The upwards trend was expected to resume with strength this week, which is exactly what is happening so far. The Elliott wave count targets remain the same.

Summary: Strength in this upwards trend may be expected to continue for a while yet. The next short-term target is at 3,058. Look for corrections to continue to be very shallow and brief.

The mid-term target remains at 3,104 for a more time consuming consolidation or pullback, which may also be shallow.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

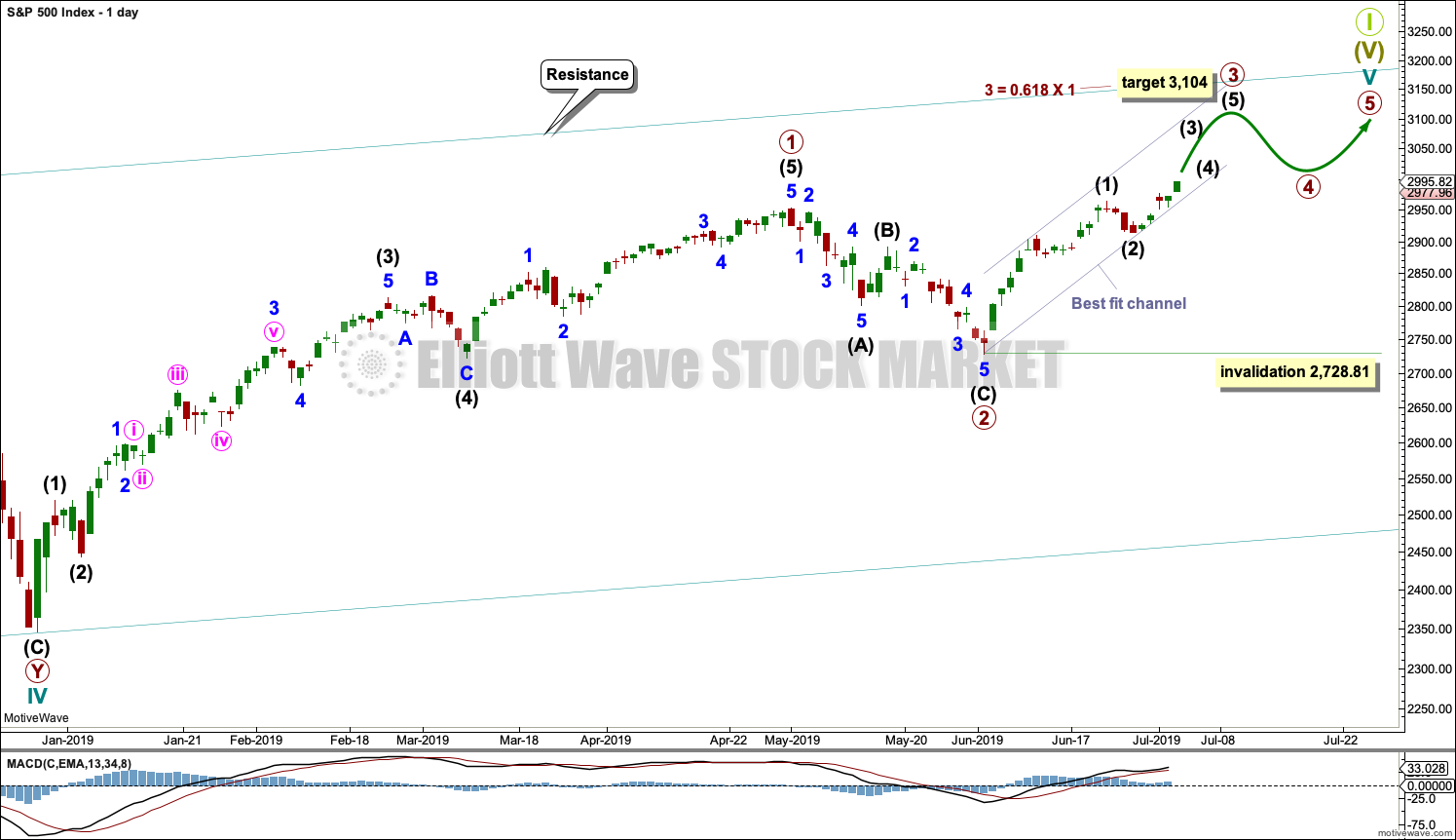

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary waves 1 and 2 may now be complete. Within primary wave 3, no second wave correction may move beyond its start below 2,728.81.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary waves 1 and 2 may be complete.

Primary wave 3 must move above the end of primary wave 1 (this rule has now been met). Primary wave 3 may only subdivide as an impulse. Within the impulse, intermediate wave (1) may have been over at the last high. Intermediate wave (2) may now also be complete, but if it continues lower it may not move beyond the start of intermediate wave (1) below 2,728.81.

When primary wave 3 is over, then primary wave 4 may be a shallow sideways consolidation.

Thereafter, primary wave 5 should move above the end of primary wave 3 to avoid a truncation.

Primary wave 1 lasted 86 sessions, 3 short of a Fibonacci 89. Primary wave 2 lasted 22 sessions, 1 longer than a Fibonacci 21. Primary wave 3 may end about a Fibonacci 55 sessions, give or take two or three sessions either side. This is a rough guideline only.

So far primary wave 3 has lasted 22 sessions.

Corrections within primary wave 3 so far have found support at the lower edge of the grey best fit channel. Copy this channel over to the hourly chart.

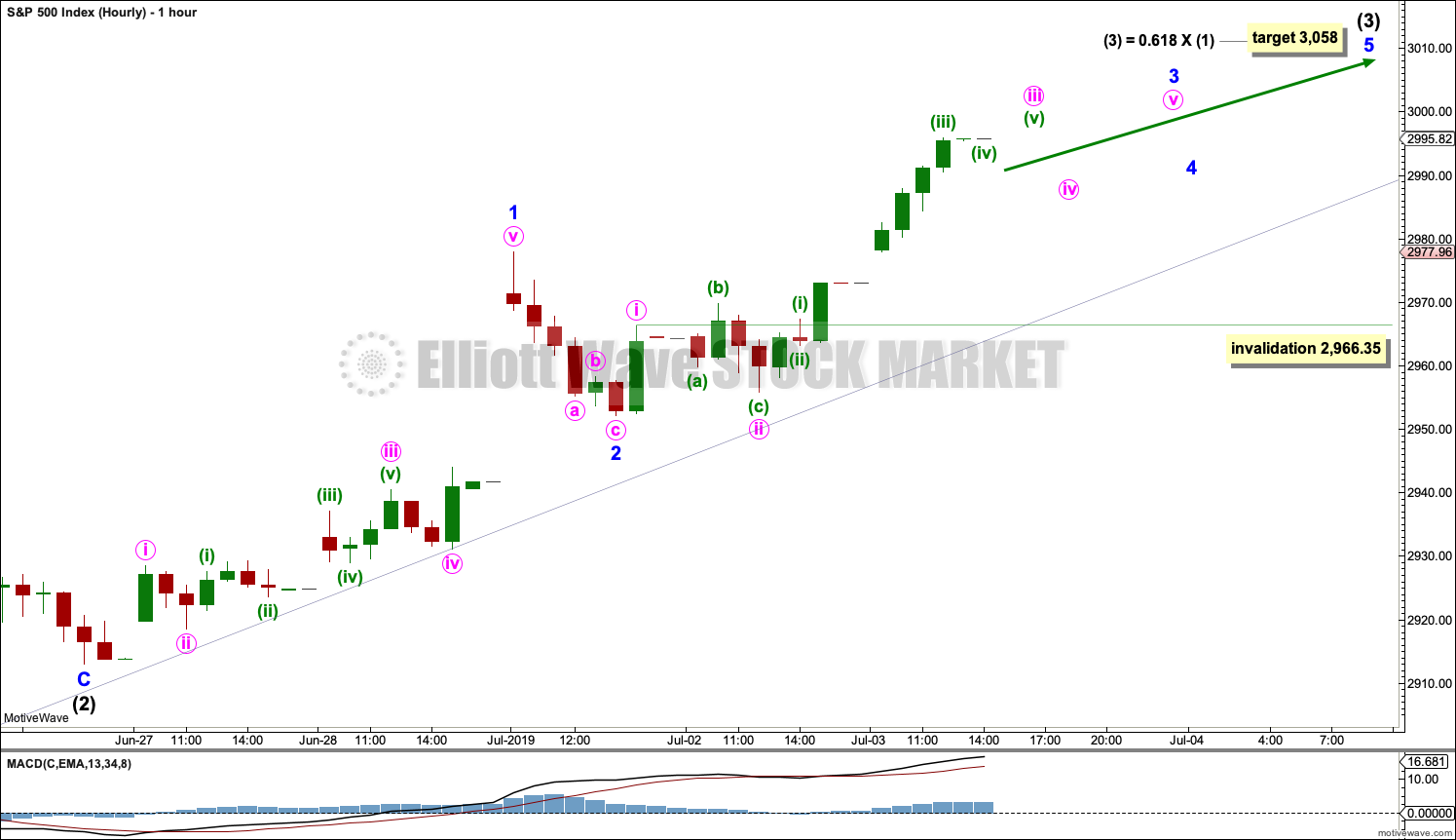

HOURLY CHART

Intermediate wave (3) within primary wave 3 may have begun. So far it is exhibiting an increase in strength.

The target calculated fits with higher targets at higher degrees, and the limit on the weekly chart.

Intermediate wave (3) may only subdivide as an impulse. Within the impulse, minor waves 1 and 2 may be complete. Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute wave iv may not move into minute wave i price territory below 2,966.35.

Pullbacks are currently finding support at the lower edge of the best fit channel. They may continue to do so while intermediate wave (3) nears its end.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

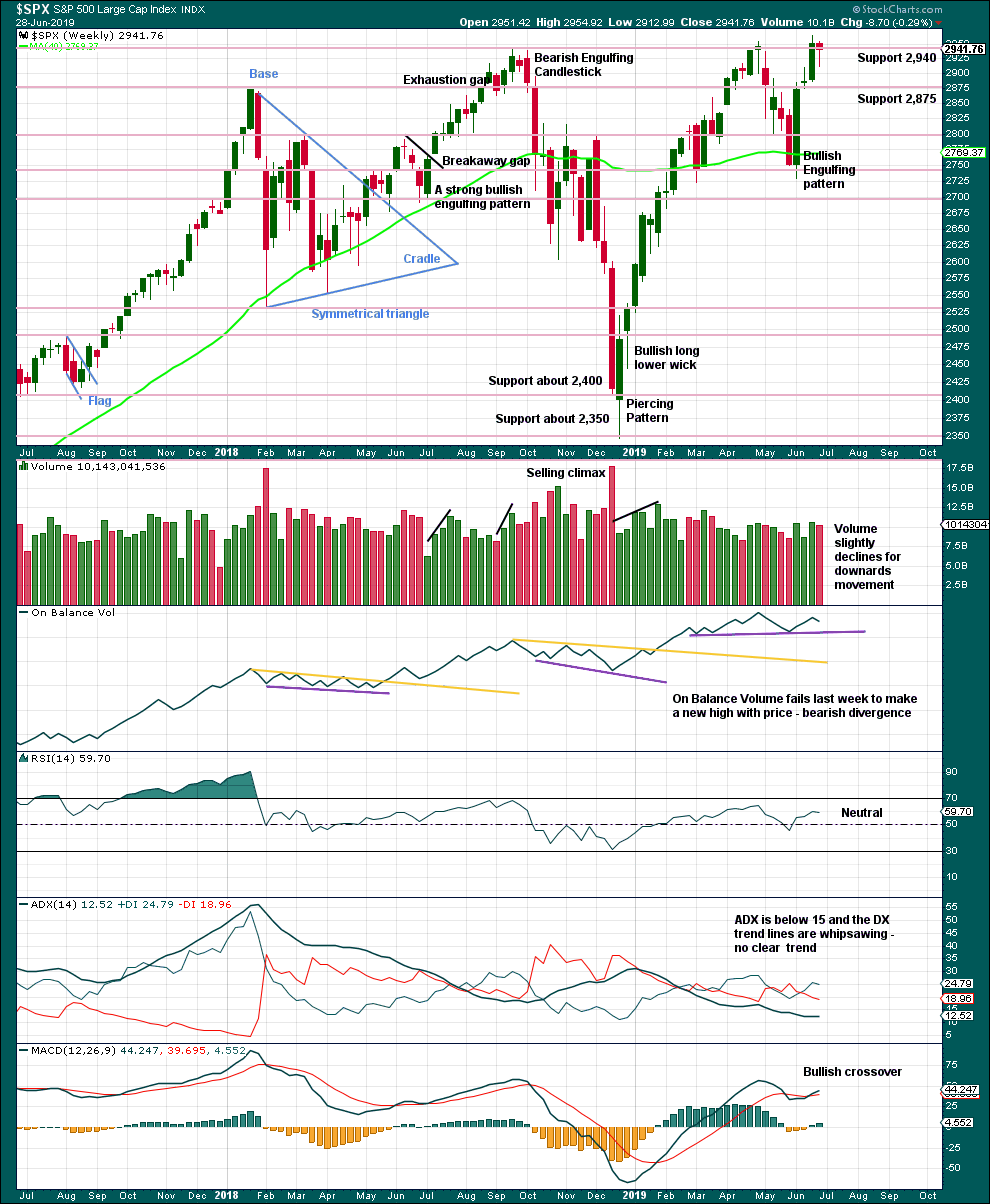

Click chart to enlarge. Chart courtesy of StockCharts.com.

A long lower wick suggests more upwards movement this week.

DAILY CHART

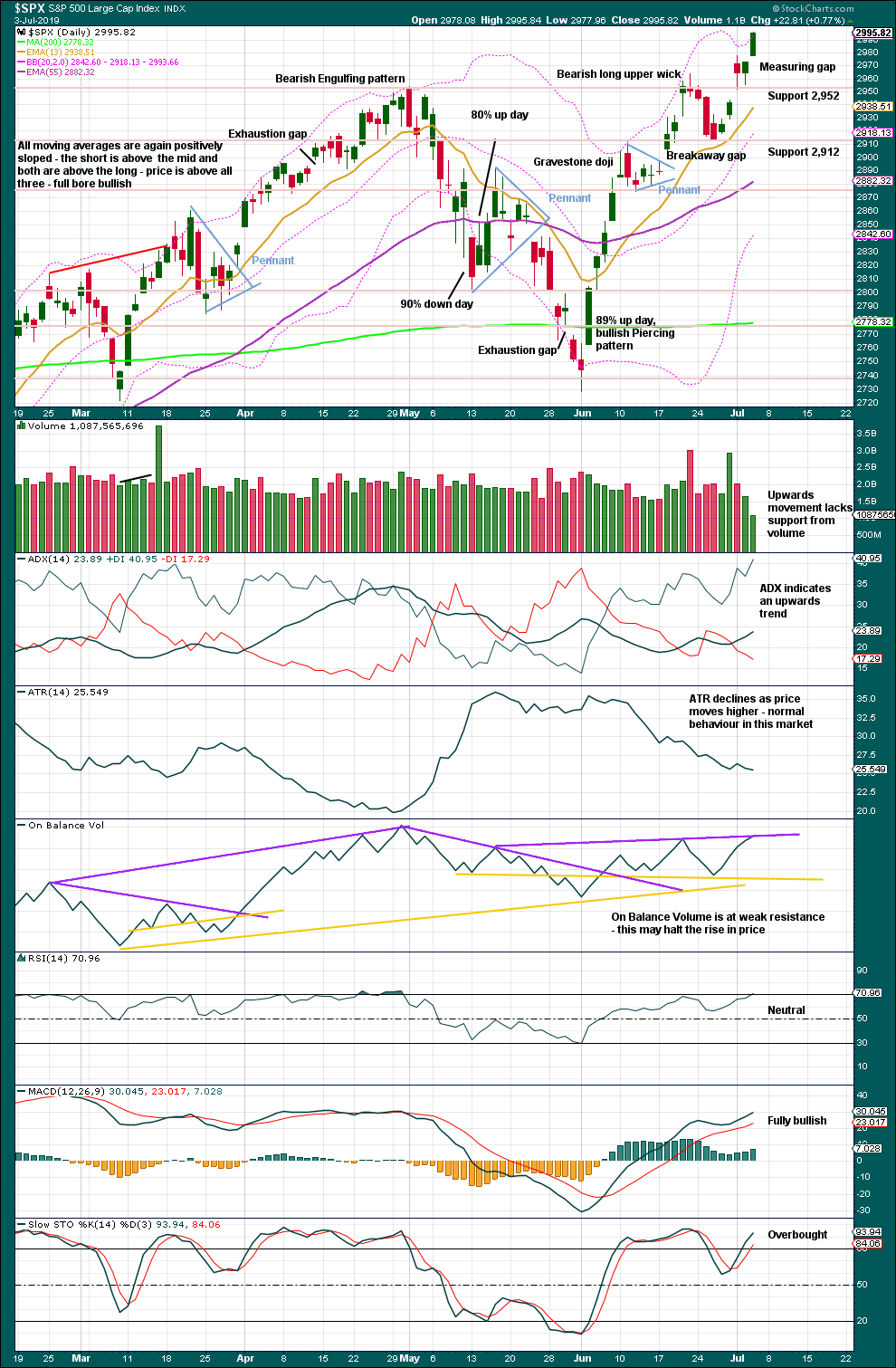

Click chart to enlarge. Chart courtesy of StockCharts.com.

Rising price on light and declining volume has been a feature of this market now for years at all time frames. While some support from volume is expected as likely for the Elliott wave count which expects the middle of a third wave may be unfolding, it is not necessary to see in current market conditions.

Another gap today may be another measuring gap. It gives a target at 2,998.95, which has almost been met. The shaven head of today’s candlestick strongly suggests more upwards movement tomorrow.

Lighter volume today is not of a concern given this was a short trading session as New York closed at 1 p.m. for the Fourth of July holiday tomorrow.

BREADTH – AD LINE

WEEKLY CHART

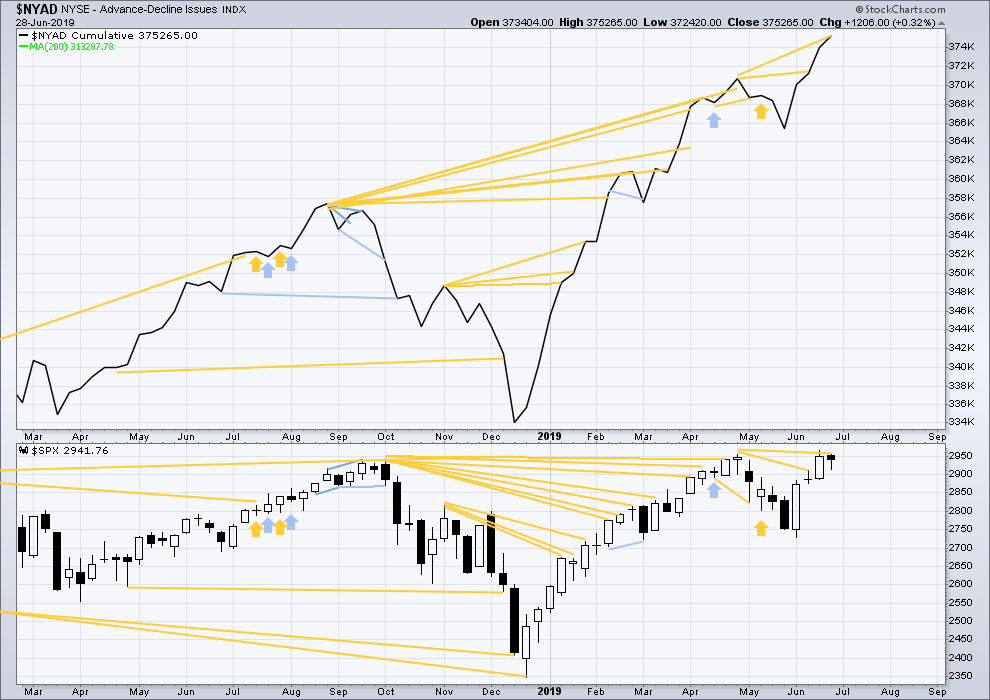

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid October 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Three weeks ago large caps made new all time highs, but mid caps are a little distance off doing so and small caps are lagging far behind. This is normal in the latter stages of an aged bull market.

For the shorter term, there is strength within mid and large caps. Last week both have made new short-term swing highs above prior highs of the 20th of June.

DAILY CHART

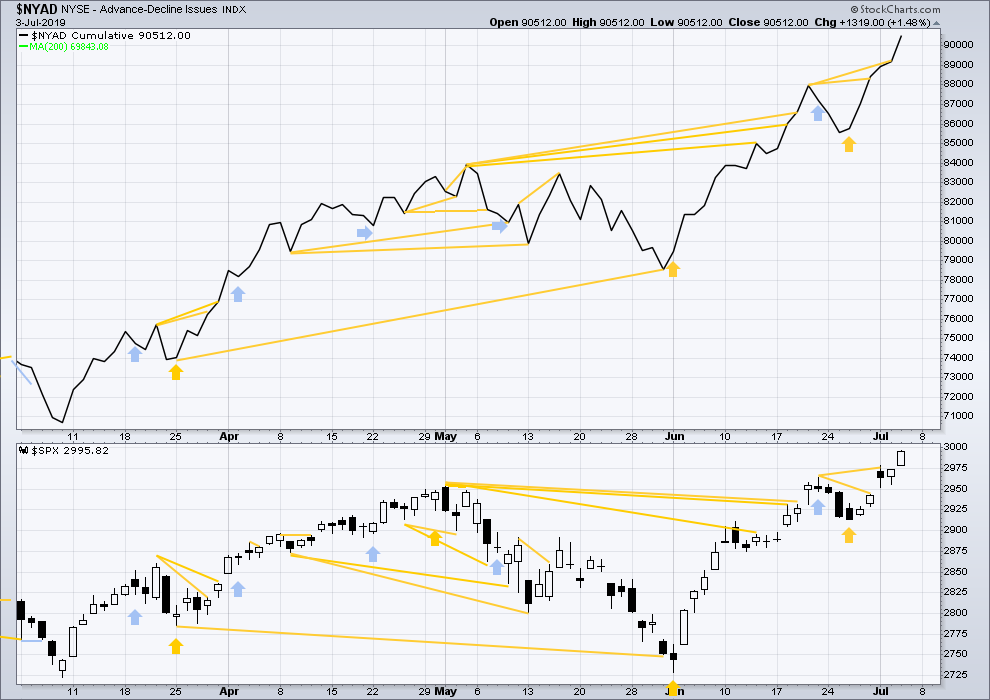

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line has made a new all time high again today along with price. Upwards movement from price has support from rising market breadth, which is bullish.

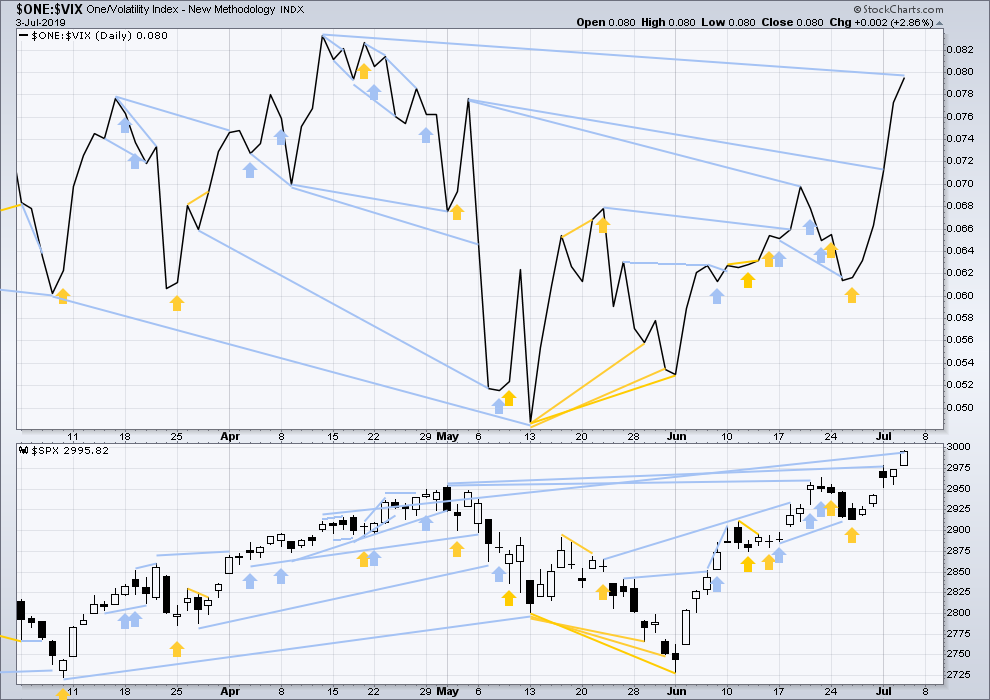

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Long-term bearish divergence remains. It may develop further before the upwards trend ends.

Last week price moved sideways and inverted VIX has moved slightly higher. Upwards movement within the week has support from declining VIX, which may be interpreted as bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has today moved strongly higher with price. Price has made a new all time high, but inverted VIX remains below the mid-term high of the 12th of April and below its all time high on the 8th of August 2018. Mid and long-term bearish divergence remains.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 09:15 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

After no surf for 2 months we tried to surf yesterday. Both of us were wobbly, and it was such a shame because the waves were a nice solid 3ft and clean peeling A frames.

Cesar surfed only 35 minutes. Normally in those kind of excellent conditions we’d be out for about 3 hours, getting 20-30 waves each (I have a GoPro and film the session and can count my waves). So for only 1/2 an hour and Cesar only 3 waves and me 2, that’s pathetic.

Surfing really is a physically demanding sport, and we’re woefully out of shape! It may take a week or two of good waves to get back into our usual surfing shape now.

Anyway, I just wanted to share that with you all. It’s freezing cold down here in NZ, the middle of our winter and the water is COLD. Full 4:3 suits with hoods, booties and gloves. Still stoked!

So happy to be home in IMO the most beautiful country in the world (but I know I’m biased).

Ohhhhh dear. I just wont. I won’t utter a peep.

It’s okay. Things are looking up. Managed 1.5 hrs this morning and lost count of my waves, so that’s better. Still not back in full form, but it won’t take long.

Fingers and toes in danger of frost bite though 🙂

Good morning everybody!

The low today has bounced up off the support line perfectly, and minute iv remains just above minute i price territory. The invalidation point remains intact.

For those of you who have Motive Wave software it will try and tell you that a fourth wave can’t overlap second wave price territory. But that’s not the rule at all. The rule is a fourth wave may not overlap first wave territory, and here the rule is respected. When MW tells me it’s wrong I choose to “ignore issues”.

Now I’ll wait for minute v to move above the end of minute iii to avoid a truncation, in other words, for another new ATH. When that’s done the invalidation point moves up to the end of minor 1 at 2,977.93 and we may then look out for the next pullback to be labelled minor 4.

Keep expecting the support line to hold, until it doesn’t. I’d expect it to hold until intermediate (3) is complete. Intermediate (4) may break below the line.

You’ve been seeing it well Lara, thank you much!

Here’s the squeeze with more sensitivity at work on RUT weekly. All the squeeze action (black dots on the bars, far less chart clutter than the traditional squeeze indicator across the bottom) from the first half of 2018 doesn’t show on the traditional squeeze indicator…but does when you adjust the keltner channel deviation from 1.5 to 1.8. The current squeeze state does show on the traditional indicator as well, but this more sensitive one starts one candle earlier. I will say, this weekly squeeze on RUT while it powers up is another strong bullish indicator. In my opinion.

SPX daily shows the lower channel (wedge?) to be tagged and turned off of, and right now at least the action looks pretty bullish.

Yeah looks pretty strong, looks like a 3rd wave…. so i guess down move in the morning was another second wave of some degree….. let’s see how it closes..

Also Lara will guide in the right direction later 🙂

Anyone use the squeeze indicator? It is described re: the settings of the Bollinger band (length = 20, deviation = 2.0) and Keltners (length = 20, deviation = 1.5) in the book “Mastering the Trade”, so those are not a secret. Now there is a “Squeeze Pro” indicator, which provides more sensitivity. For many hundreds of $’s you too can have it along with a training class on how to use it. I watched the promo videos, lots of chart examples. Funny thing, when I adjust my homegrown squeeze indicator to use a Keltner deviation of 1.9 instead of 1.5…I get results very similar (but not exactly) to the increased sensitivity “squeeze pro”. Hmm. Close enough. Think I’ll save my $600 or $800 or whatever $’s. Indicator salespeople….

Wow, didn’t expect that after ES such a good rally

New York is closed today for the 4th of July holiday, and so there is no new data to analyse.

Analysis resumes tomorrow.

“The middle of the third wave may have passed today.”

(A comment from yesterday)

What degree wave are you referring to ? Primary or Intermediate ?

Thanks Lara

All of the above. Also, minor.