Another inside day comes with a small signal from the AD line.

Summary: At this stage, it would be best to let price tell us if primary wave 3 is over or not.

While price remains above 2,864.12, then this may still be another pullback within an ongoing upwards trend. The target is now at 3,012.

If price makes a new low by any amount at any time frame below 2,864.12, then some confidence that primary wave 4 has begun may be had. Targets are either 2,716.89 or 2,578.30. There is now enough bearishness from the AD line to take this possibility fairly seriously. Primary wave 4 is expected to be a large choppy consolidation, which may last about a Fibonacci 13 weeks.

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length and 1.618 the length of intermediate wave (1). The next Fibonacci ratio in the sequence is 2.618 giving a target at 3,124. If the target at 3,012 is met and passed, then this would be the next calculated target.

A target for intermediate wave (5) to end is calculated at minor degree.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Within intermediate wave (5), minor wave 3 was extended. Minor wave 5 may also extend.

Minute wave ii may not move beyond the start of minute wave i below 2,864.12.

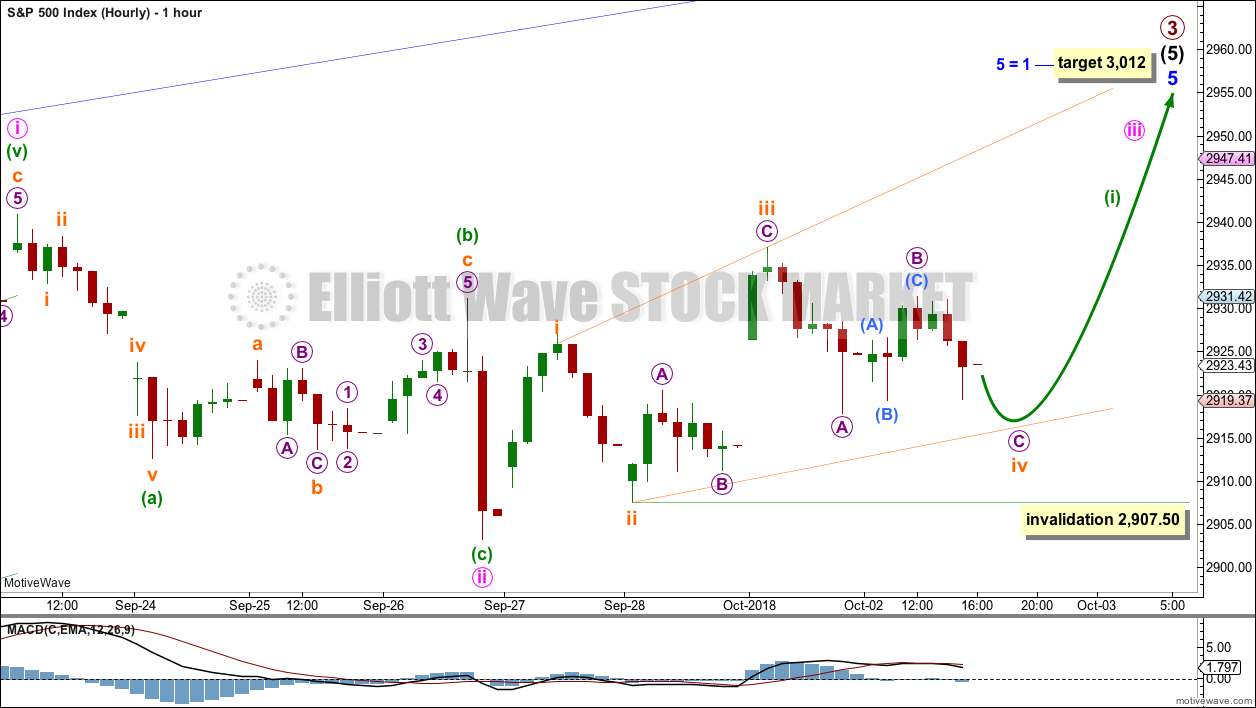

HOURLY CHART

If minor wave 5 extends, then it may have begun with a leading expanding diagonal for minute wave i.

Minute wave ii may be a complete zigzag. Minute wave iii may have begun. This hourly wave count has good proportion at the daily chart level, and for this reason it is the main hourly wave count.

Overlapping of the last two sessions suggests another leading diagonal may be unfolding for minuette wave (i). Within the diagonal, subminuette wave iv may not move beyond the end of subminuette wave ii below 2,907.50.

The diagonal is expanding: subminuette wave iii is longer than subminuette wave i, and subminuette wave iv so far is longer than subminuette wave ii. The last upwards wave of subminuette wave v must be longer than subminuette wave iii, which was 29.56 points in length.

If this first hourly chart is invalidated with a new low by any amount at any time frame, then the second hourly chart below may be used.

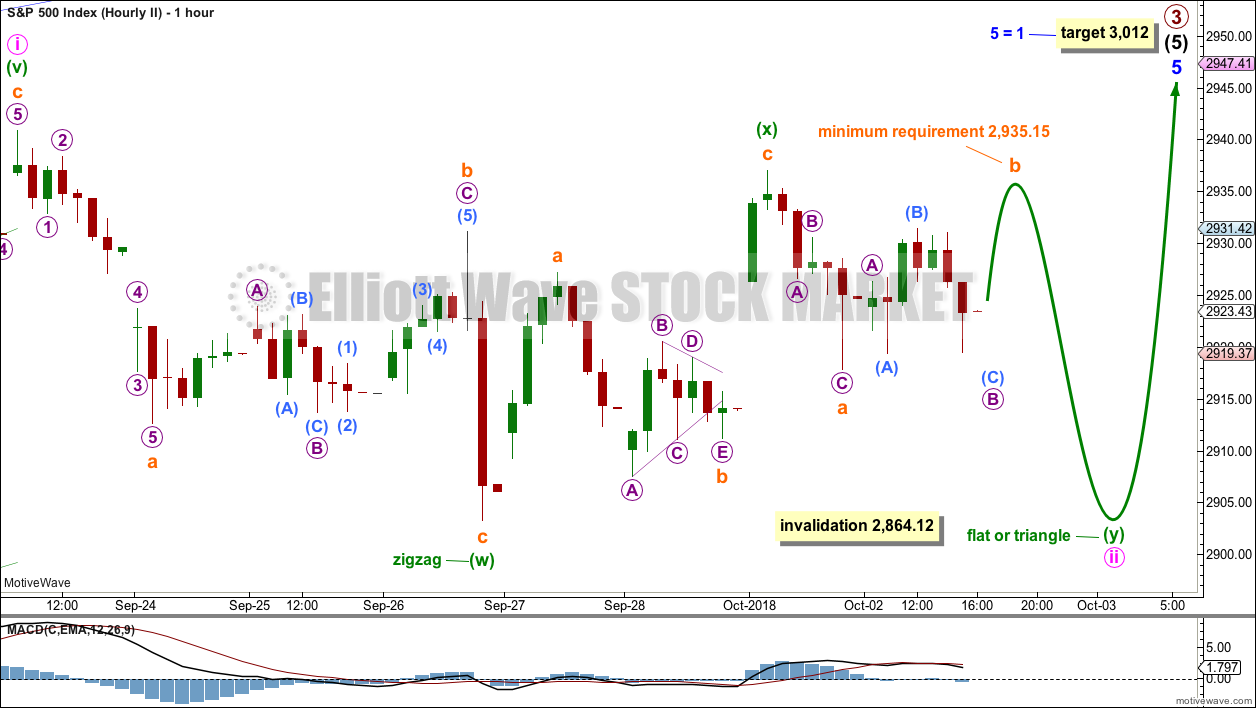

HOURLY CHART II

It is also possible that minute wave ii may not be over and may continue sideways as a double combination.

The first structure in a double may be a complete zigzag labelled minuette wave (w). The double may be joined by a three in the opposite direction, a zigzag labelled minuette wave (x). X waves within combinations are usually very deep, where X waves within double zigzags are usually more shallow. Here, minuette wave (x) is a 89.7 depth of minuette wave (w), which is very deep, so a double combination would be more likely.

Minute wave ii may not be unfolding as a flat correction if upwards movement ends here for the short term, because then minuette wave (b) would be 0.03 less than a 0.9 length of minuette wave (a); the minimum requirement for B waves within flats at 0.9 would not be met.

The second structure in a double combination is most commonly a flat correction, although occasionally it may be a triangle. Minuette wave (y) would most likely unfold as a flat correction. It would most likely end about the same level as minuette wave (w) at 2,903.28, so that the whole structure takes up time and moves price sideways, which is the purpose of the second structure within a combination.

The upwards wave of subminuette wave b within the flat correction of minuette wave (y) has not yet met the minimum requirement of 0.9 the length of subminuette wave a, which would be achieved at 2,935.15. Subminuette wave b may make a new price extreme above the start of subminuette wave a at 2,937.06, as in an expanded flat correction.

Subminuette wave c would be most likely to end below the end of subminuette wave a at 2,917.91 to avoid a truncation.

Minute wave ii may not move beyond the start of minute wave i below 2,864.12.

ALTERNATE ELLIOTT WAVE COUNT

DAILY CHART

It is possible to see now that primary wave 3 could be over at the last high by simply moving the degree of labelling within minor wave 5 up one degree.

It is reasonably common for the S&P to exhibit a Fibonacci ratio between two actionary waves within an impulse, and uncommon for it to exhibit Fibonacci ratios between all three actionary waves within an impulse. The lack of a Fibonacci ratio for minor wave 5 within this wave count is not of any concern; this looks typical.

Primary wave 4 would most likely end somewhere within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its price territory from 2,872.87 to 2,532.69. Within this range sit two Fibonacci ratios giving two targets. The lower 0.382 Fibonacci ratio may be more likely.

Primary wave 2 unfolded as a shallow regular flat correction lasting 10 weeks. Primary wave 4 may exhibit alternation in structure and may most likely unfold as a zigzag, triangle or combination. A zigzag would be the most likely structure as these are the most common corrective structures and would provide the best alternation with primary wave 2.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05. However, the lows in primary wave 4 should not get close to this point. The lower edge of the teal channel on the weekly chart should provide very strong support.

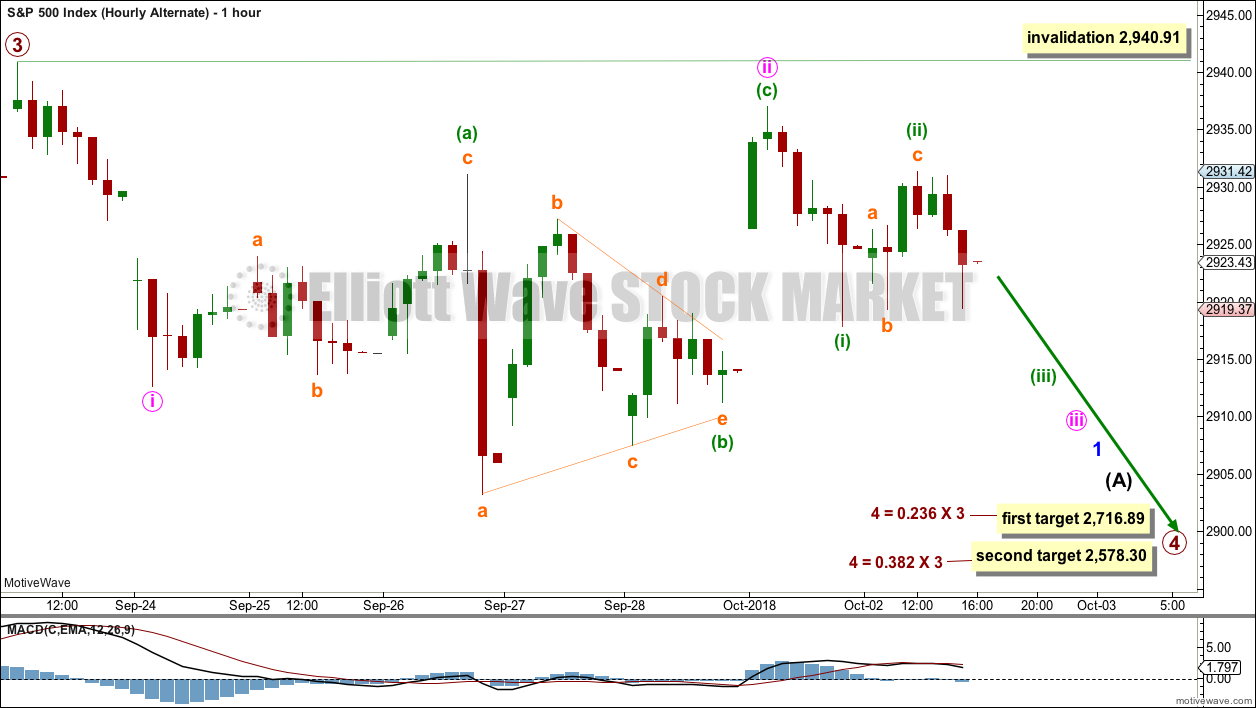

HOURLY CHART

A movement at primary wave degree should begin with a five wave structure downwards. So far that would be incomplete.

The first five down may be labelled minor wave 1. So far only minute waves i and ii may be complete. If it continues further, then minute wave ii may not move beyond the start of minute wave i above 2,940.91.

Minute wave iii should exhibit an increase in downwards momentum.

TECHNICAL ANALYSIS

WEEKLY CHART

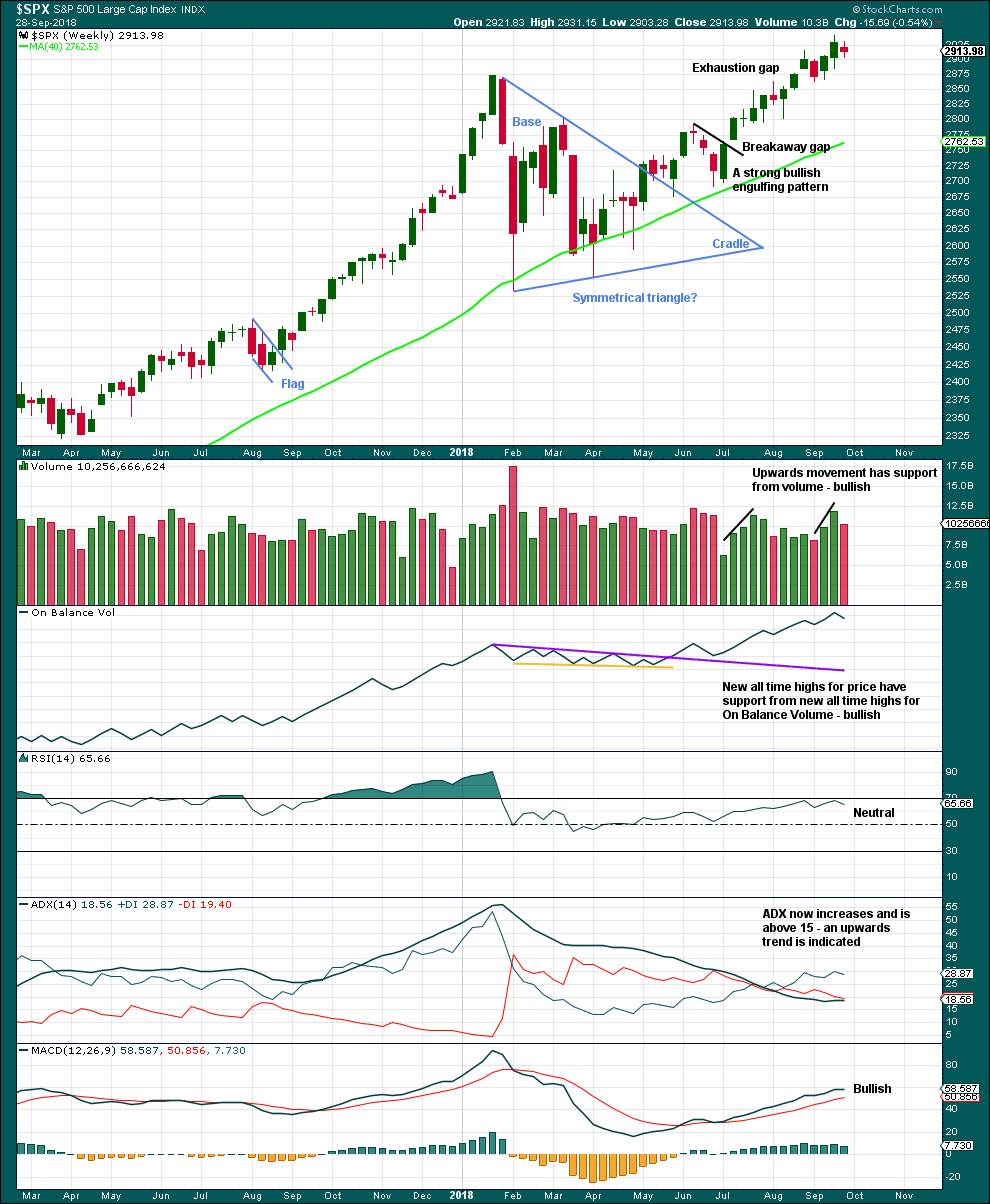

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This target has not yet been met.

Last week completed an inside week with the balance of volume downwards and the candlestick closing red. Downwards movement within last week does not have support from volume. At this time frame, this week looks like a small pause within an ongoing upwards trend.

DAILY CHART

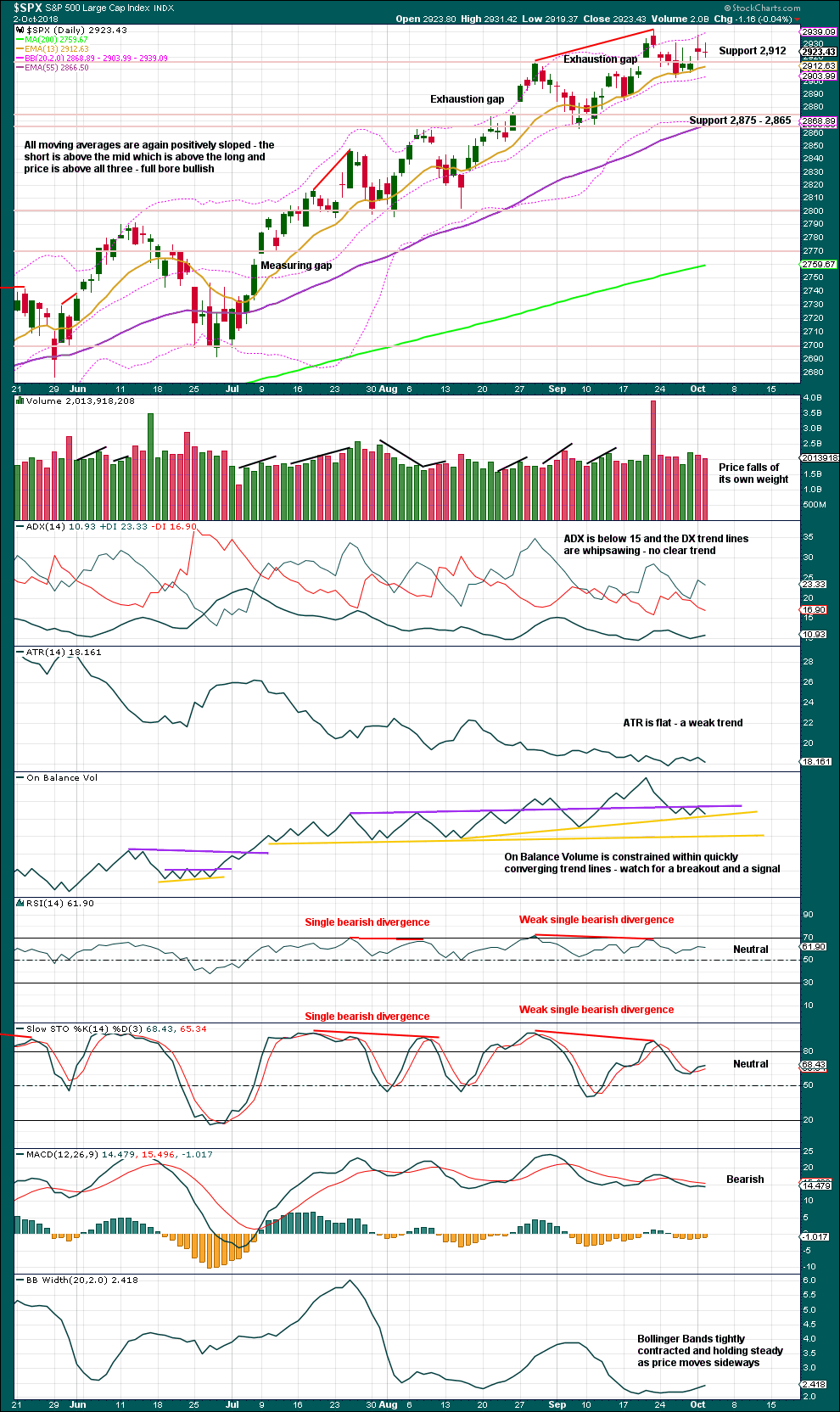

Click chart to enlarge. Chart courtesy of StockCharts.com.

Closure of the last gap is bearish. The gap is now labelled an exhaustion gap.

An inside day with the balance of volume down does not have support from volume today. Price is now range bound with resistance about 2,940 and support about 2,905. On Balance Volume is also now range bound; it may give a signal either before price or with price to add confidence in a breakout.

The bottom line remains that an upwards trend remains intact until price makes a new swing low. Look now for strong support about 2,875 – 2,865. If price makes a new swing low below 2,864.12, that would indicate a change from an upwards trend to either a larger sideways consolidation or a new downwards trend.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

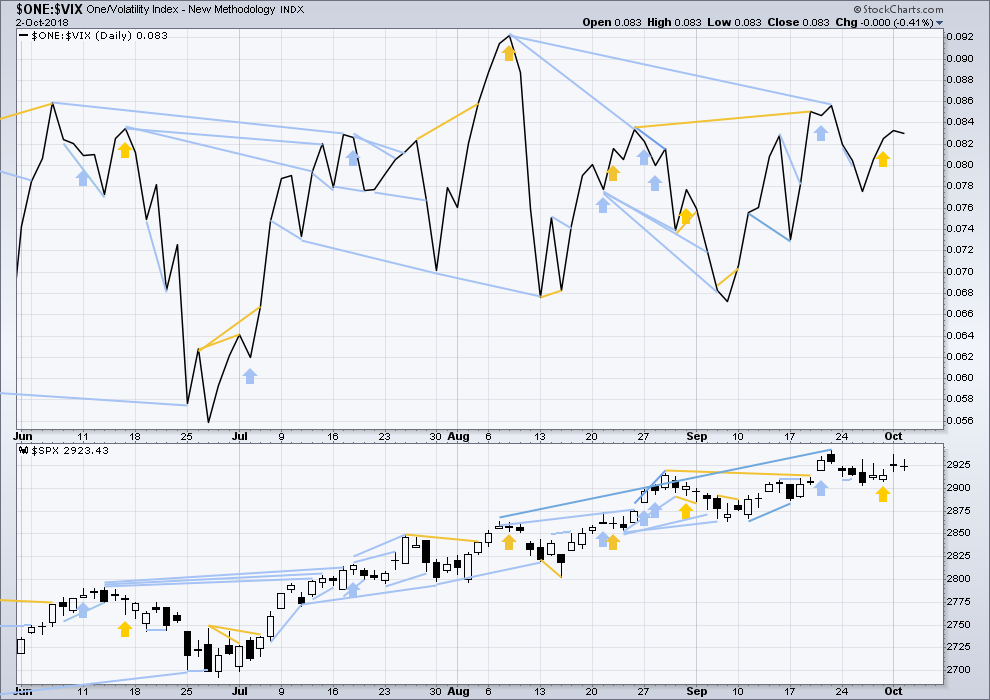

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made another new all time high, but inverted VIX has not. This divergence may persist for some time. It may remain at the end of primary wave 3, and may develop further to the end of primary wave 5.

Downwards movement within last week has support from a normal increase in market volatility. There is no new short term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Downwards movement within the last session has a normal increase in market volatility as inverted VIX declines. There is no new divergence.

Mid term bearish divergence between price and inverted VIX can be seen on both daily and weekly charts now. However, this may not be a good timing tool in identifying the end of primary wave 3; divergence may develop further before primary wave 3 ends.

BREADTH – AD LINE

WEEKLY CHART

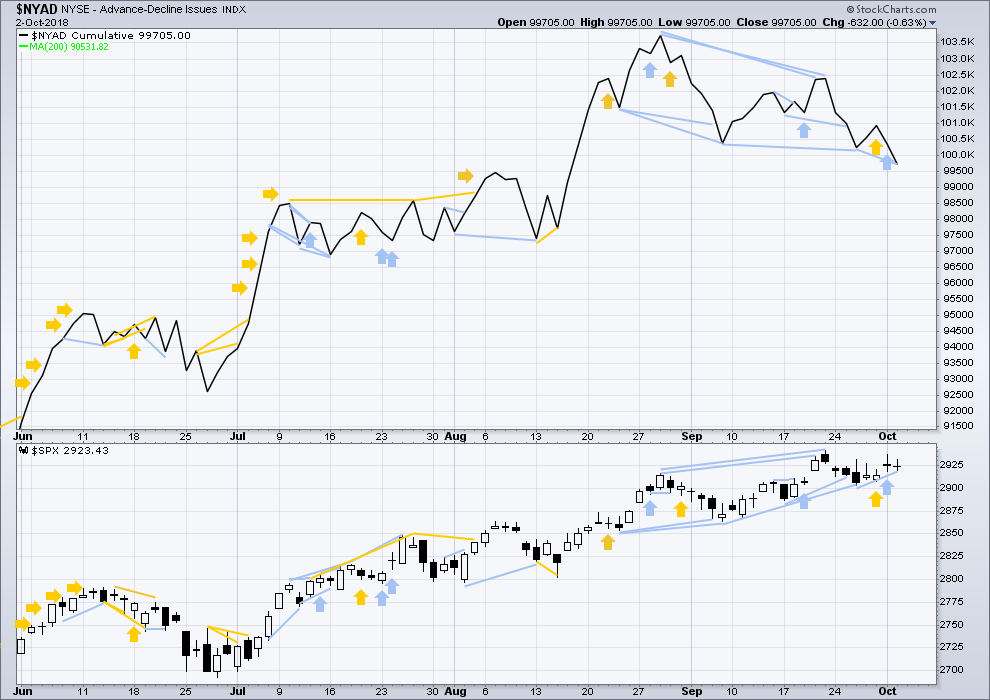

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

There is still short term bearish divergence at the weekly chart level between price and the AD line. It is possible now that the end of primary wave 3 is quite close.

For the last completed week, price moved sideways. Downwards movement within the week has support from an increase in breadth.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line on the 29th of August means that the beginning of any bear market may be at the end of December 2018, but it may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

The AD line has made a new swing low below the prior low five sessions ago, but price has not. This divergence is bearish for the short term. This may support the main hourly chart for the short term, or the alternate hourly wave count.

There is now a cluster of bearish signals at the daily chart from the AD line; this offers now some reasonable support to the new alternate Elliott wave count.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time today and small and mid caps lagging.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

All of DJIA, DJT, S&P500 and Nasdaq have made recent new all time highs. This provides Dow Theory confirmation that the bull market continues.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

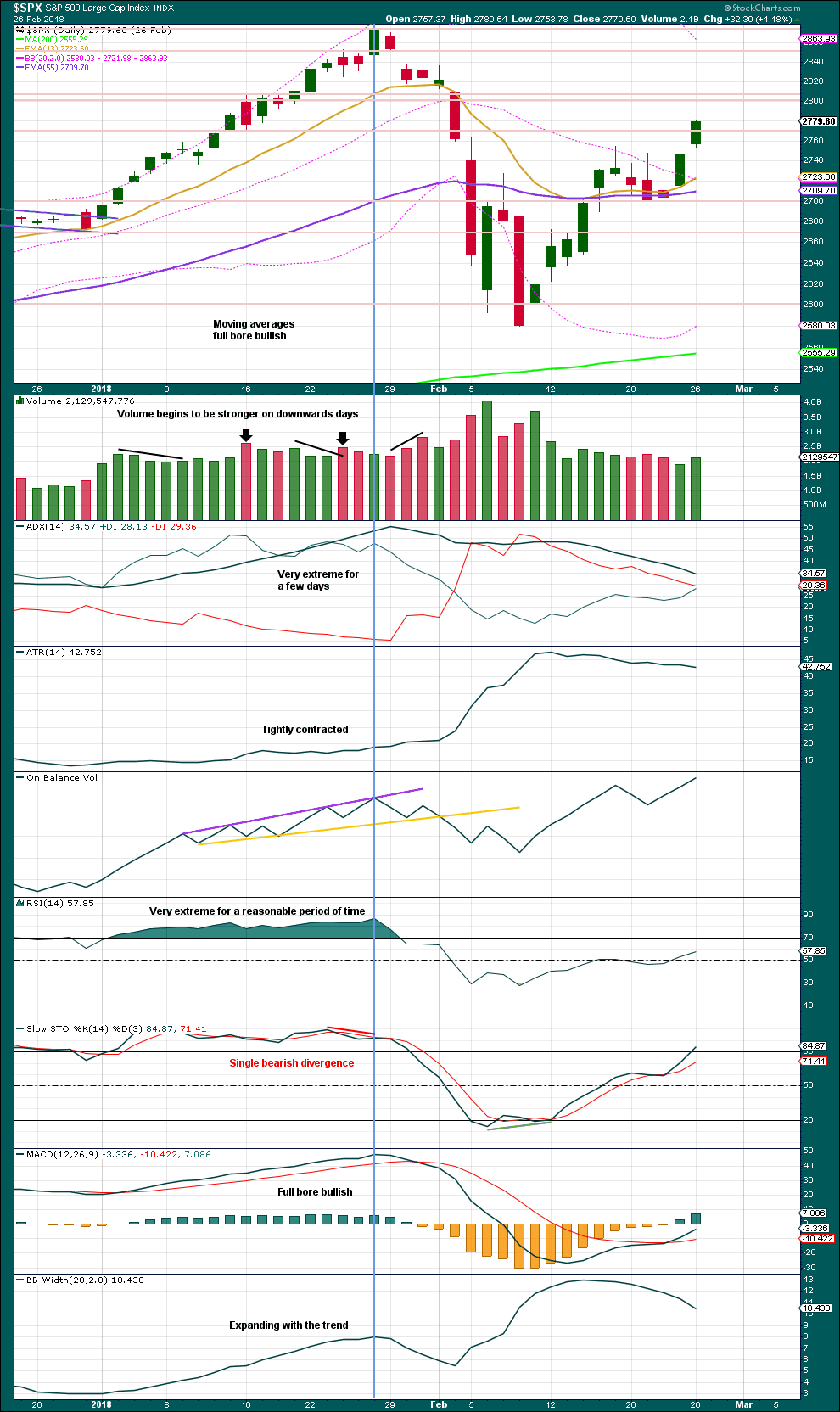

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

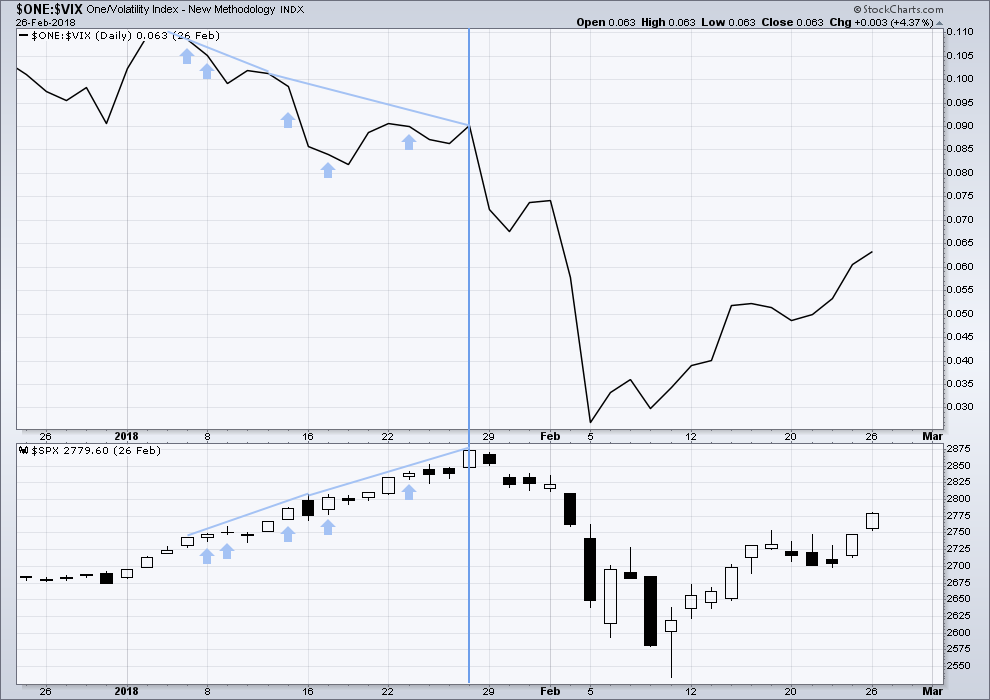

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 05:31 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

The yield on the 10-year absolutely took off today and hit a new 52 week high. These are levels not seen since 2011. “Rising yields” was the ham fisted explanation we got when stocks tanked 12% out of seemingly nowhere in February (the trade war had yet to really get going). Are we going to see a repeat? Someone check how many open VIX contracts Goldman has, LOL

Thousands BO, Thousands……

Updated hourly chart:

If a diagonal is unfolding then micro B within submineutte iv should find very strong support at the lower orange diagonal ii-iv trend line. Diagonals, like triangles, normally adhere very well indeed to their trend lines.

Subminuette wave v can’t be over because it needs to be longer than subminuette wave iii…. although, in my research I’ve done a full detailed wave count on Bitcoin, and in there on the daily chart I did find a movement which should only be counted as a leading diagonal and within it the third wave was the longest. So I suspect a rule may need to be re-written.

But I’m going to investigate that further and see if I can find any other clear examples first.

Hi Lara, Thank you for your daily chart analysis. I also trade bitcoin, if possible could you post this chart? 🙂 Thanks again.

Sure. I have to publish something today on EWG for public analysis, so I’ll do Bitcoin.

Thanks 🙂

Hi Lara,

USoil tipped higher today invalidating the triangle count. Can you please update the oil analysis?

Okay

I did under Lara’s Weekly, will add that commentary to the Oil analysis as well

Looks like we’ve got some strong downward movement?!

Ring ring

3:27pm step in to ramp, insanity continues. I hope everyone can see and identify this chicanery.

Sumpn’ whack right now…

I see triangles

UUP has again pushed through the 61.8% retrace of the Jan 2017 high to Jan 2018 low. This the weekly chart. Weekly trend is neutral but any more up and it’ll move to “up” for certain. Monthly trend is “up”.

I expect this one to hold and price to move on up to the 78.6% derived (sqrt(0.618)) retracement level show. At least. Bull call debit spread time for me here.

It took a great many years to occur and today the 30 Year US Treasury has finally penetrated a yield of 3.26% and right now is at 3.30%. It has met the 1st part of my test… moving above 3.26% & now it has to move materially higher over the next few days to meet the 2nd part of my test. If it does that then a new higher level of yields will be established over the coming months.

If it fails to do that and moves back below 3.26% and materially lower in yield then it’s a FAILED break out and nothing has changed… the Yield curve will continue to flatten.

So now, at this time, it’s a wait and see!

Thank you for the notice Joeseph. Another important piece of the puzzle… maybe I should be watching this one at least weekly as well.

TLT weekly.

No smokes and mirrors here, only a secular down trend. This is weekly bars. FINALLY the big 8 month long range from 116-122.5 has been broken to the down side! And in doing so blowing out of a 16 week squeeze. Next stop is 112.6, the 1.272 extension of the Dec ’17 high to May ’18 low.

Digging deeper into TLT by going up to the monthly time frame. Exciting opportunity to make $ here IMO. I’ve marked the 3 most likely stall/turn spots based on retrace and extension level clusters. The monthly is STILL in a squeeze as the price falls.

“tops are a process”

and

there is often “churning at the top”.

I see a heck of a lot of churn (highly overlapped action), at the daily and hourly, and it’s continuing. Now I can make out a semblance of yet another “ending diagonal” (probably not really but if I see structure, I note it) as a result of this overlapped churn.

Gad. More evidence of the top brewing in my book.

Head/shoulders top in IYT (transports ETF). Daily chart shown. Measured move target about 196, right where a 50% retrace fibo level sits. Also in day 9 of a squeeze.

AMD Bounce at 0.618, good risk reward here, going long again

Thanks Peter I took it long, don’t see it as much more than a dead cat bounce though (I could easily be wrong), so I’ve already taken my few $$ profit.

looking very impulsive …

ES: Rang the register…. be happy ? Or short this back down?

RUT is bouncing off a combined 100% and 78% of recent swings. Not stable yet but if RUT manages to exceed yesterday’s high at 1674.87 I will view the correction as very likely over.

Above yesterday’s high. I’m rather long…

A little timing analysis: the last two daily tf swing moves up were EACH 11 days exactly (the minor 3, and now the minute iii-iv-v).

The conclusion of the minute iii-iv-v should end the P3 and initiate the P4 down. Today is day 6 of that upward swing.

Five more days to symmetry. October 10. Which was the date I projected about two weeks ago as the likely P3 top date, as well.

VIX down to 11.6. I think it’s below 11 and perhaps in the 10.5-10.8 range at the top.

I am waiting patiently to begin accumulation of short positions / instruments. While Lara is great with targets, they are only targets. The current target of 3012 is not that far away. Perhaps the SPX will not be able to break 3000. It appears to me that all the indices are getting lined up with one another in preparation for Primary 4. The DJIA to make a new ATH was the last necessary index. Now RUT is showing that it will lead the way down as it did to the upside. Patience Patience Patience will be rewarded in the end. I am looking for the first wave down to take us to about 2550.

My current best projection of the price at the top is 2961-2966. 1.27% extension fibos lining up with upper channel lines at the proper date, all a reasonable “5-6 days” of trading activity away.

If you think squeezes lead to big moves…

My equal weighted FAANGM (yes I include Microsoft in the traditional FAANG list) is on a squeeze (volatility contraction).

At the weekly tf (3 bars).

At the daily tf (6 bars).

At the hour tf (8 bars).

It’s a-gonna go. Sooner or later, there will be BIG movement in the monsters of tech. And our P4 knowledge tells us it’s like to be down, down, down, when it starts.

Lara, we all know that triangles and diagonals don’t always pan out in the end, but I appreciate how quick you are to ID them as real possibilies to consider. Good eye! Good open mind! Thank you!

Thank you very much Curtis

I think its peculiar that when you look at the hourly candles on the SPX, there are a lot of long lower wicks starting on September 24th. However, on the daily charts there are upper long wicks, most days closing pretty far from their highs…

I see a lot of early signals of a daily level trend change for SPX. Trying to catch the start of it, because the monthly, weekly and daily trends are all still “strong up” or “up” on my charts.

– the volume power spike 8 sessions ago on a gap open bar that closed red strongly suggests to me a significant swing high

– the steadily declining AD line

– double tops in SPX and NDX

– divergent outright weakness in RUT

The strongest weekly tf trend line is very close to the price action, and has held for 8 weeks. The much wider intermediate 5 lower channel line is way down in price around 2875. Lots of room to fall without compromising the monthly trend and only slightly slowing the weekly trend.

I’m focused on that first trend line break and then the fall of the 2903 swing low…and then it might be off to the cascading sell off P4 race. Or not; perhaps the price holds above the bullish count invalidation. One move at time.

A significant correction: the mega volume 9/21 top day was a Dark Cloud Cover candle.

Does it make a difference that it was option expiration? That usually skews the volume. If it was a normal trading day it definitely would have significance without a doubt?

Perhaps, but I don’t remember seeing a volume spike like that one in…well, I just don’t remember! But it’s all noise now because it appears the main is definitely on, and it’s up to new ATH’s very soon. Let ‘er rip!!!

I’ve thought about that question quite a lot. And my conclusion, is that no, I do not think that we can dismiss those volume spikes on option expiration dates.

On those dates volume is of course much higher. But the balance of it, up or down, is still a measure of sentiment just as much as every other day.

If anyone else has more in-depth thoughts on this then please do share.