For the short term, a small amount of upwards movement to either 2,871 or 2,898 was expected for Friday. Upwards movement reached 2,893.63.

Summary: Two short to mid-term bearish wave counts (main daily chart and alternate daily chart) expect a very little upwards movement to 2,898 but not above 2,943.31 on Monday. Thereafter, the downwards trend may resume with strength. The target is now at 2,663 or within a zone 2,578 to 2,476.

A bullish wave count (second alternate daily chart) requires price to not move below 2,822.12. This bullish wave count expects strong upwards movement to a target at 3,120. This bullish wave count, at the time of publication of this report, now has a little support from classic technical analysis. If Monday completes as an 80% up day, it would become the main wave count again.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

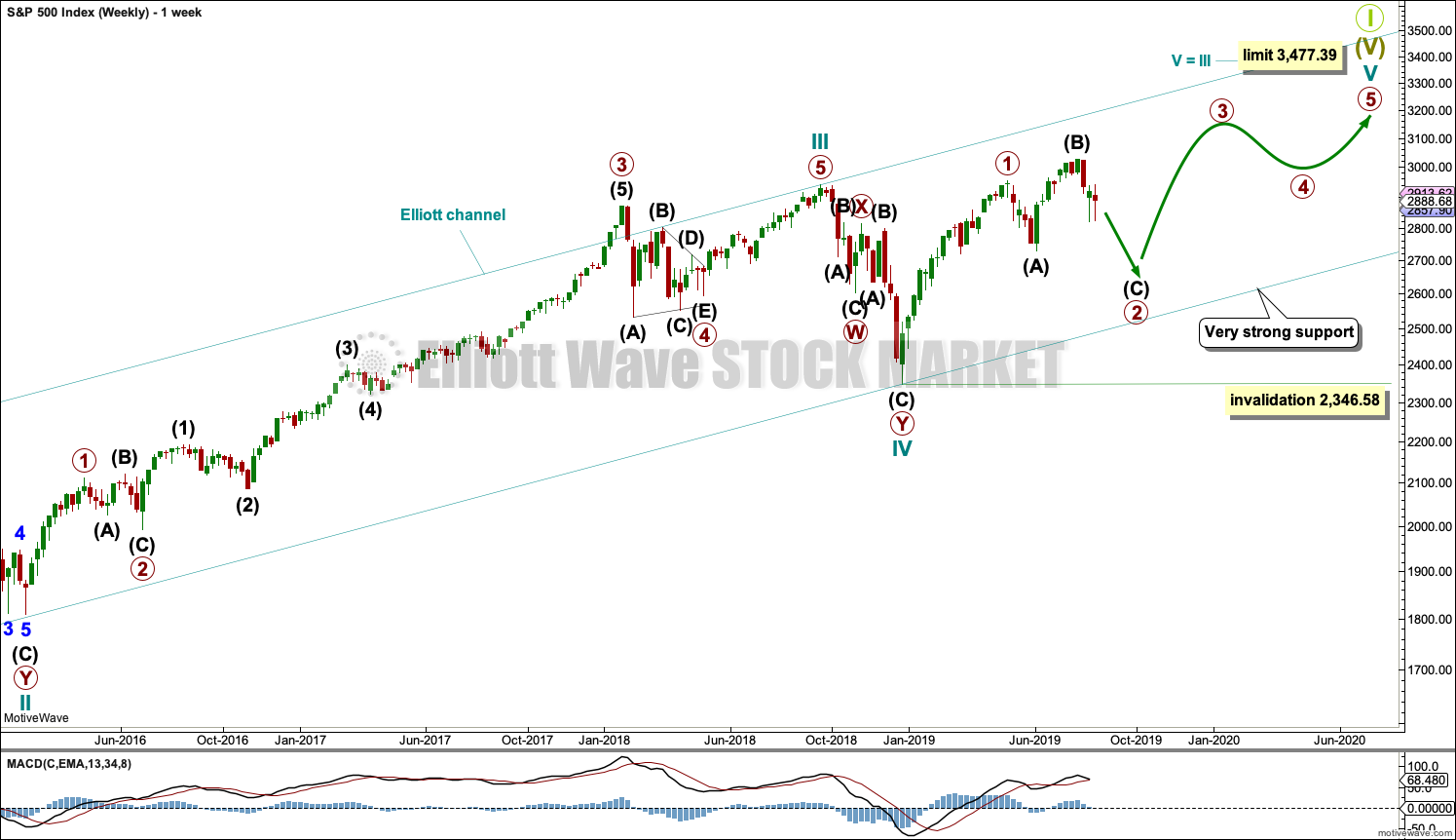

The two weekly Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. This main wave count expects that cycle wave V may be unfolding as an impulse.

The daily charts below will now focus on all of cycle wave V.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

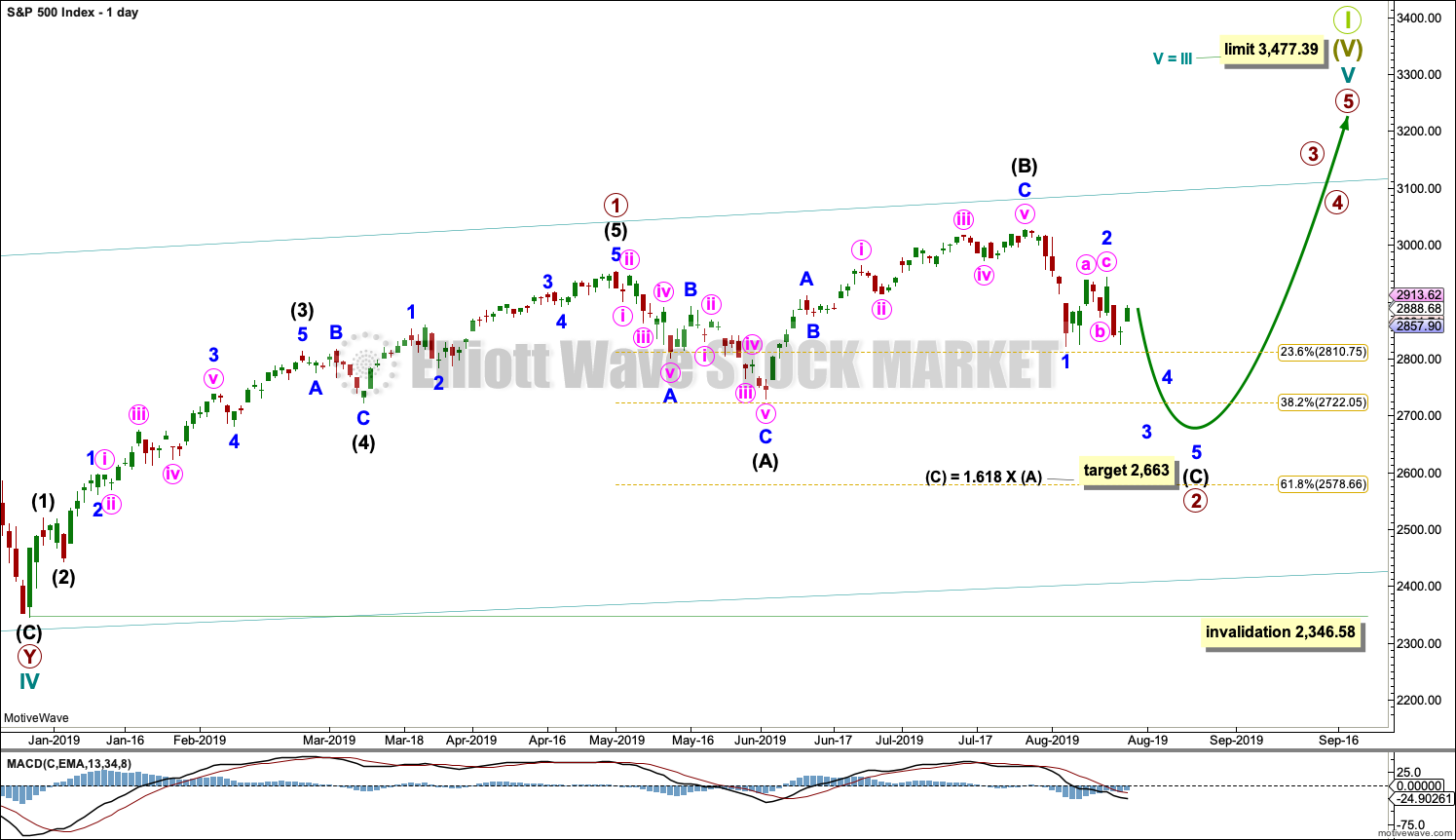

MAIN DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary wave 1 only may be complete.

Primary wave 2 may be unfolding as an expanded flat correction. These are reasonably common Elliott wave corrective structures. Flat corrections subdivide 3-3-5. Expanded flats have B waves which are 1.05 or more the length of their A waves. In this example for primary wave 2, intermediate wave (B) is a 1.33 length of intermediate wave (A). The target for intermediate wave (C) expects it to exhibit the most common Fibonacci Ratio to intermediate wave (A) within an expanded flat.

If price reaches the target at 2,663 and keeps falling, then the next target would be the 0.618 Fibonacci Ratio of primary wave 1 at 2,578.66.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

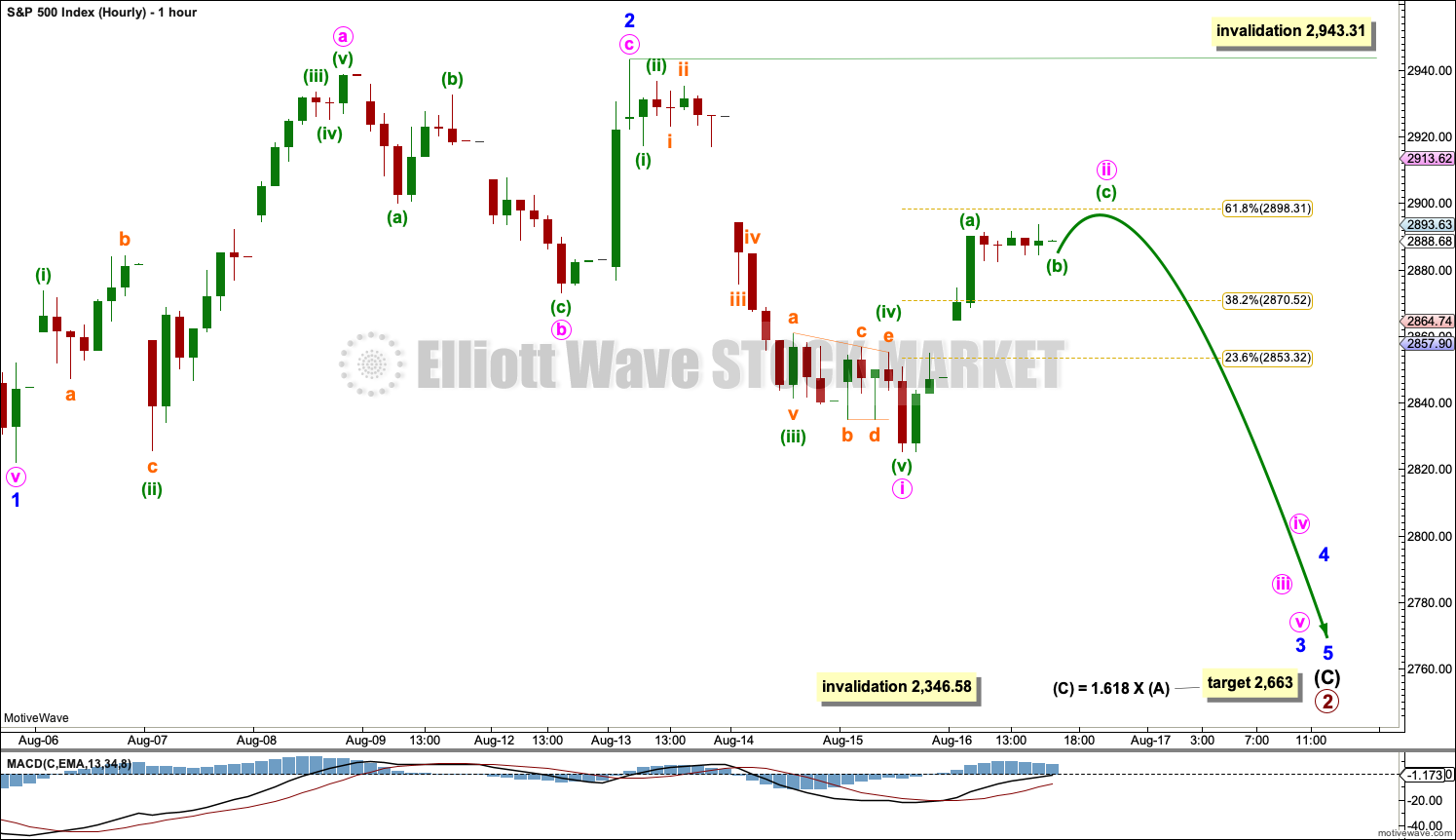

MAIN HOURLY CHART

Intermediate wave (C) must subdivide as a five wave structure. Minor wave 1 may have been complete at the last low.

Minor wave 2 may be now a complete single zigzag.

Minor wave 3 may only subdivide as an impulse. Minute wave i within minor wave 3 may be complete. Minute wave ii should unfold over a day or so as a relatively brief bounce. Minute wave ii may not move beyond the start of minute wave i above 2,943.31.

Minute wave ii may now end on Monday about the 0.618 Fibonacci Ratio.

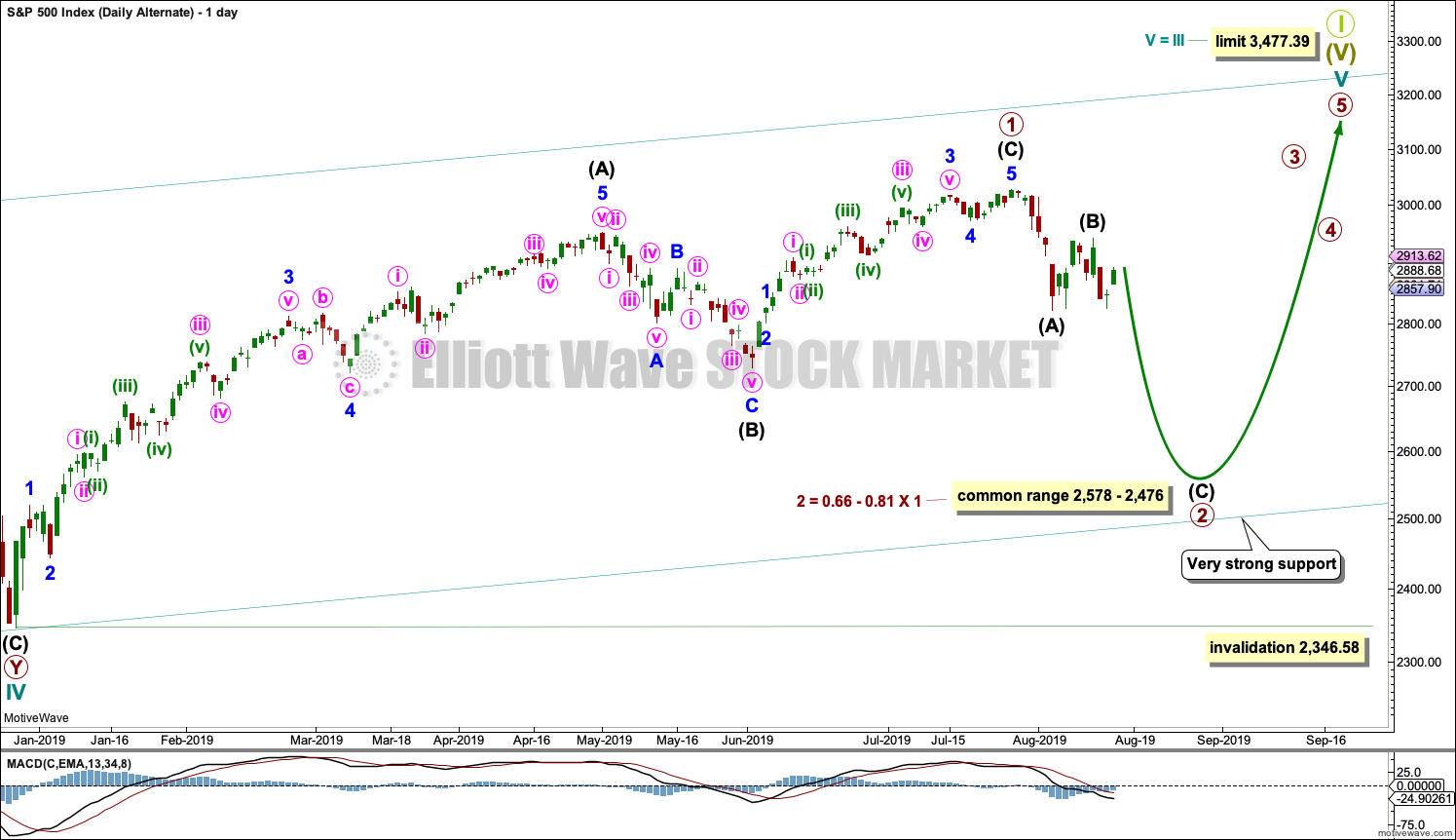

ALTERNATE DAILY CHART

This first alternate daily chart considers the other structural possibility for cycle wave V, that of an ending diagonal.

All sub-waves within an ending diagonal must subdivide as zigzags. Primary wave 1 may have been complete as a zigzag at the last all time high on the 26th of July.

Primary wave 2 may be continuing lower as a zigzag.

Within diagonals, sub-waves 2 and 4 are normally very deep, ending within a range of 0.66 to 0.81 the prior wave. This range for primary wave 2 is from 2,578 to 2,476. Primary wave 2 may possibly come as low as the lower edge of the teal channel, which is copied over from the weekly chart.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

SECOND ALTERNATE DAILY CHART

There is now at the end of this week a little support from classic technical analysis for this wave count. If Monday completes an 80% upside day, then it would again become the main wave count.

Cycle wave V is seen as an impulse for this wave count.

Within cycle wave V, primary waves 1 and 2 may be complete. Primary wave 3 may have begun.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate waves (1) and (2) may be complete.

Intermediate wave (3) may have begun. Intermediate wave (3) may only subdivide as an impulse. Within the impulse of intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 2,822.12.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

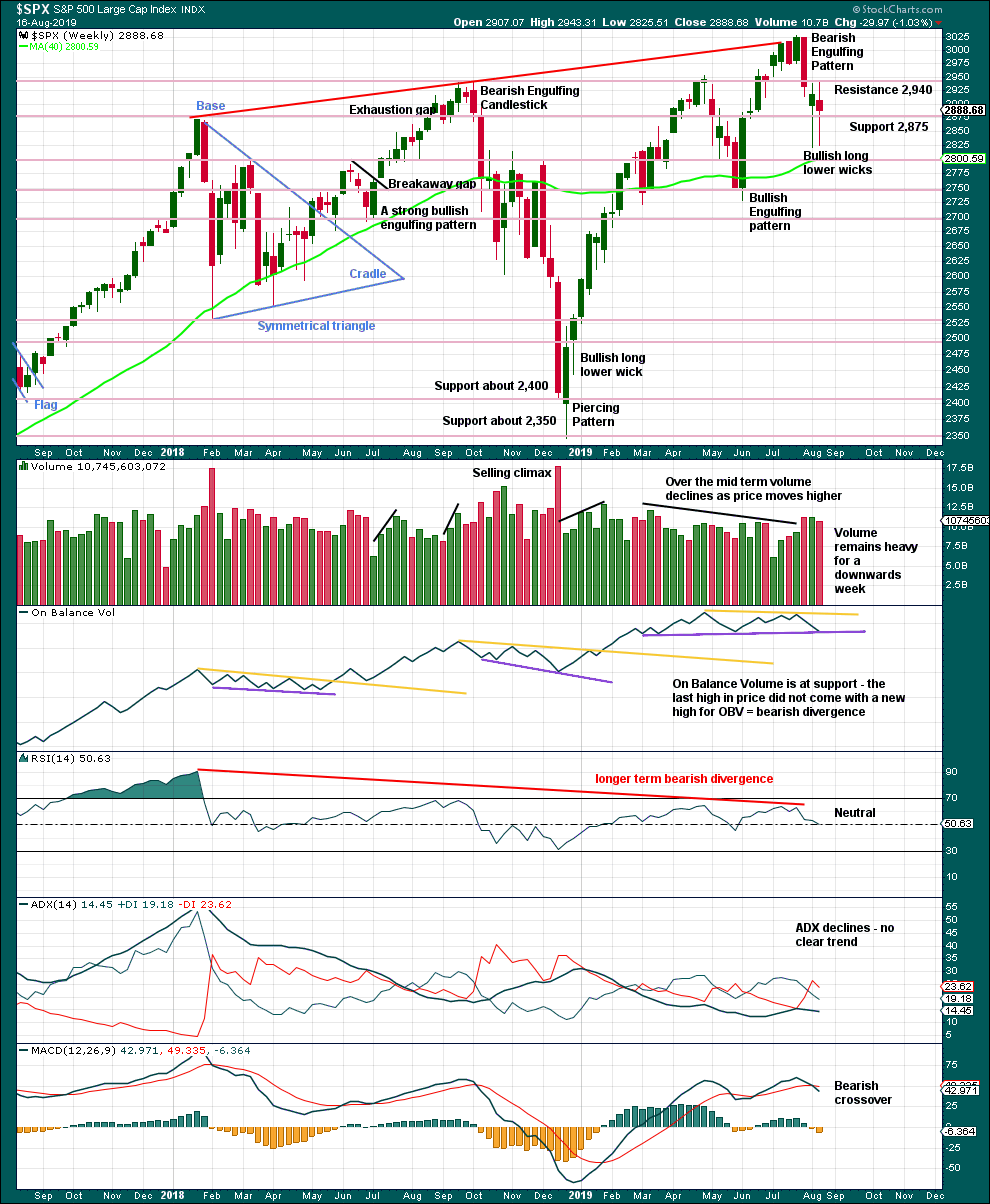

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This weekly candlestick completes an upwards week with a slightly higher high and a slightly higher low, but the balance of volume is down and the candlestick is red. Long lower wicks and On Balance Volume at support suggest the downside here may now be limited.

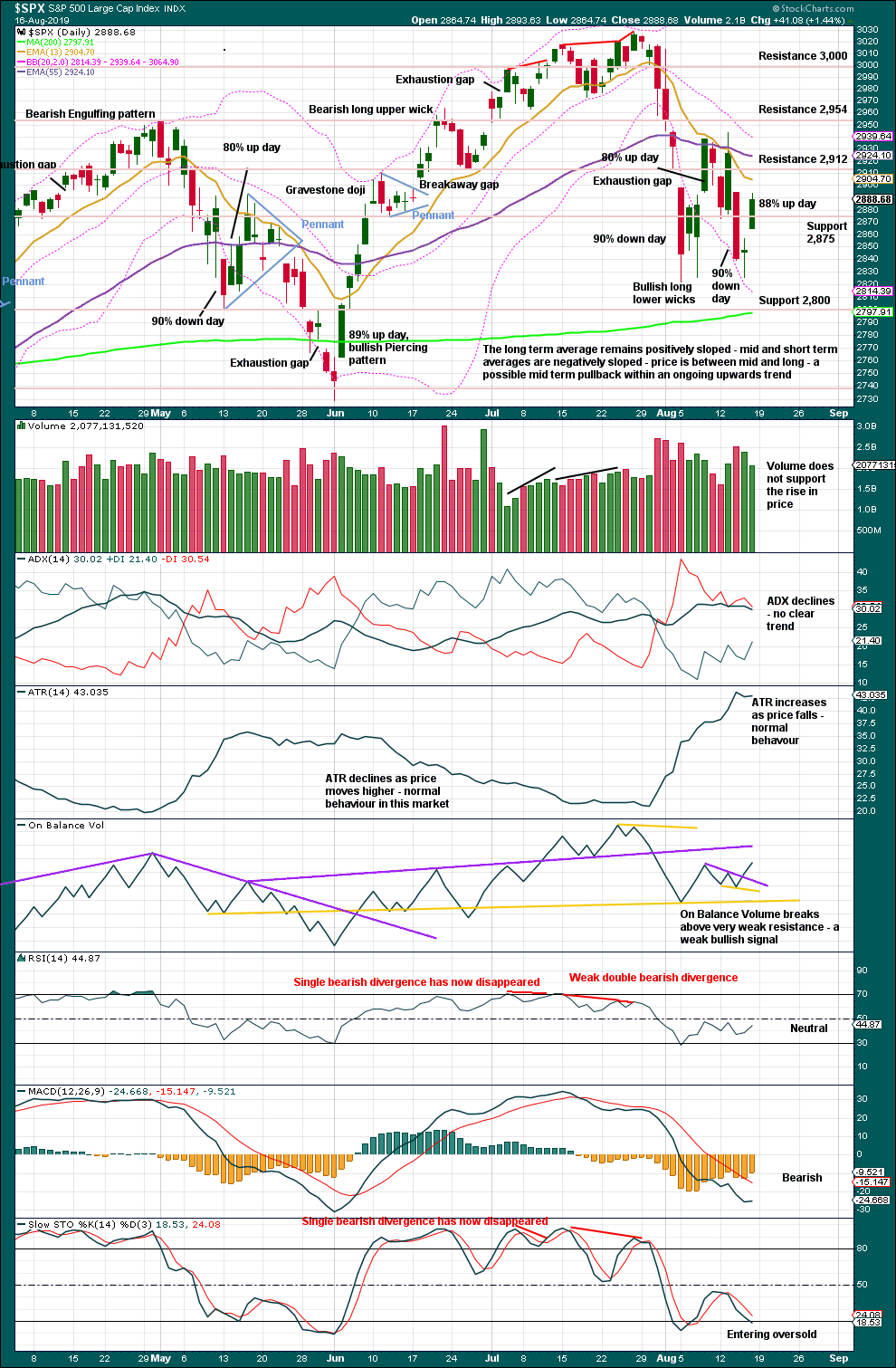

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Two 90% down days are now followed by an 88% up day. To see a shift of sentiment from bearish to bullish, and a bottom event, either one 90% up day or two back to back 80% up days within five days of the last 90% down day should be seen.

Thus, if Monday prints an 80% up day (or better), then this condition would be met and a bullish outlook would be warranted.

However, with the data in hand at the close of the week, the condition is not yet met and a bearish outlook prevails.

Neither RSI nor Stochastics are oversold. There is room for price to continue falling. Look for next support about 2,800.

The signal from On Balance Volume is very weak because the resistance line breached is only just able to be drawn, is not long held, not often tested and has some slope.

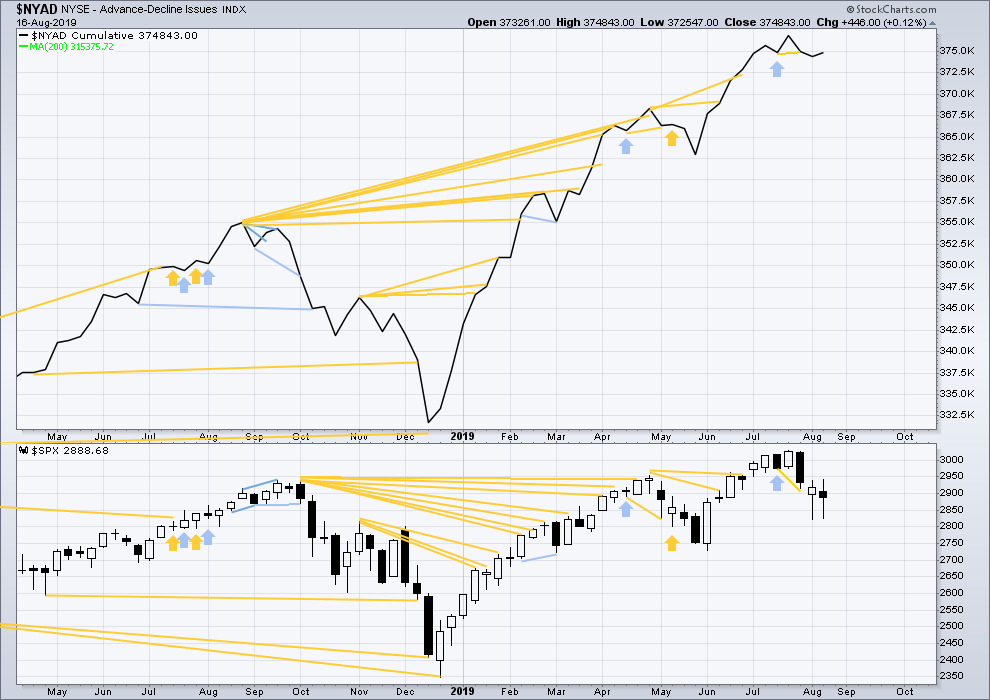

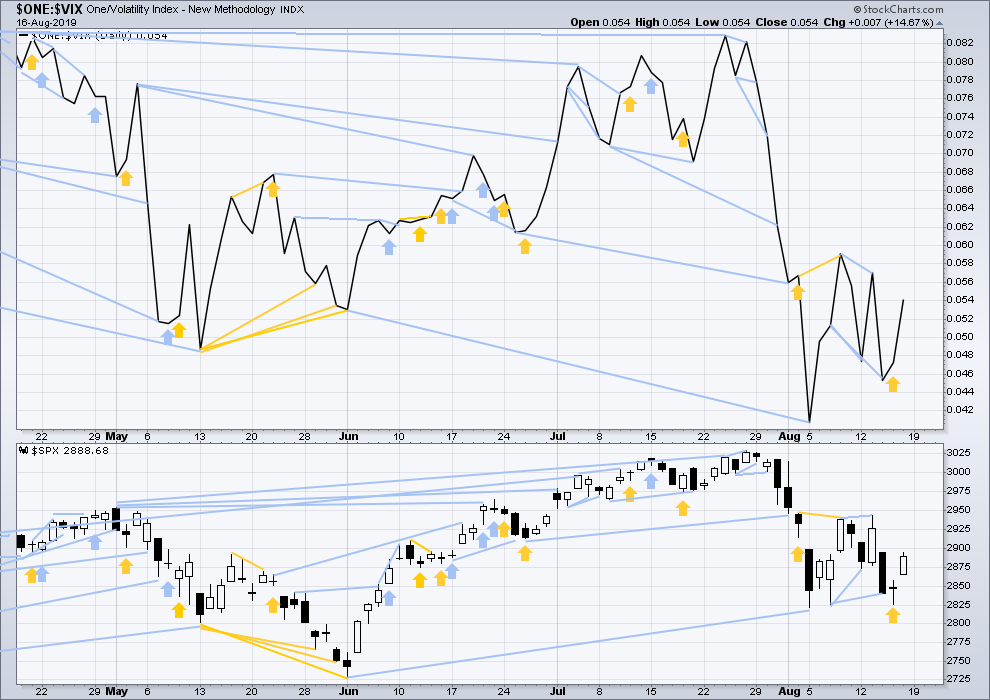

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid November 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

This week both the AD line and price have moved slightly higher. There is no new short-term divergence.

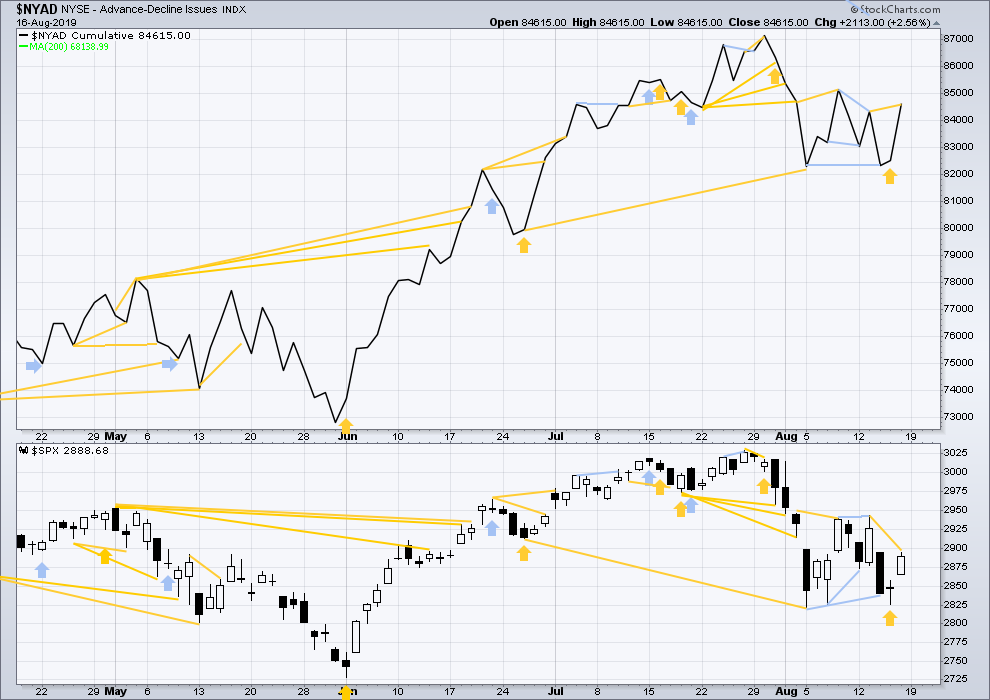

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

On Friday the AD line has made a new short-term swing high above the prior high three sessions prior, but price has not. This divergence is bullish for the short term and offers a little support to the second alternate Elliott wave count.

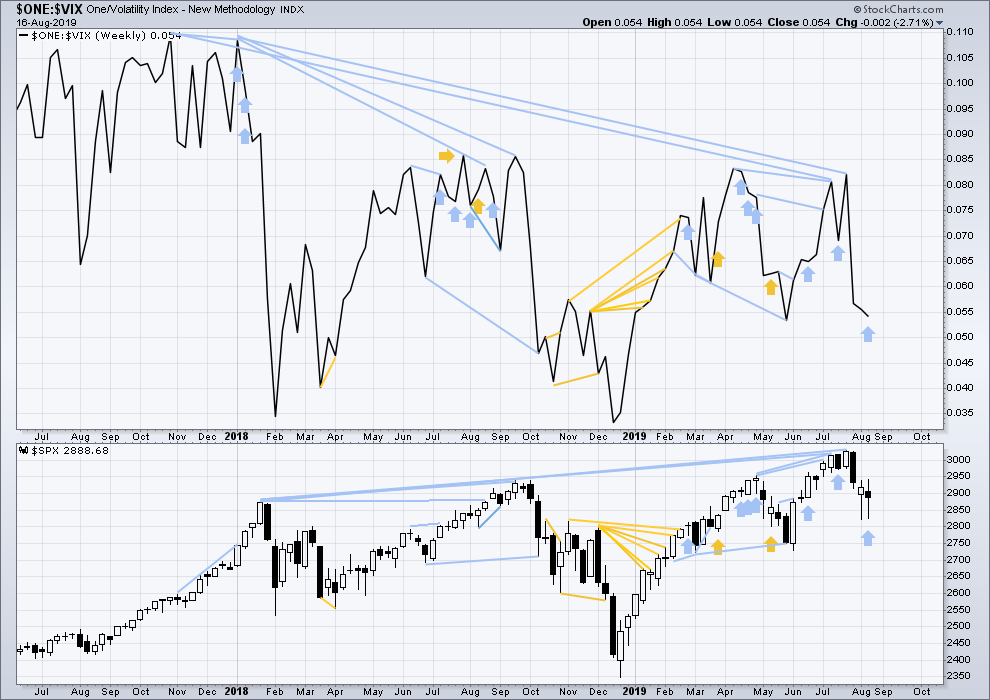

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and nine months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

This week price has moved very slightly higher although the candlestick closed red, but inverted VIX has moved a little lower. This divergence is bearish, but it is contrary to the AD line and shall not be given weight in this analysis.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

On Friday both inverted VIX and price have moved higher. There is no new short-term divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 01:34 a.m. EST on August 17, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Main hourly chart updated:

An hourly chart for the second alternate (bullish) wave count:

TLT count. All according to Hoyle so far…I’d like to get paid for the ‘fly centered at 150 in mid-Sept!

For the first time since the correction started, the McClellan Oscillator has exceeded zero. In fact, intraday it has exceeded +20. If it closes here, this will be the confirmation of the buy signal which began nine trading days ago.

I have closed my short positions from Friday afternoon at a small loss.

I have to call the long, wide RUT correction over here, a big WXY. Certainly could be wrong and it continues to do corrective sideways action (or tanks), but to my eye the structure is “complete”. Open to critique.

SPX just filled the gap at 2925 per my comments Friday sold all my longs. Happy trading!

Wow. Breakaway gap Friday and strength…big continuation gap today? No strength on day session open yet though. A/D very high, 8-1 kind of #’s. And breaking up through the 76-78% Fibo levels is awfully bullish to me; usually that’s an indication a market is going to move over time to the 100% level and typically even higher.

I was contrarian and went long RUT at the open Friday morning. And I’ll continue to be a tad contrarian and say the chart (this is /RTY, RUT futures with overnight data, hourly) looks rather constructive. We’ll see if the key overhead pivot levels get taken out or not.

oops, here…

Joeseph, any thoughts on the current notion of some ( notably the very able Mohammed El Erian) that this time the yield inversion is different…?

Verne,

the most interesting thing I found to be that this time it’s different and the distinction is in previous inversions were due to short end rising faster than long end but this time it’s due because long end are dropping faster than short end, ie it’s due to yields dropping rather than rising

Yes indeed. Harbinger of deflationary times ahead perhaps…

Joseph is not here anymore.

Thanks Lara. I’m glad I flattened out this weekend aside from a couple of cheap otm put spreads. In the absence of any more negative trade headlines or escalations in HK protests on Sunday, it seems like the conditions are forming for an upside rocket launch here…

Although it all seems bearish long term, we are presumably still in a mid cycle (5) uptrend and due for a big rally at some point. It seems like rates are now being cut around the globe and QE4 is on. Thanks for keeping us on our toes.

Fed minutes and Jackson Hole next week.

You’re welcome Jonathan.

I had to look up “Jackson Hole”. Compared to NZ, some of the place names in the USA are rather odd. At least, they look odd to me.

I expect markets will move quickly on Friday after a Fed speech. Perhaps a breakout either way.

Let’s see how strong this upwards day is today to see if the wave counts need to be swapped over.

This is just too easy, #1. I guess I need to get a life (or heal from this dreadfully painful shoulder replacement.) At least that irksome rabbit isn’t here any more.

Have a great weekend every one.

Like trading, all streaks come to an abrupt end. Enjoy it while it lasts. Best of luck with recovery.

You were saying Doc..?!