Upwards movement was expected for Friday’s session.

The session made a higher high and a higher low, but it closed with a red candlestick.

Summary: Price may move lower to complete a second wave correction on Monday, and this is supported by short term divergence between price and the AD line. The short term target is at 2,128, but this may not be low enough. Price should find support at the lilac trend line. Overall, upwards movement is expected to end about 2,240 on the 25th of October.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

MAIN WAVE COUNT

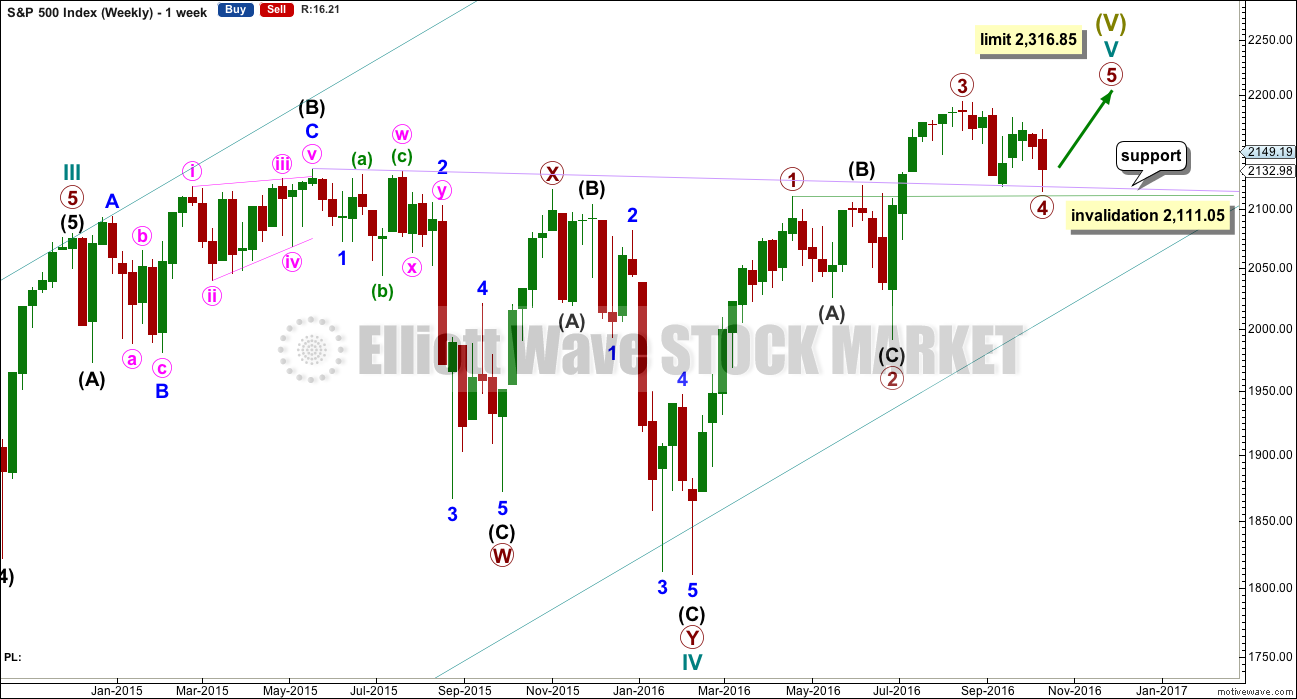

WEEKLY CHART

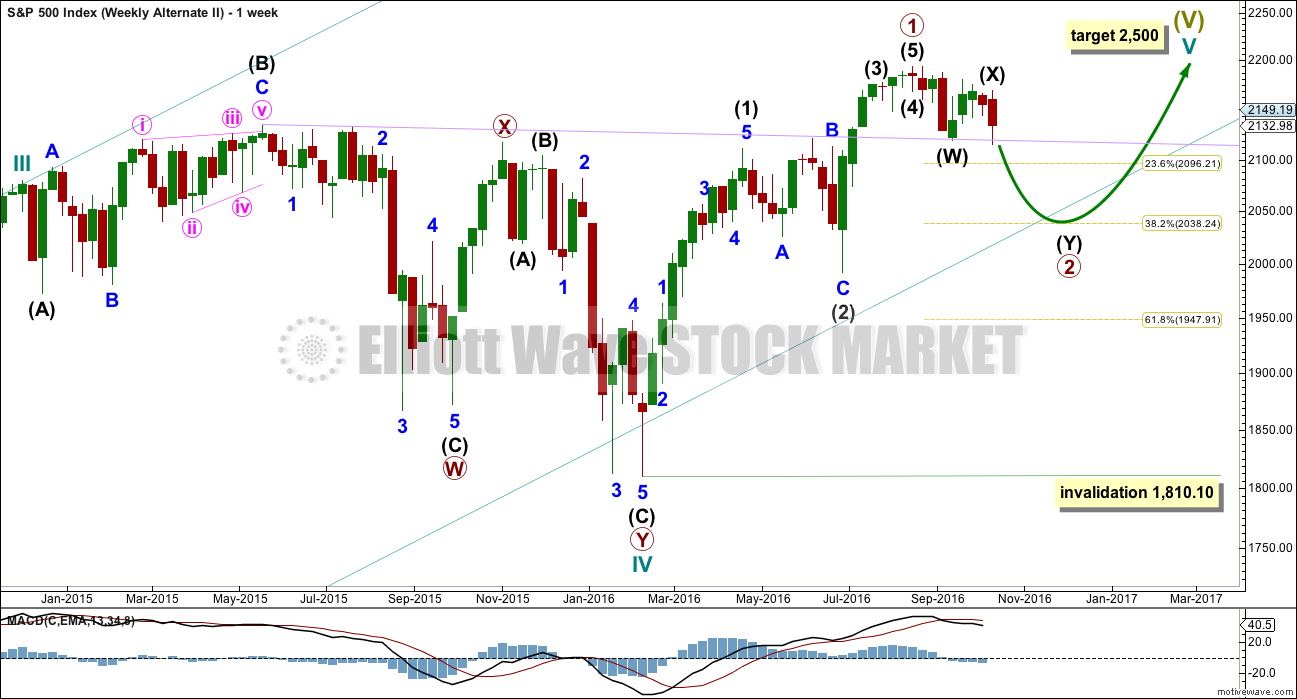

Cycle wave V must subdivide as a five wave structure. I have two wave counts for upwards movement of cycle wave V. This main wave count is presented first only because we should assume the trend remains the same until proven otherwise. Assume that downwards movement is a correction within the upwards trend, until proven it is not.

Primary wave 3 is shorter than primary wave 1, but shows stronger momentum and volume as a third wave normally does. Because primary wave 3 is shorter than primary wave 1 this will limit primary wave 5 to no longer than equality in length with primary wave 3, so that the core Elliott wave rule stating a third wave may not be the shortest is met. Primary wave 5 has a limit at 2,316.85.

Primary wave 2 was a shallow 0.40 expanded flat correction. Primary wave 4 may have ended as a shallow 0.39 double zigzag. There is no alternation in depth, but there is good alternation in structure.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

It is also possible to move the degree of labelling within cycle wave V all down one degree. It may be only primary wave 1 unfolding. The invalidation point for this idea is at 1,810.10. That chart will not be published at this time in order to keep the number of charts manageable. The probability that this upwards impulse is only primary wave 1 is even with the probability that it is cycle wave V in its entirety.

When the five wave structure upwards labelled primary wave 5 is complete, then my main wave count will move the labelling within cycle wave V all down one degree and expect that only primary wave 1 may be complete. The labelling as it is here will become an alternate wave count. This is because we should always assume the trend remains the same until proven otherwise. We should always assume that a counter trend movement is a correction, until price tells us it’s not.

DAILY CHART

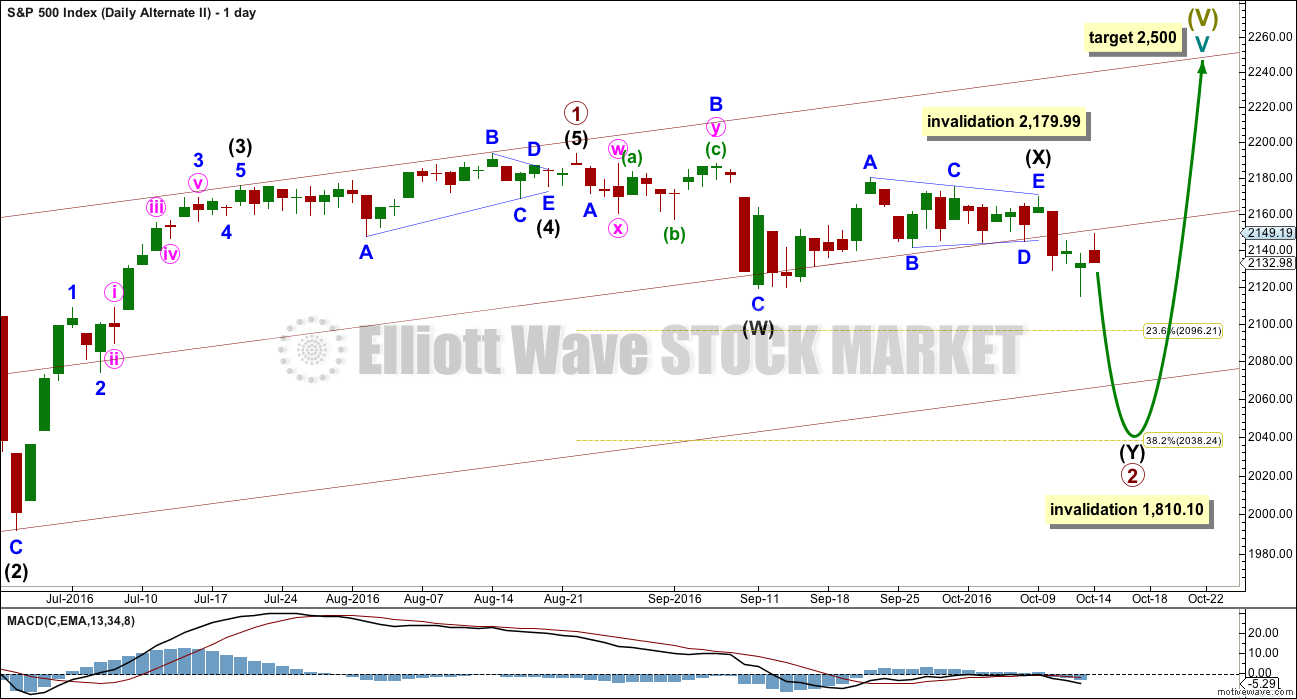

Primary wave 3 is moved to the last all time high. If it ended there, then this is where primary wave 4 has begun.

Primary wave 3 is 16.14 points longer than 0.618 the length of primary wave 1. This is a reasonable difference. But as it is less than 10% the length of primary wave 3, it is my judgement that it is close enough to say these waves exhibit a Fibonacci ratio to each other.

If this pattern continues, then about 2,240 primary wave 5 would reach 0.618 the length of primary wave 3. If this target is wrong, it may be too high. When intermediate waves (1) through to (4) are complete, then the target may be changed as it may be calculated at a second degree.

There is good proportion for this wave count. Primary wave 1 lasted 46 days, primary wave 2 lasted 47 days, primary wave 3 lasted a Fibonacci 34 days, and primary wave 4 lasted 42 days so far.

Primary wave 4 fits perfectly as a double zigzag. The second zigzag in the double should have ended today, with a small overshoot of the lilac trend line. This line should provide very strong support. There is almost no room left for primary wave 4 to move into.

If primary wave 4 continues any further, it may not move into primary wave 1 price territory below 2,111.05.

Primary wave 5 must be a five wave structure, so it is most likely to be a simple impulse. It may be relatively quick, and would be very likely to make at least a slight new high above the end of primary wave 3 at 2,193.81 to avoid a truncation.

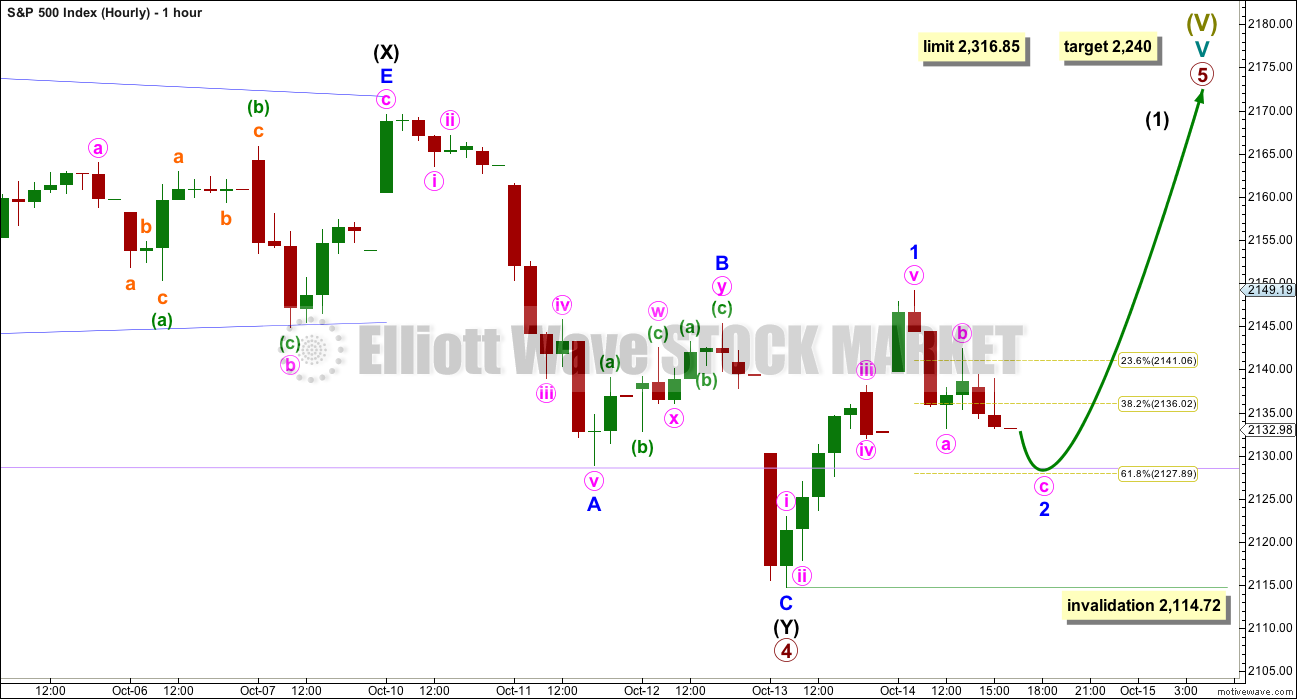

HOURLY CHART

At this stage, I will leave the degree of labelling as it is, but it may need to be moved up one degree in coming days if this structure unfolds as expected and primary wave 5 is quick and relatively short. Because primary wave 3 is shorter than primary wave 1, primary wave 5 may be surprisingly short.

So far a first wave up may be complete. This may be minor wave 1, or it may also be intermediate wave (1).

A second wave correction downwards follows the first wave up. Minor wave 2 does not look complete on the five minute chart, so it may move lower when markets open on Monday. It may not move beyond the start of minor wave 1 below 2,114.72. Minor wave 2 may end about the 0.618 Fibonacci ratio of minor wave 1 at 2,128, which is also where the lilac trend line sits. That line should offer strong support.

ALTERNATE WAVE COUNT

WEEKLY CHART

What if an impulse upwards is complete? The implications are important. If this is possible, then primary wave 1 within cycle wave V may be complete.

With downwards movement from the high of primary wave 1 now clearly a three and not a five, the possibility that cycle wave V and Super Cycle wave (V) are over has substantially reduced. This possibility would be eliminated if price can make a new all time high above 2,193.81.

If an impulse upwards is complete, then a second wave correction may be unfolding for primary wave 2. Expectations on how deep primary wave 2 is likely to be are now adjusted. It may be expected now to more likely only reach the 0.382 Fibonacci ratio about 2,038.

At this stage, it looks like price has found strong support at the lilac trend line.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10.

DAILY CHART

If an impulse upwards is complete, then how may it subdivide and are proportions good?

Intermediate wave (1) was an impulse lasting 47 days. Intermediate wave (2) was an expanded flat lasting 47 days. Intermediate wave (3) fits as an impulse lasting 16 days, and it is 2.04 points short of 0.618 the length of intermediate wave (1). So far this alternate wave count is identical to the main wave count (with the exception of the degree of labelling, but here it may also be moved up one degree).

Intermediate wave (4) may have been a running contracting triangle lasting 22 days and very shallow at only 0.0027 the depth of intermediate wave (3). At its end it effected only a 0.5 point retracement. There is perfect alternation between the deeper expanded flat of intermediate wave (2) and the very shallow triangle of intermediate wave (4). All subdivisions fit and the proportion is good.

Intermediate wave (5) would be very brief at only 18.29 points. Intermediate wave (5) is 1.43 points longer than 0.056 the length of intermediate wave (1).

At this stage, primary wave 2 now has a completed zigzag downwards that did not reach the 0.236 Fibonacci ratio. It is very unlikely for this wave count that primary wave 2 is over there; the correction is too brief and shallow. Upwards movement labelled intermediate wave (X) is so far less than 0.9 the length of the prior wave down labelled intermediate wave (W). The minimum for a flat correction has not been met. Primary wave 2 may continue lower as a double zigzag. A second zigzag in the double may be required to deepen the correction closer to the 0.382 Fibonacci ratio.

Intermediate wave (W) lasted a Fibonacci 13 sessions. Intermediate wave (X) is now changed today to see a triangle unfolding sideways. X waves may subdivide as any corrective structure (including multiples), and a triangle is possible here.

If minor wave C within the triangle for intermediate wave (X) moves any higher, then it may not move beyond the end of minor wave A above 2,179.99. It is possible today that the triangle for intermediate wave (X) is over and the breakout downwards may come quickly.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10. A new low below this point would see the degree of labelling within cycle wave V moved up one degree. At that stage, a trend change at Super Cycle degree would be expected and a new bear market to span several years would be confirmed.

HOURLY CHART

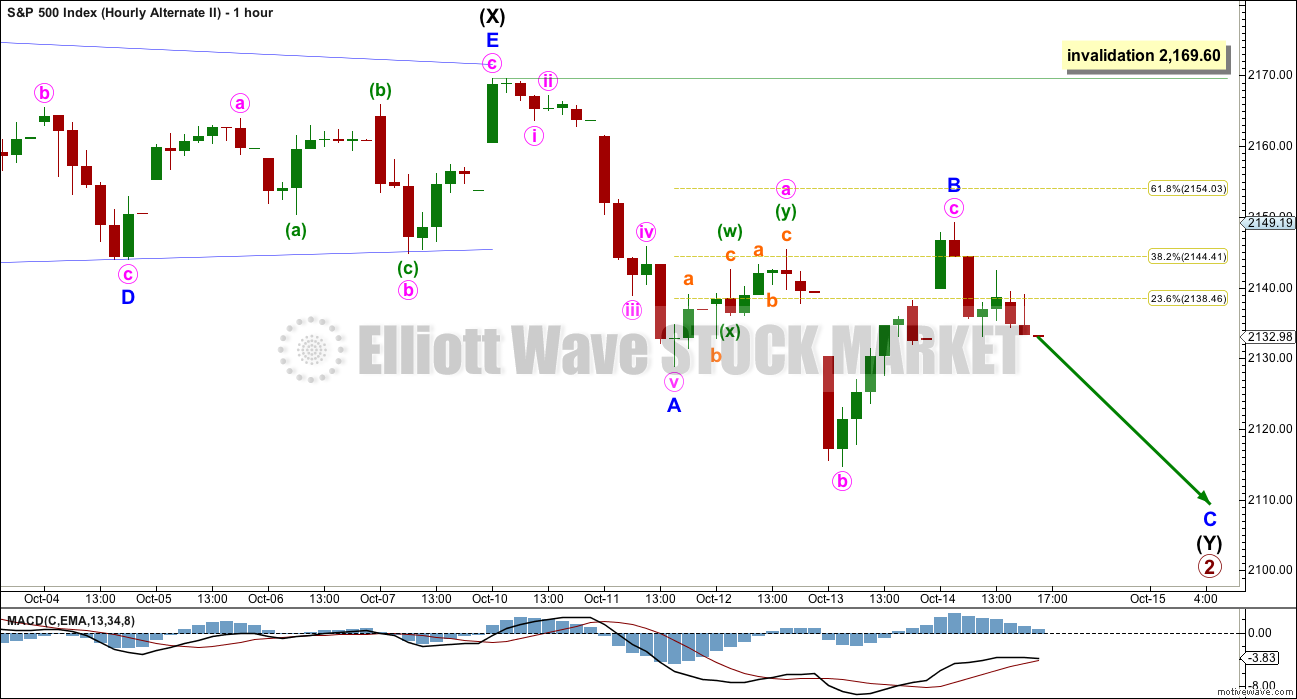

Intermediate wave (X) will fit as a regular contracting triangle. Intermediate wave (Y) should subdivide as a zigzag to deepen the correction. Within intermediate wave (Y), the correction for minor wave B may not move beyond the start of minor wave A above 2,169.60.

Within the zigzag of intermediate wave (Y), minor waves A and B may be complete. Upwards movement for Friday’s session may have been minor wave B continuing further as an expanded flat correction.

While it is possible that intermediate wave (Y) is a complete zigzag, it is also possible that it may continue lower to deepen the correction for primary wave 2. The second zigzag in the double should end further beyond the end of the first zigzag for the double zigzag to have a typical look.

TECHNICAL ANALYSIS

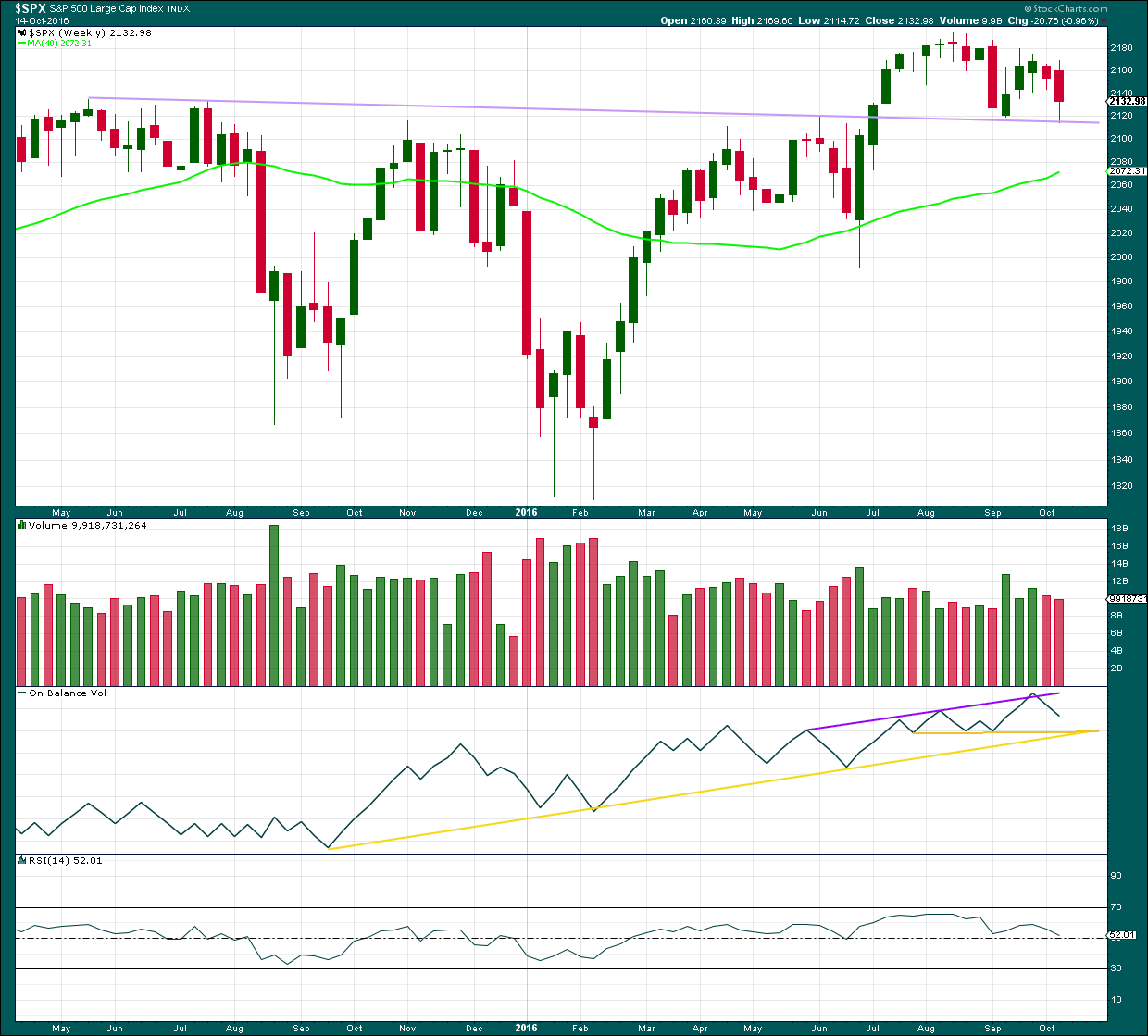

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The lilac trend line has strong technical significance. Price broke through resistance, turned down to test support for the first time, and then moved up and away from this line. It was reasonable to conclude that a new all time high is a likely consequence of this typical behaviour.

Now price has come back down for a second test of the lilac trend line. This line is expected to continue to provide support because support at this line is so strong. A break below this line would be a highly significant bearish signal.

Volume for this second downwards week is slightly lighter than the prior upwards week. The fall in price has less support from volume this week but not by much.

Volume for the two downwards weeks is lighter than two out of three of the prior upwards weeks. Mid term, at the weekly chart level, it still looks like price has more support for upwards movement than downwards from volume.

On Balance Volume has some distance to go before it finds support at either of the yellow lines.

RSI is close to neutral. There is plenty of room for price to rise or fall. There is no mid term divergence between price and RSI to indicate weakness.

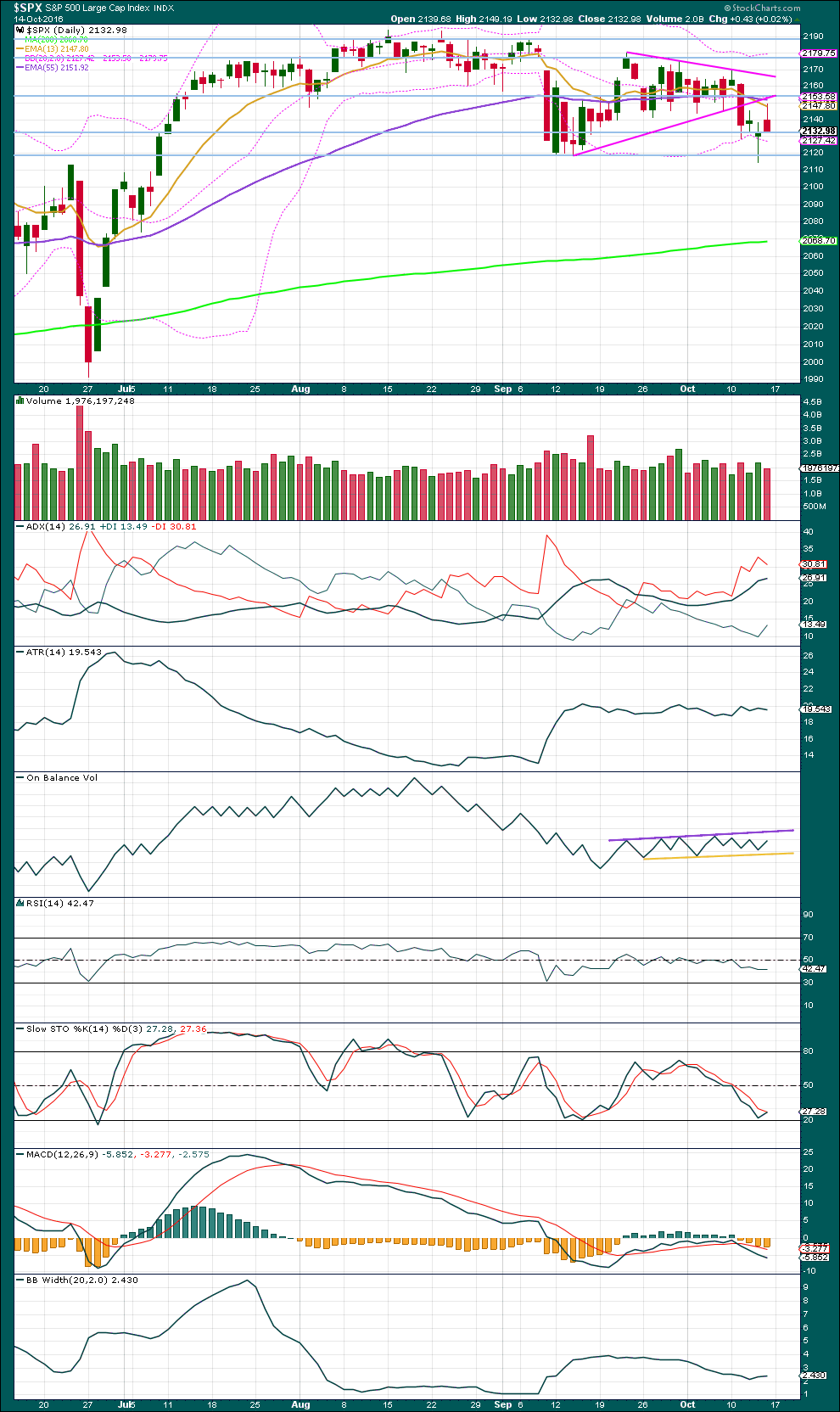

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Friday’s session closed with a red daily candlestick, which has lighter volume than the prior upwards day. Overall, price moved lower for Friday’s session, although price gapped open higher. Overall, there is less support for downwards movement than there is for upwards movement. A further rise in price for Monday would be a reasonable expectation.

Price may be finding some resistance about 2,155.

ADX is still increasing and the -DX line is still above the +DX line. A downwards trend is still indicated.

ATR still disagrees as it is overall flat.

Bollinger Bands may beginning to agree that there is a trend. They may be beginning to widen again.

On Balance Volume has not yet broken out of its range to indicate the next direction from price.

RSI is still reasonably close to neutral. There is plenty of room for price to rise or fall.

Stochastics is returning from just above oversold. Price has just bounced up from support. A continuation of an overall upwards swing would be expected, if this market is still consolidating.

The short term sell signal from MACD on 11th of October still remains intact.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. It appears so far that divergence between inverted VIX and price is again working to indicate short term movements spanning one or two days.

Price today had a higher high and a higher low. Although the session closed red, overall it was upwards. Inverted VIX has moved higher today, so no divergence is noted today between price and inverted VIX.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term bullish and bearish divergence is again working between price and the AD line to show the direction for the following one or two days.

For Friday the 14th of October, price made a new high above the session two days prior, on the 12th of October, but the AD line failed to make a corresponding new high. This short term divergence is bearish. Although price has made a higher high, it is weak because the new high is not supported by market breadth. This short term divergence may be followed by one or two days of downwards movement.

DOW THEORY

Major lows within the old bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the bear market from November 2014:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 12:41 a.m. EST on 15th October, 2016.

For the weekend… for Rodney and Verne and all the other dog owners here.

I’ve just come back from a week with my favourite Aunt, she has dogs. She has one mid sized dog called Max who is World’s Best Dog. I love him so much.

I’d change the lyrics here to Stinky Stinky Dog Friend though, because he stinks 🙂

Some weirdness from the New Zealand music scene… a bit old now but still good.

https://www.youtube.com/watch?v=bvCaAG8shXs

Well, I am not sure what to say. Thank you, I think.

Our affinity to canines might unite us. But our choices of music shall not, I am afraid. I shall wait for the next great music from New Zealand to jump on the bandwagon.

That’s okay, it is weird. And an acquired taste 🙂

Steely Dan’s Aja has got to be one of my all-time favorite albums.

Chuck Rainey absolutely tears it up with that funkadelic bass riff on Peg. Every time I hear that song I want to get out my Fender Precision and play along – popping string snaps all the way home! Too bad they don’t make too many albums like this anymore… 🙂

Agreed. Probably one of the best albums of all time. Ever.

just an observation, not a prediction…check the SVXY price action from mid-June 2015 into mid-August 2015…compare to the price action from late-August 2016 to present…the indicators look similar (displaying negative divergence with price)…if it plays out the market could drop like a rock…

one other point of interest…SPX closed the week under 2,134.72…as we all know, that was previously regarded as a very important price level…

http://elliottwavestockmarket.com/2016/07/12/sp-500-elliott-wave-technical-analysis-11th-july-2016/

Yep! Yep! Yep! Ten bagger on the way! 🙂

It’s setting up a massive head and shoulders pattern and the downside implication is huge. I plan on trading its opposite cousin UVXY. I will probably open a very large bullish put spread and use the proceeds to establish a long UVXY 20 strike call position going out toward the end of November. That is sometimes called a double vertical and if you are right about the move they can absolutely explode! We don’t get to many opportunities to hand it to Mr. Market. One may be on the horizon… 🙂