Downwards movement was expected. A lower low and a lower high fits this expectation for the session.

Summary: The first large pullback within cycle wave V may have arrived. It may be labelled either intermediate wave (1) or primary wave 1. The target is at 2,472, which may be met in three or five weeks.

The bigger picture still expects that a low may now be in place. Further confidence in this view may be had now that price has made new high above 2,631.09. The target is at 3,045 with a limit at 3,477.39. The Elliott wave count has support classic technical analysis.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

The monthly chart was last published here.

ELLIOTT WAVE COUNT

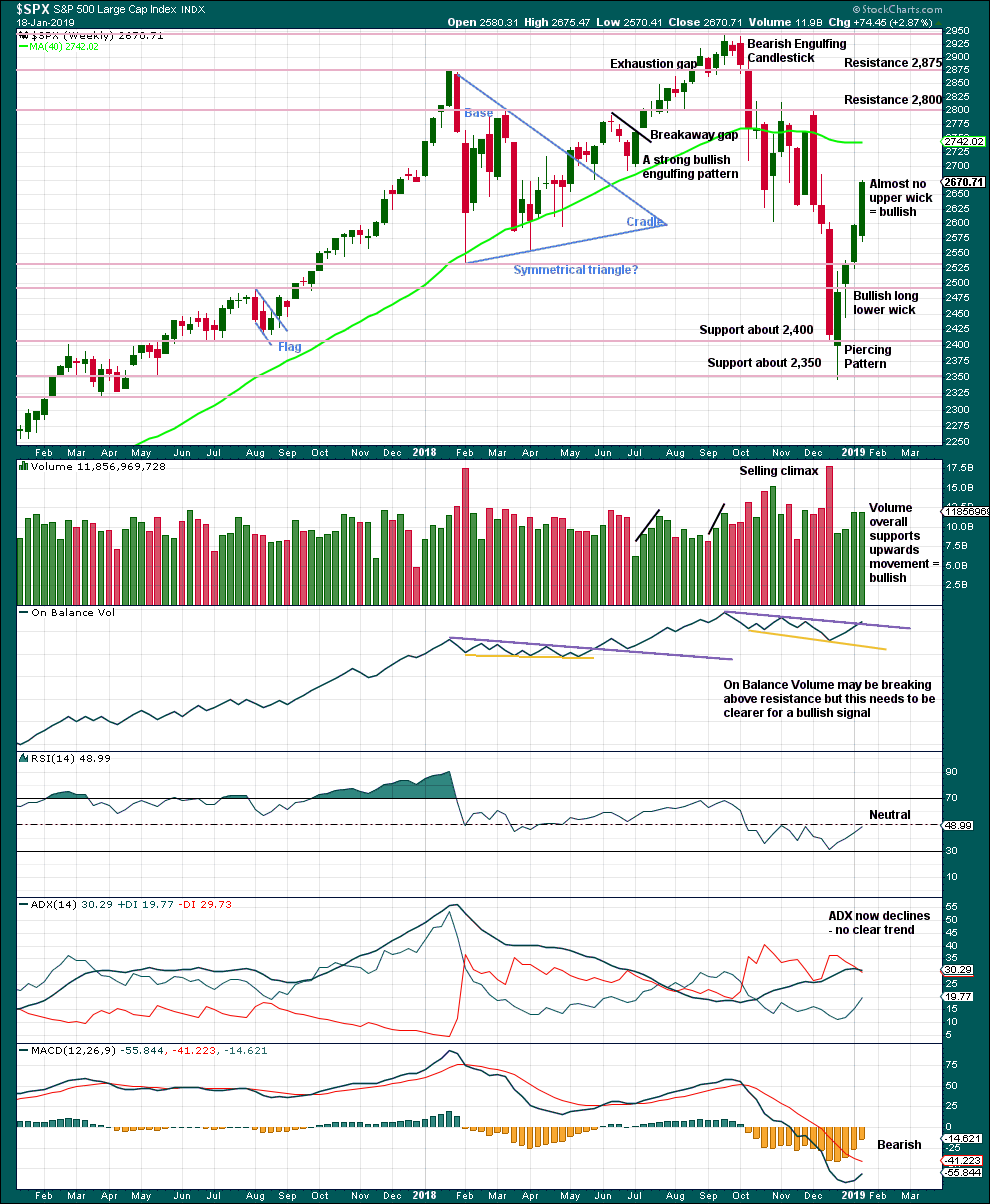

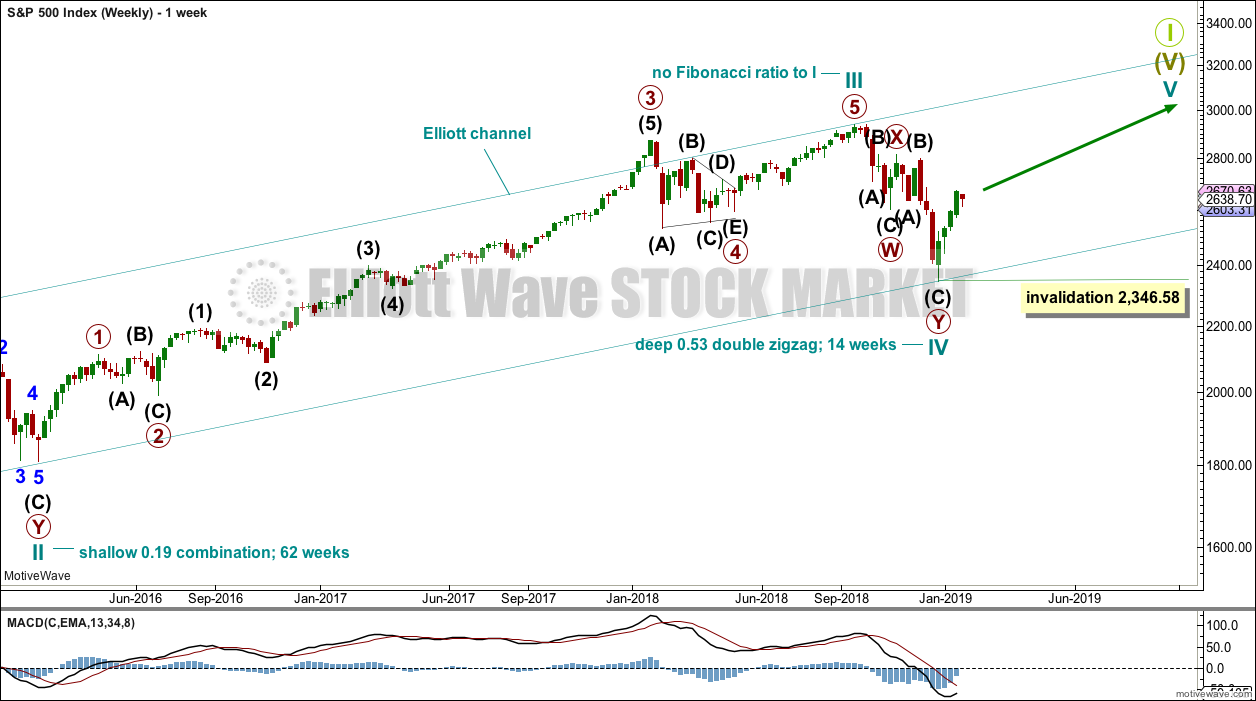

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

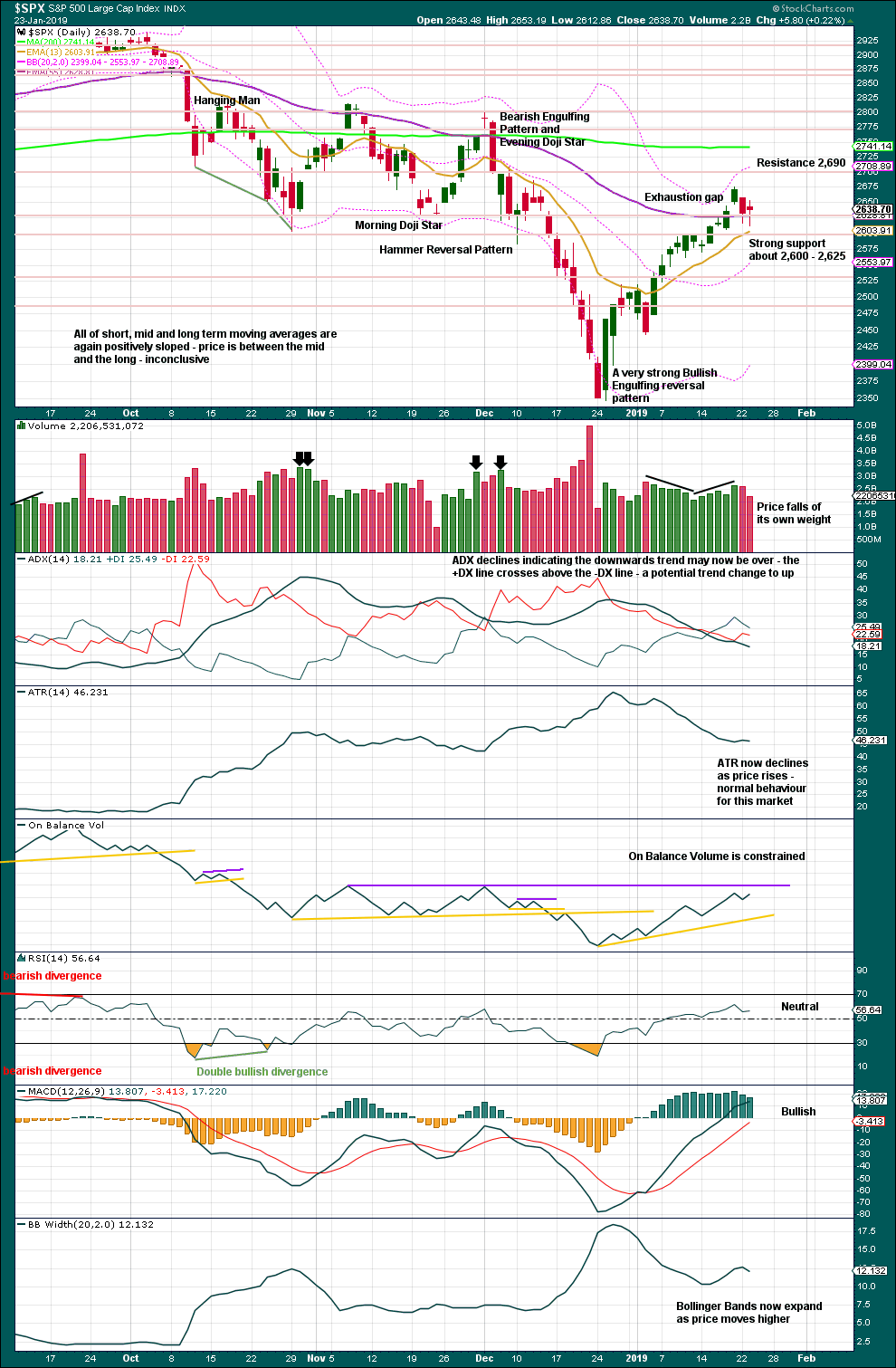

DAILY CHART

The daily chart will focus on the structure of cycle waves IV and V.

Cycle wave IV may be a complete double zigzag. This would provide perfect alternation with the combination of cycle wave II. Double zigzags are fairly common corrective structures.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Within the five wave structure for cycle wave V, primary wave 1 would be incomplete. Within primary wave 1, intermediate wave (1) may now be complete. The degree of labelling within cycle wave V may need to be adjusted as it unfolds further. At this stage, an adjustment may be to move the degree of labelling within cycle wave V up one degree; it is possible that it could be primary wave 1 now complete.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Two hourly charts are given below. The main hourly chart follows labelling of intermediate wave (1) on the daily chart. The alternate does not have as good a look.

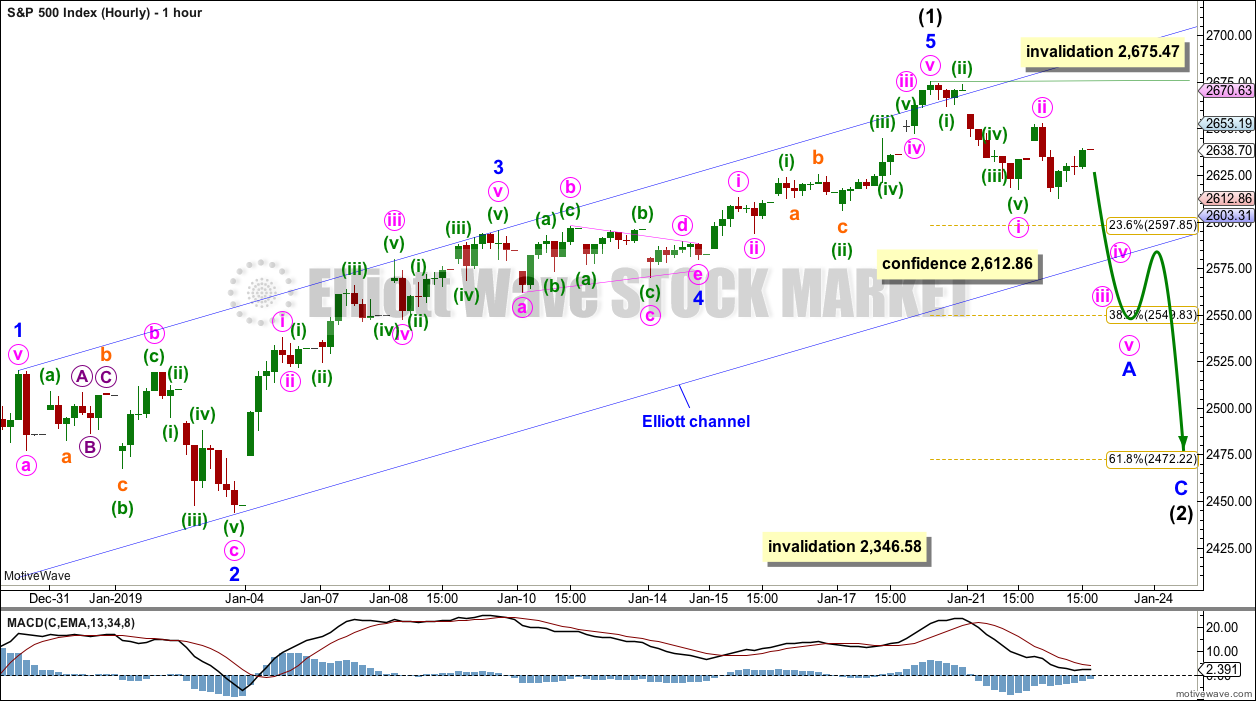

MAIN HOURLY CHART

Intermediate wave (1) may be a complete impulse.

There is perfect alternation between a shallow 0.42 zigzag for minor wave 2 and a much more shallow 0.10 triangle for minor wave 4. Minor wave 2 lasted 27 hours and minor wave 4 lasted 25 hours; their proportion is close to perfect in terms of time.

Within this wave count, minor wave 3 is shorter than minor wave 1. There is a close Fibonacci ratio between minor waves 5 and 3.

This wave count agrees with MACD. The strongest momentum is within minor wave 3. Minor wave 5 shows slightly weaker momentum.

Intermediate wave (2) looks like it may have begun with a five wave structure down. This is labelled minute wave i. If this is correct, then minute wave ii may not move beyond the start of minute wave i above 2,675.47.

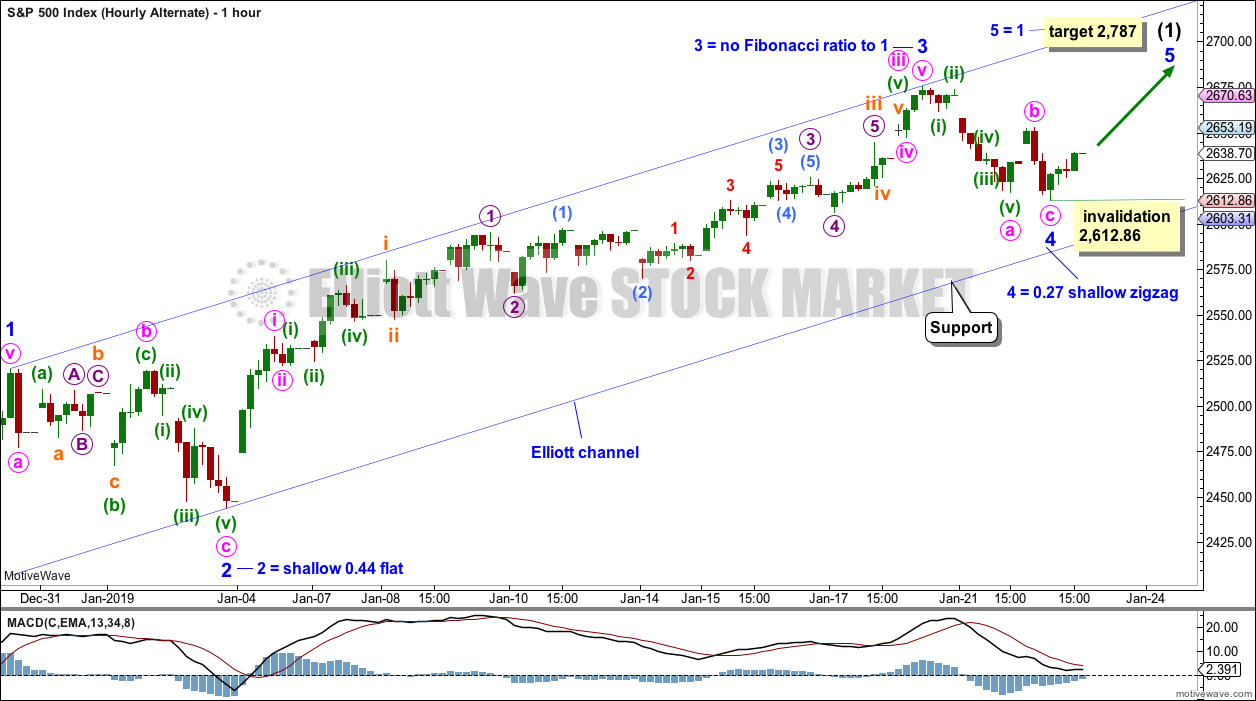

ALTERNATE HOURLY CHART

It is possible that minor wave 3 was over at the last high. This wave count ignores what looks like a triangle and on higher time frames minor wave 3 looks like a three wave structure.

Minor wave 4 may have ended today as a quick shallow zigzag. There is perfect alternation between minor waves 2 and 4.

Within minor wave 5, no second wave correction may move beyond its start below 2,612.86.

The target expects minor wave 5 to exhibit the most common Fibonacci ratio to minor wave 1.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

From the all time high to the low of last week, price moved lower by 20.2% of market value meeting the definition for a bear market.

It should be noted that the large fall in price from May 2011 to October 2011 also met this definition of a bear market, yet it was only a very large pullback within a bull market, which so far has lasted almost 10 years.

Again, last weekly candlestick has almost no upper wick. With price closing almost at the high for the week, it looks reasonable to expect more upwards movement this week.

Last week volume has very slightly declined from the prior week. The decline is so slight, this will not be read as bearish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Over a fairly long period of time this ageing bull market has been characterised by upwards movement on light and declining volume and low ATR. For the short to mid term, little concern may be had if price now rises again on declining volume. Current market conditions have allowed for this during a sustained rise in price.

It is also normal for this market to have lower ATR during bullish phases, and strongly increasing ATR during bearish phases. Currently, declining ATR is normal and not of a concern.

Considering the larger picture from the Elliott wave count, some weakness approaching the end of Grand Super Cycle wave I is to be expected.

From Kirkpatrick and Dhalquist, “Technical Analysis” page 152:

“A 90% downside day occurs when on a particular day, the percentage of downside volume exceeds the total of upside and downside volume by 90% and the percentage of downside points exceeds the total of gained points and lost points by 90%. A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals”…

and “A major reversal is singled when an NPDD is followed by a 90% upside day or two 80% upside days back-to-back”.

The current situation saw two 80% downside days on December 20th and 21st, then a near 90% downside day with 88.97% downside on December 24th. This very heavy selling pressure on three sessions very close together may be sufficient to exhibit the pressure observed in a 90% downside day.

This has now been followed by two 90% upside days: on December 26th and again on 4th January.

The current situation looks very much like a major low has been found.

The last gap is now closed indicating it is an exhaustion gap. A deeper pullback may now be expected. However, today’s session completes a doji with a lack of volume. This candlestick looks like a small pause within an ongoing upwards trend, which would support the alternate hourly wave count.

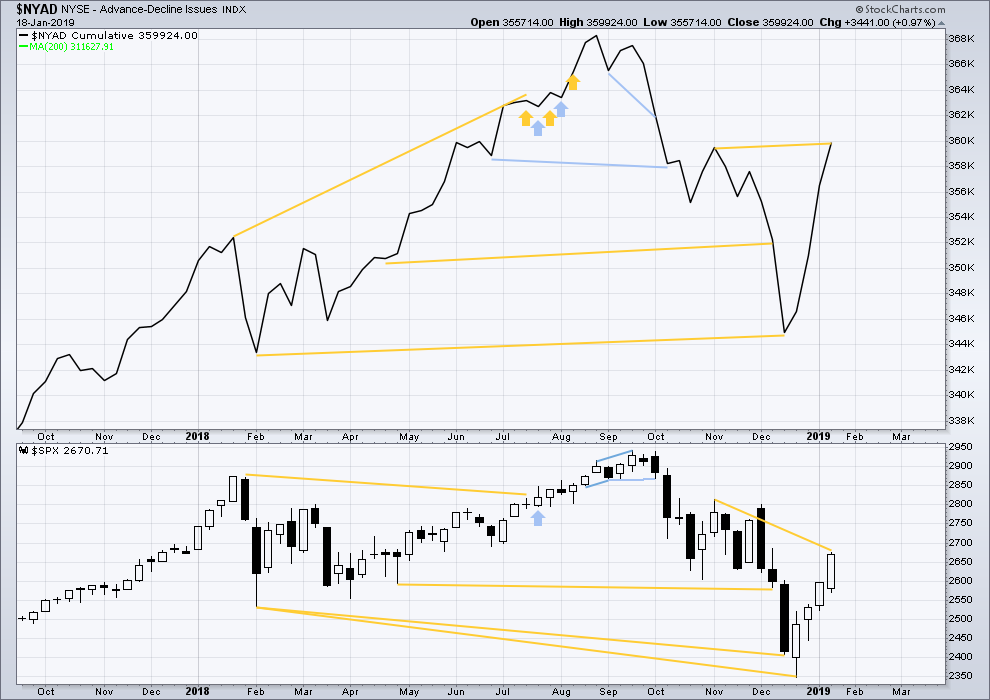

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Last week the AD line has made a new high above the prior swing high of the week beginning 5th of November 2018, but price has not. This divergence is bullish for the mid term.

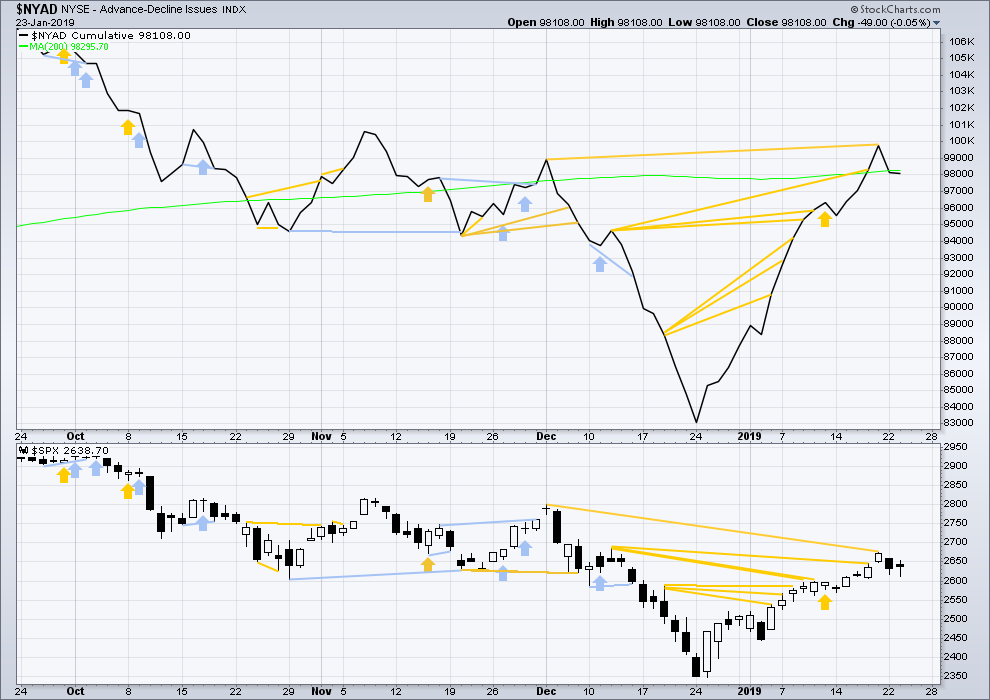

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

There is now a cluster of bullish signals from the AD line. This supports the main Elliott wave count.

Today price moved slightly lower and the AD line slightly declined. There is no new divergence.

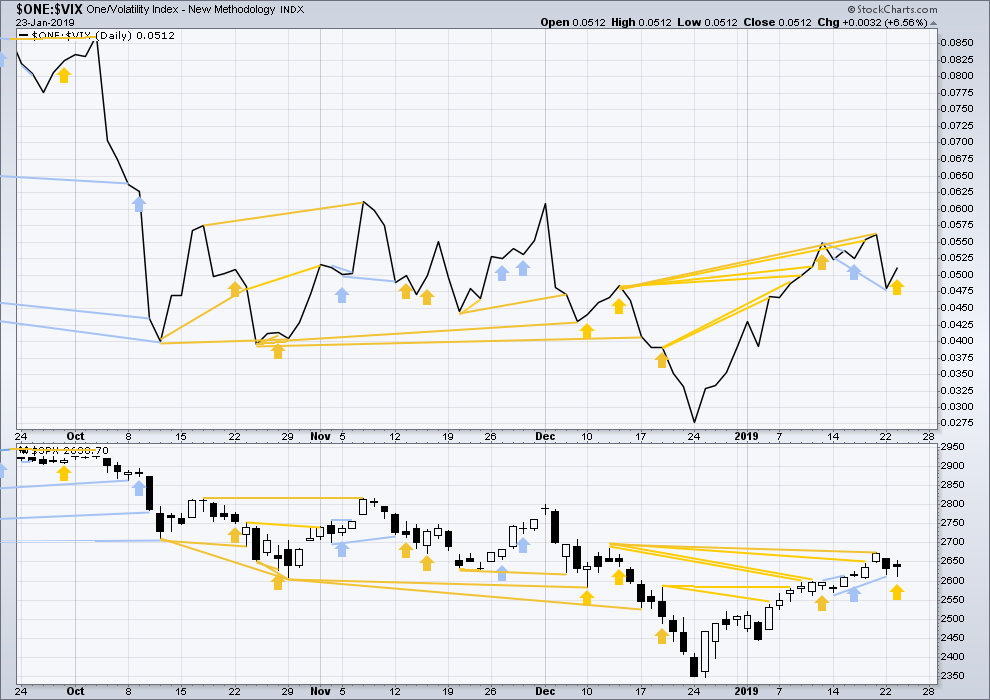

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

This week inverted VIX has made a slight new high above the prior swing high of the weeks beginning 26th of November and 3rd of December 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

There is now a cluster of bullish signals from inverted VIX. This supports the main Elliott wave count.

Today price moved slightly lower, but inverted VIX has moved higher. This divergence is bullish and supports the alternate Elliott wave count.

DOW THEORY

Dow Theory confirms a bear market. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

Published @ 06:32 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Updated main hourly chart:

Two overlapping first and second waves may be complete. Actually, three, now.

A winding up of potential energy. The breakout should be down.

Pushing the vix harder and harder to get a lower price

S and p 10 -15 points under the high and the vix is getting pounded

Feels like a topping process

But you never know how long they can hammer the vix futures

It’s just not getting the results … and it’s creating a close relationship to spot vix and vix futures that could lead to a big spike

Volume looking anemic

Probably waiting to make the move tomorrow after option decay

1,2,1,2,1,2,1,2 ……. 3 please!

tops are a process…

A turn at the 78.6, a lower swing high, a break down out of the channel…

anybody short 2647?

I short through the 38.50 vxx puts sold at .25

And upside sp calls at the 265 strike for tomorrow

Looking to buy cheap vxx calls late day or tomorrow morning

Just sold some s and p 262 puts in this down

As a slight hedge

I am feeling g a tight range for the day into tomorrow

Let’s premiums decay

Also laying in Gm shorts here

DJIA didn’t make a new low yesterday, but the VIX suppression was very clear & favours the alternate but DJIA will have to make a new low to complete minor 4 for the alternate.. hence seems like it was a B wave of (ii) & we are now in c of (ii) in both….

I have similar my thoughts and sentiments. Looking for a short opportunity above 2700. However, the target for Minor 5 in the alternate is way up at 2787. I was not thinking quite that high.

As Lara mentions, one issue with the alternate is the three wave look of Minor 3 on the daily charts. To me this is a big issue. That is why I am saying, A Tale of Two Counts. I think they have an equal probability or close to it.

Pushing the vix futures below the spot vix again to juice the s and p

A dangerous proposition

With VXX maturing after 10 years of humongous profits

All shorts will be covered an maturity on Tuesday

News vxxb will not have the large bowl apoke to start with

But will be starting at a high market

So pounding that will not be as easy because it won’t have 10 years of massive overhang leverage on it

A large short above

Should have watched my typing

A Tale of Two Cities – rather I mean Two Counts.

SOH awaiting further evidence.

Hi Rodney. I was curious about any effects of the magnesium on the PVCs?

Hi ari,

I did see you asked a couple of days ago. I am still sort of out of action with the surgery.

I am not feeling any PVC’s whatsoever. Absolutely no issues or symptoms. However, I do not know if it is the magnesium taurate or the metoprolol prescribed by the doc. I have a 3 month check-up in March. I am considering asking to stop the meds and see what happens. Any thoughts?

Thanks for the recommendation on the magnesium. I might add ‘free’ recommendation. Have a great day.