waves 2 and 4 are normally very deep, ending within a range of 0.66 to 0.81 the prior wave. This range for primary wave 2 is from 2,578 to 2,476. Primary wave 2 may possibly come as low as the lower edge of the teal channel, which is copied over from the weekly chart.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

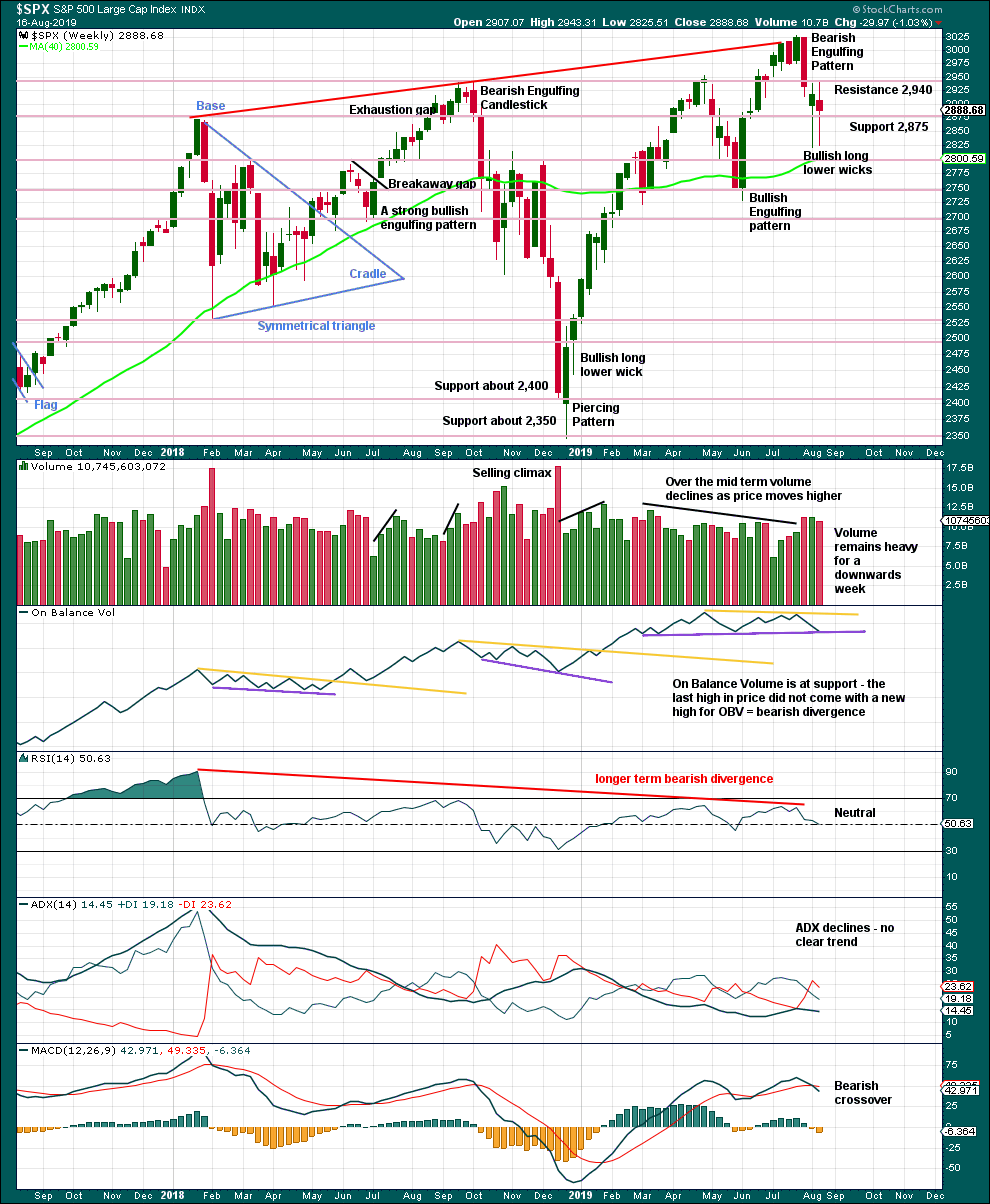

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last weekly candlestick completes an upwards week with a slightly higher high and a slightly higher low, but the balance of volume is down and the candlestick is red. Long lower wicks and On Balance Volume at support suggest the downside here may now be limited.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Lowry’s data now indicates Friday was a 90% OCO up day. Monday is a near 80% up day. Conditions for a sustainable low may now be in place, so a more bullish outlook is warranted.

The last two gaps may be pattern gaps as they occur so far within a consolidation zone which has resistance about 2,940 and support about 2,820.

A decline in volume for upwards movement is not of a concern. Price has been rising for years in this market on light and declining volume.

A close above the high of the 13th of August at 2,943.31, preferably with support from volume, would indicate confidence that the low is sustainable. At that stage, it would be reasonable to expect new all time highs.

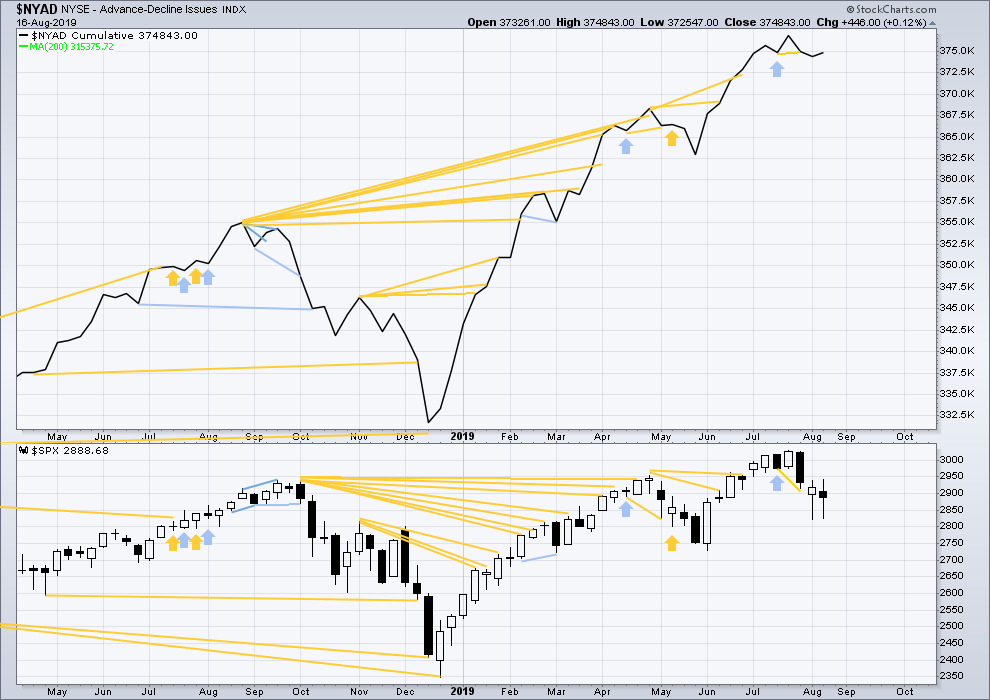

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again recently, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid November 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week both the AD line and price have moved slightly higher. There is no new short-term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line has made another new high above the prior high of the 13th of August, but price has not. This divergence is bullish and supports the main Elliott wave count.

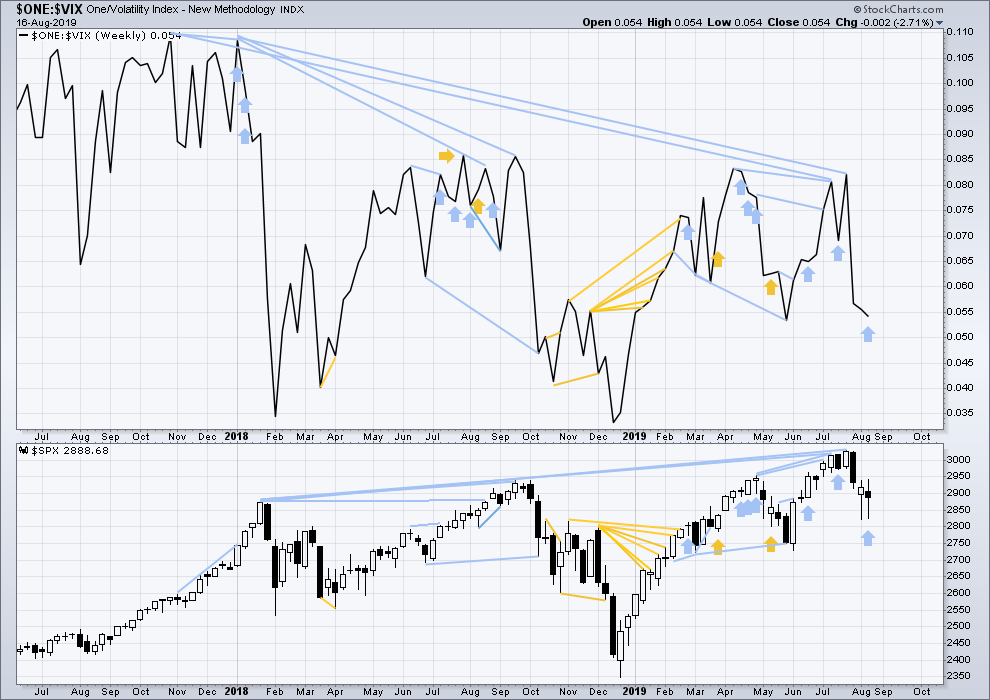

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and nine months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

Last week price has moved very slightly higher although the candlestick closed red, but inverted VIX has moved a little lower. This divergence is bearish, but it is contrary to the AD line and shall not be given weight in this analysis.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has made a new high again above the prior high of the 13th of August, but price has not. This divergence is bullish and confirms the bullish signal from the AD line. This supports the main Elliott wave count.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 08:44 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

Although I’ve still labelled minute ii over, the degree of labelling within it could still be moved down one and it may still continue sideways as a double flat or double combination. So the invalidation point must remain the same.

So far as trading set-ups go, sometimes you don’t have to know exactly what Mr. Market is going to do, and frankly most times you should not care if correctly positioned. We know we are going to likely see a big move tomorrow. A SPY 290 straddle, tomorrow expiration, ought to deliver some nice coin whichever way price breaks. In fact, it just might turn out to be a double dipper…! 🙂

A new low under 2904 will break 2900 and likely guarantee some dovish blather from Powell tomorrow. How high the ensuing bounce goes will be telling….

this market is bouncing like a super ball.

RUT’s bounce is particularly strong. Don’t small caps benefit the most from dropping interest rates?

Apparently financials are a big part of RUT, and they don’t do as well with falling interest rates… so i’ve been told anyway.

Back up to probe morning’s gap…fighting to hold onto 2920….

Man 2920 … you r good !

Awww…shucks!! 🙂

I think the main area of resistance is SPX 2925-2930 area, which we’re approaching now… lets see what happens here.

likely to stay range bound until the Powell fireworks tomorrow.

Is that Harley hog you’re ridin’??! 🙂

Are any members here trading with the Bottarelli “War Room” posse?

Watch and do a few things with Bryan ….. I have been doing straddles and strangles on high short interest equities for many years . I have had some big winners , and some big losers . Bryan seems to do well with straight out earnings strangles .

His rapid fire trading style is definitely not for everyone.

The more experienced traders have had to do a lot of coaching for many of the newer traders not accustomed to it. The reviews of his approach have been mixed at best since he started the new service. 🙂

O.K traders, let’s see how this next wave down reacts to gap from Aug 16…that will tell you what you need to know… 🙂

A bounce at the August 16 gap around 2895 may be an early hint that “good” news from Powell is expected tomorrow; a closure of the gap means we are likely going to test next support around 2820….

The confidence of the so-called “smart money” in the certitude of bankster relief from a potential market implosion is quite stunning. The absence of a gap higher in VIX is clearly telling us the risk/parity trade is alive and well and simply not yet being unwound. Will Powell deliver?!

Interesting!

Surrender of 2920 puts 2900 in play. The bulls/banksters seemed determined to defend it.

An intra-day breach not conclusive without a CLOSE below the pivot.

Any move below 2899.78 and the bulls have a problem…

What a candle ….

It is looking like another failed upside breakout attempt. It could mean, “Look out below!”

Like a butter knife

HOT knife…through “BUH-DAH”…. 🙂

Is there some news driving this? Thought I took my profits too early (again)….nope!! Got out just in time.

Before I forget, let me first say that any remarks I make here such as “You dog you!” are all in good fun and jest. I would be mortified if anyone took such remarks seriously or offensive. I just want to be clear on that.

I am still sitting on the fence with no long or short positions in the equity markets. I am thinking the odds favor an upside breakout but just slightly. Until such a breakout happens, we have the risk of the present correction / consolidation continuing and deepening. The last several attempts to break above 2940 have been thwarted which is not a good sign of strength. So, I am on the fence.

Anyone notice TGT today? Up 20% on earnings. Strong retail -> consumer spending -> less recession risk -> more bullish investment community. Maybe. I don’t really do funnymentals though I do monitor the excellent fundamental analysis several times a week report from “John Galt” / TheoDark at the theotrade site. Really detailed assessment of all the day to day economic reports, central bank moves, etc. and relation of all that to markets. For me it’s right up there in value with the Ciovacco short takes; different, but really insightful.

My view and map of the battlefield. Obviously if it breaks the trend line it’s time for a new map!!! Lol!! Breaking above the resistance box will be a big buy (more) trigger for me. And generally vice versa (though I may want to see other proof points of a market down move before committing short).

Bingo!

You dog you!

Drat!

4th and liking the alternates …

You bear you! Do I detect a hint of positional bias?

The market is yet again at a critical cusp. Breaking up much at all…and a billion short covering buy orders start firing!! Don’t be late to that party or worse…be caught the wrong way if those dominoes start to tumble. We could see a mega short squeeze fulfilling the 3 of 3 of 3 of 5 thesis.

I’m just waiting for the market to inform me if it’s up and away or back down through the lower range, and I’ll get aboard and try to take a bite out of the middle.

I got the 1-3% rule in mind, and this is a 3% bet for me. I’m ok to be wrong, the macros for me point down, but my timing can way off …. the beauty is that at 3% I can try again later

Arf!!!