Upwards movement continues as the main Elliott wave count expects.

A strong new signal today from On Balance Volume supports the main Elliott wave count.

Summary: The pullback looks like is over. On Balance Volume makes a strong, new all time high today on the daily chart; this supports a bullish wave count. The short term volume profile remains bullish.

For the short term, bearish divergence today from the AD line may indicate that tomorrow may begin with a little downwards movement; a target would be at 2,896. Thereafter, price may turn upwards towards a new all time high.

A new all time high above 2,916.50 would confirm the bullish wave count. At that stage, the target would then be in a small zone from 3,041 (Elliott wave) to 3,045 (classic analysis).

A new low below 2,802.49 would strongly indicate the bearish wave count is most likely. The target for a multi month consolidation of primary wave 4 would then be at either 2,698 (0.236 Fibonacci ratio) or 2,563 (0.382 Fibonacci ratio).

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

MAIN ELLIOTT WAVE COUNT – BULL

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

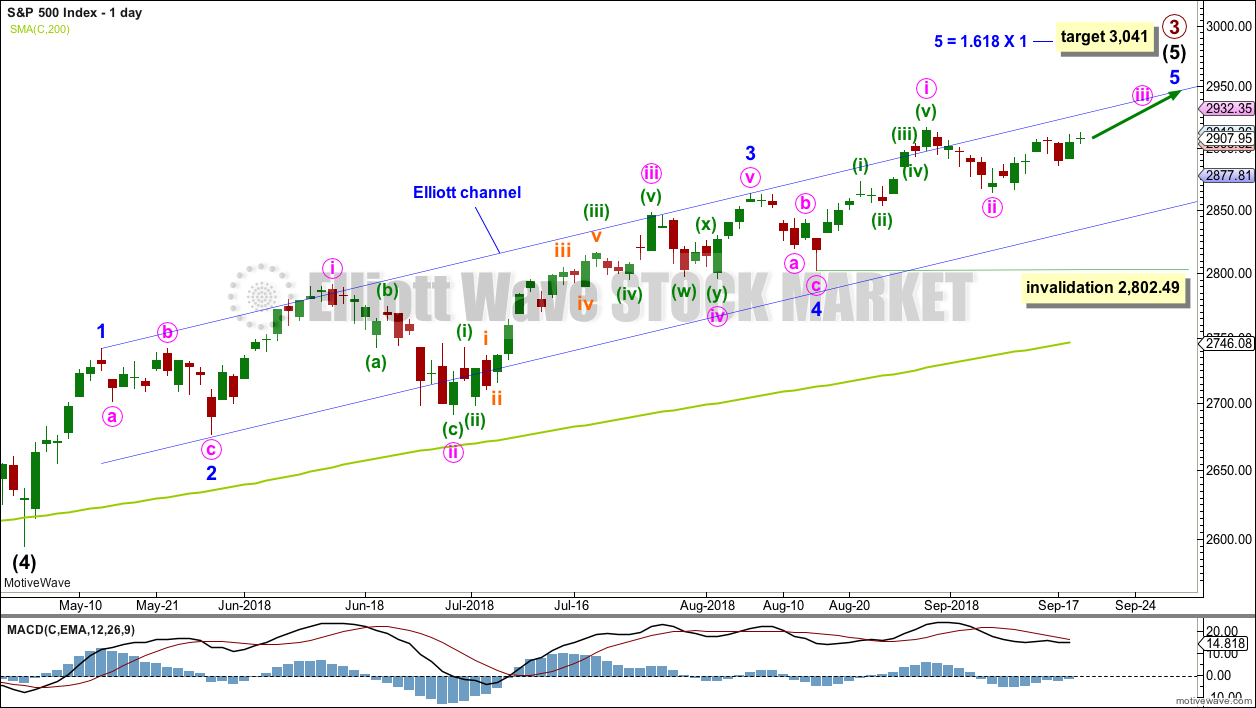

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next target was at 2,922, 1.618 the length of intermediate wave (1), which may have been almost met.

A target for intermediate wave (5) to end is recalculated at minor degree. Because this target is so close to the classic analysis target at 3,045, it does have a reasonable probability.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Assume the upwards trend remains intact while price remains above 2,802.49. The trend remains the same until proven otherwise.

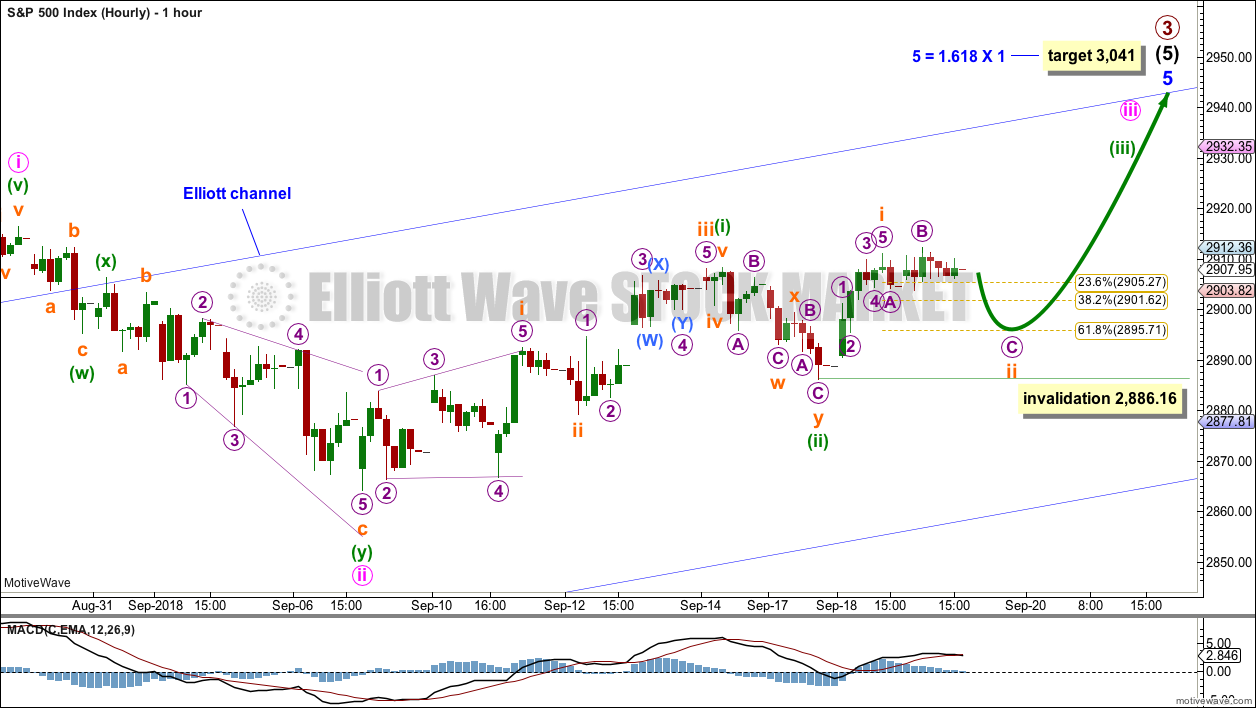

HOURLY CHART

Because we should assume the trend remains the same, until proven otherwise, this will still remain the main wave count while price remains above 2,802.49. It also now has good support from classic technical analysis.

Within intermediate wave (5) so far, minor wave 1 was relatively short and minor wave 3 extended (but does not exhibit a Fibonacci ratio to minor wave 1). Two actionary waves within an impulse may extend, so minor wave 5 may be extending.

Within minor wave 5, minute wave i may have been over at the last high. Minute wave ii may now be a completed double zigzag, ending just below the 0.382 Fibonacci ratio of minute wave i. Double zigzags are reasonably common structures.

Minute wave iii must subdivide as an impulse. Within minute wave iii, minuette waves (i) and (ii) may be complete.

Minuette wave (iii) must subdivide as an impulse. Within minuette wave (iii), subminuette wave i may be complete. Subminuette wave ii may continue a little lower tomorrow as an expanded flat correction. If the target at the 0.618 Fibonacci ratio is wrong, then it may be too low. An increasing upwards pull from the middle of a third wave may force subminuette wave ii to be more shallow than second waves more commonly are.

Subminuette wave ii may not move beyond the start of subminuette wave i below 2,886.16.

ALTERNATE ELLIOTT WAVE COUNT – BEAR

WEEKLY CHART

The probability of this alternate wave count is reduced at the end of last week because it does not have support from classic technical analysis.

It is possible that primary wave 3 was over at the last high. Fibonacci ratios are noted on the chart.

Primary wave 2 was a shallow flat lasting 10 weeks. Primary wave 4 may be expected to exhibit alternation in one or both of depth and structure. Primary wave 4 may last about a Fibonacci 8, 13 or possibly even 21 weeks to exhibit reasonable proportion to primary wave 2.

Primary wave 2 shows up on the monthly chart. Primary wave 4 may be expected to last at least one month, and likely longer, for the wave count to have the right look at the monthly chart level.

Primary wave 4 may end about the lower edge of the maroon Elliott channel. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree: intermediate wave (4) has its price territory from 2,872.87 to 2,532.69.

The channel on this bear wave count is redrawn about primary degree waves using Elliott’s first technique. The overshoot at the end of intermediate wave (3) is very typical; third waves are usually the strongest wave within an impulse and may end with strength. The lower edge of this channel contains all deeper pullbacks since the end of primary wave 2, and so it looks fairly likely that primary wave 4 may end about the lower edge of this maroon channel.

If primary wave 4 is deeper than expected, then it should find very strong support at the lower edge of the teal channel. This channel, copied over from the monthly chart, has provided support for all deeper pullbacks within this bear market since March 2009.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

DAILY CHART

The first movement down within primary wave 4 should be a five wave structure, which should be visible at the daily chart level. While that is incomplete, no second wave correction may move beyond the start of the first wave above 2,916.50.

Within the target range of 2,872.87 to 2,532.69 sit the 0.236 and 0.382 Fibonacci ratios of primary wave 3. The 0.236 Fibonacci ratio at 2,698 would be the first target. If price keeps falling through this first target, then the next target would be the 0.382 Fibonacci ratio at 2,563.

Primary wave 4 would most likely be a zigzag, combination or triangle. Within a zigzag, intermediate wave (A) must subdivide as a five wave structure. Within a combination or triangle, intermediate wave (A) (or (X) ) should subdivide as a three wave structure, most likely a zigzag.

Within primary wave 4, downwards waves may be swift and very strong.

HOURLY CHART

The last wave down, which is here labelled minute wave i, is very choppy and overlapping and will not subdivide as an impulse.

Minute wave i may be seen as a leading contracting diagonal. Within a leading diagonal: sub-waves 1, 3 and 5 are most commonly zigzags but may also sub-divide as impulses, sub-waves 2 and 4 may only subdivide as zigzags, and wave 4 must overlap wave 1 price territory. Within a contracting diagonal, the trend lines must converge. This wave count meets all Elliott wave rules for a leading contracting diagonal, but the extended length of minuette wave (i) gives it a strange look.

Within the zigzag of minuette wave (i), subminuette wave c is seen as an ending expanding diagonal. Within micro wave 5, sub-micro wave (B) is not well contained within the diagonal trend lines. The trend lines do diverge but only barely. This structure also looks strange.

This wave count meets all Elliott wave rules, but it does not have the right look. The probability is low.

Minute wave ii may be a reasonably rare triple zigzag. The rarity of triples must reduce the probability of this wave count further.

Minute wave ii may not move beyond the start of minute wave i above 2,916.50. A new all time high this week would firmly invalidate this bearish wave count at all time frames.

This bearish wave count now has only one first and second wave complete. Some increase in downwards momentum may be expected to develop over next week if this wave count is correct.

TECHNICAL ANALYSIS

WEEKLY CHART

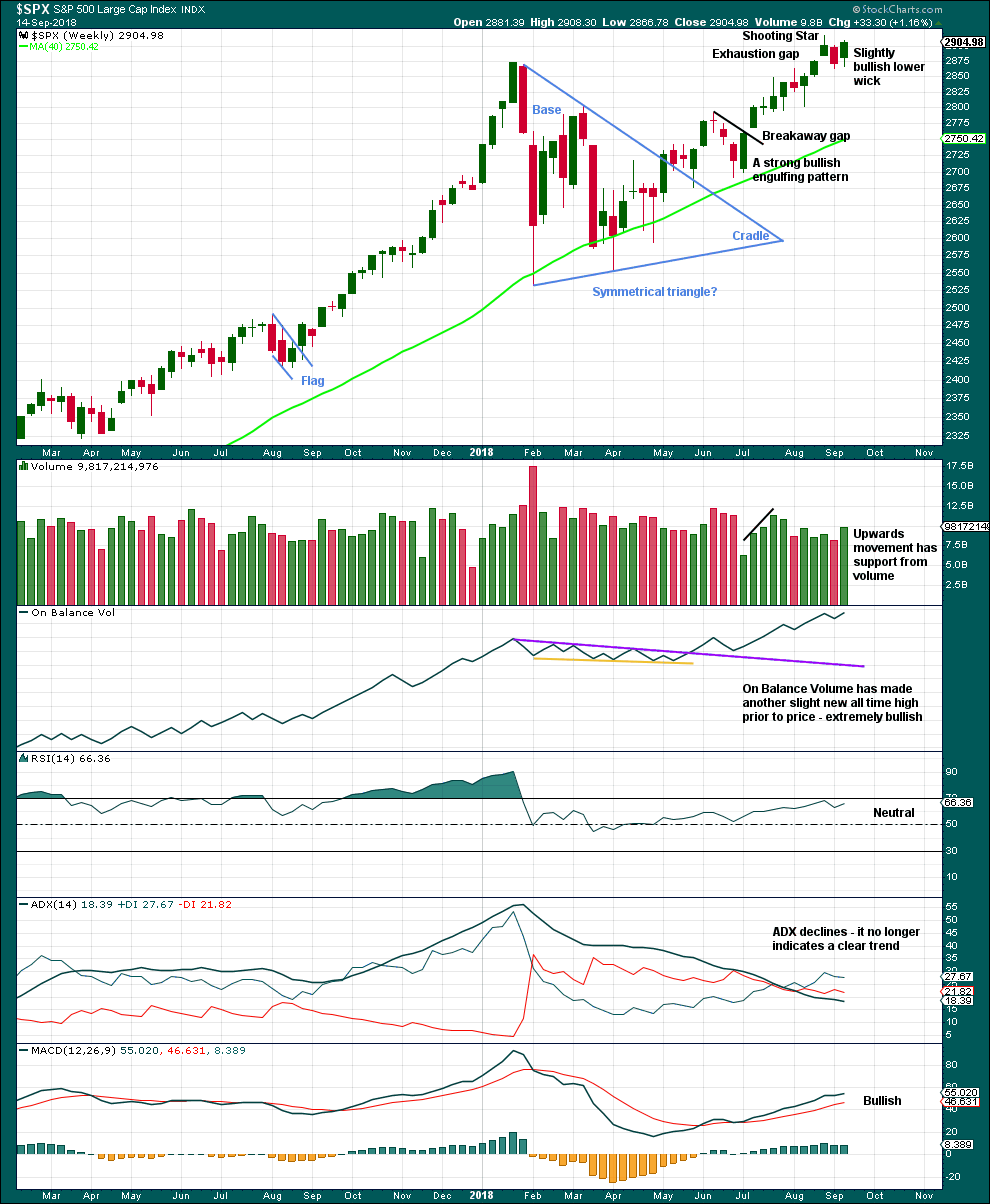

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is very close to the new Elliott wave target at 3,041.

It now looks most likely that the downwards week two weeks ago is a typical backtest of support after the new all time high.

The bullish signal from On Balance Volume is given reasonable weight in this analysis. It supports the main Elliott wave count.

DAILY CHART

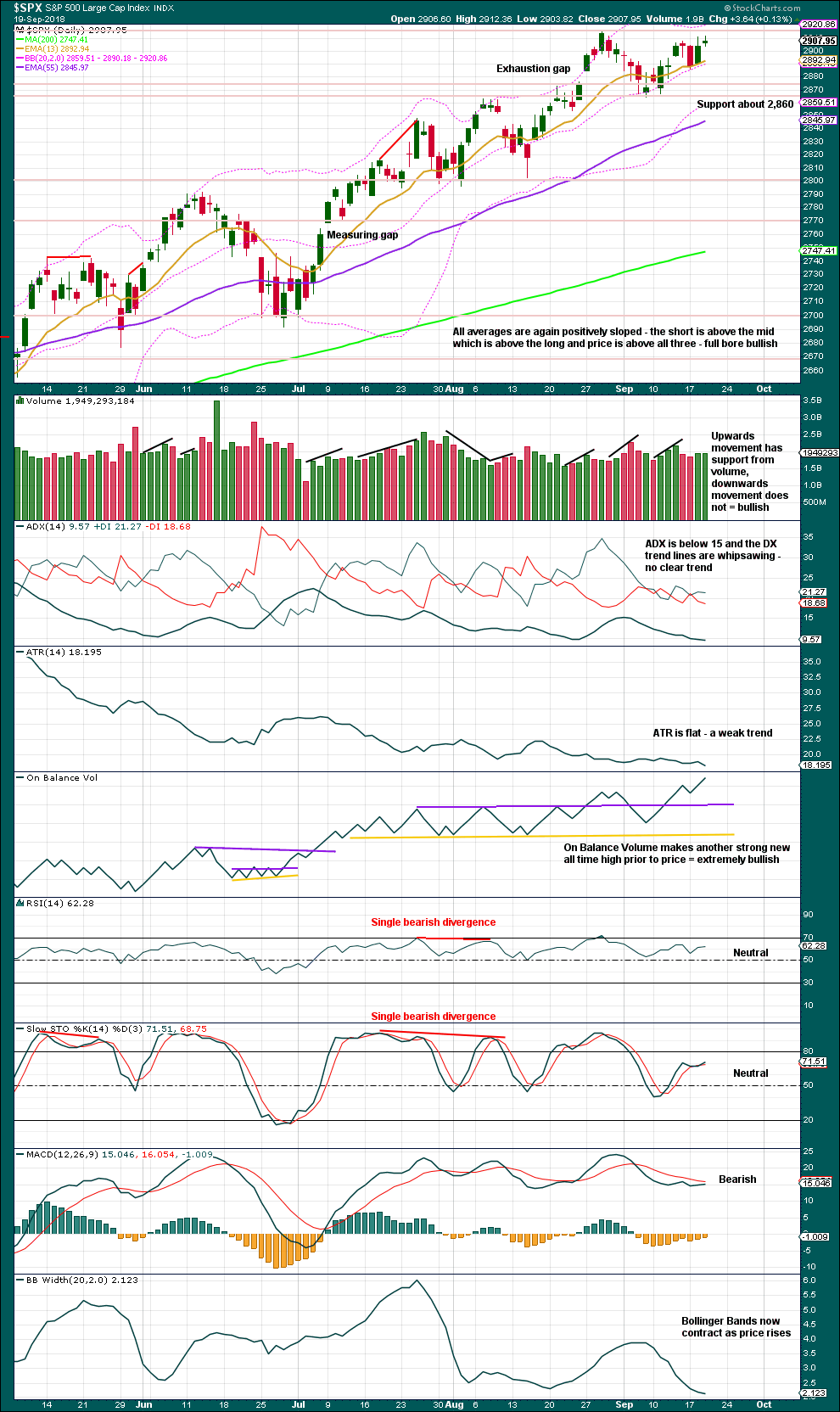

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. While the last swing low at 2,802.49 has not been breached, there will still be a series of higher highs and higher lows in place; the upwards trend should be assumed to remain intact until proven otherwise. A bullish engulfing candlestick pattern with support from volume comes after another pullback. This is a strong indication that the pullback may be over. Look now for the upwards trend to resume.

A new all time high would be an upwards breakout of the current small consolidation. A new low below support at 2,864.12 would be a downwards breakout. It is a downwards day during the consolidation that has strongest volume, suggesting a downwards breakout may be more likely than upwards.

When price is range bound, then candlestick reversal patterns should not be considered when they appear within a consolidation. For a reversal pattern to indicate a reversal, there has to be something to reverse; there is no trend to reverse within a sideways movement. With price now more clearly range bound, the last noted patterns of a Bearish Engulfing pattern and an Evening Star should not be considered bearish reversals.

Reasonable weight is given in this analysis to the strong new all time high from On Balance Volume. Although today’s session completes as a small doji with slightly lighter volume, it still moved price slightly higher and the short term volume profile remains overall bullish.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

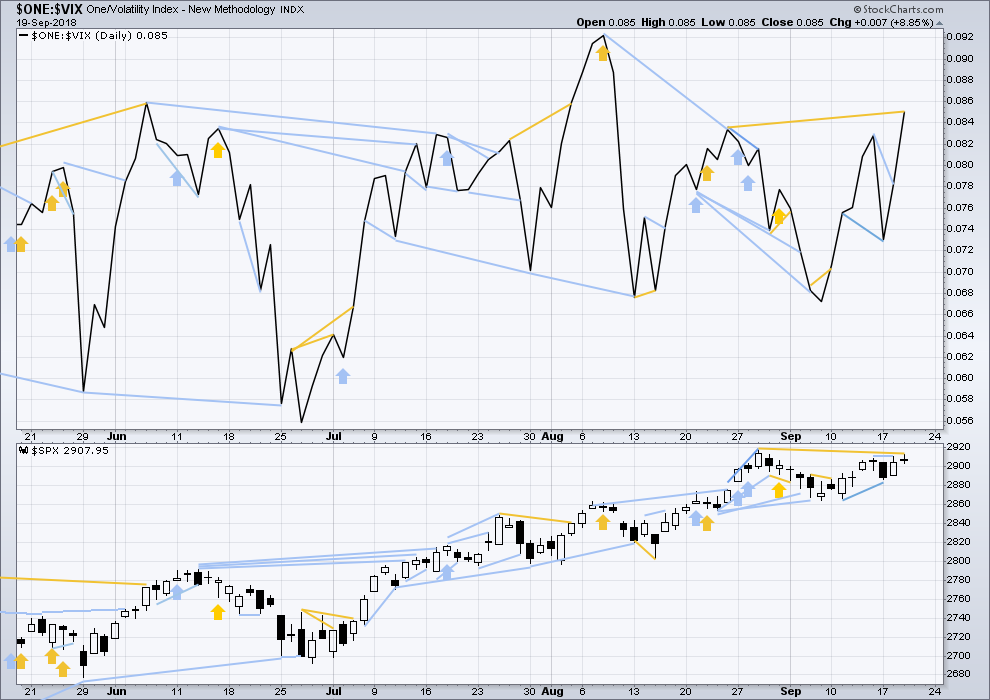

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time. It may remain at the end of primary wave 3, and may develop further to the end of primary wave 5.

Strong bearish divergence noted two weeks ago has now been followed by an upwards week. It is considered to have failed.

Upwards movement in price has support last week from a normal corresponding decline in market volatility. There is no new divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Bearish divergence noted in yesterday’s analysis has not been followed by any downwards movement, so it may have failed.

Today price moved slightly higher and inverted VIX moved strongly higher. The rise in price today comes with a strong decline in market volatility, which is bullish. Inverted VIX has made a new short term swing high, but price has not; this is short term bullish divergence.

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

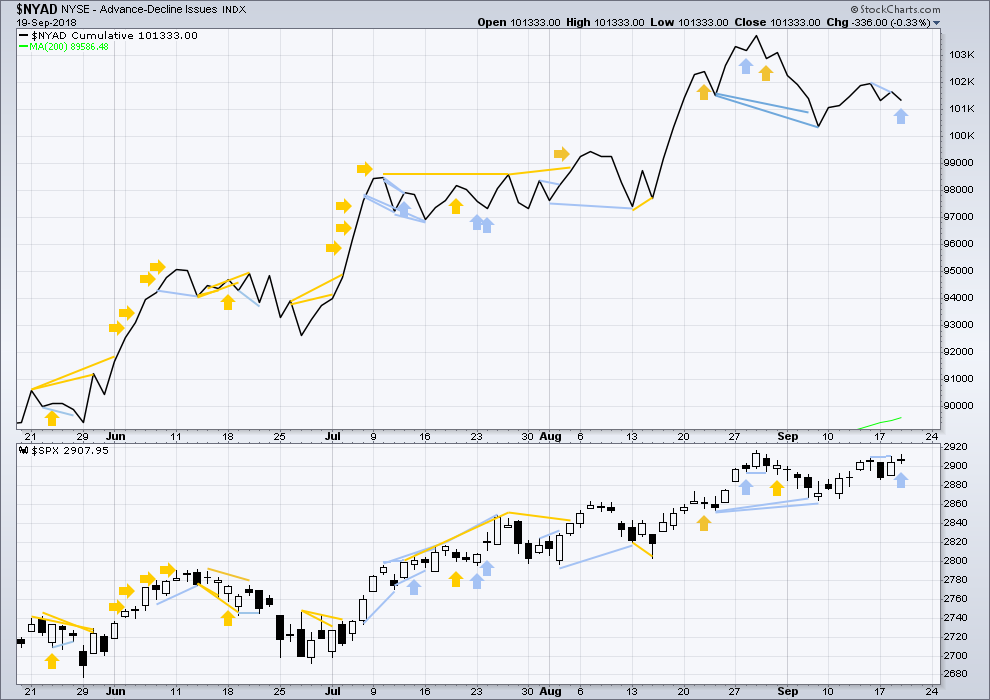

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

Short term weak divergence between price and the AD line noted last week has now been followed by an upwards week. It is considered to have failed.

There is no new divergence this week between price and the AD line.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Rising price has support from rising market breadth, but breadth is not rising as fast as price. This is a little bearish. Some divergence towards the end of primary wave 3 may be expected to develop; this bearishness may fit the main Elliott wave count.

Today price moved slightly higher, but the AD line moved slightly lower. This divergence is bearish, but it is weak because the difference is not great and today saw mostly sideways movement.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time highs on the 29th of August and small and mid caps lagging.

All of small, mid and large caps saw price rise last week. The rise in price has support from market breadth.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

DJT made another new all time high last week. It may be leading the market.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

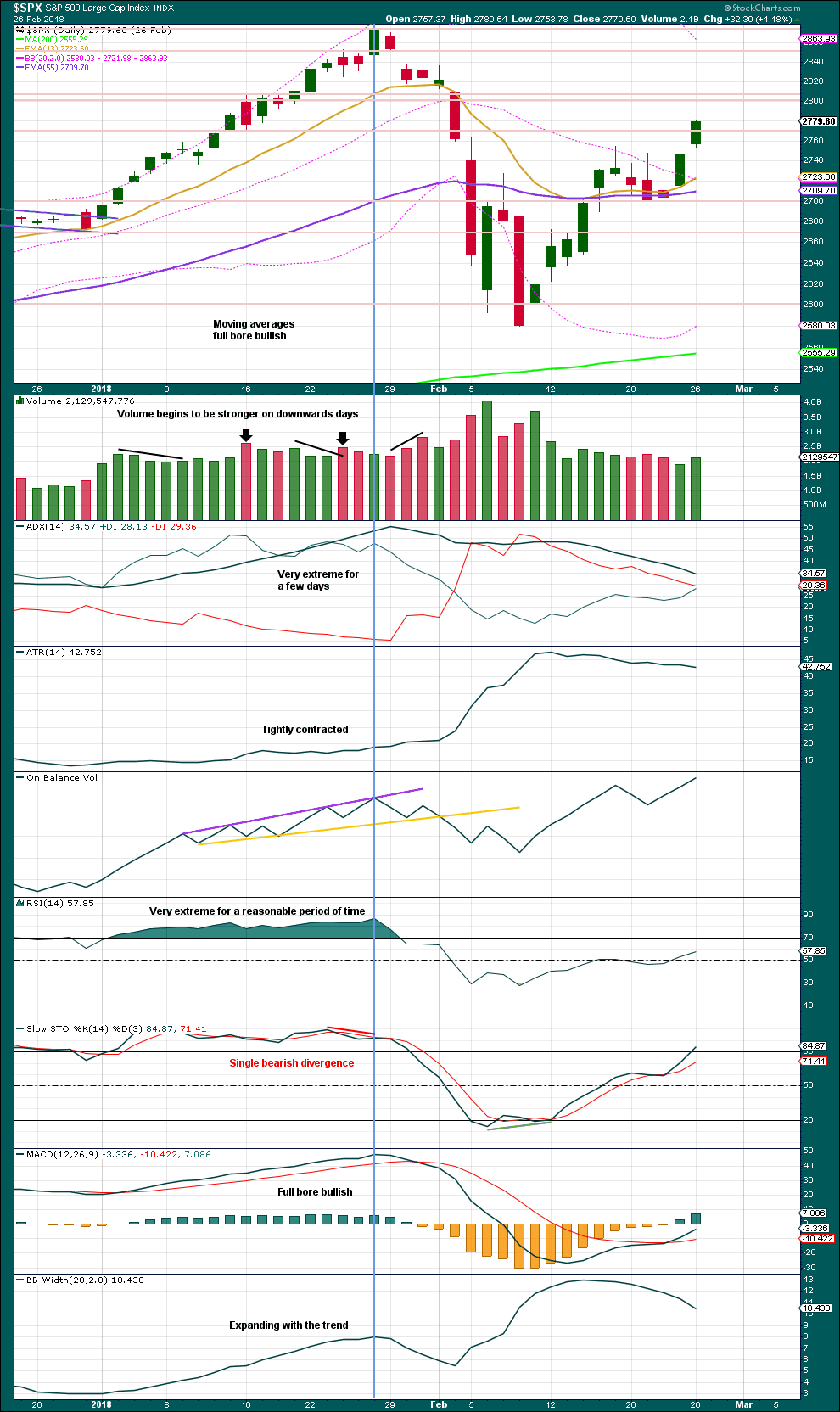

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

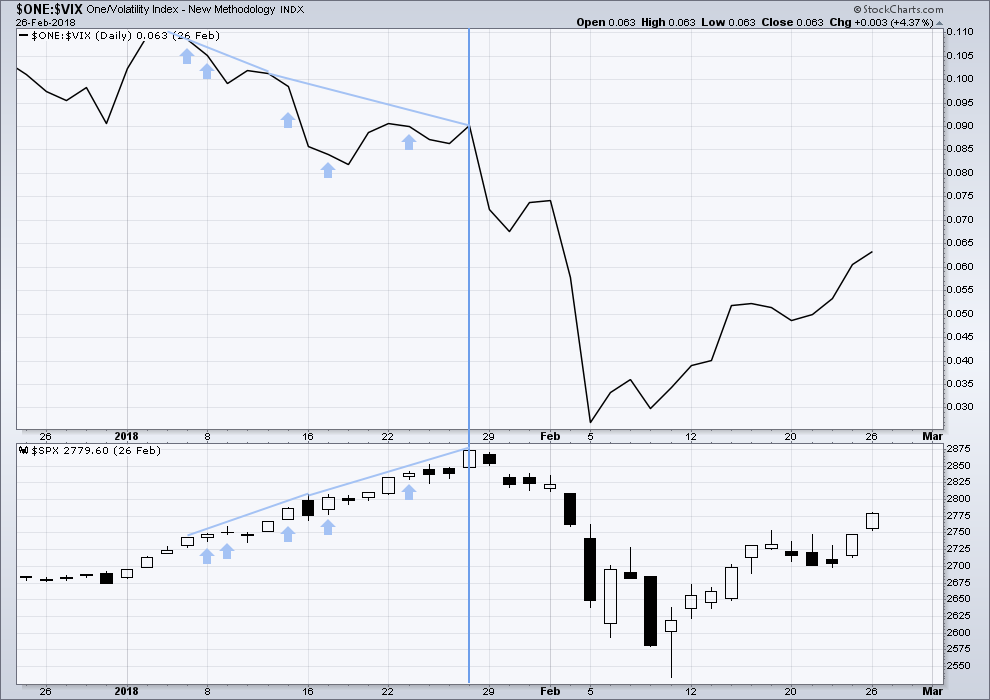

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 10:37 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

FYI everybody, I updated my Bitcoin analysis over at Elliott Wave Gold yesterday.

VIX has no business printing a green candle on a day of multiple ATH.

deep iv tomorrow?

I was thinking the same Verne. I thought it would be going towards and under its BB like a magnet.

With a green VIX candle, we might be closer to start of P4. Also the DOW finished its second day above its upper BB, and SPX also closed above its BB.

All those out together, and I have a hard time seeing the market keep closing higher and higher from here.

However, much respect and admiration to Lara’s analysis. Today I closed 2/3 of my very profitable long position 🙂

Lara is stunning in her target precision. I am splitting the difference with bull put spreads. VIX hinting put options about to get bit pricier.

EEM has come back up to it’s weekly TF down trend line, and is in full bore downtrend at this TF and at the monthly.

The options market in EEM is one of the most liquid of any instrument. For example, Dec strike calls ATM have open interest of over 80,000 contracts. It’s massive.

So, I kind of look at that trend line as a potentially self-fulfilling prophecy. I have a put debit spread on, small, and if price goes against me, I’ll hold and manage through (add to or buy back the sold puts for a profit) the expected upcoming P4, which should tumble just about all equity markets.

The NDX looks to me like it’s in a 5 wave move off the spring ’18 lows. And now it’s in a 5 wave ending diagonal of that 5 wave move (finished d, moving up in the final e now and will finish…early October).

I admit right out I’m a hack EW analyst. So my count here is highly suspect. That said, it is corroborating what we suspect overall: a cliff approaching in October.

Hi Kevin. As mentioned before numerous times, I enjoy your analysis. And you’re right more often than not…

However, I see the move from NDX high of 8/30 to the low of 9/7 as a 5 wave structure. And it seems to me since then we’re having a 3 wave corrective structure. I’ve been bullish QQQ, but today I closed 2/3 of my long position. Will keep the rest to see if your wave count is on track.

As always, thanks for your great posts.

There’s nothing I like more than alternative views Ari! Well, and sushi and an empty 4’er left and a few other things but…

I’ll assess that alternative wave count, I’m sure it’s quite legitimate at this point.

The current bearish wave count is invalidated. So we can have a little clarity for at least a little while.

The target remains the same and still has a reasonable probability. When minute waves i, ii, iii and iv are complete within minor wave 5 then I will add to the target calculation at minute degree, at that time it may change (but probably not by much) or that may provide a second target.

Today’s gap looks like a classic breakaway gap. These are not closed. They can be used to set stops, just below the lower edge of the gap at 2,910.17.

I just re-balanced my FAANG equal weighted ticker (AMZN+11.8*FB+8.8*AAPL+5.3*NFLX+1.6*GOOGL).

Here’s the weekly chart. TREND at the weekly level is now NEUTRAL for these leaders!

And note the large DOUBLE TOP.

The lower blue Darvas box line is what I’m watching: that breaks to the downside and IT’S ON. In my opinion. Still should be a few weeks, with probably just more ranging inside the existing box until the break down.

Hey thanks for making that easier to read Kevin. My eyes are not that good in my old age

My current take on the EW situation leading up to the top of the Primary 3.

Levels for the top of this minute iii up in play: 2938 then 2947.6.

My best estimate is the 2947.6 derived fibo will be the minute iii top, then a minute iv as shown, then the final minute v to complete the minor 5, intermediate 5 and primary 3 and start up the primary 4 down. I’m still projecting a top date overall of around Oct 10.

One day at a time…but keeping an eye on the future!

Kevin, appreciate your insights. I have a little trouble reading your charts though, can’t read the numbers. A picture is worth a thousand words though.

Yea I’d like to get those fibo level #’s larger too, but don’t see any way in ToS to do that. It’s also why I quote what I think are the important #’s often. It is the bigger picture that counts, and if the exact #’s are important to you (as they are to me), you should be running the same levels on your own chart with your own data, IMO. I don’t ever expect anyone to “directly” use my charts, I really mean them just to share ideas and outlooks and if someone wants to leverage them, the specifics should be recreated.

Kevin, I agree with Jerry, appreciate your analysis but can’t read numbers on your charts.

I’ll see what if anything I can do about that.

Does that work?

Kevin, AMD finishing consolidating, time to go long?

Finished consolidation? Or finishing topping?

Here’s the hourly chart. I see price breaking a trend line to down side; that raise my concern level re: any possible longs. Price is bouncing in a large rectangle (Darvas box). I’d be quite concerned if price breaks down below it. One approach would be to get on board on the smaller side when price TURNS UP off the bottom of this box, then perhaps add as price rises. On the other side, stop right underneath (just blow 29.5 it appears). That’s how I’d play it. The danger is that there’s a pile of such stops under 29.5, someone (who is short?) is going to gun for them, and when they fire, price will drop several points VERY quickly. It’s a dangerous set up IMO. I won’t likely be trading it.

thanks for sharing, i’ll stay nimble

VIX open gap at 11.31 precisely hit today.

I am out of long trades. Perhaps a bit early, but I hear some thunder on the horizon…..

Rare gaps higher in many a futures index.

Unprecedented 14 Hindenburg Omens on the clock with 12 in a row, so spectacular collapse of market breadth continues.

Incredible bullishness in the face of potential fireworks dead ahead….

TLT has come all the way down in the big rectangular range it established since February, and in the process popped out of 16 weeks of squeeze. Last time that happened it immediately hit bottom and turned up, and that behavior appears likely to happen again. So while I have a longer term short…I’m taking a shorter term long here to see if I can grab a move from the current 117 area back up to 122-ish.

First! And it looks like an upside day as Lara’s bullish count suggests. VIX might very well be heading below it’s bollinger band in short order of the upside in futures market holds in the cash market…

Yee-haw!!! Finally, a break out to the upside, and FINALLY, the death of that bear count!!! (For now…)

And congrats on the pole position Ari…I was sleepin’!