Yesterday’s analysis expected a short term pullback to continue. A little upwards movement within the pullback fits expectations as wave B unfolds. The Elliott wave count remains the same.

Summary: A little more downwards movement tomorrow may end about 2,688 to 2,686. The pullback may find support at the lilac trend line. Thereafter, the upwards trend should continue to develop.

The long to mid term Elliott wave target is at 2,922, and a classic analysis target is now at 3,045.

Corrections are an opportunity to join the trend.

New all time highs from both the AD line and On Balance Volume give a high level of confidence to the expectation that price is likely to follow through to new all time highs.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

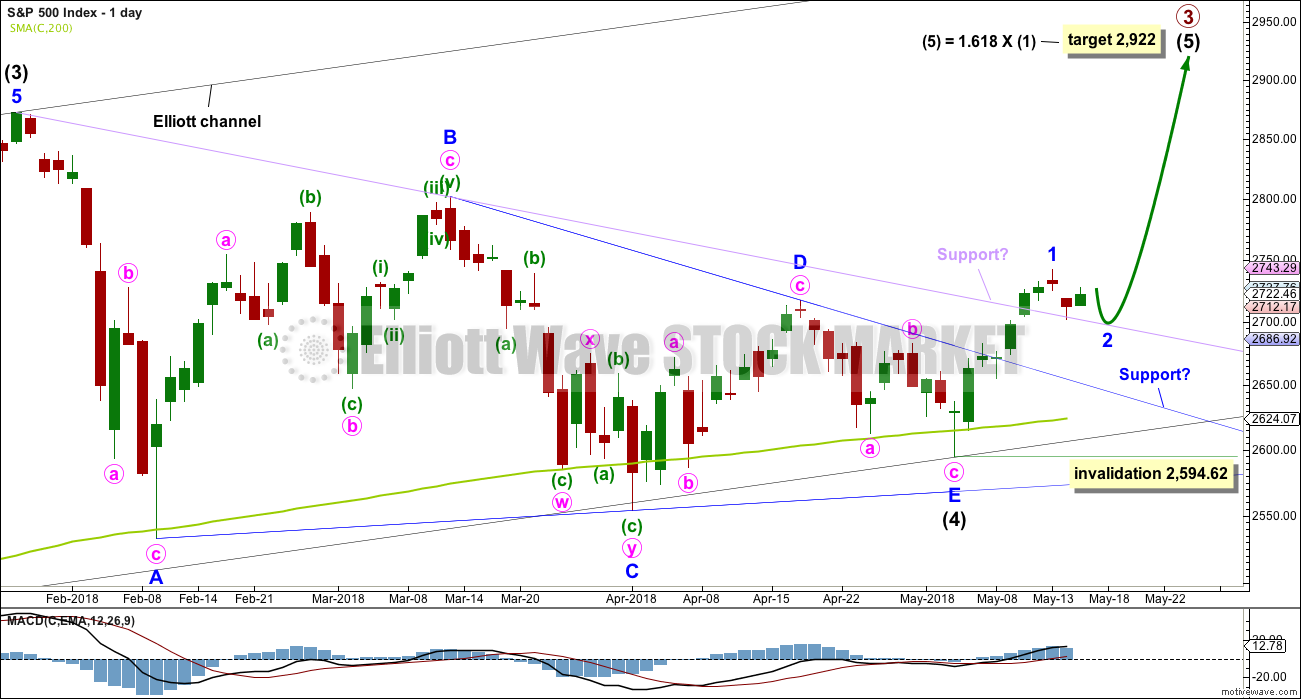

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

If intermediate wave (4) were to continue further as either a flat or combination, both possibilities would require another deep pullback to end at or below 2,532.69. With both On Balance Volume and the AD line making a new all time highs, that possibility looks extremely unlikely.

If intermediate wave (4) were to continue further, it would now be grossly disproportionate to intermediate wave (2). Both classic technical analysis and Elliott wave analysis now suggest these alternate ideas should be discarded based upon a very low probability.

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A resistance line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Upwards movement has sliced cleanly through this line, finding no resistance before breaking it. This line may offer some support for any pullbacks. Price found support at that line yesterday. A breach of that line does not mean the classic triangle is invalid and that price must make new lows, only that the pullback is deeper. Look for next support at the blue Elliott wave triangle B-D trend line.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is now about the 5th of June.

HOURLY CHART

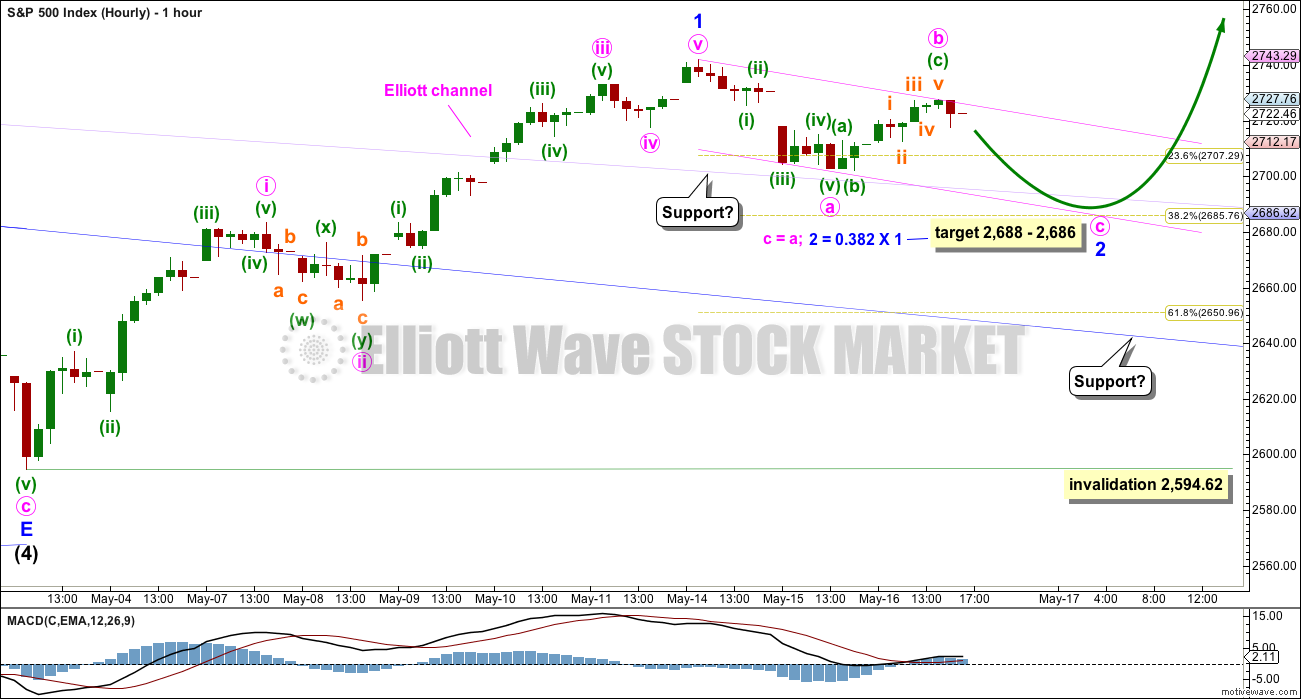

Intermediate wave (5) must subdivide as either an impulse or an ending diagonal. An impulse is much more common and that shall be how this is labelled, until price shows otherwise.

Minor wave 1 is a complete five wave impulse. The middle portion of minuette wave (iii) does not have as good a look for this wave count, but the S&P does not always have good looking impulses.

Minor wave 1 may have lasted seven days. Minor wave 2 may be expected to last about three to eight days to have reasonable proportion to minor wave 1. Targets for minor wave 2 may be the 0.382 and 0.618 Fibonacci ratios.

Minor wave 2 may be subdividing as a zigzag, and within it minute wave a may be a complete five wave impulse. Minute wave b may have completed today. If minute wave a is correctly labelled as a five, then minute wave b may not move beyond its start above 2,742.10. A target at two degrees is now calculated; this is about where price may find support at the lilac trend line.

It is also possible that minute wave a is incorrectly labelled. It may be a complete double zigzag. If minute wave a is a corrective structure, then minor wave 2 may be unfolding as a flat correction. Within a flat correction, minute wave b may make a new high above the start of minute wave a at 2,742.10 as in an expanded flat. It is for this reason that an upper invalidation point is not added to this hourly chart.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,594.62.

TECHNICAL ANALYSIS

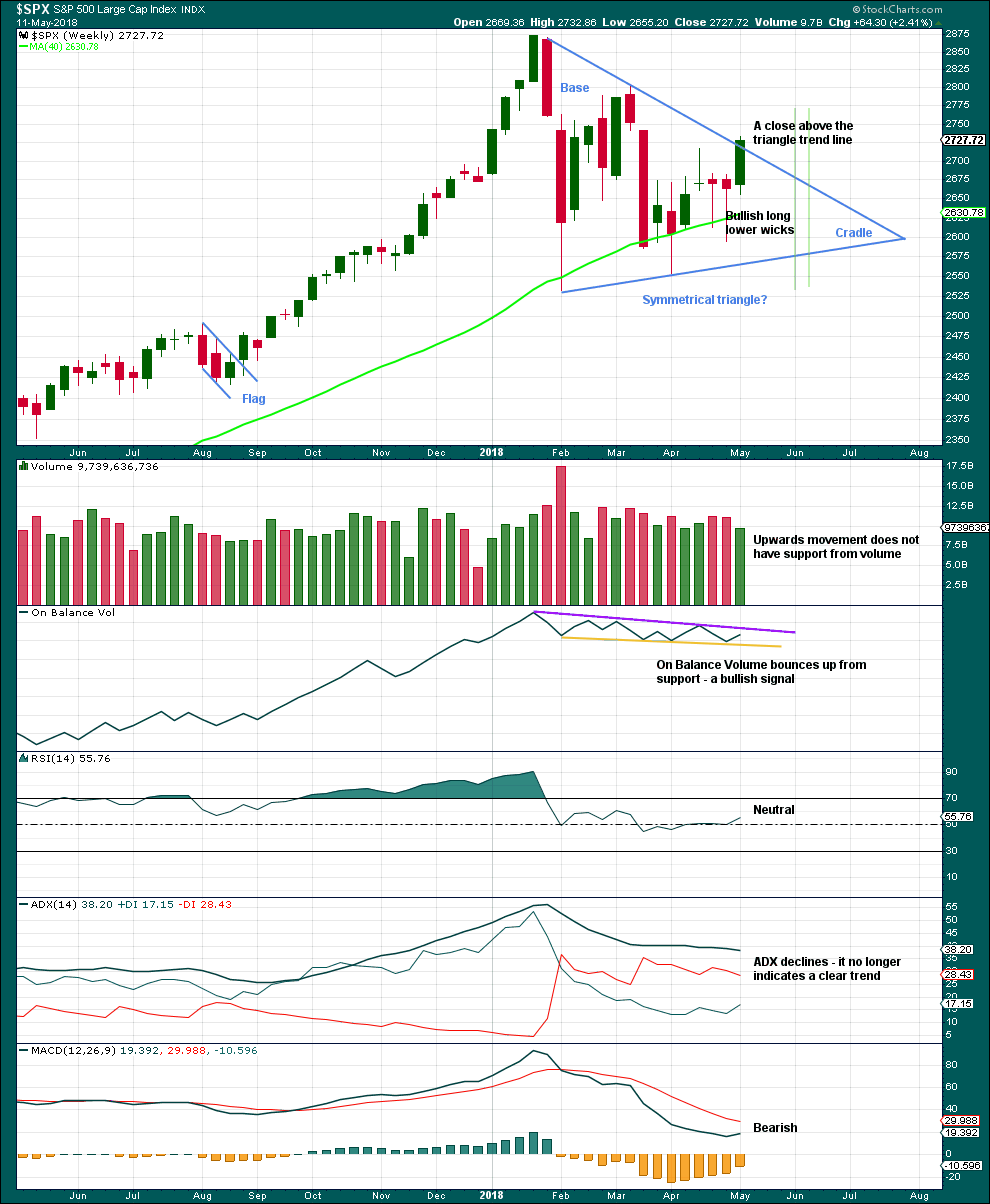

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout may have happened last week. There was a high trading range within the triangle, but volume declined.

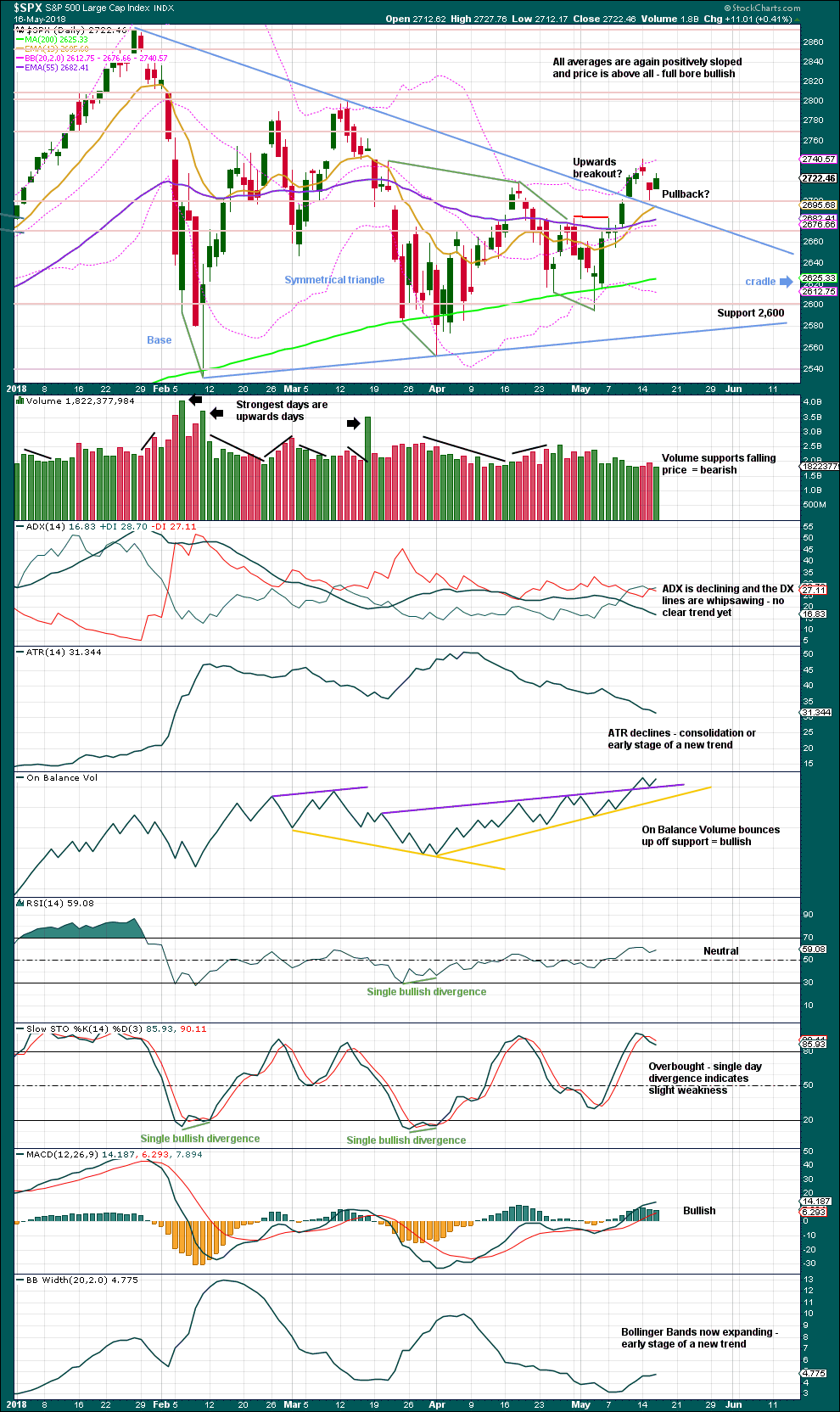

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete, and price has completed an upwards breakout. There may be some small cause for concern that the upwards breakout does not have support from volume. However, in current market conditions only some small concern is had here. Rising price on light and declining volume has been a feature of this market for many months, yet price continues to rise.

After an upwards breakout, pullbacks occur 59% of the time. A pullback may find support at the upper triangle trend line and may be used as an opportunity to join a trend. The trend line sits slightly differently here with StockCharts data than it does on BarChart data used for the Elliott wave analysis. Here, there is a little more room for the pullback to move lower. If price moves lower, then the last gap will be closed and would then be considered a pattern gap and not a measuring gap.

Symmetrical triangles suffer from many false breakouts. If price returns back into the triangle, then the breakout will be considered false and the triangle trend line will be redrawn.

The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

For the short term, the next smaller consolidation or pullback may come about 2,811. This shorter term target is calculated using the measuring gap. That gap may now provide support and may be used to pull up stops on long positions. The gap still remains just open; if it provides support, then tomorrow should not see any downwards movement.

On Balance Volume has made a new all time high, providing a very strong bullish signal; expect price to follow.

The volume profile is bearish for the last few days. This supports the hourly Elliott wave count.

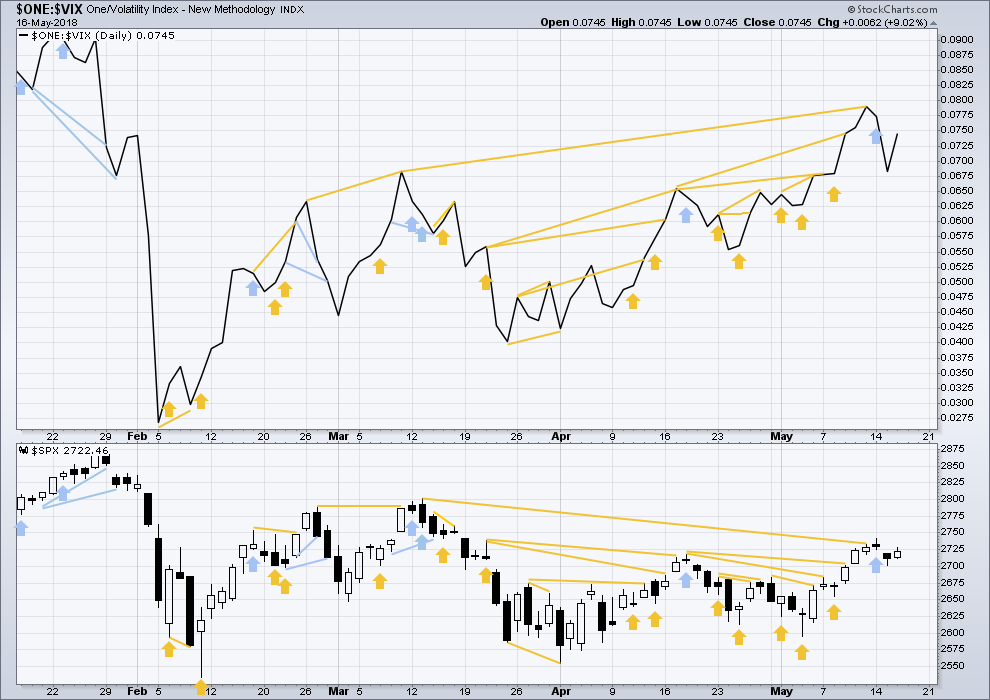

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still a cluster of bullish signals on inverted VIX. Overall, this may offer support to the main Elliott wave count.

Inverted VIX is much higher than the prior swing high of the 9th / 13th March, but price is not yet. Reading VIX as a leading indicator, this divergence is bullish.

Both price and inverted VIX moved higher today. There is no divergence.

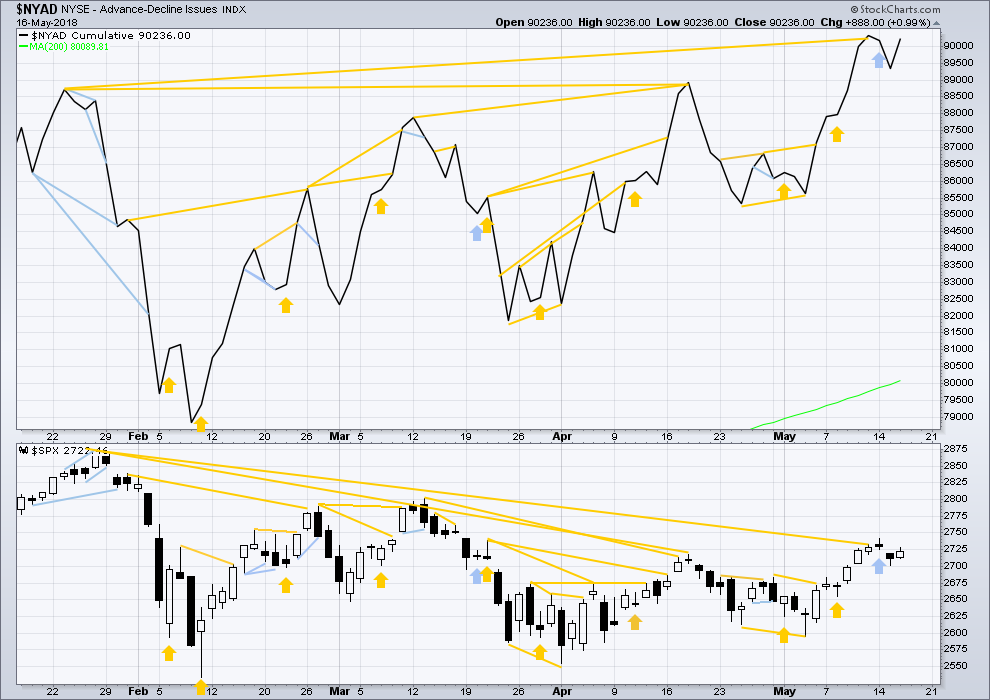

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Small caps have made a new all time high last week, but mid and large caps have yet to do so. This divergence may be interpreted as bullish. Small caps may now be leading the market.

Breadth should be read as a leading indicator.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

The AD line has made another new all time high. This is a very strong bullish signal, and is one reason why the more bearish Elliott wave counts are discarded. It is extremely likely now that price shall follow with a new all time high.

Both price and the AD line moved higher today. There is no new divergence.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 08:30 p.m. EST.

Minor 2 still looks incomplete. I’m leaving the target at the 0.382 Fibonacci ratio because that’s where the lilac trend line will provide support.

Lara I’m wondering if there’s any significant potenital that in fact it’s a 1-2-3 and now 4 in progress off the early May low, and the 3 is shorter than the 1 (chart). Obviously, such a count have a vastly different expected top vs. the current main, which is extremely bullish. Thoughts?

I should have said with the 4 completed and the 5 up underway, as diagrammed in the chart (proper proportions for such a count). Key question is, is such a count feasible here? Vs. the count in the hourly main?

Yes, it’s feasible.

I’ll have it as an alternate today, as it seems to be a popular idea. And when charted it doesn’t look too bad.

I like this better too. Thanks for posting.

Last night’s analysis indicated the target range for minute c of Minor 2 is 2688-2686 which aligns with .382 retracement of Minor 1. 0.618 would take it lower to about 2650. I will step in at the 2688 level. Patiently waiting like I did for 4 months during the Intermediate 4 triangle.

The upper trend line of the Intermediate 4 drawn from the top of Intermediate 3 is roughly about 2690. Minor 2 might find strong support here and complete the back test of the triangle breakout. Classical TA.

This lends support to the EW 0.382 retrace to complete Minor 2 as opposed to the much lower 0.618 retrace target. It looks to me like Minor 2 will complete tomorrow.

I think you may have nailed it. Find out tomorrow or Monday!

Good man! Exited half my spreads for better than break even. Waiting for target to buy back remaining short calls. Rare for breakout not to tag top trend-line with high volume reversal. 🙂

It may not hold but at the moment, a perfect hit and bounce off the 61.8% retrace on SPX. This pullback could be over…

now I’m waiting for the bullish symmetry (largist up move in the down move) to get exceeded, around 2724.8…

nope and nope…little war goin’ on between the species here. I’m sure all the open short money is worried more than a little about the potential for an upside explosion. Waiting for some kind of indication of next move to present itself.

2688? All aboard ?

Is this impulse down second zigzag of the double?

MACD crossover on the 1 hour

Rally from here, or bull trap?

yeah now I’m lost …..

The minor 2 wasn’t particularly deep. The minor 3 has (probably) launched (largely confirmed when price exceed the May 14 high). We could see a minor 2 flat here, with price getting up to around 2737, then dropping back to 2702 again. Could. If you are trading a timeframe higher, and using the hourly to enter…anywhere in here is pretty good, IMO. If you are day trading, yea you need to be careful, price is in an uncertain area at the moment.

If SPX makes a new high above 2742.10 then I might consider that minor 2 may be complete. Below that, I still see Lara’s hourly chart as on track. She stated that 2742.10 can be exceeded even without invalidating the hourly count.

So the question for me is do I begin scaling in long now in thoughts minor 2 is over, or do I wait patiently for a lower low for minor 2? I think I will wait patiently with the downside of buying in above 2742. Right now at 2731+ I think minor 2 as presenting is right on. It is moving sideways to use up time.

Superb analysis Lara. Excellent cautionary note about volume and the possible symmetrical triangle. Either way, an outstanding trading opportunity lies ahead, either on the third wave up or the E wave reversal. Lock and Load!

Indeed Verne!! With this pullback being a relatively shallow 2 (so far), a push up is extremely bullish, the price area of expected high mometum is right where a boatload of shorts start feeling serious pain. Here’s an interesting weekly view of SPX, with a “fractal energy” subplot (the yellow meandering line). The chart shows what happens when this indicator gets into it’s current position: some major upside damage, months worth. Nothing is certain. But it might be a Really Fine Time at the low of this current 2 to get a serious position. Might be….

That has been my plan now for a few weeks. Get 50% long on triangle breakout and another (serious) 50% long at low of Minor 2. Trading the 3rd waves is the best EW opportunity to make money. Couple this with an excellent TA trade and one might just make some (serious) profits.

My friend Paul Simon once sang, “Get with the plan, Stan.”

“Don’t need a decoy, Roy

Just get on the bus Gus,

Don’t need to discuss much!

And set yourself free…”

I think that was “50 Ways to Make Some Money”, yeah.

Wouldn’t that have been nice, 50 Ways to Make Some Money! As a matter of fact, that song made Paul Simon some ‘serious’ money. And I think it was actually, “Get a new plan, Stan.”

Put in 6% of my trading equity into SPX Dec. calls the moment SPX started to show just a little strength this morning…in like Flynn, and committed to the intermediate term. A new ATH in late summer will float my boat. Looks like this minute 2 was a real shorty, and I’d think that has to be quite bullish in the short term too.

Thank you very much Verne!

🙂