Downwards movement was expected as most likely, but an end to the bounce was unconfirmed.

Price moved slightly higher before turning down to complete a small red candlestick.

Summary: Upwards movement is still more likely over than not, but this is unconfirmed. A new low below 1,891 and below the channel on the hourly chart would provide confidence it is over. The invalidation point for the preferred wave count remains at 2,104.27. A big third wave should still be approaching, so be aware of surprises to the downside.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

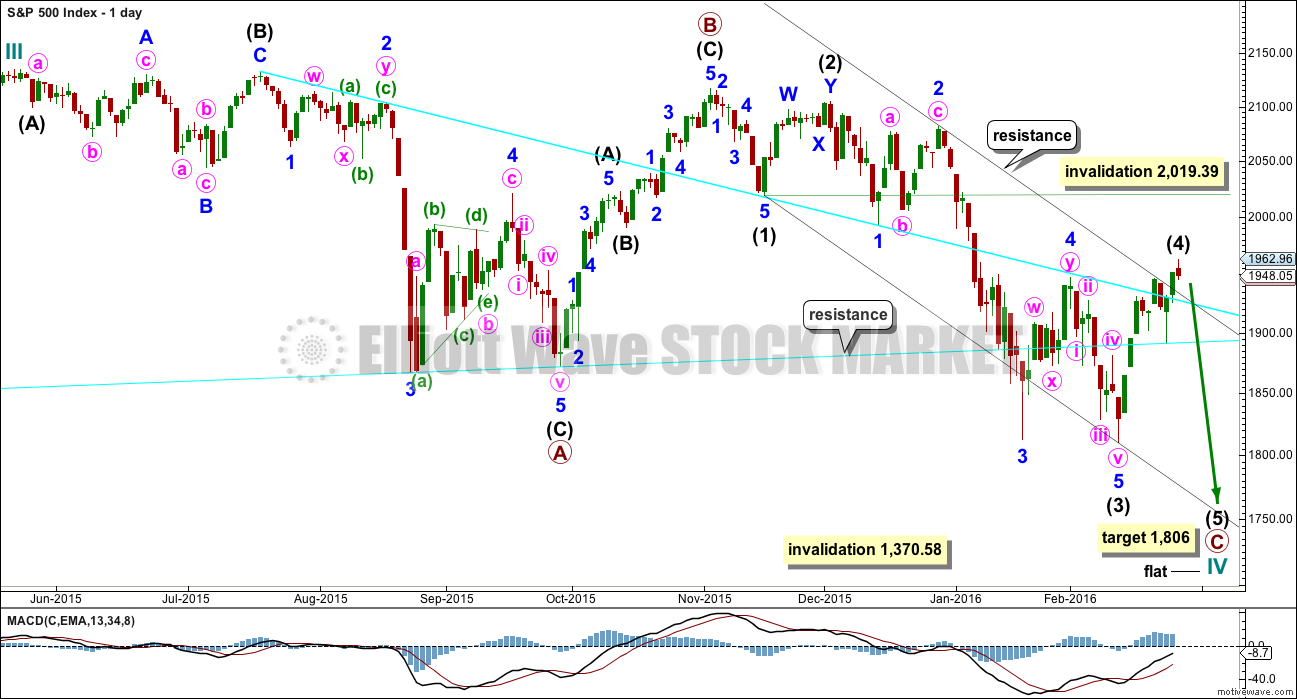

BULL ELLIOTT WAVE COUNT

DAILY CHART – FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, or combination. This first daily chart looks at a flat correction.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

Primary wave C should subdivide as a five.

Within the new downwards wave of primary wave C, intermediate waves (1), (2) and now (3) may be complete.Intermediate wave (4) may now be over, finding resistance at the upper edge of the black channel. It is just within the fourth wave of one lesser degree still, which is a common place for a fourth wave to end.

Intermediate wave (2) was a deep double zigzag. Intermediate wave (4) may be a complete shallow 0.46 zigzag. There is alternation in depth and a little in structure.

At 1,806 intermediate wave (5) would reach 1.618 the length of intermediate wave (1). This would see intermediate wave (5) move below the end of intermediate wave (3) at 1,847 avoiding a truncation. Primary wave C would end below the end of primary wave A but not too far. Cycle wave IV would have a reasonable regular flat look.

The idea of a flat correction for cycle wave IV has the best look for the bull wave count. The structure would be nearly complete and at the monthly level cycle wave IV would be relatively in proportion to cycle wave II.

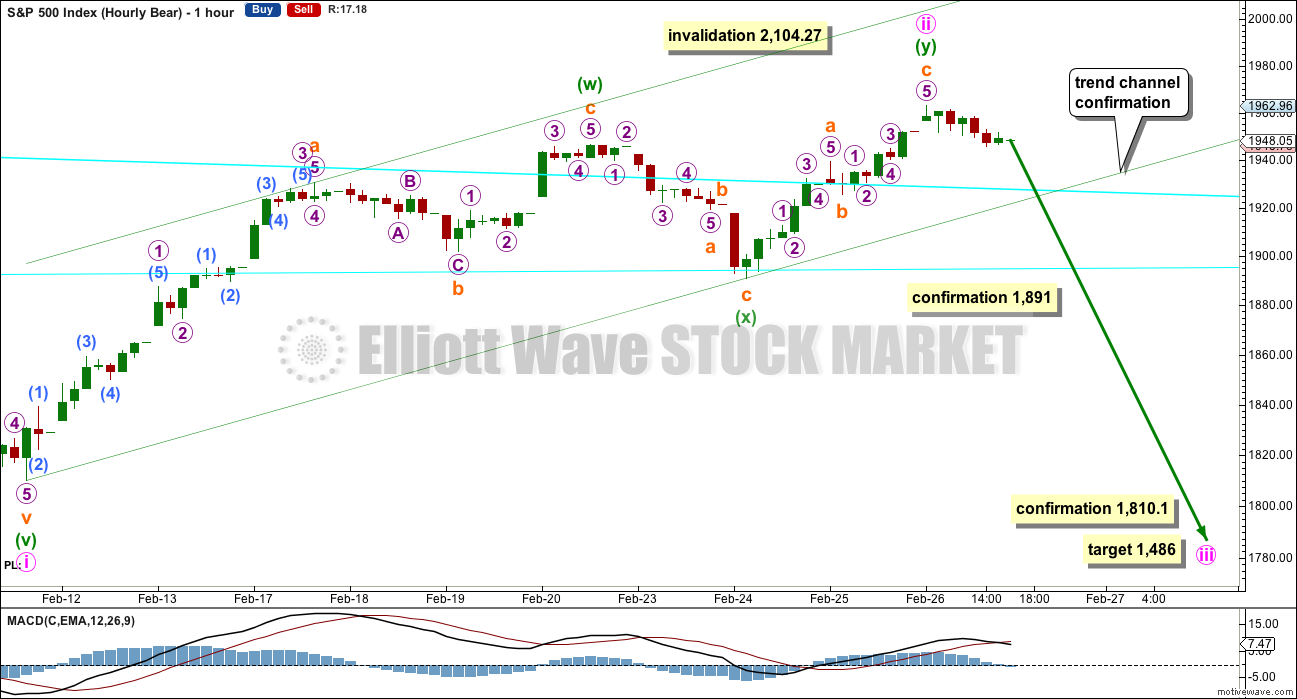

HOURLY CHART

Both hourly charts are again the same, so comment will be with the preferred bear wave count.

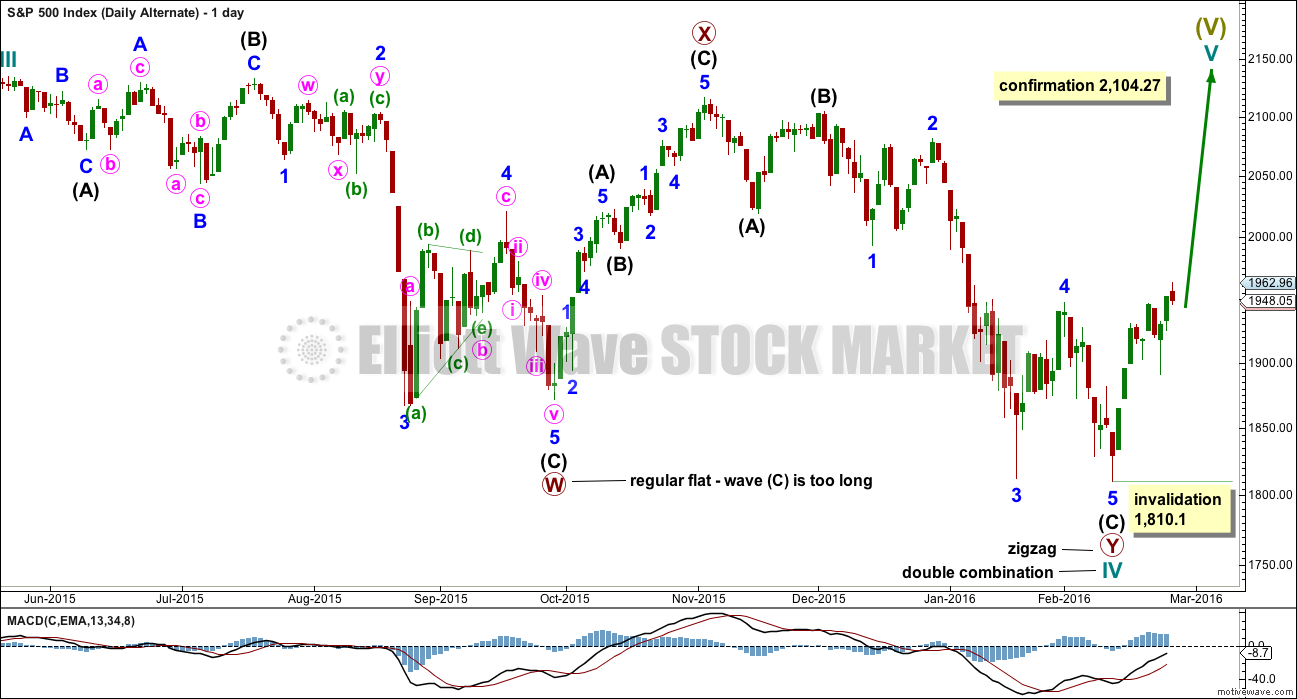

DAILY CHART – COMBINATION

This idea is technically possible, but it does not have the right look. It is presented only to consider all possibilities.

If cycle wave IV is a combination, then the first structure may have been a flat correction. But within primary wave W, the type of flat is a regular flat because intermediate wave (B) is less than 105% of intermediate wave (A). Regular flats are sideways movements. Their C waves normally are about even in length with their A waves and normally end only a little beyond the end of the A wave. This possible regular flat has a C wave which ends well beyond the end of the A wave, which gives this possible flat correction a very atypical look.

If cycle wave IV is a combination, then the first structure must be seen as a flat, despite its problems. The second structure of primary wave Y can only be seen as a zigzag because it does not meet the rules for a flat correction.

If cycle wave IV is a combination, then it would be complete. The combination would be a flat – X – zigzag.

Within the new bull market of cycle wave V, no second wave correction may move beyond the start of its first wave below 1,810.10.

I do not have any confidence in this wave count. It should only be used if price confirms it by invalidating all other options above 2,104.27.

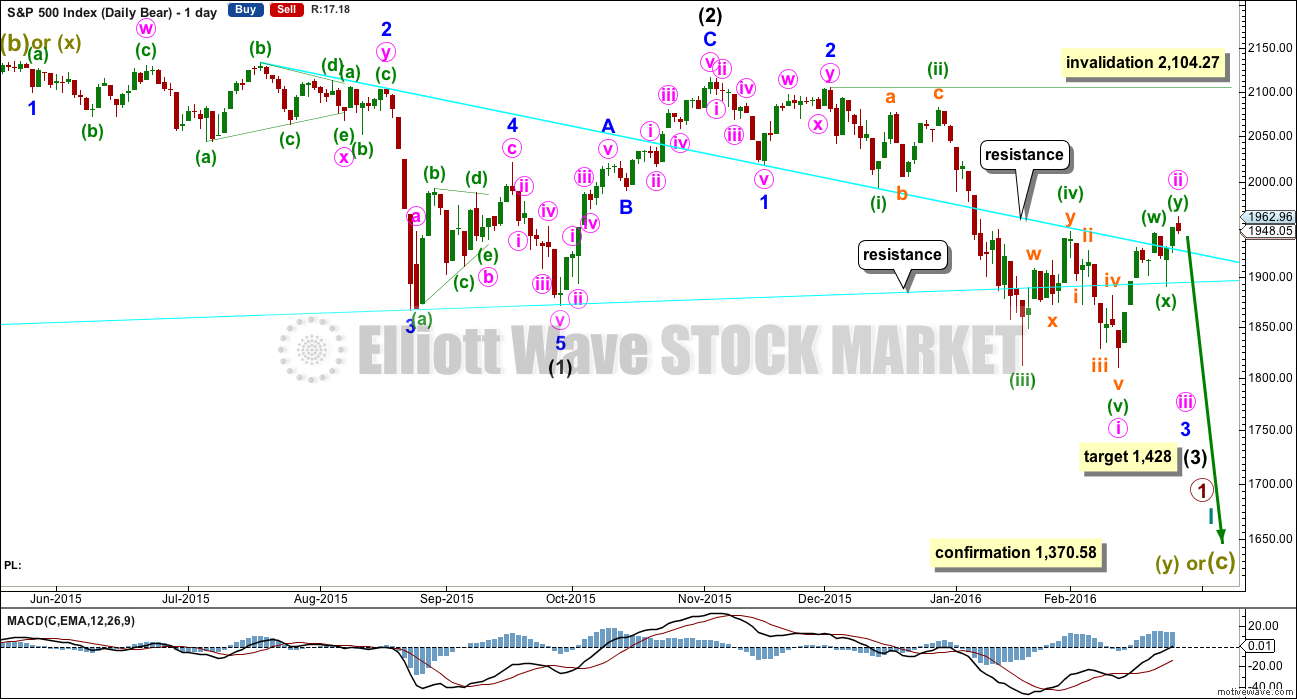

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Downwards movement so far within January still looks like a third wave. This third wave for intermediate wave (3) still has a long way to go. It has to move far enough below the price territory of intermediate wave (1), which has its extreme at 1,867.01, to allow room for a following fourth wave correction to unfold which must remain below intermediate wave (1) price territory.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

Intermediate wave (2) lasted 25 sessions (no Fibonacci number) and minor wave 2 lasted 11 sessions (no Fibonacci number). Minute wave ii may now be complete in ten sessions (no Fibonacci number). Although minute wave ii is seen as a double zigzag, which fits best on the hourly chart, it has a single zigzag look at the daily chart level. This mirrors the structure for minor wave 2 earlier on in November 2015. That correction looks like a single zigzag on the daily chart, but on the hourly chart it subdivides as a double zigzag with the second zigzag in the double very brief and short.

Minute wave ii may not move beyond the start of minute wave i above 2,104.27.

HOURLY CHART

Minute wave ii may have continued higher as a double zigzag. The second zigzag in the double is a complete structure. It may be over as labelled, or this may only be subminuette wave a within the second zigzag. I am labelling it over because on the five minute chart downwards movements for Friday’s session subdivide best as fives, one of which is very clear.

Confirmation that this upwards movement is complete would come first with a breach of the channel containing minute wave ii. Thereafter, a new low below 1,891 would provide substantial confidence at this stage.

A target is today calculated for minute wave iii, but it comes with the caveat that it may be removed or it may change if minute wave ii continues higher. The caveat will remain while a trend change is unconfirmed. At 1,486 minute wave iii would reach 1.618 the length of minute wave i. This would see minute wave i extended and minute wave iii extended within minor wave 3. Minute wave v would be expected to be short.

There is still double negative divergence with price and MACD at the hourly chart level. This is bearish.

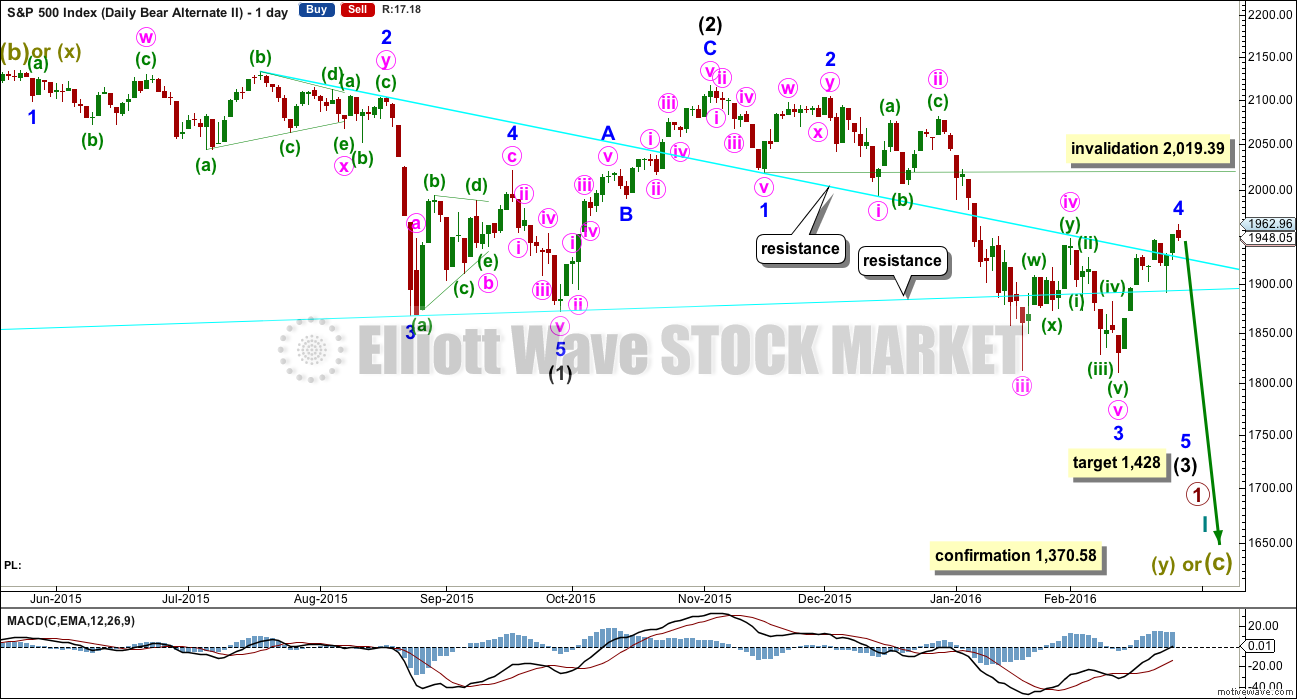

ALTERNATE DAILY CHART

I have previously noted this idea in the text and now it is time to chart it, so that the implications are clear.

Within the downwards impulse unfolding, it may be that intermediate waves (1) and (2) are complete and now minor waves 1, 2 and 3 may also be complete within intermediate wave (3).

This wave count expects minor wave 5 to be extended within intermediate wave (3). Minor wave 5 should also show a strong increase in momentum, so that at its end intermediate wave (3) has clearly stronger momentum than intermediate wave (1).

There is no difference to the target for intermediate wave (3). This wave count makes a difference to the invalidation point. Minor wave 4 may not move into minor wave 1 price territory above 2,019.39.

This wave count also has a lower probability than the main bear wave count. This wave count would be more typical of commodities than the S&P.

Minor wave 2 lasted 11 days. Minor wave 4 may be over in 10 days, which is not a Fibonacci number.

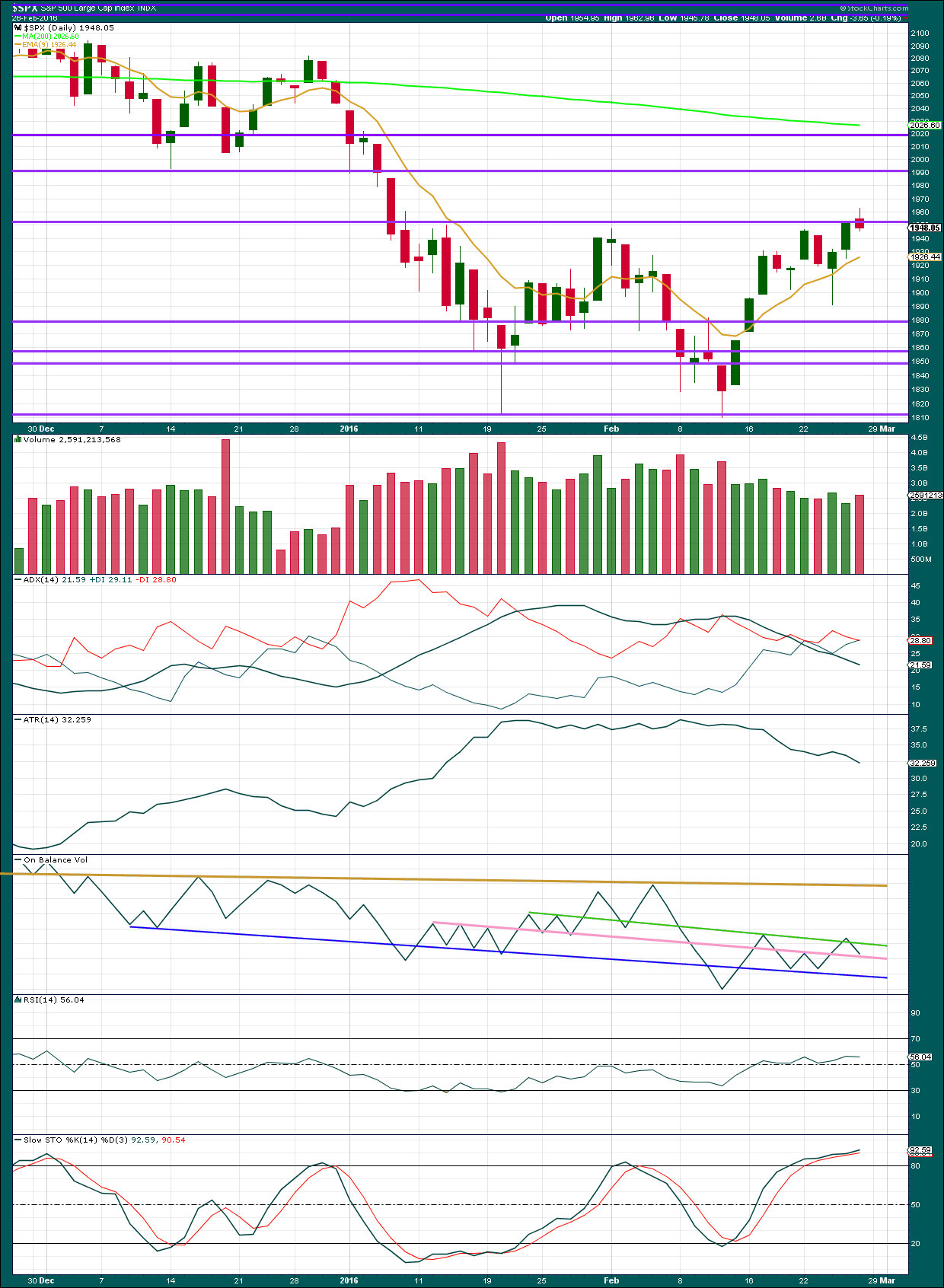

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Apart from the first three days of this bounce, upwards movement sees volume decline. Now a downwards day sees an increase in volume. This volume profile is bearish. This upwards movement again is very likely to be a correction against a downwards trend. The increase in volume for Friday’s red candlestick gives some support for seeing the bounce over now.

ADX still indicates the market is not trending. It has not indicated a trend change either: the -DX line is touching +DX line, but they have not crossed.

ATR agrees. It too indicates the market is not trending; it is consolidating.

With the market consolidating, it should be expected that price may swing from resistance to support and back again until a breakout occurs. Stochastics may be used to assist in identifying when price will turn. At this stage, price has found resistance about 1,950 and Stochastics is overbought. This approach would expect a downwards swing about here.

RSI is still just above neutral. There is plenty of room for this market to rise or fall. RSI shows weak slight bearish divergence for Friday’s session; while price made a new high RSI moved slightly lower.

On Balance Volume has turned down from the green trend line. The strength of that line is reinforced. This is a weak bearish signal. A break below the pink line would be a stronger bearish signal from OBV. A break below the dark blue line would be another strong bearish signal from OBV.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then my modified Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point. So far the S&P has made a new low below 1,821.61, but it has not closed below 1,821.61.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

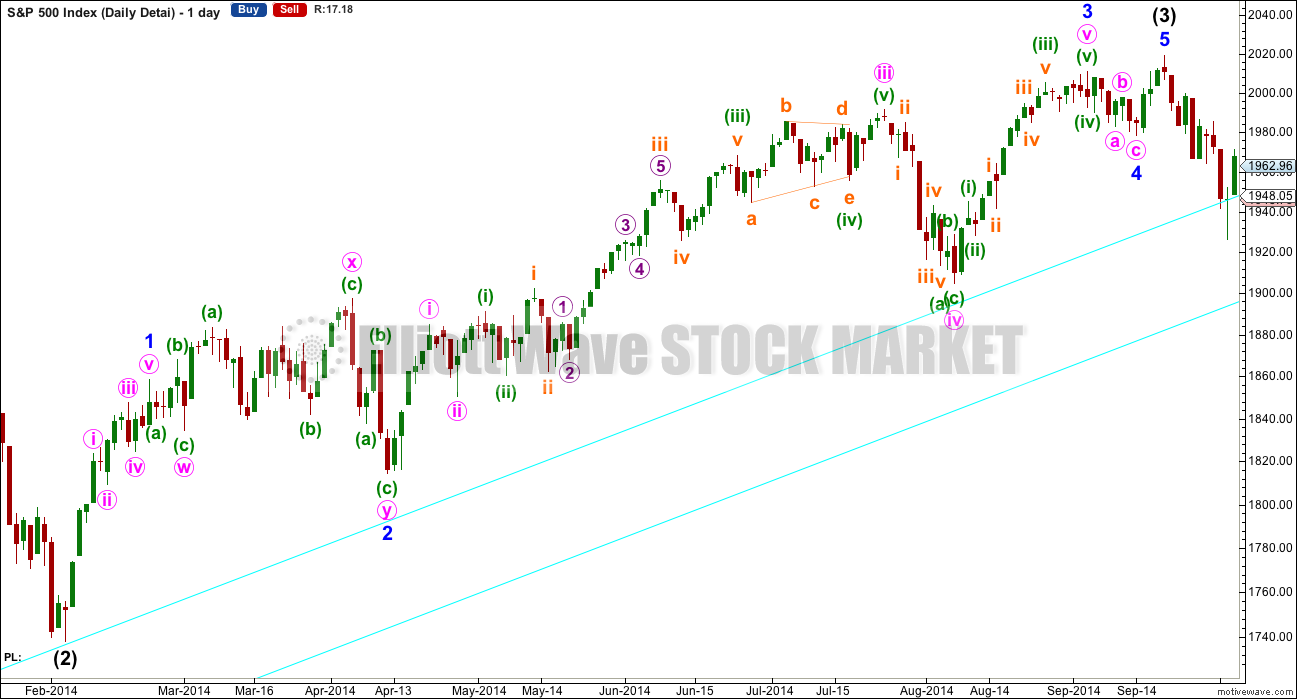

THIRD WAVE EXAMPLE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is the detail of the middle of the third wave in the last bull market. It spans February 2014 to October 2014, eight months.

The middle of intermediate wave (3) is extended.

Right down to micro degree, within each third wave it is the middle, the third wave, which is extended.

The whole structure has a stretched out middle. This makes each correction within it more time consuming than corrections at these low degrees normally are. It begins with a lot of overlapping.

For the S&P this is a very normal looking third wave. Although this is a third wave within a bull market, a third wave within a bear market most often looks the same or very similar. The only difference is bear market third waves may end more sharply with strong fifth waves.

This analysis is published @ 03:12 p.m. EST on 27th February, 2016.

Count future compatible with count of Lara until ((ii)). If count my continued (Yellow area in the graph attachment) true, then trading day begins with a gap down to end the wave i subminuette .

Graph 30 minutes more clearly count

Missed it by a minute 🙂

Aha! Early Bird! 🙂