Upwards movement was expected to a target at either 2,192 or 2,199.

The session began with a little upwards movement but only to 2,185.44 before turning down.

Summary: The trend remains the same, until proven otherwise. Assume the trend is up while price is above 2,147.58. The mid term targets are 2,332 or 2,445. If price makes a new low below 2,147.58, then probability will shift to a deep pullback beginning, target zone 1,938 to 1,881.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

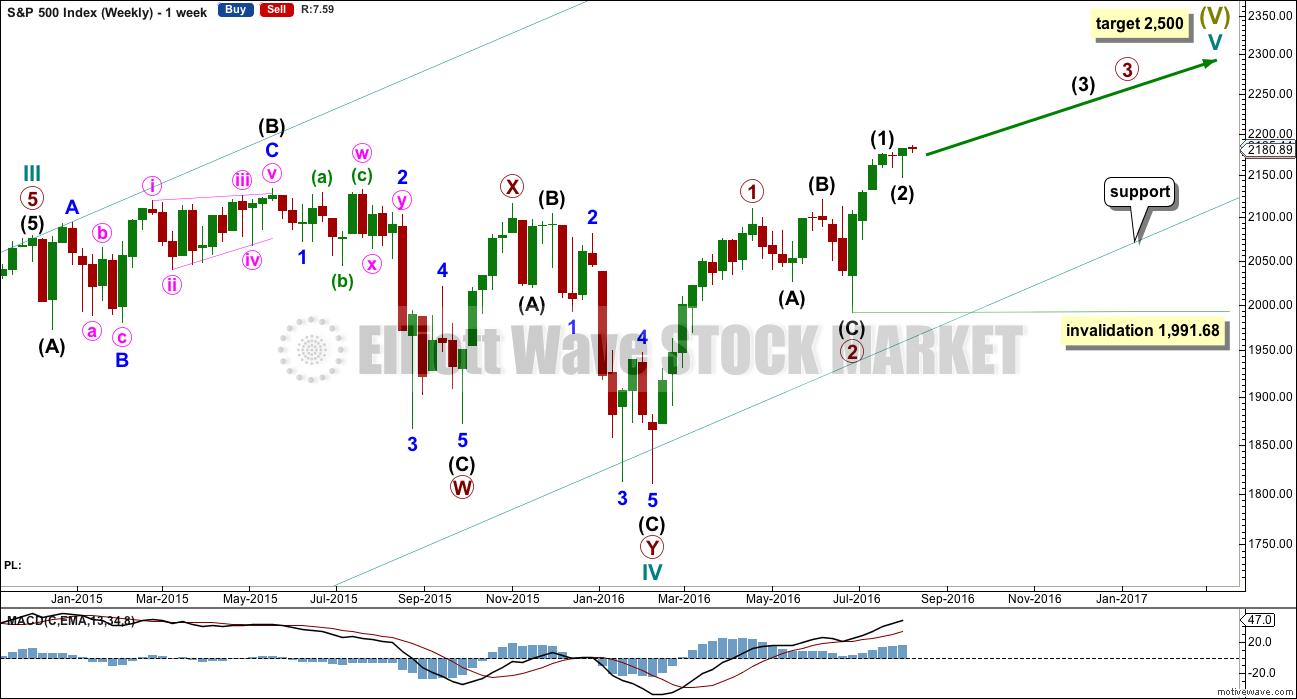

MAIN WAVE COUNT

WEEKLY CHART

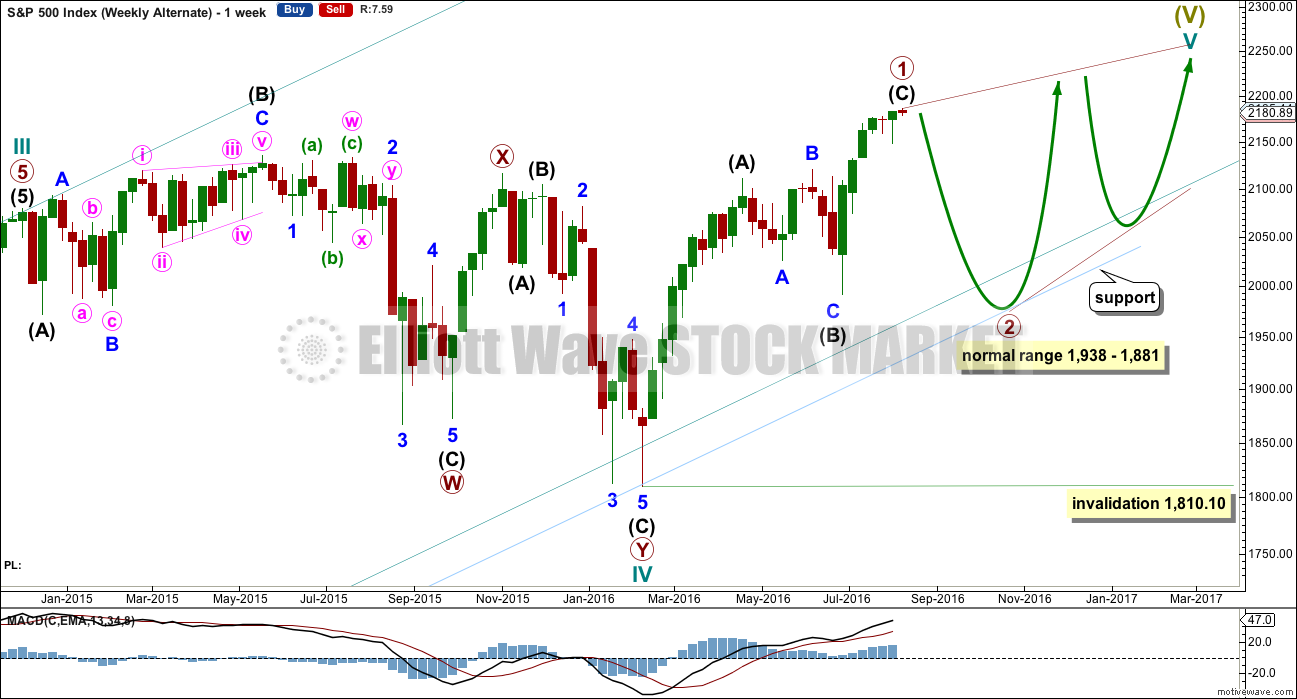

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV is seen as a more shallow 0.28 double combination lasting 15 months. With cycle wave IV five times the duration of cycle wave II, it should be over there.

Cycle wave I lasted 28 months (not a Fibonacci number), cycle wave II lasted a Fibonacci 3 months, cycle wave III lasted 38 months (not a Fibonacci number), and cycle wave IV lasted 15 months (two more than a Fibonacci 13).

If the target for cycle wave V is for it to be equal in length with cycle wave I, then it may also be expected to be about equal in duration. So far cycle wave V is in its sixth month. After this month, a further 22 months to total 28 seems a reasonable expectation, or possibly a further 15 months to total a Fibonacci 21.

This first weekly wave count expects the more common structure of an impulse is unfolding for cycle wave V. Within cycle wave V, primary waves 1 and now 2 should be over. Within primary wave 3, no second wave correction may move beyond its start below 1,991.68.

There is one other possible structure for cycle wave V, an ending diagonal. This is covered in an alternate.

DAILY CHART

Primary wave 2 is complete as a shallow regular flat correction. Primary wave 3 is underway.

Within primary wave 3, intermediate wave (1) is a complete impulse. Intermediate wave (2) may now be a complete flat correction.

If the degree of labelling within intermediate wave (2) is moved down one degree (alternate labelling), then it is still possible that only minor wave A is complete as a flat correction. It is possible that intermediate wave (2) may complete further sideways as a longer lasting flat correction, or a double flat or double combination. All options would expect sideways movement though, not a deep pullback.

Within a possible continuation of intermediate wave (2), there is no upper invalidation point for the idea because there is no rule stating a limit for a B wave within a flat. There is a convention within Elliott wave that states once the possible B wave is longer than twice the length of the A wave the probability that a flat is unfolding is so low the idea should be discarded. Here that price point would be at 2,203.68.

Above 2,203.68 more confidence in this wave count and the targets may be had.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,991.68.

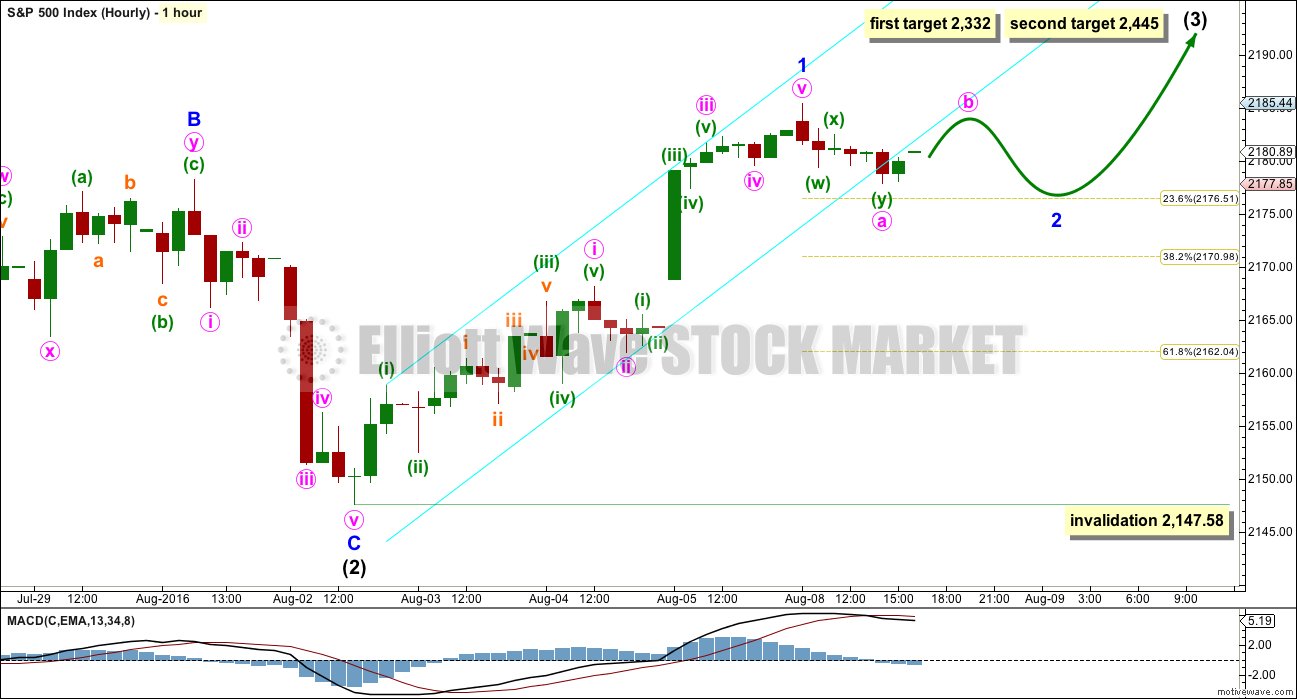

HOURLY CHART

Minor wave 1 now fits as a complete impulse. With downwards movement for Monday’s session showing as a small red daily candlestick, it looks like minor wave 1 was over at Monday’s high, falling short of the first target by 6.56 points.

Ratios within minor wave 1 are: minute wave iii is 0.81 short of equality in length with minute wave i, and minute wave v has no Fibonacci ratio to either of minute waves i or iii.

On the five minute chart, minor wave 2 may have begun with a double zigzag downwards. This may be minute wave a as a three wave structure; minor wave 2 would be indicated as unfolding as a flat correction. Alternatively, minor wave 2 may be over as a very brief and very shallow double zigzag today. The wave count would have better proportion though if it were to continue further, so that is how it is labelled.

If minor wave 2 is a flat correction, then within it minute wave b should move higher to reach a minimum 0.9 length of minute wave a at 2,184.68. The normal range for minute wave b of a flat correction is from 1 to 1.38 the length of minute wave a, giving an expected range for upwards movement to end from 2,185.44 to 2,188.32.

Thereafter, minute wave c downwards should end below the end of minute wave a at 2,177.85 to avoid a truncation.

When minute wave b is a complete three wave structure, then the type of flat may be known and a target may be calculated for minute wave c down. That cannot be done yet. At this early stage, minor wave 2 may be expected to end about either the 0.236 Fibonacci ratio at 2,177 or the 0.382 Fibonacci ratio at 2,171.

Minor wave 2 may continue overall sideways for another two to four days. This would give a good proportion to the impulse of minor wave 1 it is correcting, which lasted four days.

At 2,332 intermediate wave (3) would reach equality in length with intermediate wave (1). This is a reasonable Fibonacci ratio to use for the target because intermediate wave (2) would be very shallow at only 0.15 of intermediate wave (1).

At 2,445 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Intermediate wave (3) may only subdivide as an impulse. Minor wave 1 would still be incomplete within intermediate wave (3). Minor wave 2 may not move beyond the start of minor wave 1 below 2,147.58.

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate may again diverge from the main wave count, so it will again be published.

The other structural possibility for cycle wave V is an ending diagonal. Ending diagonals are more often contracting than expanding, so that is what this alternate will expect.

Ending diagonals require all sub-waves to subdivide as zigzags. Zigzags subdivide 5-3-5. Thus primary wave 1 may now be a complete (or almost complete) zigzag, labelled intermediate waves (A)-(B)-(C) which subdivides 5-3-5.

The normal depth for second and fourth waves of diagonals is from 0.66 to 0.81 the prior actionary wave. Primary wave 2 may end within this range, from 1,938 to 1,881.

Primary wave 2 may not move beyond the start of primary wave 1 below 1,810.10.

When primary wave 2 is a complete zigzag, then another zigzag upwards for primary wave 3 must make a new high above the end of primary wave 1. It would most likely be shorter than primary wave 1 as diagonals are more commonly contracting. If primary wave 3 is longer than primary wave 1, then an expanding diagonal would be indicated.

The psychology of diagonals is quite different to impulses. Diagonals contain corrective characteristics and subdivide as a series of zigzags. When diagonals turn up in fifth wave positions, they take on some of the properties of the correction which inevitably follows them. The deterioration in fundamentals and underlying technicals is more extreme and more evident. There is some support for this idea at this time.

The final target of 2,500 would not be able to be reached by an ending contracting diagonal. The final target for this alternate would be calculated only when primary wave 4 is complete.

The classic pattern equivalent is a rising wedge.

DAILY CHART

It is possible now that intermediate wave (C) is a complete five wave impulse. However, this wave count suffers from disproportion between minor waves 2 and 4 which gives this possible impulse an odd look.

Because this wave count expects to see a substantial trend change here from bull to bear for a multi week deep pullback, it absolutely requires some indication from price before confidence may be had in it. A new low below 2,147.58 this week would add confidence.

TECHNICAL ANALYSIS

WEEKLY CHART

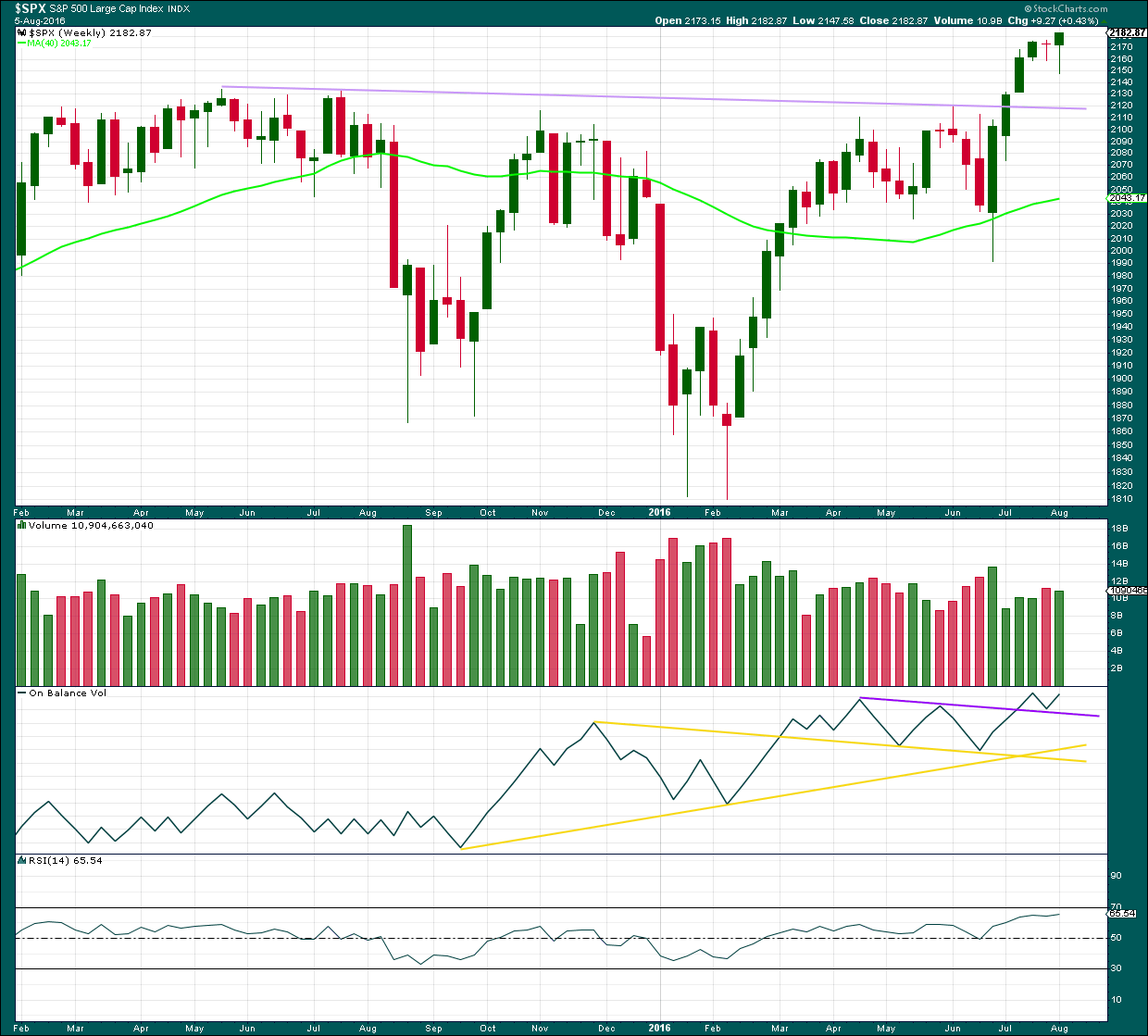

Click chart to enlarge. Chart courtesy of StockCharts.com.

The bearish implications of the stalled candlestick pattern should now be fulfilled with two weeks of a small consolidation.

Last week ended with a new high at the close. The weekly candlestick is a hanging man, but due to the bullish implications of the long lower wick and the green real body this requires confirmation with a downwards week before the bearish implications can be considered seriously.

At this stage, any deeper pullback should find strong support at the lilac trend line. Support at this line should stop any pullback from being very deep.

Last week the bulls were dominant. They rallied to push price out of a consolidation and managed to hold price above prior resistance to close above on Friday. The long lower wick of this weekly candlestick is bullish.

The weekly candlestick comes with slightly lighter volume than last downwards week. The rise in price was not well supported by volume. But that has been a common pattern in recent months, so perhaps not too much bearishness should be read in to this here.

On Balance Volume is still bullish as it remains above the purple trend line.

RSI is not yet overbought. There is room yet for a further rise in price.

DAILY CHART

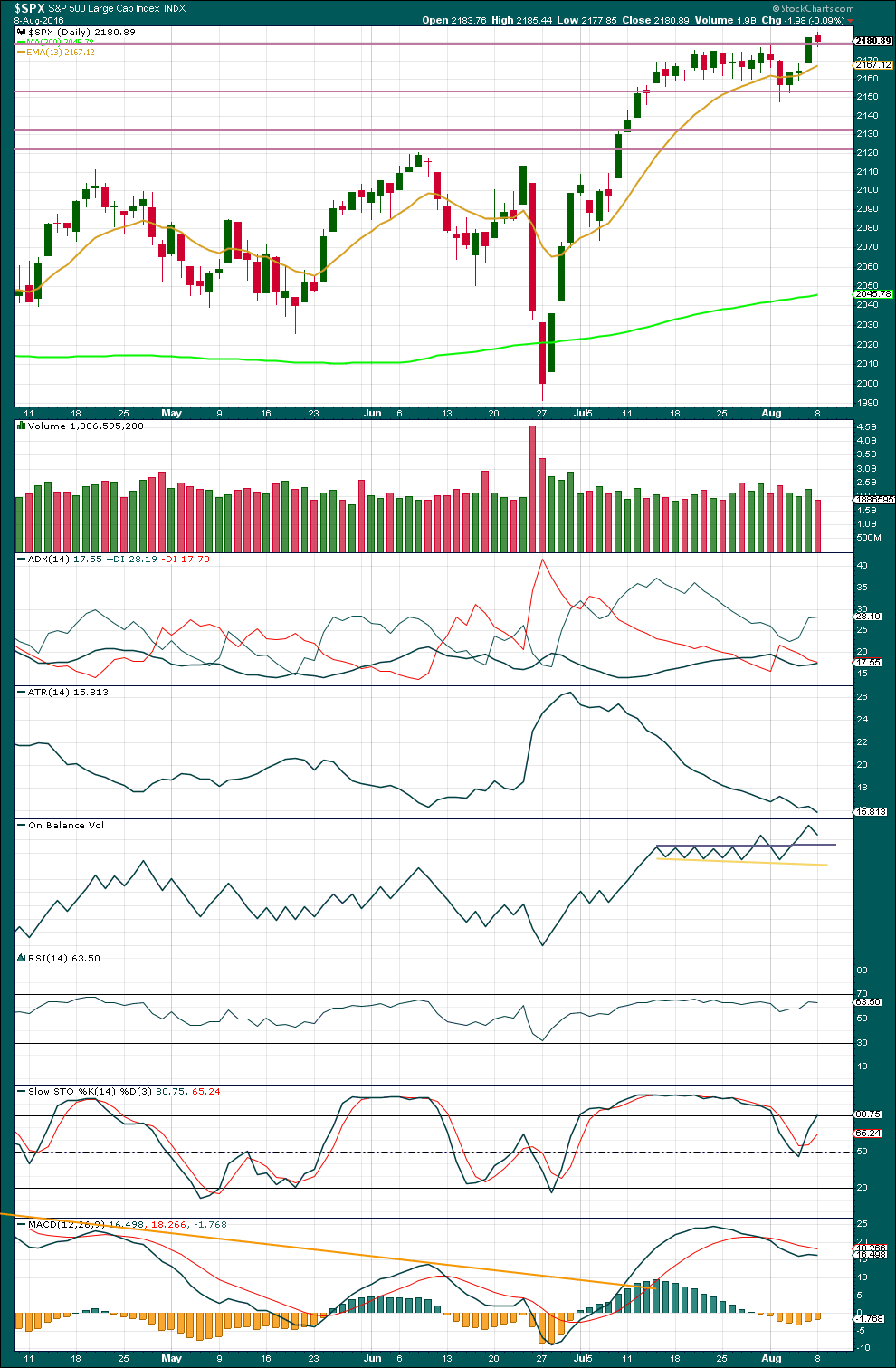

Click chart to enlarge. Chart courtesy of StockCharts.com.

A sideways consolidation has ended. Price has broken above resistance and closed above that point for Friday’s session. The horizontal line about 2,175 should now provide support.

Friday had some support for the rise in price from volume.

It now looks like Monday’s session has offered a typical back test to the prior support line about 2,175 with a small downwards day. With Monday’s session coming on lighter volume, the fall in price is not supported by volume and looks like a counter trend movement. This supports the main Elliott wave count over the alternate.

ADX turned upwards on Friday and is still upwards for Monday. The +DX line is above the -DX line. An upwards trend is again indicated.

ATR has not yet turned upwards. Some disagreement between these two trending indicators at the start of a trend is common. If ATR also turns upwards, then further confidence may be had in the main Elliott wave count. For now some caution is advised.

On Balance Volume is bullish above the grey line. There is no divergence with price and OBV.

RSI is not yet overbought. There is room for price to rise. There is divergence between price and RSI at the high of Friday and the high of 20th of July, indicating some weakness in price. But recently divergence between price and indicators has proven to be unreliable. It is treated with some suspicion here. It may disappear again.

Stochastics also shows strong divergence, but this is even less reliable than RSI and divergence, so it is given zero weight in this analysis. Stochastics is not extreme. There is plenty of room for price to rise.

Lowry Research shows this rise comes with increasing market breadth. There is not enough selling pressure for price to fall; the consolidation looks like a period of accumulation. With a breakout on slightly higher volume for Friday, this accumulation phase looks to be over and the sideways range was a pause in an upwards trend and not the start of a new downwards trend. With broad agreement between Lowry’s analysis and this analysis presented here, I have more confidence in the upwards trend continuing.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volatility is declining as price is rising. This is normal for an upwards trend.

There is an example of multi day divergence with price and VIX (blue lines) which did lead to some downwards movement. The downwards movement that resulted from this divergence lasted only for two days, but it did make a new low.

BREADTH – AD LINE

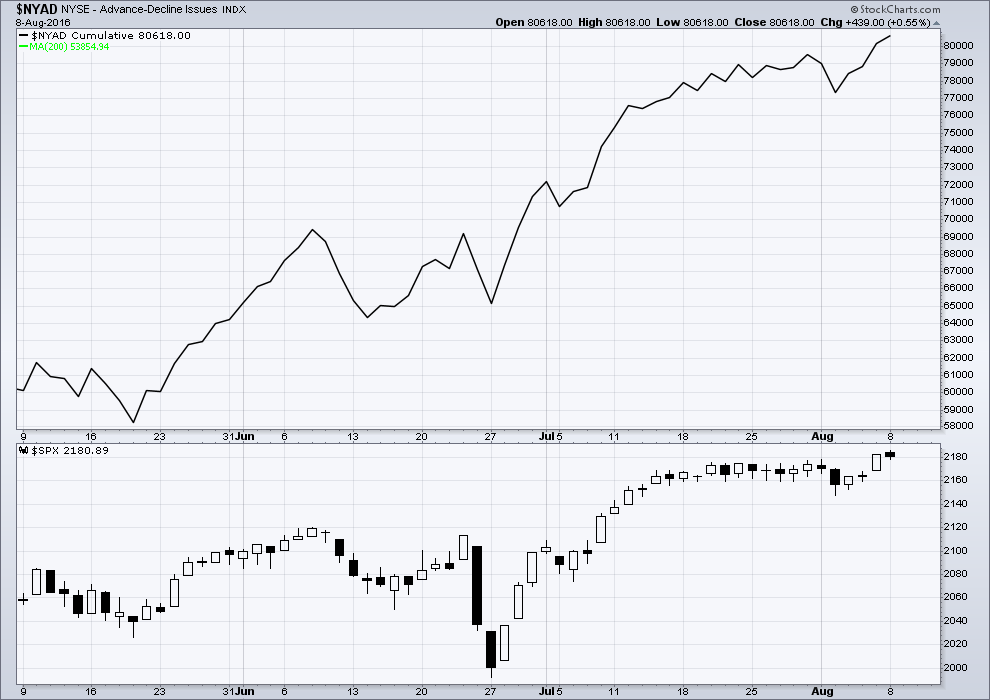

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is support from market breadth as price is rising. The AD line shows no divergence with price; it is making new highs with price.

DOW THEORY

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd Nobember, 2015) – has now closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – has not closed above this point yet.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 11:46 p.m. EST.

Minor 2 as an expanded flat looks very good so far. Minute b is within the normal range, and it’s 1.29 X minute a so the flat is expanded.

At 2,175 minute c = 1.618 X minute a

And minor 2 would be just below the 0.236 Fibonacci ratio. Then the correction could be done.

If we get a confirmation of five down, three up with a new daily low, ready to buy equal amounts of UVXY calls and SVXY puts to determine where the biggest bang for the buck lies at volatility extremes. This trade does not come around that often so a confirmation of the start of a reasonable correction would be awesome….

Mr. Market continues to be coy. He absolutely refused to give any definitive sign of his intentions today, at least to my satisfaction. At the risk of sounding like a broken record, I would ordinarily short UVXY at the end of a down-trend if it put up a chart like SVXY printed today. If we get no strong move down tomorrow, we would have witnessed the ultimate head-fake in the VIX futures ETF SVXY today. Not only would the usual trigger for a move down have failed, a third wave up starting tomorrow means it would have signaled the exact opposite of what that chart action normally does. For me it would be a first. Strange times indeed! ‘Bye all!

If this is a fourth up underway, should reverse around 2181.90, area of the fourth wave of the third down. With a new low we’ll probably see a furious second wave up to scatter the eager beavers and that would be a great place to load up on puts. Keep an eye on VIX as it should stay in the green even with a strong corrective second wave….

New low under 2178.61 confirms impulse down on 15 min chart.

I count 5 waves down off the top (new 52 week high) on a 5 minute chart. This could be the start of something serious. Hat tip to Verne on the inverted VIX chart!

Exiting calls. This upward move appears to be over. Doji above upper BB for SVXY is signaling reversal.

I rarely post but I appreciate and pay attention to your comments! Thx!

Patiently waiting for Gold to trigger buy with move above 1350.00 which should come today or tomorrow if an impulse up underway. I think we may see a “shake the trees” move just prior to the blast higher and have a few “stink bids” locked and loaded just in case….anybody else long PM and the miners? 🙂

Yep, long junior miners – Patriot, Timberline and a few others.

Moved stop to exit contingent on fill of SPX gap from yesterday’s close at 2180.89…

Changing open order to a roll to 219.00 strike if contracts bid over 1.00

I think SPX 2200.00 looks like a safe target at a minimum. Holding my nose and buying the SPY 218.5 calls expiring this Saturday@ 0.76 per contract. Open STC order at 1.10

Hard stop if contracts fall to 0.50, or SPX moves back below 2186.00

That previous post was basically an exercise in thinking out loud. As has been stated so often, we are seeing that market correlations that once could be relied upon to give high probability signals about market direction seemed to have completely broken down lately. I am curious to see if volatility is also now a broken measure in this strange market. It is to my eye, and based on past experience suggesting an interim top is in place and if that is not the case, it would confirm another broken metric imo.

Maybe “broken” isn’t quite the right word.

Maybe we should think of it as not in synch at this time… because conditions are so extreme.

And conditions will return to normal and those metrics will work again. Just not for now.

In the scheme of things it may be a short time frame. In our human understanding of things it may take too long.

This is a possibility… in the realm of possibilities. I am feeling very philosophical this evening 🙂

LSD will do that to you. (Lacking Synchronized Diagonals)

True.

As will a good Sauvignon Blanc 🙂

You may be right Lara. Perhaps “distorted” might be a better word to describe what is happening. I fully agree that the great principle of Reversion to the Mean applies even to distorted markets, at which time we can expect also a return to some semblance of normalcy so far as market signals are concerned. I must say I do like the philosophising… 🙂

Despite the odd look, the ending diagonal fits the volatility profile and is similar to something we saw last August with a spike in UVXY coming in the middle of a fourth wave. In this case, SVXY the inverse, put in a low on August 2, the day the long fourth wave completes. The subsequent spike of SVXY above the BB would be consistent with volatility profile at the end of a fifth wave.

I know that is not how the SPX chart is labeled but SVXY made its first penetration above the upper BB on August 1 at the SPX intra-day high of 2178.29 during the consolidation and that would be normally expected to happen at the end of a third wave up. During an impulse up, one normally would expect SVXY to make that first penetration at the conclusion of a third wave, followed by a second penetration at the conclusion of the fifth wave. With the exception of the first penetration coming at the end of the third wave according to our current label (although it did come at the actual SPX high toward the end of the fourth wave), SVXY reflected a complete impulse up perfectly, as would UVXY an impulse down.

First!!!! 🙂

If Doc allows me to be first…maybe this market will come down 🙂

PC ratio have been higher than normal the last two sessions in favor of put buying but tis market refuses to pullback… One of these days it will have too. Sidelines for now

Quite a few traders are not convinced the current rally is the real deal it seems. SPX 2185 is the line in the sand for many of them, and should be decisively taken out to confirm the uptrend.

Futures are strangely muted considering we should be on the threshold of a third up at several degrees. I guess it could be that minor two is not over…we’ll see.

I think with no response from The Doc so far… it’s yours 🙂