A strong signal from the AD line today means that the alternate Elliott wave counts will be discarded.

There is now reasonable confidence in the main Elliott wave count. Today’s open gap may be used to calculate a target using classic technical analysis, to add to the Elliott wave target.

Summary: A short term Elliott wave target today is 2,744. A short term classic analysis target today is 2,811. At about one of these points a small consolidation or pullback may be expected.

The long to mid term Elliott wave target is at 2,922, and a classic analysis target is now at 3,045.

Corrections are an opportunity to join the trend.

If On Balance Volume makes a new all time high tomorrow or in the next few days, then the level of confidence in this analysis would be very high.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

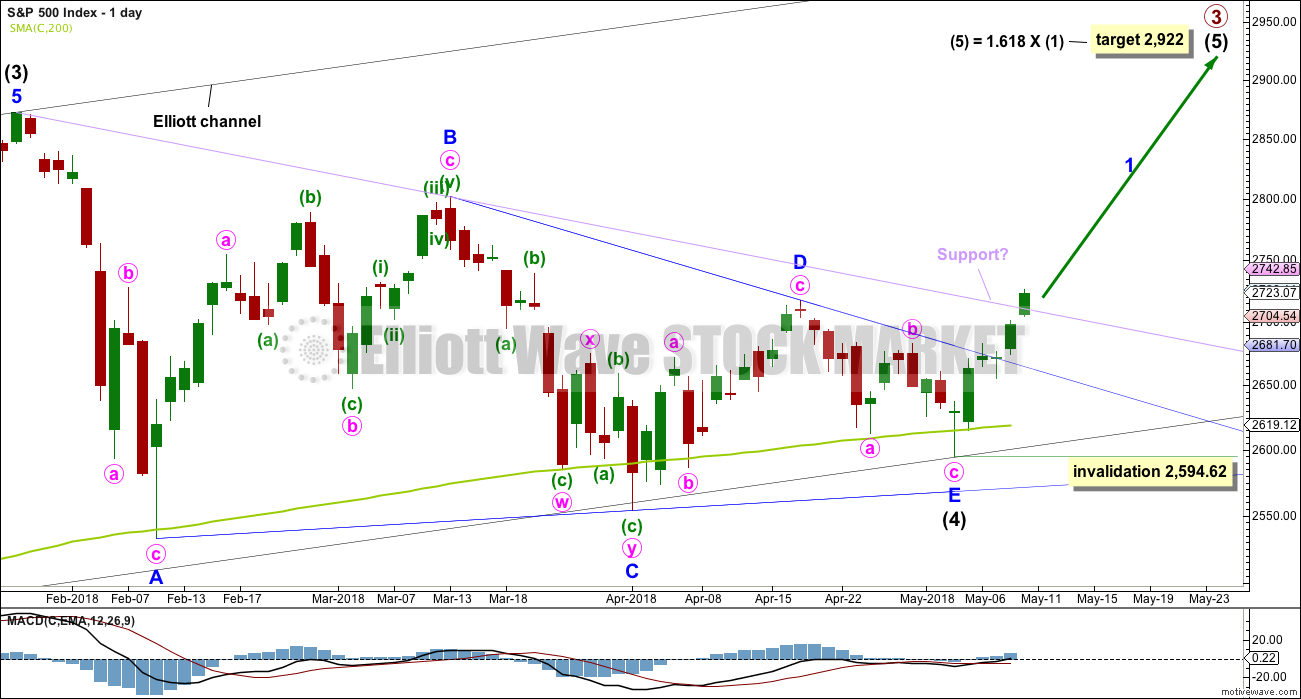

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

If intermediate wave (4) were to continue further as either a flat or combination, both possibilities would require another deep pullback to end at or below 2,532.69. With the AD line making a new all time high today, that possibility looks extremely unlikely.

If intermediate wave (4) were to continue further, it would now be grossly disproportionate to intermediate wave (2). Both classic technical analysis and Elliott wave analysis now suggest these alternate ideas should be discarded based upon a very low probability.

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just above the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line, with a full daily candlestick above and not touching the trend line. This indicates that it should now be over if the triangle is correctly labelled.

A resistance line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Today’s upwards movement has sliced cleanly through this line, finding no resistance before breaking it. This line may offer some support for any pullbacks.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is about the 3rd of June.

HOURLY CHART

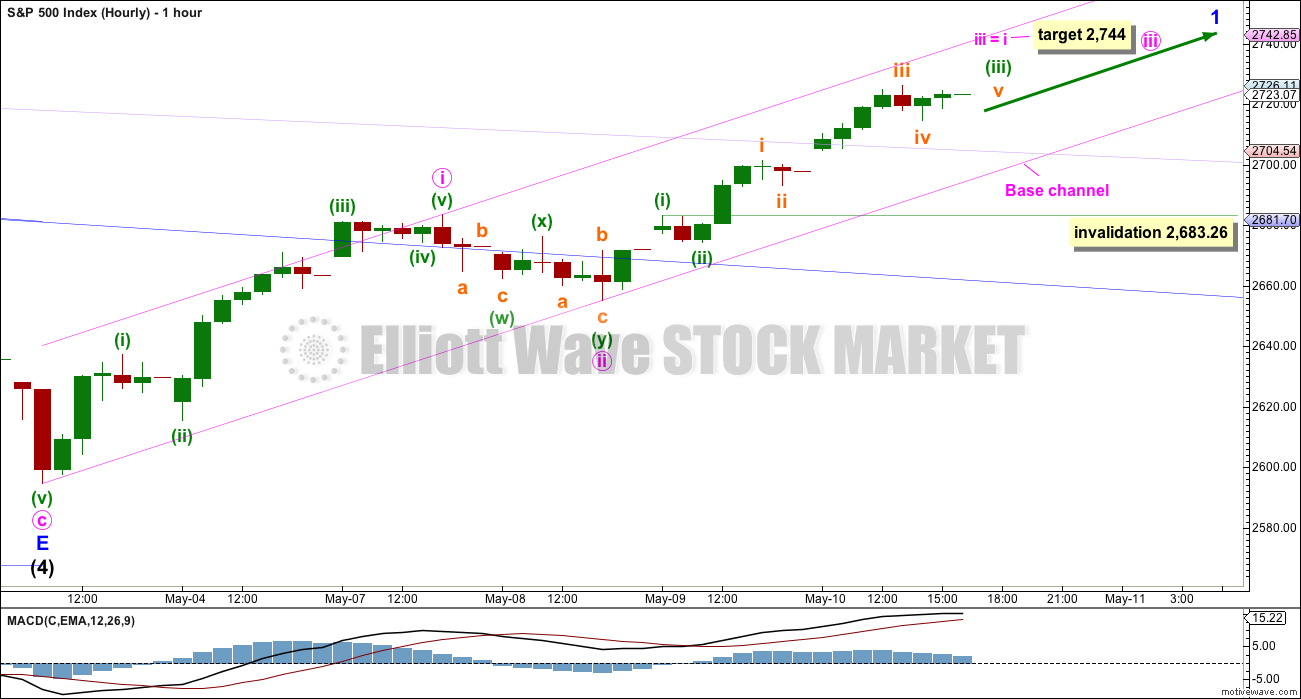

Intermediate wave (5) must subdivide as either an impulse or an ending diagonal. An impulse is much more common and that shall be how this is labelled, until price shows otherwise.

So far minor wave 1 may be incomplete and subdividing as an impulse.

Within minor wave 1, minute waves i and ii may be complete. The target for minute wave iii expects only equality in length with minute wave i because minute wave ii was very shallow.

Minute wave iii may only subdivide as an impulse, and within it minuette waves (i) and (ii) may be complete. Minuette wave (iii) may not be over at the high labelled subminuette wave i because the rule regarding third waves not being the shortest would be broken. Minuette wave (iii) looks incomplete.

When minuette wave (iii) is complete, then the following correction for minuette wave (iv) may not move into minuette wave (i) price territory below 2,683.26.

A base channel is drawn about minute waves i and ii. Along the way up, corrections should find support about the lower edge of this channel. Minute wave iii may have the power to break above the upper edge of the base channel.

TECHNICAL ANALYSIS

WEEKLY CHART

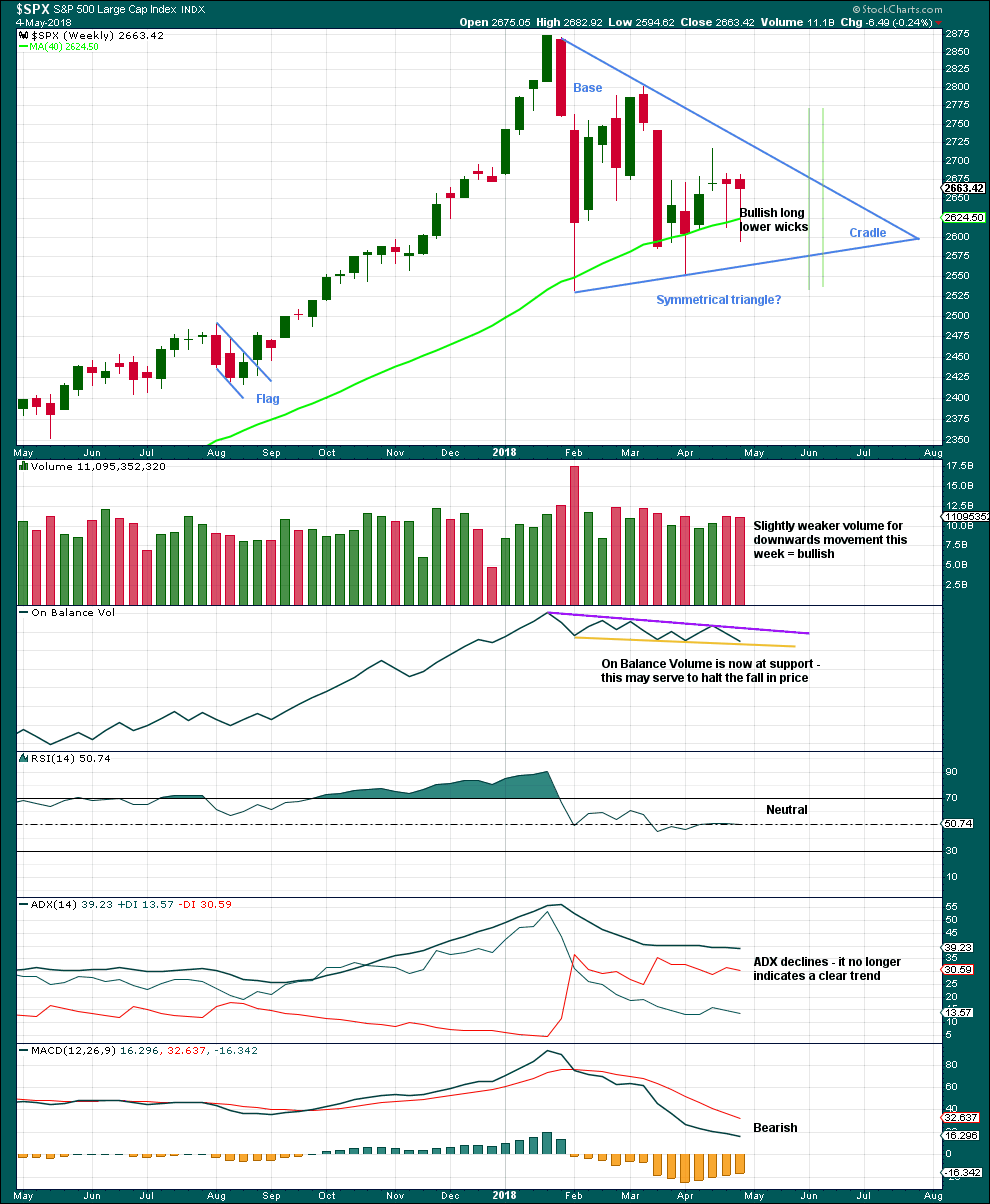

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout has not yet happened. There is a high trading range within the triangle, but volume is declining.

The triangle may yet have another 5 – 6 weeks if it breaks out at the green lines.

Now two bullish long lower wicks are complete, and the second wick is even longer so more bullish. On Balance Volume is at support, which may halt the fall in price. The resistance line on On Balance Volume is slightly adjusted to have stronger technical significance.

DAILY CHART

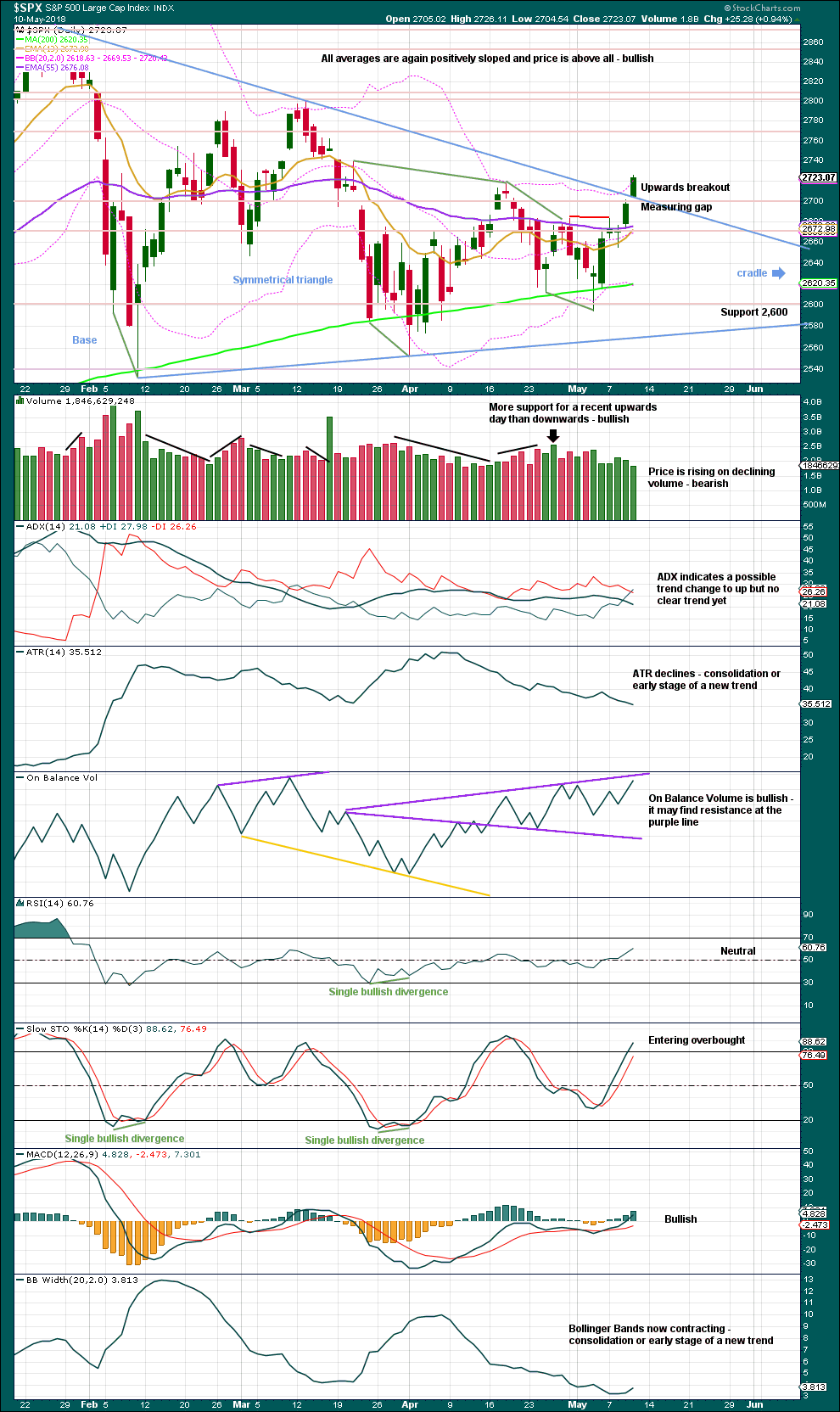

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete, and today may have completed an upwards breakout. There may be some small cause for concern today that the upwards breakout does not have support from volume. However, in current market conditions only some small concern is had here. Rising price on light and declining volume has been a feature of this market for many months, yet price continues to rise.

Breakouts from symmetrical triangles most commonly occur from 73% to 75% of the length from base to cradle. In this instance, the breakout has come earlier.

After an upwards breakout, pullbacks occur 59% of the time. A pullback may find support at the upper triangle trend line and may be used as an opportunity to join a trend.

The base distance is 340.18 (this was incorrectly calculated in last analysis as 320.28). Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

For the short term, the next smaller consolidation or pullback may come about 2,811. This shorter term target is calculated using the measuring gap that appeared at today’s open. That gap may now provide support and may be used to pull up stops on long positions.

On Balance Volume has moved strongly higher today to make a new high above its prior swing high of the 16th of March, but price has not. This divergence is bullish. On Balance Volume is very bullish, and is one of two major reasons why the alternate Elliott wave counts have been discarded today. If On Balance Volume makes a new all time high, that would provide a very strong bullish signal; expect price to follow.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

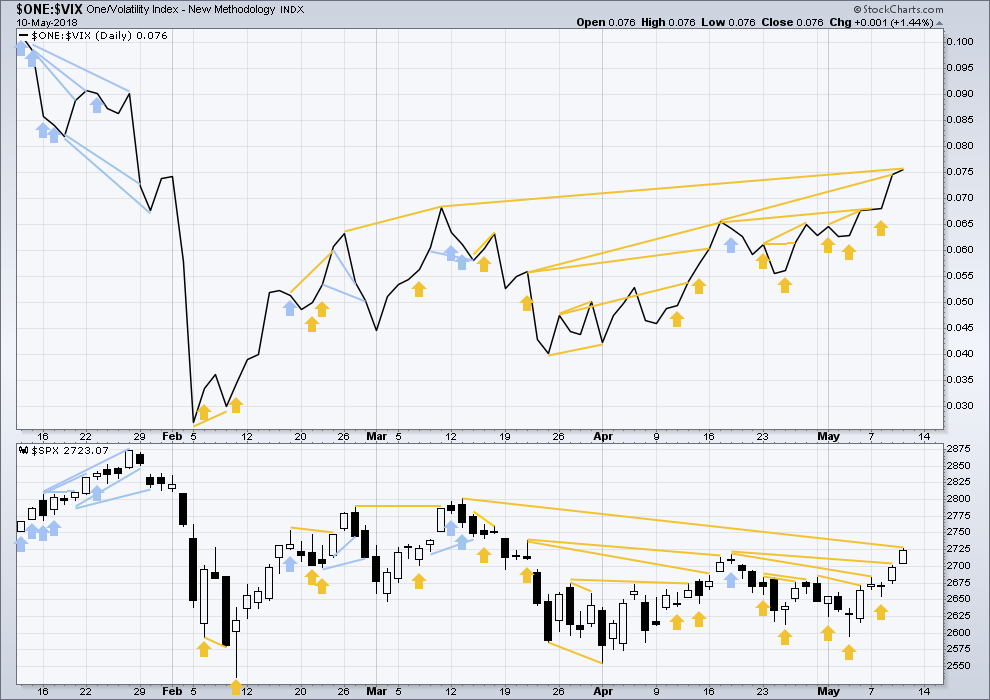

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still a cluster of bullish signals on inverted VIX. Overall, this may offer support to the main Elliott wave count.

Inverted VIX today is much higher than the prior swing high of the 9th / 13th March, but price is not yet. Reading VIX as a leading indicator, this divergence is bullish.

BREADTH – AD LINE

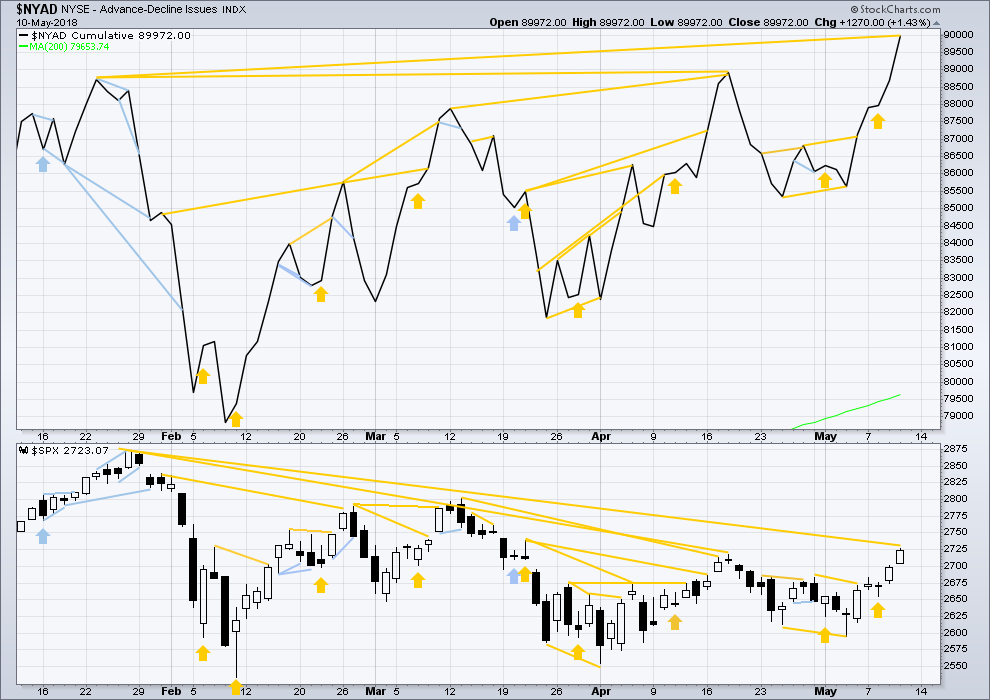

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. A new all time high from the AD line this week means that any bear market may now be an absolute minimum of 4 months away.

For most recent days, both mid and small caps have now made new small swing highs above the prior highs of the 30th of April (mid caps) and the 26th of April (small caps). Only large caps have not yet made new small swing high above the 30th of April. Small and mid caps may be leading the market. This divergence is interpreted as bullish.

Breadth should be read as a leading indicator.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

The AD line has made another new all time high today. This is a very strong bullish signal, and is one reason today why the more bearish Elliott wave counts are discarded. It is extremely likely now that price shall follow with a new all time high.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:45 p.m. EST.

A smaller turn window for May 11 to 13 was the noticed for markets, we shall see what next week brings but big stocks were pinned to numbers for options expiry thus controlled action on indexes.

Apologies everybody for not being here in time this morning. We have guests, it was a very late night last night.

Analysis will be published today, relatively early in the weekend for you.

The analysis is done and will be published shortly. Apologies again for it not being earlier.

Seems like everyone is waiting to see when/where minor 1 will end, and minor 2 begin for a leg down 🙂

Also Vern not posting 🙁

But I do enjoy reading Kevin’s updates. Keep them coming Kevin… Learning a lot from your strategies.

Thank you Ari, good to know they are of value.

My latest this afternoon getting into RSI with a period of 2 (!!), and LaGuerreRSI. Together, I am so far rather impressed, but a lot more investigation needed.

crickets …

The potential analogue for the current and expected action over the next few days is Feb 16. A sideways/down 4 wave selloff for a few days, then a final 5 up to complete the overall 5 wave push off the May 3 low. Maybe today turns and pushes up more…but it would really surprise me.

Looking for a swing high at the time marked with the area and in the zone marked with the box. At which point I’ll be cashing all longs and looking for a larger “2” back down, within this overall channel I’ve drawn in (a redux of the prior channel, and we can see how that one ended!).

One note: Lara’s marked Wednesday morning’s gap as “continuation”. I note that almost every swing high in this intermediate 4 was immediately preceeded by a gap and go up day. Feb 26, Mar 9, Apr 5, Apr 17. So…careful ya’ll.

“One note: Lara’s marked Wednesday morning’s gap as “continuation”. I note that almost every swing high in this intermediate 4 was immediately preceeded by a gap and go up day. Feb 26, Mar 9, Apr 5, Apr 17. So…careful ya’ll.”

Yes, quite true. A very good point.

It could continue to be so, if price is within the same conditions as intermediate (4).

It is also possible that the prior bull market conditions have resumed, in which case the gap may work better as a measuring or continuation gap. A halfway gap.

Pay to the order of: Rodney

Amount: One and no/100 US dollars.

Signed: Kevin

Perhaps it should go into escrow…there’s still a (faint) chance of a combination revival…

The combination could be revived. I don’t like your chances, but I have to acknowledge it is a possibility.

Your indebtedness and payment is acknowledged. I’ll bet you another dollar and give you 3 to 1 odds that 2580 will not be broken until Primary 4 or afterwards.

Lol!!!! I like a gambler! But come on Rodney, you’ve gotta lay more balanced odds than that. While I like to seriously entertain all possibilities…I only bet on the reasonably likely ones!!

My counter offer: double or nothing, otherwise same terms, but at 2700….

Now you’re being a scalper!

I’d love another shot at 2700. i don’t know if the retest will occur.

He he!!! Well, I gotta try…I’m underwater here!!

Yea, I think after this 5 wave up completes, the 2 back down is likely to be a deep one, just to create the maximal pain on retail market participants. I see these giant swings as market manipulation by the big/smart money in lieu of a backdrop of consistent buying pressure; it enables them to drive the market for a while, buy low and selling high with confidence that they are in control. Perhaps the background buying pressure is getting the upper hand again, but that remains to be seen.

Kevin,

I am expecting the same but not until market has convinced everyone that bulls are back and majority of retail money is riding long. I think we will see ATH across the indexes before the drop to wipe some serious coin in the coming months.