The main Elliott wave count from yesterday’s analysis expected price to move higher.

Assume the trend is the same, until proven otherwise.

Summary: In the short term, assume the trend remains up while price remains within the channel on the hourly chart, and above 2,108.71. Again, there is some slight bullishness from volume to suggest more upwards movement short term, and from On Balance Volume for the mid term. The target is at 2,263 but a reasonable pullback may not arrive until 2,292. A new low below 2,108.71 would confirm a trend change. Once a trend change is confirmed the target would be at 1,963.

Last monthly chart for the main wave count is here.

New updates to this analysis are in bold.

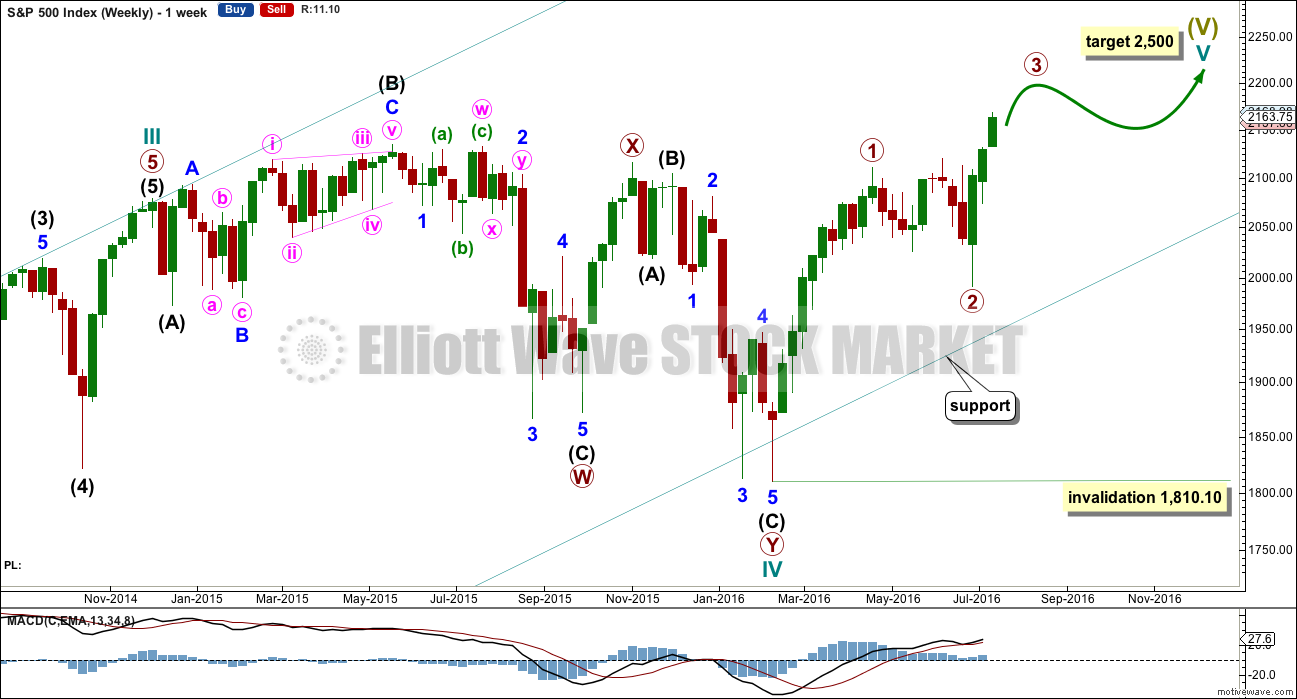

WEEKLY CHART

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV is now seen as a more shallow 0.28 double combination lasting 14 months. With cycle wave IV nearly five times the duration of cycle wave II, it should be over there.

After some consideration I will place the final invalidation point for this bull wave count at 1,810.10. A new low below that point at this time would be a very strong indication of a trend change at Super Cycle degree, from bull to bear. This is because were cycle wave IV to continue further sideways it would be grossly disproportionate to cycle wave I and would end substantially outside of the wide teal channel copied over here from the monthly chart.

Cycle wave I lasted 28 months (not a Fibonacci number), cycle wave II lasted a Fibonacci 3 months, cycle wave III lasted 38 months (not a Fibonacci number), and cycle wave IV lasted 14 months (one more than a Fibonacci 13).

If the target for cycle wave V is for it to be equal in length with cycle wave I, then it may also be expected to be about equal in duration. So far cycle wave V is in its fifth month. After this month, a further 23 months to total 28 seems a reasonable expectation, or possibly a further 16 months to total a Fibonacci 21.

Wave count I should be preferred while price remains above 2,109.08. If price moves below 2,109.08, then wave count II would be confirmed.

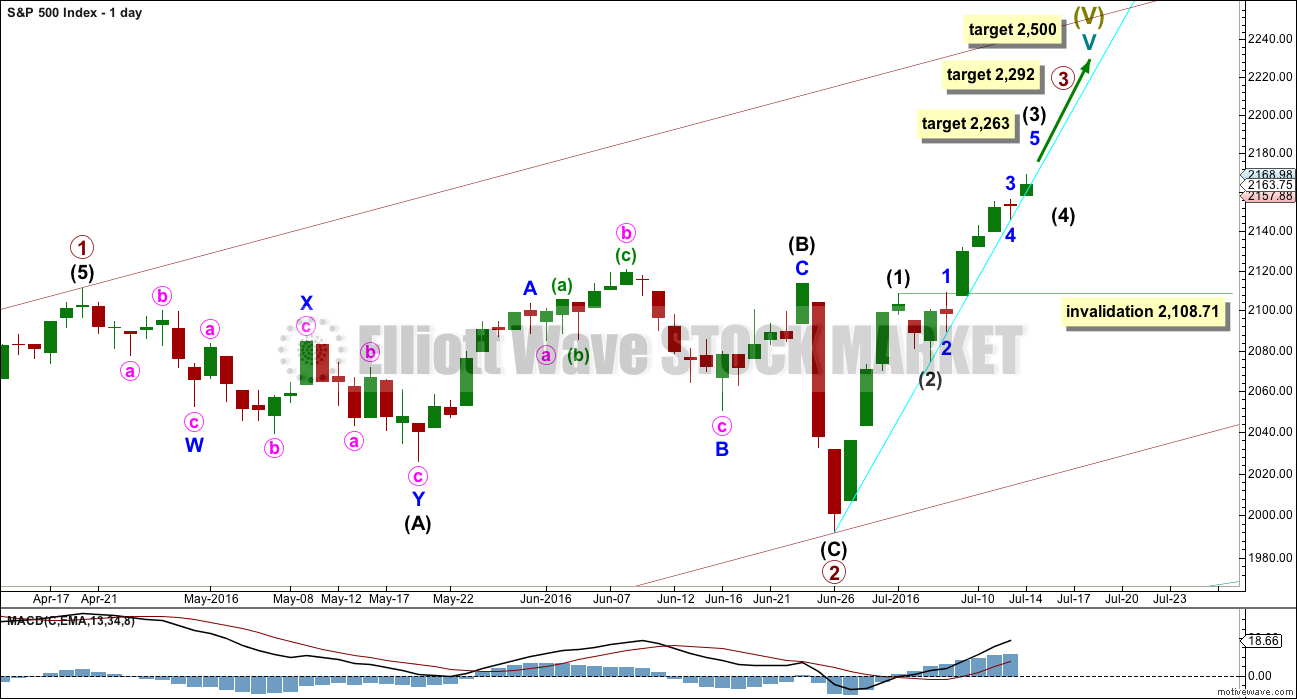

DAILY CHART I

It is possible that primary wave 2 is already complete as a shallow regular flat correction. Primary wave 3 may have begun.

At 2,292 primary wave 3 would reach equality in length with primary wave 1. This is the ratio used for the target in this instance because primary wave 2 was relatively shallow and it fits neatly with the high probability target of 2,500 for cycle wave V to end.

Primary wave 3 may only subdivide as an impulse. So far within it intermediate waves (1) and (2) may be complete.

Within intermediate wave (3), no second wave correction may move beyond its start below 2,074.02.

At this stage, it looks like intermediate wave (3) may have seen minor waves 1 through to 4 complete. This labelling assumes an extended wave for minor wave 5 to reach the target. Alternatively, the degree of labelling within intermediate wave (3) may be changed.

When intermediate wave (3) is a complete impulse, then intermediate wave (4) may unfold for a short term pullback. The expectation would be for intermediate wave (4) to last only a few days; intermediate wave (2) may have been over in just two. Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,108.71.

At 2,263 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

A support line is added in cyan. So far price is finding support at this line. If a daily candlestick is printed below this line, then a deeper correction would be expected to have begun.

A reasonable pullback may not be seen until primary wave 3 is over. When it is complete, then the following correction for primary wave 4 would be most likely a zigzag and must remain above primary wave 1 price territory at 2,111.05.

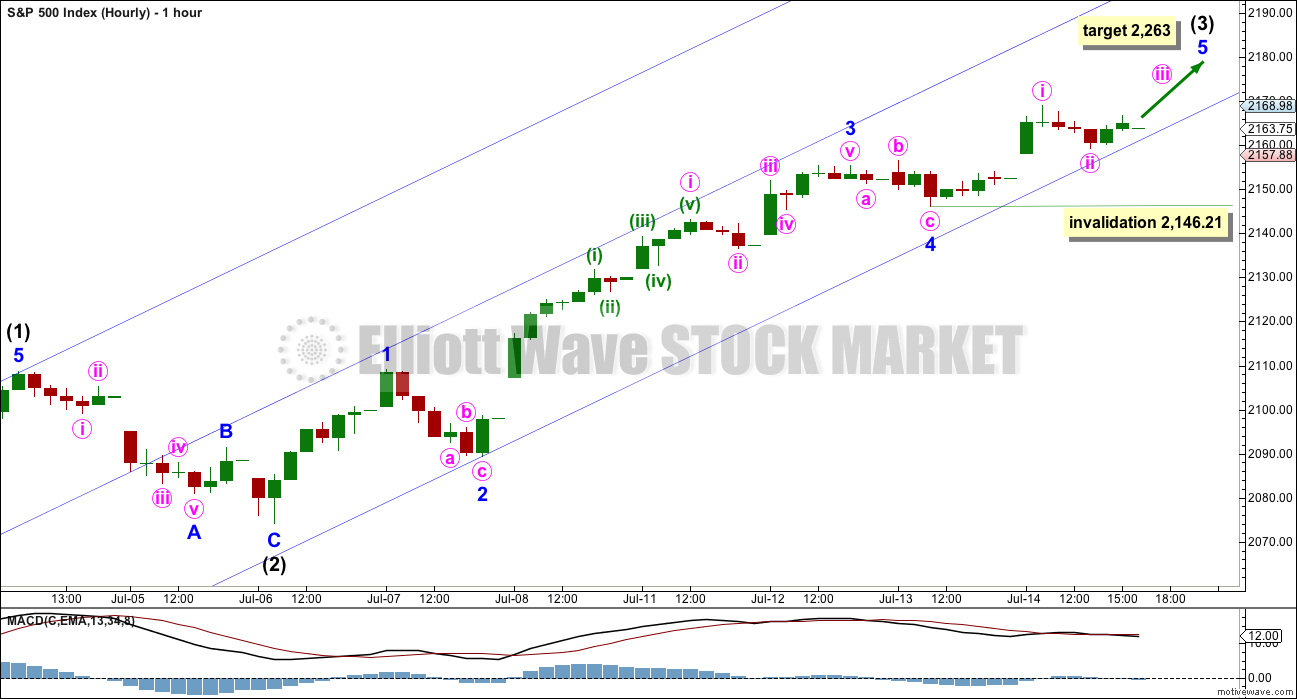

HOURLY CHART I

Intermediate wave (3) should still be incomplete for this wave count. It has not lasted long enough nor moved far enough above the end of intermediate wave (1).

At its end, intermediate wave (3) should be far enough above intermediate wave (1) to allow for subsequent room for downwards / sideways movement for intermediate wave (4) to unfold and remain above intermediate wave (1) price territory.

Within intermediate wave (3), minor waves 1 through to 4 may all be complete. Minor wave 5 may be extending. Within minor wave 5, the correction of minute wave ii may not move beyond the start of minute wave i below 2,146.21.

If price moves below 2,146.21 in the next day or so, then downwards movement may be a deeper correction. For this first wave count the degree of labelling within intermediate wave (3) would all be moved down one degree. At this time, a deeper correction may be minor wave 2; only an impulse for minor wave 1 upwards may be complete as a long extended first wave.

The channel is redrawn as a best fit today, shown more clearly on the second hourly chart below. Upwards movement is weakening, sitting lower and lower within the channel.

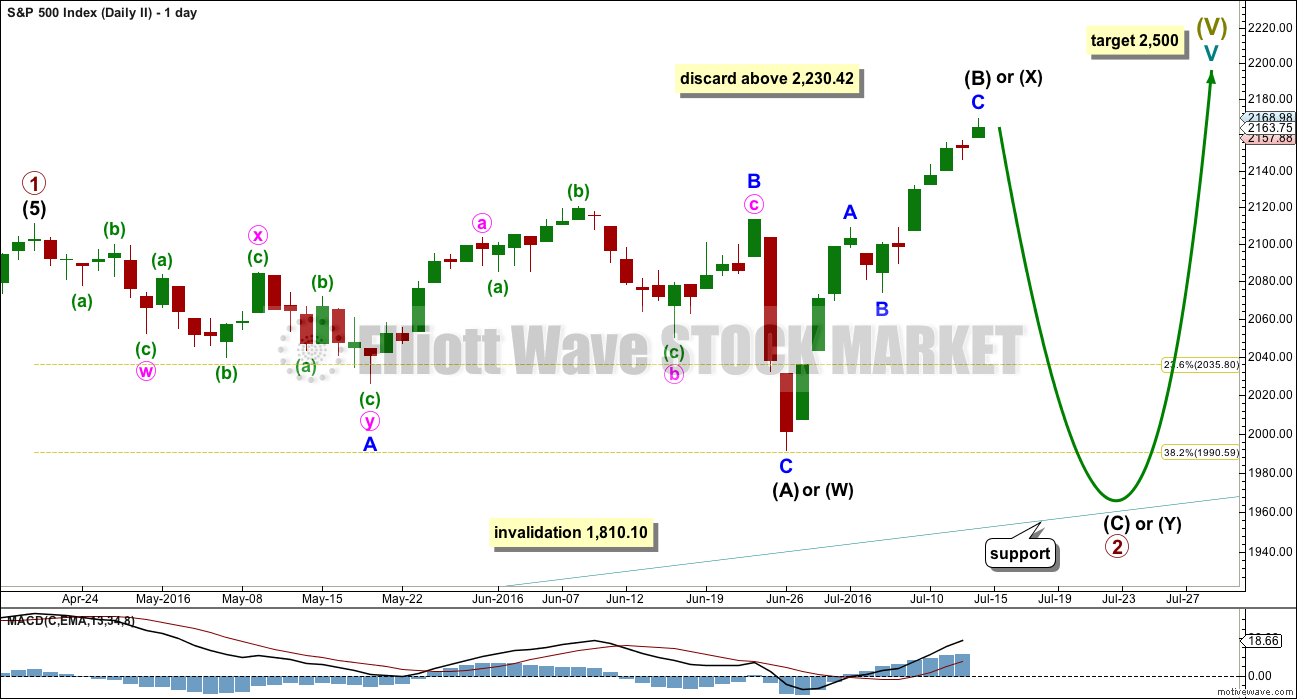

DAILY CHART II

This wave count still has a reasonable probability.

The common length for intermediate wave (B) is from 1 to 1.38 the length of intermediate wave (A), giving a range from 2,111.05 to 2,156.41. At today’s high intermediate wave (B) is now 1.48 the length of intermediate wave (A), longer than the common range but not yet at the maximum convention of 2.

The idea of a flat correction should be discarded when intermediate wave (B) exceeds twice the length of intermediate wave (A) above 2,230.42.

When intermediate wave (B) is complete, then a target may be calculated for intermediate wave (C) downwards. It would most likely end at least slightly below the end of intermediate wave (A) at 1,991.68 to avoid a truncation and a very rare running flat. It may end when price comes down to touch the lower edge of the channel copied over from the monthly chart.

Primary wave 2 may also be relabelled as a combination. The first structure in a double combination may be a complete regular flat labelled intermediate wave (W). The double would be joined by an almost complete zigzag in the opposite direction labelled intermediate wave (X). The second structure in the double may be a flat (for a double flat) or a zigzag to complete a double combination. It would be expected to end about the same level as the first structure in the double at 1,991.68, so that the whole structure moves sideways.

An expanded flat for primary wave 2 is more likely than a double combination because these are more common structures for second waves.

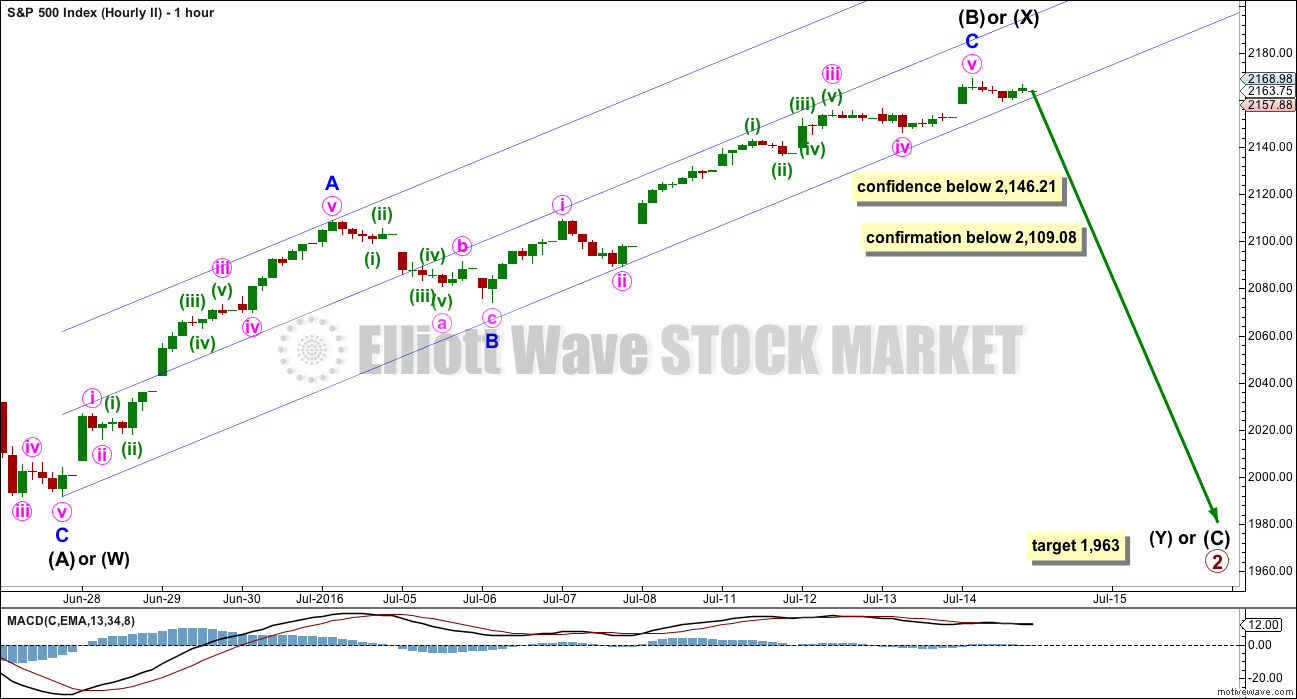

HOURLY CHART II

The upwards zigzag of intermediate wave (B) or (X) may again be over.

A new low below 2,146.21 would add some confidence to the idea that a pullback of a larger degree has begun. But there would still be multiple wave counts valid at that stage.

A new low below 2,108.71 would at this stage invalidate wave count I and provide some confirmation for wave count II.

At 1,963 intermediate wave (C) would reach 1.618 the length of intermediate wave (A). This is the most common ratio for a C wave of an expanded flat, so it has a reasonable probability.

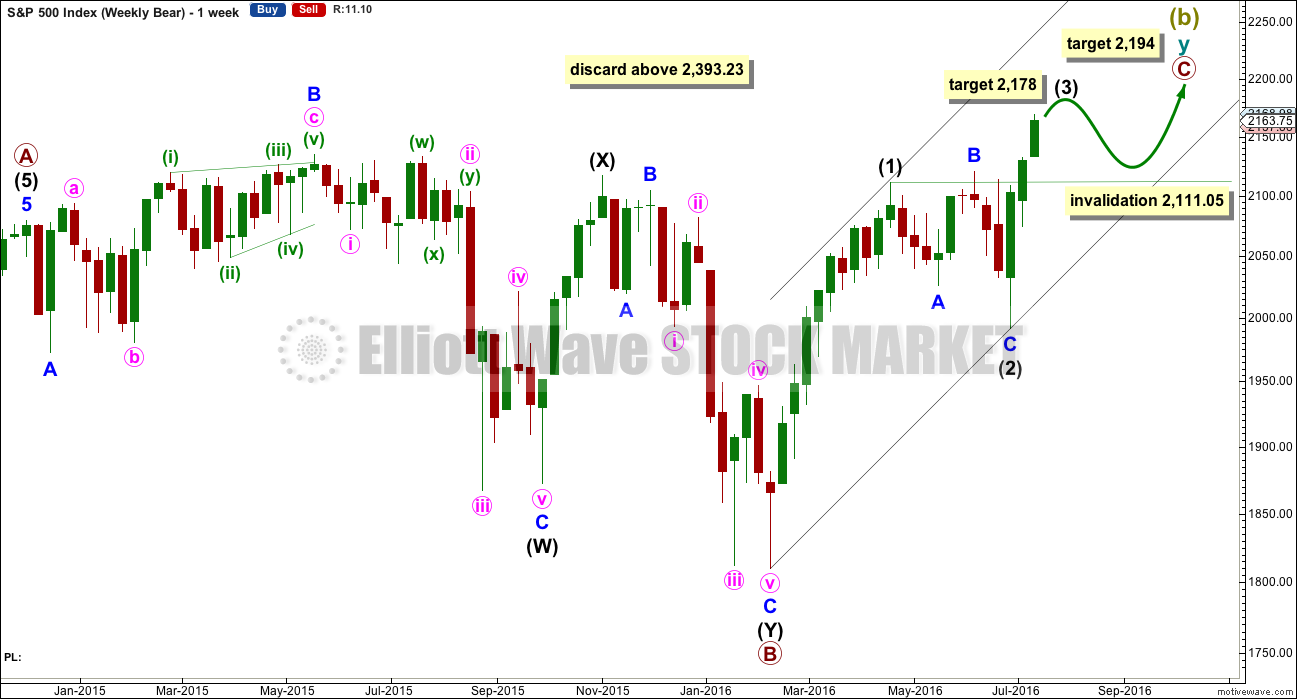

BEAR WAVE COUNT – WEEKLY CHART

It would still be possible that a Super Cycle trend change is close if Super Cycle wave (b) (or (x) ) is subdividing as a double zigzag.

However, the expected direction and structure is now the same short and mid term for this idea as it is for the main wave count.

Within the second zigzag of cycle wave y, primary wave C must complete as a five wave structure.

So far Super Cycle wave (b) is 1.72 the length of Super Cycle wave (a). This is comfortably longer than the normal range which is up to 1.38, but still within the allowable convention of up to 2 times the length of wave A.

Above 2,393.23 Super Cycle wave (b) would be more than twice the length of Super Cycle wave (a). Above this price point the convention states that the probability of a flat correction unfolding is too low for reasonable consideration. Above that point this bear wave count should be discarded. The same principle is applied to the idea of a double combination for Grand Super Cycle wave II

A five wave structure upwards would still need to complete for primary wave C. So far upwards movement is a very strong three wave looking structure. Trying to see this as either a complete or almost complete five would be trying to fit in what one may want to see to the waves, ignoring what is actually there.

At 2,178 intermediate wave (3) would reach 0.618 the length of intermediate wave (1).

Thereafter, intermediate wave (4) may move sideways for a few weeks as a very shallow correction. Thereafter, intermediate wave (5) would most likely make a new high. At 2,194 primary wave C would reach 0.382 the length of primary wave A. This final target is close to the round number of 2,200 and so offers a reasonable probability.

If price reaches 2,200 or close to it, then this idea would again be assessed, and an attempt made to determine its probability. The situation between now and then though may change.

The important conclusion is more upwards movement is extremely likely, as a five up is needed to complete.

TECHNICAL ANALYSIS

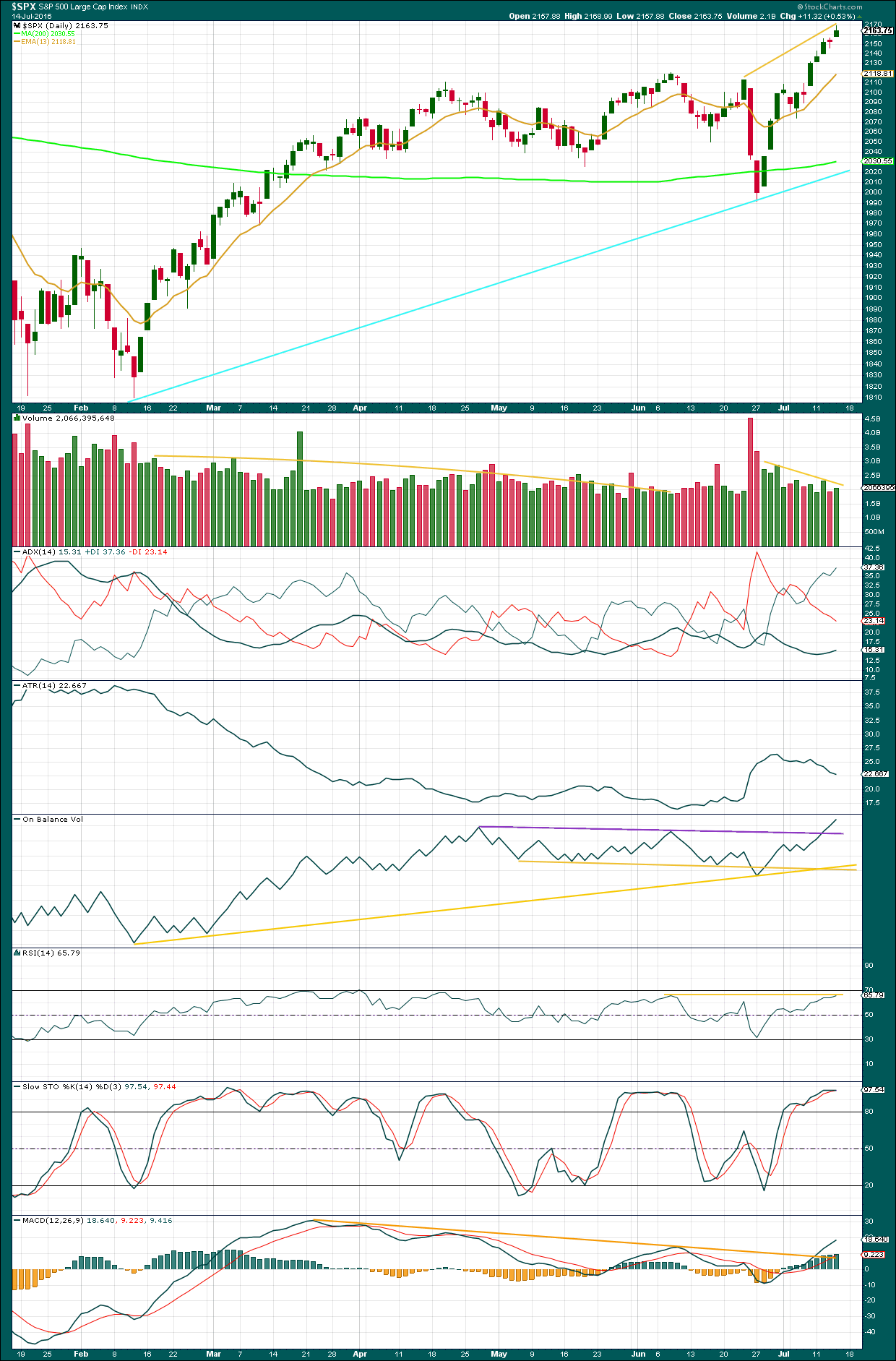

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

In the short term, I would not expect to see a larger pullback in this upwards trend begin until a green daily candlestick is printed and comes on lighter volume than the day before and lighter volume than any prior downwards day. Confidence in a deeper pullback may be had if a red daily candlestick can be printed and comes on an increase in volume from a prior upwards day.

In short, the volume profile is still short term bullish. Today saw upwards movement with volume stronger than the prior downwards day. Overall, there was some support for upwards movement today.

The volume profile is however mid term bearish. As price is rising overall volume is still declining, illustrated by the downwards sloping trend line on volume.

ADX finally indicates there is an upwards trend in place. ATR still disagrees. Again, there is something wrong with this trend. Each day the distance managed upward in price by the bulls gets less and less. Bulls look exhausted. Yet price keeps rising.

On Balance Volume has no resistance and price has no resistance above. There is nothing to stop price rising with strength. On Balance Volume gave a bullish signal when it broke above the longer term trend line on the monthly chart, and more recently the break above the purple line on this daily chart. This supports the rise in price.

RSI still exhibits divergence with price indicating price is weak, but recently divergence is very unreliable. I will not give it much weight.

Stochastics no longer exhibits divergence with price. Price moved higher today and Stochastics also moved higher. There is no divergence to indicate a trend change here.

MACD is bullish with the break above its trend line. But MACD still exhibits longer term divergence with price back to the highs on 22nd of March. Normally, this would support wave count II over wave count I, but at this time divergence previously noted has just disappeared. It is not reliable.

Overall, because of the slight increase in volume and bullishness from On Balance Volume, it is again my judgement that wave count I has a higher probability than wave count II. Assume the trend remains the same, until price proves it does not. Assume price will keep rising until a red daily candlestick is printed that has stronger volume than a prior upwards day.

There is some concern today with extreme bullish sentiment as evidenced by CNN’s Fear & Greed Index at 90%, extreme bullishness. Again, this gives cause for concern over wave count I but this can move further into extreme as price continues up. This bullish sentiment does not say that price must turn here and now, only that the end is close.

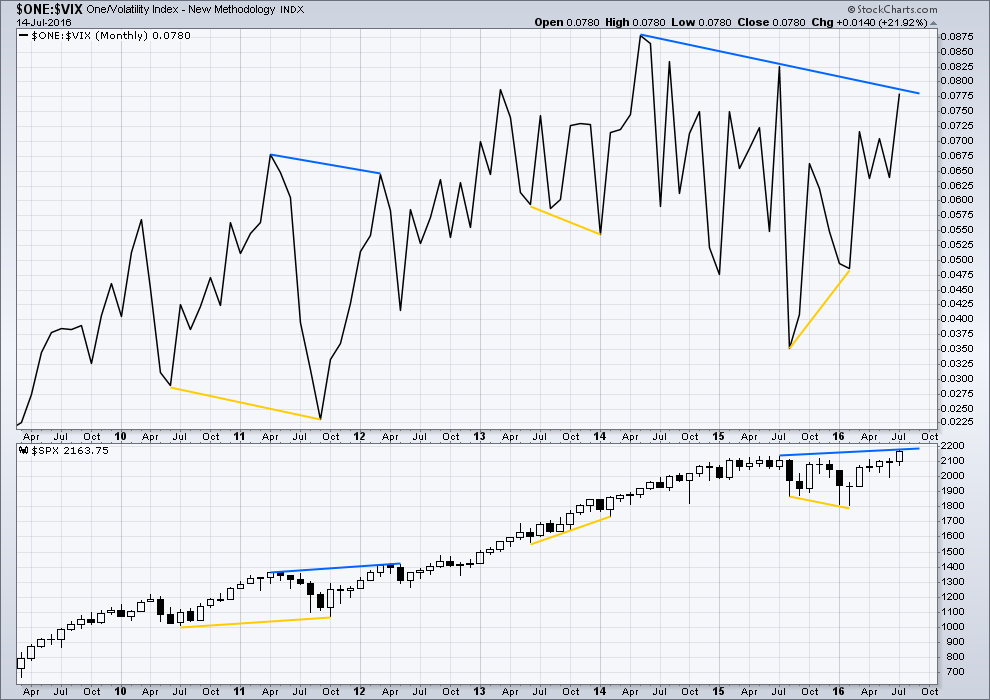

VOLATILITY – INVERTED VIX MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

VIX from StockCharts is inverted. As price moves higher, inverted VIX should also move higher indicating a decline in volatility which is normal as price moves higher. As price moves lower, inverted VIX should also move lower indicating an increase in volatility which is normal with falling price.

There is still strong multi month divergence with price and VIX. While price has moved to new all time highs, this has not come with a corresponding decline in volatility below the prior all time high at 2,134. This strong multi month divergence between price and VIX indicates that this rise in price is weak and is highly likely to be more than fully retraced. However, this does not tell us when and where price must turn; it is a warning only and can often be a rather early warning.

At this time, although divergence with price and VIX at the daily chart level has been recently proven to be unreliable (and so at this time will no longer be considered), I will continue to assume that divergence with price and VIX at the monthly chart level over longer time periods remains reliable until proven otherwise.

This supports the idea that price may be in a fifth wave up. Divergence between the end of a cycle degree wave III and a cycle degree wave V would be reasonable to see. Fifth waves are weaker than third waves. This strong divergence indicates that price targets may be too high and time expectations may be too long. However, it remains to be seen if this divergence will be reliable.

DOW THEORY

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd Nobember, 2015) – has now closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – has not closed above this point yet.

Dow Theory Conclusion: Original Dow Theory still sees price in a bear market because the transportations have failed to confirm an end to that bear market. Modified Dow Theory (adding S&P and Nasdaq) has failed still to confirm an end to the old bull market, modified Dow Theory sees price still in a bull market.

This analysis is published @ 08:56 p.m. EST.

Looking at after-hours trading in SPY: The ETF hit the 214 price level. I thought this was noteworthy because this low exceeds the low from 13-July (214.35), which mirrored on the main hourly for the S&P index would invalidate the main hourly count.

Now, I understand this does not constitute an actual invalidation of the main hourly, but I just wonder if this might be an early warning of some sort…I guess it all depends how we open on Monday.

I canceled my subscription to Prechter’s Elliott Wave Theorist today. I will continue for the time being to read Steve Hochberg’s Financial Forecast as he was right on the money with his recent wave counts. Today’s issue from Prechter was particularly pathetic as he spent the entire issue re-hashing the past history of oil prices, as if that would be of any use whatsoever to folk interested in what it is doing today. But don’t worry, he will pick up the story in Part II yet to come. Unbelievable!

Yep! The West is behind it, or at least gave tacit approval. I am listening to Richard Haas of CFR being interviewed on Bloomberg and reading between the lines they were expecting this. “Nuff Said!

If expected then….business as usual? Since that means no war?

That would be my guess. Turkey has one of the largest armies in NATO and everyone is going to have to tread very carefully. Let’s hope Erdogan goes quietly. My suspicion is that he will not and will be willing to sacrifice his own people’s welfare in an attempt to remain in power. The Turkish army is doing what the Egyptian army did to try and keep the country from becoming a religious state imo.

How can he not go quietly. He has to deal with a large army against him… I’m just guessing most people living in Turkey are secular folks. Erdogan has been trying to turn the country into a religious state… if anything the military coup will stabilize the country; in the long term.

Joe could be right that we are seeing a “black swan” event. I could be mistaken about Saudi Arabia involvement as well. There has been an ongoing struggle in Turkey between those wanting to maintain a secular state moving toward more Western values and those trying to turn the country into another Ottoman Empire with Erdogan as Sultan. Even Western media has of late reported that the man has lost his mind with his increasingly authoritarian approach to ruling the country, his brutal treatment of the Kurds and endemic corruption and nepotism in his government. Apparently the secularists have had enough of the man, and have decided it is time to put him out to pasture. They may have the support of the West who may think Erdogan has become a liability…

Erdogan remains true to form, encouraging Turkish citizens to go into streets and probably get shot. He, rather than quietly work behind the scenes to deal with this, is now threatening the military and telling them the are “going to pay a heavy price for this!”

Hey Erdie, listen up! These guys are not journalists that you can bully and throw in jail just because you don’t like their reporting; these guys have machine guns, they have mortars, and they have tanks!

Hi Friends,, so what did I miss while I was in Cabo? ok, just kiddin,, I can see alot has happened.

Woo! Hoo! Welcome back Doc. You mean to tell me they don’t have internet in Cabo?!

Just kidding. Good for you to take time away….

Welcome back Doc!

You missed heaps. The wave count has completely changed.

The bear is dead.

Long live the bull.

Even my weekly “bear” is bullish mid term.

Beware of the Zombie Bear! 🙂

Turkey has been taken over in a Military COUP!

market off 10 points, UVXY can’t even break $7…what gives??

Armed Forces have fully seized control of Turkey!

I must say I am not surprised. The man in charge over there was driving them off a cliff. He must have totally lost his mind blowing that Russian plane out of the sky. I guess his lame apology came a bit too late. This could get ugly as I doubt this has been initiated by the West for Erdogan was Obama’s philosophical twin. As the German comedian rhymed, Erdo-wee, Erdo-woo, Erdogan!

I smell Saudi Arabia all over this as they were royally steamed over his mending fences with Israel and Russia, as well as cracking down on ISIS. Now there is a dangerous set of degenerates masquerading as a state…

What futures are doing on a Friday night is rarely of any real significance, or any night immediately after the close for that matter. There is an awful lot of real estate between now and the open on Monday. I would not take any of this too seriously. Then again, it sometimes indicates some people know something the rest of us don’t. A good reminder of why it is always important to hedge your positions against the unexpected, as well as the unpredictable!

Well, the other guys are seeing us in an extended wave up and their labels expect the strongest portion of the move is yet ahead. Maybe there is something to that inverted HS pattern in RUT someone posted today. Don’t forget that monster bull AAPL call spread somebody made a few days back. This bull just might have some legs left.

Have a great weekend all! 🙂

Vern,

I am expecting the ATH top to be in place between July 22 and Aug 8. We have seen this scene played out over and over again…bears really can press even when the markets dropped huge after brexit. This must be a concern for anyone trying to short this market no matter what the fundamentals are saying, price being printed is the real deal that we have to live with.

Any particular reason why you expect the top for that time period?

I always thought a crash would come sometime in the Fall which ideally would be in the middle of a P3 wave to the downside. If you are right about that top coming in August, it would be difficult to see how we could get a primary wave down, followed by a primary degree correction, and be in the middle of a P3 down by Fall.

Black Swan in progress????

Futures dropping like a rock! Anyone know???

Could be post Opex positioning.

Market is so overcooked on upside too…

These are SIGNIFICANT moves though…

Attempted Military COUP in Turkey! Still in Progress!

That is a NATO Country! That is NOT good!

10 min left to get out!

Gold, Yen and T-Bonds all making SIGNIFICANT spikes up up after hours.

ES selling off at 4:30 re-open, now down to LOD.

Yen held 50 DMA and nice hammer candle.

Personally, I think we are entering Lara’s Daily II Chart – wild ride coming.

There is a lot of time between now and market open on monday, To think that Fed and Banksters will allow this to slip away this easily will be a major mistake.

I agree. Just another Brexit moment.

Stocks a little frothy…

http://seekingalpha.com/article/3988649-bulls-vs-bears-indicators-point-potential-knock

spy expiring in two weeks…

Look at how the Open Interest is drying in calls…..you know what i think

CNN’s Fear and Greed index slightly lower at 89% extreme greed today.

how is one to interpret that?

That’s a good question.

Still extreme, still pointing to a larger decline. But like all indicators it doesn’t tell the decline must begin here and now. It can get more extreme and stay extreme for a while yet.

The slight decline today because a red candlestick / down day

SPY 1 week out

expected move is 2.3 in line

SPY P/C ratio increasing to 1.2 in neutral territory

One thing I dont like is the huge pop in out of money call at 218. Either it is smart money or dumb ass money

iwm expiring in two weeks…

you can see bulls taking profits as shown in open interest drying up at the in the money calls….bears are adding up looks like

I will post for SPY soon, but here is the option chain expiring next week on IWM

expected move $1.89

P/C ratio = 1.6 in favor of bears

I would say….looking at Open Interst change for 1 week out and next week out…

I favor bears….a list a pull back to 118. That would put hte SPX down $30

This is really difficult to figure…. my first instinct would be to label todays downwards day intermediate (4), but only as its closed as a small red candlestick.

If volume is up today then that’s how I’ll probably label it. It looks like a complete impulse on the daily and hourly charts. But it fell well short of the target. There’s no ratio between (1) and (3) if (3) is over now.

Price is drifting lower below the channel, but the S&P just doesn’t work well with channels. It could still continue higher. The channel breach is a weak bearish signal, very weak.

If this is the start of intermediate (4) then to be in proportion with (2) it may continue overall lower, choppy and overlapping, for another couple of days or so.

Daily candlestick on SPX, INDU and NYSE are hanging mans – however on the SPX the lower wick is a little short of meeting the criteria.

More like a spinning top? the body is too big for a doji

Teacher, I wrote ‘hanging man’, not doji. Maybe spinning top on SPX, but NYSE and INDU seem to match a hanging man.

Please don’t hit my knuckles with a ruler.

I know, and I ignored the hanging man because you already figured out it’s not a hanging man.

I never did rap anyone over the knuckles, it’s illegal in NZ.

I did kick kids out though when they really annoyed me. But my tolerance for their antics (I find teenagers SO funny) was probably always too high, so they got away with quite a lot. Unless I told them to settle down, then they were pretty good.

Oh that is really too funny. We had an English teacher (his name now escapes me) and the nickname we gave him was “Settle Down!” because of the frequency with which he used the expression to admonish us! ROFL!

Drives me crazy that I cannot remember his name, although I can clearly see his face, red hair, tall somewhat portly frame, and the smell of hand-rolled cigarettes…

Good. VIX producing a bottoming signal IMHO.

Verne,

Are you seeing this correction as A-B-C, with the C wave still yet to complete?

I am leaning toward the main count with a final fifth wave up to come to put in a top. I assume you are talking about the big picture and not just this possible fourth wave…which on IWM looks like some kind of triangle…not sure about SPX…

Teacher should be arriving soon. Everyone clean up your desks and look like nothing happened.

LOL…. Will I get spanked with the ruler today???

A vision of my grammar school days… spanked with a ruler by a nun!

Me too! I went to Catholic grammar school. Still remember Sister Schroeder 🙂

Did she play the piano? 🙂

Don’t know. Probably.

Same… I had several Nuns as Teachers in my 8 years (1965-1973)… They were tuff and provided strict discipline. They would probably be arrested here in 2016.

But you know what? It was a solid foundational education.

Agreed! Wouldn’t trade it!

LOL

Only if you don’t use stops Joe 🙂

ROFL

I actually did used to teach high school science / biology / geography.

I’ve never told you all that before 🙂

Awesome. Cheers 🙂

Aha! I KNEW IT! That voice always said “Lecturer” to my ears. Maybe it was because growing up in the BVI so many of my teachers were British. 🙂

Hahahahahah

Yeah, I can’t help the teacher thing, it comes through doesn’t it!

I only did it for 5 years. My last school this is what they had to say… not much.

I second this kid’s comments: “Miss Frost is amazing! She is the best teacher ever and soooo knows her stuff. She’s really nice too.” 🙂

🙂

I really miss them. I love teenagers; their energy and how they see the world in black and white. And they’re hilarious!

I always thought scientific literacy was just as important in todays world as the ability to read and write. I loved teaching science to kids.

dear jim and Joseph my brother the chart is s&p 500 in 4 houres and the target 1970

Back at you on the SPX 4H 🙂

https://www.tradingview.com/x/1d8AOllZ/

Izak,

The SPX 4H was the key!, Zoomed out it created these lines which support Hurst and Neural net predictions. Let’s see what happens!

https://www.tradingview.com/x/yiWCqHI6/

I think you’re missing a few labels there Jim 🙂

But, TBH, for a short term idea it has merit, this looking to see if a move is a three or a five, labelling it, and not putting it into wider context.

Short term that is. If context is ignored then eventually one day it’ll come and wreck your plans.

Ok tnx. We watch and wait.

Amazing what chart mayhem one can get away with when the teacher is sleeping and the sub it out as well (Lara & Olga) 😉

🙂

Are You Going to Claw the Bull or NOT!!!!!! Make up your mind already!!!!!

Verne, of course all do respect for your great comments, ideas and trades. I see you as class mate to get crib notes from to do well on the test 🙂 Meanwhile, Joseph and I are shooting Bear spit wades at each other. LOL.

Hyuk! Hyuk! 🙂

LOL, YEP…. I just don’t know what to make of any of these charts and technical’s anymore! All I know is all I know based on years of my financial industry experience. New AT Highs/New Bull Market/Bull Count in conjunction with all else I really know…. Makes absolutely no logical sense to me.

Therefore, I don’t trust any of what has gone on this week! I will never change my mind on this… NEVER!

But I am not an idiot… I am trying to figure out what to do with my situation and when. I am expecting all these counts to be adjusted and/or a new solution to materialize… because that is what always seems to happen at some point. Remember, I have been a subscriber of EWI for several years and why I make that previous statement.

Not this time I think

GS a bit squirrel like, but I am watching it on the monthly for clues…

https://www.tradingview.com/x/zfC2dWxB/

jim you are great 😉

wake up my friend what more than that

What is this a chart of?, sorry can’t see.

dear jim and Joseph my brother the chart is s&p 500 in 4 houres and the target 1970

Please write your price points in a post… I can’t read the numbers.

Thanks My Friend

Here is what the neural nets are saying of late….

http://www.forecasts.org/stpoor.htm

jim great stuff 🙂

Fourth wave moving a bit lower to draw in some pre-mature bears before the final move up. Still looking for volatility to confirm that it is terminal….

hi my brother Joseph 🙂

Hello… You have any individual stocks? See Posts below.

sorry i play only index and curency

Be honest… Is currency easier than these mad indexes?

Here is what the Hurst cycle boys think could happen…

http://elliottwavepredictions.com/

So according to that… 2177.67 is the END! Am I reading them correctly Jim?

Sid says the Hurst move will most likely hit in August and yes the target is 2177.67 so far. Bear Candy 🙂

Ah… yes… that darn moving target to the upside and the elusive downside targets that never get anywhere close.

jim and vernecarty im like sure that we are in wave 4 and we going to 1800 s&p and than from 1800 b egin wave 5 in the intermidate when finish wave for 5 that it wave 3

It is a possibility. The one potential problem is that wave four, if it continues looses all proportion with its counterpart second wave.

izak…personal question: what software are you using for the drawing? email me at jules_bassale@yahoo.com. Thanks

http://www.elliottwavedesk.com

Do you use the Premium or other?

How long have you been using this?

That count must have a low probability. You’ve labelled it as a triple zigzag. But it looks all wrong for a triple zigzag. The second and third zigzags should be deepening the correction and they barely are.

Triples are very rare. I’ve only ever seen about three.

For people new to EW it seems that the W-X-Y-X-Z labelling is the most often incorrectly used. It’s so bad actually that whenever I see a move labelled as a triple I now suspect the person who labelled it is not fully familiar with EW rules and guidelines. Because invariably I’ll look more closely and see rules broken and guidelines ignored.

Izak…. I’ve just realised my comment could be read as rather harsh.

Please don’t take it that way. I’m only offering my feedback based on my experience with Elliott wave.

Good on you for having a go, it’s hard. Just stay away from the triples… there’s almost always a better neater solution.

Both VIX and UVXY flirting with green territory today. Are they telling us to prepare for a final move up? If they both continue North synchronously with the move of the indices up I am going to be paying very close attention. I was prepared to take a bit of a haircut on my VIX shares but they are hanging tough. Actually a bit in the green surprisingly…!

Reloading TLT puts…

look again what i think

scalping long here on e-minis

one more little down and then should be up for rest of day, scalpingwise

getting mixed signals on my scalp long, thus covering for small +

…and now the market will take off Ha!

what about that

Yes, Here is my take I posted earlier but no comments yet if it works at all with EW rules.

https://www.tradingview.com/x/FnkZQlYK/

I for one hope it does! As things stand right now, I would take that wave 4 and then fold!

But the way things go for me, if I fold, it will finally break lower at Super Cycle degree.

I pretty sure I am going to get an EW spanking from the experts 🙂

No Doubt… Sorry, I am not yet a good counter to comment more. IT’s why I stay a member of two EW services. + reading others out there publicly.

It seems to me there is a large enough EW herd out there… that it may affect the trading of the waves. ??? I don’t know… but these larger bear counts always seem to not follow through to the downside.

They tease for part of the way… then FK U up the A_s!

I am not sure I understand these wave label numbers Izak. What is the wave number for that ABC correction after the wave you label as a five up? It is supposed to be a fourth wave at intermediate degree with the prior wave labelled five being a five of a third wave?

This is exactly what I have on the monthly chart…

With the exception of how I’m seeing the subdivisions for the fourth wave which has currently ended. In my wave count it’s ended anyway.

dear vermecarty thanks a lot for the information that you give , sorry for my english

from what i understand from you you think that we are in wave 4 and we have to go down in the s&p???? i realy want to see it on the chart where i can read information and see this information on the chart of s&p i can pay for subcribtion on reliable additional thanks vermecarty i wait 🙂

Verne often muses on very short time frames, and is often playing UVXY not S&P500.

So when he’s talking a fourth wave I expect he may be talking minor 4 (on the hourly chart in this analysis) and not cycle IV.

Verne can correct me if I’m wrong here.

Filled on SPY bullish put spreads.

Good luck!

TLT at an important support shelf around 138.50 Taking some off the table until I see how it reacts. Will reload on any bounce, or a break below followed by a return to kiss…

Based on my reading of IWM I think SPX may now be in a fourth wave at some degree. I am selling the July week 5 SPX bullish 207/210 put spreads (limit 0.15) to start accumulating a short position courtesy of Mr. Market. Certainly not a big payday but the object is to get positioned, not get paid….

RUT 1206-1207 key resistance and in nose bleed territory…

The daily IWM chart looking very much like a fourth wave triangle underway. We should have one more pop to the upside and it really should begin later today as the second wave also lasted three days. I think a top is closer than we think folks….barring some kind of wave extension of course…if the next move up blows through the upper BB I would think that’s it….

See response below

dear vermecarty thanks a lot for the information that you give , sorry for my english

from what i understand from you you think that we are in wave 4 and we have to go down in the s&p???? i realy want to see it on the chart where i can read information and see this information on the chart of s&p i can pay for subcribtion on reliable additional thanks vermecarty i wait 🙂

I think we are definitely in a fourth wave for IWM and so we may be seeing the same for SPX. If that is the case then we have at least one more wave up in SPX which could be terminal, or could be part of an extended wave with more upside after a second wave correction…I don’t think we will know for sure for a few more days yet…

I am looking for a number of good stocks to trade…

But… Each of the stocks prices must be between $8 to $20. I want to hold multiple stocks at a time for swing trades and buy a minimum of 1000 shares each.

Do any of you trade or know of any individual stocks in this price range that are good for trading?

Greatly appreciate any help! I want to build a good size watch list. Thanks, Joe

Sick of these move only one way stock indexes!

May want to check out Barchart and use their stock screener – a great tool. You can plug in most any parameter/criteria. Then it screens all the stocks in seconds giving you what your looking for. Membership is free.

Thanks… That is a plan if I don’t get much of a response here. I also have the screener in the TD Ameritrade & Thinkorswim platform.

But I was looking for stocks that members here may be trading in that price range? Stocks with enough volatility that you’re trading successfully. That work well with EW & the basic technicals most use.

The Stock Indexes are Broken and/or manipulated! No rhyme or reason to movements anymore.

I am opening ES short positions for a 35 – 40 pt move down into early next week.

I would be expecting a small bounce, and if it fails, will be considering Lara’s daily alternative count to play out (Daily and Hourly Chart II).

Going forward I will also be posting my positions

Current Short 9 Sept ES @ 2159.

75% of Max Position of 12 contracts.

GLTA

IWM has been a pretty good coal mine canary of late. It signaled the turn off the bottom and may do the same at the top. Hopefully we can identify a few additional indicants along with out wave counts to help us spot important market turns. The upper BB in VIX has been quite accurate of late in spotting interim market bottoms. Now if we could find a good talisman for market tops… 🙂

4 days now of lower highs on RUT.

If it does not hold 1205 by Monday = Likely failed breakout.

Yep. IWM made its strongest move above the upper BB three days ago which I am interpreting to be the end of a third wave up. We may now be in some kind of fourth so it would be nice to get confirmation with a final move higher with a quick reversal to the downside. Definitely bears watching, no pun intended…

Here is my view of the RUT:

https://www.tradingview.com/x/XcEAUDjh/

Mark Arbeter watching for huge bullish neckline breakthrough….

If the upper BB moves up to accommodate the HS break-out I would buy it. If it blows through it I would consider it a head-fake and a terminal move.

yes, but on 4 hour chart RUT is forming a perfect bull flag, usually a wave 4. So little wave 5 up yet to go. (about ‘4 days of lower highs on RUT’).

There is a real possibility it could be the start of a big move higher. Looking at the recent low, it looks like a big ZZ correction with this the start of an impulsive wave up. After this fifth wave up it should become evident. Is it possible we are really about to see all the other indices play catch up to SPX? If that happens I would have to say hats off to the banksters!

Or this is the wave 2 correction of a prior wave 1 and that a huge wave 3 is underway.

Both verne and peter, i honestly think the group could benefit from a wave count. I know this is a spx website but maybe…just maybe…RUT could give us a glue. ?

That did occur to me as well Jules. Ordinarily towards the end of this kind of second wave correction you would see VIX starting to edge higher but right now it is looking fairly moribund. I think Lara’s more bullish count my be correct and that we have more upside ahead to complete a fifth wave….

I agree with you! Im glad others are looking at RUT for clues a pullback! Thats why i have been asking people thoughts on it. It often leads the markets, not always. The futures tf has completed the structure but cash seems to be in iv. Not sure what that means. One question i have is where can we expect target 1 of rut to go for wave5. That might tell us where spx might top too for short term

imo VIX is working on the charts yet; 4 hour chart with VIX in blue.

Some one posted a cycle chart a few days ago suggesting VIX could muddle along in this channel for quite some time. Lara pointed out the absence of overhead resistance so even though momentum is quite weak, we could see a steady grind higher for quite awhile with priced pinned against the upper BB. Not a very favorable scenario for traders but it is what it is….still not comfortable trading the long side. I may put a toe in the water with a few bullish put spreads but I remain deeply suspicious of the move higher….so what else is new? 🙂

True…spx and Dow no resistance, but qqq, Russell and transports are like an anchor against the sails of the Dow and spx

The last scalp trade posted last night is working out well, if one didn’t get stopped out on the decline when the news broke of the terrorist attack.

Saddened and angered by the loss of life and harms caused by evil last night in France.

The situation in France is a true heartbreak.

Joeseph’s point about the colossal failure of news services is poignant.

It may in part account for the irrational behaviour of the masses – they are totally clueless. While our hearts go out in sympathy to the French people for all the senseless violence and bloodshed they have been experiencing the last years, have you heard a single intelligent query about WHY this is happening there??!! I know I have not.

Why do so many think they can avoid the unavoidable principle of sowing and reaping?

Apparently Nicolas Sarkozy, who was Europe’s most rabid leader and chief instigator in the destruction on one of Africa’s most stable and prosperous nations out of pure spite and malice, is now seeing chickens come home to roost. The murder of its legitimate leader resulted in the deaths of literally tens of thousands of innocent people. I think historians will look back at that act of recklessness as the single proximate cause of the ultimate dissolution of the E.U.

We in the US will also pay a price for our part.

Rememer “We came, we saw, he died!” ??!! Nuff said. 🙁

I completely agree with you on the lack of analysis regarding causes. It seems to be given as a superficial “terrorists” and “evil” with no analysis of the history of the regions.

We are all the products of history.

I find Robert Fisk a good writer for the Middle East, but he can be a bit rambling and hard to read.

I have been following this Technical Analyst for a year now. His market calls have been very good. He offers free reports at the link below.

http://www.seeitmarket.com/author/mark-arbeter/

Hope everyone has a profitable day!

There is NO media reporting on this at all… so therefore most have no clue!

Global Corporate Defaults Just Hit 100, On Pace To Surpass Financial Crisis Record

The bizarre financial paradoxes unleashed by central planning continue.

While the S&P rises to new all time highs day after day, the IMF is about to downgrade global growth again, $13 trillion in global bonds trade with a negative yield, and the shape of the US yield curve is where it was the last time the US entered a recession. But what remains the most perplexing aspect of the unprecedented disconnect between market surreality and fundamentals, is the ongoing surge in corporate defaults, which is now on pace to surpass 2009, the worst year in history for corporate bankruptcies.

http://www.zerohedge.com/news/2016-07-14/global-corporate-defaults-just-hit-100-pace-surpass-financial-crisis-record

Sold another 25% of my shorts this morning and have added to the longs. Bear at heart but if thats not where the profit is we have to go with the trend. Hoping for a move up into Monday and too take some profit and load off another 25% of the short positions left

Awful news in France overnight, thoughts really go out to the victims and all involved

A few years ago, my job changed our retirement plan and did more automatic enrolling, and automatic increases. Our Finance team said it was about changing IRS regulations. (IRS = The US tax enforcement/collection agency).

It seems plausible to me that the increasing price on decreasing volume is just millions of Americans putting away 1-10% of their paycheck every two weeks. This auto enrollment and auto increase is pretty new, i think the law about was passed in 2006, but it took the IRS time to implement the rules. That might be why the S&P hit an ATH first; most people just pick a S&P index fund by default.

Not enough people are cashing out their retirement accounts yet. So there’s no selling pressure.

I know that I am not presenting evidence. Any ideas on what I can read and report back on this hypothesis?

Or what about a ratio of people adding vs withdrawing vs leaving funds in retirement accounts?

imo this source of funds is not driving the market to new highs. The reason why is it stays somewhat the same every month. If a person is investing in a SP 500 index fund $300 this month, they did the same last month, are doing the same next month….it is not a flood of new monies. The new monies are coming from the central banks of Japan, Germany, China, UK and the USA (through their pet banks).

Yep! With some 10K baby boomers retiring daily. Cessation of inflows to the markets coupled with the increasing number of position liquidations of folk leaving the workplace and needing funds to live on means there is a net loss from this source…no way around it…

2

First!

And finally, the early evening starts with a modest drop in the futures… hopefully it’s finally time for some (dare I say…) profit taking?

amen to that! maybe the tragedy in France will weaken markets a little tomorrow. RUT seems to be stuck….didnt advance higher today.

and that futures drop just went *poof*

back in positive territory

It’s just the DUMB Ass market believing the pure fictional data put out by the Chinese Govt.!

Fed Loses Another Excuse As China “Super Friday” Data Dump Beats Expectations

China’s ‘Super Friday’ data dump arrived and despite the 10% devaluation in the Renminbi basket over the past year, and an utterly incredible spike in borrowing, China economic data merely muddles through in its centrally-planned goal-seeked way.

Earlier ‘researchers’ proclaimed Chinese GDP at around 6.5% but China GDP grew at 6.7% YoY (beating expectations of 6.6%). While Fixed Asset Investment disappointed (+9.0% vs +9.4% exp), Retail Sales (+10.6%) and Industrial Production (+6.2%) beat expectations.

http://www.zerohedge.com/news/2016-07-14/china

I cannot for the life of me understand why Western news services continue to report Chinese economic data. They ought to be sued for journalistic malpractice…

Don’t forget instability in foreign markets will result in monies pouring into US markets 🙂 US seems to be the only stable game as it looks now…

FYI Ben Bernanke is talking BOJ into issuing ‘Perpetual Maturity Bonds’ that just keep paying interest….this seems to be the next stimulus instrument to hit the street..

I read that the BOJ Does NOT have the legal authority to issue bonds directly to the market.

SO unless the laws are changed by the Jap Govt. and the Jap people allow it…. this rumor is pure fiction!