Upwards movement was expected.

Price moved sideways to print a small green doji daily candlestick.

Summary: The trend remains the same, until proven otherwise. Assume the trend is up while price is above 2,147.58. The mid term targets are 2,332 or 2,445. If price makes a new low below 2,147.58, then overall sideways movement for a continuation of a longer consolidation would be expected. At this stage, a deeper pullback looks increasingly unlikely. There is not enough selling pressure which would be required to push price lower.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

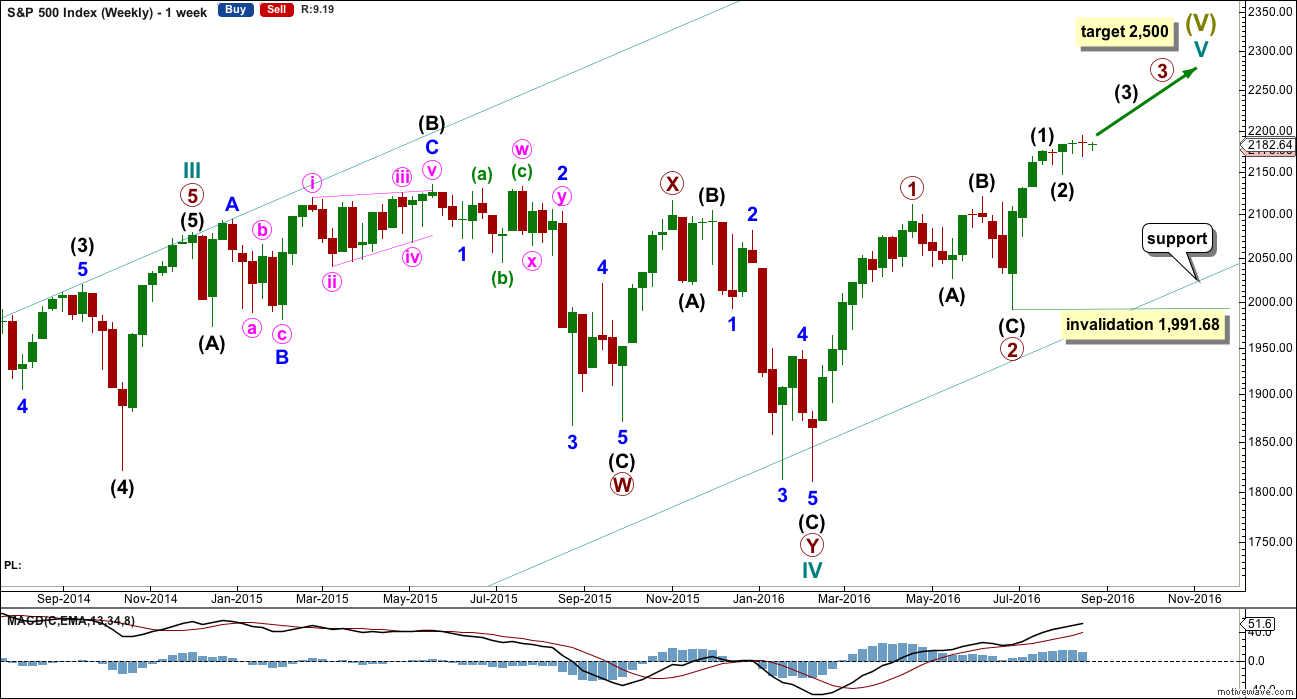

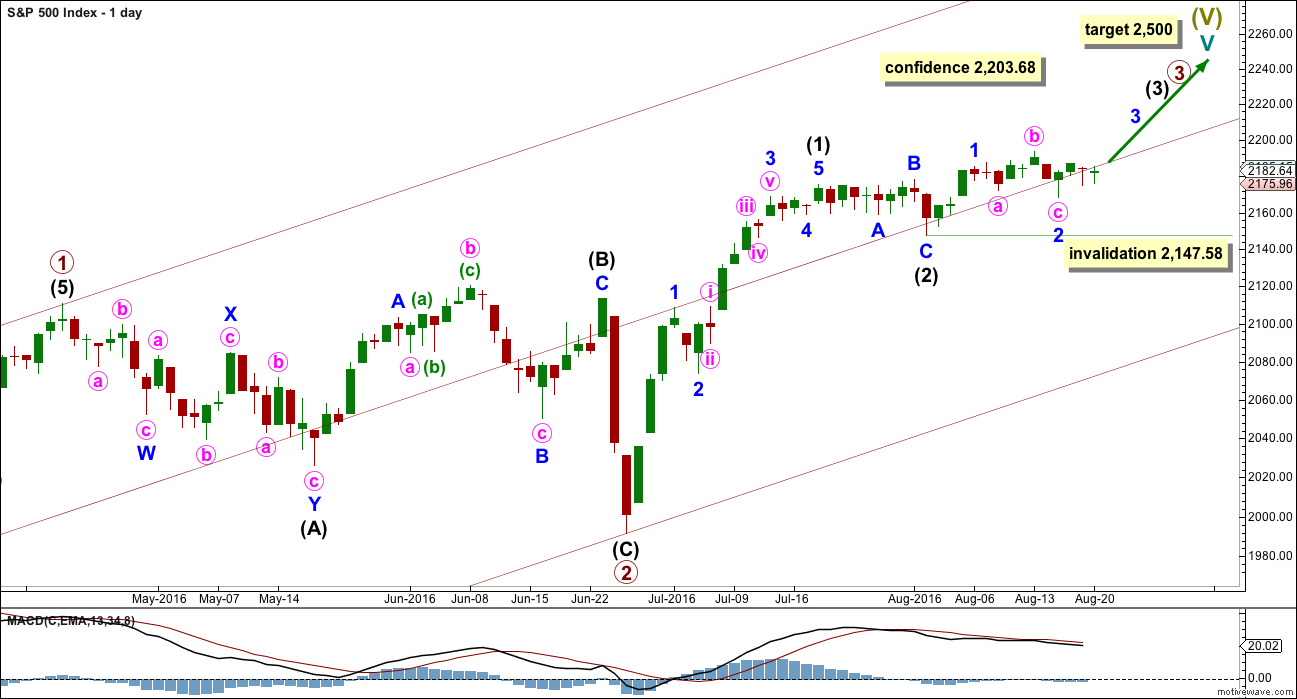

MAIN WAVE COUNT

WEEKLY CHART

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV is seen as a more shallow 0.28 double combination lasting 15 months. With cycle wave IV five times the duration of cycle wave II, it should be over there.

Cycle wave I lasted 28 months (not a Fibonacci number), cycle wave II lasted a Fibonacci 3 months, cycle wave III lasted 38 months (not a Fibonacci number), and cycle wave IV lasted 15 months (two more than a Fibonacci 13).

If the target for cycle wave V is for it to be equal in length with cycle wave I, then it may also be expected to be about equal in duration. So far cycle wave V is in its sixth month. After this month, a further 22 months to total 28 seems a reasonable expectation, or possibly a further 15 months to total a Fibonacci 21.

This first weekly wave count expects the more common structure of an impulse is unfolding for cycle wave V. Within cycle wave V, primary waves 1 and now 2 should be over. Within primary wave 3, no second wave correction may move beyond its start below 1,991.68. If price makes a new high above 2,203.68, then that would provide enough confidence that intermediate wave (2) should be over to move the invalidation point on the weekly chart up to 2,147.58.

There is one other possible structure for cycle wave V, an ending diagonal. This is covered in an alternate.

DAILY CHART

Primary wave 2 is complete as a shallow regular flat correction. Primary wave 3 is underway.

Within primary wave 3, intermediate wave (1) is a complete impulse. Intermediate wave (2) may now be a complete flat correction.

It is still just possible that intermediate wave (2) may not be complete and could continue sideways and a little lower. A deep pullback would not be expected, only a sideways combination, double flat or slightly lower expanded flat would be indicated. If price moves above 2,203.68, then upwards movement from the low at 2,147.58 would be more than twice the length of intermediate wave (2). At that stage, the probability that upwards movement is a B wave within intermediate wave (2) would be so low the idea should be discarded. A new high above 2,203.68 would add confidence in the upwards trend.

If price moves below 2,147.58, then this main wave count would change to see intermediate wave (2) continuing further sideways. The alternate would remain an alternate. The invalidation point would move down to the start of intermediate wave (1).

Within intermediate wave (3), no second wave correction may move beyond its start below 2,147.58.

Add a mid line to the base channel drawn about primary waves 1 and 2. Draw this channel from the start of primary wave 1 (seen on the weekly chart) to the end of primary wave 2, then place a parallel copy on the end of primary wave 1. The mid line may provide some support along the way up.

At this stage, it looks most likely that intermediate wave (3) has begun. It should be expected to show the subdivisions of minor waves 2 and 4 clearly on the daily chart with one to a few red daily candlesticks or doji. With minor wave 2 now showing as two red candlesticks, one doji and a green candlestick with a long lower wick, this wave count so far has a typical look.

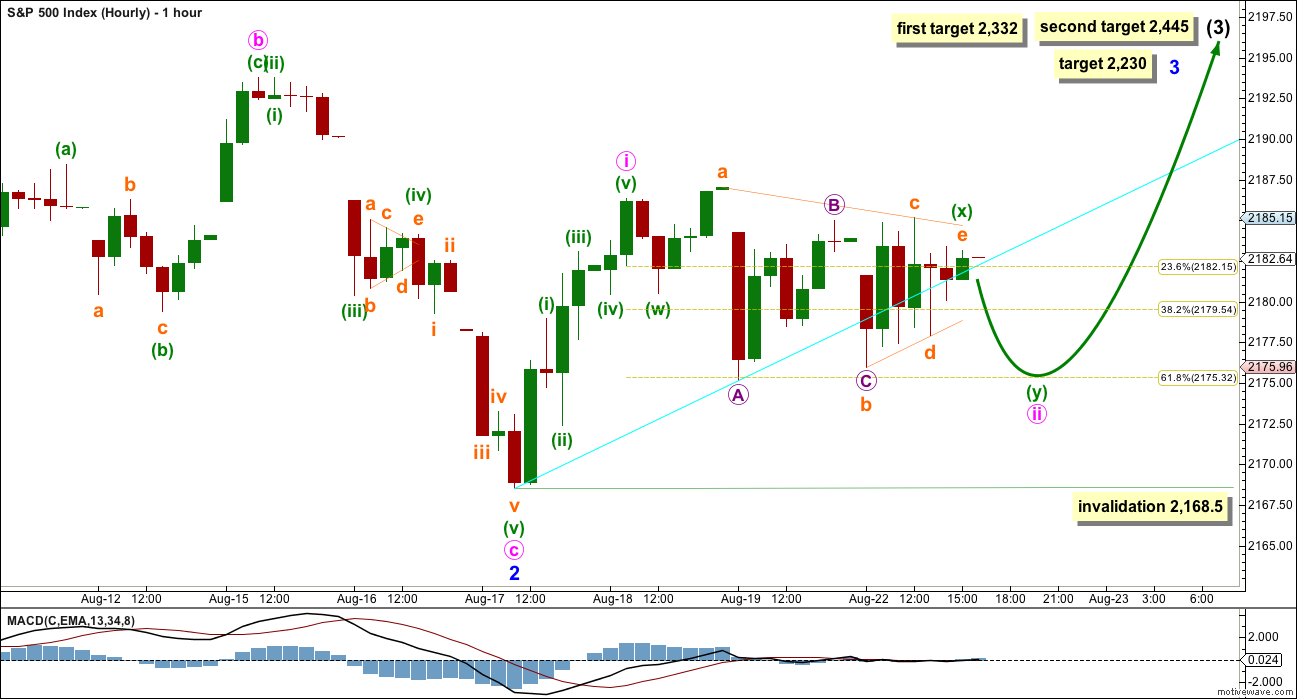

HOURLY CHART

A triangle is unfolding sideways for Monday’s session. This is supported by MACD flat at the zero level.

In trying to see the triangle beginning at the low labelled micro wave A within subminuette wave b, the rules for a contracting triangle cannot be met. Via a quick process of elimination, it looks like the triangle must have begun as labelled at the low labelled minuette wave (w). If this labelling is correct, then the direction of entry to the triangle was downwards, so the direction of exit should be downwards.

Minute wave ii may be continuing as a double zigzag or combination. Within the double, the first structure labelled minuette wave (w) fits as a quick zigzag on the five minute chart. The double is joined by a “three” in the opposite direction, a running contracting triangle labelled minuette wave (x).

The second structure in the double may be a zigzag to complete a double zigzag, or a flat correction to complete a double combination.

Minute wave ii may not move beyond the start of minute wave i below 2,168.50.

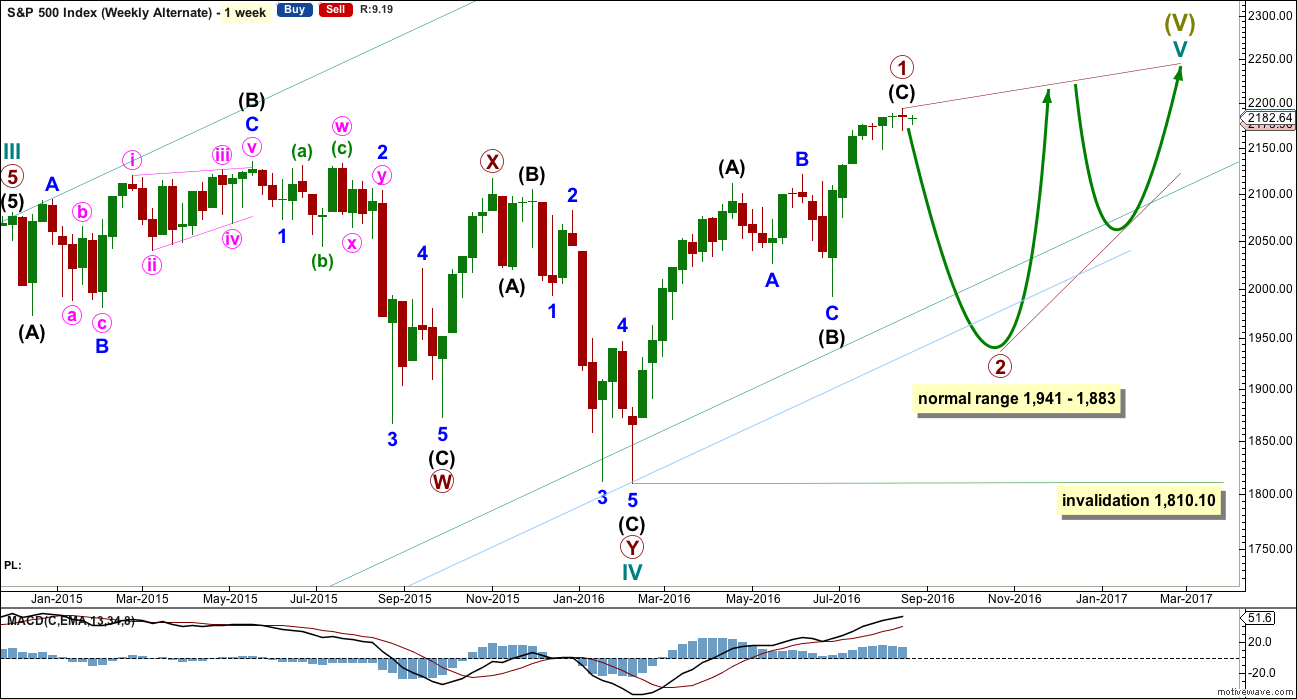

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate may diverge from the main wave count.

The other structural possibility for cycle wave V is an ending diagonal. Ending diagonals are more often contracting than expanding, so that is what this alternate will expect.

Ending diagonals require all sub-waves to subdivide as zigzags. Zigzags subdivide 5-3-5. Thus primary wave 1 may now be a complete (or almost complete) zigzag, labelled intermediate waves (A)-(B)-(C) which subdivides 5-3-5.

The normal depth for second and fourth waves of diagonals is from 0.66 to 0.81 the prior actionary wave. Primary wave 2 may end within this range, from 1,941 to 1,883.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10.

When primary wave 2 is a complete zigzag, then another zigzag upwards for primary wave 3 must make a new high above the end of primary wave 1. It would most likely be shorter than primary wave 1 as diagonals are more commonly contracting. If primary wave 3 is longer than primary wave 1, then an expanding diagonal would be indicated.

The psychology of diagonals is quite different to impulses. Diagonals contain corrective characteristics and subdivide as a series of zigzags. When diagonals turn up in fifth wave positions, they take on some of the properties of the correction which inevitably follows them. The deterioration in fundamentals and underlying technicals is more extreme and more evident. There is some support for this idea at this time.

The final target of 2,500 would not be able to be reached by an ending contracting diagonal. The final target for this alternate would be calculated only when primary wave 4 is complete.

The classic pattern equivalent is a rising wedge.

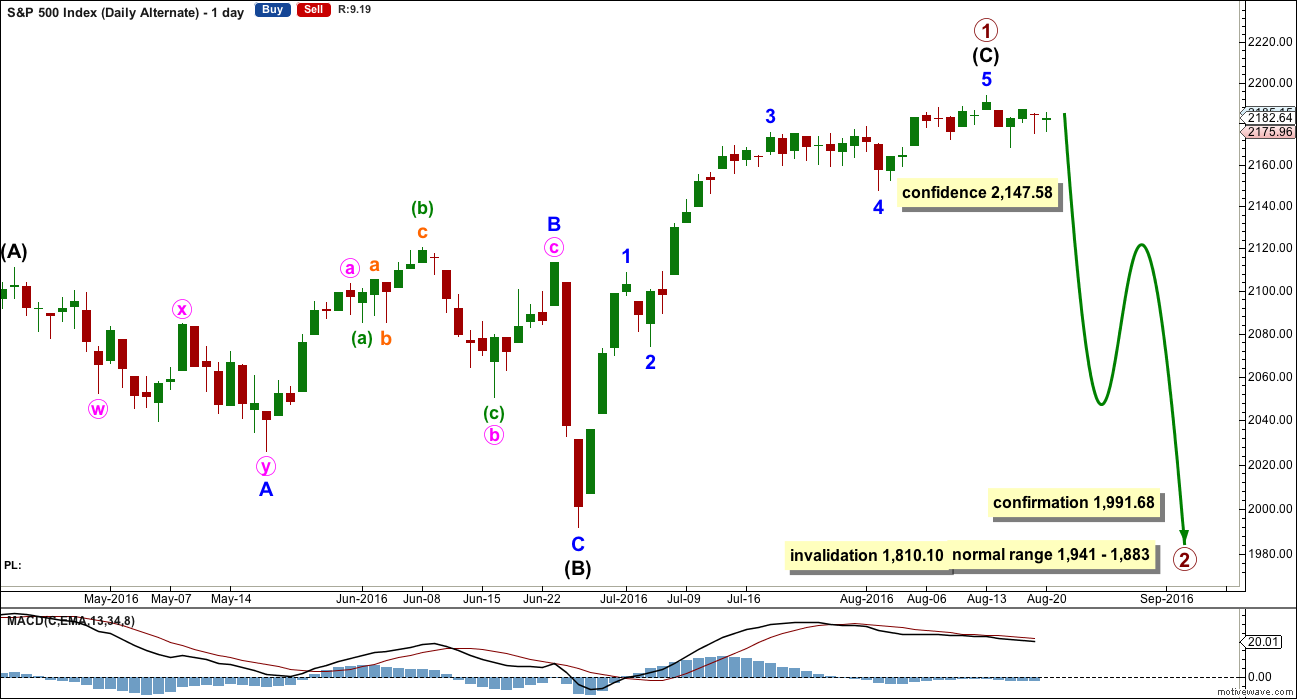

DAILY CHART

It is possible now that intermediate wave (C) is a complete five wave impulse. However, this wave count suffers from disproportion between minor waves 2 and 4 which gives this possible impulse an odd look. It looks like a three where it should look like a five. However, the S&P just does not always have waves which look right at all time frames.

Because this wave count expects to see a substantial trend change here from bull to bear for a multi week deep pullback, it absolutely requires some indication from price before confidence may be had in it. A new low below 2,147.58 would add confidence.

At this stage, there is not enough selling pressure to support this wave count. When the market has fallen recently, it has fallen of its own weight. For a deep pullback sellers would have to enter the market and be active enough to push price lower. That is not happening at this time.

TECHNICAL ANALYSIS

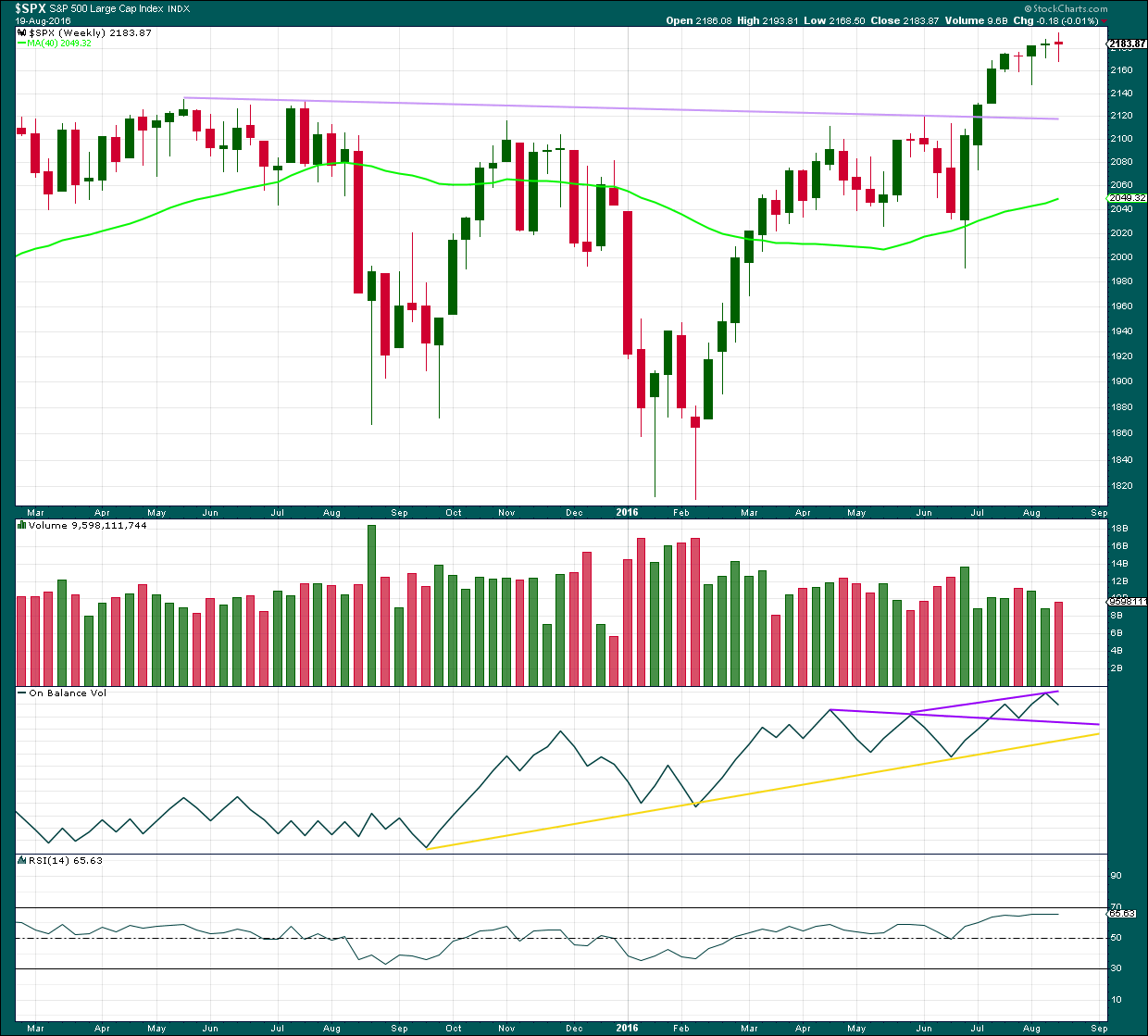

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week completes another doji candlestick, this time with a slightly wider range than the week before. Overall, this doji represents a balance between bulls and bears with the bears very slightly stronger to complete a red candlestick. A slight increase in volume is slightly bearish, but in this instance because the candelstick is a doji we should look inside at the daily volume bars for a clearer picture.

On Balance Volume remains bullish while it is above the longer purple trend line. A new trend line is added last week. A break above this shorter and steeper line would be another bullish signal.

RSI is still not extreme. There is room for price to rise further.

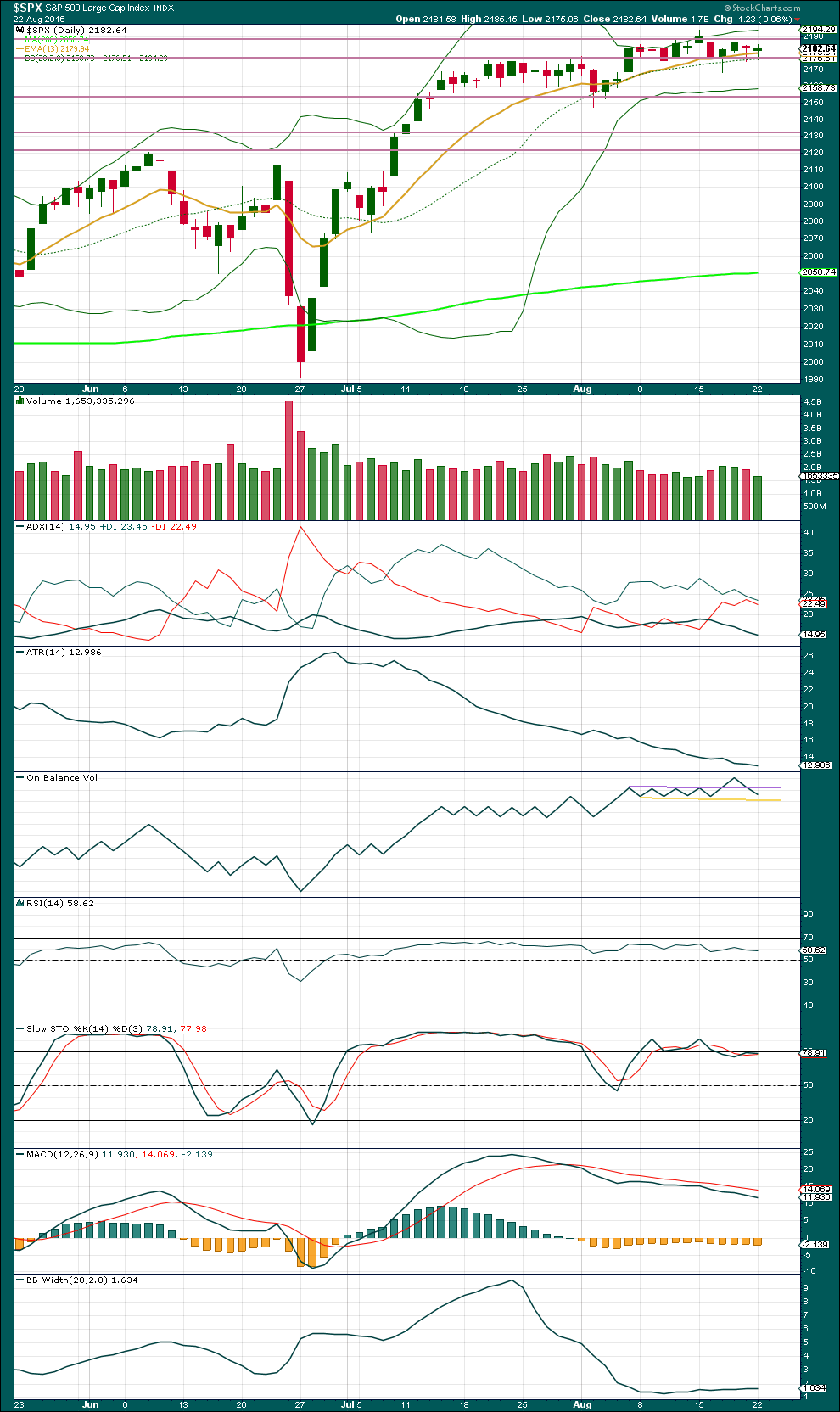

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Two overall sideways days with declining volume look very corrective. With the red doji for Friday showing a decline in volume and now a green doji showing a further decline in volume, the short term volume profile here is neither bullish nor bearish.

The long lower wicks of Friday’s and Wednesday’s sessions last week now indicate some bullishness, where previously the longer upper wicks of 9th and 15th of August indicated some bearishness.

Price may be finding some resistance at the horizontal trend line about 2,185. A break above resistance on a day with some increase in volume would add further confidence to the wave count.

While price has essentially been moving sideways since about 14th of July (with an upwards bias), ATR is declining. It should be expected that ATR will again start to increase as a trend becomes stronger and clearer.

ADX is still declining, but during this entire time the +DX line has remained above the -DX line. No trend change has been indicated from ADX; the trend remains up. ADX may be indicating an interruption to the upward trend by some sideways consolidation, which is what has been happening.

The bullish signal from On Balance Volume with a break above the purple trend line is now negated with OBV returning to below the line. OBV should be expected to find support now at the yellow line, and this support may serve to halt the fall in price. The purple line has been weakened. Another break above it would be a bullish signal, but a weaker signal.

RSI is not yet extreme. There is room for price to rise or fall. There is no divergence at this stage between price and RSI to indicate weakness, but even if there was it would not be given much weight. The absence of divergence offers some slight support to this analysis today.

Stochastics is close to overbought, but this oscillator may remain extreme for reasonable periods of time during a trending market. If the market is still consolidating, a downwards swing from price would be expected here.

Momentum has been declining as price has been moving overall sideways. There is divergence between price and MACD, but this is unreliable at this time and is still not given any weight in this analysis.

Bollinger Bands remain tightly contracted but may be beginning to widen a little. It would be normal to expect them to again expand as some volatility returns to this market and price starts to more clearly trend. That is what the Elliott wave count expects to happen today. It remains to be seen if this market can behave normally at this time though.

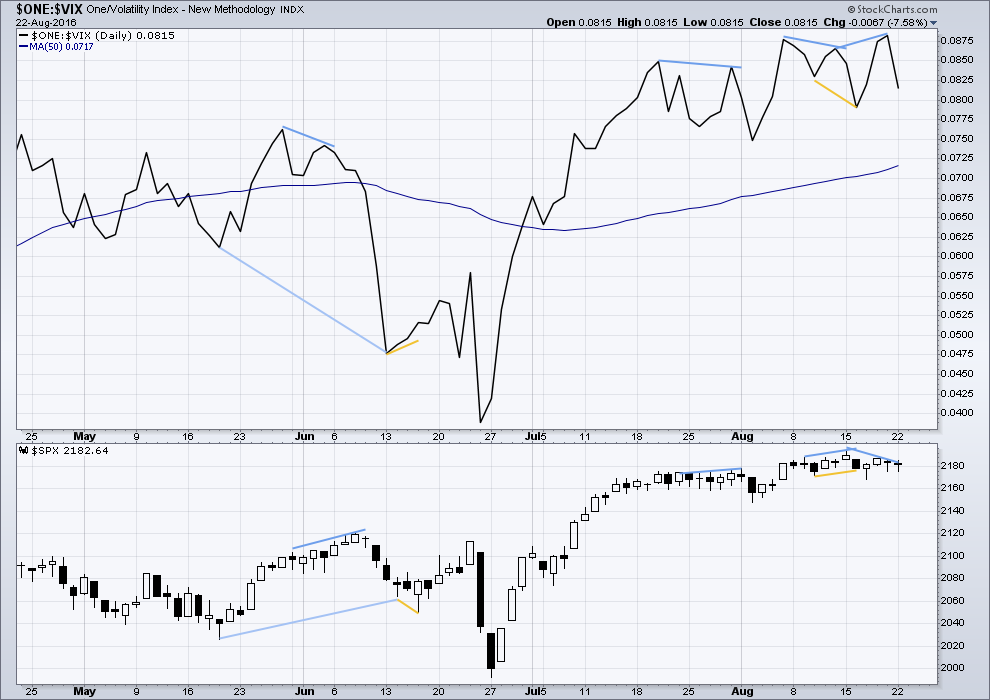

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volatility is declining as price is rising. This is normal for an upwards trend.

There are a few instances of multi day divergence between price and inverted VIX noted here. Bearish divergence is blue. Bullish divergence is yellow. Each of these instances was followed by expected price movement if only for two days. Divergence with VIX and price is not always working, but it is still sometimes working. So it will be noted.

Most recently two examples are noted: one of regular bearish divergence and one of hidden bullish divergence. In each case this was followed by the indicated direction for price for two days.

There is a more recent signal of hidden bearish divergence between price and VIX. From the high of 15th of August to the high of 18th of August, price has made a lower high but inverted VIX has made a higher high (recent blue lines). This indicates weakness to upwards movement from price. It is possible that this hidden bearish divergence was resolved by the red daily candlestick and new low for Friday, so Friday’s downwards movement may have been the result and may now have resolved this.

It appears so far that divergence between inverted VIX and price is again working to indicate short term movements spanning one or two days.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is support from market breadth as price is rising.

Hidden bearish divergence between price and the AD line has now been followed by a red daily candlestick, which made a new low below the day before. This divergence may again be working, like VIX, to indicate short term movements for the next one or two days.

DOW THEORY

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd November, 2015) – closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – closed above this point on 1st August, 2016.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 10:54 p.m. EST.

The international banking system now finally has a way to bypass the US bullying when it comes to international transfers. If your bank has not signed on to the new RIPPLE network, insist that they do, or find another bank that has. It’s about time! 🙂

O.K. Folks. I know the usual triggers are somewhat busted but a green VIX print on what should be the start of a third up is a very cautionary note.

We have now penetrated the lower (extended) line of that triangle from which price broke out- generally a very bearish sign….

Well my expected downwards thrust out of the triangle didn’t work.

Back to the drawing board for the very short term structure.

A combination still, and it sure does look like there’s a triangle in there. It will meet all EW rules if the triangle is minuette (y) of the combination.

Todays high would be another first wave complete I think.

Hi Lara:

How does a Y wave down divide? Same as a C?

Y waves can be any corrective structure. So they can be zigzags, flats or triangles.

This one is a running contracting triangle.

Overall the whole structure of minute ii moves sideways, as a combination should.

What I see is IWM (Russell 2000) leading the market. From what I see on my chart, we are riding a powerful channel higher on the daily and 4-hour charts. I show that we are at upper channel resistance and there is a long-term trendline that can act as resistance. Without using EW, I feel that this is a good place to bet on the downside. I would like to enter long the equities when (and if) IWM revisits the 119 level, near a 50% retracement from its latest move and still within the upper channel.

A break above this channel destroys my idea and I would rather sit the sidelines.

I personally think that it’s more likely to go sideways until Yellen speaks. Anyone have thoughts on this? I know it disagrees with EW right now, so I’m just trying to decipher what the market is trying to tell us…

With today’s gap up, the SPX has formed a 5 day island reversal as seen on the 4 hour, hourly and 15 minute charts. This can be a powerful indicator of a strong move up. Today’s gap cannot be filled. Nor can the gap on 8/16 be filled.

If the gaps hold and we see a move above today’s high we may be off to the races putting us above the round 2200 level into the mid 2200’s. Volume must also confirm to have a solid signal that agrees with the main EW count.

All that could be the indicator to confirm we are in the middle of a 3rd of a 3rd of a 3rd up. The one thing we have not seen in this bull market from 2009 is a blow off top. Could it be now? Reaching 2500 by the end of September?

Thanks Lara for the guidance. Still 100% long in both short term and long term accounts. The long term is by far the larger of the accounts (by design). I am enjoying the slow grind upwards day after day.

Opened a buy order on SPX puts contingent on any move below 2176.00 (this week’s expiration 218.50 at limit 0.65)

Yep. A move below 2182.64 will have my finger hovering above the short button. A move below yesterday’s low will trigger an execute…the bullish case looking kinda weak to me tbh….if we get a strong green candle for VIX time to really careful…the move down will not be tentative like the moves up…it will be quite decisive…

At the moment of truth as regards this potential break-out. Now testing top line and a reversal back up here critical for the bullish case…

Looks like an impulse down from this morning’s high with an extended fifth wave. Lately that has mean absolutely nada but I guess we will see….

Once again the market makers refused to fill my bid for VIX at 11.50 but I am not budging. I did buy back my calls for a little more than half at the day’s low so at least I am not going to get called away on my remaining shares. VIX not acting like this “break-out” is going to stick. If price moves below the lower leg of that triangle…muy malo for the bulls imo…

I am rolling on the floor with laughter over the ongoing Clinton e-mail saga.

First of all where does Hillary get off trying to throw Colin Powell under the bus by blaming him for her e-mail scam? Amazing!

Anyway, the FBI is now scrambling to cover its hiny by “discovering” an additional 15,000 of the missing e-mails! Yeah right!

Let me expliain, shall I?

Since they sent a cat burglar to try and scale the Ecuadoran embassy wall and apparently take a shot at silencing Julian Assange (can you believe they let the guy get away??!!), WikiLeaks is no doubt going to dump the rest of its stash and do so in a hurry. It looks to me like the FBI is trying to get out in front of the news cycle that will be unleashed as a result of the new disclosures.

You cannot make this stuff up! 🙂

Rumours are that its not going to be pretty.

Wow! They tried to assassinate an Australian citizen, in an Ecuadorian embassy in London…

Yeah. Can’t make that stuff up.

That’s…. so so wrong on so many levels.

I am even more mystified that the person got away. Every embassy has highly trained personnel ( including snipers) to deal with just this sort of thing. It reflects very badly on the Ecuadoran government that the intruder was not captured or “neutralised”. There is no way he should have gotten as far as he did, apparently outside Assange’s window….

I missed that…hoping Clinton goes down from the emails!

WikiLeaks tweeting that FBI new batch of e-mails represent a bomb-shell for the Clinton campaign. My theory is that Assange sent them to Comey and told him: “Either you realease them or I will!”

Cashed in the SPY 18.50 calls of my straddle trade. Still holding 18.50 puts. Will reload calls with a successful re-test of top line of triangle and lighten up on remaining puts.

Today a good example of why triangle thrusts should never be chased. You have to be expecting them to make a good trade.

Triangles often show up as penultimate wave formations. This move out of it needs to stick and not reverse lower. Ideally we see a re-test of top line of triangle and a new daily high…VIX also needs to STAY red…a new 52 week low would be a great bullish confirmation…

As expected, nice strong move out of triangle formation. We may see a return to test top line and if that holds, I will be buying calls!

Quite a few traders commenting on the fact that it seems only the algos and central banks are trading these days. Several also saying that in all the years they have been trading they have never seen some of the things they are seeing in the market right now. I must say that I have to agree. I will remain in the volatility arena as I think it is the one place not entirely subject to the schemes of the bots and the banksters!

Futures indicating a tepid break up from the triangle. I would not be surprised to see that reverse. Hopefully the pop will be enough to drive VIX down to 11.50 and cut the price of my covered calls in half.

First? 11pm in the Appalachian Mountains and enjoying a late night read.

🙂

I think we need to wake up The Doc.

Mr Market needs resuscitating Doc. Got your defibrillator handy there?