Price has moved higher for Tuesday as expected. A new high above 2,354.54 supports the main wave count over the alternate.

Summary: The next wave up to a target at 2,455 may have begun today. The invalidation point is at 2,327.58. When a five up for minute wave i is complete, then a three down for minute wave ii may be brief and shallow and may offer a good entry opportunity to join the upwards trend.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

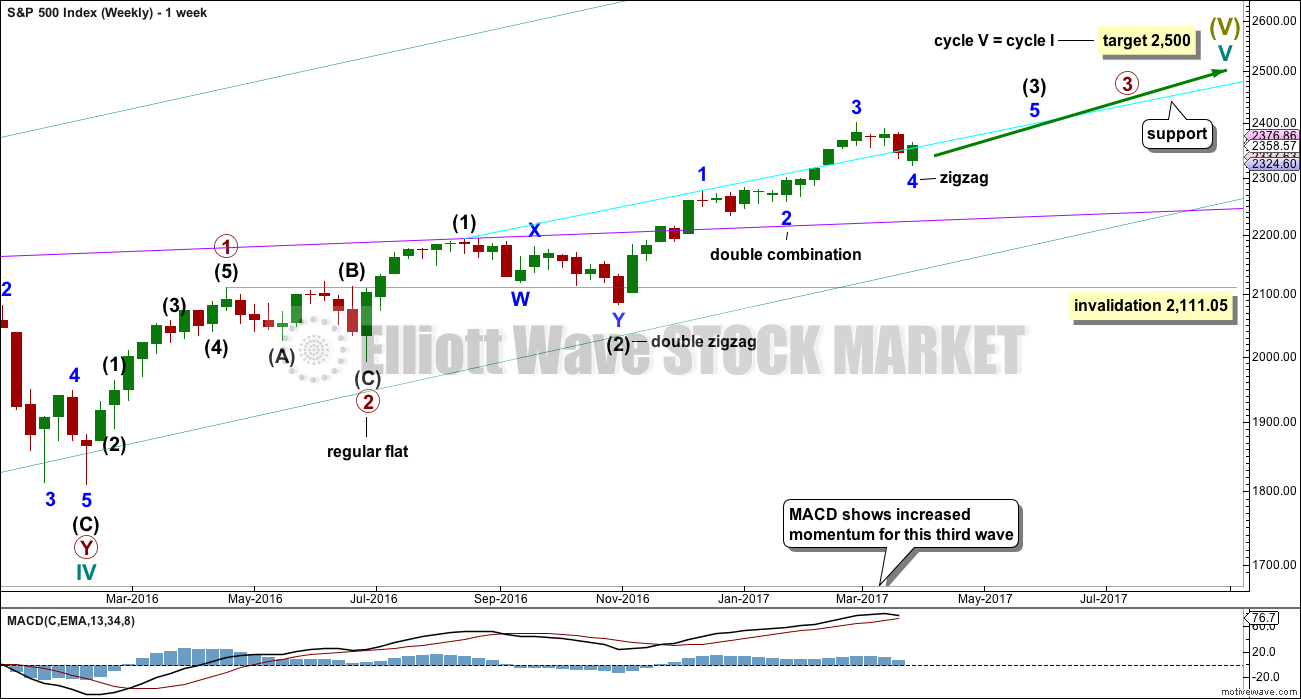

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V is an incomplete structure. Within cycle wave V, primary wave 3 may be incomplete or it may be complete (alternate wave count below).

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

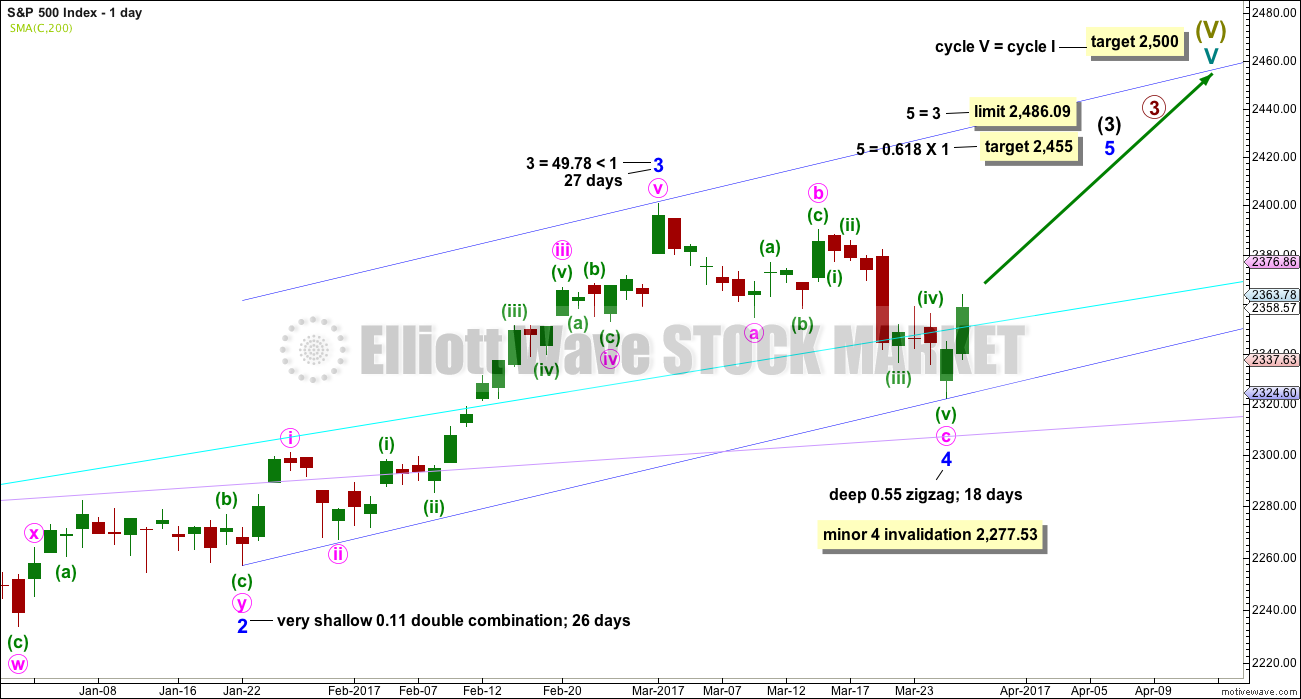

DAILY CHART

All subdivisions are seen in exactly the same way for both daily wave counts, only here the degree of labelling within intermediate wave (3) is moved down one degree.

This wave count expects the current correction is minor wave 4, which may not move into minor wave 1 price territory below 2,277.53. A new low below this point would confirm the correction could not be minor wave 4 and that would provide confidence it should be primary wave 4.

Minor wave 4 is a little below the fourth wave of one lesser degree. Because it has now clearly breached an Elliott channel drawn using the first technique, the channel is now redrawn using Elliott’s second technique. There is good alternation between the very shallow combination of minor wave 2 and the deeper zigzag of minor wave 4.

If minor wave 4 is over, then a target for minor wave 5 is calculated.

Although price breached the cyan trend line, price has today closed back above the trend line. The concern yesterday over the line breach is alleviated today.

Minor wave 3 is shorter than minor wave 1. So that the core Elliott wave rule stating a third wave may not be the shortest is met, minor wave 5 is limited to no longer than equality in length with minor wave 3.

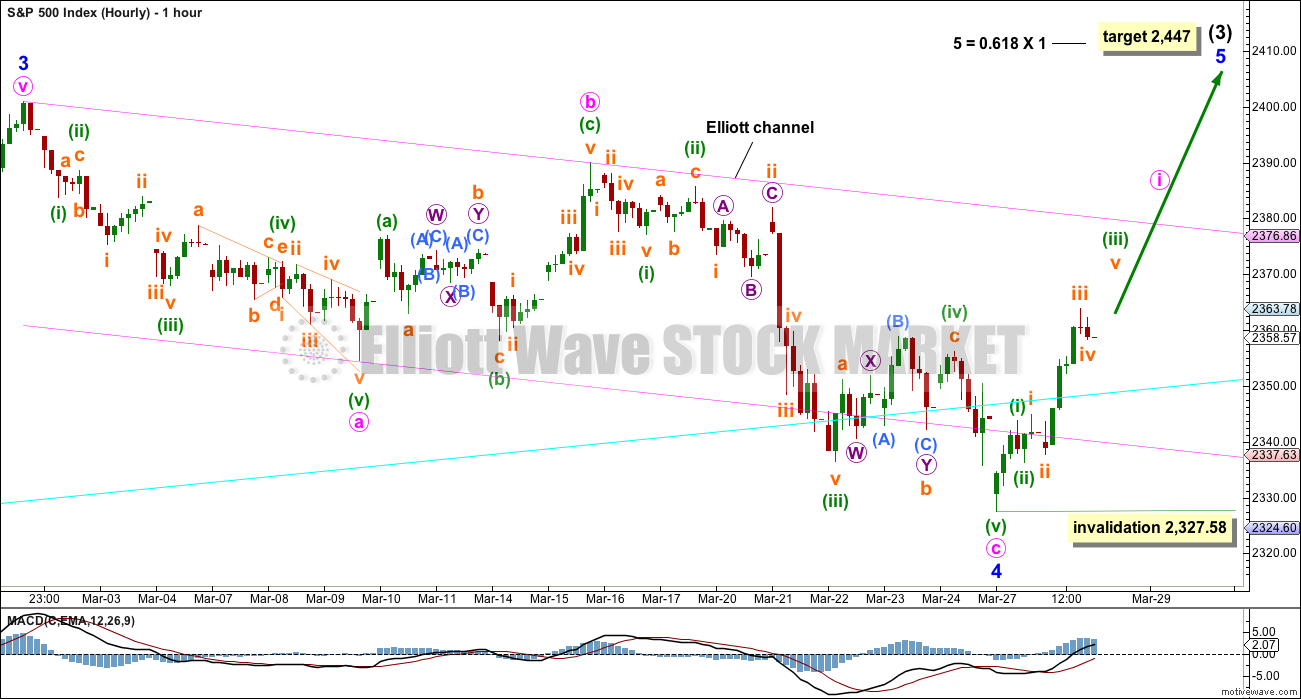

HOURLY CHART

Minor wave 4 may now be a complete zigzag. Minor wave 5 may now have begun.

Minor wave 5 may subdivide as either an impulse or an ending diagonal; an impulse is more common. At this stage, both will be considered.

No matter what structure minor wave 5 unfolds as, minute wave ii may not move beyond the start of minute wave i below 2,327.58.

Recently, when this market trends the corrections have tended to be relatively brief and shallow. An exception to this recent tendency would be minute wave ii of minor wave 3 (seen on the daily chart). Look out for another possible brief and shallow correction for minute wave ii to come.

Minute wave ii may offer an opportunity to join the new upwards trend.

Always use a stop and do not invest more than 1-5% of equity on any one trade. Manage risk: It is the most important aspect of trading.

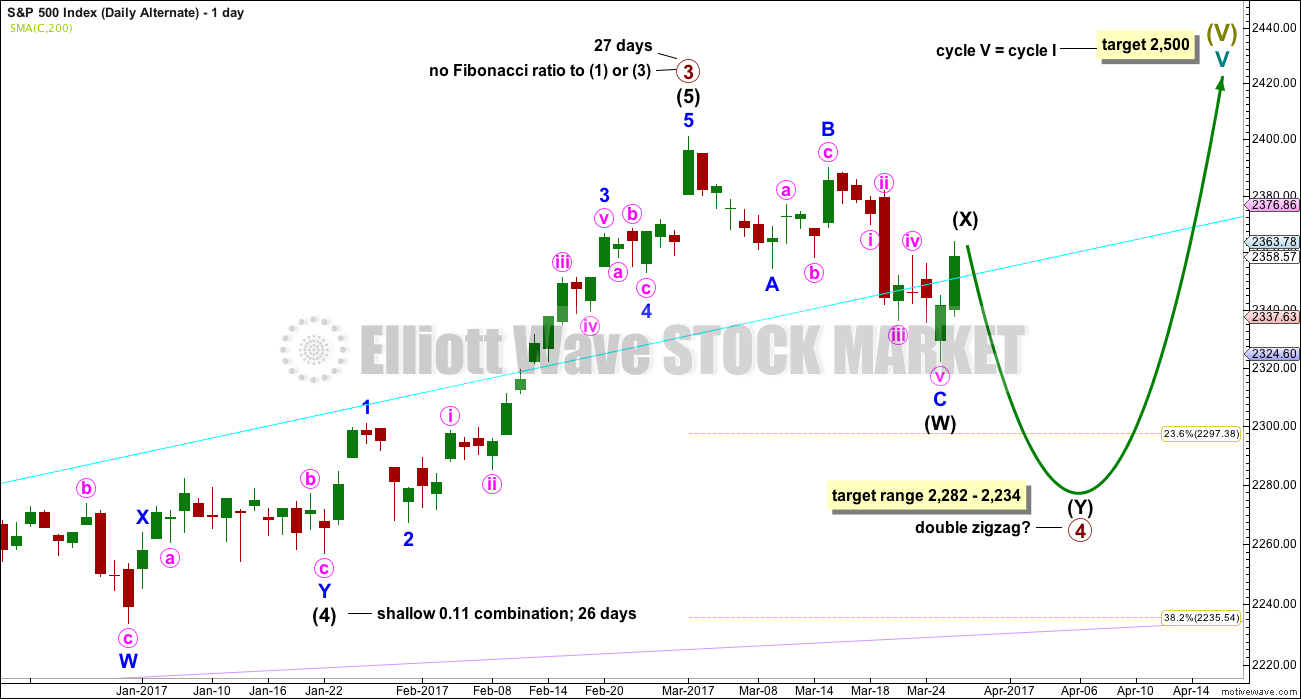

ALTERNATE DAILY CHART

The subdivisions of upwards movement from the end of intermediate wave (2) are seen in the same way for both wave counts. The degree of labelling here is moved up one degree, so it is possible that primary wave 3 could be over.

Primary wave 2 was a flat correction lasting 47 days (not a Fibonacci number). Primary wave 4 may be unfolding as a double zigzag. It may total a Fibonacci 34 or 55 sessions.

Within double zigzags, the X wave is almost always brief and shallow. There is no rule stating a maximum for X waves, but they should not make a new price extreme beyond the start of the first zigzag in the double.

X waves within combinations may make new price extremes (they may be equivalent to B waves within expanded flats), but in this instance primary wave 4 would be unlikely to be a combination as it would exhibit poor alternation with the flat correction of primary wave 2.

If a new high above 2,400.98 is seen, then this alternate would be discarded.

The correction for primary wave 4 should be a multi week pullback, and it may not move into primary wave 1 price territory below 2,111.05.

TECHNICAL ANALYSIS

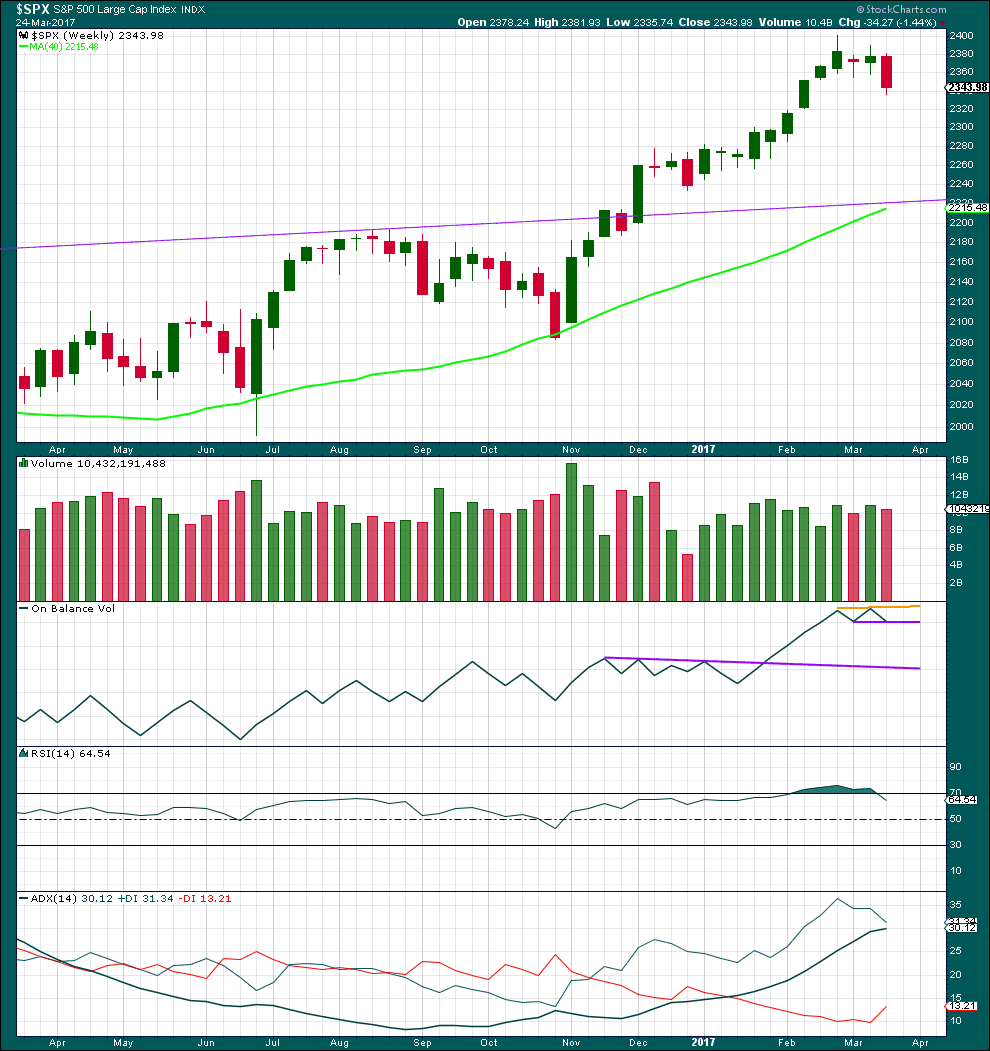

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The week before last completed a green weekly candlestick that moved price upwards on some increase in volume. Now last week completes a red weekly candlestick that moves price lower on a slight decline in volume. The volume profile short term looks bullish.

New trend lines are drawn across On Balance Volume, but these do not yet have any reasonable technical significance.

RSI is now back down from overbought.

ADX still indicates an upwards trend that is not yet extreme, but it is nearing extreme.

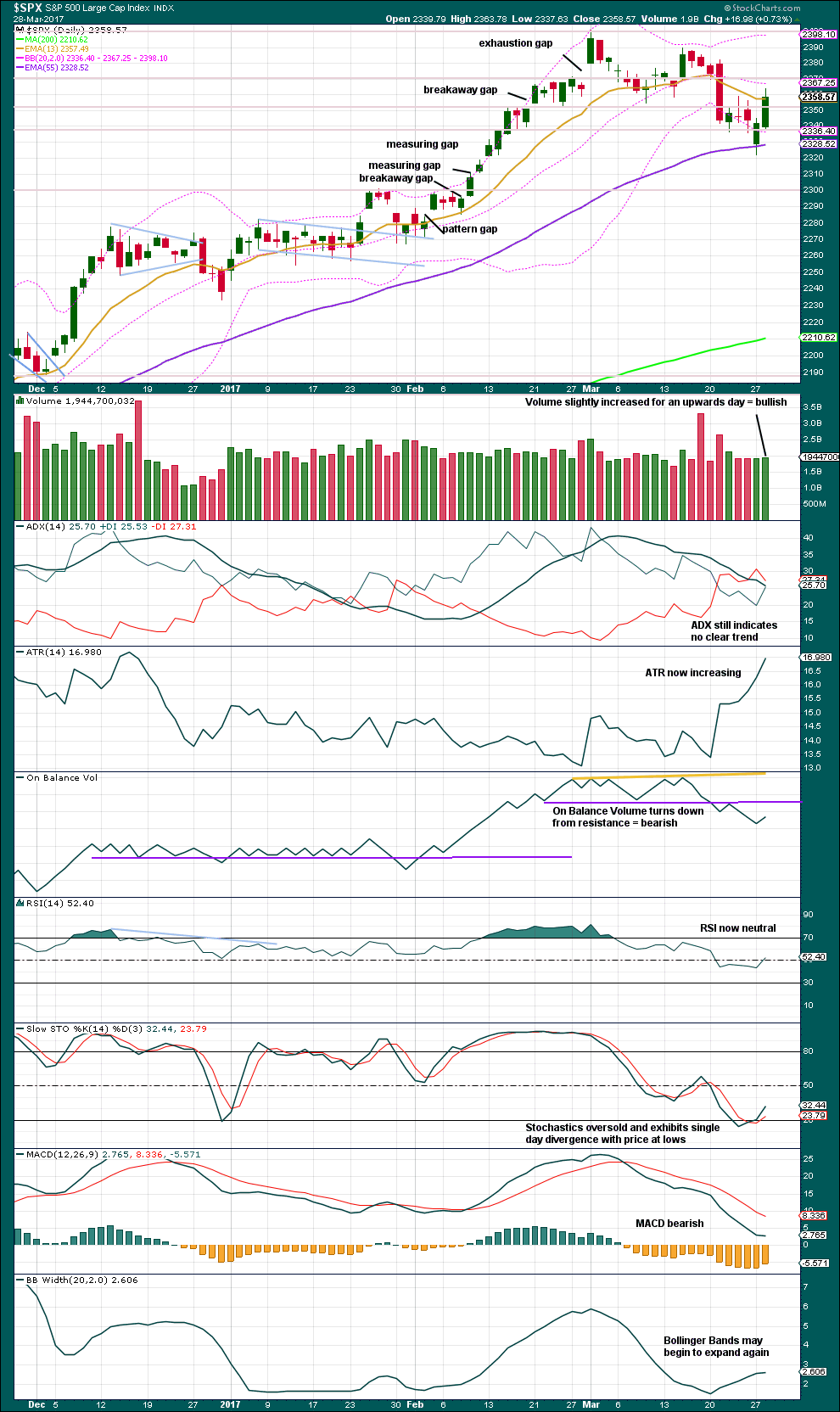

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Today completes a bullish engulfing candlestick pattern. This is a fairly reliable reversal pattern when coming after a downwards movement.

Volume today is bullish, ATR is bullish, and Stochastics exhibits bullish divergence while oversold.

MACD and On Balance Volume are still bearish.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Bearish divergence and bullish divergence spanning a few short days used to be a fairly reliable indicator of the next one or two days direction for price; normally, bearish divergence would be followed by one or two days of downwards movement and vice versa for bullish divergence.

However, what once worked does not necessarily have to continue to work. Markets and market conditions change. We have to be flexible and change with them.

Recent unusual, and sometimes very strong, single day divergence between price and inverted VIX is noted with arrows on the price chart. Members can see that this is not proving useful in predicting the next direction for price.

Divergence will be continued to be noted, particularly when it is strong, but at this time it will be given little weight in this analysis. If it proves to again begin to work fairly consistently, then it will again be given weight.

Bullish divergence has now been followed by a strong upwards day. It is considered to have proven correct. It may yet be followed by one more upwards day before it could be considered resolved.

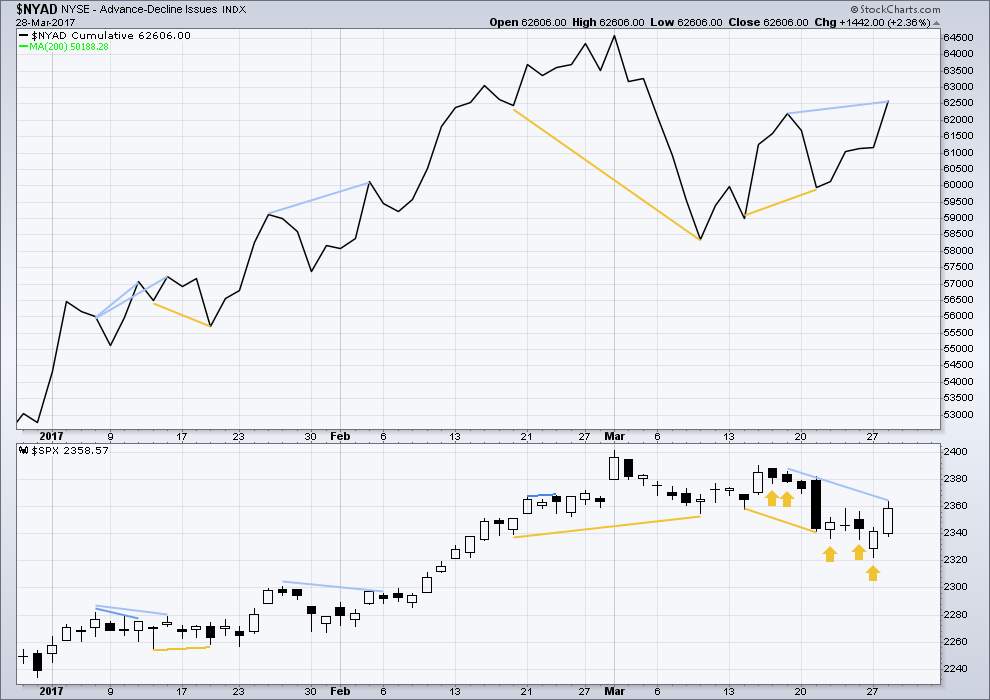

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

The rise in price has support from a rise in market breadth. Lowry’s OCO AD line also shows new highs along with price. Normally, before the end of a bull market the OCO AD line and the regular AD line should show divergence with price for about 4-6 months. With no divergence, this market has support from breadth.

There is short term bullish divergence between the AD line and price from yesterday’s low to the low of 14th of March (and also back to the 9th of March). Price has not come with a corresponding decline in market breadth while it has made a new low. There is weakness within this downwards movement from price. This supports the main hourly Elliott wave count which sees a low in place.

Bullish divergence has now been followed by a strong upwards day. It may yet require one more upwards day before it is resolved.

There is new short term bearish divergence today between today’s high and the high of the 17th of March. This indicates weakness in price and it may be followed by one or two downwards days.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq continue to make new all time highs. This confirms a bull market continues.

This analysis is published @ 09:03 p.m. EST.

I’m off again Kiwi searching today (really don’t want to call it hunting). We didn’t find him last week, so a bigger effort this week. This may take some time. Analysis will probably be later than normal today, but will certainly be done by the end of my day.

Here is hoping for an encounter with baby Kiwi! 🙂

Well, we got so close to Tom the Kiwi. Less than 1m away, he was sighted, we had him surrounded in a thicket of bracken. But he still managed to slip away, there were only three of us and he had the advantage of territory.

Next time. His transmitter needs to be changed, so we have to try again.

Hourly chart updated:

After examination of the 5 minute chart again I’m deciding to put subminuette iii and iv lower down.

Minuette (iv) and (v) could end quickly, that would make minute i over. Then for minute ii down. The 0.382 Fibonacci ratio would be the first target, the 0.618 the second. Equally likely, 50:50.

Quarter ending window dressing

Wascally wabbit! 🙂

hey,, thats my line

Just thought I’d fill in till you showed up! 🙂