Downwards movement was expected to continue. This is what happened.

Summary: This is still a bear market rally until proven otherwise. A final fifth wave up is required to complete the structure. On Balance Volume strongly suggests that downwards movement for Thursday is over. The target is 2,124. The invalidation point for this rally is 2,134.72.

To see last published monthly charts click here.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

New updates to this analysis are in bold.

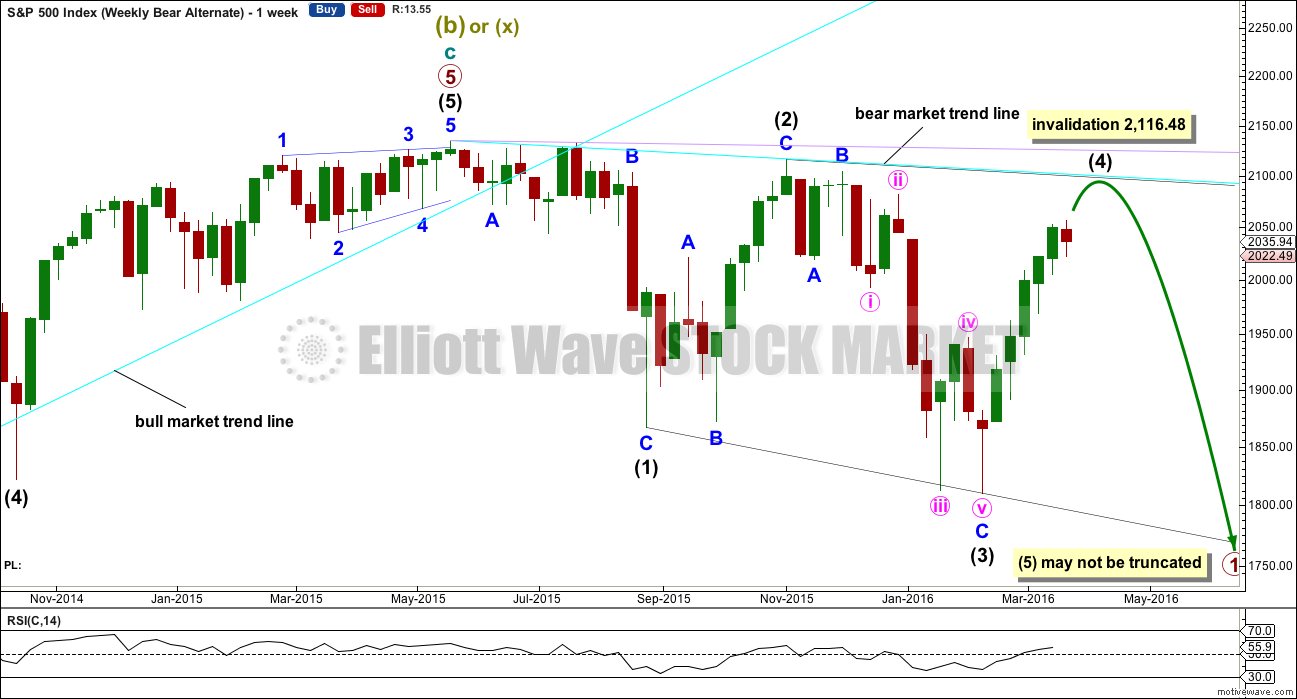

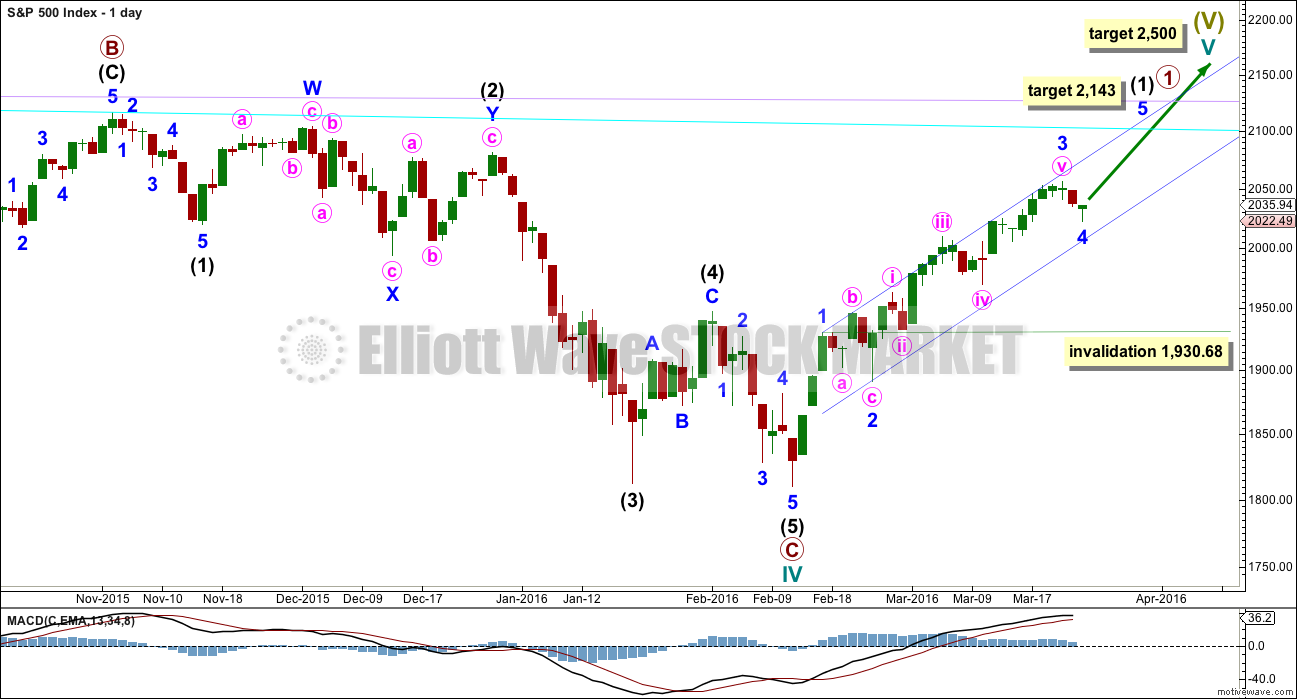

BEAR ELLIOTT WAVE COUNT

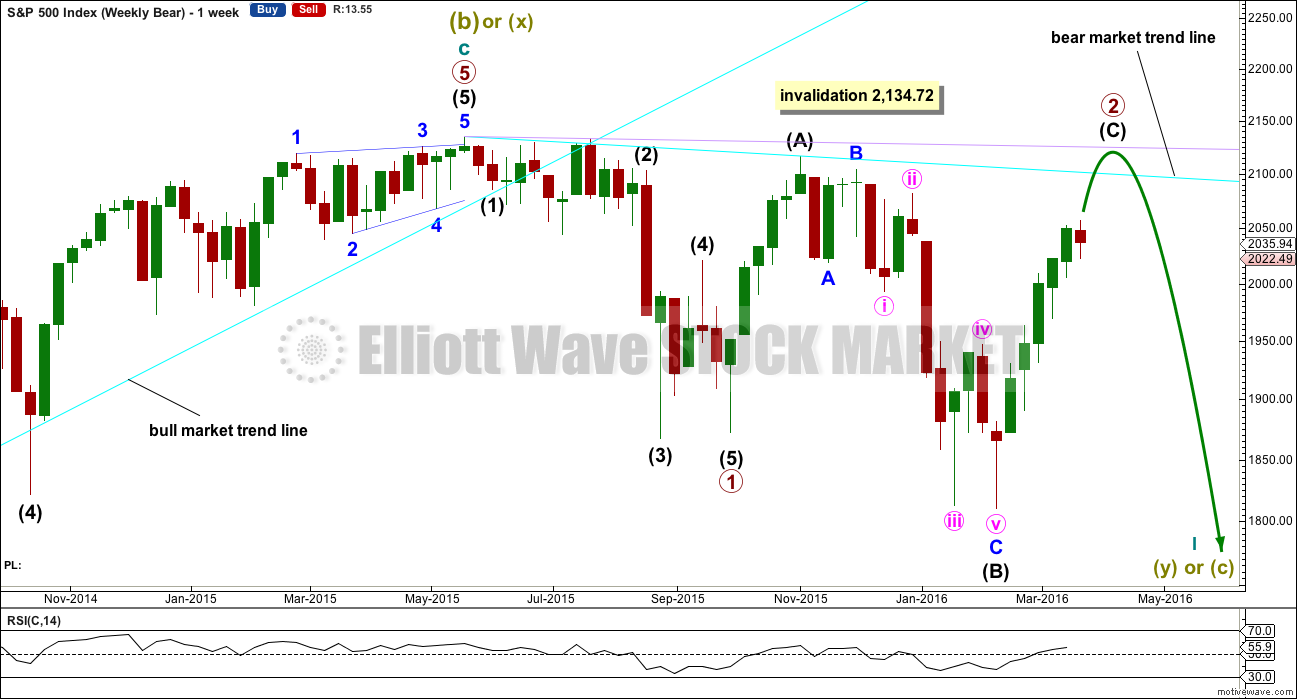

WEEKLY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Primary wave 1 may be complete and may have lasted 19 weeks, two short of a Fibonacci 21. So far primary wave 2 is in its 24th week. It looks unlikely to continue for another 10 weeks to total a Fibonacci 34, so it may end in about two to five weeks time. This would still give reasonable proportion between primary waves 1 and 2. Corrections (particularly more time consuming flat corrections) do have a tendency to be longer lasting than impulses.

Primary wave 2 may be unfolding as an expanded or running flat. Within primary wave 2, intermediate wave (A) was a deep zigzag (which will also subdivide as a double zigzag). Intermediate wave (B) fits perfectly as a zigzag and is a 1.21 length of intermediate wave (A). This is within the normal range for a B wave of a flat of 1 to 1.38.

Intermediate wave (C) is likely to make at least a slight new high above the end of intermediate wave (A) at 2,116.48 to avoid a truncation and a very rare running flat. However, price may find very strong resistance at the final bear market trend line. This line may hold price down and it may not be able to avoid a truncation. A rare running flat may occur before a very strong third wave down.

If price moves above 2,116.48, then the new alternate bear wave count would be invalidated. At that stage, if there is no new alternate for the bear, then this would be the only bear wave count.

Primary wave 2 may not move beyond the start of primary wave 1 above 2,134.72.

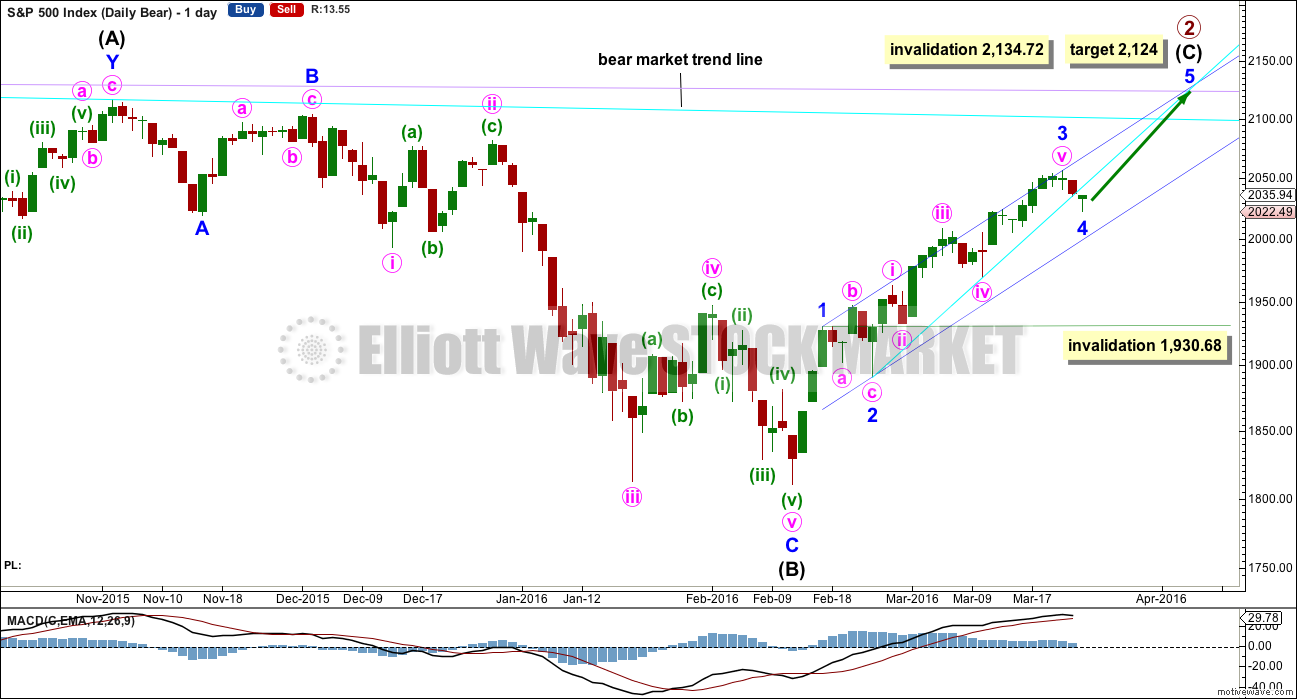

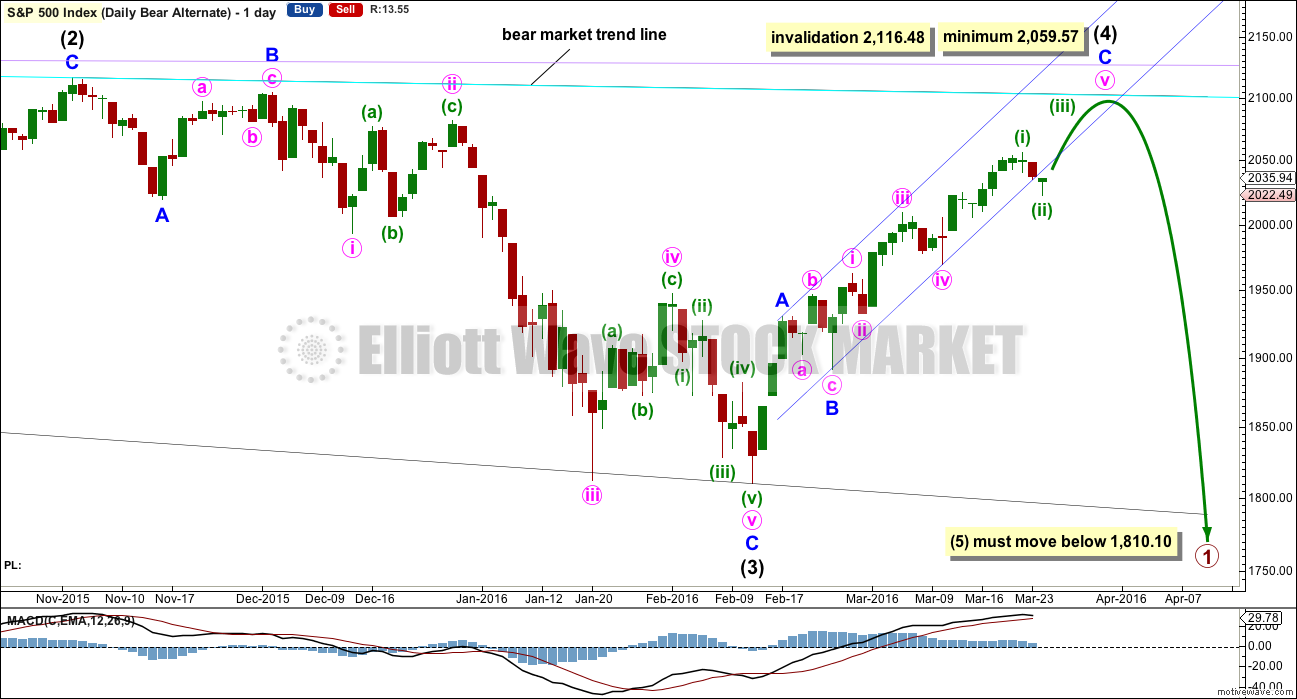

DAILY CHART

Intermediate wave (A) fits as a single or double zigzag.

Intermediate wave (B) fits perfectly as a zigzag. There is no Fibonacci ratio between minor waves A and C.

Intermediate wave (C) must subdivide as a five wave structure. It is not unfolding as an ending diagonal, so it must be unfolding as a more common impulse.

Intermediate wave (C) does not have to move above the end of intermediate wave (A) at 2,116.48, but it is likely to do so to avoid a truncation. If it is truncated and primary wave 2 is a rare running flat, then the truncation is not likely to be very large. As soon as price is very close to 2,116.48 this wave count looks at the possibility of a trend change.

The next wave down for this wave count would be a strong third wave at primary wave degree.

A bull market trend line for this rally is drawn across the first two small swing lows as per the approach outlined by Magee. This upwards sloping cyan line may provide support for corrections along the way up. Price broke below the cyan line today. It may now provide resistance. The S&P has a tendency to break out of channels or below lines and then continue in the prior direction. It may do this again here.

At 2,124 minor wave 5 would reach 0.618 the length of minor wave 3. Intermediate wave (C) would avoid a truncation and the wave count would remain valid. Primary wave 2 would fulfill its purpose of convincing everyone that a new bull market is underway, and it would do that right before primary wave 3 surprises everyone.

If it continues lower, then minor wave 4 downwards may not move into minor wave 1 price territory below 1,930.68.

The cursory count is now nine within intermediate wave (C). This is impulsive. Intermediate wave (C) could be counted as a complete impulse. However, if this wave count is correct to see intermediate wave (C) over here, it would require a massive truncation of 59.88 points. For an intermediate degree wave, this would have an exceptionally low probability. The probability is so low it should not be considered.

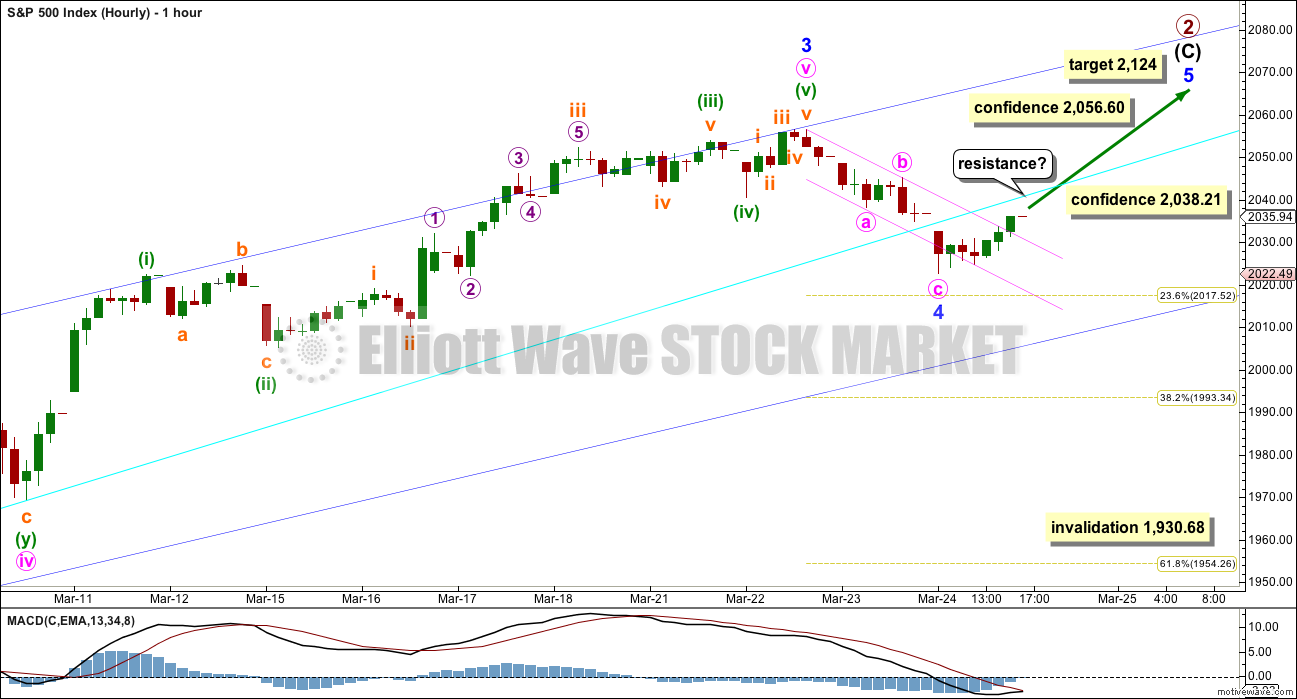

HOURLY CHART

The structure of minor wave 4 can be seen as complete and the proportion looks good on the daily chart.

There is no Fibonacci ratio between minute waves a and c within minor wave 4.

Price has broken out of the small Elliott channel containing this zigzag. This is an early indication that minor wave 4 may be over.

At 2,124 minor wave 5 would reach 0.618 the length of minor wave 3. If minor wave 4 moves any lower, then this target must be recalculated. It is provisional only.

At this stage, from an Elliott wave perspective, it is about a 50:50 probability that minor wave 4 is over or it may continue lower.

If minor wave 4 continues lower, it may do so as a double zigzag and still provide alternation with the expanded flat of minor wave 2. Double zigzags are very common structures. Minor wave 4 may end when price finds support at the lower edge of the Elliott channel.

Double zigzags should have a slope against the prior trend. To achieve this their X waves are normally shallow and should not make a new price extreme beyond the start of the first zigzag. A new high above 2,056.60 would confirm that minor wave 4 is not continuing lower as a double zigzag.

However, minor wave 4 may also continue sideways as a triangle and still exhibit alternation with the expanded flat of minor wave 2. 40% of triangles are running triangles which see wave B make a new price extreme beyond the start of wave A. A new high above 2,056.60 would not eliminate a running triangle.

A new high above 2,056.60 would add confidence to the idea that minor wave 4 is most likely over, but it cannot confirm it. At that stage, the structure of upwards movement (is it a three or a five?) would be analysed to see if it would be minor wave 4 continuing or minor wave 5 upwards underway. A five up on the hourly chart would be required for confirmation that minor wave 4 is over.

In the short term, a new high above 2,038.21 would add some confidence to the idea that minor wave 4 is over, and would add substantial confidence to the idea that we do not have a high in place yet. At that stage, upwards movement could not be a fourth wave correction within an impulse unfolding lower. At that stage, the wave down labelled minor wave 4 would be confirmed as a complete three (which may or may not be minor wave 4 in its entirety).

If minor wave 4 continues any lower, it may not move into minor wave 1 price territory below 1,930.68.

ALTERNATE WEEKLY CHART

Primary wave 1 may subdivide as one of two possible structures. The main bear count sees it as a complete impulse. This alternate sees it as an incomplete leading diagonal.

The diagonal must be expanding because intermediate wave (3) is longer than intermediate wave (1). Leading expanding diagonals are not common structures, so that reduces the probability of this wave count to an alternate.

Intermediate wave (4) must continue higher and may find resistance at the cyan bear market trend line. Intermediate wave (4) may not move above the end of intermediate wave (2) at 2,116.48.

ALTERNATE DAILY CHART

Within a leading diagonal, subwaves 2 and 4 must subdivide as zigzags. Subwaves 1, 3 and 5 are most commonly zigzags but may also sometimes appear to be impulses.

Intermediate wave (3) down fits best as a zigzag.

In a diagonal the fourth wave must overlap first wave price territory. The rule for the end of a fourth wave is it may not move beyond the end of the second wave.

Expanding diagonals are not very common. Leading expanding diagonals are less common.

Intermediate wave (4) must be longer than intermediate wave (2), so it must end above 2,059.57. If this minimum is not met, this wave count would be invalid. The trend lines must diverge.

Leading diagonals may not have truncated fifth waves. Intermediate wave (5) would most likely be a zigzag, must end below 1,810.10, and must be longer in length than intermediate wave (3) which was 306.38 points.

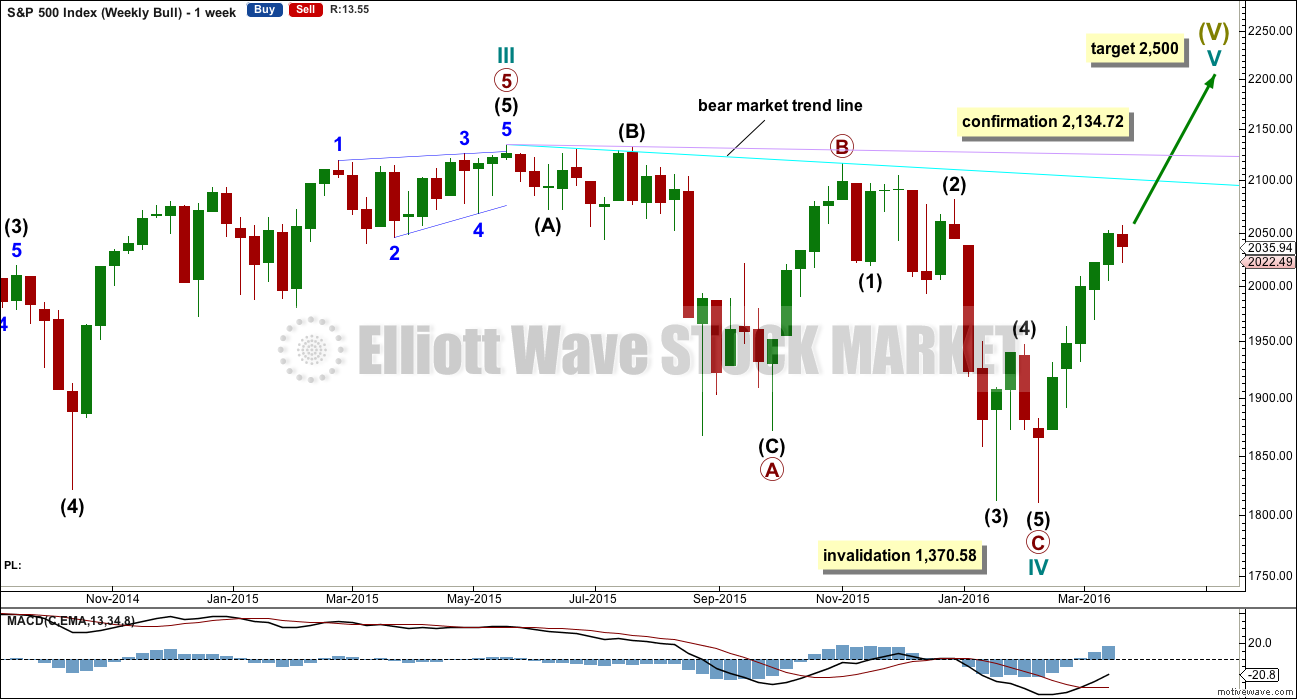

BULL ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV may be a complete shallow 0.19 regular flat correction, exhibiting some alternation with cycle wave II.

At 2,500 cycle wave V would reach equality in length with cycle wave I.

Price remains below the final bear market trend line. This line is drawn from the all time high at 2,134.72 to the swing high labelled primary wave B at 2,116.48 on November 2015. This line is drawn using the approach outlined by Magee in the classic “Technical Analysis of Stock Trends”. To use it correctly we should assume that a bear market remains intact until this line is breached by a close of 3% or more of market value. In practice, that price point would be a new all time high which would invalidate any bear wave count.

This wave count requires price confirmation with a new all time high above 2,134.72.

While price has not made a new high, while it remains below the final bear market trend line and while technical indicators point to weakness in upwards movement, this very bullish wave count comes with a strong caveat. I do not have confidence in it.

DAILY CHART

Upwards movement cannot now be a fourth wave correction for intermediate wave (4) as price is now back up in intermediate wave (1) territory above 2,019.39. This has provided some clarity.

For the bullish wave count, it means that primary wave C must be over as a complete five wave impulse.

Intermediate wave (2) is seen as an atypical double zigzag. It is atypical in that it moves sideways. Double zigzags should have a clear slope against the prior trend to have the right look. Within a double zigzag, the second zigzag exists to deepen the correction when the first zigzag does not move price deep enough. Not only does this second zigzag not deepen the correction, it fails to move at all beyond the end of the first zigzag. This structure technically meets rules, but it looks completely wrong. This gives the wave count a low probability.

If the bull market has resumed, it must begin with a five wave structure upwards at the daily and weekly chart level. So far that is incomplete.

Downwards movement may not be a lower degree correction within minute wave v because it is in price territory of the first wave within minute wave v. This downwards movement must be minor wave 4. At 2,143 minor wave 5 would reach equality in length with minor wave 1.

Minor wave 4 may not move into minor wave 1 price territory below 1,930.68.

TECHNICAL ANALYSIS

DAILY CHART

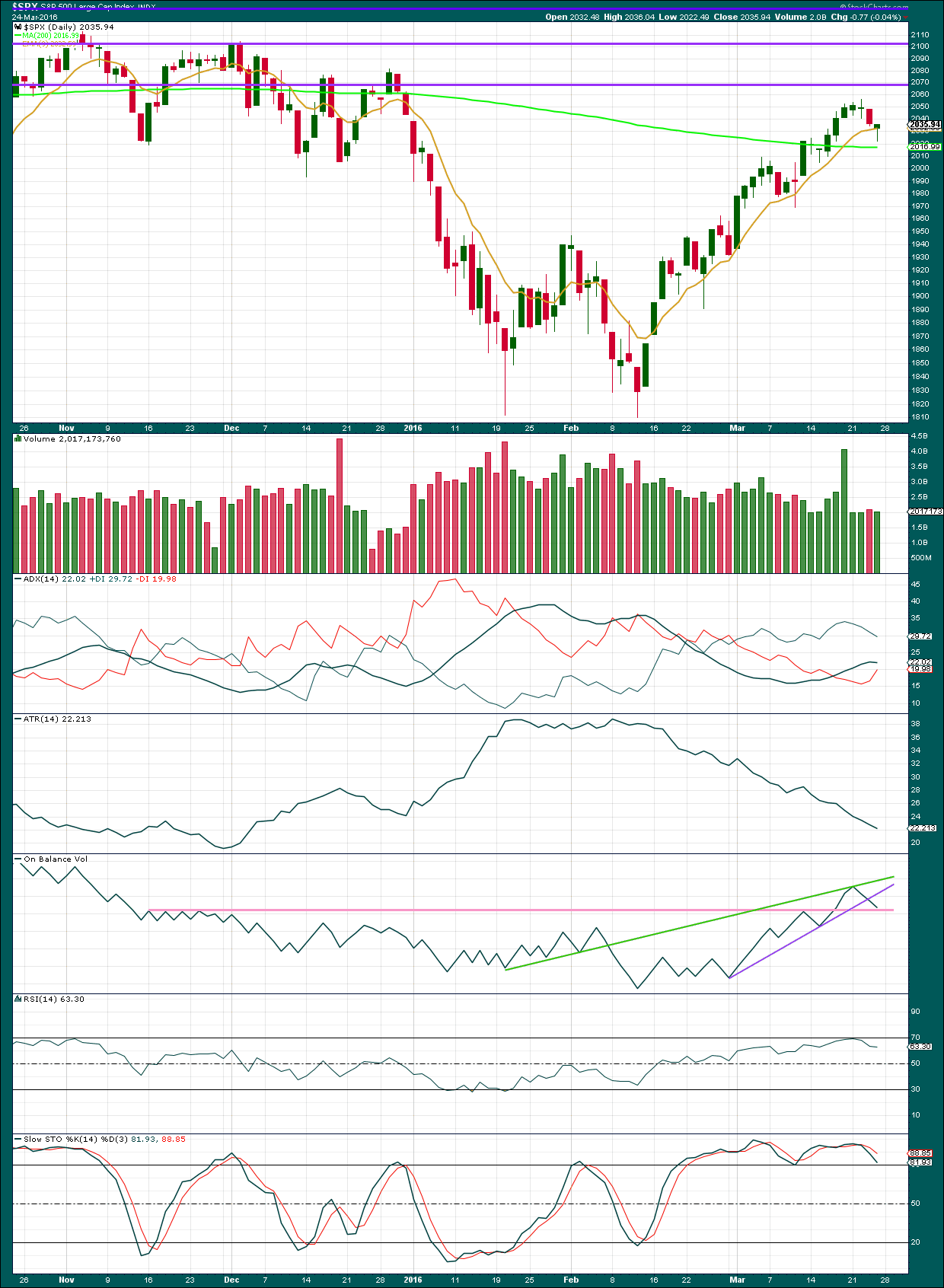

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume data on StockCharts is different to that given from NYSE, the home of this index. Comments on volume will be based on NYSE volume data when it differs from StockCharts.

NYSE volume data shows a decline in volume as price fell yesterday and now an increase in volume for a green daily candlestick. Overall, price moved upwards for Thursday on slightly increased volume. The rise in price is supported by volume. This supports the idea that price should continue to rise; a countertrend movement has lighter and declining volume. This supports the Elliott wave count short term.

Thursday’s green candlestick indicates that although the bears started out the session strongly they were unable to hold the lows of the day. The bulls rallied and overcame the bears. The long lower shadow and shaven head indicate the bulls finished very strongly. But the real body is small, so this market is still anaemic.

ADX is today flat indicating the market is no longer trending. It is finally in agreement with ATR.

ATR is indicating this upwards movement in price is weak, and it is coming on a clearly declining range. This is not normal for sustained price movement.

On Balance Volume is today finding support at the pink trend line. This line is long held, horizontal and repeatedly tested. It offers strong technical significance. If OBV turns up from here, it will be providing a strong bullish signal. If that happens on the first trading session next week, then more confidence may be had in the target at 2,124.

Because this trend line on OBV is so significant it is very likely to hold and stop price falling further. This indicates that minor wave 4 is likely to be over, or at least the lowest price extreme within it has been reached.

RSI has not yet reached overbought, so some more upwards movement to bring this indicator higher would complete the picture.

Stochastics may remain extreme for reasonable periods of time during a trending market.

Since the all time high in 20th May, 2015, price has made a series of lower highs and lower lows. Price broke below a long held bull market trend line indicating a new bear market. The 200 day moving average slowly turned from increasing to decreasing. Price remains below the bear market trend line drawn on the Elliott wave charts. All these technical indicators still point to price being in a bear market currently.

If price closes 3% or more of market value above the bear market trend line, then the analysis will change from bearish to bullish. While this has not happened, it should be assumed that the trend remains the same until proven otherwise.

ADVANCE DECLINE LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

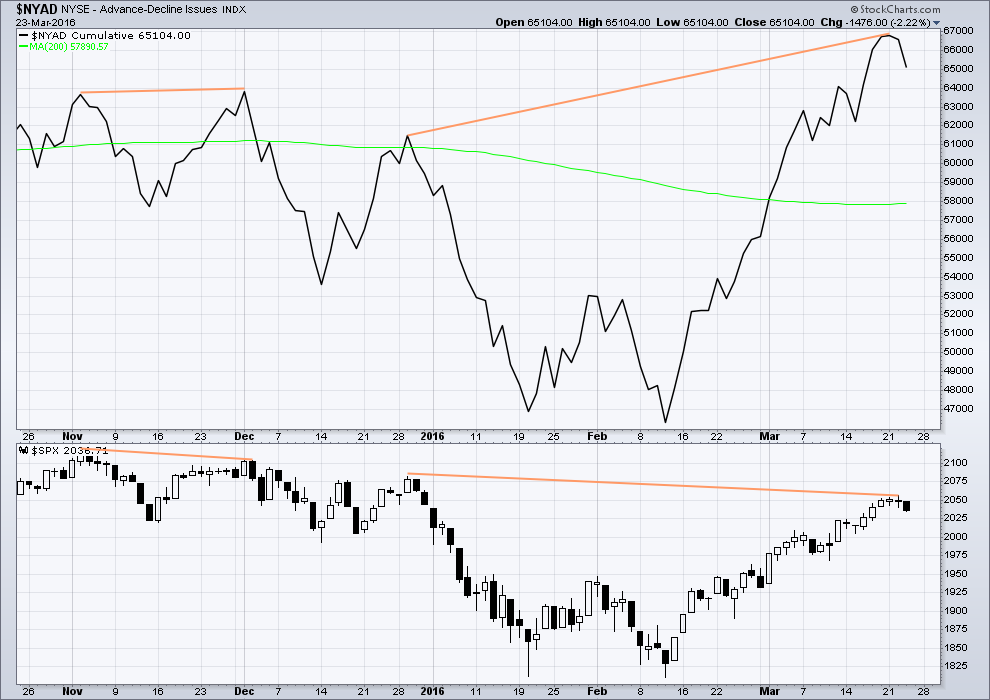

The Advance Decline line shows no short term (day to day basis) divergence with price. With the AD line increasing, this indicates the number of advancing stocks exceeds the number of declining stocks. This indicates that there is breadth to this upwards movement.

Longer term, looking back over the last five months, there are two cases of hidden bearish divergence between price and the AD line.

From November 2015 to December 2015 the AD line made a new high while price failed to make a corresponding high. This indicated weakness in price and preceded new lows for price.

Now again from 29th December, 2015, to now the AD line is making new highs but price has so far failed to also make corresponding new highs. This again is an indication of weakness in price. Despite price rising with market breadth increasing, the breadth increase is not translating to substantial rises in price.

It remains to be seen if price can make new highs beyond the prior highs of 29th December, 2015. If price can manage to do that, then this hidden bearish divergence will no longer be correct, but the fact that it is so strong at this stage is significant. The AD line will be watched daily to see if this bearish divergence continues or disappears.

The 200 day moving average for the AD line is now increasing. Even if the 200 day MA points up this alone would not be enough to indicate a new bull market. During November 2015 the 200 day MA for the AD line turned upwards and yet price still made subsequent new lows.

DOW THEORY

I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then my modified Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJIA: 15,855.12 – close below on 25th August 2015.

DJT: 7,700.49 – close below on 24th August 2015.

Russell 2000: 1,343.51 – close below on 25th August 2015.

This analysis is published @ 07:03 p.m. EST.

I can see a five up developing.

And with a new high above 2,038.21 the last wave down now is confirmed as complete and it fits best as a three.

So with a three down on the hourly chart that indicates it was a counter trend movement. Which means we can have more confidence in expecting new highs for the S&P.

The analysis will remain exactly the same.

Some interesting divergences developing. NASDAQ overlapped March 14 high of 4762.27 at 4760.03…

Seeing as its quiet here this weekend, I’ll share what I’m up to.

Having another family trip this time to the west coast (North Island still, original name right?).

This is my office for the next few days 🙂

The west coast is wilder and more rugged than the east where I live. East coast has horseshoe shaped bays with white sand beaches fringed with Pohutukawa trees, rocky headlands and interesting rock pools.

The west coast has long sweeps of black sand beaches, majestic cliffs, huge surf and extensive sand dunes. AKA the movie “The Piano”

Another serene view! Thanks for sharing!

Speaking of black sand beaches, it reminds me of the first time I visited NY and my host enthusiastically took me to what they called a “beach”. Well, you can imagine my consternation as a denizen of the Caribbean and accustomed to pristine, brilliant, glistening white sand beaches , when we showed up at that beach. The sand was all black! I remember thinking – You’ve got to be kidding me! You guys call this a beach???!!!! I have of course subsequently learned, in many places they do indeed! 🙂

I guess it meets the requirement of ocean + sand, so yeah, a beach.

We’ve got the lot here in NZ. Black, white, grey, pink and yellow.

Beautiful,,, be careful on those waves, we need your brain working on those other E waves,, have a great holiday.

No worries. Its 5-6ft here today so too big for me. There’s just no way I could get my 9’6″ longboard out in that.

It can be a challenge to decide how much weight to assign to sentiment, versus the expected wave count when making trading decisions. The possible expanding diagonal would for example, be very much at variance from what we would expect when looking at how volatility played out during intermediate waves one and three. Under the expanding diagonal count, we see a substantially greater volatility spike during intermediate one down, than we do during intermediate three. I do not remember ever seeing that happen at intermediate degree. It will be interesting to see whether, as the waves play out, we could look back in hindsight and conclude that based on volatility, we could have assigned a lower probability, if not entirely eliminated, the expanding diagonal; by the same token, if I were to close my eyes and base my decision on just what volatility is doing at the moment, irrespective of what I think the wave count is, I would conclude that we are completing a correction of at the very least intermediate, and more likely because of the new 52 week low and overshoot of the 200 dma, primary degree. How the waves play out in the next few weeks will go a long way toward informing my thinking on how much credence we can place on sentiment during wave development…I think it is now saying something huge is on the horizon…just thinking out loud…. 🙂

A good point Verne. Thanks for pointing that out.

I’ll take another look at the leading diagonal count next to volatility. The third wave which made a new low should have had more volatility for sure.

But if that wave down has less volatility, that absolutely fits a B wave.

why am I always first

The lack of comments recently is telling. From my point of view I’m tired of wasting my days watching the market aimlessly sniff around like a lost dog (certainly didn’t turn Bullish btw – but that prob doesn’t surprise anyone here).

C’mon Mr Market – lets do this already!! 🙂 🙂

Great analysis as always Lara – many thanks!!

You’re welcome.

I’m thinking there may be a little profit to be made on this last wave up actually. But the potential of primary wave 3 makes me nervous about a long position.

Yep. I have light compliment of SPX calls picked up yesterday that I plan on unloading like a hot potato the second they post a 15-20% profit. I think we are not going to have any trouble seeing the topping process when primary two ends since we are keenly keeping an eye out for it. I think we are going to see a huge bearish engulfing candle. The folks who are going to get hammered are the ones buying the talking heads mantra sounding the “all clear!”.

Which will be almost all at the end of this rally.

IF I’m right.

I keep looking at the monthly and weekly charts, and the monthly TA chart, and the probability is on the bear count.

But at the end of primary 2 this is going to be a huge call to make! It’ll be nerve wracking.

As we would expect from a primary two up!

I feel like this one got away from us since it took the form of an expanded flat with all those wild swings. I had such carefully laid plans to trade primary two up after what I was quite confident would be a clear signal to the end of primary one down with the typical blow-off top in volatility, only to be totally bamboozled by that unprecedented divergence (at least as long as I have been trading it) between VIX and UVXY we witnessed back in August. I still shake my head in amazement every time I look at those charts. As someone recently said, if it were easy we would all be billionaires! I plan on watching this one with a keen eye, a very keen eye indeed. I have a feeling this market is not quite done throwing curve balls…if I see another divergence in VIX and UVXY like we saw for primary one down, there’s definitely gonna have to some tactical changes…

So far, penetration of the upper BB still seems to be a very reliable signal. 🙂

If you comment that you see divergence between VIX and UVXY again I’ll be taking a more critical eye to the wave count.

I think that last wave down as a B wave makes sense. Something was off, not right about it.

I’m learning that B waves in the S&P may have a few warning flags.

The other thing I remember your commenting on was the “managed decline” which was spooky.

And I also noticed the corrections within it were all zigzags.. I think all of them. Which was weird and really put me off… I kept expecting more downwards movement to resolve the middle of a third wave and then to see some different kinds of corrections for fourth waves.

So yeah, quite a few things off about that wave. I’ll pay more attention to your comments, VIX and UVXY in future.

The calm before the storm Olga. I hope everyone is having a good one 🙂

It is truly fascinating that there are a few folk who still see the possibility of a huge fourth wave triangle developing in DJI, with that option being eliminated only be a take out of the Feb 11 lows. The count would see wave D ending just about now with a sharp wave E decline to end above the Feb 11 lows, then on to new highs for the DOW in a fifth wave up. I think the tenor of the action around the 200 dma is going to be telling. DJI action has been stronger than SPX and the former is considerably higher above its 200 dma, both of which also happen to currently be in the area of the infamous round number pivots. A primary three down should absolutely demolish both the 200 dma and round number pivots with nary a backward look. The wrangling around those numbers during the last decline was an early warning of more upside and I am learning to pay more attention to that very reliable caution flag. SPX will probably lead the way down and surrender the 2000 pivot (on close) before DJI does, and that would be an early sign of where things were headed. Of course, DJI could also reverse roles and just as it led to the upside, could play catchup and accelerate past SPX in a primary three tsunami. Jeff Clark shows the similar bearish rising wedge pattern that we saw last year playing out in the current rally and it is almost complete with price approaching the apex of the wedge. Are you ready??!! 🙂

For you UVXY buffs, the next several days should present a great entry opportunity as it drifts back toward, but not taking out, the recent lows. Thursday’s action was classic, as the MMs sell the initial pop to dislodge the eager beavers. Look for it to drift back down toward 22 or thereabouts

and grab yourself a 10 bagger…! The gap up open as the short sellers cover will be the trigger. 🙂

Verne,

If price goes towards SPX 2100 and higher as Lara is projecting, wouldn’t UVXY probably make new lows as price keeps trecking higher? I’m going to guess it will probably test the lower BB’s…

It could, but I expect what would more likely happen is that it makes a higher low. We are already seeing divergence with a new 52 week low absent a new SPX 52 week high.

Verne,

For the past three weeks, I have been watching the two rallies you show on your chart. They are quite similar. So similar, in fact, I am waiting for the big surprise. When will the current rally diverge? Or will it follow the same pattern back down to 1810? The next week or two we should begin to see the answer.

BYW, your chart shows clearly that MACD is positioned for a big drop!

I think the kind of price action we are seeing is what happens with central bank buying in an attempt to resist the major trend- the swings become more and more extreme. I suspect the next plunge will once again be followed by another protracted second wave; traders are going to have to be nimble. I plan on playing it safe and allowing VIX to tag the end of the first impulse down. I am curious to see how UVXY behaves on the next leg down-especially if it remains below the upper BB until intermediate three of primary three completes. I think it is going to be very chaotic; especially for those not expecting a primary degree decline if that is what in fact unfolds.

BTW, has anyone else seen the few analysts who have labelled the fifth wave up as a truncation ending below the ATH? I have seen at least one or two charts with that wave count, this making the current move up an intermediate wave.

I think the fifth wave up as a truncation ending below the ATH warrants our consideration. Thanks for bringing it to our attention Verne.