Upwards movement within the session did not make a new high. Price remains below the invalidation point on the hourly Elliott wave count.

Summary: Some downwards movement to find support at the lilac / purple trend line is expected, about 2,211. If this target is wrong, it may be a little too low. Use the trend line as a preference. If this correction ends in a total Fibonacci 34 sessions, it may end on the 2nd of February. Thereafter, the bull market should resume.

This bull market is strong and healthy. Use this correction as another opportunity to join the trend.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

MAIN ELLIOTT WAVE COUNT

DAILY CHART

Intermediate wave (4) is exhibiting alternation with intermediate wave (2). Intermediate wave (2) is a double zigzag and intermediate wave (4) is an incomplete expanded flat.

Along the way up to the final target at 2,500 a more time consuming fourth wave correction for primary wave 4 would be expected for this wave count.

The purple trend line is the most important piece of technical analysis on all charts. Draw it carefully from prior all time highs of 2,134.28 on the 21st of May, 2015, to 2,193.81 on the 15th of August, 2016. Extend it out. Daily charts are on a semi log scale.

The correction for intermediate wave (4) should end if price comes down to touch the purple trend line.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81.

At this stage, intermediate wave (4) has lasted 23 sessions. With the very slow rate of this correction it may now be possible for it to continue for another 11 sessions to total a Fibonacci 34. This would see it end on the 2nd of February.

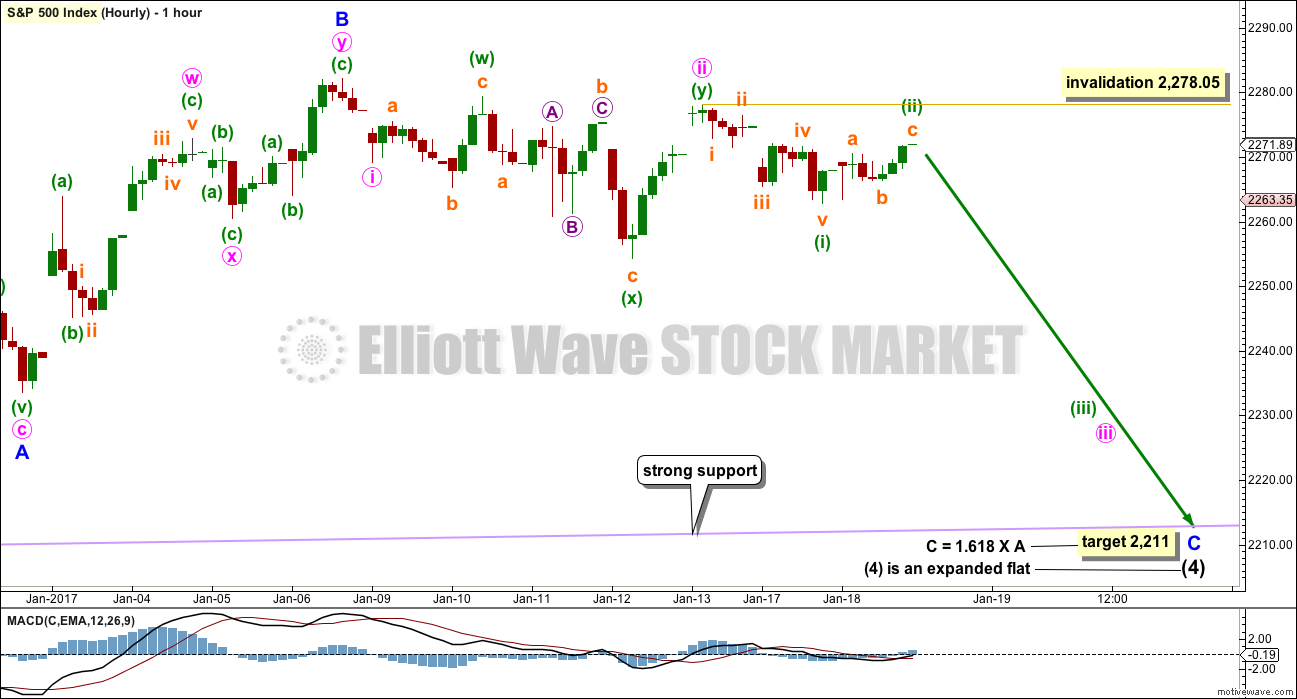

HOURLY CHART

If the target calculated is wrong, it may be too low. Price may find strong support just above the target at the purple trend line. This line is copied over carefully from daily and weekly charts, which are both on semi log scales. This hourly chart is on an arithmetic scale, meaning the line will sit slightly differently. Both should be watched carefully.

Minor wave C must complete as a five wave structure. It is extremely likely to make at least a slight new low below the end of minor wave A at 2,233.62 to avoid a truncation and a very rare running flat.

Minute wave ii may not move beyond the start of minute wave i above 2,282.10.

Minute wave ii is a combination: flat – X – zigzag. The structure is complete. While double combinations are common, triples are very rare. For this reason it is very likely that minute wave ii is over now. Minute wave iii downwards should show some increase in momentum over the next few days.

Within minute wave iii, minuette waves (i) and (ii) may now be complete. If minuette wave (ii) moves higher tomorrow, then it may not move beyond the start of minuette wave (i) above 2,278.05.

When minute wave iii is over, then minute wave iv should unfold sideways and may not move into minute wave i price territory.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

What if the main wave count is wrong? What if cycle wave V is complete already? Does that fit?

Yes, it does. But this wave count has very little support from classic technical analysis.

If price makes a new low below 2,193.81, then a variation of this wave count would be the new main wave count. At that stage, the degree of labelling within cycle wave V would be moved all down one degree. Only primary wave 1 of cycle wave V may be over.

I am discarding the idea that primary wave 5 may continue much further. It cannot because the core Elliott wave rule stating a third wave may not be the shortest within an impulse must be met. Here, primary wave 3 is shorter than primary wave 1 by 60.94 points. Primary wave 3 may not be the shortest wave, so primary wave 5 is limited to no longer than equality in length with primary wave 3 at 2,286.92. So far primary wave 5 is 4.82 points shorter than primary wave 3, so thus far the rule is met.

Only a new low below 1,810.10 could finally confirm this wave count. At that stage, downwards movement could not be a second wave correction within cycle wave V, so cycle wave V would then have to be over. Only at that point would price indicate a multi generational trend change has arrived. Dow Theory would also need confirmation from DJIA and DJT to confirm such a large trend change.

When cycle wave V is over, it would complete a Grand Super Cycle wave. A trend change from bull to bear would be expected, a once in a multi generational bear market. This wave count expects to see a huge market crash, bigger than the Great Depression. The size of this trend change absolutely requires price confirmation and technical indication before any confidence at all could be had in a wave count such as this.

This wave count does not have support from Lowry’s. They see an increase in market breadth is currently supporting the rise in price. Normally, market breadth begins to diverge from price 4-6 months prior to a final high and a change from a bull to a bear market. There is no divergence at all at this point in time.

ADX at the monthly chart level does not support this wave count. This trend is not extreme: ADX is below 20 and increasing at the monthly chart level. At market highs ADX is most often extreme (not always, it wasn’t in September 2007).

The only piece of technical analysis I can see at this stage is strong multi month divergence with RSI at the monthly chart level. This is common before a turn from a bull to bear market. However, this divergence can persist for very long periods of time. RSI and price exhibited divergence, for 45 months, prior to the high of March 2000 going back to June 1996. This is a warning of a coming bear market, but it is not particularly useful for timing.

At this time, price and RSI at the monthly chart level exhibit divergence back to November 2013, a period now of 37 months.

This wave count is just one possibility in the world of many possibilities. It does not have a good probability, I would judge it to be as low as 5-10%. However, low probability does not mean it cannot happen. Sometimes low probability outcomes do occur; when they do, they are never what was expected. This wave count is published in the spirit of always considering possibilities, with the knowledge that nothing is impossible.

TECHNICAL ANALYSIS

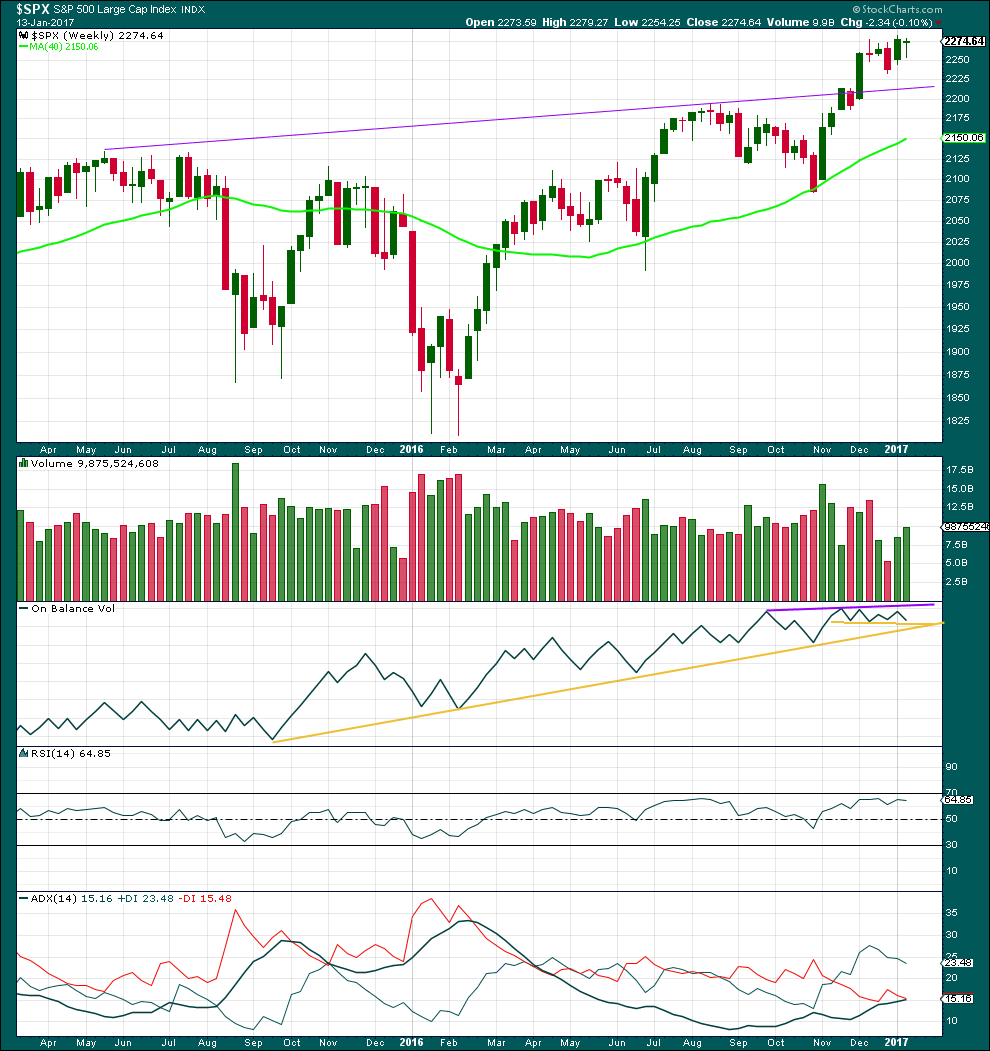

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week completes an inside week for a Dragonfly doji. Doji are common within consolidations, so this does not signal any trend change but does support the idea that price is consolidating for the week.

The week completed with stronger volume, the balance of which was downwards. There was some support for downwards movement during the week and this also supports the idea that price is within a consolidation that may move lower.

RSI is not extreme. There is room still for price to continue higher when the consolidation is complete.

ADX indicates price is most likely in the early stages of a new trend. The black ADX line is increasing and above 15 but below both directional lines, so the trend is young. The +DX line is above the -DX line, so the trend is indicated as upwards.

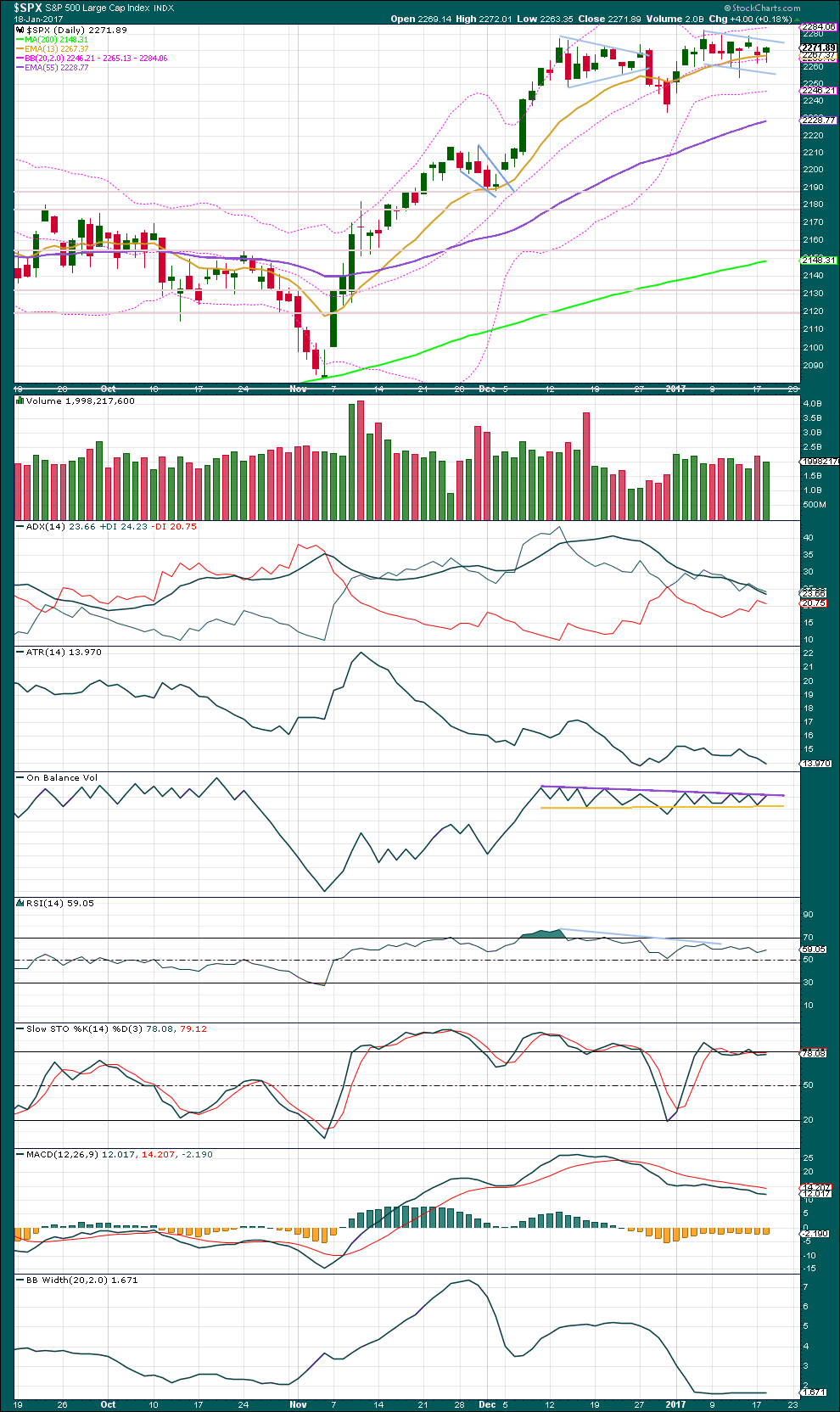

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An inside day moved price mostly higher to complete a small hanging man candlestick pattern with a small range body. This is not a reversal signal as it comes within a consolidation. A candlestick reversal pattern needs something to reverse and here price has moved sideways.

The slight rise in price within this session does not have support from volume. This may be followed by a downwards day tomorrow.

A small bull flag pattern looks like it may be unfolding, delineated by blue trend lines. The lower line may offer support, but the purple line on the weekly TA chart should be used as a preference because it has stronger technical significance.

All three moving averages are pointing up and price is above all three so far. This indicates an upwards trend overall.

ADX is currently declining, indicating a correction within the larger upwards trend is currently unfolding. This is bringing ADX down from extreme. So far no trend change from up to down has been indicated as the +DX line remains above the -DX line.

Price so far is finding resistance about 2,280 and support about 2,230 while it is consolidating. The purple trend line on the weekly TA chart should be used for support.

On Balance Volume today has come up to touch the upper purple resistance line. This may assist to halt the rise in price here as this line offers resistance. OBV is tightly constrained and the lines are converging. A breakout by OBV may precede a breakout from price.

There was divergence between price and RSI at the last all time high. This supports the Elliott wave count which sees the last high as the end of a B wave. B waves are suckers and they normally exhibit signs of weakness.

Some more downwards movement may be required here to bring Stochastics down from extreme overbought.

MACD remains bearish. Bollinger Bands remain very tightly constrained. Some return shortly of volatility to this market may be a reasonable expectation.

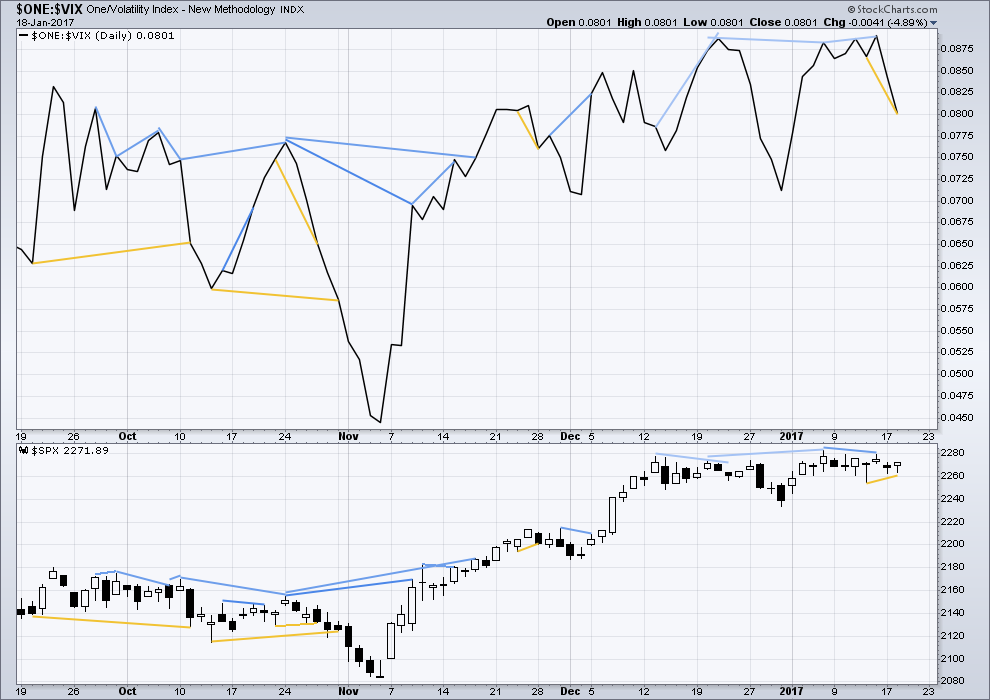

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is mostly working to indicate short term movements spanning one or two days. While this seems to be working more often than not, it is not always working. As with everything in technical analysis, there is nothing that is certain. This is an exercise in probability.

Short term hidden bullish divergence noted yesterday has continued further today, shown with yellow trend lines. However, it is also noted that in three of the last four instances (all shown on this chart with yellow trend lines) bullish divergence was not followed by upwards movement. Only the first instance shown here to the 11th of October was followed by one day of upwards movement. It will not be given much weight today as it appears to be not working more often than it does work.

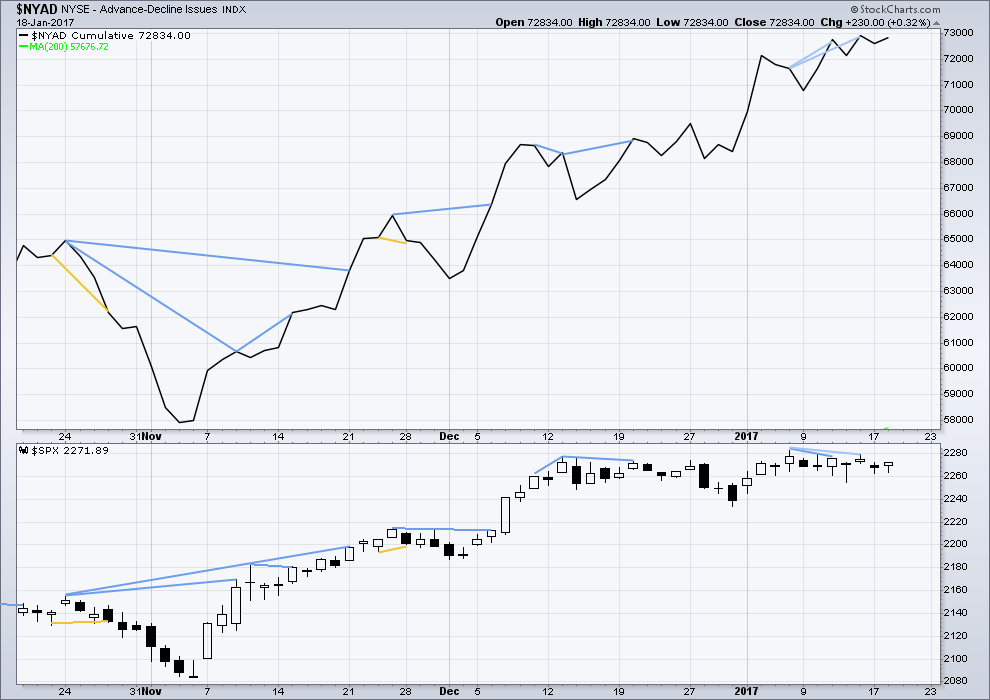

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

There is no new divergence today, either bullish or bearish, between price and the AD line.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq have made new all time highs in December of 2016. This confirms a bull market continues.

This analysis is published @ 10:02 p.m. EST.

Chris Ciovacco:

How Was The Collective Mood As Stocks Started A 19-Year Secular Bull Run In 1982?

http://seekingalpha.com/article/4037991-collective-mood-stocks-started-19-year-secular-bull-run-1982?app=1&uprof=44&isDirectRoadblock=false

I wonder how he rectify’s the COT reports, Consumer Sentiment, Investor’s Intelligence, VIX, et al, which highlight quite the opposite of pessimism. In addition, 1982 was in fact a bear market where the draw down in the DOW was 24% from peak, not present all time highs. Seems there is little to no similarities between the two periods in question.

“1982 was in fact a bear market where the draw down in the DOW was 24% from peak”

??

I’m looking at DJIA monthly chart for 1982. It opened January 1982 at 882.52, and closed December 1982 at 1,077.91. A gain of 164.03 points.

That’s bullish.

High April of 1981 at 1024, low August of 1982 760; bear market. Not bullish.

In the SPX, the 81-82 bear market was a 27.8 percent drawdown; 140.52 to 101.44. So again, little to no parallels could be drawn between that period and now.

True.

I read your comment literally as 1982 calendar year.

So you are correct, and Mr Ciovacco is also correct. August 1982 saw the end of a bear market, and the start of a strong bull market.

Just 1 catch to this idea… in 1982 The price-earnings ratio’s were mostly in single digits. Company’s stock prices were undervalued.

What is going to create economic growth is Corporations making real investments in new production (not stock buy-backs). These investments lower EPS until the production kicks in… That is 12 to 18 months down the road.

Same thing for investments in new businesses. High expense upfront then needs time to reach critical mass in revenue… then profits kick in. 18 months to 2 years.

I hate to say it but gotta be careful of a short squeeze after trumps speech. Everyone is expecting a correction. I thought it might come early but so far flatline.