Upwards movement was expected from the main Elliott wave count for Thursday’s session.

This did not happen. Price moved lower and sideways to complete a small red doji.

Summary: The Elliott wave count expects more upwards movement from here to show an increase in upwards momentum and be supported by volume. This expectation for upwards movement tomorrow has support from simple divergence between price and VIX. The short term target remains at 2,180 and the final target at 2,240.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

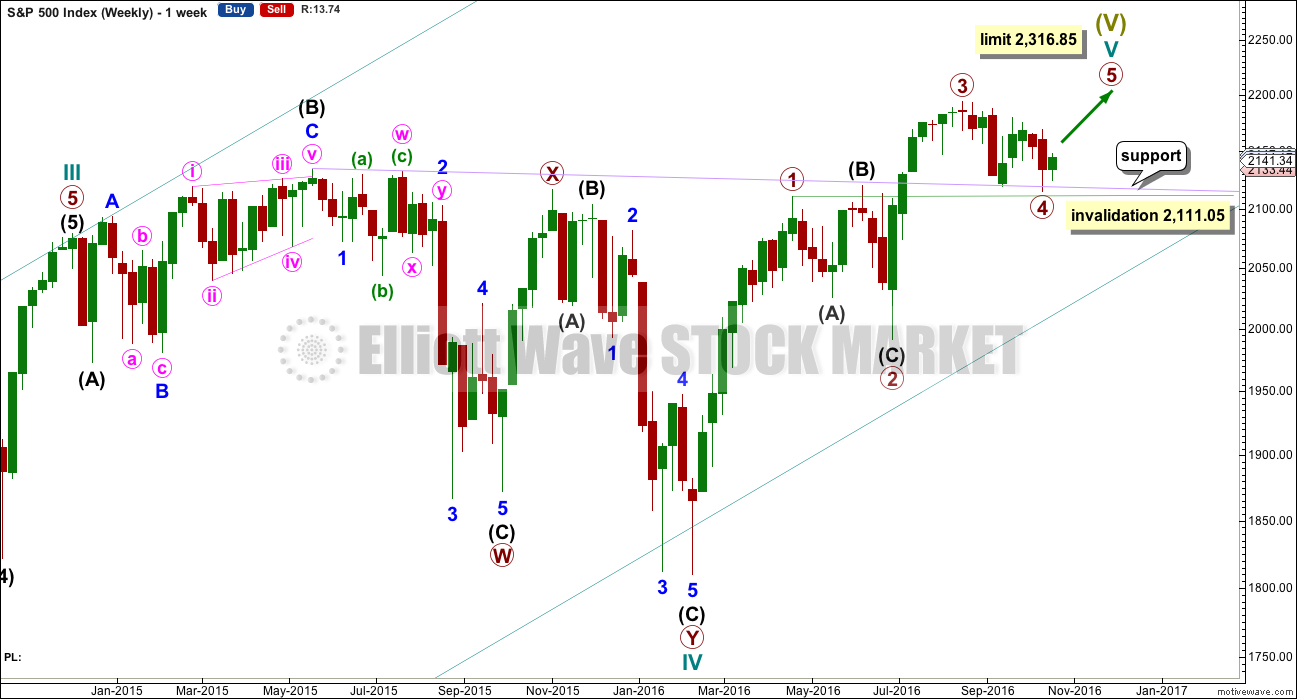

MAIN WAVE COUNT

WEEKLY CHART

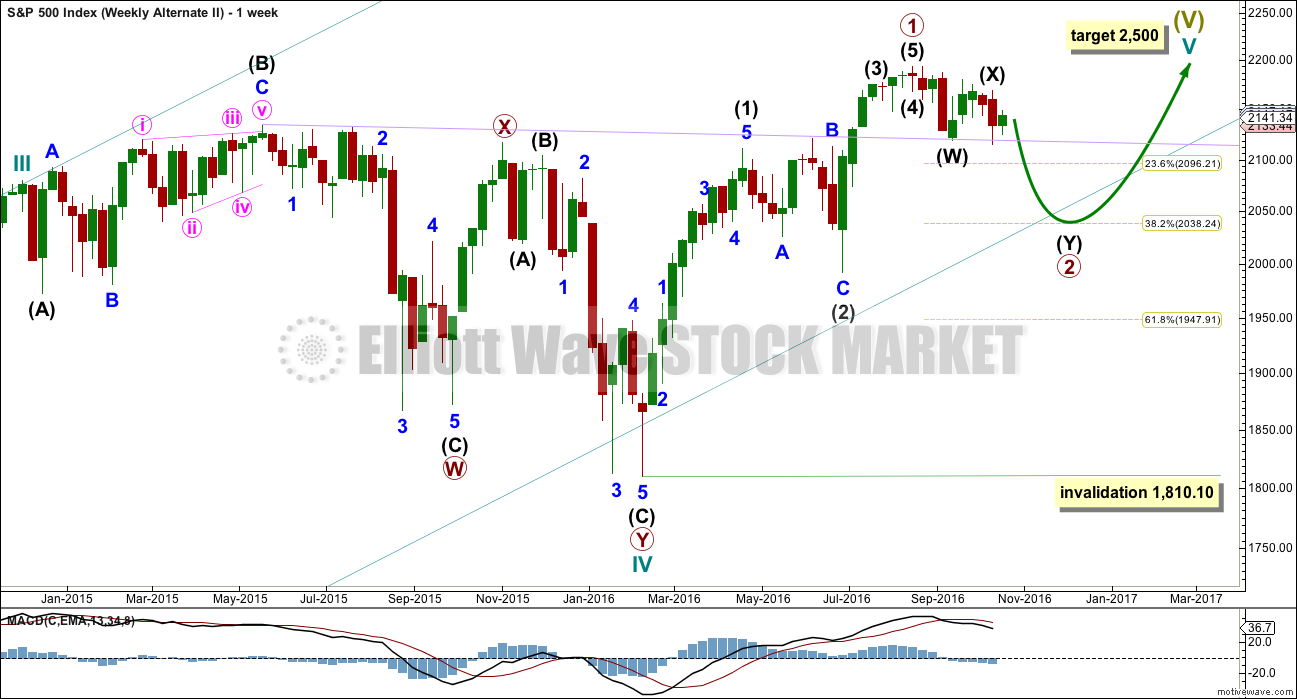

Cycle wave V must subdivide as a five wave structure. I have two wave counts for upwards movement of cycle wave V. This main wave count is presented first only because we should assume the trend remains the same until proven otherwise. Assume that downwards movement is a correction within the upwards trend, until proven it is not.

Primary wave 3 is shorter than primary wave 1, but shows stronger momentum and volume as a third wave normally does. Because primary wave 3 is shorter than primary wave 1 this will limit primary wave 5 to no longer than equality in length with primary wave 3, so that the core Elliott wave rule stating a third wave may not be the shortest is met. Primary wave 5 has a limit at 2,316.85.

Primary wave 2 was a shallow 0.40 expanded flat correction. Primary wave 4 may have ended as a shallow 0.39 double zigzag. There is no alternation in depth, but there is good alternation in structure.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

It is also possible to move the degree of labelling within cycle wave V all down one degree. It may be only primary wave 1 unfolding. The invalidation point for this idea is at 1,810.10. That chart will not be published at this time in order to keep the number of charts manageable. The probability that this upwards impulse is only primary wave 1 is even with the probability that it is cycle wave V in its entirety.

When the five wave structure upwards labelled primary wave 5 is complete, then my main wave count will move the labelling within cycle wave V all down one degree and expect that only primary wave 1 may be complete. The labelling as it is here will become an alternate wave count. This is because we should always assume the trend remains the same until proven otherwise. We should always assume that a counter trend movement is a correction, until price tells us it’s not.

DAILY CHART

Primary wave 3 is moved to the last all time high. If it ended there, then this is where primary wave 4 has begun.

Primary wave 3 is 16.14 points longer than 0.618 the length of primary wave 1. This is a reasonable difference. But as it is less than 10% the length of primary wave 3, it is my judgement that it is close enough to say these waves exhibit a Fibonacci ratio to each other.

If this pattern continues, then about 2,240 primary wave 5 would reach 0.618 the length of primary wave 3. If this target is wrong, it may be too high. When intermediate waves (1) through to (4) are complete, then the target may be changed as it may be calculated at a second degree.

There is good proportion for this wave count. Primary wave 1 lasted 46 days, primary wave 2 lasted 47 days, primary wave 3 lasted a Fibonacci 34 days, and primary wave 4 lasted 42 days. So far primary wave 5 has lasted five days. If it exhibits a Fibonacci duration, it is likely to be more brief than primary wave 3. A Fibonacci 13 days may be reasonably likely at this stage. That would see primary wave 5 end on 1st of November. It does not look like primary wave 5 may manage to end now within October, because it is moving too slowly so far to complete in a Fibonacci 8 days on the 25th of October.

Primary wave 4 fits perfectly as a double zigzag. The second zigzag in the double should have ended with a small overshoot of the lilac trend line. This line should provide very strong support. There is almost no room left for primary wave 4 to move into.

If primary wave 4 continues any further, it may not move into primary wave 1 price territory below 2,111.05.

Primary wave 5 must be a five wave structure, so it is most likely to be a simple impulse. It may be relatively quick, and would be very likely to make at least a slight new high above the end of primary wave 3 at 2,193.81 to avoid a truncation. So far it looks like it is unfolding as an impulse rather than an ending diagonal. Within the impulse of intermediate wave (3), the correction of minor wave 2 is now clear as a red doji candlestick. This is typical for third waves of the S&P, so now at the daily chart level this part of the wave count has the right look.

Because primary wave 5 must be shorter in length than primary wave 3, each of its sub-waves should be shorter in length and duration. For this reason intermediate waves (1) and (2) are labelled as complete within primary wave 5. Intermediate wave (2) may today have ended when price came to almost again touch the lilac trend line.

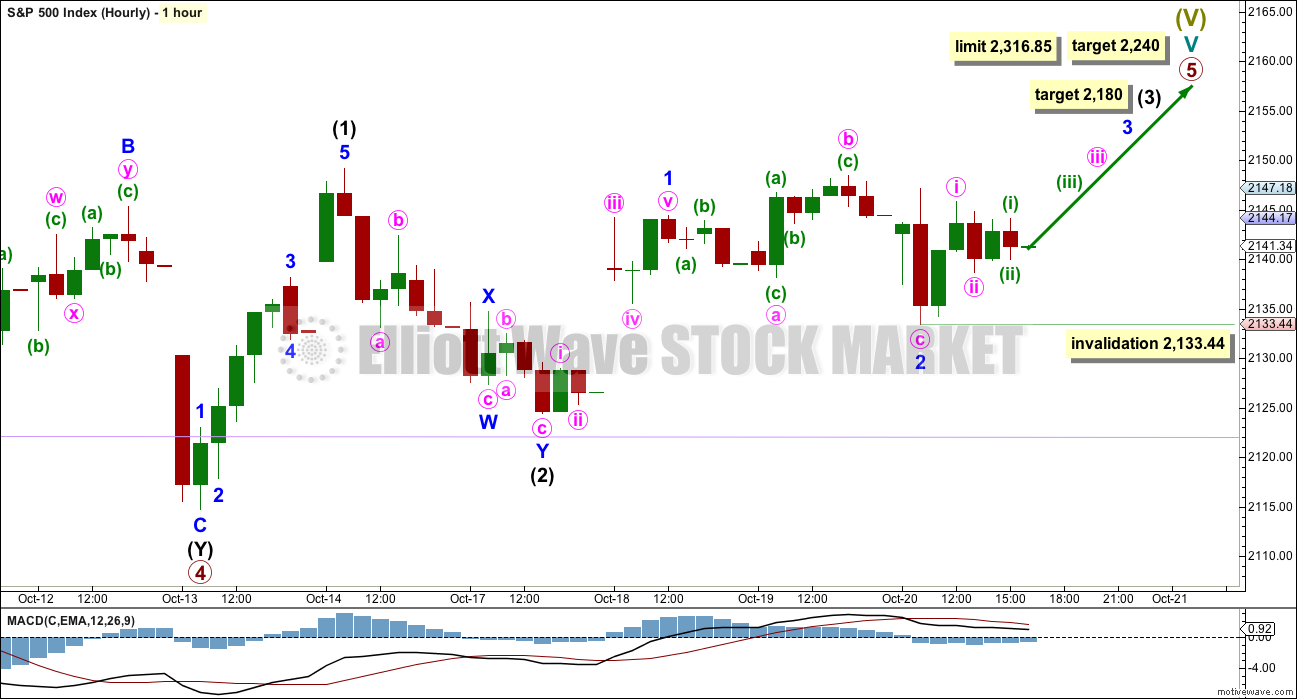

HOURLY CHART

So far primary wave 5 looks like it is unfolding as an impulse, but it may still morph into a combination. An impulse is the more common structure.

Within the impulse, at 2,180 intermediate wave (3) would reach 1.618 the length of intermediate wave (1). Intermediate wave (3) may only subdivide as an impulse. It is showing its subdivisions clearly at a higher time frame on the daily chart.

Minor wave 2 moved lower as an expanded flat correction. Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute wave ii may not move beyond the start of minute wave i below 2,133.44.

This wave count expects to see strong upwards movement tomorrow for the middle of a third wave.

ALTERNATE WAVE COUNT

WEEKLY CHART

What if an impulse upwards is complete? The implications are important. If this is possible, then primary wave 1 within cycle wave V may be complete.

With downwards movement from the high of primary wave 1 now clearly a three and not a five, the possibility that cycle wave V and Super Cycle wave (V) are over has substantially reduced. This possibility would be eliminated if price can make a new all time high above 2,193.81.

If an impulse upwards is complete, then a second wave correction may be unfolding for primary wave 2. Expectations on how deep primary wave 2 is likely to be are now adjusted. It may be expected now to more likely only reach the 0.382 Fibonacci ratio about 2,038.

At this stage, it looks like price has found strong support at the lilac trend line.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10.

DAILY CHART

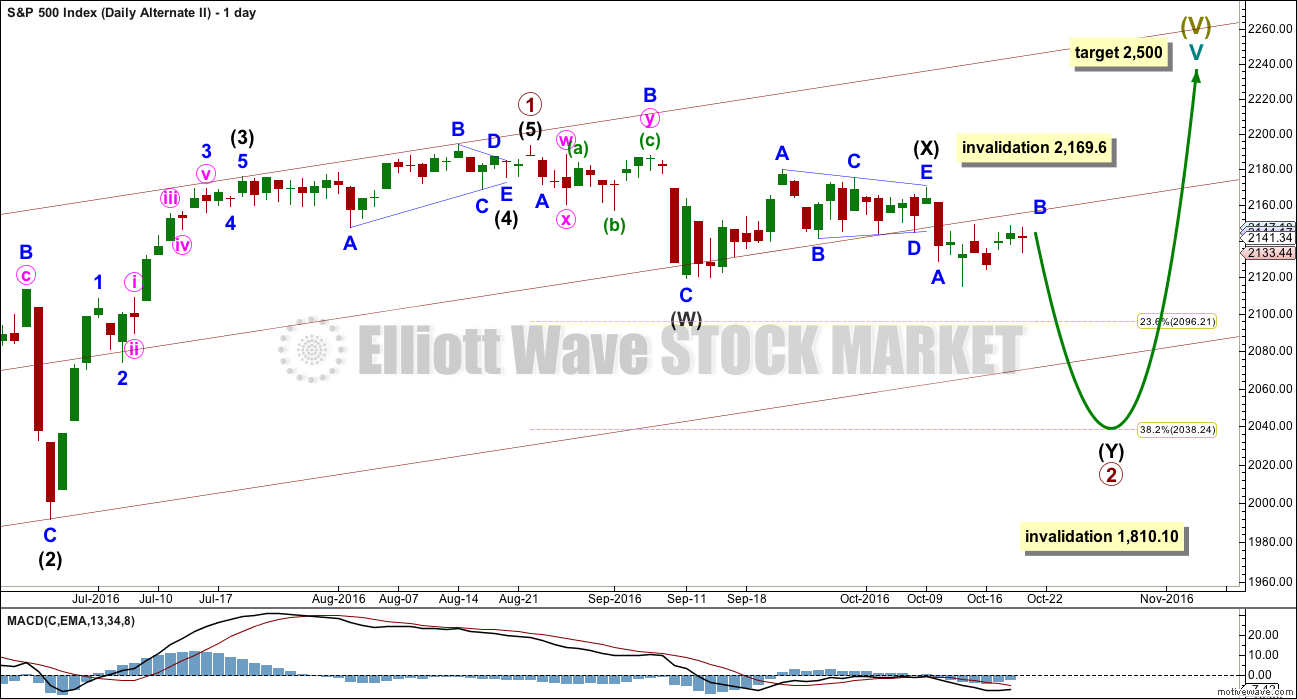

If an impulse upwards is complete, then how may it subdivide and are proportions good?

Intermediate wave (1) was an impulse lasting 47 days. Intermediate wave (2) was an expanded flat lasting 47 days. Intermediate wave (3) fits as an impulse lasting 16 days, and it is 2.04 points short of 0.618 the length of intermediate wave (1). So far this alternate wave count is identical to the main wave count (with the exception of the degree of labelling, but here it may also be moved up one degree).

Intermediate wave (4) may have been a running contracting triangle lasting 22 days and very shallow at only 0.0027 the depth of intermediate wave (3). At its end it effected only a 0.5 point retracement. There is perfect alternation between the deeper expanded flat of intermediate wave (2) and the very shallow triangle of intermediate wave (4). All subdivisions fit and the proportion is good.

Intermediate wave (5) would be very brief at only 18.29 points. Intermediate wave (5) is 1.43 points longer than 0.056 the length of intermediate wave (1).

At this stage, primary wave 2 now has a completed zigzag downwards that did not reach the 0.236 Fibonacci ratio. It is very unlikely for this wave count that primary wave 2 is over there; the correction is too brief and shallow. Upwards movement labelled intermediate wave (X) is so far less than 0.9 the length of the prior wave down labelled intermediate wave (W). The minimum for a flat correction has not been met. Primary wave 2 may continue lower as a double zigzag. A second zigzag in the double may be required to deepen the correction closer to the 0.382 Fibonacci ratio.

Intermediate wave (W) lasted a Fibonacci 13 sessions. Intermediate wave (X) is a complete triangle. X waves may subdivide as any corrective structure (including multiples), and a triangle is possible here.

If minor wave B within the second zigzag of intermediate wave (Y) moves any higher, it may not move beyond the start of minor wave A above 2,169.60.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10. A new low below this point would see the degree of labelling within cycle wave V moved up one degree. At that stage, a trend change at Super Cycle degree would be expected and a new bear market to span several years would be confirmed.

HOURLY CHART

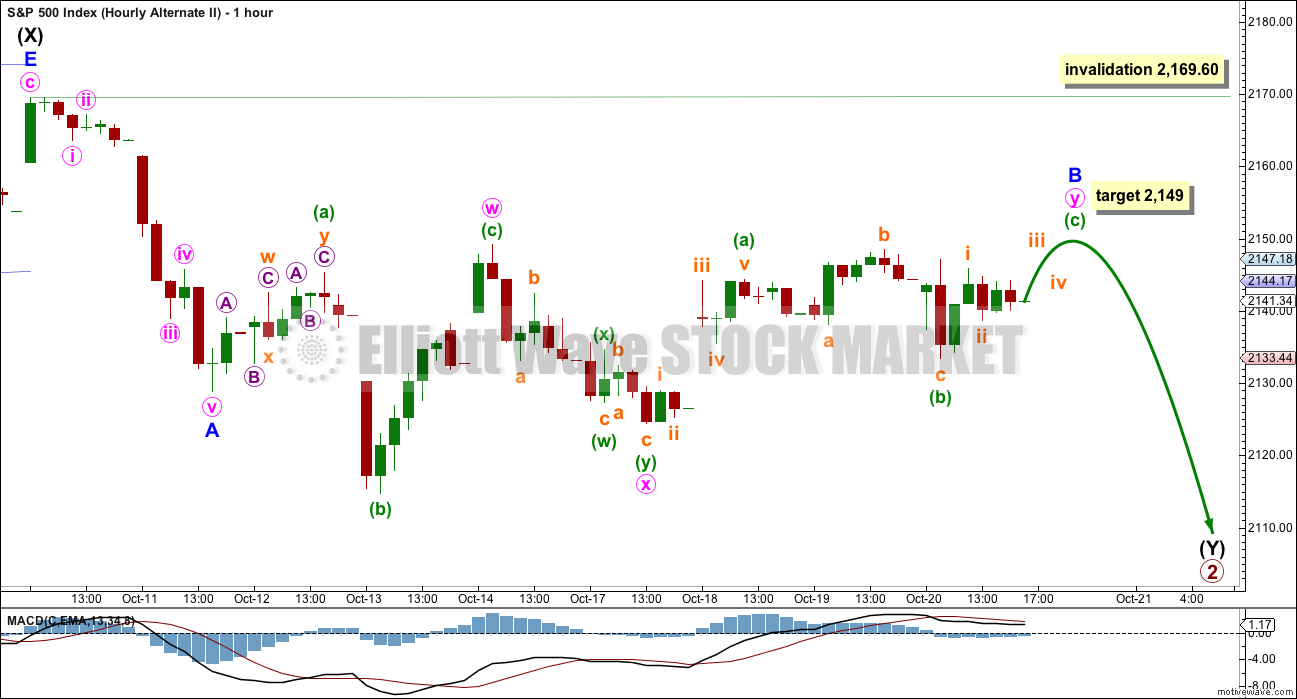

Intermediate wave (Y) should subdivide as a zigzag to deepen the correction.

This wave count is again adjusted slightly. Minor wave B is still seen as incomplete, but now it is seen as a double combination: expanded flat – X – zigzag. Within the zigzag of minute wave y, the last wave up for minuette wave (c) needs to complete as a five wave structure. Minute wave y may end about the same level as minuete wave w at 2,149, so that the whole structure moves overall sideways.

This wave count requires confirmation with a new low below 2,111.05 before it should be used.

TECHNICAL ANALYSIS

WEEKLY CHART

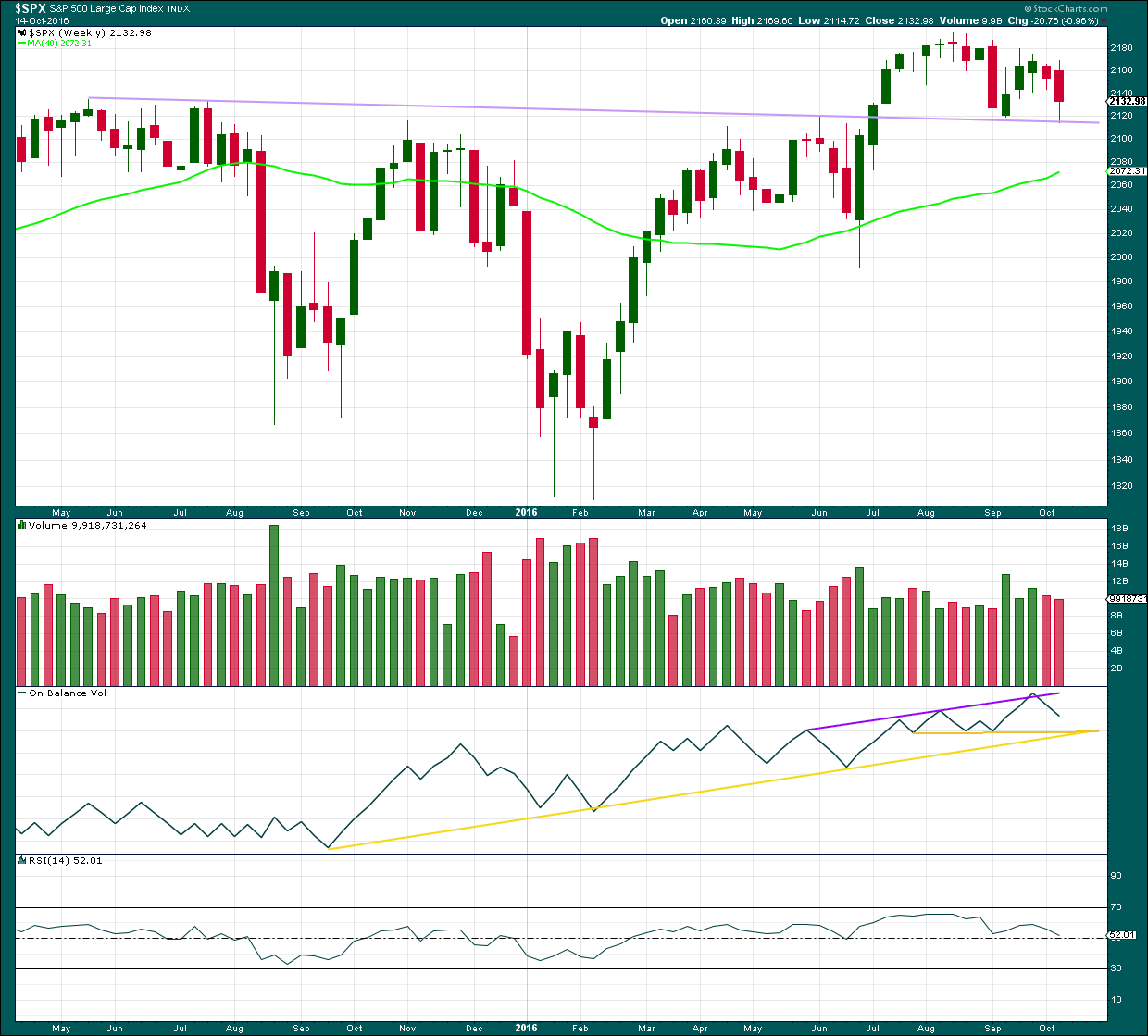

Click chart to enlarge. Chart courtesy of StockCharts.com.

The lilac trend line has strong technical significance. Price broke through resistance, turned down to test support for the first time, and then moved up and away from this line. It was reasonable to conclude that a new all time high is a likely consequence of this typical behaviour.

Now price has come back down for a second test of the lilac trend line. This line is expected to continue to provide support because support at this line is so strong. A break below this line would be a highly significant bearish signal.

Volume for a second downwards week is slightly lighter than the prior upwards week. The fall in price has less support from volume but not by much.

Volume for the two downwards weeks is lighter than two out of three of the prior upwards weeks. Mid term, at the weekly chart level, it still looks like price has more support for upwards movement than downwards from volume.

On Balance Volume has some distance to go before it finds support at either of the yellow lines.

RSI is close to neutral. There is plenty of room for price to rise or fall. There is no mid term divergence between price and RSI to indicate weakness.

DAILY CHART

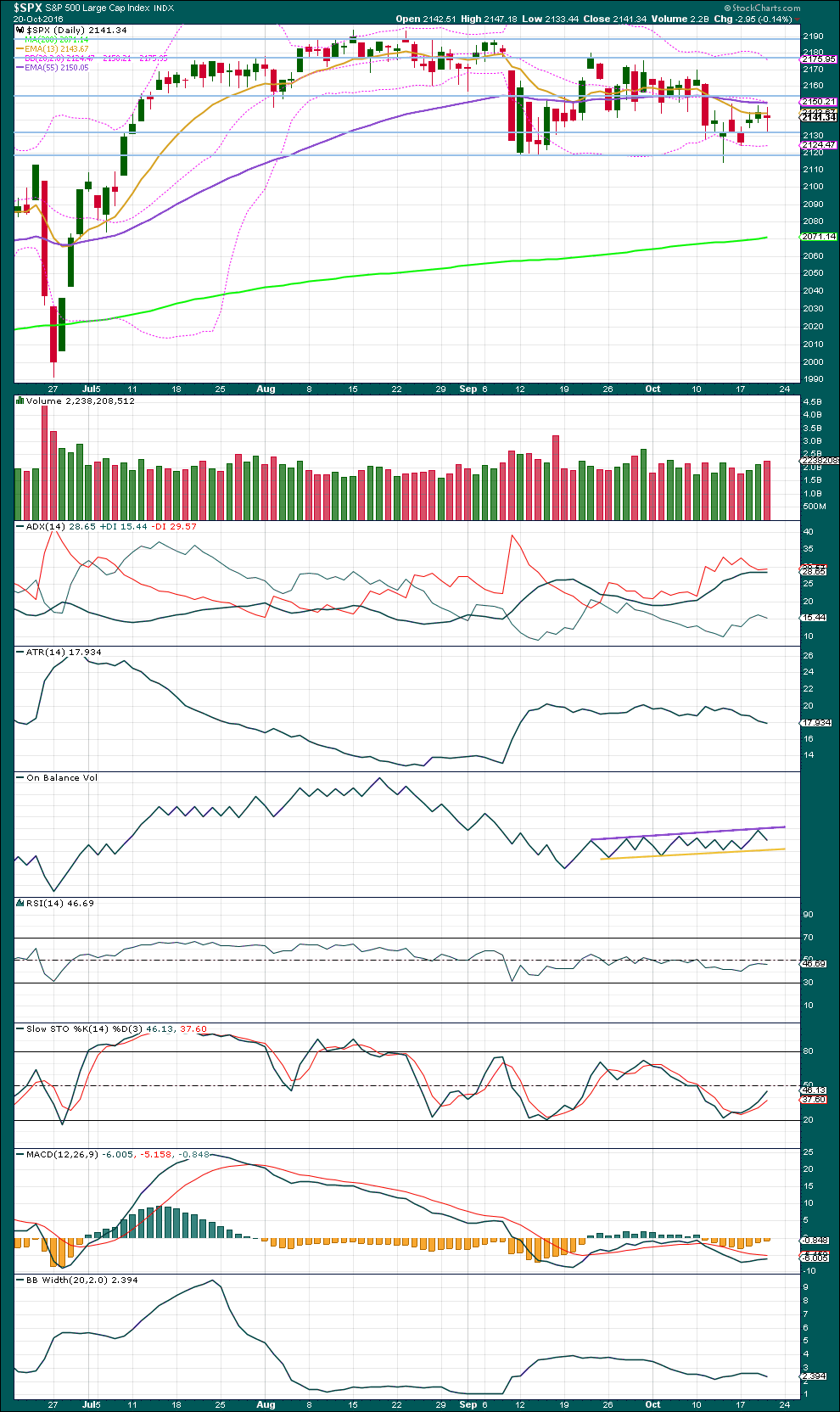

Click chart to enlarge. Chart courtesy of StockCharts.com.

A downwards day comes with a further increase in volume. This suggests that more downwards movement may unfold tomorrow, but this is in opposition to the main Elliott wave count.

Price may find resistance about 2,155, 2,180 and finally about 2,190.

ADX today showed a slight increase, again indicating a downwards trend in place.

ATR and Bollinger Bands disagree that this market is trending. ATR is declining and Bollinger Bands slightly contracted today.

On Balance Volume remains constrained within two trend lines. These lines are not too steeply sloped, are reasonably long held, and are now repeatedly tested. They now have good technical significance. A break out of this range may precede a breakout from price, so it should be taken as a strong signal. OBV today found resistance at the purple line and turned down from there reinforcing the strength of that line.

RSI is close to neutral. There is plenty of room for price to rise or fall.

Stochastics is returning from just above oversold; price may be returning from support. It would be reasonable to expect overall a continuation of an upwards swing from price here to end only when it reaches resistance and Stochastics is close to overbought at the same time.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is again working to indicate short term movements spanning one or two days.

There is today a single day simple divergence with inverted VIX and price. Price today moved sideways / lower and printed a lower high and a lower low and closed red, but completed a doji. On Balance Volume indicated more support for downwards movement than upwards.

While price moved mostly lower, volatility today declined but should have increased. With declining volatility today, this indicates weakness in price and should be followed by upwards movement tomorrow.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

The AD line yesterday made a higher high above the prior high four sessions ago on the 14th of October, but price has made a lower high. This is hidden bearish divergence and indicates weakness in price. This has been followed now by one day of overall downwards movement as today price made a lower high and a lower low. This divergence may now be resolved.

There is no divergence today between price and the AD line. The AD line also declined while price moved overall lower.

DOW THEORY

Major lows within the old bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the bear market from November 2014:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 08:32 p.m. EST.

Again, I had my invalidation point too low.

Minor 2 fits as a regular flat correction. Minute waves a and b are both “threes”. A triangle is classified as a three. Minute b is over 0.9 the length of minute a.

It really should be over now. So with the knowledge that I’ve got the end of minor 2 wrong twice in a row, I’m still going to expect that finally it’s done.

If this session closes with a lower high and a lower low, i.e. downwards, and VIX shows a decline in volatility, then that divergence will be even stronger.

That’s very strange behaviour from VIX. Pretty sure the correct interpretation there is bullish…. still thinking it through.

I’m done for the week. Nothing serious is going to take place to the downside with the round number pivots intact. The bulls seem unable to mount a sustainable advance and to even recover the 50 DMA. Staying in cash except for short Euro and long TLT (for the abc bounce). Have a great week-end everybody. Don’t let the banksters get you down; their day is coming….Cheeerio!

Bye Verne

It will be interesting to see if we have a negation of the DJI hammer by end of day selling as we had yesterday. It would be nice to see the index re-take at least the 21 EMA to confirm an uptrend…

VIX seems to have put in a bottom at 13.29.

VXX and UVXY still heading South although all indices except NADAQ Comp remain below yesterday’s close. Very peculiar indeed!

Cancelled that order. I can’t ignore that hammer developing in DJI. It has been a reliable signal of an impending move higher in the recent past.

Buying VIX November 16 expiration 14.50 calls for 1.95 per contract. Hard stop if contracts trade below 1.65…..

Some folk think the Nasdaq Comp finished up an ending diagonal and traced out an initial impulse down, followed by an a,b,c corrective move up. That opens the possibility that we are seeing a second wave bounce, unless of course the abc correction is not yet done…just thinking out loud….

Are we looking at a genuine reversal off the bottom or is this the mother of all head fakes unfolding? Nasdaq comp is already in the green off the plunge this morning so that is certainly looking bullish at the moment….

Of course we could just go back to the old stand-by of building yet another rising wedge…why the hell not…?! 🙂

I can only conclude that everyone is absolutely convinced this market is about to go on to all time highs. There is simply no other rational explanation for the price action in VIX futures instruments. The bid/ask on VIX 14.50 calls expiring next week is now down to 40/55 so I’m opening a stink bid for 0.30 just to see if the euphoria continues and escalates… 🙂

Once again, new 52 week lows in VXX and UVXY. Either this market is about to take off to the upside like a bat out of you-know-where, or the trading public has gone totally nuts!

We are not exactly at new ATH so what to make of this remarkable complacency is to me quite a mystery. I have never seen anything like this! Hard to resist reloading those VIX 14.50 calls but after what those SOBs did this morning I think I am going to just observe for a bit….something mighty strange is going on here…

if the bears are going to take these pivots, now is the time. If they don’t do it today I think we are headed higher in the short and intermediate term and will be going neutral until this contest is conclusively resolved. This sideways action is getting really tiresome…

I took screen shots on several platforms of what happened this morning and am sending a scathing letter to the SEC. Not that it is going to do any good. If anyone thinks that this cabal of con men don’t collude with one another to rip off retail investors and traders I’ve got news for ya….

I raised royal hell with Schwabb and presto! Bids suddenly appeared! Sold 14.50 contracts for 0.75.

They should have been bid at close to 1.00 even at the open. I literally got robbed of 20 large this morning.

Can you believe these crooked SOB’s??!!!

That’s horrible!

Now I have seen everything. The bid on every single strike price for VIX call options are ALL up 35 -45 %….except….yep, you guessed it, 14.50 strike. This is one of those occasions where I miss my Bottarelli homies. There is a reason I call these people banksters!

Rolling long VIX position at the open. Will sell all 1000 14.50 strike calls expiring next week and buy November 14.50 strike calls. Cost basis for current position is 0.58 per contract.

A contest around DJI 18,000.00 underway in the futures market. The bulls did manage to move price about 3% past the pivot after regaining it back in July but have since then given up a lot of those gains and are now struggling to maintain price above it. If it gives way to day odds are the bears will take price about 3% in the opposite direction prior to resumption of the up-trend. How we close I think we give some indication of the near-term market direction.

Lara,

I expect a retest of the lows before turning upwards. All my hourly indicators are still pointing downwards and VIX is oversold and ready to spike up. I was expecting a downward slide into the close but that did not happen.

Rajesh

Good call Rajesh. You were right. I had my invalidation point too close again 🙁

Well, well, well, not so quick. SPX put up the top of the right shoulder today. It seems like the shoulder will complete on Monday morning with a run down to neckline running through 2122-2127. VIX is again set to spike up.