A small upwards day fits expectations for the short term. At the end of the week, volume and breadth are pointing to the direction for next week.

Summary: The upwards trend is expected to fairly likely resume with strength next week. The pullback may be over at the low of the 26th of June. Strong volume on Friday with new all time highs for the AD line support this view.

The next short-term target is at 3,058. This next upwards wave may exhibit further strength. Look for corrections to continue to be very shallow and brief.

The mid-term target remains at 3,104 for a more time consuming consolidation or pullback, which may also be shallow.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

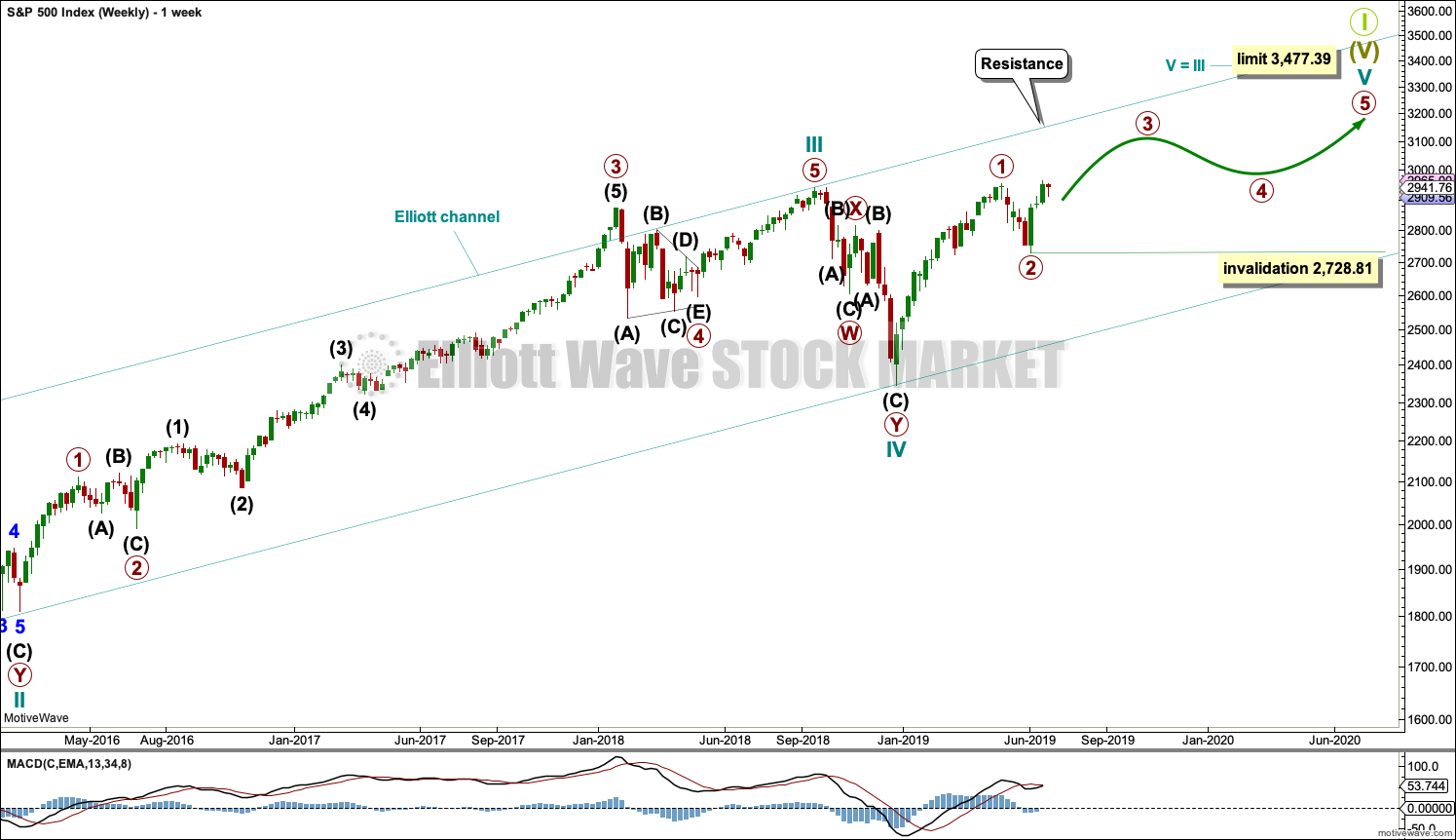

WEEKLY CHART

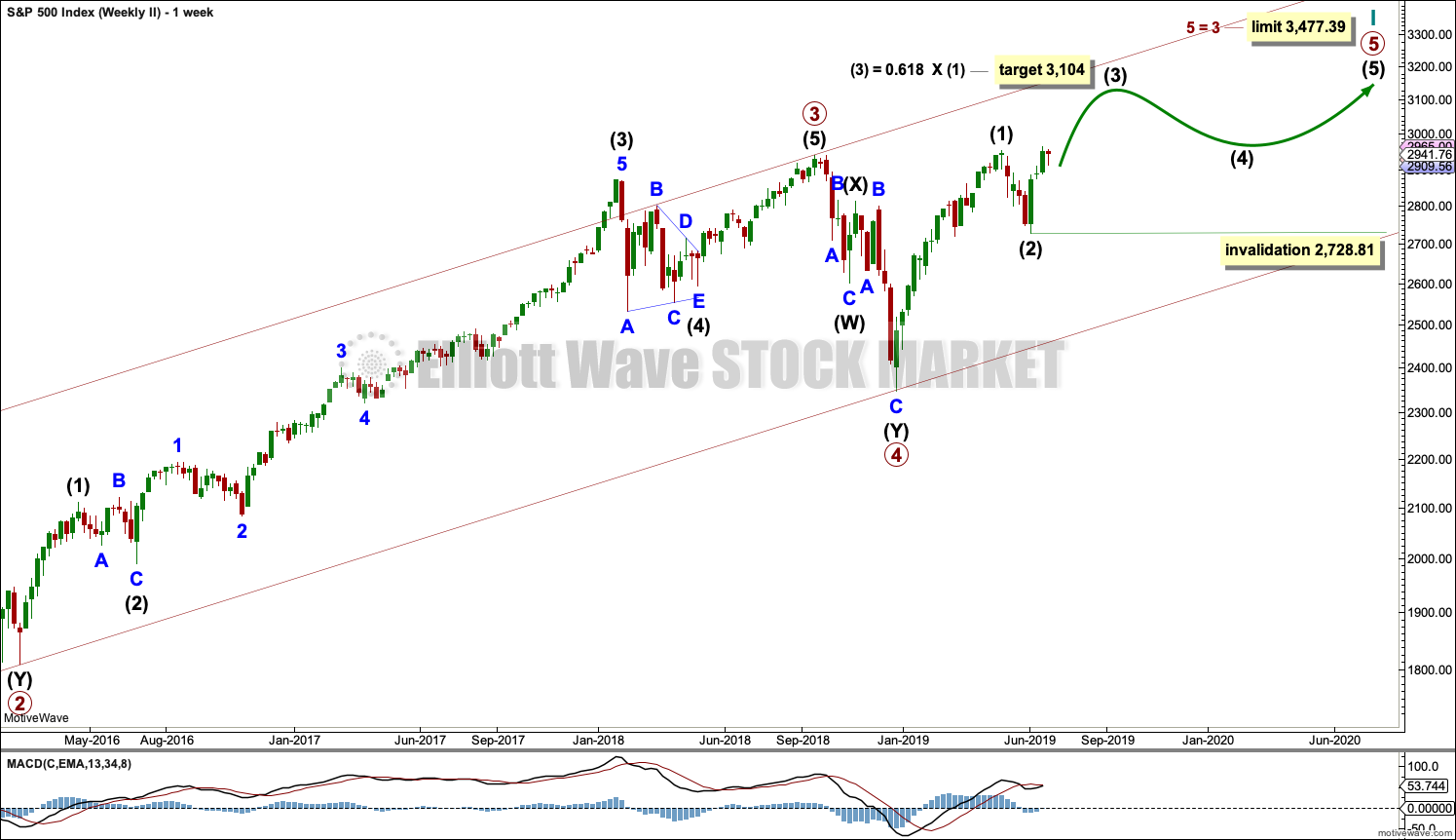

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary waves 1 and 2 may now be complete. Within primary wave 3, no second wave correction may move beyond its start below 2,728.81.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

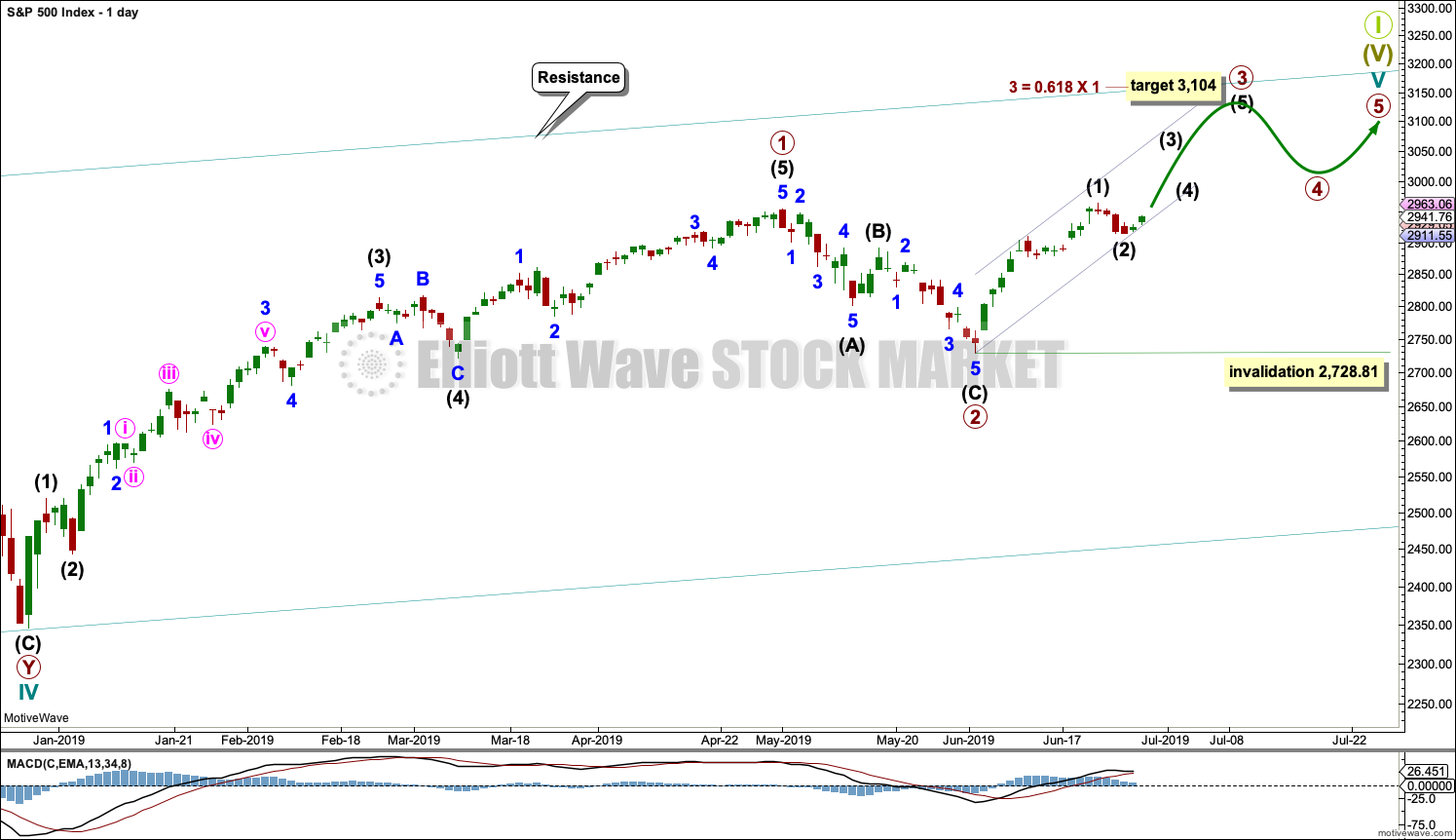

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary waves 1 and 2 may be complete.

Primary wave 3 must move above the end of primary wave 1 (this rule has now been met). Primary wave 3 may only subdivide as an impulse. Within the impulse, intermediate wave (1) may have been over at the last high. Intermediate wave (2) may now also be complete, but if it continues lower it may not move beyond the start of intermediate wave (1) below 2,728.81.

When primary wave 3 is over, then primary wave 4 may be a shallow sideways consolidation.

Thereafter, primary wave 5 should move above the end of primary wave 3 to avoid a truncation.

Primary wave 1 lasted 86 sessions, 3 short of a Fibonacci 89. Primary wave 2 lasted 22 sessions, 1 longer than a Fibonacci 21. Primary wave 3 may end about a Fibonacci 55 sessions, give or take two or three sessions either side. This is a rough guideline only.

So far primary wave 3 has lasted 19 sessions.

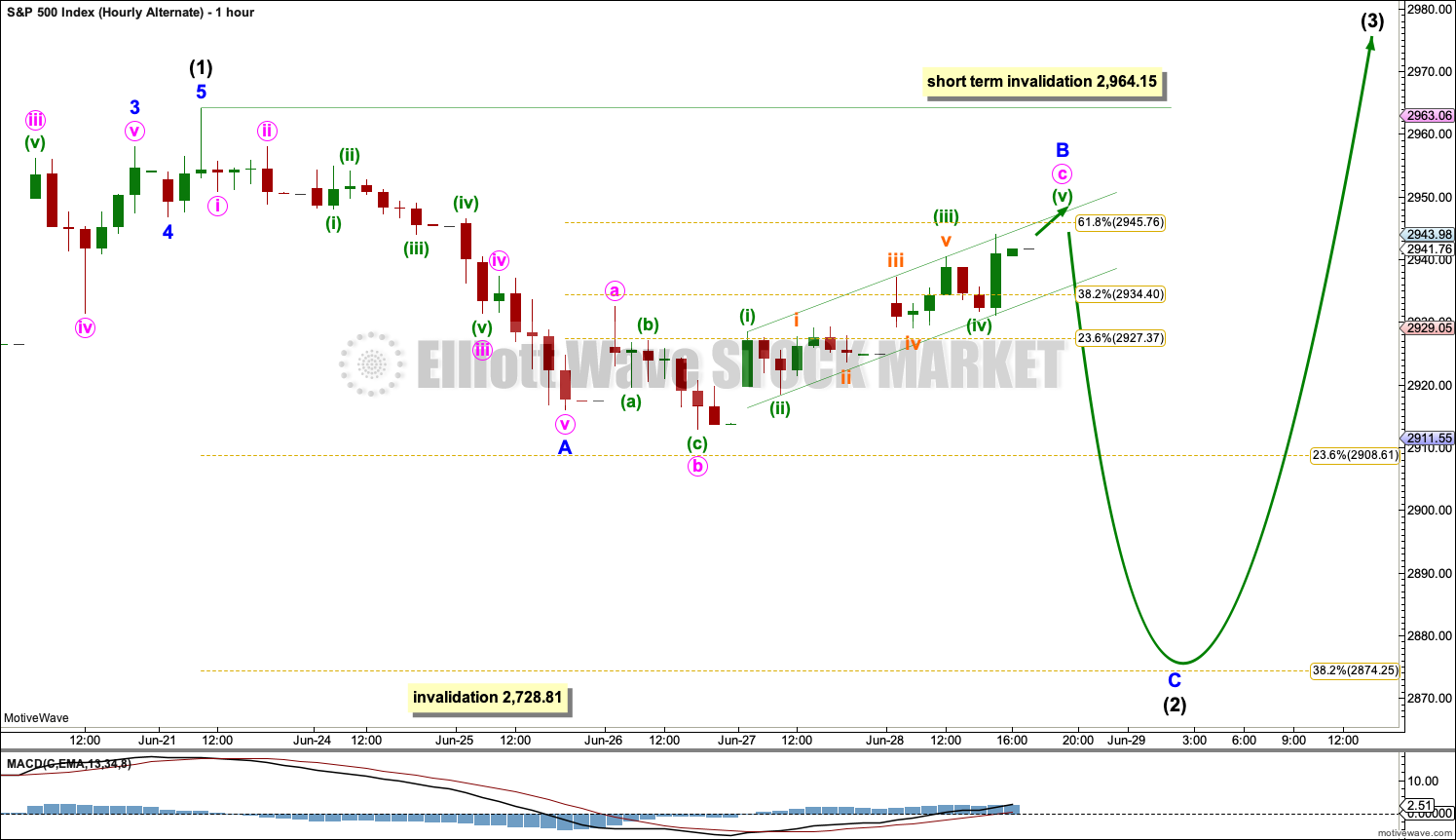

MAIN HOURLY CHART

It is possible that intermediate wave (2) may be a quick shallow zigzag.

Intermediate wave (3) within primary wave 3 may have begun. It should have support from volume, and it should exhibit an increase in strength.

The target calculated fits with higher targets at higher degrees, and the limit on the weekly chart.

Intermediate wave (3) may only subdivide as an impulse. Within the impulse, minor wave 2 may not move beyond the start of minor wave 1 below 2,912.99.

ALTERNATE HOURLY CHART

This short-term wave count expects that intermediate wave (2) may be continuing lower.

Intermediate wave (2) would most likely subdivide as a zigzag. Minor wave A would most likely subdivide as a five wave structure, and it may be a complete impulse. Minor wave B may may not move beyond the start of minor wave A above 2,964.15. Minor wave B may be continuing higher as an expanded flat. It may not move beyond the start of minor wave A above 2,964.15.

When minor wave B may be complete, then the Fibonacci ratio between minor waves A and C may be used to again calculate a target for minor wave C to end. The target calculated will probably be more shallow than the 0.382 Fibonacci ratio.

The strong upwards pull of intermediate wave (3) within primary wave 3 just ahead may force intermediate wave (2) to be relatively shallow.

At the end of this week, this alternate hourly chart does not have good support from classic technical analysis: strong volume on Friday does not look like a B wave. This alternate hourly wave count may be discarded early next week if upwards movement continues to show strength as the main hourly chart expects.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

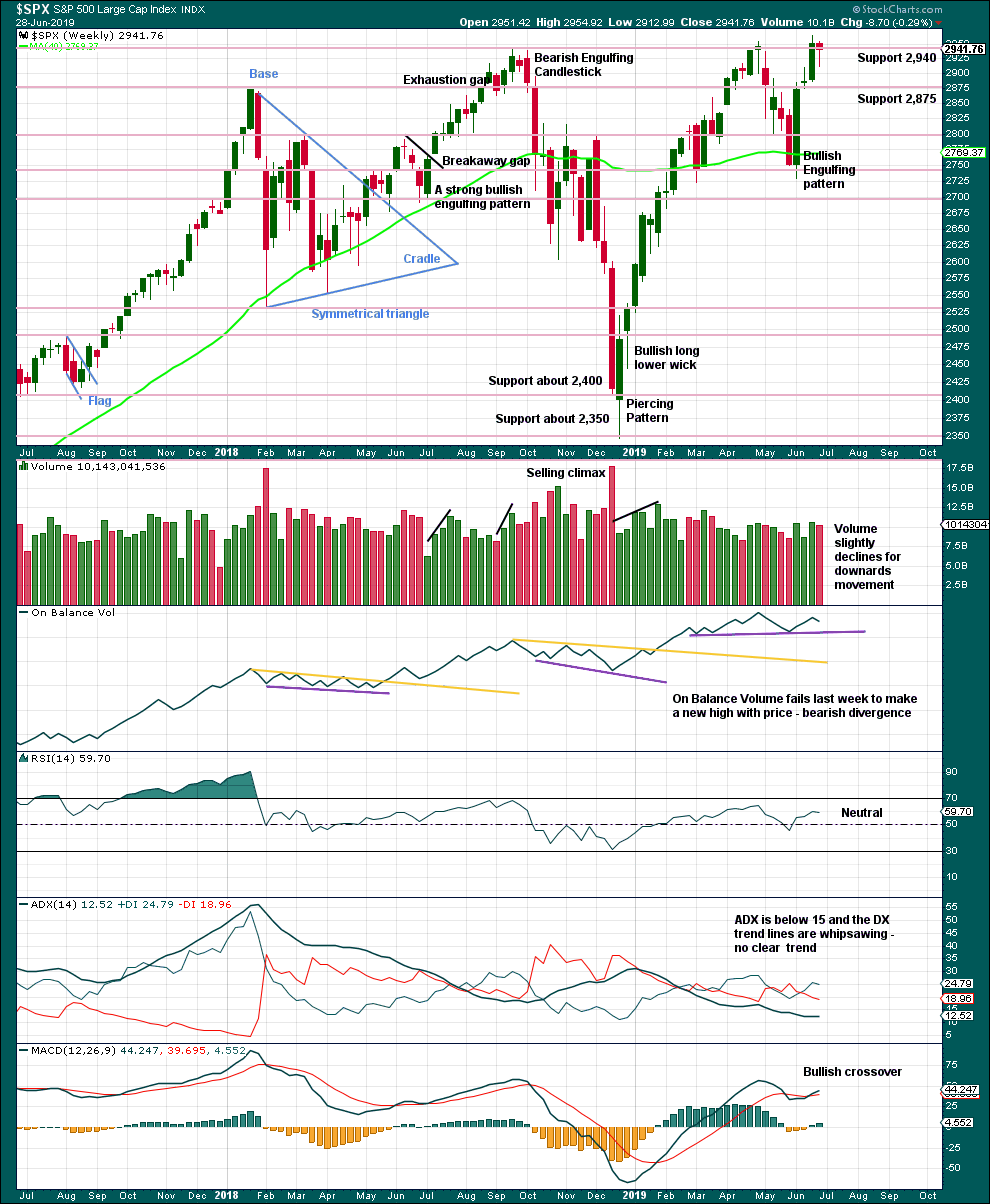

Click chart to enlarge. Chart courtesy of StockCharts.com.

A long lower wick suggests more upwards movement next week.

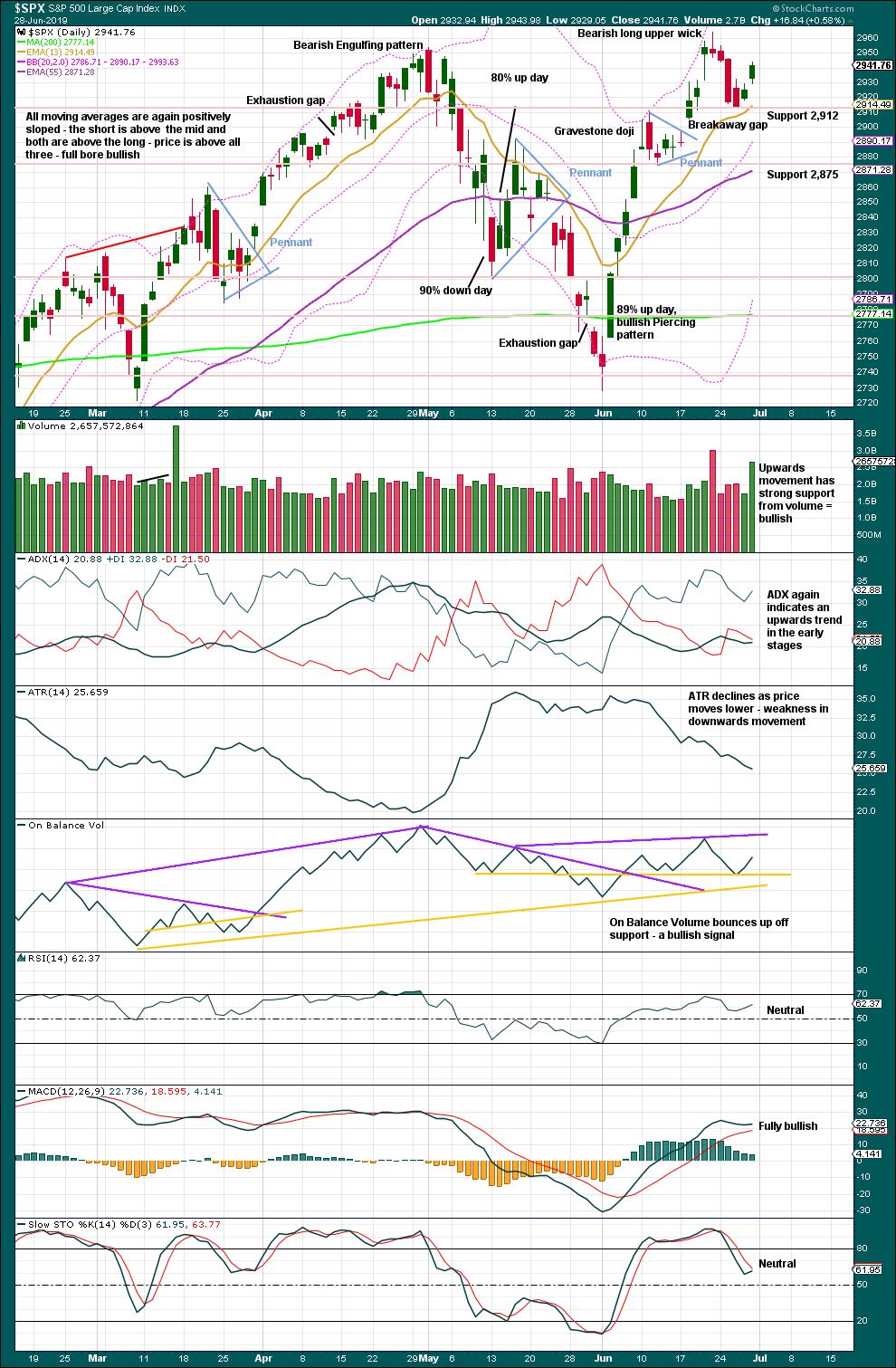

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support may have held about 2,912. The bounce has strength; the pullback may be over.

RSI and Stochastics are not extreme. ADX indicates an upwards trend in its early stages. This chart is very bullish.

BREADTH – AD LINE

WEEKLY CHART

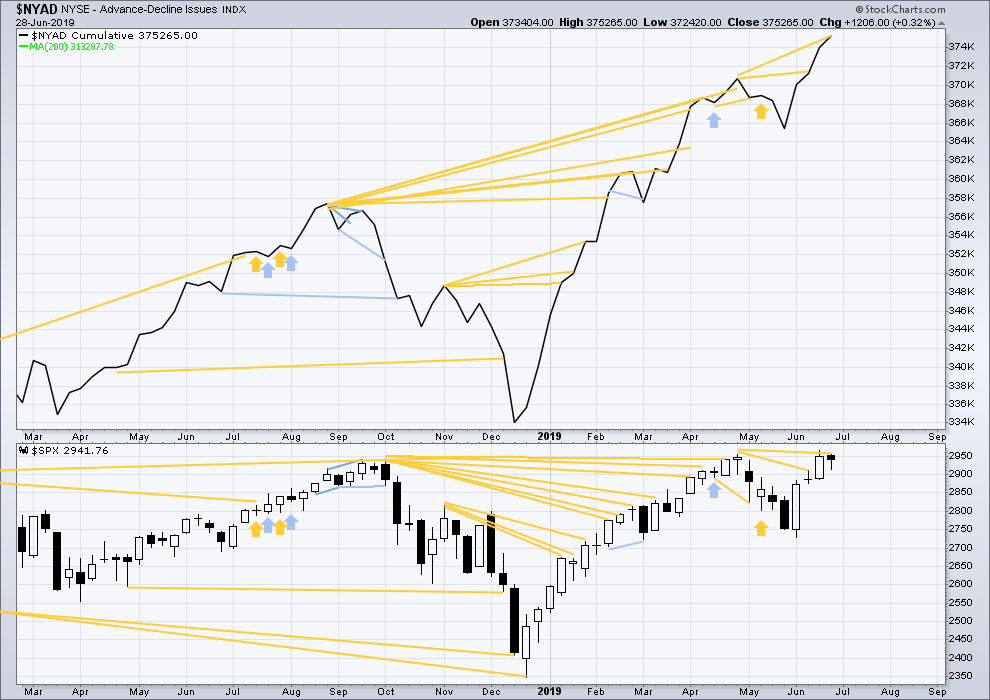

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid October 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Two weeks ago large caps made new all time highs, but mid caps are a little distance off doing so and small caps are lagging far behind. This is normal in the latter stages of an aged bull market.

For the shorter term, there is strength within mid and large caps. This week both have made new short-term swing highs above prior highs of the 20th of June.

DAILY CHART

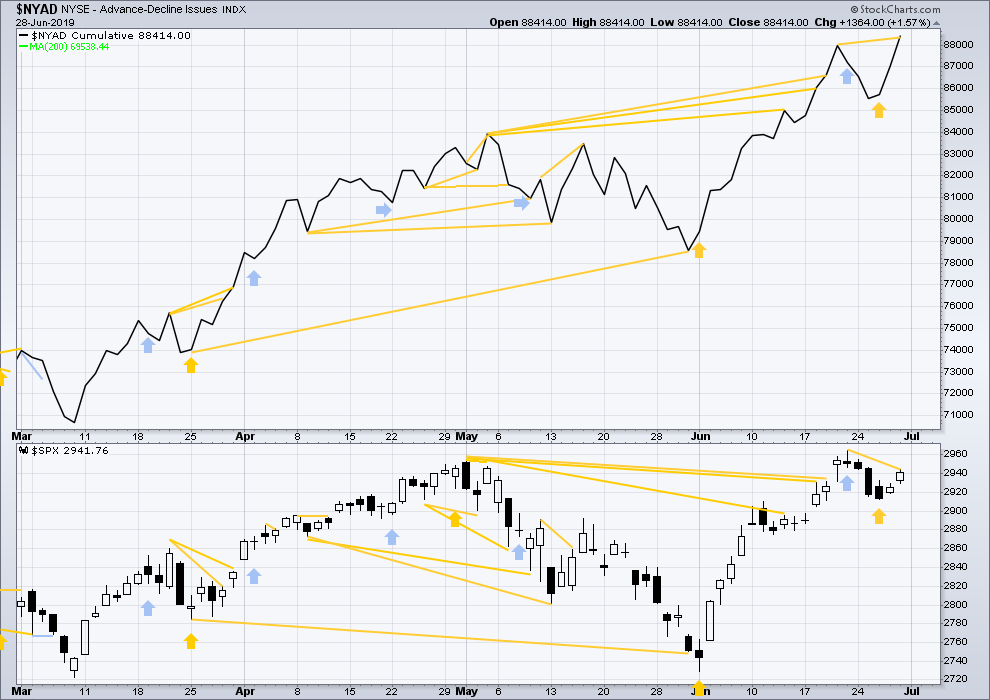

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line has made a new all time high on Friday, but price has not. This divergence is bullish.

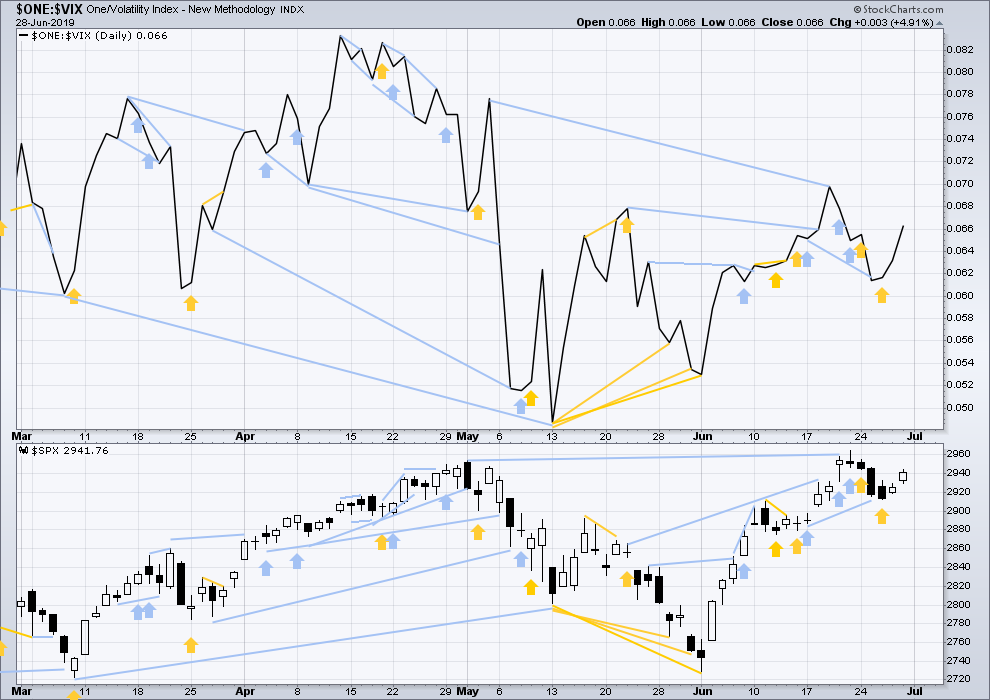

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Long-term bearish divergence remains. It may develop further before the upwards trend ends.

This week price moved sideways and inverted VIX has moved slightly higher. Upwards movement within the week has support from declining VIX, which may be interpreted as bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today both price and inverted VIX have moved higher. Neither have made new highs. There is no new divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 07:53 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

I’m back home and back to a normal schedule today. Analysis will be published after NY close as normal again.

Updated hourly chart prior to NY close:

There may now be a series of four first and second waves complete; minuette, minor, intermediate and primary. There may be a strong jump in increase ahead this week.

Minute ii fits as an expanded flat.

3 hour tail candle triggered my long yesterday…. so beautiful, this is on the SPXL

also they didn’t close the gap…

Updated daily, hourly and classic TA charts below with a brief commentary.

Summary: Another new all time high from price was expected and has support from rising market breadth.

The Elliott wave structure is incomplete. The target for intermediate (3) remains at 3,058, and the target for primary wave 3 remains at 3,014.

Daily chart updated:

A third wave at intermediate and minor degree may be in the early to mid stages.

For now I will leave the invalidation point as is, but shortly it may be moved up to the end of intermediate wave (2).

Targets and the wave count remain the same. Price is behaving as expected.

Hourly chart updated:

I am leaning towards seeing minor wave 2 as over at todays low. It would then be brief and shallow, which is expected due now to the strong upwards pull of a third wave at minor, intermediate and primary degree.

However, it is also possible it could continue sideways or lower. The invalidation point must remain at the start of minor wave 1.

Classic technical analysis updated:

If the gap up today is a measuring gap (or breakaway gap) it may offer support at 2,943.98.

If it is a measuring gap then the short term target is 2,983.21 which is almost met.

Today’s candlestick completes as a spinning top. This is not a reversal, it simply represents a balance and indecision today. This can occur within a trend, as a small pause.

AD line daily chart:

A new high today from price has support from a new high from the AD line. Upwards movement has good support from rising market breadth. This is bullish.

VIX daily chart updated:

A new all time high today from price comes with a new short term swing high from inverted VIX, but mid term bearish divergence remains as does long term divergence.

Open up my short term longs….

Nice. What triggered you long?

I watched uvxy and vix closely today and felt there was still a sense of security for the upside. I don’t always trust month end and 1st day of month trading due to rebalancing. Especially at the start of new fiscal year for many…

this?

Don’t think it’s a leading diagonal, but this bears watching.

If that’s a 1-2-3-4 (vs. Lara’s 1-2-3), then 3 is shorter than 1 and 5 is limited to the white horizontal line overhead. Watch for resistance and possibly wave completion around those extension fibo’s.

Today feels very confusing.

Agreed.

I have learned that when you are up that much that fast…. a portion of the winning position must be sold. And then SOH awaiting more information.

Good Monday to all. I’ve seen in the past and wonder now whether this is a completed 2 moving into an early 3 or the latter stage of a B wave in an expanded flat. I understand there is great latitude for subjectivity, but can anyone provide any tips they use to confirm one way or the other. Thanks

I lean on Lara’s judgement which is based on lots of factors, primarily the underlying technical analysis. I was thinking “this is pretty strong for a B wave” late Friday; she confirmed that thinking over the weekend for me. Though I defensively closed a couple of profitable positions going into the weekend thinking we would see that C down; well, discretion is the better part of valor! All that money is shoved back in now.

Hi everybody. I’ve just sent a email to all members, but I’ll post this here in case anyone misses that.

I’m flying from the USA back home to New Zealand today. It’s a 14 hour flight. I then have a 3 hour drive to get home. I’ll be unable to give you a full updated analysis for the Monday 1st July session, but I will post updated charts for daily and hourly and classic technical analysis here in comments, with commentary.

Thank you all very much for your patience and understanding. Normally I schedule travel on the weekends to avoid this, but in this case I was unable to do so.

Also, thank you very much to the USA for a really friendly and enjoyable visit. I was able to also catch up with a member in Austin TX which was a lot of fun.

I am glad you had a great trip and enjoyed the USA. We do hope to see you again!

Gap up city!

Yeah, huge pop! Missed that bus.

Yes, me too. I was waiting for a low below 2900 for the Intermediate 2 low. So I missed adding long positions in my short term trading account. The good news is I am 100% long in my long term account which dwarfs the small term account. Today’s move to new ATH’s will be a pleasant addition to my current long profits.

I am leaving tomorrow or Wednesday for a long trek in the mountains. Thus, I will stop pursuing a short term trade. I don’t like to go away with open positions in a shorter term trading account even though I would have stop loss orders in place. So I will leave with no thoughts as to the market and give my mind a rest. I’ll be back in a week or so for a couple of days before I head out on another adventure. Take care all.

Enjoy and thanks for keeping the bears at bay Rodney.

Gap up city!

Woo Hoo!

You rascally rabbit you! Hmmmmm.