Upwards movement unfolded for the session exactly as expected, ending almost at the target which was at 2,038.15.

Summary: In the short term, some sideways movement is most likely to complete a fourth wave correction for another two or four days, with two more likely. Thereafter, the downwards trend should resume. If upwards movement breaks above 2,050.37, then the correction may be another deep second wave and the target would be at 2,067, but this is less likely.

Trading advice (not intended for more experienced members): For short positions opened close to 2,113 or above, traders with a longer horizon may like to still hold onto those. If price continues sideways tomorrow, then another point to enter short would be looked for the day after; patience with this correction is advised. It is strongly advised for inexperienced traders to not take long positions. Stick with the trend. The trend is down.

Stops (and risk) for longer term positions may now be moved down to just above 2,050.37, or for positions opened above 2,113.32 to just above 2,113.32 if holding on.

Last published monthly charts are here.

New updates to this analysis are in bold.

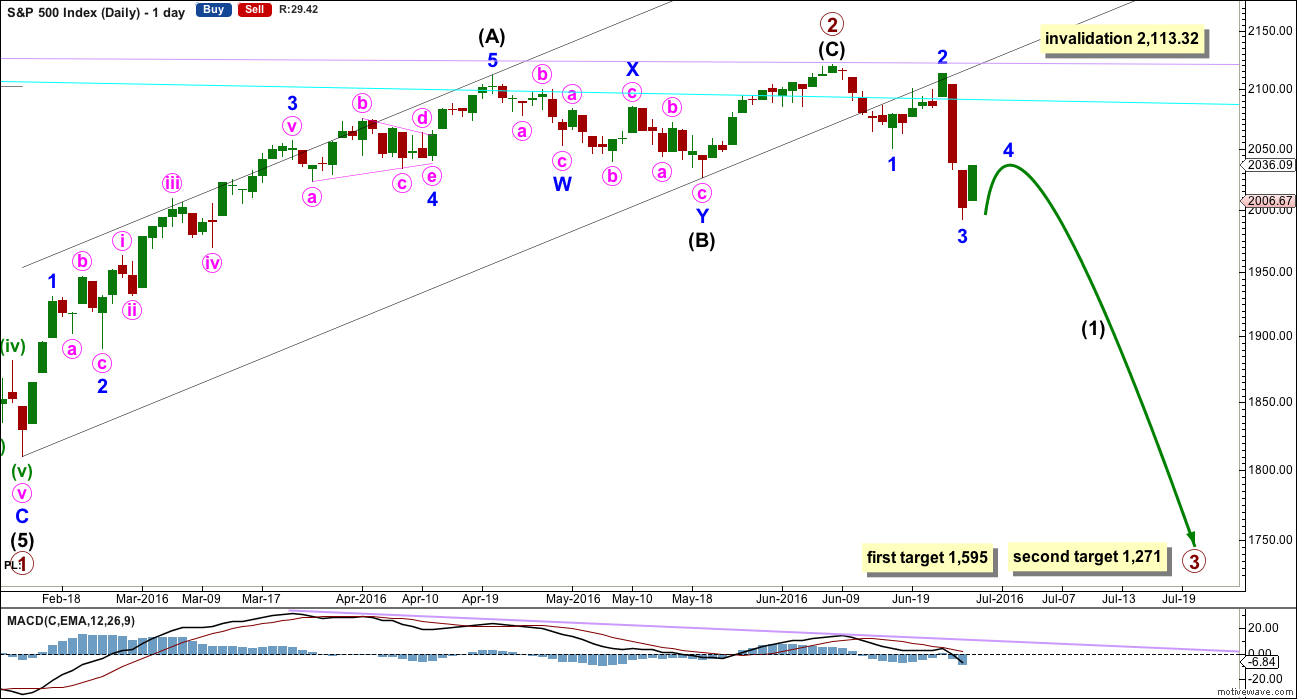

BEAR ELLIOTT WAVE COUNT

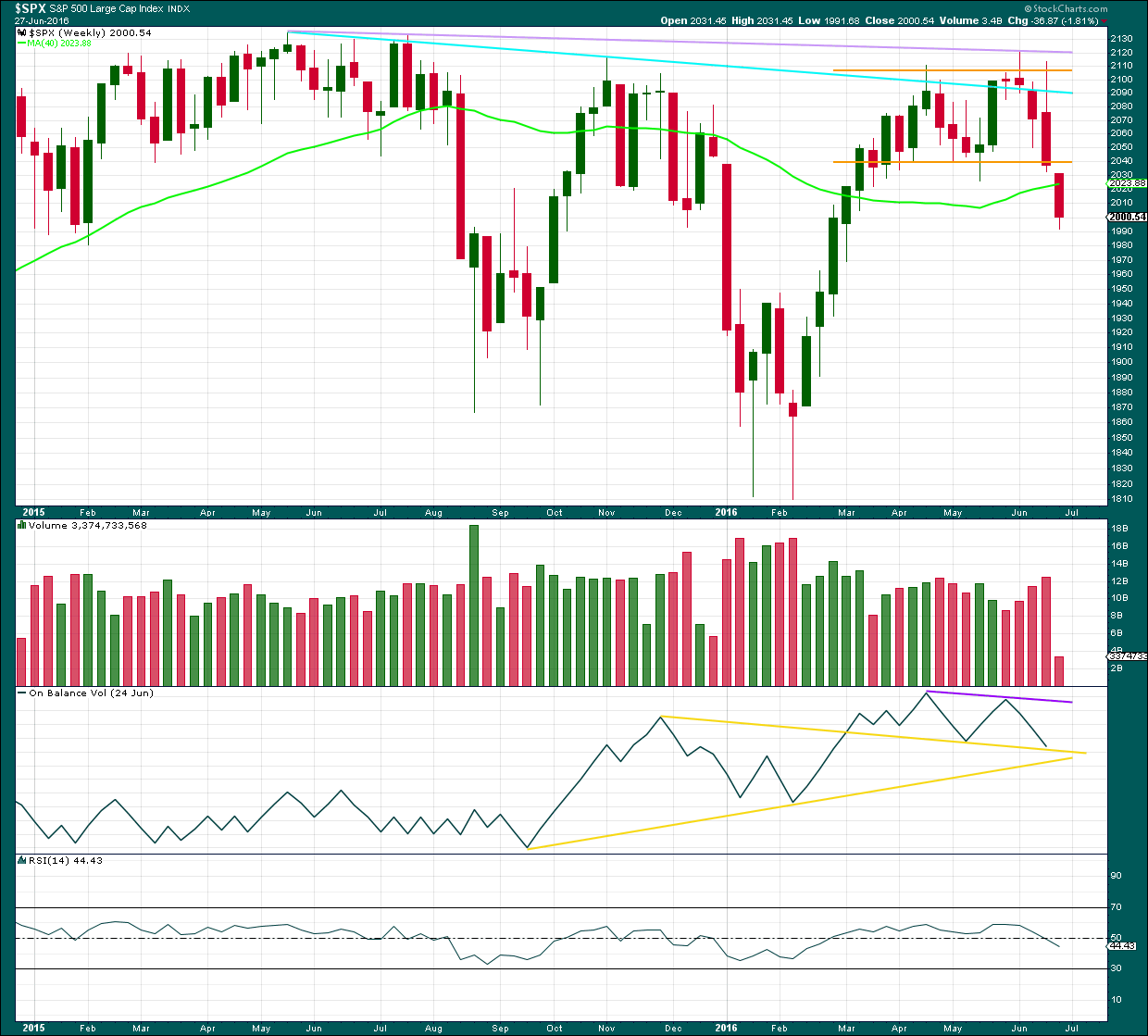

WEEKLY CHART

The box is added to the weekly chart. Price has been range bound for months. A breakout will eventually happen. The S&P often forms slow rounding tops, and this looks like what is happening here at a monthly / weekly time frame.

Primary wave 1 is seen as complete as a leading expanding diagonal. Primary wave 2 would be expected to be complete here or very soon indeed.

Leading diagonals are not rare, but they are not very common either. Leading diagonals are more often contracting than expanding. This wave count does not rely on a rare structure, but leading expanding diagonals are not common structures either.

Leading diagonals require sub waves 2 and 4 to be zigzags. Sub waves 1, 3 and 5 are most commonly zigzags but sometimes may appear to be impulses. In this case all subdivisions fit perfectly as zigzags and look like threes on the weekly and daily charts. There are no truncations and no rare structures in this wave count.

The fourth wave must overlap first wave price territory within a diagonal. It may not move beyond the end of the second wave.

Leading diagonals in first wave positions are often followed by very deep second wave corrections. Primary wave 2 would be the most common structure for a second wave, a zigzag, and fits the description of very deep. It may not move beyond the start of primary wave 1 above 2,134.72.

So far it looks like price is finding resistance at the lilac trend line. Price has not managed to break above it.

I have two Elliott wave counts at the daily chart level. Only one will have an hourly chart; a second will be added when the daily wave counts materially diverge.

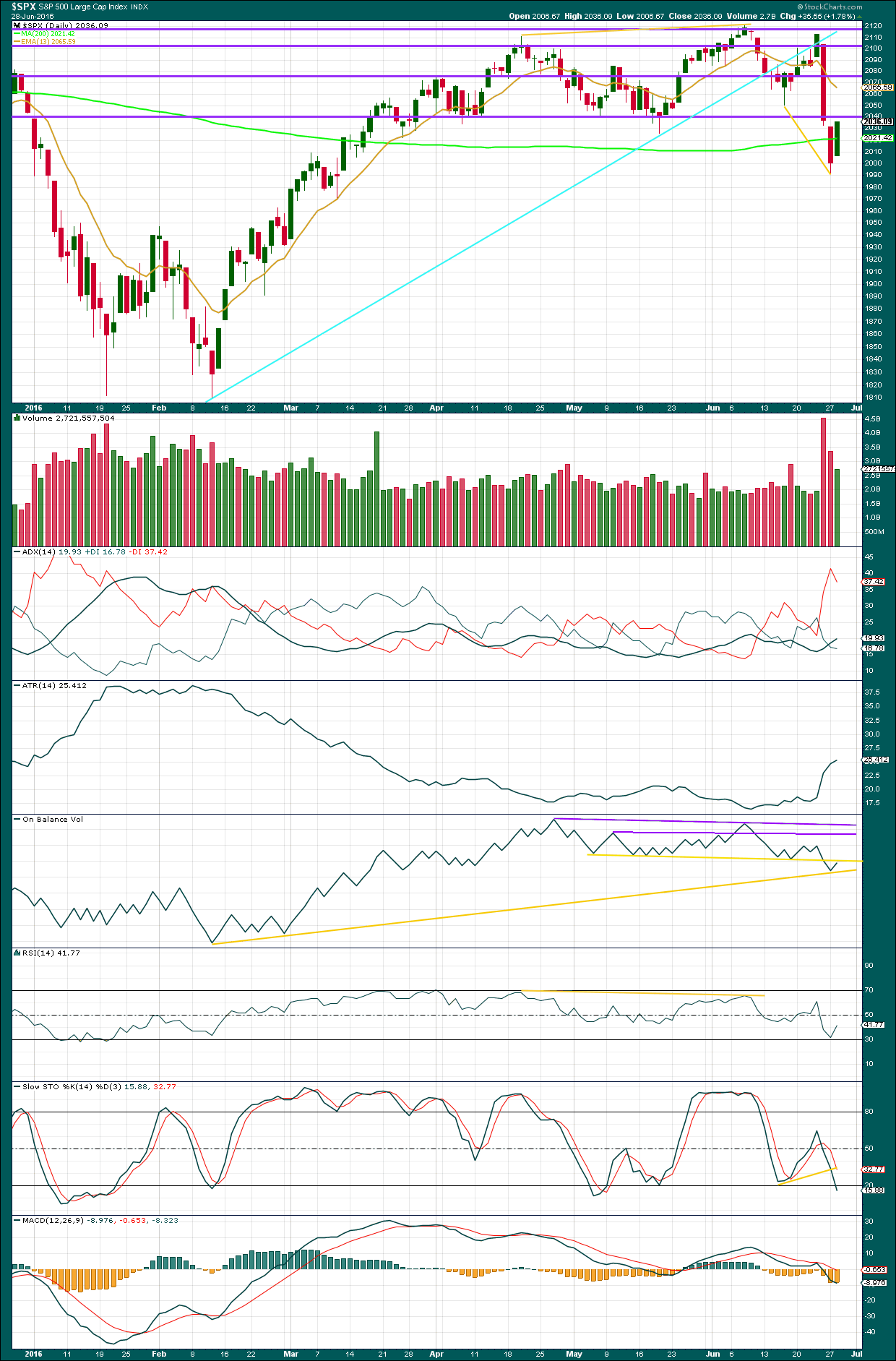

DAILY CHART

Primary wave 2 may have been a zigzag over earlier on 7th of June at 2,120.55. Thereafter intermediate wave (1) may be underway.

Within intermediate wave (1), minor wave 3 may have ended. Minor wave 3 is 8.09 points longer than 1.618 the length of minor wave 1.

Minor wave 2 was a very deep 0.90 double zigzag correction lasting a Fibonacci five days. Given the guideline of alternation, minor wave 4 may be expected to be shallow and maybe quicker too than minor wave 2. Minor wave 4 may be expected to be a flat, combination or triangle and may last a Fibonacci three, five or maybe even eight days, with a Fibonacci three days the expectation as most likely at this early stage. The downwards pull of a third wave should now be getting stronger, and past behaviour of the S&P in a bear market shows more time consuming second wave corrections than fourth wave corrections. This does not have to be the case here of course, but we should anticipate it as very likely.

After a bounce for minor wave 4, then minor wave 5 down would most likely be about 70 points in length if it reaches equality with minor wave 1. That would complete a five down for intermediate wave (1), which should be followed by a deeper more time consuming correction for intermediate wave (2).

Bear markets do not move price in a straight line. They have deep corrections along the way which must be anticipated. At this stage, future deep corrections may find strong resistance about the cyan trend line. I would not expect the lilac line to be tested again. If it is, it would offer final resistance, and I would not expect it to be breached at all. This means that any short positions opened above 2,100 may remain profitable for a very long time indeed, if traders would like to hold onto them.

Targets for primary wave 3 remain the same. At 1,595 primary wave 3 would reach 1.618 the length of primary wave 1. If price keeps falling through this first target, or if when price gets there the structure is incomplete, then the next target is at 1,271 where primary wave 3 would reach 2.618 the length of primary wave 1. The lower target is more likely because primary wave 2 was very deep at 0.96 of primary wave 1.

HOURLY CHART

Minor wave 3 is 8.33 points longer than 1.618 the length of minor wave 1. It has stronger momentum and volume than minor wave 1, so this looks like a typical third wave.

Upwards movement for Tuesday’ s session looks like the start of minor wave 4.

Minor wave 2 was a relatively deep double zigzag. Given the guideline of alternation, minor wave 4 is unlikely to be a single or multiple zigzag and unlikely to be over at today’s high. This is likely to be only a zigzag for the first movement within minor wave 4.

If minor wave 4 is a flat correction, then within it minute wave a is a complete three, a zigzag. Minute wave b must retrace a minimum 0.9 length of minute wave a at 1,996.12. If minor wave 4 is a flat correction, then the normal range for minute wave b within it is 1 to 1.38 the length of minute wave a at 1,991.8 to 1,974.82.

If minor wave 4 is a double combination, then the first structure within the double would be a zigzag labelled minute wave w. The double may be joined by a three in the opposite direction labelled minute wave x which would most likely be very deep and may make a new low below the start of the first structure in the double at 1,991.68. There is no minimum nor maximum depth for minute wave x, and it must only be a corrective structure.

If minor wave 4 is a triangle, then there is no minimum nor maximum depth for minute wave b within it. It must only be a three wave structure. Minute wave b of a triangle may also make a new low below the start of minute wave a at 1,991.68 as in a running triangle.

What all that essentially means is to expect choppy overlapping sideways movement for another two or so sessions. A new low may be part of the correction, so a new low at this stage does not mean minor wave 4 is over.

Minor wave 4 may not move into minor wave 1 price territory above 2,050.37. If price moves above 2,050.37, then use the alternate hourly chart below.

ALTERNATE HOURLY CHART

By simply moving the degree of labelling within the last downwards wave down one degree, it may be that minor wave 3 is not over and minute wave i may have just completed. The correction which began today may be minute wave ii, another second wave correction.

The dark blue channel is a base channel. Draw the first trend line from the start of minor wave 1 to the end of minor wave 2, then place a parallel copy on the end of minor wave 1. A third wave should break below the base channel; minor wave 3 has done this which confirms a third wave.

Once a base channel is breached by a strong third wave, then it should offer resistance for a throwback. This lower blue trend line indicates that the correction which began today may be more likely shallow than deep which fits the main hourly wave count better than this alternate.

But base channels don’t always work as expected, so all possibilities should be considered.

If price breaks above 2,050.37, then the correction cannot be a fourth wave and must be another second wave correction. At that stage, the most likely structure for minuette wave ii would be a double zigzag to end about the 0.618 Fibonacci ratio at 2,067.

Minute wave ii may not move beyond the start of minute wave i above 2,113.32.

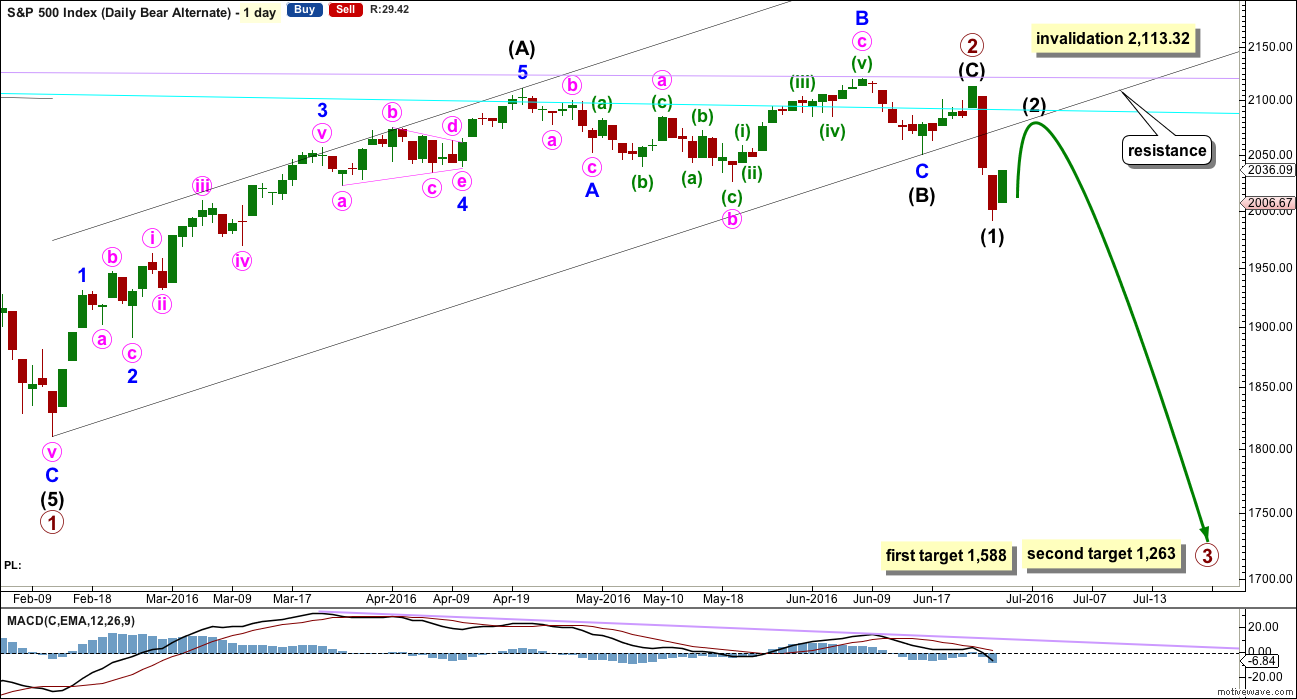

ALTERNATE DAILY CHART

Primary wave 2 is relabelled. Intermediate wave (B) within it may have been more time consuming than previously expected. It subdivides as an expanded flat, minor wave B is a 1.16 correction of minor wave A and there is no Fibonacci ratio between minor waves A and C. Minor wave C ends slightly below the end of minor wave A avoiding a truncation.

Within primary wave 3, no second wave correction may move beyond the start of its first wave above 2,113.32.

At this stage, this alternate does not diverge from the main wave count at the hourly chart level. Both see an impulse downwards complete and both would expect a correction to most likely unfold. Again, look out for continuing surprises to the downside.

This alternate is judged to have a lower probability than the main wave count because it does not have as good a look.

Targets are slightly different for primary wave 3 because for this alternate it begins at a slightly different point. The lower target is still favoured because primary wave 2 was very deep. At 1,588 primary wave 3 would reach 1.618 the length of primary wave 1. At 1,263 primary wave 3 would reach 2.618 the length of primary wave 1.

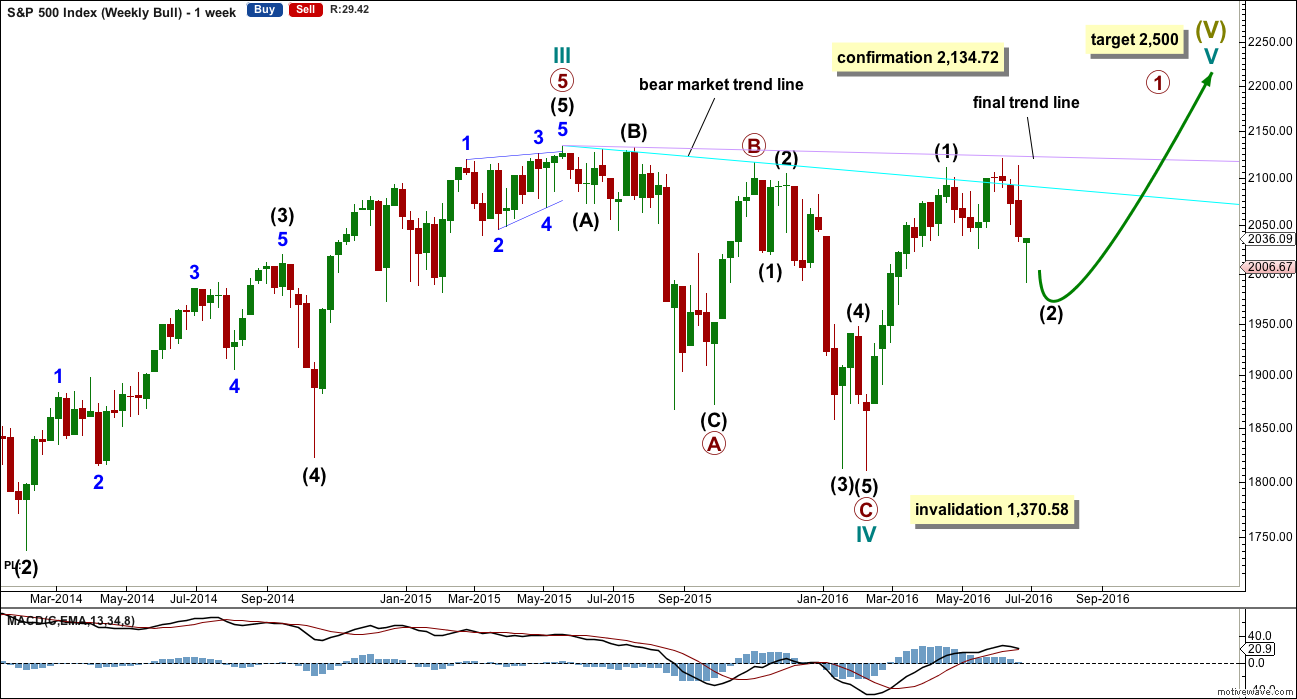

BULL ELLIOTT WAVE COUNT

WEEKLY CHART

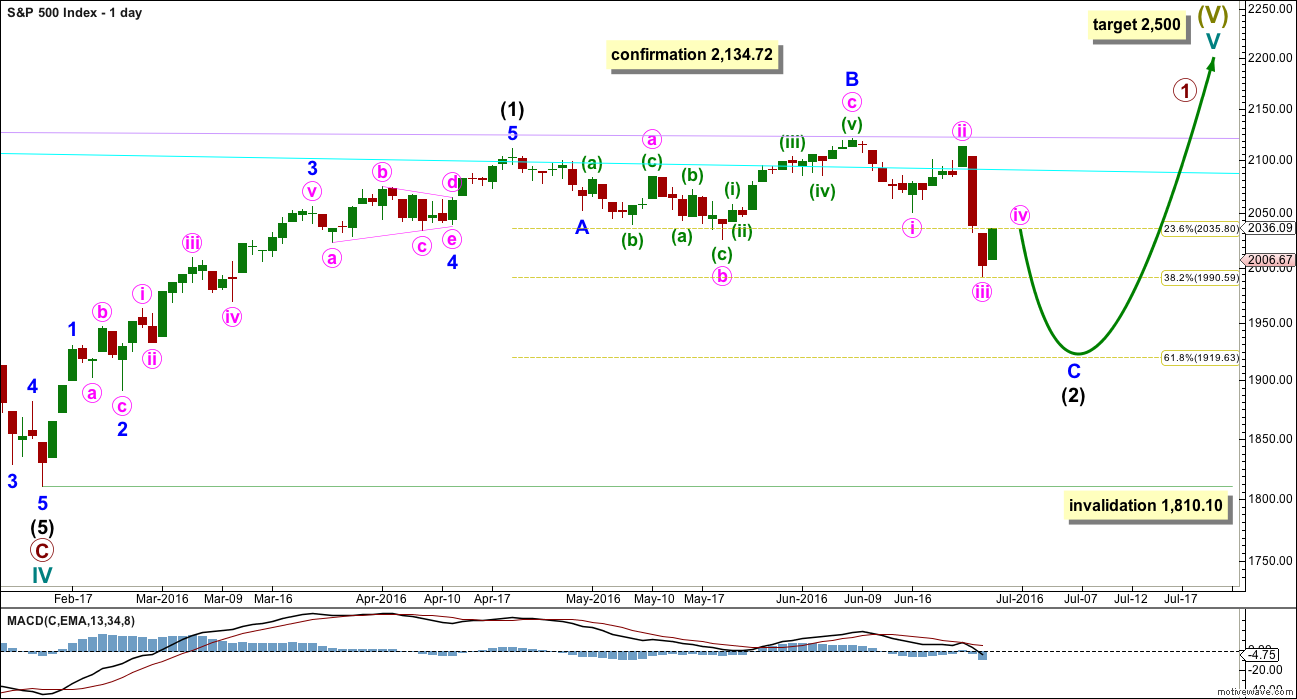

Cycle wave IV is seen as a complete flat correction. Within cycle wave IV, primary wave C is still seen as a five wave impulse.

Intermediate wave (3) has a strong three wave look to it on the weekly and daily charts. For the S&P, a large wave like this one at intermediate degree should look like an impulse at higher time frames. The three wave look substantially reduces the probability of this wave count. Subdivisions have been checked on the hourly chart, which will fit.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV may be a complete shallow 0.19 regular flat correction, exhibiting some alternation with cycle wave II and lasting nine months. Cycle wave IV would be grossly disproportionate to cycle wave II, and would have to move substantially out of a trend channel on the monthly chart, for it to continue further sideways as a double flat, triangle or combination. For this reason, although it is possible, it looks less likely that cycle wave IV would continue further. It should be over at the low as labelled.

At 2,500 cycle wave V would reach equality in length with cycle wave I.

Price has now broken a little above the bear market trend line. This line is drawn from the all time high at 2,134.72 to the swing high labelled primary wave B at 2,116.48 on November 2015. This line is drawn using the approach outlined by Magee in the classic “Technical Analysis of Stock Trends”. To use it correctly we should assume that a bear market remains intact until this line is breached by a close of 3% or more of market value. Now that the line is breached, the price point at which it is breached is calculated about 2,093.58. 3% of market value above this line would be 2,156.38, which would be above the all time high and the confirmation point.

This wave count requires price confirmation with a new all time high above 2,134.72.

While price has not made a new high, while it remains below the final trend line (lilac) and while technical indicators point to weakness in upwards movement, this very bullish wave count comes with a strong caveat. I still do not have confidence in it. It is produced as an alternate, because all possibilities must be considered. Price managed to keep making new highs for years on light and declining volume, so it is possible that this pattern may continue to new all time highs for cycle wave V.

The invalidation point will remain on the weekly chart at 1,370.58. Cycle wave IV may not move into cycle wave I price territory.

This invalidation point allows for the possibility that cycle wave IV may not be complete and may continue sideways for another one to two years as a double flat or double combination. Because both double flats and double combinations are both sideways movements, a new low substantially below the end of primary wave C at 1,810.10 should see this wave count discarded on the basis of a very low probability long before price makes a new low below 1,370.58.

DAILY CHART

Intermediate wave (2) may be continuing lower. The 0.618 Fibonacci ratio would be a reasonable target at 1,920.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,810.10.

I still do not have confidence in this wave count. It absolutely requires a new all time high above 2,134.72 before it would be taken seriously. This wave count has no support from classic technical analysis at the monthly chart level.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another strong downwards week is supported by an increase in volume. If next week can remain below the lower orange support line, then a downwards breakout from consolidation would be confirmed.

Overall price is falling on increasing volume For four weeks in a row. This supports a downwards trend.

On Balance Volume trend lines have been redrawn again. OBV may be finding support this week at the first yellow line. This may initiate a bounce next week, but it does not indicate how long the bounce may last for though, only that a bounce here is likely.

RSI is neutral. There is plenty of room for price to fall. This downwards wave may only be considered over when RSI reaches oversold at the weekly chart level, and preferably also exhibits divergence with price at a low. This was seen at both the last two important weekly lows, so it will be expected as likely to show up again.

Price has been range bound for several weeks at the weekly chart level. It is not breaking down below the lower edge of support which is about 2,040 (orange lines). If this week’s session closes below 2,040 with a red weekly candlestick on higher volume, then it would be a classic breakout to the downside.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Friday’s strong downwards day came with a strong increase in volume. The fall in price was well supported by volume. There is a clear downwards trend for the S&P at this time.

Price today moved higher on lighter volume than the prior two downwards days. However, volume for today’s upwards day is the strongest volume for an upwards day (excluding options expiry dates) all the way back to 4th of March. There was some support for upwards movement from price today, but not as much support as there was for prior downwards movement. The volume profile is still bearish.

With relatively high volume for toda’ys upwards day, some more upwards / sideways movement should be expected before the bulls are tired enough to allow the bears to again be in charge. This supports the hourly Elliott wave counts, but does not indicate which hourly wave count is correct.

Today’s strong green daily candlestick completes a bullish engulfing pattern, the strongest reversal pattern. It comes after a decline, so the signal should correctly be interpreted as indicating a trend change. A trend change does not mean from down to up though. It can also equally mean from down to sideways. This supports the idea of some more upwards / sideways movement and supports the hourly Elliott wave counts.

ADX is increasing and the -DX line is above the +DX line. There is a trend and it is down.

ATR strongly agrees as it too is increasing.

On Balance Volume today has found support at the lower yellow line and come up to touch the upper yellow line. The break below the upper yellow line by OBV was a very bearish signal, so that line may now be expected to provide resistance. This supports the main hourly Elliott wave count over the alternate hourly Elliott wave count. If OBV finds resistance here, then it may force sideways movement rather than upwards and may hold down price and stop further rises. A break below the lower yellow line would be bearish. A break above the upper yellow line would be bullish.

RSI is not yet oversold. There is still room for price to move lower. A low may be only expected to be in place when RSI reaches oversold and preferably also exhibits some divergence with price at lows. There is no divergence with price and RSI at the lows to indicate weakness in price.

Price today moved upwards and Stochastics moved strongly downwards (red arrow). There is no longer divergence between price and Stochastics at the last two swing lows.

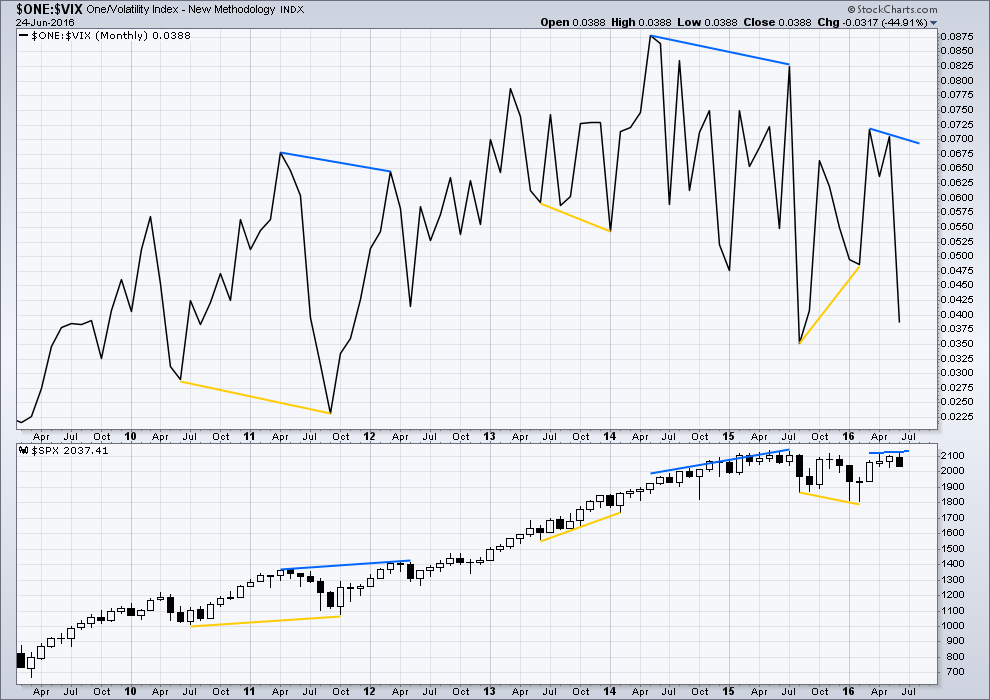

VOLATILITY – INVERTED VIX MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Several instances of large divergence between price and VIX (inverted) are noted here. Blue is bearish divergence and yellow is bullish divergence (rather than red and green, for our colour blind members).

Volatility declines as inverted VIX rises, which is normal for a bull market. Volatility increases as inverted VIX declines, which is normal for a bear market. Each time there is strong multi month divergence between price and VIX, it was followed by a strong movement from price: bearish divergence was followed by a fall in price and bullish divergence was followed by a rise in price.

There is still current multi month divergence between price and VIX: from the high in April 2016 price has made new highs in the last few days but VIX has failed so far to follow with new highs. This regular bearish divergence still indicates weakness in price.

At the end of this week, there is no bullish divergence at the monthly chart level from VIX. Overall, more downwards movement is still indicated for price.

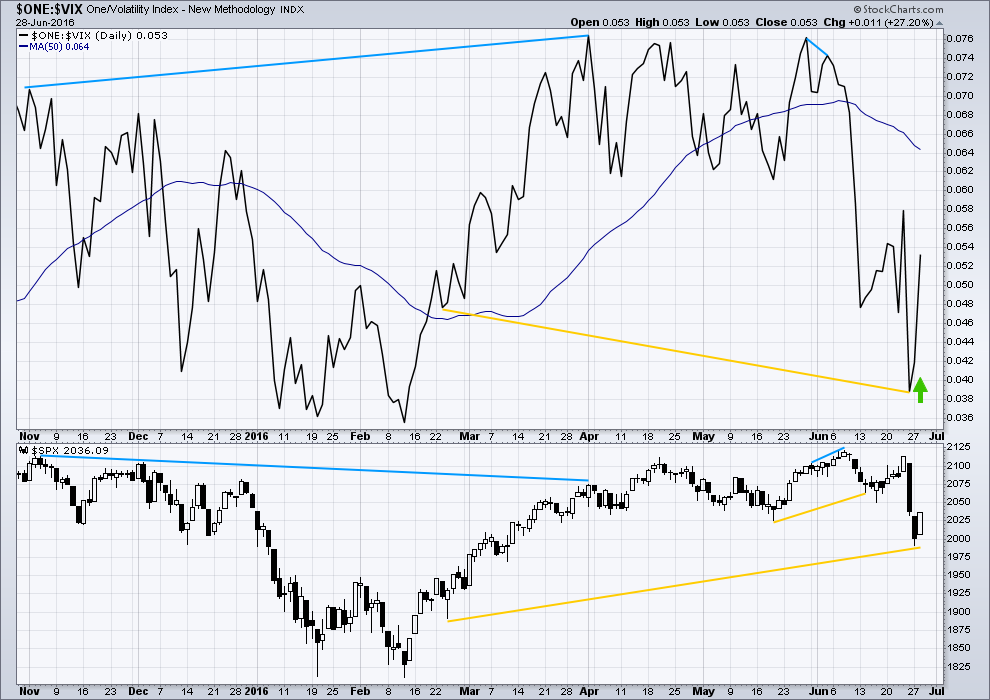

VOLATILITY – INVERTED VIX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is an instance of longer term possible hidden bullish divergence noted here between price and inverted VIX with longer yellow lines. From the low of 24th February, volatility has strongly increased yet this has not yet translated into corresponding lows for price.

Price moved strongly lower for Monday’s session yet volatility declined, identified by the small green arrow. This short term bullish divergence should be taken seriously. It indicates price is very likely to move higher short term. This bullish divergence will probably need more than one day of upwards movement to resolve it, so this still supports the hourly Elliott wave counts.

Price today moved upwards and volatility declined. This is normal and to be expected.

While I would not give much weight to divergence between price and many oscillators, such as Stochastics, I will give weight to divergence between price and VIX. Analysis of the monthly chart for the last year and a half shows it to be fairly reliable.

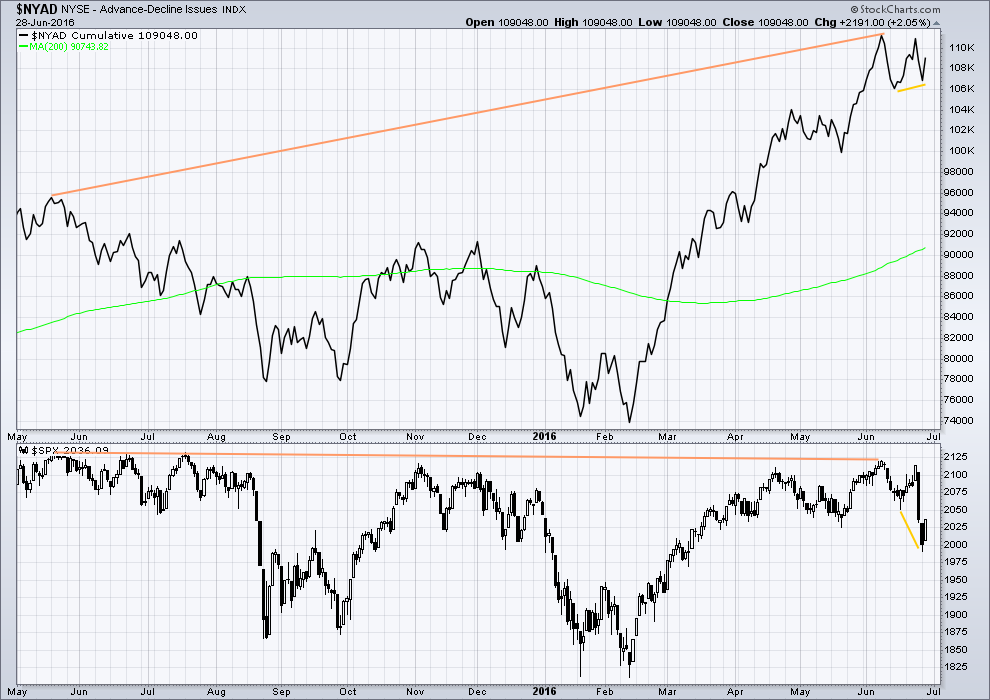

BREADTH – ADVANCE DECLINE LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the AD line increasing, this indicates the number of advancing stocks exceeds the number of declining stocks. This indicates that there is breadth to prior upwards movement.

Taking a look at the bigger picture back to and including the all time high on May 2015, the AD line is making substantial new highs but price so far has not. While market breadth is increasing beyond the point it was at in May 2015, this has not translated (yet) into a corresponding rise in price. Price is weak. This is hidden bearish divergence.

There is divergence between price and the AD line indicated by short yellow lines. Price made new lows but the AD line has failed to make corresponding new lows. This indicates some weakness to downwards movement from price. There is less breadth to downwards movement this time. This divergence is bullish and also supports the hourly Elliott wave count.

DOW THEORY

The last major lows within the bull market are noted below. Both the industrials and transportation indicies have closed below these price points on a daily closing basis; original Dow Theory has confirmed a bear market. By adding in the S&P500 and Nasdaq a modified Dow Theory has not confirmed a new bear market.

Within the new bear market, major highs are noted. For original Dow Theory to confirm the end of the current bear market and the start of a new bull market, the transportation index needs to confirm. It has not done so yet.

Major lows within the prior bull market:

DJIA: 15,855.12 (15th October, 2014) – closed below on 25th August, 2015.

DJT: 7,700.49 (12th October, 2014) – closed below on 24th August, 2015.

S&P500: 1,821.61 (15th October, 2014) – has not closed below this point yet.

Nasdaq: 4,117.84 (15th October, 2014) – has not closed below this point yet.

Major highs within the new bear market:

DJIA: 17,977.85 (4th November, 2015) – closed above on 18th April, 2016.

DJT: 8,358.20 (20th November, 2015) – has not closed above this point yet.

S&P500: 2,116.48 (3rd Nobember, 2015) – has now closed above this point on 8th June, 2016.

Nasdaq: 5,176.77 (2nd December, 2015) – has not closed above this point yet.

It is a reasonable conclusion that the indices are currently in a bear market. The trend remains the same until proven otherwise. Dow Theory is one of the oldest and simplest of all technical analysis methods. It is often accused of being late because it requires huge price movements to confirm a change from bull to bear. In this instance, it is interesting that so many analysts remain bullish while Dow Theory has confirmed a bear market. It is my personal opinion that Dow Theory should not be accused of being late as it seems to be ignored when it does not give the conclusion so many analysts want to see.

This analysis is published @ 10:23 p.m. EST.

OK, so who knows the XABCD? Not going to explain it cause I’m going to bed. Good night. (chart is 45min S&P 500 CFD).

I’ve opened another short position (stop is just below breakeven on my first short) entry 2,074.27, stop just above 2,129.98 (my broker uses after hours futures data and it makes a difference to where I have to put stops, this is the last swing high from the daily chart) to risk only 5% of equity on this trade.

I’m comfortable with having to hold it underwater for a few days. Divergence with VIX today and also the AD line tells me the probability of a turn here or very soon is high.

Target for now 1,271 but that will probably change.

Dr. Andrews, inventor of Pitchforks, original course states five observations concerning the Median Line (ML).

“There is a high probability that:

1. prices will reach the latest ML

2. prices will either reverse on meeting the ML or gap through it

3. when prices pass through the ML, they will pull back to it

4. when prices reverse before reaching the ML, leaving a “space”, they will

move more in the opposite direction than when prices were rising toward the

ML

5. prices reverse at any ML or extension of a prior ML” 6

His words were “prices will come to the Median Line 80% of the time”. He believed the fork system to be based on physics, natural laws, and also some geometry. I’ve seen mathematical formulas, will have to look for them. I have an old 80 page manual on them. I thought more people knew about these, hence the light info about them originally.

Thanks for that Peter!

I think most of us will have seen them, but have only a superficial knowledge of how they work. So your info is most helpful.

There is more to them of course; and there are more percentages available…just like explaining EW in one paragraph. To be able to use it after one paragraph would be impossible trading real money.

Just an idea here:

Wave 1 down: 2121 to 2050

Wave 2: a: 2050 to 2113, b: 2113 to 1992, c: 1992 to 2077, so c is about to finish and wave 3 down is about to start, the target for wave 3 is 1864.

Echoing to Vene’s points, I am sharing my position and reason:

I bough UVXY last night but found out I was too early so this moring I shorted UVXY to offset my loss (from SPX 2034 to 2066). I am looking at tomorrow to see some wave down. I also noticed the divergence today. If you look at $BCMM and Skew today, they are extremely high. They are almost at the same level as pre-Brexit yesterday and today. But I am a beginner in EW counting, so it’s very difficult to count it right as it happens especially for wave 4.

Another point I want to make is: waving counting is one thing, trading skill is another thing.

I will strongly agree with your statement, wave counting is one thing, trading is a separate skill set.

In fact, I’d go so far as analysis is a separate skill from actual trading.

So thank you for sharing your trade Zheng. We can all learn from watching each other.

Ris – believed you asked for time targets for end of Intermediate wave (2) up. Chart is S&P 500 CFD contract, 30 minute. Forking shows the possible time targets given the Fib numbers/or resistance numbers of retracement 2084 and 2087 (.78 Fib for example for 2087). If there is to be a 100% retracement the method is to add another parallel line on the top side the same distance apart as each of the others: if that did happen then would take us into Friday. Saying forking is a tool just like all the rest, not 100%, but useful. Times shown on chart.

Ok, let the jokes fly on my ‘forking’.

Not ready to stick a fork in it yet, not done?

someone is feeling better!

EDIT: forgot the TA….the market is going to go higher tomorrow because I have put options to buy.

LOL

Yes, Nurofen is a wonderful thing 🙂

Not sure about your TA there though Peter.

Is price supposed to come up to touch the upper edge of the fork? How often does that happen? in other words, how reliable is that fork?

As Yogi Berra said, “When you come to a fork in the road, take it”.

the lines of a fork are support and here, resistance. The middle line is the strongest one. Think of it as pivot points in concept, you get say 3 supports, 3 resistances for the time period you’re looking at. You don’t really know which one is the one it is going to be, they are targets. But then tie them into Fib. numbers, which I did, and they become stronger targets. Don’t know the numbers pertaining to accuracy to each line, mainly because it changes depending on the time length of the chart, the price action, where is price coming from up or down?, the size of the fork pattern (a year, a week, an hour?), etc.. Hard to explain in one paragraph. Yet, you can use them to predict time too once you establish a good price target. Chart posted is example.

Thank you very much Peter for the explanation. It makes sense to me.

much more posted above! in new comment

Peter,

My EW charting is no way near you folks so taking baby steps with Fibonacci retracements as those seem to work in shorter timeframes better for me. If we take the move from Monday’s Low (1991) to today’s High (2073). We have the following likely retracement targets

0.236 2053.648

0.382 2041.676

0.500 2032

0.618 2022.324 (most logical point for a pause or short term trend change)

0.786 2008.548

1.000 1991

Also, assuming that the move from 1991 to 2073 was ‘a’ the next logical move is down for wave ‘b’ to somewhere between 2022-2009. Followed by ramp higher for wave ‘c’ to 2,087 (as that represent the 0.786 level from the bigger drop from 2,113). Thoughts?

StockCharts data is close to final. I see divergence today with price and inverted VIX, bearish. As you know, I take that one seriously. It indicates we should go down tomorrow.

Normally divergence with price and VIX seems to be followed by the expected move the very next session, but I have seen it continue for three days before price turned (although that was on overall sideways movement, here we have clear upwards movement).

So for frustrated bears, this is a good indicator the bounce may be over at todays high. From what I see so far.

I’ll be adding to my short position here.

The Headlines show sentiment? From Yahoo Finance as of now:

“That’s all, folks – the Brexit crisis is over”

Thanks, that looks pretty bullish.

I’d be more confident of a turn here if greed was more dominant. But today this indicator has it at only 60. Not yet extreme.

I like this CNN indicator as it’s updated daily. I’m just not sure how accurate / reliable it is. Just another small piece of the puzzle.

Thanks for the heads up Lara. I am sorry about your neck. Muscular – Spinal issues are never any fun and can be quite debilitating. I am a former football (American) player and know all about these issues. I hope you feel better soon.

I am also sorry your patience has been tested so much. But I appreciate your intervention and hope I can continue as a member making worthwhile contributions. I have so appreciated this forum and the people on it. I’d be very sad to see it go away or become a place that creates more TA & trading issues than it solves. You’ll notice I have not been around a whole lot recently.

Keep up the great work.

I figured your shorts may be underwater and causing some stress. I figured that may be why you were more absent than present lately.

This forum will stay, I may just be tougher on the moderation. I let things pass which annoy myself but seem to be appreciated by others. I don’t think I’m going to do that anymore.

When the emotion here affects my analysis then it has gone too far. I need to stay objective and unemotional.

Cheers Rodney. May your shorts all drain soon.

For those that miss my rant below:

My patience is wearing very thin indeed. A couple of people here (one in particular knows who they are, I have warned this person before) are at last chance.

If you don’t read my analysis and don’t take my trading advice, and you’re only here for the community, then you may find that community no longer accessible to you if you can’t stick to facts and keep jumping in with emotion.

Every single time price comes up for a correction the bullishness here increases. I’m actually viewing it as a contrarian indicator, which so far is proving somewhat useful (looking on the bright side).

But it is exhausting. I am not well today and my patience is very thin.

So here is what I am expecting to see:

If you post a chart with labels it had better darn well be a good EW count, no random stick a couple of numbers and letters on it and call it EW.

If you make a prediction then it needs to have some technical analysis to back it up. No random predictions. If you make a prediction of a new ATH then you have better justify that with some solid TA.

This is a technical analysis site. Anyone ignoring technical analysis will be removed. My patience is that thin today.

Now, even if my wave count is horribly wrong and we do end up with a new all time high I will stand by these comments. Because if someone can show me solid TA reasons for it I’ll change my position on a dime.

It has to be obvious to even the most casual participant that there are a number of serious and reasonably well-informed traders on the forum. No one objects to a differing opinion. It should however, be an opinion based on fact and reason. It is grossly disrespectful to both the host and other traders to be constantly voicing opinions, particularly when contrary to Lara’s analysis, not in any way supported by attendant and supporting information. Here is what I would humbly suggest: before you spout off about what you think the market is going to do – preface that opinion with exactly what trades you are making based on your viewpoint and conviction. What you actually do, speaks volumes more that just your opinion. There are a few individuals with different perspectives that have provide quite reasonable basis for their views. I am of course not talking about those individuals. If you are trading nothing, based on your market opinion, that is exactly what it is worth to other traders, no offcence. “Nuff said! 🙂

A good point actually Verne.

For the bullish traders amongst the membership, I am aware that you are using technical analysis (as opposed to fundamental) and I am expecting that you are successful traders.

Sharing some trading insights with us all would be very valuable information. Then we could all (including me) learn from your experience, knowledge and practice.

Oh I forgot. I was filled at 1.85 for my July 10 strike puts. I did end up using a spread by adding 5 strike puts for a spread of 5 points. Plan is still to take assignment if UVXY below 10 in three weeks. 🙂

Sorry I’m late today folks, not well.

The alternate hourly wave count (or a variation of it) is correct. This is another second wave correction.

These second wave corrections are getting exhausting psychologically.

So far I have it as a double zigzag, but I will look at the five minute chart and see how that fits before publishing the hourly for that.

It’s close to the 0.618 Fibonacci ratio, a reasonable place for it to end here.

Hope you feel better! 🙂

Thank you Tom. Too much computer use actually, my neck has seized up.

So to anyone asking for analysis of any other market, the answer this week will be no. Until this issue is resolved.

Standing up and working at a countertop seems to be pretty good for now though.

Now, if the wind would switch to offshore I could go surfing and I’m sure that would solve my neck problems!

Any comments on this article from Zero H??? From options & VIX people…

The Real ‘Fear’ Index Just Went To ’11’

http://www.zerohedge.com/news/2016-06-28/real-fear-index-just-went-11

Here is a taste of it…

“A funny thing has happened below the surface of the markets since late last year. As first The Fed, then The BoJ, and The ECB respectively saw their credibility crushed into a mumbling excuse pool of elite utterances as global bond yields crashed along with global growth and inflation expectations, professional investors have been busily buying crash protection (carefully masking their buying by managing ‘normal’ risk measure like VIX through endless nefarious cash, ETF, and Futures manipulation). But now, a week after ‘Black Swan’ bets soared ahead of the central-plan-destroying Brexit vote, the real ‘fear’ index has spiked to unprecedentedly high levels.

With VIX flip-flopping to and fro at the whim of every fast money trader…”

This is the alternate bear count as I see it at this time… the minuette wave b looks unusual for a triangle but it works on the 3 min chart.

This is minuette w (b)

Thank you Gary

Interesting to have a few days off, then come back and read through the comments on this board… 🙂

Time for me to share another chart.

As a bull, i had expected wave 2 to drag out all summer… But, given the strength in the market I’m considering the possibility that wave 2 might might well be over and we have in fact begun 3 to the upside already.

The low from 1990 up to 2070 still counts as a 3, but if market pulls back and stays above 2040(ish), before turning into an impulsive 5, then loading up long on the next corrective pullback will be the trade of 2016 imhumbleo

P.S. the vertical lines are fib lines. uncanny timing of the turns don’t you think? 🙂

No matter how much I have been puking… I completely disagree this is a 3 up and a bull count! Not with the R & D that has already begun! IMO! and what 30yr UST has signaled.

Respectfully

So Stuart, you do not see your wave B as a five wave impulse?

Hi Gary,

Could well be, and in fact an alternative I’m also considering (which would actually be my favoured) is one where wave B is on this chart is actually just the end of wave one up, and that this Wave 2 correction continues for another couple of months before completing circa 1950ish

I’m no wave counter by any means.

All i’m worried about is being on the right side of the market as much as i can be 🙂

Hello Stuart – have concerns on the chart wave count where the red A down is not five waves; the red B up is not 3 waves. And then the whole up from the Feb. low was really rotten inside, i.e. low volume, unconfirmed by many other indexes, etc.. And fundamentals going the other way.

Hi Peter,

What can i say? I’m no expert wave counter, but i suggested in early March that maybe this was an impulse up from the Feb lows and the market went up another 200 points… 🙂

Rotten to the core this market may be but i wont fight the tape for long if the message it’s sending tells me what I’m thinking might be wrong

The above count isn’t my primary expectation, but presented as a what if, just in case the market defies all logic again 🙂

I was long the entire Feb. large wave up, made a killing, but still was a bear. I was long up too into Thursday June 23rd, made another killing pulling out 191 basis points (long and shorting too during it), but still a bear. Just because the large wave up from Feb. low did go way up does not mean we are in a bull market.

I agree Peter.

How far that wave retraces will likely determine the bull versus bear scenario.

If we don’t break much below 1950, that would be a major clue.

Stuart: Your C wave subdivides A-B-C

C waves subdivide as fives, not threes. With the exception of C waves within triangles, which is clearly not what this is.

Your EW labels are an invalid count.

Hi Lara,

Defo not going to disagree with you over EW rules, that’s your realm of expertise. How about this count? Valid under EW?

Thanks 🙂

My realm of expertise isn’t just EW, it’s technical analysis. I am a CMT for a reason.

This idea is better, yes. But I’ve said this before and you’re still not doing it so I’ll say it again. It needs to be put into context. EW is fractal. If you ignore the bigger picture then it doesn’t work. Your labels here are too few to see the larger context.

Now you have to resolve the problem that the first wave looks like a three, not a five (which is probably why your first chart had the label for 1 over to the left, that looks like an impulse).

And if you can resolve that and have 1 where you now do, then what about 2 being over at the low? It’s a zigzag. It could be done there.

Thanks Lara,

Was working of your bull count which has IV completed at Feb lows. Sorry i should have made that clearer.

I’m not sure about seeing the move up from Feb as a 3 though. I would think its possible to count a 5 up for primary one (to be positioned where it is) a la the count on chart below?

Assuming that count resolves the positioning issue – then for 2 to complete so quickly (as a zigzag) to me, doesn’t seem right somehow…

If i was to think of it in EW terms (as in wave 2’s job is to trick everyone) it would need more opposing sentiment to build (possibily) over a longer period of time to propel it into the wave 3.

That would be my take, and so ideally wave 2 would last longer. But nothing would surprise me right now 🙂

Hi Stuart,

Could I ask what instrument you are charting above. I guess I just assumed it was the S&P 500. If it is, then your wave b of A shows a new high that I don’t show. And, if wave (a) is an impulse then wave (b) should not exceed wave (a). If you are charting an expanded flat for wave (A) then: 1. I don’t have data of wave (b) making new high. 2. wave (a) appears to be an impulse.

Hi Gary,

It’s the US500… or continous SPX

During cash hours is identical to SPX but outside hours is (i supect) derived from ES.

I guess that would explain the price difference you see.

I agree, if 2 was over there it does look too quick and shallow.

I also agree that the upwards wave may subdivide as a five, as you have labelled it. But you must agree that it does have an overall look of a three wave movement.

Now the problem is the S&P just does not always have threes that look like threes and fives that look like fives. But my approach to this problem is this: if a move looks like one and your wave count relies on labelling it as the other, then an alternate absolutely must be considered. What if it’s wrong? What if it is what it loos like? The probability must be judged to be lower.

If you are working off my bullish wave count then you absolutely must acknowledge the problem of structure within primary wave C down; there intermediate (3) has a very strong three wave look to it. Sure, you can make it subdivide as a five on the hourly chart, but that’s a big third wave down. It should look like an impulse.

Not acknowledging this problem means you could be glossing over an issue which is serious, and seeing what you want to see rather than what is actually there.

Any wave count which does not have that problem must necessarily have a higher probability.

Because after all Elliott wave is an exercise in probability, as is all technical analysis.

I’ll just add too, that if you now see a three down for only wave A of your second wave correction, then you have to see B up as a B wave of a flat, or an X wave of a double zigzag (or combination).

If the upwards wave is <0.9 of the three down then you can no longer label it A-B-C because the minimum rule for B of a flat would not be met.

An EW technicality which is important.

Tagging the bottom of the gap, acting as resistance.

Rolling over, with a rounded top, lower highs, this has the look of a waterfall sell off…

After hours push up, but price spikes indicate price looking to go down…

Bought Puts before the close…

SPX target using .786 (as we are past .618 of course) is 2087.02. Fork charting would have that at about 10:30amCST tomorrow.

NOTE: .76 is the incorrect Fib ratio. The correct one is .786.

Spooning leads to forking…

Just FYI 🙂

Calling shotgun on being the big spoon, and not little spoon 🙂

LOL…How are you Stuart? Hope you are well.

What do you think of this move here?

Hi Quang Vo,

Just posted above. Either bullish wave 2 correction is over, and this is the start of the move up, OR just another correction.

Will be confirmed (for me) by the final structure the move from 1990 takes., so that’s what I’m watching right now.

Both VIX and UVXY not close to session lows while SPX making highs for today. We must be close to the end of this face ripping correction…

Could this be IT?

I sure hope so, I feel like puking…so we must be close.

Would love to see this…..

“At 1,588 primary wave 3 would reach 1.618 the length of primary wave 1. At 1,263 primary wave 3 would reach 2.618 the length of primary wave 1.”

I have been puking for several weeks now! These LT positions of mine are getting painful with erosion that is.

My bucket is ready again.

VIX is diverging!

US treasuries haven’t budged……They don’t think this bear move in equities are over.

Overbought doesn’t even begin to describe this move…..

Here’s to Lara’s bear count being right, I am 1/2 short

Double top in place… does it push higher or fail?

still thinking market will want to fill the gap on the daily chart….so higher yet

Yep. Looking at the way UVXY is sinking, it is likely going up.

These banksters are serious….

laura your bullish wave chart looks right on… this feels like a wave 3 up.

laura you do a great job.. lots of hard work..

The Bear Counts are her preferred counts until proven otherwise.

She has issues with the bull count… I am sure she will address your post after she arrives here around 3:30PM ET or so.

No. Each time I address Stuarts posts he ignores me.

I let him remain because other members appear to appreciate his input.

I have addressed Stuarts concerns. If he chose to take notice he would already know what my problems are with that bull wave count.

No problem Lara… I will leave that part out next time I reply to something like this. If I reply.

Fork chart….noting it is for S&P 500 CFD contract, close enough. The time target to reach the upper slopped line for 2084 is at 2:30pm on June 30th, tomorrow. 30 minute chart. Note how it gapped up through the red sloping ‘middle line’ – which is many times the strongest of all the lines. Many times too it takes a wave 3 of some degree to do that, which is what we had here

minute 3 target 1.618 the length of minute 1?

If you accept the June 27th low 1,991.80 as Intermediate (1) down, and that move down of 121.16 x 1.618 = 196.04 basis points down from where ever (2) up we are in now ends. IF 2084, then first down target is 1,887.96. IF 2084 and using 2.618 ratio, 317.20 points down gives target of 1,766.80.

Peter,

I like those targets but the challenge is unless it cuts through 0.618 and 0.786 first, we will not know if the trend is reversed. Yesterday and Today are clear examples of the face ripping rally typical of bear markets. If past is any indicator, we are likely to see majority of the move happening in the futures market ahead of the regular hours.

Do you have any time frames around these targets?

If this is a 1-2, 1-2 down (starting from the June 8th high) it will be a heck of a 3rd down. Would go to 2.618 ratio for a target down then once this second 2 top ends.

test

Remember there is a gap on the daily chart, market will want to fill it. 2084 makes sense then.

Peter,

Glad to see you keeping your options open as I think given the manipulation going in the market, it is best to have a balanced view for better risk management. I read the analysis here along with other reports to better understand possibilities going forward.

the tough part is now it can end at any time as it has met the price structure, what Joseph pointed out in a post below. I bought two little OEX put options out of the money, to test the bidding, so I can watch premium moves, for late July. Will load up on them at each point higher (Friday maybe).

Peter,

I picked a few UVXY but can tell you that bidding is very tight. not saying that it is telling something but just an observation. I have been poking at few bids but very difficult to get price break. I would rather pick some discounted puts into the EOD ramp (as the markets have been doing that lately on positive days). SOH and watching how this one closes.

yea, i’m not an options guy but for the chance here it is the right time to do options (Bear believer that I am). If I lose my premiums no big deal. Taking the chance for the 3 of 3 payday.

clarifying I’m not going into put options in any scale until we hit 2084ish; then the 100% re-tracement if it goes up that far. As my Fork chart above posted shows timing might be at 2:30pmCST tomorrow. But price action itself always rules.

Peter,

I understand what you are sharing. I am watching the bid/ask very carefully for hints.

PUERTO RICO GOVERNOR SAYS COMMONWEALTH WILL DEFAULT ON JULY 1

Legislation passed by the senate… will give the legal means for PR to restructure it’s debt.

Background:

{The Island’s status as a U.S. territory left officials there with no recourse, since a quirk in the bankruptcy code leaves territories without access to the same bankruptcy protections afforded to states and municipalities.}

This is NOT a Bail Out as the media & others are painting this to be. NO Funds will be provided by any US Agency. Just the legal freedom to negotiate a re-structure… all be it under a oversight board. Not sure I like this part unless there is major PR representation on this board.

like it if no taxpayer money is going into it; another federal government screw up where they let the tax benefits for the island expire years ago, companies left = no jobs = no money = no taxes paid = default in 2016

PR should be allowed to file a Chapter 9 BK… but current law doesn’t allow it.

BTW: Chapter 9 BK will be actively used through out the USA to get out from under all that State & Municipal Debt. You know… those so called safe, insured bonds. Where the insurers of those bonds can’t earn a safe return anymore… to back that insurance.

Zero sympathy for PR. They are US citizens can hop on a plane and come to mainland anytime for a job, they don’t because it’s sunshine, rum drinks, dancing and government handouts in PR. Couple of years ago oil boom in Dakota had recruiters in PR looking for all types of workers, a no skill truck driver could make $100K per year. Did anyone give up the easy sunshine and government handouts for $100K per year in cold Dakotas? Very few. Let it all collapse.

Nor do I … but they should have the same Chapter 9 BK rights and any other State or Municipality. The point also is that the debt defaults have started and are only going to get much worse. Question: Based on this backdrop and it showing more evidence each day… how can it continue to be hidden and how can any bull count still be valid?

As for bull or bear count, PR is just a minor part of the USA SPX or DOW picture–part of the big EW picture, already factored in to EW count. As for their rights–the legal / financial consequences have been know for the last 50 years. PR enjoyed the great life while it lasted–while most Americans worked tough jobs in drudge cold and snow, PR enjoyed rum drinks, beach, laid back life on credit. They knew the rules of the game. Now let them and their creditors be responsible for their actions.

PR goes under, all government handouts dry up, citizens must move to mainland and actually get a job, land values in PR plummet, mainland citizens who worked hard and saved money can now afford to buy cheap homes and retire to sunshine in PR. That’s what should happen. Zero government intervention and don’t change the rules after the game is played.

Edit: Lara, feel free to wipe comments on PR. My frustration with government intervention has little to do with with your EW analysis. I should not have posted PR nonsense.

No, that’s fine actually. You can all discuss other topics. It’s just random predictions on what markets may do with no TA support which is annoying.

Yet again another low probability outcome seems to be happening in front of us. Lately, I have been paying special attention to low probability outcomes.

Yet you missed the high probability plummet after the Brexit vote.

No doubt, a very strong channel uptrend on hourly! although hitting the upper edges of the channel, so should need a breather soon. Big question is if/when it breaks this channel downward.

Moment of truth with 2,066 approaching fast a string break above will give some indication on likely direction for days/week ahead.

EDIT: meant strong not string

thus far, Lara’s alternate daily and hourly charts are on the money…seeing technical signs that support the alternate charts…good luck with your trading…

Chris Ciovacco re 2066…

https://twitter.com/CiovaccoCapital/status/748182395984183296

2079 ish is the underside of the black channel line today. This can end at anytime once a structure completes.

This could be an expanded flat when using overnight data for SPX.

If this is minute II of a minor 3 down then this is quite a substantial retrace. I can understand minor 2 being a large retrace but then I thought we would be swiftly down in minor 3.

I’m sure Lara’s alt count showed an *initial* fib target of 2066?

This is my last comment for a while as I’m starting to get wound up – you can lead a horse to water……

I for one, and I’m sure I speak for several others, appreciate all that you do here Olga. Sounds like several (including me) are just frustrated.

I believe in EW, however, too many times we have the wrong count…

Which usually costs us money or opportunities to make money. I am a momentum trend trader and for some reason I missed this move. By no means is this a rip on Lara, she is the best I have ever come across.

I am backing away from posting too because I need to get my head back on straight, but wanted to thank you for all that you do on this board.

It happens every second wave correction. Every. Single. One.

I’m losing patience today too Olga TBH, probably because I’m not well.

Each time price rises the bulls come here and insist it will keep rising. To new all time highs have been called for. Usually with very little technical analysis to support those calls.

The higher the correction goes the stronger the bullishness in this forum. And I have to moderate it…. and read it all…. Previously it would affect my wave count, now it’s just annoying.

Technical analysis people. This is a technical analysis site, not a Make Random Predictions site.

If you make a prediction I want to see some solid TA to support it.

Posting charts with a very few labels to look EW is not TA nor is it EW of any usefulness.

My patience is wearing very thin indeed today…. out with the moderation hammer I go.

Rant over.

Well Lara, hopefully I wasn’t being horrible. I was just upset (at myself) that I missed the wave 2 up, which should have been a tradable event, even within a primary bear count.

No, you’re fine. You’ll know if I’m not happy with any of your comments because I will address the issue immediately. I’m not going to muck around and have people guessing, that’s not conducive to a collegial sharing atmosphere.

I missed it too, and today am kicking myself for not following through and opening a long hedge.

But lets be fair, I did get the target for the last low (I had minor 3 at 2,000) fairly close, just over 8 points off, and did predict this bounce, just had two ideas of how high it could go.

All entirely trade-able.

Some comments here are bothering me *alot* more than the waves today – tells me it’s time to take some time out. The factless emotion is through the roof imho – can do without it 🙁

I hear ya Olga. I really do sometimes wonder why some people even bother to read Lara’s analysis. I am out as well. Have a great weekend!

Looking like UVXY wants to go below $10 soon….more ramp in the offering for the trading session

UVXY now below $10…

This retrace is just totally unbelievable!

It is currently less than the 61.8% retrace – what is unbelievable(!) about it?

Agree and there is more to come if you consider the drop from Friday and Monday, you will get to 2,082ish as retracement. Fibonacci 0.618 level. Don’t forget from recent market action the retracements have been deep so best be prepared for it.

2082 is 0.618 retrace level of which wave?

Olga,

Sorry should have said 0.768 level not 0.618. Here is how I have worked the numbers

I used the drop from June 23 High (2,113) and Low from Monday (1991) giving the 0.618 level as 2,066 but 0.768 level is 2086ish. Given the over throws we have seen lately, I am leaning towards the 2086 hence the comment above.

YEP… Follow the count and follow the signal the 30 Year UST is sending…

30Yr UST Bond is up 14/32’s in price to a Yield of 2.253%….. almost at it’s all time historical closing low in yield and I have been told the all time intra-day low is 2.20%. These were set in End Jan – 1st day of Feb of 2015.

The Rally Up is BOGUS! The R & the D is now here! But you won’t read or hear about it for a few months.

Anyone say TRAP? I prefer FINAL TRAP.

interesting the S&P 100, the CFD S&P 500, the March ’17 e-minis and the Sept.16 S&P 500 futures all made a new low on Monday the 27th…..where the Sept. emini and SPX did not. Clear warning market was going to shoot higher. (and yes I missed it)

wow, what a move from the lows, kicking myself for not trading catching this on the long side.

Considering where we are in the wave count, the last thing I am concerned about is catching the remnants of a terminal wave higher. I am selling 1000 contracts of UVXY puts, July standard expiration 10.00 strikes for limit price of 1.75. The current bid is 1.37/1.38, but I expect a spike lower to push the bid to between 1.75 to 2.00 per contract. I am willing to take delivery of 100,000.00 shares of UVXY at a final price of 8.25 per share if filled on this open order. If UVXY is above 10 at expiration I will not complain! Leaving early so have a great rest of the day everybody. Remember to always hedge! 🙂

Vern,

Are these naked PUTs ? Some other TAs are calling for ATH into July 15 so a strong possibility of you getting assigned the shares on UVXY.

If that is the case, a reverse split might happen – would that be good or bad for your position? I’d guess not good?

And why on earth would I not take UVXY at 8.25 per share ahead of a primary wave to the downside? I am not looking at the same wave count as those expecting new ATH. I subscribe to Lara’s service for a reason you know… 🙂

Couldn’t have said it better myself!! 🙂 🙂

Calling for a ATH without any technical evidence creates unnecessary emotion imho. Everyone has a right to an opinion but it is not necessary to keep banging on about it without providing evidence.

There must be a ton of Bullish websites out there – for heavens sake let’s at least invalidate Lara’s bear counts first.

Verne,

With all due respect, it’s hard to see/argue with a 70+ move in the ES and realize that the only trade I had was a 5 point loser because I traded against the the short term trend. Had I been a little less bearish and traded 100 contracts on the long side and caught 50 points, it would have been a $250k pay day in under 24 hours.

Wish I would have been a little more nimble. All I can do now is wait and watch. I’ll get over it, but dang…..

Quang,

There are going to be a lot of opportunities for traders to play the market swings in the future. I will not be too concerned about missing a few as hindsight is 20/20. Learn and implement as it works for you based on your experience.

I hear you. Been there more times than I care to remember. If we believe Lara’s wave count is right, and I certainly do, I will happily forego 250K to the upside, to get positioned for a bigger payday to the downside. It is all a matter of perspective and strategy I guess….

Held calls but closed them yesterday – way too early – out of excessive caution. Missed a lot of this move.

FWIW, do not look back. Look forward. I bought the upside at the lows, and I just couldn’t hold through today, sold yesterday… Remember, the trend is down… The higher the market goes, the better you can position for the short side. Your big bets/risks should be to the downside… Look forward to the posibility that this is a 2nd wave correction of some sort, and the 3rd wave down most likely still coming.

Good luck…

Don’t kick yourself: yes you knew it was going higher, but you had no idea it would be a strong zig zag up. You couldn’t accurately figure out a risk/reward ratio and rightly stayed out.

I’m kicking myself. I considered an upside hedge while I hold onto my shorts, I knew it would go up, but I didn’t ‘expect it to go up this much so my risk / reward calculation didn’t consider this.

Oh well. Next time maybe.

That label of a complete intermediate one down is most intriguing.

I always thought the coming decline in the market would unfold far faster than any one expected because of the protracted time of unending CB intervention.

An intermediate wave, even an impulsive one completing in three days takes this concept to scary new levels. I think it is a very real possibility that we are indeed already in intermediate two up, ahead of intermediate three of primary three, the big cahuna.

The only caveat is that these kinds of crashes happen typically in the fall. We will see…..

Vern,

I am building my reserve position piece by piece a trade at a time for the big one…remember Rome wasn’t build on one day..

Ris that is smart. We all look back at trades we wish we had made.

It is far more important to have a trading plan and be disciplined in its implementation. If I had a dollar for every trade I closed and watched it explode two to three times higher I would be a billionaire! (Just kidding, but you get the idea!) 🙂

Here we go again! This market is Fixed!

Unbelievable!

I am more and more convinced that 20% to 30% DOWN in ONE Day… will be the resolution to this madness!

Provided we stay below Thursdays high we’re good. Just nested 1,2’s – there is still alot of belief in buy the dip and new ATH so this kind of reaction is expected.

Alot of people still think the drop was a gift – they’ll chase momentum and trigger stops.

Keep counting those waves – it’ll save yer sanity 🙂

Thanks… I will, that’s why I am here. It’s my Italian-American Blood that gets the best of me at times.

If it is intermediate two up, I suspect we will see a manic run at the invalidation point of 2113.32. That will be my assumption if UVXY breaks 10.00

I also think the manic run, if it takes place, will happen going into Friday’s session; perhaps spurred by some FED blandishment?

Chart updated – had labels in wrong place.

One way to look at this action. This whole wave up could also be just wave (w) of a double zig zag with (x) down and (y) up still to go, but price will prob reach 61.8 fib, so 2nd zig zag not necessary to move price higher imo.

And.. still put (i) in the wrong place!!! Ahhhggg – should be 2023.

That will make a difference to the invalidation point of (iv) down

The reason I say the following, is that I witnessed 1987 and the lead up to it and I was in tuned to all that was going on at that time.

“I am more and more convinced that 20% to 30% DOWN in ONE Day… will be the resolution to this madness!”

What is scary… is that back then, the economics were sound. We had growth mostly north of 4%+. Tremendous employment growth… with great paying jobs being created! The foundation for the stock rally to the year 2000 was laid & built in the 1980’s.

Today… the economics are NOT sound… The jobs being created today are mostly part time minimum wage jobs. We have declining growth worldwide. We have exploding debt at record levels with NO end in sight to exploding debt levels.

Now (last 4-5 years) like then people were amazed at how high the market was going and thought new highs would continue on well into the future.

Then the bottom fell out in One Day & the following several weeks. But then it recovered.

This time, it will not recover… it will continue down to where it all started. New All Time Highs will not be seen again in my remaining life-time.

I have faith in the alt daily Bear Count… It looks like the underside of the channel is at 2079ish today. If you believe in this count then anywhere from here to 2079 can end this advance… once a structure at lower degree is completed. Olga posted one below or above… not sure where this post will be placed.

This is likely another 2nd wave – first target 2066, then 2084.

Yep! 🙂

Olga,

As I had stated it on Monday intraday, I am looking market (S&P) to hit 2,082 before picking significant short position. I think we have been very aggressive in assuming that bear count will work whereas the market has larger resources and influence to control it much better than what individual retail investor have at their disposal.

FED is probably enjoying the turmoil in EURO as it helps fuel the demand for US Dollar. Looking now to short NUGT as it will likely come down hard…:)

I do not share the view that the tail wags the dog Ris, so respectfully disagree with your reasoning, albeit that doesn’t mean your target won’t turn out to be correct.

My long term belief that the news follows EW (not vice versa) has worked for me for a long time. If your belief that the FED makes the market works for you then that’s great. It’s all about what works for each of us at the end of the day.

Olga,

Understand your point but it all depends on the timeframe that one is looking for. Timing is everything in these markets and it is very difficult to align trading to it.

I think we should hit the 2075 to 2080 area today in what is now clearly a second wave. If it is intermediate degree UVXY should initiate a new series of 52 week lows beginning before the close today. We should see a spike down in that case. If it is at minute degree I would expect UVXY to hold above ten. A lot of careless folk are going to probably get trapped this week-end. Then again, maybe there is an instinctual sense of what is blowing in the wind and folk may head for the exits before the close on Friday…

Agree on folks trapped but likely hit the target tomorrow or early Friday morning.

Could it be that minute 1 finished at 2054.96 instead of the 2050.37 point? If that is true it would allow a little more breathing room to the upside but not much.

Both points violated at the open so it doesn’t matter. Alternate daily bear count in play. 2067 is not the target for minute ii.

I am hoping to see UVXY below $9.50 before the week ends given the pace at which it is being sold. I feel for options holders as the decay is brutal.

I’m waking up to big upside on my UVXY puts.

Barry,

Congrats, I am happy with my trade on UVXY yesterday and now waiting for the next move on UVXY.

If this is intermediate two up it will. If a second wave of lower degree or a fourth wave it will probably not. In either case it is setting up for the year’s biggest pop.

Vern,

Biggest pop in S&P or UVXY, please clarify?

If we are in intermediate two up of primary three I think UVXY will make a new 52 week low. For the subsequent start of intermediate three of primary three UVXY would be expected to make its high for the year in the middle of that wave down. If minor four is still underway, I would be expecting a lower high at the end of minor five.

I like when you speak this clearly 🙂

Why would you feel sorry for holders of UVXY put options? If they are nimble, puts should pop quite nicely at the open. I am still holding a 9 puts from my last spread trade that are starting to show some life! 🙂

Vern,

Meant Call holders for UVXY (should have been more clear).

I figured that’s what you meant! 🙂

FWIW, US markets are closed on Monday for 4th of July and I personally don’t feel that banksters will allow them to fall into the Independence day speech by the President 🙂

I’m glad I covered my late afternoon shorts last night. Took a small loss, but had to do it.

wasn’t the 4th of July a cycle day someone here posted? holidays can typically be a change in trend too

Yes, Philip had 7/5 as a cycle date

A new ATH might be possible between now and 8 July, 2016. All the panic overseas is going to feed more many into US markets JMHO.

McClellan also stated he thought the high would be around July 5.

Yup and few others are of the same opinion.

I really would like to see some TA to support this idea.

Something. Anything.

I am genuinely curious as to what TA gives them cause to call for a new ATH. I keep thinking, there’s something I’m missing here. But no one is posting the TA reasons for the call…. just when we get a rally the call is made.

Assuming they remain in control… 🙂

First, Brexit, and now, more bloodshed.

Something very strange is going on in Europe, perhaps harbingers of darkening global social mood.

I don’t know how many people saw that Bloomberg story on Monday about the extremely unusual activity of short sellers targeting Turkish Airlines. I even briefly checked to see if I could find a ticker for US markets to try an figure out what was going on. Of course now we know.

Erdogan though he could keep Islamic State as his personal pet snake.

Buying their stolen oil.

Providing medical treatment to their wounded.

Providing passports and unhindered travel through Turkey to Syria, and numerous other entanglements ad nauseam. I am praying that the good people of Turkey place the blame for this heart-breaking tragedy squarely where it belongs.

I am also quite curious to know what Putin knew about this. He is not a man to easily forgive or forget. I suspect Erdogan knew something bad was about to happen. His sudden and totally unexpected lame apology to the family of the Russian pilot murdered by Turkey in hindsight suggests he perhaps now understands what a catastrophic error in judgment and unspeakable hubris that particular act represented. If he was too stupid to not allowed himself to be goaded into it by the war-mongering US state department, I guess he and the Turkish people are now going to have to pay the piper. How sad!!

Banksters are pumping world markets in an attempt to shore up the dams.

Meanwhile Puerto Rico faces another 2 billion in general obligation payments this Friday, money they are saying the do not have. It will be the first miss of GO payments by the island. Lawmakers are promising a rescue.

Lara… post Brexit is it not worth a look at any European markets ?

Sure. I should update FTSE. Will publish tomorrow.

TBH I’ve not been confident of my FTSE count and wanted price to clarify first.

wooo!! 🙂 uno

second!

turd,, by the way,, its woo hoo Alicia, Verne says whoo hoo

doc, I was in such a race to be first I was lazy and typed the short version lol, but yes, whoo hoo!!

You like Vernes better than mine?

No doc, both equally 🙂