Price moved lower with a lower low and lower high, as expected. But with a green daily candlestick and signals today from the AD line and inverted VIX, the short term outlook is adjusted for tomorrow.

Summary: Expect now for the short term a little more upwards movement to end about 2,734 – 2,735. Thereafter, look for a few days of downwards movement.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

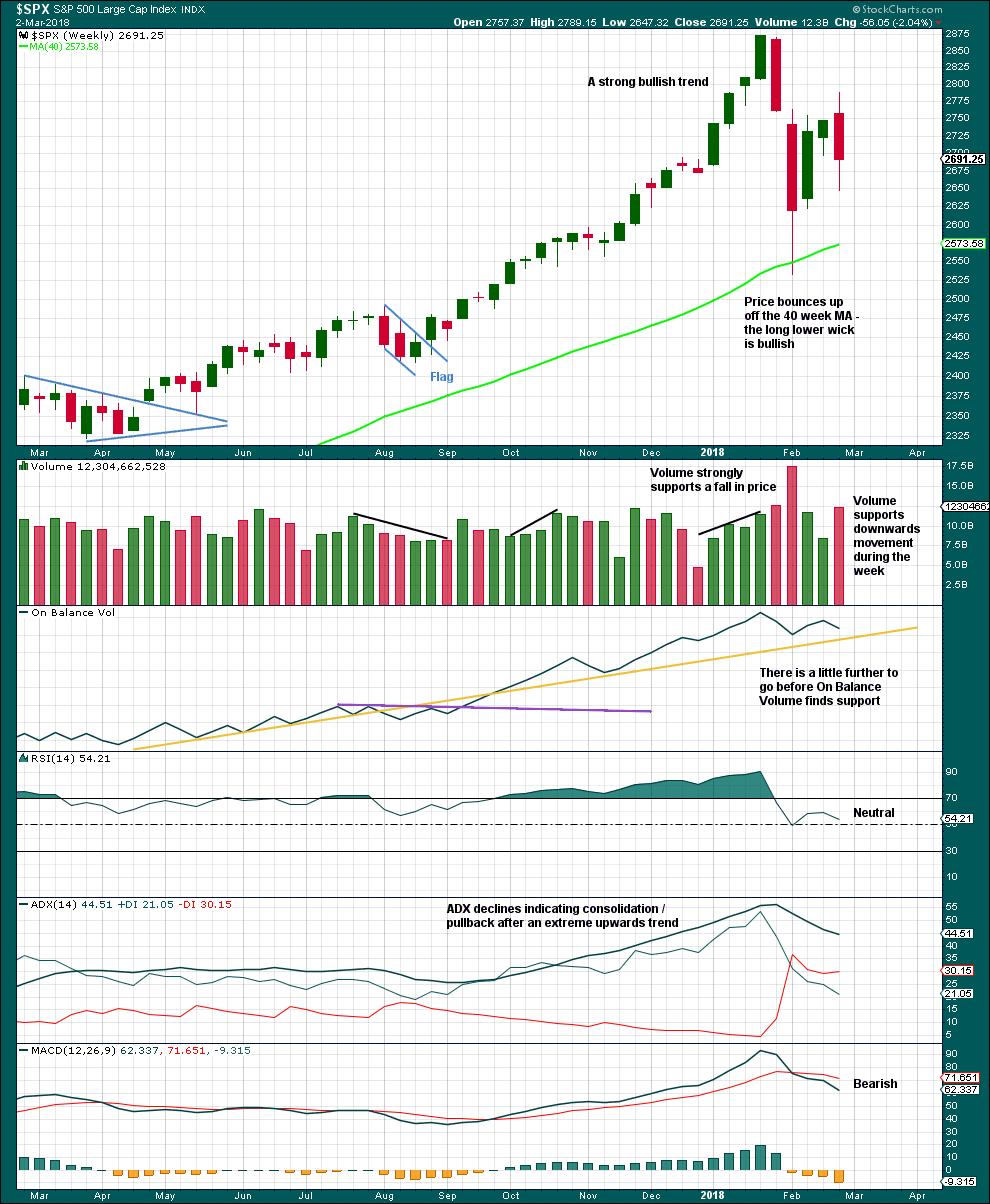

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique. The upper edge may provide resistance for intermediate wave (5).

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. At this stage, it now looks like intermediate wave (4) may be continuing further sideways as a combination or triangle. These two ideas are today separated into two separate daily charts. They are judged to have an even probability at this stage.

A double zigzag would also be possible for intermediate wave (4), but because intermediate wave (2) was a double zigzag this is the least likely structure for intermediate wave (4) to be. Alternation should be expected until price proves otherwise.

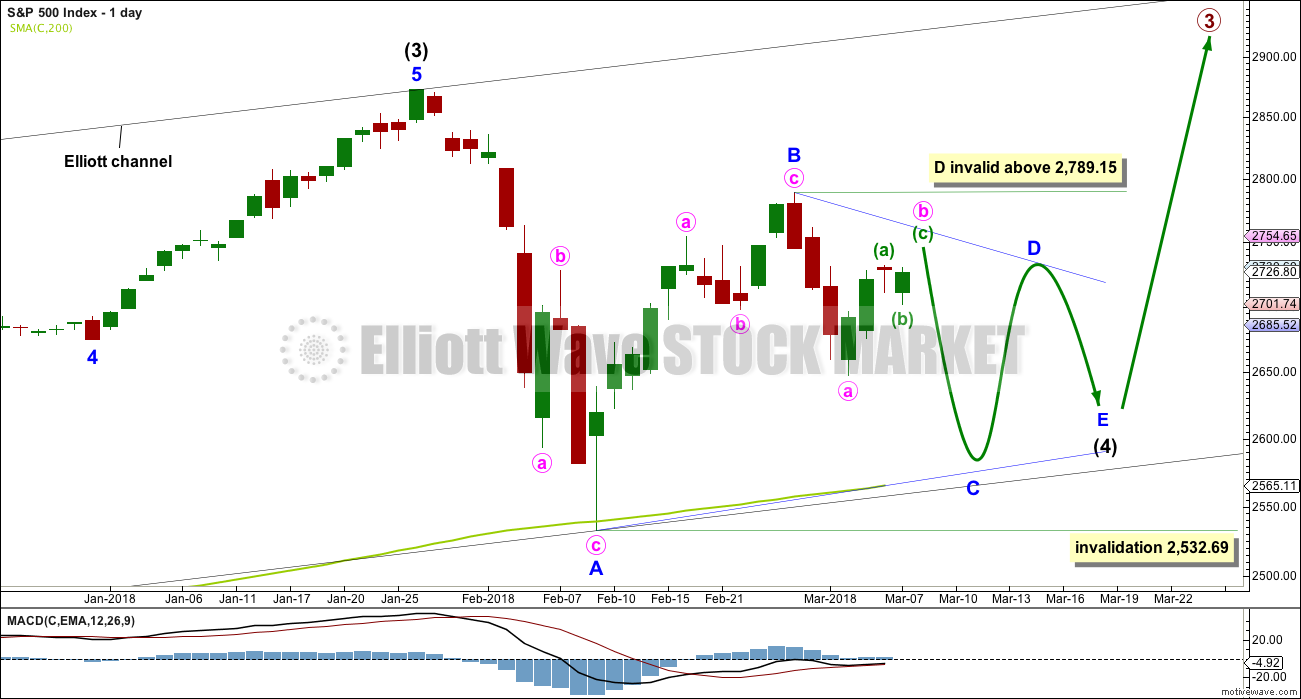

DAILY CHART – TRIANGLE

This first daily chart looks at the possibility that intermediate wave (4) may be continuing sideways as a regular contracting or regular barrier triangle.

Four of the five sub-waves within a triangle must subdivide as zigzags. One sub-wave may be a more complicated multiple, most often this is wave C.

Minor wave C may not move beyond the end of minor wave A below 2,532.69.

A common length for triangle sub-waves is from 0.8 to 0.85 of the prior sub-wave. This gives a target range of 2,584 – 2,571 for minor wave C downwards.

Minor wave D of a contracting triangle may not move beyond the end of minor wave B above 2,789.15. Minor wave D of a barrier triangle may end about the same level as minor wave B so that the B-D trend line remains essentially flat. In practice this means that minor wave D may end slightly above 2,789.15. This invalidation point is not black and white.

Thereafter, minor wave E may not move beyond the end of minor wave C.

A triangle may continue to find support about the 200 day moving average, possibly with small overshoots.

An expanding triangle will not be considered because they are extremely rare structures. I have never seen one in my now 10 years of daily Elliott wave analysis, and so we should not expect this to be a first.

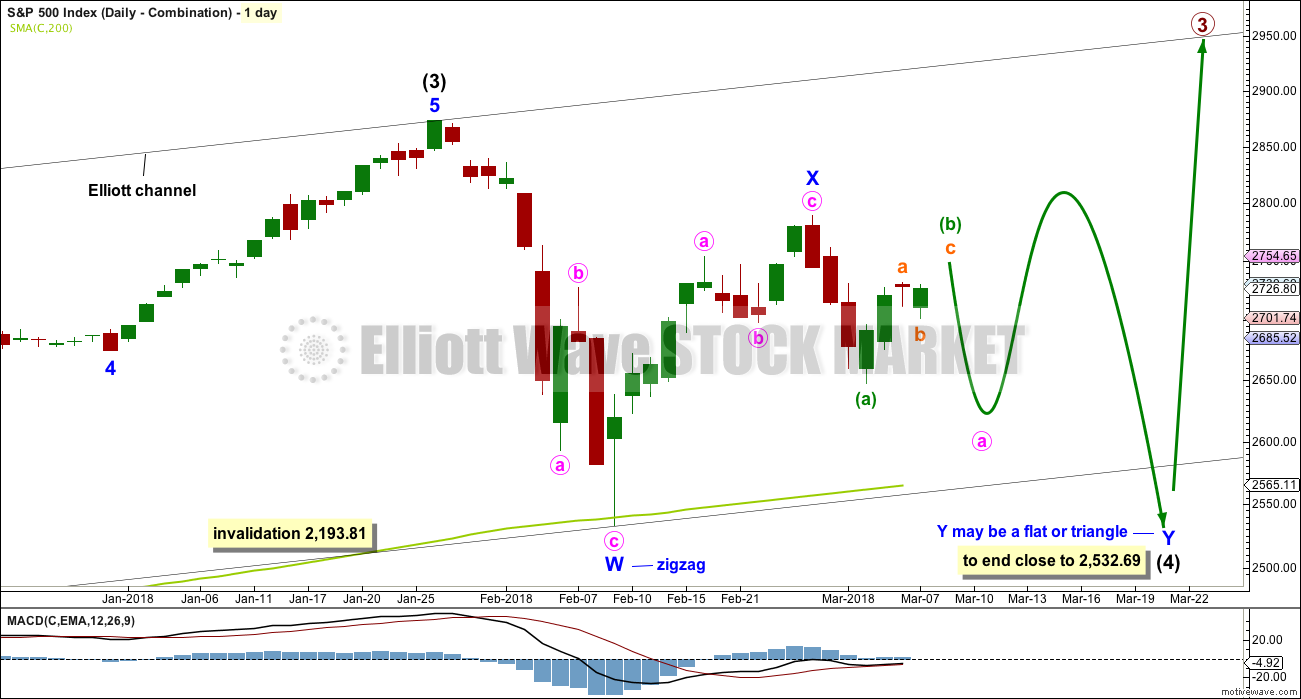

DAILY CHART – COMBINATION

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double would be joined by a complete three in the opposite direction, a zigzag labelled minor wave X.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but in my experience this is very rare.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average.

At this stage, both wave counts expect a zigzag downwards to be unfolding. The degree of labelling would be different, but the structure would be the same. One hourly chart at this time will suffice for both daily wave counts.

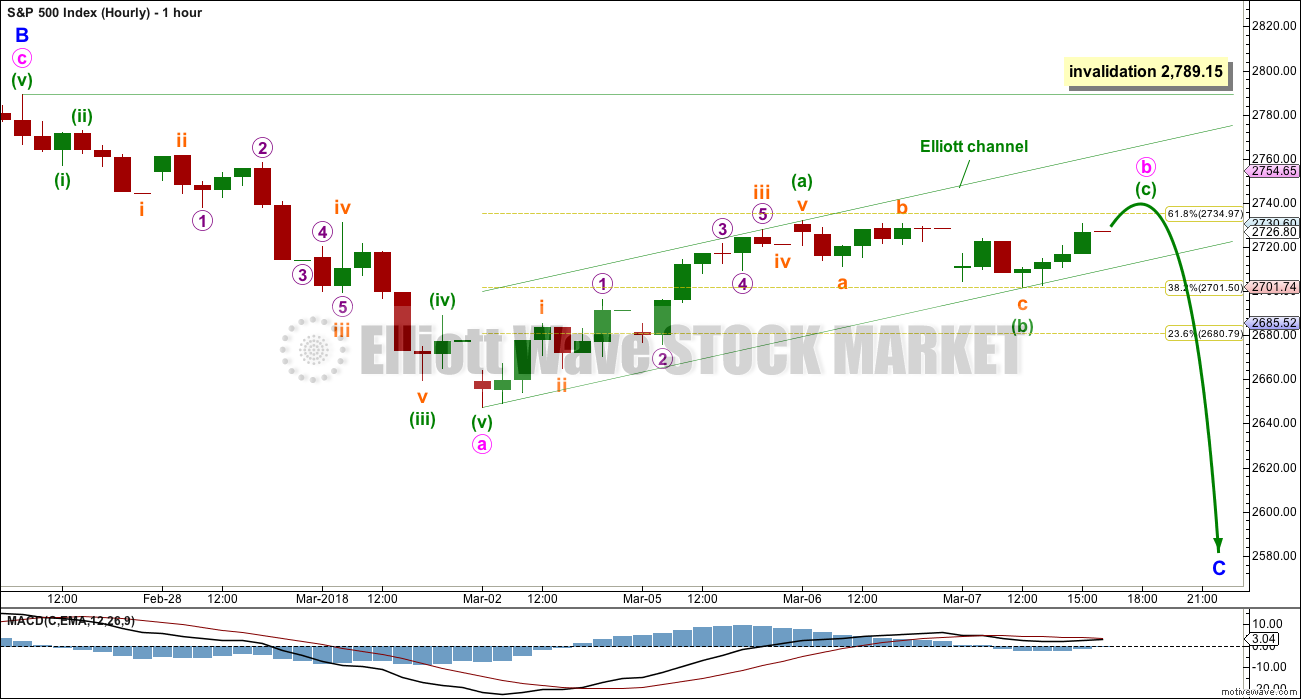

HOURLY CHART

Both daily wave counts expect a zigzag is unfolding lower. The triangle wave count sees it as minor wave C. The combination wave count sees it as minute wave a. The degree of labelling on this hourly chart fits the triangle wave count. It would be labelled one degree lower for the combination wave count.

It looks most likely today that minute wave b is incomplete and may move higher tomorrow. This wave count today has support from short term volume and bullish divergence with price and the AD line, as well as inverted VIX.

At 2,734 minuette wave (c) would reach 0.382 the length of minuette wave (a), and at 2,735 minute wave b would reach 0.618 the length of minute wave a. This would be the target for a little more upwards movement tomorrow.

Thereafter, minute wave c downwards should begin.

Minute wave b may not move beyond the start of minute wave a above 2,789.15.

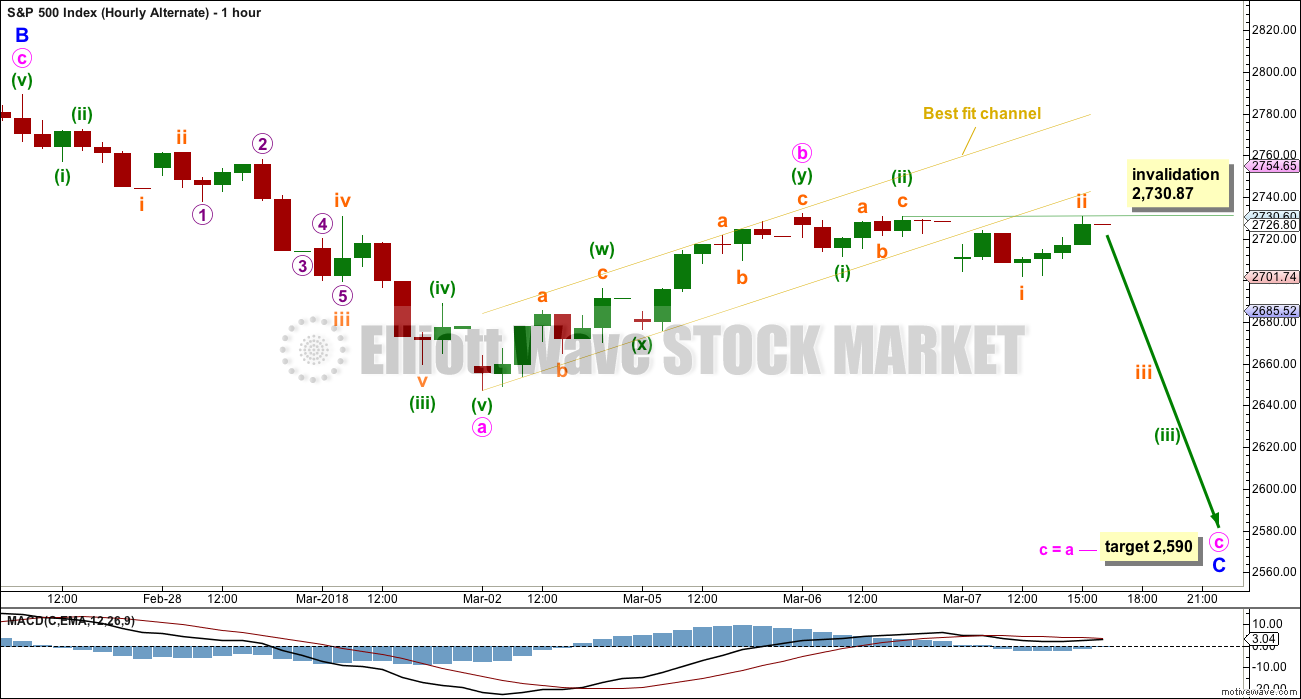

ALTERNATE HOURLY CHART

Minute wave b may still be a complete double zigzag.

If minute wave b is over here, then a target may be calculated for minute wave c to exhibit the most common Fibonacci ratio to minute wave a. At this point, it is just above the target zone shown on the daily chart.

There may now be two overlapping first and second waves within minute wave c. This wave count would expect an increase in downwards momentum tomorrow. Subminuette wave ii may not move beyond the start of subminuette wave i above 2,730.87.

The best fit channel contains all of minute wave b. This channel is breached by downwards movement suggesting the upwards wave labelled minute wave b is complete and a new wave has begun. Minute wave c may last about two to four sessions. If it lasts another two sessions, then minor wave C may total a Fibonacci eight sessions.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This consolidation is bringing ADX down from very extreme and RSI from extremely overbought. There will again be room for a trend to develop when it is complete.

Short term volume suggests downwards movement is incomplete. Support on On Balance Volume may assist to halt a fall in price along with the 40 week (200 day) moving average.

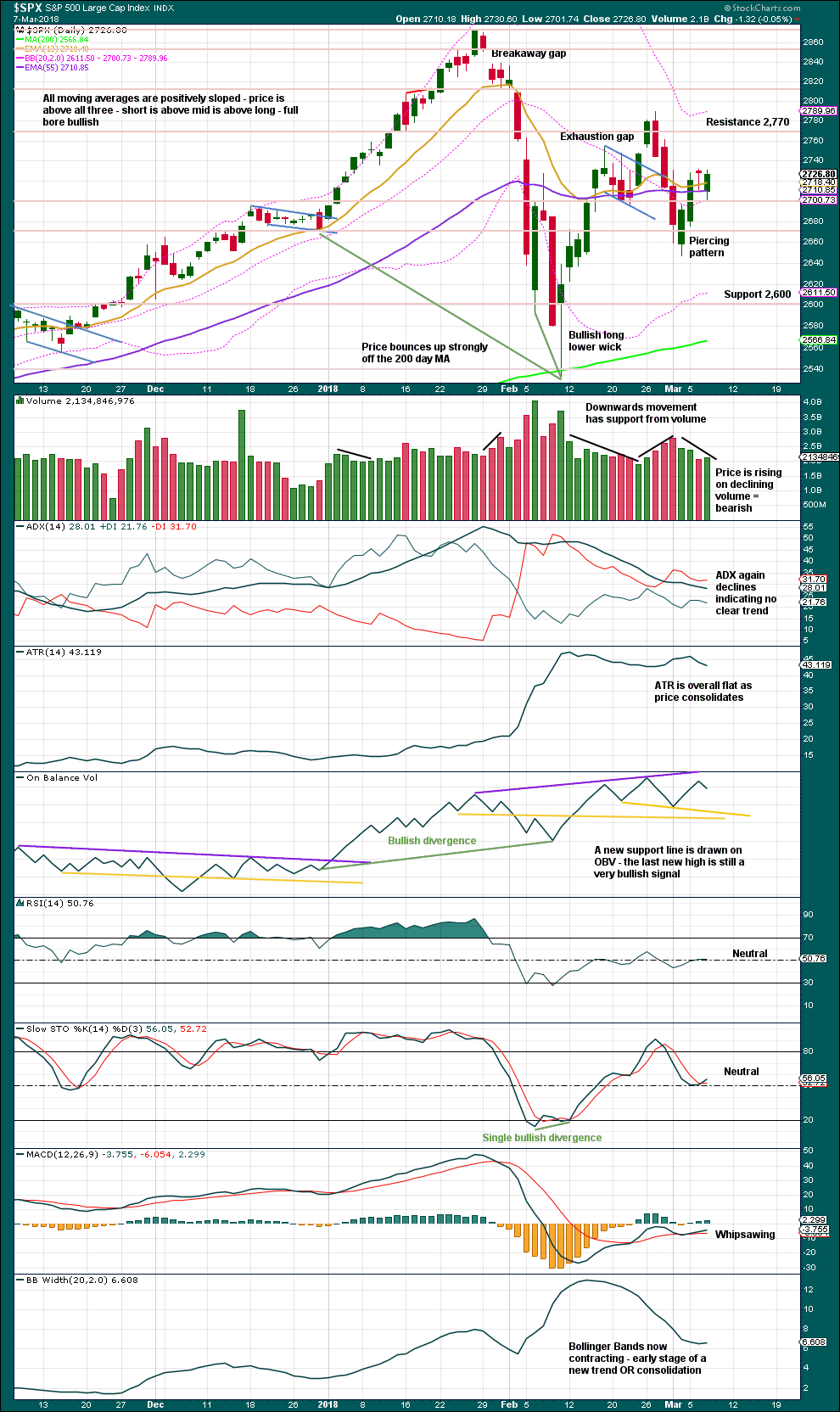

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The possible Hanging Man reversal pattern does not have bearish confirmation, so it cannot be read as a reversal signal.

While overall volume is still declining as price rises, which is bearish, for the very short term some small increase in volume for upwards movement within Wednesday’s session suggests a little more upwards movement tomorrow.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Price has moved lower today with a lower low and a lower high. The rise in inverted VIX will be interpreted as a leading indicator and as bullish.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps last week completed an outside week. All sectors of the market at this time appear to be in a consolidation.

Breadth should be read as a leading indicator.

Price has moved lower today with a lower low and a lower high. A rise in market breadth is bullish divergence with price and may be followed by one or two days of upwards movement.

DOW THEORY

All indices have made new all time highs as recently as six weeks ago, confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,039.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 06:50 p.m. EST.

I’m travelling home from Gisborne today, hence no updated charts as I’m on the road.

Will be stopping shortly to work.

Thank you all for your patience. Back to normal tomorrow.

The market looks really weak today it rallied in the morning and now it seems to barely stay positive today.

Kevin are you currently short right now?

Or are you long up to that trend line?

Thank You

Currently long, very small, with an expectation that the squeeze at the hourly level will resolve itself with some kind of upward push in prices. The support I have for that view is that I still have a positive trend indicator at the hourly level. But the market overall is in a “go nowhere” mode, and perhaps just waiting for better conditions is a good move.

It’s some kind of choppy downward-sloping consolidation. Seems ripe for the upward push Kevin expects. I’m not long at the moment, but I do have a STB long if market rallys yet today.

Alright! A day trade that didn’t get strangled in the crib!

(Too many of those lately.)

Ok. So we just hit 2733.5 ….. C wave time?

Apparently nyet!

I have long signals at the 5 minute and hourly level, and there is now a squeeze ongoing at the hourly level (2 hours worth so far). Whether that resolves upward or downward is uncertain, but the short term trends indicate up. That big downtrend line looms overhead, and I’ve made a small bet price will get there before anything of significant starts up to the downside. Stopping under this morning’s swing low. I’m not going to counter trend trade this market at this point. To much consistent upside pressure still at work.

ps: squeeze indicator just turned on at the 5 minute level too.

Where do you see the downward trend resistance? Around 2750?

I’m using the down trend line formed by the Jan 29 top through the Feb 27 top. Its coming down right now through about 2760, and perhaps SPX meets it around 2756 or so? It looks like that price level may coincide with the Feb 16 top, another “point of resistance”.

I’ll add that the current action in SPX today looks extremely weak and toppish right here, right now.

I agree about the weakness today. Although, I felt exactly the opposite yesterday when the market had every reason to go down but did not. Whenever I’ve observed that in the past, we tend to continue higher in the short term. That’s just anecdotal.

Using Lara’s target around 2,735, does there appear to be a head and shoulders formed during the Feb-March consolidation? Sure looks like 2,735 is a key level. I’d cover shorts with a close above there and re-enter around 2,755.

First??

Is everyone still asleep

Late night for me Paresh. So, yes, I just got up. Have a great day. I have another late night coming this evening as well. That is one thing I am looking forward to when I retire in a few years, no more late night meetings or events that take me away from being with my bride of 42 years.

42 years! That’s a fabulous achievement Rodney