Yesterday’s main hourly Elliott wave count expected a small correction to continue sideways or lower. A little downwards movement to complete a doji candlestick for the session fits this expectation.

Summary: The target is now at 2,922. The correction may be over. Upwards movement may resume tomorrow. This view has some support from divergence between price and the AD line and VIX. However, this divergence is weak.

It is also possible that the small correction may move sideways and a little lower for one to a few days. This view has support from bearish divergence between price and On Balance Volume and a bearish short term volume profile.

Traders with a lower risk appetite may set stops just below Friday’s low. For those comfortable with the possibility of an underwater position for a few days, stops may be just below 2,553.80.

A more cautious approach here may be to wait for an upwards breakout above the triangle B-D trend line before entering a long position.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

It is possible still that a low may not be in place; intermediate wave (4) could still continue further. Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. However, it would be extremely likely to remain within the wider teal channel (copied over from the monthly chart) if it were to be reasonably deep. This channel contains the entire bull market since the low in March 2009, with only two small overshoots at the end of cycle wave IV. If this channel is breached, then the idea of cycle wave V continuing higher would be discarded well before the invalidation point is breached.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, there are still three possible structures for intermediate wave (4): a triangle, a combination, and a flat correction. All three will be published. The triangle is preferred because that would see price find support about the 200 day moving average. While this average provides support, it is reasonable to expect it to continue (until it is clearly breached).

The triangle may be complete now, but the other two possibilities of a flat and combination may be incomplete.

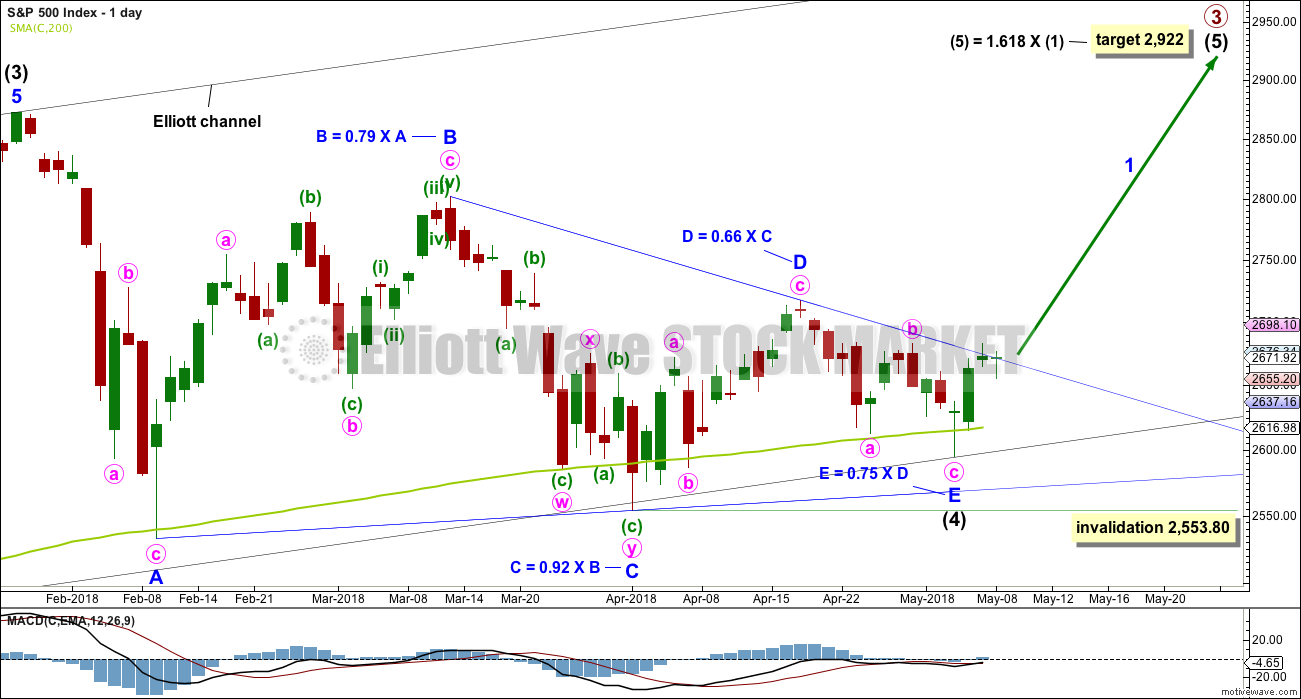

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just above the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

It must still be accepted that the risk with this wave count is that a low may not yet be in place; intermediate wave (4) could continue lower. For this triangle wave count, minor wave E may not move beyond the end of minor wave C below 2,553.80.

When price has clearly broken out above the upper triangle B-D trend line, then the invalidation point may be moved up to the end of intermediate wave (4). A clear breach requires a full daily candlestick above and not touching the trend line.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is about the 3rd of June.

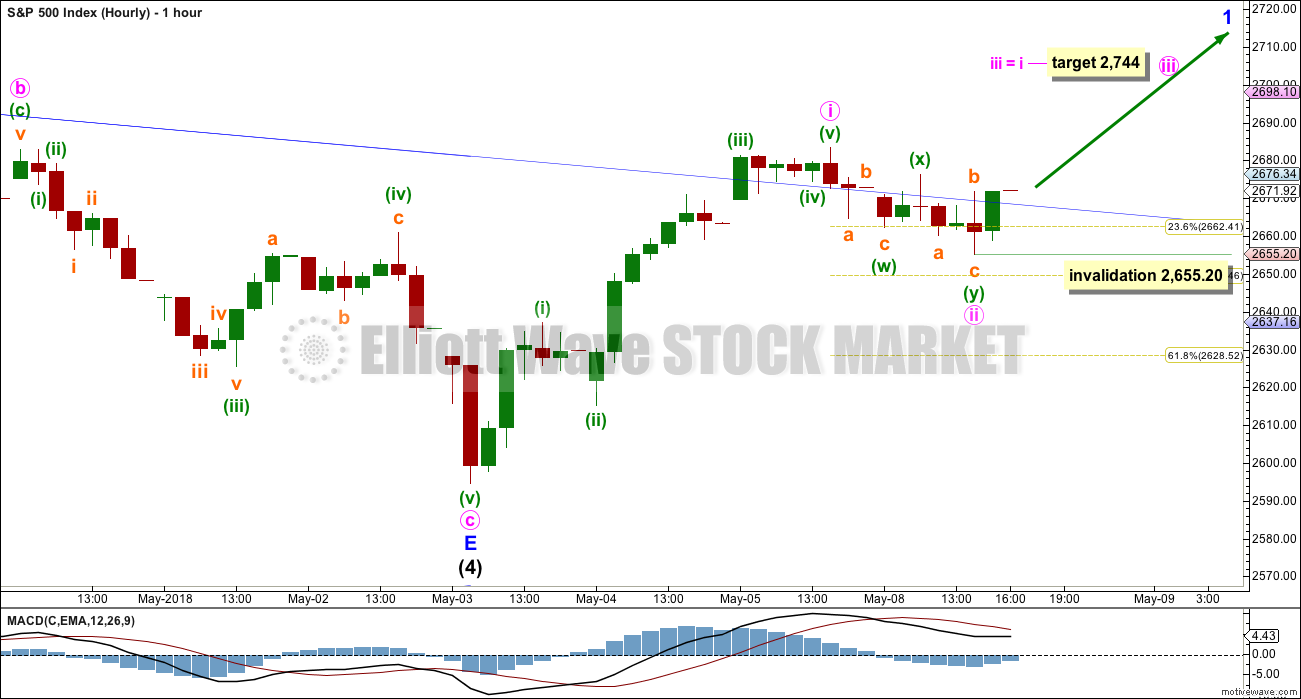

HOURLY CHART

Minute wave i may have been over at the last high. If minute wave ii begins there, then it subdivides well as a double zigzag.

Double zigzags are common, but triples are very rare. It would be possible but highly unlikely that minute wave ii could continue lower as a triple zigzag. It would be most likely to be over here.

Within minute wave iii, no second wave correction may move beyond the start of its first wave below 2,655.20.

The target for minute wave iii expects equality in length with minute wave i, because minute wave ii for this wave count is very shallow.

ALTERNATE HOURLY CHART

It is also still possible that minute wave ii may be incomplete.

Minute wave ii may continue as a flat or combination. It may not subdivide as a triangle for the sole corrective structure.

If minute wave ii continues further as a flat correction, then within it minuette wave (a) is a completed zigzag and minuette wave (b) may be an expanded flat, which must retrace a minimum 0.9 length of minuette wave (a) at 2,681.24, and which may make a new high above the start of minuette wave (a) at 2,683.35 (expanded flats are very common structures).

If minute wave ii continues further as a double combination, then the first structure in the double may be a completed zigzag labelled minuette wave (w). The double may be joined by an incomplete three in the opposite direction, a flat labelled minuette wave (x). There is no minimum requirement for X waves within combinations, and they may make new price extremes beyond the start of W waves.

Minute wave ii may continue sideways and lower for another one to few sessions. Minute wave ii may not move beyond the start of minute wave i below 2,594.62.

ALTERNATE WAVE COUNTS

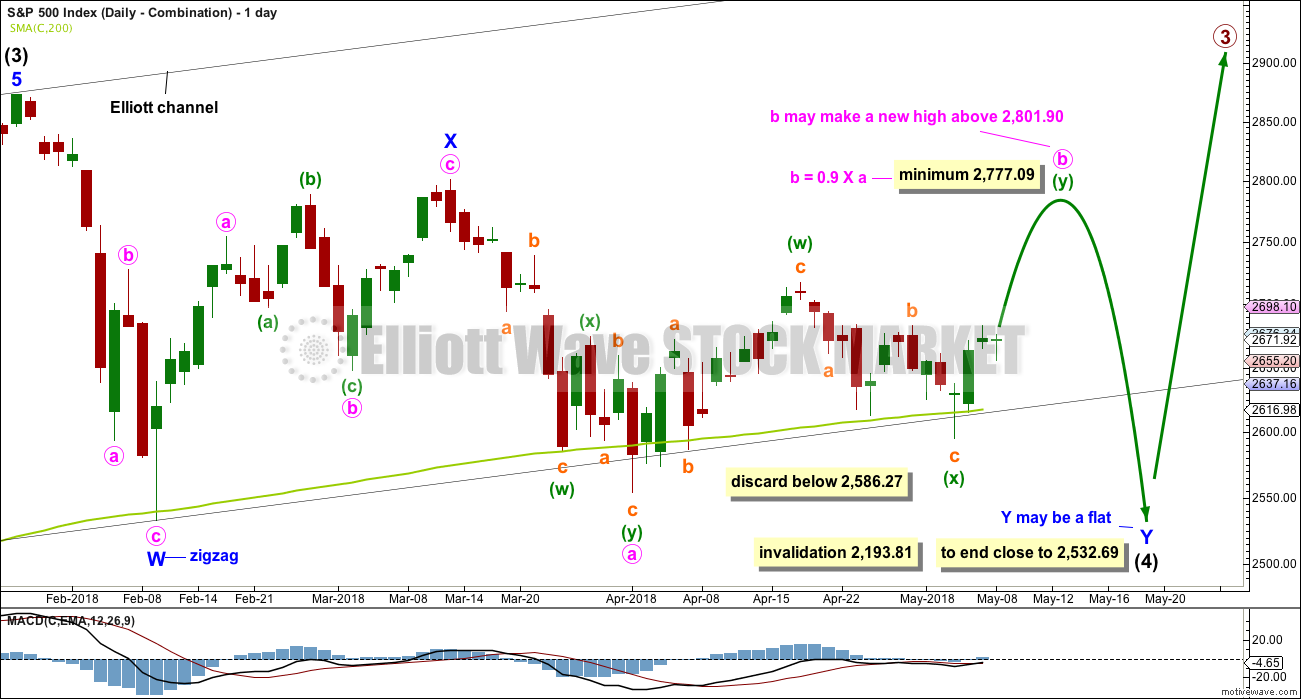

DAILY CHART – COMBINATION

I have charted a triangle a great many times over the years, sometimes even to completion, only to see the structure subsequently invalidated by price. When that has happened, the correction has turned out to be something else, usually a combination. Therefore, it is important to always consider an alternate when a triangle may be unfolding or complete.

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but at this stage the expected direction for that idea does not differ now from the main wave count.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag. It may also be a double zigzag.

Minute wave b must now reach a minimum 0.90 length of minute wave a. Minute wave b may be unfolding as a double zigzag. Within a double zigzag, the second zigzag exists to deepen the correction when the first zigzag did not move price deep enough. Double zigzags normally have a strong slope like single zigzags. To achieve a strong slope the X wave within a double zigzag is normally brief and shallow, most importantly shallow (it rarely moves beyond the start of the first zigzag). A new low now below 2,586.27 should see the idea of a double zigzag for minute wave b discarded.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely but does have precedent in this bull market.

Minute wave b may make a new high above the start of minute wave a if minor wave Y is an expanded flat. There is no maximum length for minute wave b, but there is a convention within Elliott wave that states when minute wave b is longer than twice the length of minute wave a the idea of a flat correction continuing should be discarded based upon a very low probability. That price point would be at 3,050. However, if price makes a new all time high and upwards movement exhibits strength, then this idea would be discarded at that point. Minute wave b should exhibit obvious internal weakness, not strength.

At this stage, the very bullish signal from the AD line making a new all time high puts substantial doubt on this wave count. It has very little support from classic technical analysis.

DAILY CHART – FLAT

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above. A target is calculated for minor wave B to end, which would see it end within the common range.

Minor wave B may be a regular flat correction, and within it minute wave a may have been a single zigzag and minute wave b may have been a double zigzag. This has a very good fit.

However, minute wave c must be a five wave structure for this wave count and now the depth and duration of subminuette wave ii looks wrong. The probability that minute wave c upwards is unfolding as an impulse is now reduced. It is possible that it could be a diagonal, but that too has a relatively low probability as the diagonal would need to be expanding to achieve the minimum price target for minor wave B, and expanding ending diagonals are not very common.

At its end minor wave B should exhibit obvious weakness. If price makes a new all time high and exhibits strength, then this wave count should be discarded.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This is possible but may be less likely than a smaller breach. The bullish signal from the AD line making a new all time high puts substantial doubt on this wave count.

TECHNICAL ANALYSIS

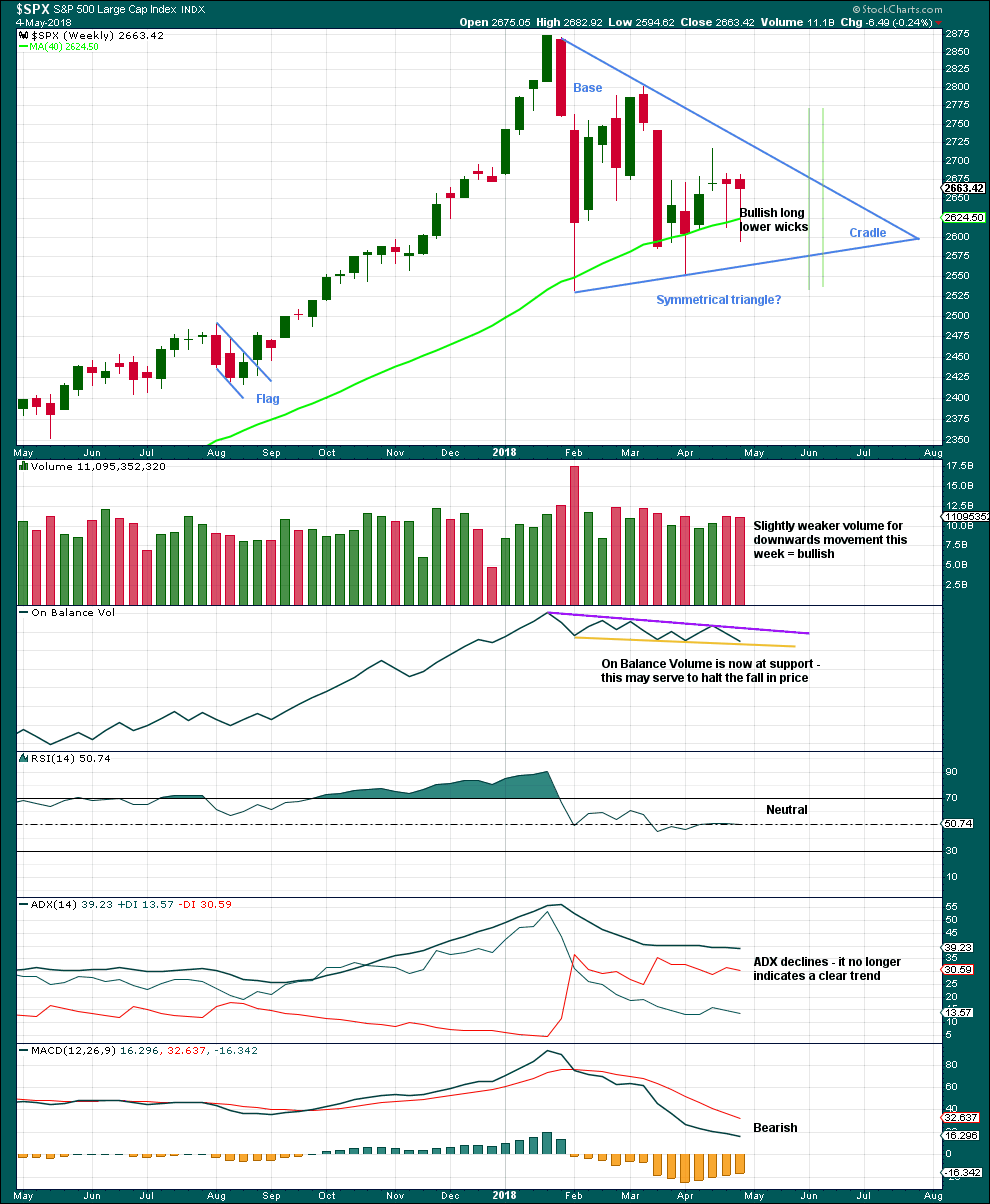

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout has not yet happened. There is a high trading range within the triangle, but volume is declining.

The triangle may yet have another 5 – 6 weeks if it breaks out at the green lines.

Now two bullish long lower wicks are complete, and the second wick is even longer so more bullish. On Balance Volume is at support, which may halt the fall in price. The resistance line on On Balance Volume is slightly adjusted to have stronger technical significance.

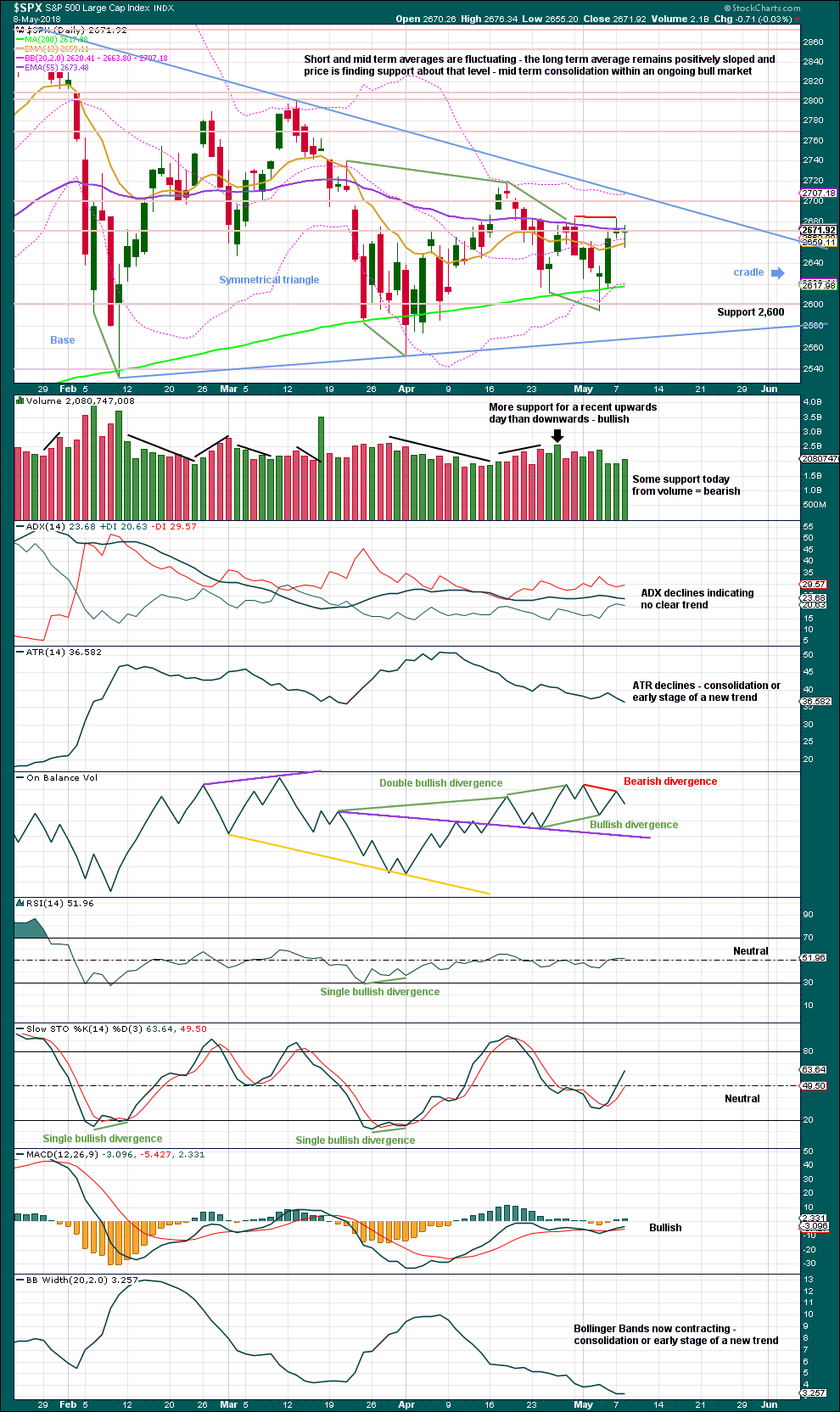

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

During this large consolidation, there are two green daily candlesticks with strongest volume:

1. the 6th of February was a downwards day, but it closed green and the balance of volume that day was upwards; this has the strongest volume during the consolidation.

2. the 16th of March was an inside day, which closed green and has the balance of volume upwards; this has the next strongest volume.

This market has been range bound since the last all time high. Volume suggests an upwards breakout is more likely than downwards. With price coiling in an ever decreasing range, it looks like a classic symmetrical triangle is forming. These are similar but not completely the same as Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns while Elliott wave triangles are always continuation patterns.

Breakouts from symmetrical triangles most commonly occur from 73% to 75% of the length from base to cradle. In this instance, that would be in another 16 to 18 sessions. A breakout should be a close above or below the triangle trend lines, and an upwards breakout should have support from volume for confidence.

After an upwards breakout, pullbacks occur 59% of the time. After a downwards breakout, throwbacks occur 37% of the time.

After a breakout, the base distance (the vertical distance between the initial upper and lower reversal point prices) may be added to the breakout price point to calculate a target. Here, the base distance is 320.28 points.

There is bearish divergence between price and On Balance Volume, as noted. This offers some support to the alternate hourly chart.

Price moved lower today, but the candlestick closed green. The balance of volume was downwards. Downwards movement during today’s session has some support from volume. This also offers support to the alternate hourly chart.

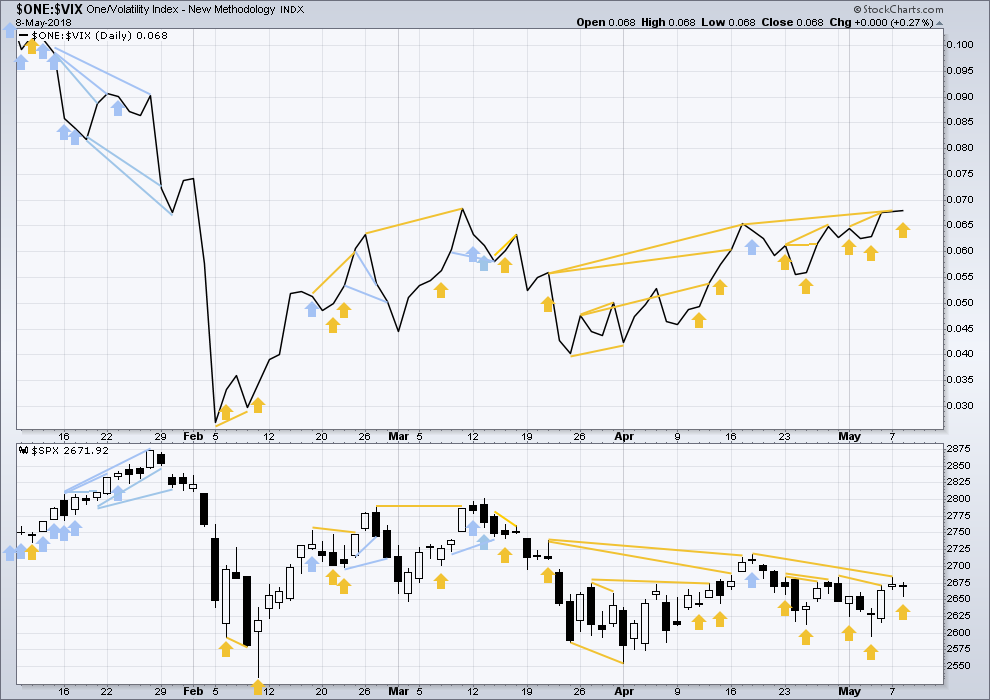

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still a cluster of bullish signals on inverted VIX. Overall, this may offer support to the main Elliott wave count.

Price moved lower today, but inverted VIX has moved higher. This divergence is bullish, but it is weak because inverted VIX has only moved very slightly higher.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. A new all time high from the AD line this week means that any bear market may now be an absolute minimum of 4 months away.

For most recent days, both mid and small caps have now made new small swing highs above the prior highs of the 30th of April (mid caps) and the 26th of April (small caps). Only large caps have not yet made new small swing high above the 30th of April. Small and mid caps may be leading the market. This divergence is interpreted as bullish.

Breadth should be read as a leading indicator.

The new all time high from the AD line remains very strongly bullish and supports the main Elliott wave count. This new all time high from the AD line will be given much weight in this analysis. This is the piece of technical evidence on which I am relying most heavily in expecting a low may be in place here or very soon.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

Bullish divergence noted in last analysis has been followed by a downwards day. It may have failed, or it may yet be followed by some upwards movement.

Price moved lower today, but the AD line moved higher. This is again bullish divergence, but this is only weak because the AD line has moved only very slightly higher.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 08:24 p.m. EST.

Nice green candelstick we can hold with both hands!

Going to be cautious and trade small positions as I have a fear of heights lately when I see a chart go vertical like today. 🙂

The triangle upper B-D trend line will be fully breached at the daily chart level today, this gives me reasonable confidence for that wave count that the triangle should be over.

The other two wave counts; combination and flat, remain valid but have a lower probability.

I’ll only really be able to discard those alternate ideas if price makes a new ATH and shows strength. If technicals get more bullish before then I may discard earlier.

For now, onwards and upwards as expected. I’m moving the invalidation point on the daily main count up to the end of the triangle at 2,594.62 today.

now that the triangle trend line is breached I’d expect it to provide support.

particularly as it was around about where price found some resistance along the way up. resistance now turns to support.

A contrarian view (different from Lara’s main hourly) of the EW count situation. I believe a 5 wave “1” is approaching completion, and then there will be an abc “2” (shown) that takes price back to at least the 38% retrace zone, and possibly much deeper. More churn, just like we’ve had for months. If price goes barrelling above 2720 and keeps moving up, this is inaccurate. If it’s right…technically this v wave push up could end any moment, though at the lower TF I don’t think its quite cooked yet.

I’ve rung my cash registers (“the money’s for nothin’ and the check’s for free!!”). At 2.7 x daily profit target, I’m giddy. Market may I have a 4 wave correction now, please, thank you very much??? How about a pullback to 2685….

Wave 3 is just shy the length of 1?

Maybe. Or maybe this….honestly, what I’m calling a 4 here looks a lot more like a 4 to me than a higher timeframe 2. A shallow 4 vs. the rather deep (but less time) 2. And now a 5 wave up that has started with a 1, 2, and now a 3 in progress. A 4 should bring prices back to 2685-90 I’d guess. I could all washed up here though….

ps: look at that price approach to the impending lower squeezing BB and the turn up and go!!! A reasonably predictable pattern in general, and when coupled with a bullish count…GET ON IT!!!

Nice Kevin, great job and good exit. Took off small SPX calls hedging my VIX position, now going full position for better or for worse. A sustained breakout above 2717 will force me out.

Thanks Chris. I suspect 2717 is not going to be breached today, and there should be some kind of corrective action coming; if this is a approaching completion 5 wave up, then a significant 2 down should be coming. As for my (early?) exits, I try to take the attitude of “any profit exit is a good exit”, because in the abstract, there’s infinite amount of $$ we are failing to make every moment! So concern about the “money I could have made” is absurd; that’s infinite, every moment!!! I rarely see a substantial profit on my position page that I’m not hungry to put in my pocket! Since I’m workin’ it all day session long, why let those profits go back to zero??? That’s how I roll, anyway, despite all my “good intentions” about holding a trade for the longer term. I’m coin operated, lol!!!

In this environment, it is the only way to be. I will also add that this action is destroying loads of capital on all sides from all investors, and historically it’s usually just before turns.

Just as US Dollar Index ran out of steam, SPX took off like a rocket. B D line breached, closed SPX long calls to take profits. Not convinced of anything about the triangle being closed, so acting conservative in SPX’s moves.

If this waves a knockin, time to start a rockin…

“Get out in the market, shimmy til ya shake somethin loose!” Used to play that SRV song in one of my old bands, we’d open with it because it ROCKS. “Some bad honky-tonker’s really layin’ it down!”. Yeaaah!

Hilarious

Laughing my way to the bank today!!! “A good day…”

I’m going to call a high here, not necessarily for today but for a daily timeframe swing high. It’s gonna turn around 2717 folks. You heard it here first….I’ll be very happy to be wrong!!! But ready in case I’m right, too. See the chart I posted early to see why I think that.

Can you remind me your BB and KC settings? Thanks.

my keltner shows:

middle period: 21

ATR period: 8

upper range: 1.8

lower range: 1.8

My bb:

top period: 21

bottom period: 21

Std dev top: 1.8

Std dev bottom: 1.8

No shifting.

US Dollar Index just trading above 93 yesterday and today. SPX hitting resistance at the B D line, but may break through once the dollar’s rally runs out of steam.

I will continue to at least raise the contrarian view that the triangle may not have finished a D wave, because the “primary” triangle lines are wider than what’s we’ve used to claim completion of the D and E wave. See chart. Not it makes any significant different in the short term. Do note the MAJOR squeeze underway now in SPX daily (orange BB’s inside blue Keltners, 21 period). So up above price is (a) significant fibo resistance then band resistance with a squeeze on, then the “major” triangle line. If it breaks through all THAT, then yup, the triangle is complete. But I do believe significantly more price action is needed to confirm the current definition of a triangle is proper and complete. I’m doubtful (but I’m always a skeptic, it helps keep me profitable day to day!! See a profit grab a profit isn’t the worst idea in this wild market!).

BTW, I have EVERY TIME FRAME on a buy in SPX (stochasticRSI crossover): weekly, daily, hourly, 5 minute. Fascinating…

BTW the white horizontal lines well above market are the price levels of symmetric projections of the prior swings. Properly adjusted to be “equal size” in points, given this is a semi-log scale chart.

Yep, that’s the upper edge of the classic triangle pattern and it’s reasonable to expect some resistance there.

A breakout above that line (with support from volume) would be a classic upwards breakout. That would add substantial confidence to a low in place.

Looking for an SPX green candlestick to close above the B D line today. VIX tapped 14.12 low overnight.

can spx push through the 2682-3 resistance today? That would be big. It’s a huge pivot at this point.

Knock #1 rejected!!! Maybe #2 a bit later….??

I’m a bit suspicious that if and when price does break up through 2683, it just might be short squeeze time. And this market could soar. I don’t know if the bears can hold it back today, the buying pressure here seems stronger.

Lara

I think it might be useful if you published a table of successful and unsuccessful counts for gold and Spx so that we can get a feel for the percentage success of the EW method.

Nick, the point of EW analysis is precisely NOT what you’re asking for here. Lara is the best there is. She presents her best judgment about the most likely wave count scenarios that satisfy all EW rules and guidelines, with precise price-points at which the wave counts prove to be invalid.

It’s about probabilities, not certainties… anticipation, not firm prediction.

Asking for some kind of “hit rate” totally misses the point.

The other analogy is that it is like having several roadmaps that tell you what’s likely ahead, should you end up in that area of town. However, for this analogy, YOU aren’t driving, the market is driving…you are trying to anticipate where it’s heading, and which turn it might take next. Having a map is hugely valuable. But it doesn’t guarantee anything. And if the car heads off the other way…oops, wrong map, get that other one!!

I know it is a case of probability, but the data on the counts would throw light on this probability. I reckon it’s about 50:50, perhaps 60:40. And I know that this is OK providing you get your Risk Reward ratios right.

I guess it was a bit of a cheeky request!

Not to be argumentative, Nick, but to merely illustrate the problem: 50/50 or 60/40 of what? Main wave counts that panned out? Main wave counts that got invalidated? Alternates that eventually became the main wave counts and then panned out? Alternates that got invalidated? Alternates that simply got discarded? Not to mention valid alternates that Lara never published…

It would have to be on main wave counts – otherwise there would not be a point.

Every single day’s report would have to be “measured” at different points in the future for “correctness”, to some defined standard…hard to define, hard to do, and frankly, not much value. If you want to place bet’s on pure EW analysis, I’d say place your bets on the weekly level view, and make them long timeframe. Like right now, you can place a bet that the weekly level count is reasonable, and price WILL be going back to the ATH and above. I have a SPY call ratio backspread (sold ITM calls, bought 2x OTM calls) with expiration out in December that is targeting this move, for example.

I get this request fairly frequently. Maybe I should put it in the FAQ’s?

I did try this once before, years ago. And this is the problem I found.

I tried to measure how accurate the main count was in predicting following day price direction. Up, down or sideways? There were multiple problems. I’ll try to outline:

If I expect price to go up, but it has a few days of basing action first, does that mean my first few days were wrong? If price whipsawed, invalidating the close by invalidation point on the hourly chart, then turned around and moved in the expected direction, I would have to judge the analysis wrong.

If price moved in my expected direction for a few days I’d judge it right, but that wave count may turn out to be wrong in the next day or so.

In practice it turned out to be not as easy as you think it could be. And I really did try.

And as Kevin quite rightly notes, that’s not actually the point of EW. It’s a road map for the future, and if you find yourself in a different part of town unexpectedly you need to switch maps.

Trying to have the right wave count at the start of a movement is impossible, especially for a correction. So as you switch from main to alternates, some kind of judgement system would be judging you wrong repeatedly. Yet the analysis would still cover multiple possibilities as it should. To have “wrong” judgements along the way would just be…. completely disheartening for me.

At the end of the day the proof is in your trading account. But that is only a small portion my analysis, and the rest of it is your trading skill. And that’s a whole other discussion. Because analysis and trading are two different skill sets. And many members here profit repeatedly from my analysis, yet plenty come and go with losses (probably most of them unexperienced traders).

Firsht! 🙂