Downwards movement was expected.

An alternate Elliott wave count allowed for some more upwards movement.

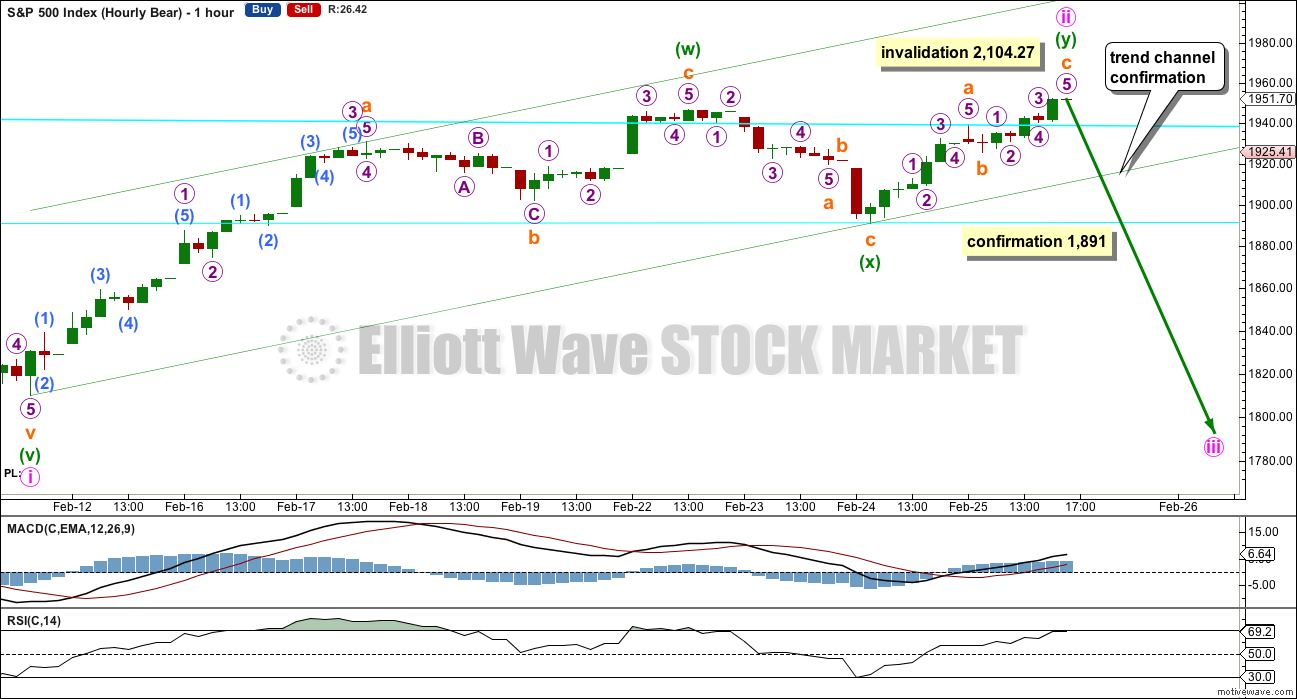

Summary: Upwards movement is still more likely over than not, but this is unconfirmed. A new low below 1,891 and below the channel on the hourly chart would provide confidence it is over. The invalidation point for the preferred wave count remains at 2,104.27. A big third wave should still be approaching, so be aware of surprises to the downside.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

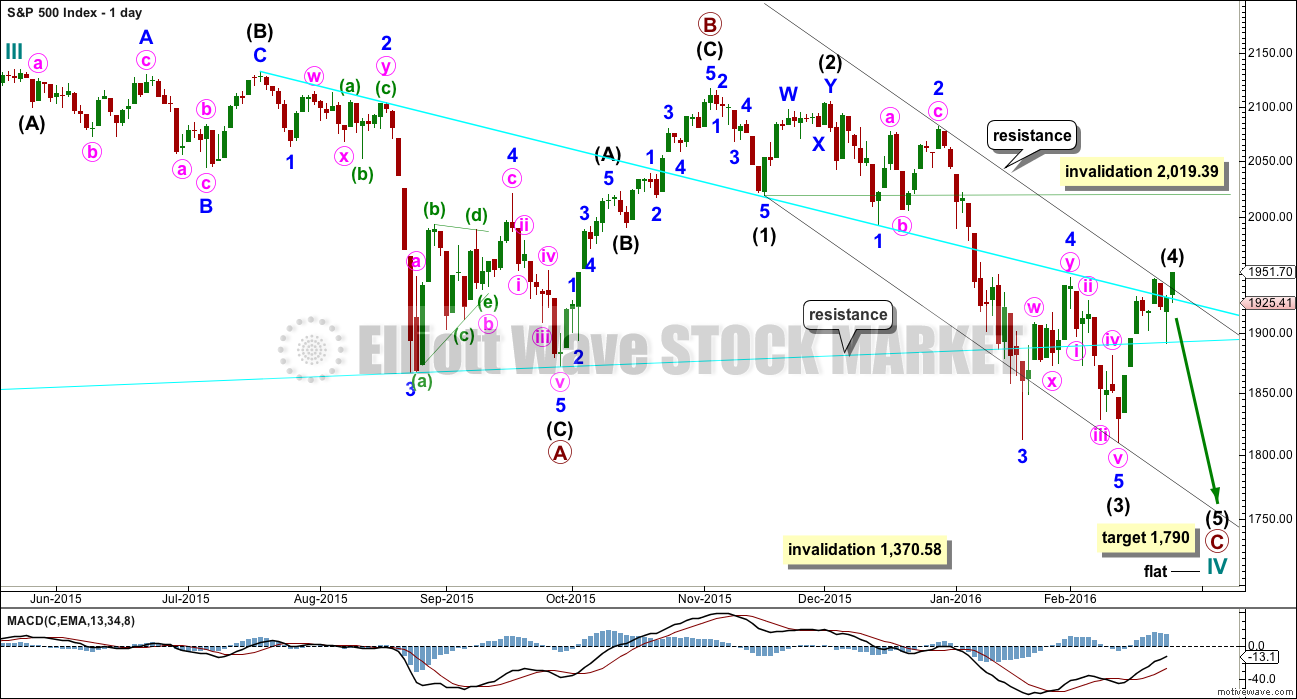

BULL ELLIOTT WAVE COUNT

DAILY CHART – FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, or combination. This first daily chart looks at a flat correction.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

Primary wave C should subdivide as a five.

Within the new downwards wave of primary wave C, intermediate waves (1), (2) and now (3) may be complete.Intermediate wave (4) may now be over, finding resistance at the upper edge of the black channel. It is just within the fourth wave of one lesser degree still, which is a common place for a fourth wave to end.

Intermediate wave (2) was a deep double zigzag. Intermediate wave (4) may be a complete shallow 0.46 zigzag. There is alternation in depth and a little in structure.

At 1,790 intermediate wave (5) would reach 1.618 the length of intermediate wave (1). This would see intermediate wave (5) move below the end of intermediate wave (3) at 1,847 avoiding a truncation. Primary wave C would end below the end of primary wave A but not too far. Cycle wave IV would have a reasonable regular flat look.

The idea of a flat correction for cycle wave IV has the best look for the bull wave count. The structure would be nearly complete and at the monthly level cycle wave IV would be relatively in proportion to cycle wave II.

HOURLY CHART

Both hourly charts are again the same, so comment will be with the preferred bear wave count.

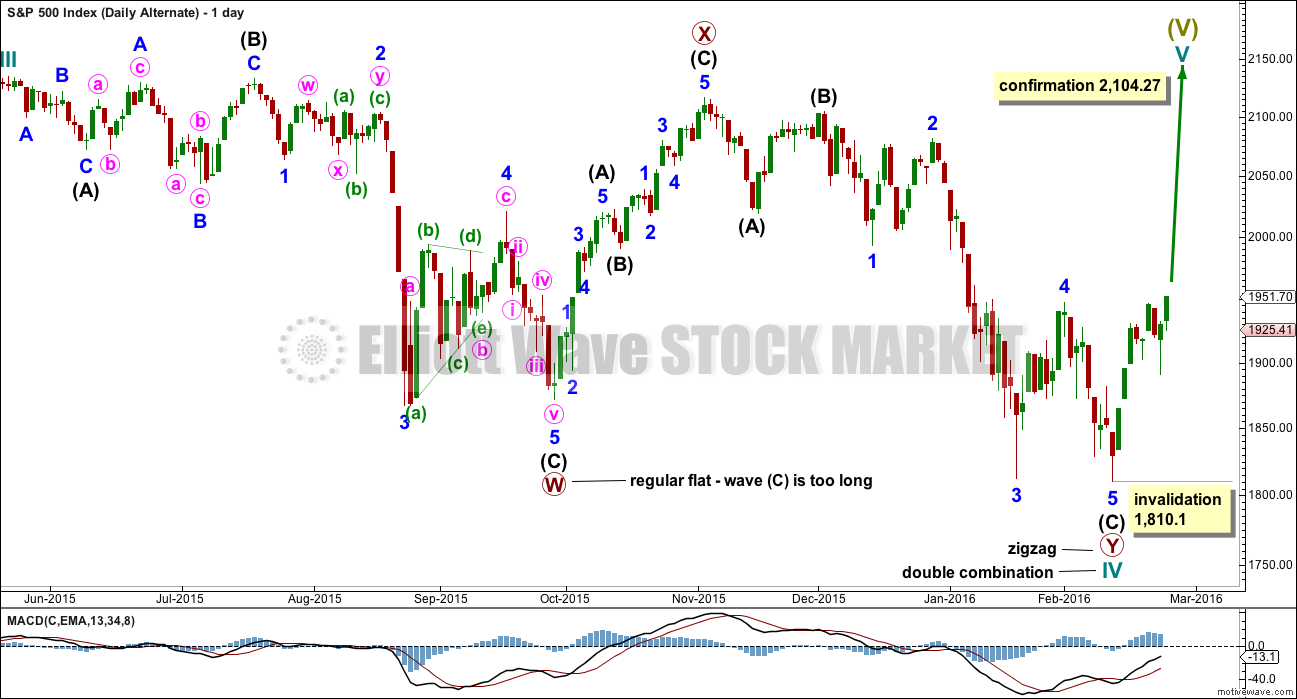

DAILY CHART – COMBINATION

This idea is technically possible, but it does not have the right look. It is presented only to consider all possibilities.

If cycle wave IV is a combination, then the first structure may have been a flat correction. But within primary wave W, the type of flat is a regular flat because intermediate wave (B) is less than 105% of intermediate wave (A). Regular flats are sideways movements. Their C waves normally are about even in length with their A waves and normally end only a little beyond the end of the A wave. This possible regular flat has a C wave which ends well beyond the end of the A wave, which gives this possible flat correction a very atypical look.

If cycle wave IV is a combination, then the first structure must be seen as a flat, despite its problems. The second structure of primary wave Y can only be seen as a zigzag because it does not meet the rules for a flat correction.

If cycle wave IV is a combination, then it would be complete. The combination would be a flat – X – zigzag.

Within the new bull market of cycle wave V, no second wave correction may move beyond the start of its first wave below 1,810.10.

I do not have any confidence in this wave count. It should only be used if price confirms it by invalidating all other options above 2,104.27.

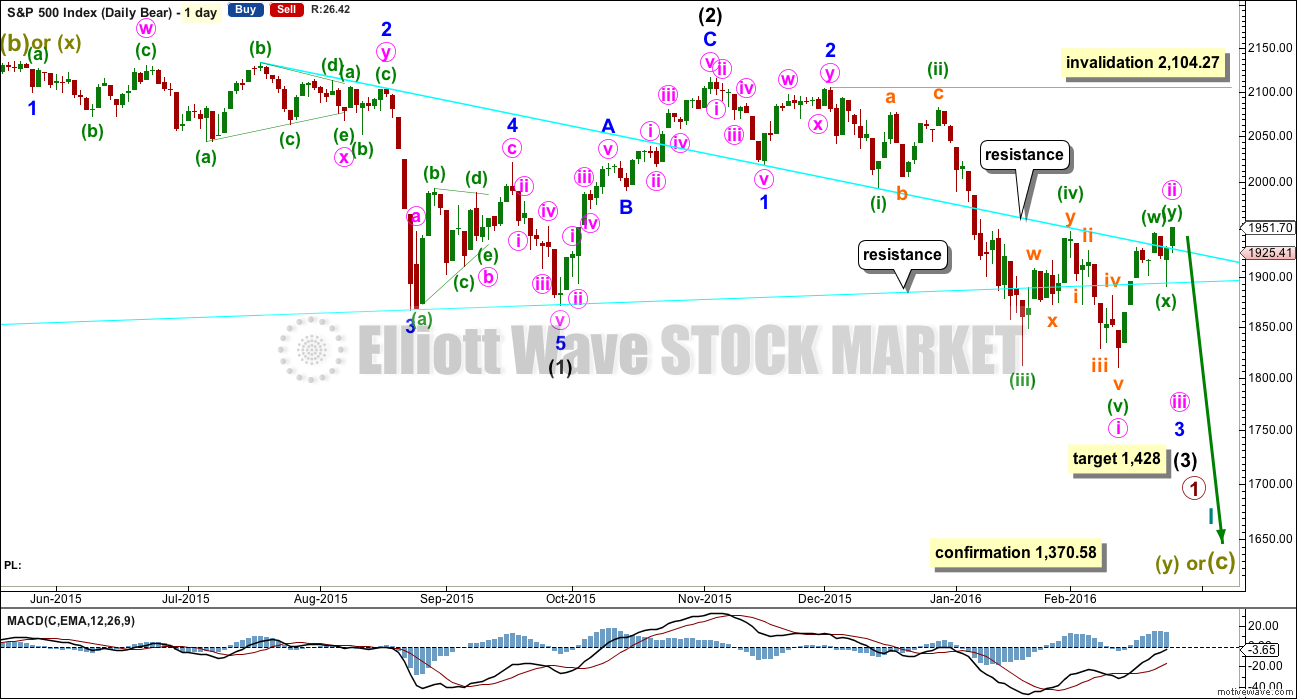

BEAR ELLIOTT WAVE COUNT

DAILY CHART

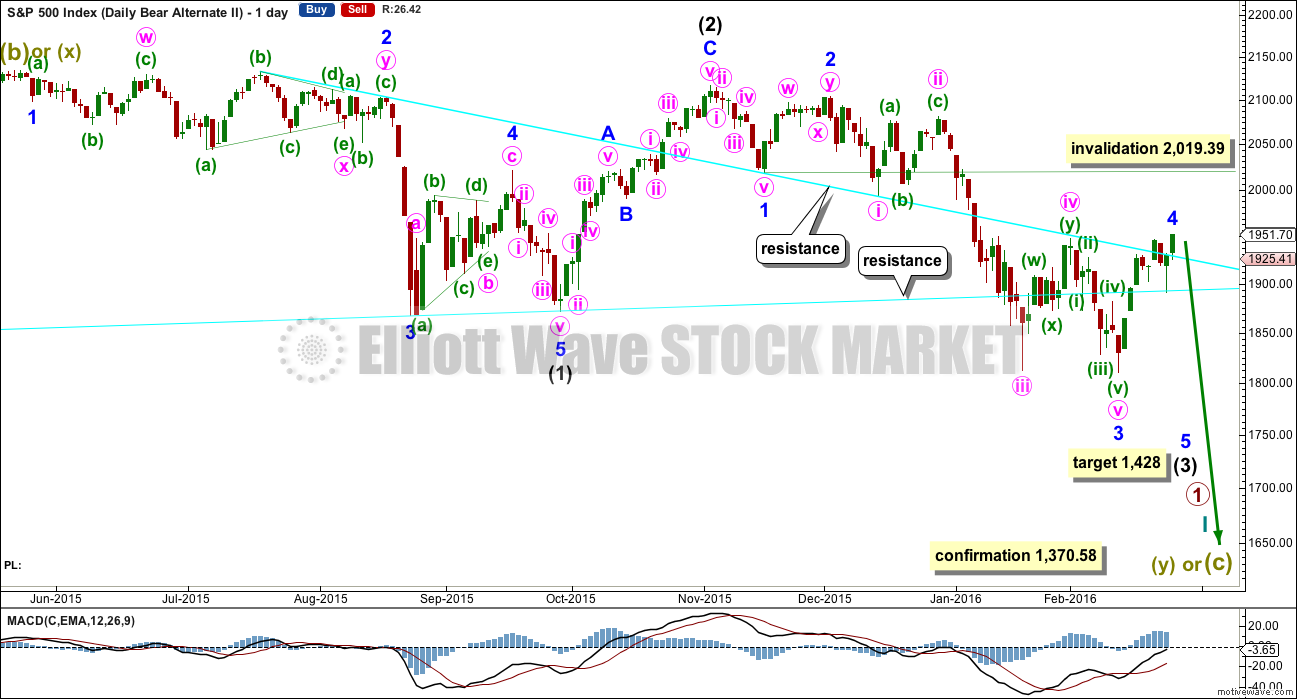

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Downwards movement so far within January still looks like a third wave. This third wave for intermediate wave (3) still has a long way to go. It has to move far enough below the price territory of intermediate wave (1), which has its extreme at 1,867.01, to allow room for a following fourth wave correction to unfold which must remain below intermediate wave (1) price territory.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

Intermediate wave (2) lasted 25 sessions (no Fibonacci number) and minor wave 2 lasted 11 sessions (no Fibonacci number). Minute wave ii may now be complete in nine sessions, one more than a Fibonacci eight. Although minute wave ii is seen as a double zigzag, which fits best on the hourly chart, it has a single zigzag look at the daily chart level. This mirrors the structure for minor wave 2 earlier on in November 2015. That correction looks like a single zigzag on the daily chart, but on the hourly chart it subdivides as a double zigzag with the second zigzag in the double very brief and short.

Minute wave ii may not move beyond the start of minute wave i above 2,104.27.

HOURLY CHART

A new high above 1,946.70 invalidated yesterday’s main hourly wave count and confirmed this wave count, which was an alternate. It is now the only hourly wave count for the bear.

Minute wave ii may have continued higher as a double zigzag. The second zigzag in the double is a complete structure. It may be over here, or it may continue higher tomorrow.

Confirmation that this upwards movement is complete would come first with a breach of the channel containing minute wave ii. Thereafter, a new low below 1,891 would provide substantial confidence at this stage.

While double zigzags are fairly common structures, triple zigzags are very rare. The only way I can see for this structure to continue higher, once price has made a new low below 1,891, would be as a very rare triple. But that would not make sense because the second X wave within a triple zigzag should not make a new price extreme beyond the first X wave. The probability that price should move lower, if it breaks below 1,891, would be very high indeed.

While there is no confirmation that minute wave ii is over, I will not calculate a target for minute wave iii because I cannot have confidence in knowing where it starts.

At today’s high there is now double negative divergence with MACD and RSI at the hourly chart level. This is bearish.

ALTERNATE DAILY CHART

I have previously noted this idea in the text and now it is time to chart it, so that the implications are clear.

Within the downwards impulse unfolding, it may be that intermediate waves (1) and (2) are complete and now minor waves 1, 2 and 3 may also be complete within intermediate wave (3).

This wave count expects minor wave 5 to be extended within intermediate wave (3). Minor wave 5 should also show a strong increase in momentum, so that at its end intermediate wave (3) has clearly stronger momentum than intermediate wave (1).

There is no difference to the target for intermediate wave (3). This wave count makes a difference to the invalidation point. Minor wave 4 may not move into minor wave 1 price territory above 2,019.39.

This wave count also has a lower probability than the main bear wave count. This wave count would be more typical of commodities than the S&P.

Minor wave 2 lasted 11 days. Minor wave 4 may be over in 6 days, which is not a Fibonacci number.

TECHNICAL ANALYSIS

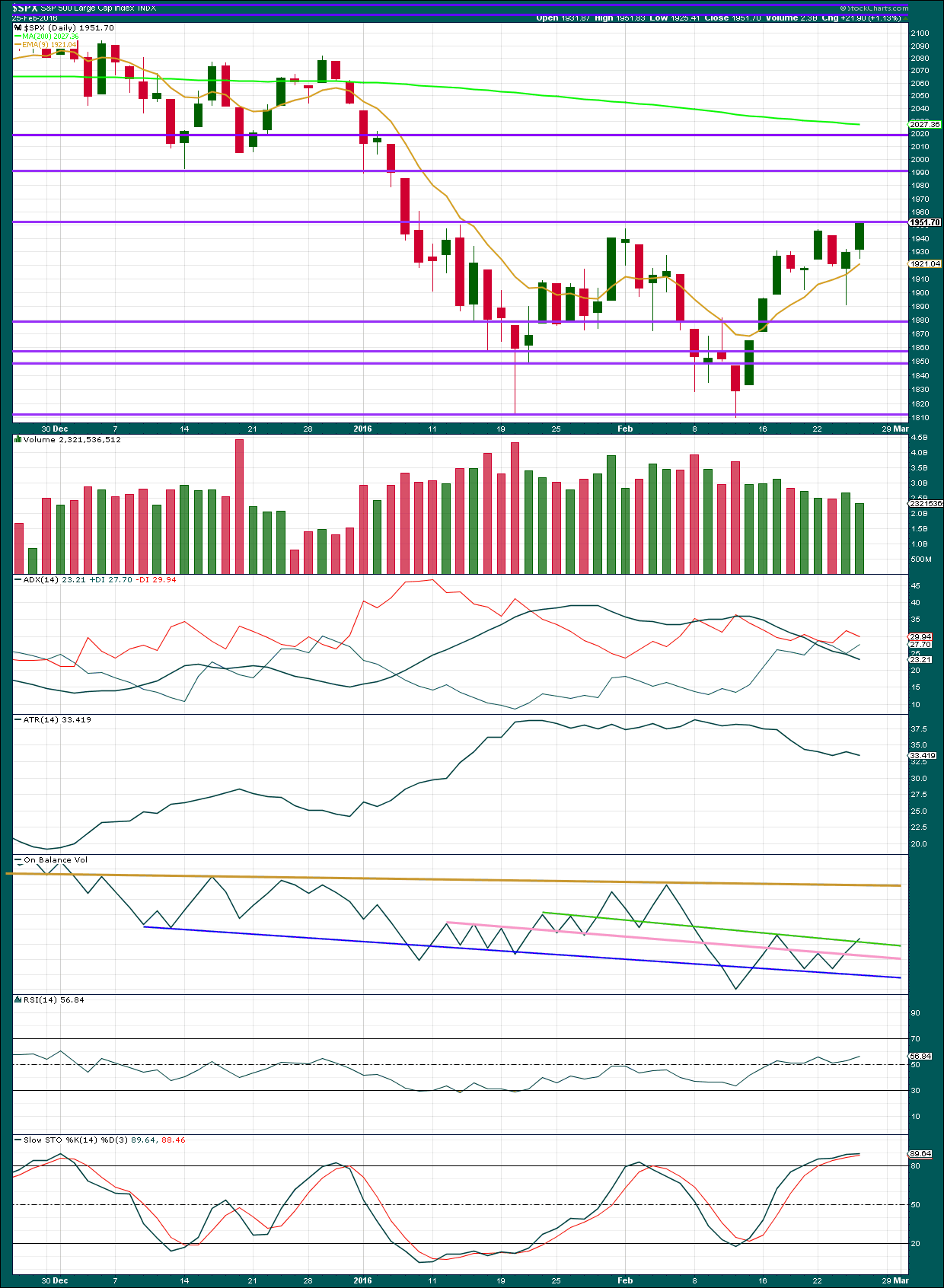

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Upwards movement again comes with a decrease in volume. The rise in price is not supported by volume, so is suspicious. Price may find some resistance at the purple horizontal line about 1,950. This has previously offered strong resistance and support.

ADX still indicates the market is not trending. It has not indicated a trend change either: the -DX line remains above the +DX line.

ATR agrees. It too indicates the market is not trending; it is consolidating.

With the market consolidating, it should be expected that price may swing from resistance to support and back again until a breakout occurs. Stochastics may be used to assist in identifying when price will turn. At this stage, price has found resistance about 1,950 and Stochastics is overbought. This approach would expect a downwards swing about here.

RSI is still just above neutral. There is plenty of room for this market to rise or fall. RSI does not show any bearish divergence with price today. Neither does VIX on a day to day basis.

On Balance Volume is breaking above the green trend line. If this break becomes clearer with more upwards movement from OBV tomorrow, that would be a fairly strong bullish signal. If OBV turns down from here, then the strength of that line would be reinforced.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then my modified Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point. So far the S&P has made a new low below 1,821.61, but it has not closed below 1,821.61.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

This analysis is published @ 10:22 p.m. EST.

I have finished the analysis and it will be proofed now early tomorrow, we have run out of time tonight here in NZ.

I have one nice piece to share with you all first. There is slight day to day divergence between price and VIX for Friday. As I’ve said before, I have found this to be a fairly reliable indicator of an end to a movement.

I am somewhat confident that Fridays high was it for the bear market rally. A new low below 1,891 and the channel would see my confidence substantially increase. If that happens on Monday / Tuesday then I’ll probably add to my short position.

And as always, sometimes I’m wrong. Manage risk carefully.

Lara,

If you have time and are able to give us an update on NASDAQ, it will be most helpful. NASDAQ seems react faster compared to the other two index.

And I’m going to not publish that VIX chart. After taking more time to look for instances where that day to day divergence didn’t work, I can find plenty.

So I must conclude that I was wrong, it’s not a very reliable indicator.

Volatility is stirring but has not yet broken out to the upside. Despite the green close today, I would not be in the least bit surprised to see a blow-off run to the upside on Monday. It would be the perfect set-up for a move to the downside rather than the meandering whimper we saw on Friday. Things already extremely overbought so I realize probability of this is low but I certainly would not be too surprised…I think a close below the round numbers would be conclusive… 🙂

The price point of confirmation, 1891, is now much closer that the 1810 point before. That is nice / fortunate. I think I am going to wait for the confirmation as one way of reducing risk. I am not sure what the invalidation point would be on the 1891 confirmation. I am sure you will give that to us before or when it happens.

The movement down past 1900 will not be a tug-of-war once it finally arrives. The pivot will be violently taken out so that itself will be a signal the down-trend had resumed.

Invalidation would probably stay the same – but my stop would be just above the previous high (that is the swing high before we took out 1891), as going beyond that would likely mean we are tracing out another zig zag (rare triple – or double depending if you go back and re-label the current as an abc rather than xyz (if that indeed would fit)).

But something probably would not smell right (momentum, wave pattern, volume etc.) before we got stopped out.

Probably the first clue that wave hasn’t finished would be a 3 wave structure to the downside rather than a 5.

Ooops – meant ‘abc rather than wxy’ not ‘abc rather than xyz ‘

As many have said here before, the level to watch is 1981. If 1981 goes…look at below.

To my fellow Americans, the American dream could still be achieved…when I graduated from college, my American dream was to be debt free. I am happy to report that not only I am completely debt free, but also I am top one percent income earner. No I wasn’t born with silver spoon or ever had anything given to me. My first job at the age 15 was working as a dishwasher in a local BBQ restaurant for a great rate of three bucks an hour (long time ago). Now I own my own business, which I am happy to report, it has 0% debt. This tells me the American dream lives on for those that are willing to work hard. It wasn’t easy, and there is no substitute for hard work, integrity, and big realistic (at times unrealistic) dreams. What I do know, no one is going to take my constitutional rights away, especially the second and the fourth amendments :). So, long live the republic, and God bless the USA.

I guess I rant too :).

I meant 1891…:) I am sure Olga will find a way to forgive me :)…

Sounds like good old ambition, entrepreneurial spirit, calculated risk, persistence and common sense to me (a bit of luck is always a bonus as well) tbh Jack.

I reckon there are quite a few members here with similar stories from outside America so not sure self made success has anything to do with America or a dream.

My first job was £29.50 *per week* (so about $1.10 per hour – government Youth Training Scheme – engineering apprenticeship). Fellow school leavers laughed their socks off – what a sucker I was. They went straight into high paid £70 / week jobs (well it seemed high paid to them (even me) at that time).

Difference today is – I cannot imagine anyone now taking a job for £29.50 (or today’s equivalent – in UK / US poss not even legal – but that’s another can of worms!) despite the future possibilities. I would have worked for free to build up experience (and still would) – that’s the difference from what I see people think like now and how I saw things back then.

As they say – no risk no reward… Not that long ago neither! (1989) 😉

Olga, your attitude towards learning and gaining experience, I think, what separates the folks that make it to the next level from those that don’t.

Engineering apprenticeship – I knew you were smart :).

I totally agree, I think the folks that have “it” get to where they want to go, no matter which country they happen to reside in.

Cheers to greater understanding…

Jack, If you don’t mind can you share your age for perspective, mine is 57.

I believe at the moment the American Dream is dead… because the quality of jobs that have been out there for recent college grads the last 7 – 8 years are almost non-existent. Therefore, you have student debt issue. They simply can’t get a job with the level of pay that can meet the SL payment and meet the expenses of a basic way of life. There no longer is a path for them… meaning you work hard, you get promoted so & etc, etc.. like back in my day.

That does NOT exist. Also, for those who don’t go to college, if you can get a job and that’s a big if… working hard and a lot of hours gets you no-where. In the past that did lead to something better.

The only path now is to create & run your own business. That path is being taken away as well… due to the larger cost of entry and larger operating cost to run. No time to work hard in your business to grow it and deal with all the regulations and mandates that are dumped into your lap. Now you need to hire people or lawyers to deal with all that unproductive Bull S_it! In the past 3 in 5 businesses didn’t make it through year 5. Now it’s worse than that.

So for the vast majority of Americans today… The American Dream is DEAD!

Unless this all changes and soon… it will be DEAD for good.

All I’ll say to this thread is I really would not like to see anyone implying that poor people are poor because they’re lazy / stupid/ lack ambition.

As long as we accept that macro economics effects peoples lives, and understand there are plenty of poor people who do work hard, then by all means continue this conversation.

I’m not saying that it has been implied because it has not, but I’ve seen these kinds of conversations go that way too often to not jump in with that warning.

This space is your space to discuss whatever you want. It doesn’t have to be limited to technical analysis or markets. So this conversation is okay.

It’s a tricky area though. Normally in teh internetz it quickly descends to a slanging match. I’m curious to see what we come up with in this more polite space.

Oh so wise! There are any number of individuals who, after a lifetime of hard work, are nonetheless going to have their financial lives ruined by the recklessness of their leaders. Already untold numbers of retirees have been very badly hurt by an inability to earn a reasonable rate of return on their hard earned capital and have unwisely put their capital at risk chasing yield. Untold tens of millions are going to discover that what they had expected to be defined benefits payable at the time of retirement, have been vaporized by toxic assets given investment grade stamps by corrupt rating agencies, which are ultimately going to eviscerate they very core of these pension funds when these assets prove to be worthless, much less providing a decent rate of return. Then there are the cases of so many pension funds, both corporate and State, that are woefully underfunded and will never be able to fulfill the obligations they bear to future pensioners. Those of us who know how to trade markets in times of crisis are a very small minority. Even those that think they know who to do it often end up being hurt badly. I so appreciate Lara’s admonition as it is a sober reminder for all of us to maintain a disposition of humility and thankfulness for the blessings we enjoy, and also a spirit of compassion for the many who are already suffering in the current economic environment, and the countless millions who will be joining them as all the chickens of fiscal and monetary malfeasance come home to roost. Thanks for the admonition Lara. I for one am grateful to be reminded. For even the most successful among us, fortunes can, and do change…

Thank you very much Lara and Vernecarty. I stand guilty in using the words ‘lazy’ and ‘entitled’ too easily in this conversation. I stand corrected.

There are many people the world over, not just in the US, that despite their best efforts they just cannot pull themselves out of their situations and circumstances. For many this mean poverty. The US has plenty of this but yet we are very fortunate relative to most the rest of the world.

I also agree about the young adults in our country. I have five adult children from 39 to 23 years old. All of them are fining it difficult to find jobs that pay well and provide benefits. There have been ups and downs. When I got out of college, I didn’t even have to look. I had the position before I graduated. The middle class in the US is shrinking.

Yet, for a large number of people in the US they do have the entitlement attitude and are lazy. The concept of the American dream has changed over time. Initially it included the opportunity for the common (not wealthy) person to own land. Today, that opportunity is all but gone. But the chances of making a good life is greater nowhere than in the USA. Those of us who are fortunate / blessed enough to live here should be grateful. I am.

Thanks again Lara and Vernecarty for pointing out these things. Lara, it makes you an excellent moderator to have broached the topic. Vernecarty you have a very large vocabulary and great skills in the English language. Some day you might tells how you came by these skills.

Very kind of you Rodney. Voracious reading. Very strict English instructors in High School in the BVI. Graduate School slavery also probably helped a bit…. 🙂

Yeah… but you still put ‘z’ where it should be an ‘s’ 😉 🙂 🙂 🙂

And so does my spell checker! 🙁

Don’t I know it. Also still conflicted about favor vs favour and Zee vs Zed. Old habits die hard, even in the US! 🙂

It’s most defiantly Zed. Yes. Zed.

https://www.youtube.com/watch?v=SbDx3M2YnKc

I looked back at my earlier comment today using the word lazy. I was referring to persons trying to make it in the stock market / financial markets using technical analysis, who expect it to be easy. As a result. when they discover how much work it requires, they are not willing to make the commitment to study and learn and all the other hard knocks most of us have taken. They often move on and try to find some other easier way. Those are whom I called lazy.

I still appreciate the corrections and reminders to be clear about use of words knowing we come from varying backgrounds and cultures as well as compassionate to those who live in poverty and destitute conditions etc.

Actually, I wasn’t responding to your comment at all Rodney.

I took no offence. My gentle reminder was not at all in response to your comment specifically.

It was in general, a warning about the topic.

I am sure there are folks that don’t accomplish things because they are lazy, not ambitious, and have a sense of entitlement.

I am also sure that there are a lot of hard-working, ambitious folks that experience misfortunes. That is just life…

It is important to understand and being able to differentiate between the two.

For me, the possible upcoming turmoil of a big wave 3 is required to reset years of excess (particularly) in developed countries. I think of it as the ‘big reset’.

Lara is absolutely right – you cannot tar everyone with the same brush. There are plenty of people out there that work very hard and get nowhere.

But I have had a lot experience with people over the years and I cannot help but think that we slowly but surely brought a lot of this upon ourselves or at the very least, were asleep at the wheel.

Below is (only some!) my real life experience – I am not pointing fingers – if anyone chooses to read this then they can draw their own conclusions:-

At University (UK), I got a small amount of sponsorship from my employer & the government paid for majority of my lessons, albeit you could only just live on it. I played in a band to make extra money at the weekends whilst my mates got trashed. I studied Electrical / Electronic Engineering which I found to be a very hard course (particularly the math). 40+ hours of class per week – was above average.

80% of the students living with me were doing silly degrees like ‘paint mixing studies’ (no I am not joking) and other courses dreamt up by the University to get as many people into their University as possible (so as to receive as much money as possible from the government).

Was that sustainable? I think that kind of abuse is at least part to blame for the fact the government no longer pays for tuition fees in UK. The idea for them doing so was to make the country more competitive (bring in more future tax through a greater educated population), not throw everyone a 3 year party.

After Uni I formed an electronics company. I wanted it to be the kind of company that I would want to work at i.e. relaxed, no need for employment contracts, everything based on trust, very good prospects of promotion, goods rates of pay etc. Yes I know now that I was very naïve, but I had very good intentions.

Needless to say a huge amount of employees took advantage of this situation. It became a bit of a joke that anyone leaving to take another job would take us to an employment tribunal, for no reason other than we were an easy target, and for them it was a bit of extra money. It cost them nothing to do so, they had nothing to lose. They knew well that our insurers would probably pay out rather than risk losing.

We necessarily got alot stricter after that (our insurers demanded it!) and ended up being just like every other company , with stupidly strict Health & Safety rules (no common sense allowed!) – restricting our exposure using contracts etc. But this was (around) 2003 – there were lots of jobs around. Just asking someone to do their job would often cause them to slam down their stuff and walk out. They knew they could walk straight into another job so did not care. Most people were often better off being on welfare than working anyway at that time.

One group of employees went a little further – stole my IP (customer database, products details etc) and started their own company using my IP / copies of (some of) my products. Cost me £250K in legal fees to effectively shut them down – got none of that money back. Not a penny.

All the above was making us less and less competitive globally and causing me sleepless nights. We slowly started replacing employees with automation (i.e. surface mount technology rather than soldering by hand), and contracting sub-assembly manufacture to South East Asia. We went from having around 200 employees in UK in 2005 to little over 10 remaining in UK / West now. Our turnover is now 5x more than it was back then but our real costs are still much less. That fact alone shows how incredibly uncompetitive UK now is imho.

I speak to other people who have similar experience so I am sure it’s not just my bad luck. This kind of stuff is deeply rooted in the West imho and it requires a big reset to get us back on course.

I later went into Aviation and had very similar experiences – could go on and on but you get the idea 🙂

Thank you Olga for sharing your experiences…

I’ve had similar experiences…and I agree with what you have stated…

Thanks Jack – that’s not good to hear but it’s good to hear…. if yer know what I mean 😉

A musician as well? My, you are a person of many talents. What instrument(s) pray tell? Your humble servant dabbles with a bit of the classical guitar, and has an affinity for the electric bass. (favorite players Daryl Jones & Jaco Pastorious) 🙂

Learnt classical piano from age of 3 (actually – more like forced to learn – what 3 year old wants to play piano?? – benefited from it since though).

Played keys (synth) in a few bands. Still do from time to time (for fun – still really enjoy the buzz).

If anyone is in Isle of Man during TT racing festival this year they will very likely see my band performing on the main stages – we’re the ones with the huge laser lightshow 🙂 Also dabble a bit in production / artist management now (new up and coming artists).

Ha Ha – we always joke with our bass player that he’s really a failed guitarist 🙂 (I’m sure you heard that joke between musicians – is meant as banter not anything mean). Classical guitar is cool.

Well that’s just about enough personal info!

That said – some bass players are more than just bass players (slapping and all that other good stuff). Our bass player can’t do that very well 😉

BTW – I can’t play a note on a guitar (well – other than open strings 🙂 )

Slap bass is mega cool. I still remember the first time I heard a bass player doing that my jaw dropped to my knees! Generally mastery of the technique separates the true funk-meisters for the funk wanna be’s. Takes a lot of time and practice to master correct angle of attack for the thumb… tell your bassist to watch Marcus Miller’s technique… 🙂

I read an interesting paper a few years ago about market crashes being nature’s way to re-balance extreme wealth inequity. It did not take long to turn Batista in a pauper despite his prior billionaire status. In these kinds of financial crises the widespread destruction of of paper assets and spiraling deflation means the very wealthy who own most of them, take disproportionate losses. A lot of the insiders have already absconded with the loot by way of debt fueled dividends and stock buybacks. The massive transfer of wealth is going to take place when all the bonds financing the insiders’ cashing out start to implode. I suspect a lot of those bonds are being held by government and corporate pension funds. There will be riots! 🙁

Totally agree – unless wealth is held in physical form, alot of very wealthy people will lose almost everything. The wealthy have alot tied up in artwork, houses, cars, trusts and the like from what I have seen, but I expect most assets to take a huge beating and the funds held in trust to go down with the bank thats holds it. Many are happy to have their accountants allocate their assets purely based on return on capital rather than return *of* capital.

I have met my share of incredibly wealthy people over the years through business and such like and low taxation in some of the places I live (like BVI) kind of attracts these types (not really my circle mind you – I can hold my own but very much working class – I’d prefer to frequent ‘spit and sawdust’ type establishments than posh restaurants).

A lot of very clever people (built very successful businesses etc) seem to have no clue about what dangers to their wealth exist out there. My jaw drops by the amount of people who have all their wealth in the same bank (£ millions !!) and view gold only as jewellery.

I am often embarrassed to even talk about wealth preservation as I am a lone voice coming across as some kind of ‘tin hat’ loony. I sometimes wonder if maybe it’s me that’s missing something rather than everyone else.

Another thing I find very strange – I know alot of people who fund their lavish lifestyle on credit which is secured on their assets (have private jets etc on credit, *huge* credit card balances).

To me this is very strange – one of the main benefits of having wealth is surely to be debt free??

But alot seem to be doing it – it seems there’s quite a few people out there who are living a life of smoke and mirrors.

What happens when their assets are suddenly worth alot less than the debt they have racked up? I wonder how many billions of this game are also on banks books awaiting detonation….

I just realised the answer to my own question – their assets currently have crazy valuations but there is a lack of buyers stupid enough to pay that price.

It is not uncommon for a £5M+ place in Isle of Man to be on the market for years.

So they are allowed to rack up massive debts backed by assets of fictitious valuation – absolutely genius! The bank covers it’s back side and can create alot more debt (so collect more interest) than it should – ‘posh sub-prime'(TM!) if you will! 🙂

The further I dig, the more scary it becomes…. When the dominoes start to fall, the same principles which led to crazy high valuations, will eventually lead to crazy low ones.

I am also a big fan of first amendment…

“Ask not what your country can do for you; ask what you can do for your country.” J. F. Kennedy

“Government exists to protect us from each other. Where government has gone beyond its limits is in deciding to protect us from ourselves.” Ronald Reagan

“The greatest leader is not necessarily the one who does the greatest things. He is the one that gets the people to do the greatest things.” Ronald Reagan

I see it as individual citizen’s responsibility to create jobs and opportunities…

In the United States individuals are the ones that create corporations like Apple, Microsoft, Facebook, Walmart, Paypal,….

It is the entitlement idea that gets us all in trouble. As adults we are only entitled to what we produce, nothing more and nothing less.

Market owes you nothing…

Society owes you nothing…

Government owes you nothing…

Only individuals are responsible for creating lasting liberty and economic expansion. I would like the governments to stay out of it.

If I lose it all, which I have in the past…I’ll get it all back and more in three years…(I think Henry Ford said similar thing).

If you want to change things for better…I recommend you to start getting busy…

I am generation X.

Either the upward correction ended today with 1950 continuing to provide formidable resistance, or it will on Monday with one last manic push to kiss the 2000 pivot area a long goodbye. I figured 1950 would be a brick wall and had my short term hard stops set at 1975 to give our beloved banksters room to play 🙂

If we get a final run-up on Monday, hear me now and believe me later – it will be second best shorting opportunity you will see this year. The next best one will be the end of P two up, probably many months from now. We will probably know which from futures Sunday evening.

I hope you are all positioned. After UVXY clears 50, I will post the chain with the best delta for the 10X upside trade. Let’s make some MMs take us shopping!

Have a great weekend everybodyyyyy!!! (a la cookie monster! ) 🙂

Lara,

Some time in the recent past you recommended a book. I cannot recall what topic. I am thinking it was candlestick analysis. I should have written down if so because I am wanting to learn more on the topic. Could you recommend such a book. Thank you in advance.

No worries.

Steve Nison, “Japanese Candlestick Charting Techniques” Second edition.

He’s the original. I like to go to the original source for information.

When I had to learn all the candlestick patterns for my exams I drew up three A3 posters; one for strong reversal patterns, one for less strong reversal patterns and a third for continuation patterns.

It’s on my list of projects to create digital formats of my posters in photoshop. For members to download and print out.

If you’re a visual learner like me it’s a great way to quickly learn them all by heart.

This downwards move is either the start of the third wave, or equally as likely (!) it could be subminuette wave b within minuette wave (y). That would mean another pop higher on Monday / Tuesday to complete the correction.

The trend is still down. This is still a correction which presents an opportunity.

1,891 is still crucial as is the green channel on the hourly bear chart. The channel must be breached for earliest confirmation. Thereafter 1,891 must be breached for reasonable confidence that this dead cat bounce is over.

When that happens then the third wave really finally should gather steam.

This behaviour really is actually quite normal for a really big third wave. They do start off slowly. When the middle of the middle of the middle… etc. extends then it gets really stretched out. All the second wave subdivisions are larger than normal, its extended in price AND time.

It is totally normal for it to convince everyone that there can be no third wave, right before it explodes.

And then eventually a series of corresponding fourth waves will convince all that its all over… and yet the fifth waves will make new lows. By the time it is at the end everyone is exhausted, believing the lows will keep on coming, and that is when it ends.

So this behaviour is par for the course. I’ll see if I can find a good chart of a long extended third wave, probably the middle of primary 3 from the last bull market. To show everyone how the low degree second and fourth waves show up clearly. How it looks stretched out.

That would be awesome to see such example charts. Thank you in advance. Thank you also for the information you give us concerning the psychological /emotional/social aspects of EW. I find them quite interesting.

I hope you enjoyed the waves yesterday.

I did Rodney. It was a challenging size for me, 3-4ft and I got totally worked and lost my hat 🙂 But I got four great waves so I’m stoked.

Possible bull flag at half mast on the five minute chart. A move out of the downward pointing rectangular flag implies a move to 2025 or there about. Just a possibility to be aware of, that is all.

Hi All,

If oil stabilizes here, then the chances of a sell off diminish greatly. Oil above 35 would take ES above 2000 so we need to be careful. 98% correlation of Oil and /ES in January and so far Feb is in a similar pattern.

Have a good weekend everyone

If S&P goes below 1891, I’ll personally be fully short irrespective oil or anything else tbh. Correlations exist until they don’t imho (albeit I don’t expect based on EW that Oil has yet found a bottom).

Very important to await confirmation though. There is still alot of potential upside risk before invalidation.

Low probability never means zero probability

I agree price is paramount. It may be our #1 indicator.

Exactly.

And the problem with that concept as I experience it is that when a low probability outcome does occur it is never what you’d expected to happen. It’s always an alternate.

And I find that members who are not very experienced don’t understand this aspect of probability and aren’t managing risk well. So when a low probability outcome occurs they complain that the main count was invalidated and the analysis is no good so they therefore cancel. I think that’s a good thing actually, this service really only suits experienced traders. I can’t teach people how to trade, I don’t think anyone can do that, one must learn by making losses and mistakes the hard way.

“I can’t teach people how to trade, I don’t think anyone can do that, one must learn by making losses and mistakes the hard way.”

Aint that the truth!!

I for one wish it weren’t – but it is…

Tbf – when I began trading I used services like this as if they had a crystal ball and obv soon learned the hard way. The difference is that this site at least points is out – other sites (when I was a member) were happy to allow members to think they were some kind of gods.

Don’t want t open up old wounds about other sites though – enuff said 🙂

The people who don’t understand those realities of EW theory and practice, are those who do not want to commit to learning and being patient. It takes time. Most are looking for the ‘golden’ system to get rich quick. They are lazy.

Something I am grateful for is the technology to do what you / we do here on your forum. I learn so very much that would have been impossible to learn some years back. The internet has opened the whole world to a world of possibilities. When I started at this there were no personal computers. Everything, including charting, was done by hand. Orders had to be phone in!!! Directly to brokers.

So for all you new subscribers, hang in there but don’t expect miracles or luck! But be encouraged if you are patient, committed and disciplined while learning how to use EW in practical ways, you are at the right place to help you be successful.

Finally a thread that I feel somewhat qualified to join in on. 🙂

I am new to both trading and EW. I found my way to this site last May (happily pulled in by one of Lara’s YouTube videos). I have been overjoyed ever since with Lara’s clear and concise treatment of EW and with the high level of knowledge and generosity of all of the members who post here. While I am still confused by the wave counts some of the time, I am always encouraged by the posts. It is also really great seeing experienced traders actually trading in the market. I get to see the timing and the reasoning behind the trades. This is incredibly valuable.

I agree that the only way to learn to trade is to trade. The tough part is that you simply don’t know how you are going to react to a trade going south until it happens to you. That is the thing that needs to be learned. My trades are small but it’s amazing how losing even a small a trade hurts. That pain helps the lesson stick. That’s what I tell myself anyway… 🙂

Learning is hard work. I struggle every day with my own impatience with my rate of learning. But it’s going to take as long as it takes… Persistence is key.

I don’t post much at this point but I study Lara’s posts and the forum comments every day. I am always amazed and always grateful.

Welcome rwatt62. Thanks for your post.

I don’t consider myself one of the experts or qualified teachers on this site. But I share and hope it is helpful to others in learning. I also share because I am open to critique of my trading strategies etc. Most beneficial of all is the ability to ask questions and get qualified answers.

I started trading in 2000. Call me bubble boy! I have made every mistake in trading that you can make and I still have plenty to learn. Only in the past 4 years have I been disciplined and trading with a plan. It isn’t an easy road, but I love my job!

It’s great to hear about the path of other members. I too have been at this awhile, my trading has been through a series of changes and with the end of the bull market I am changing once again. First a traditional tech investor I started selling options for credit a several years ago. While the bull market was still in force selling puts was easy and profitable, but I don’t want to sell options in this market. Though I have followed EW for years I got more serious last summer. I too found Lara through YouTube and am happy I did. I am struggling a bit adapting to switching trading styles but in this business you have to be flexible. I greatly appreciate and enjoy all the comments from the experienced and savvy traders that post on this board. I always feel I have a lot to learn so I welcome having that opportunity.

Brilliant, thanks for the insightful comments everyone!

If there are just a very few condensed nuggets I can offer it would be these (and I am nowhere near as experienced a trader as many of you like Verne and Olga, I defer to your experience) :

1. Risk management is THE most important aspect of trading. Stops, set carefully, don’t move them and don’t risk more than 3-5% of equity on any one trade.

2. View each loss as a lesson paid for and pay careful attention to that lesson.

3. Emotions, particularly fear and greed, are enemies. Stick to facts, analysis, technicals, remain unemotional and logical as much as possible.

looks like a doji setting up on the daily

Looks like SPX tracing out a leading diagonal first wave down. Interesting!

Interesting article that supports our bear count.

http://www.hussmanfunds.com/wmc/wmc160222.htm

Thanks for the links, very well articulated points.

This has to be one of the more anticipated crashes in history.

Wonder how that affects the way it plays out.

Your welcome. Our generation has had lots of practice with crashes.

Now that is an interesting question. I cannot tell you how many talking heads have appeared on the various media who are absolutely sure there is no recession in our future, and that the economy is “fundamentally sound”. Hard to tell if they are shysters, just plain liars, or maybe even clueless although the latter would be hard to believe. I think these folk know what is coming and are just doing the same thing they did the last time this happened- lull the retail investor into a sound sleep in a burning house. It may not be as anticipated as one would think as it is not priced in the option chains. Hope springs eternal…

The majority still believe this is just a correction based on my observations.

Perhaps the market wants to fool / trap as many people as possible before the waterfall hits. In order to accomplish that, the market must grab the public into a position where they are afraid of getting left behind this supposedly ‘renewed bull market!” Fear & Greed the two powers behind many decisions.

Last I saw, the bull – bear sentiment indicator was about neutral. Certainly not as many bulls as needed to start and fully execute the waterfall. The Fear Greed Index is moving up nicely from a low of 7 in the recent past to 57 today. If this indicator goes higher to say 80, like a year ago, then it will do the most damage in the third wave waterfall.

Just one scenario and my current thoughts.

I didn’t think that Fear Greed Index would go back up to 80 because this is probably a lower degree 2nd wave. It is in greed territory now.

http://money.cnn.com/data/fear-and-greed/

Gotta say – I’d be seriously concerned if most were thinking we were about to crash / go down hard.

If that were the case then this wave 2 has not done it’s job imo, so would probably need to go higher in order that the masses start re-living the dream.

I had the feeling people thought this was just a healthy correction especially now we are at 1950, albeit I don’t watch any of the talking heads so I really don’t know for sure.

Sentiment is (usually) a pretty useful indicator albeit a data point like all the others.

I am guessing from what I see, that the US individual investor has heard about the possible market crash for some time, like 2 years or more. The higher the market went the more people became aware of the potential. They saw 2000. They went through 2008. They don’t want to repeat either.

Thus many have not been investing their new contributions to their pensions / ira/ 401k etc. They are holding it in cash now. They have gotten their monthly statements at the end of January and they did not look good. That is another reason why the US citizens are angry and want to “throw out the bums” in Washington DC

But if the market can convince them it is a return ‘good ole times of 2010 through 2014, then they will pour in all they can so they do not get left behind. Greed!

This is my take on the part of the US where I live as well as family and friends across the nation. Right now the US citizens are very cautious. But make them believe they are missing out on making the big bucks and American Dream and they will stamped over the cliff like North American bison.

What is the number needed to get them to fear being left behind is a big question. Right now I see many sentiment and momentum indicators that cannot sustain a waterfall before becoming very oversold very quickly.

This is one way I explain to myself that this bear market is taking so long to get going. It has to be set up just right to accomplish what is coming. And at the same time, trap as many as possible.

The American Dream is NOT throwing money into the stock market.

It is much more than that. The American Dream at this moment in time is DEAD!

At this moment in time there is no light at the end of the tunnel.

Once saw that on a sign somehere:-

‘The light at the end of the tunnel has been switched off until further notice’ 🙂

Hi Joseph. Yes very true. Hope for a better life was something I had, we all had, when I grew up in this country. It is very difficult to be hopeful for a better life in the current USA.

I should have said what many perceive to be as “The American Dream.” What used to be understood as the American Dream was to have a chance to own land, work hard, make a life in freedom, help your neighbor and much more.

I used the phrase American Dream as to what I think far too many of my fellow citizens think today. Far too many think the American Dream is to come or be in America where you get everything you could ever want just because you’re American as if America owes us something. Far too many think the American Dream is to become rich. Wealth is much sought after.

Freedom is never so valued as it is when it is taken away.

Great article Tom. Hussman’s reminder that banksters are effective only when risk appetite remains elevated is I think one of the most critical points made by the article. I know many of us who have been bearish for some time based on what we see in market fundamentals (like shrinking breadth), the collapse of the Baltic Dry Index, and other global shots across the bow, have watched in amazement as the market continued to power to new highs. Even as canaries in the coal mine like HYG and JNK slowly rolled over and began a marked decline, the expected rise in risk aversion was nowhere to be seen. It really speaks to the power of market sentiment to sustain a market; albeit on fumes. This is indeed the core thesis of the EW principle of human BEHAVIOR! It was almost two years ago that I was reading one of Lara’s big picture reviews when she dropped what I think was the golden nugget, the rosetta stone as it were that would give a good clue as to when the relentless rise of the market would finally come to an end. As some you already know, it was the RSI swing failure that marked a similar terminus in 2000 and 2007. What is amazing is that she posted this observation almost a year before it actually occurred. I for one was watching for this particular inflection point like a hawk eyeing a plump bunny. Short term gyrations notwithstanding, anyone who has done the minimum of due diligence has a pretty good idea of what is dead ahead. Here is the problem- many of us who are bearish based on our paying close attention to more than just immediate daily price action, often make the deadly assumption that the same is true for ALL market participants. WRONG!!!

The fact that some indices are still only about 10% off their all-time highs, despite the plethora of cracks and fissures appearing in the system speaks to the incredible power of sentiment in charting the market’s destiny. The persistent bullishness is not only reflected in price, it is also reflected in price expectations, as option chains are insanely divorced from the carnage that will attend a decline from a GSC top. While we may be uncertain about near time fluctuations, and about what it is going to take to finally and fully dispel the bullishness of the masses (probably the onset of P three to the downside), we have pretty good grounds for a conclusion about how this is all going to end. Plan accordingly…and Stay Frosty! 🙂

Agreed.

When I see articles in the NZ Herald (a horrible publication which is rapidly descending into the gutter) on the economy it’s all roses. This is an opportunity to buy stocks at low prices. Hold onto your KiwiSaver (our retirement savings scheme, opt in) prices will rise again, it’s just a market fluctuation.

I have seen no one state the possibility of a huge bear market that could wipe out stocks, see companies broke and delisted, and banks fail.

If it is stated it is done so mockingly. For example, “economists have correctly predicted 4 of the last 2 crashes correctly” or “even a stopped clock is right twice a day”.

I get the impression we are in a minority.

Beautiful doji setting up on several indices. Silly trade on UVXY 37 calls expiring today. Just for fun folks, don’t try this at home he! he! 😀

Whoa Nelly! Those little fire-crackers just EXPLODED!

I’ll probably go ahead and take assignment tomorrow. Then again, maybe I just take the money and scoot…let’s see how high they go… 🙂

I’ll take the 50% pop and go home…don’t wanna be a piggy…! 🙂

Think that might be wise – we’re still in a channel from todays – so still looks corrective to me atm.

I’ve been scalping the short term swings from todays high using UVXY – but might be pushing my luck doing it much longer.

If we drop out of the channel might add a bit more to my core short.

Dropped out of the channel – things might be heating up.

Expecting a retest – might be a good setup?

Keep an eye on UVXY. A trade today above 41.50 in all likelihood means the end of the upward correction.

Also means I’m off partying for a week to Ibiza 🙂

Can I come?! 🙂 🙂

I used to take the ferry across from Barcelona (when taking car there for the season). Not recommended, but was the only option other than driving alot further south – is the most disgusting ferry I have ever been on (Isle of Man Steam Packet is rather nice).

Not sure if ingesting vodka through ones eyeballs will really be your scene though Verne 🙂

hmmm,, never tried that, must sting a bit

Just a tad (I imagine)!

http://www.dailymail.co.uk/news/article-1278583/Young-people-drinking-neat-vodka-EYE-quick-buzz.html

holy moly it is for real,, crazy

Sounds painful, and perhaps injurious to tear ducts. I am content with a little Amaretto and lime water ingested via the buccal cavity… 🙂

Lara,

I’m just wondering if we could be in a c wave rather than a y wave right now. In other words, could we have seen an expanded flat for wave b (starting at the end of your wave a and ending at the end of your wave x). This would mean that this final wave up would be a 5 rather than a 3. Is that correct, and does that work?

Thanks,

Peter

I did chart and consider that idea.

But it would require the upwards wave which I have labelled subminuette c within minuette (w) to be seen as a three wave zigzag. And that upwards move looks very much like a five, not a three.

That is pretty much why I stuck with the double zigzag rather than a single zigzag with B an expanded flat in it.

When you looks at the move on the daily chart you want to see the correction of 18th Feb to 24th Feb as an expanded flat for a B wave within a zigzag. But it just doesn’t work well on the hourly chart.

I must say, this whole movement looks very much like minor wave 2 and has the same issues on hourly and daily time frames.

Hi Lara – that move up from approx 1900 to 1945 (c of W) has been bugging me. The start of the move looks alot like a 3 to me?

The 3 at the end of that move also bugged me (I think I pointed it out to either you or other members the other day)

BTW – please don’t spend any time on this as in the scheme of things it makes little difference (other than it allowing for another zig zag – which I don’t even want to think about!). I realise 3s often look like 5s and vice versa.

I just thought back to it when I saw Peter’s question today as it might have explained a 3 wave wave b move up.

I think the start of it is a 1-2, 1-2

On the five minute chart it doesn’t have good proportions for some of it

But its the five minute chart… shouldn’t be relied upon too much

It will fit. That’s the main thing. But TBH it will also fit as a zigzag.

Which means the answer I gave to Peter with that as a B wave of an expanded flat would fit.

And that is one of the most difficult aspects of EW. Impulses and zigzags can look so very similar, sometimes it is just impossible to tell which structure a move is, and so sometimes it is impossible to tell if its a three or a five.

Yep! That’s what I have been surmising- that we might be a few degrees higher on this baby… 🙂

We have just fallen out of the Wave Y channel on the 1 min.

My trade from this morning was hanging by a thread but is now back in play….

We’ll see if Mr Market is bluffing or double bluffing (or bluffing the double bluff! 🙂 ).

This could just be wave 4 sideways action with a pop higher still on the table.

Or was that last pop higher a failed 5th??

Questions, questions… tick tock, tick tock 🙂

Ha Ha. You make me smile – bluff of the double bluff!

Why not bluff of the bluff of the double bluff?

Could be – yer just never know – sneaky ole market 🙂

Or it could be subminuette b sideways within the second zigzag of minuette (y).

Yeah – that looks alot more probable now.

According to the future , minimum going up to 100.0 fibonaci , 1973 end minute ((ii))

We are now above the 15, 34 and 50 day moving averages. The 13 day moving average is on the verge of crossing the 34 day moving average. This is bullish.

Perhaps we shall see the SPX tag its 100 day moving average around 2000 right now. Maybe it can go all the way to its 200 day moving average right around 2025. Just perhaps, noting certain of course. Daily MACD has finally moved into positive territory.

News flash – US Inflation doubled over the last 12 months.

That’s got to wake some day dreaming bulls…

I think there is a significant difference between being ‘scared out’ and following a disciplined plan / strategy. A new word emerged on this blog yesterday, “cubbie” which is a baby bear, infantile, and unable to care for itself. If that is what I am because I followed my plan, then so be it. I don’t think any offense was intended and I am not offended.

But, I have learned over the years that it is prudent and wise to have a stop loss point for every trade. 99.5% of the time when that stop loss is moved so as to prevent being stopped out, more money is eventually lost. It is best to have an entry and exit strategy for both winning and losing trades. It is best to stick to the original plan.

Two days ago I entered a full short position right around SPX 1940. I saw this as a low risk high reward potential trade. My downside target / goal was into the 1700’s. My stop loss was just a few points above around 1950. Subsequently the market moved down to 1890. I had a nice profit. But then suddenly it reversed powerfully and now we are over 1950. I stuck with my original plan and my stop loss was triggered. This trade did not work out. But today there is a high probability we will go even higher.

In fact, when we broke 1947, we broke out of a double bottom projecting an advance to around 2080. If this materializes, could this ‘cubbie’ ride it out and then watch the market plunge to the target of 1425. Why of course I could do that. But why not wait till we have more classical technical analysis to support our current EW count thereby giving a good strategy for entry and exit once again?

In addition, the sentiment and momentum indicators, in general, are not at extreme overbought levels or extreme bullishness levels. Once we get to those more extreme levels, then there will be sufficient power to drive the SPX through the 1875 and 1810 levels into the 1700’s before anyone realizes what has happened.

Well, my point is that if my system / strategy of trading / making money calls for me or others to be labeled as ‘cubbies’ so be it. By staying disciplined I have been fortunate to reap some good gains over the years as well as this year. I am up 29% in my short term trading account for this year in just two months. I am satisfied. This cubbie may be hibernating for a month while the foolish bulls and banksters drive the market upward. I will come out of hibernation when the available food is plentiful and ready to be devoured.

Sounds ‘smarter than your average bear’ to me (as yogi would say) 🙂

Lara was clear imho – await a break of the lower trendline, then price confirmation below X swing low. If we move below x, I’ll throw all but the kitchen sink at it!

I stayed slightly short just in case we gapped down and now I’m licking some small wounds – but the key thing is that I did it based on full knowledge.

You are totally right to use all available information and follow what works for you and your porfolio being up 29% is the only proof you need of that imho.

Keep up the good work!!

BTW (for anyone interested) – we just got a very small degree 5 down on the 1 min 🙂 If we get another move lower I’ll use it as a ‘toe in the water’ entry. The fun never stops!

Got that move lower – so increased short with a stop at 1961.26

Just dropped out the base channel of the move lower – looking good up to now (though S&P has a nasty habit of jumping right back into channels!).

Now looking for 5 down one higher degree – we might still just be in an abc down from todays high.

Well… that trade is now hanging by a thread – I’m not holding my breath but still not quite stopped out 🙂

Last move down poss a 4th wave, with another small pop higher still to go.

Congratulations on a great performance this year and great job sticking to your trading plan!

A good plan and the discipline to stick with it are essential ingredients to success. Nice work.

I think your trading sounds incredibly wise. Far better than some of the emotional traders on here. Whilst calling for a Wave 3 crash the market has rebounded massively. You will be much safer than them.

To be fair – I would say most traders on here are basing their opinions on much more than emotion. There is a huge amount of technical confirmation for being very bearish atm.

All technical signals are screaming that it is not a matter of if this wave turns around but when.

I have a pretty good grasp of EW (albeit far from perfect), so choose to ride in and out of the waves rather than sit tight atm, but that doesn’t change my focus on the overall picture which is still incredibly bearish.

On the contrary, if emotion were at play, people here would likely be bullish by recent action – but that’s where experience helps alot.

Every trader is different and has a different threshold of pain, holds different products, has different levels of experience etc, so every trader needs to do what is right for them imo.

Just my 2 cents.

I certainly agree that the longer term analysis is very well thought through- I can’t fault it. The intra-day blow by blow stuff does not seem to be nearly as well thought out though. Just my opinion. I remain bearish and am sticking to my plan.

Ah – I understand what you mean now Stuart.

Nature of the beast imho – intra day stuff is much more tricky to predict so is much more speculative by it’s very nature. Is more of a fun game than an exact science.

I (try) to base intra-day comments on what I see developing in the charts, but is still dicey at best and exactly why I always make it clear that my daily views should be taken with a pinch of salt.

I only post intra day views as members have found it useful to see one example of EW being used from a trading perspective in ‘real time’. I was concerned previously that my short term view could affect someones longer term position but I think (hope) most know to ignore my comments from a longer term perspective.

Please don’t assume that humorous designation was directed at you or anyone else on the forum because it was not. You know how I like to rant about banksters and my suspicion is that they have few victims here. Sticking to your trading plan is always the right thing to do and I think you are to be commended for trading your plan and not anyone else’s. I know I hav e learned a thing or two from watching your disciplined conservative approach. Nuff said! 🙂

Vernecarty,

As I have said many times, I have a great deal of respect for your analysis, commentary and trading savy. I have learned much from you and all the others here. I do not think the ‘cubbie’ label was directed at me. That is why I said in my first paragraph, “I don’t think any offense was intended and I am not offended.” But I am a sensitive sort of guy and could not happen to notice your comment came immediately following my announcement that I closed my short positions. I had to ask myself, if I was acting as a weak hand and got scared out of my short positions. This morning’s writing above, is my open thinking and reflecting on that question. Far to many traders / investors do not learn because they do not reflect on the plan, their execution and their emotions.

All that being said, I must admit, the gain in my short term portfolio is as a result of Lara’s excellent analysis, this forum’s great intraday commentary, my trading plan and my luck. Sometimes it is better to be lucky rather than good.

At this moment, I think we will see a retrace of the rally from 1890 to 1960. Then we will test the upper limits at least one more time.

I am am surprised you only notice the “cubbie” expression yesterday as I had “Mama Grizzly” and”Cubby” in my bearish lexicon for some time. Maybe I just have not used them here as often as I thought. I think we had a great example of our different trading styles a few days ago when you closed out a position a bit early to protect your profits, and Jack and I stayed in the trade a bit longer for a new low. We both made profits on the trade. You stated the reason for closing the trade out, and although I have not discussed this with Jack, there was also a reason why he chose to stay in over the week-end as I did and close the following Monday. Different folks, different strokes.

Criticizing someone else’s trading decisions is imo more than silly. I never do it, so no, the comment coming after you posted was entirely fortuitous. 🙂

I really need to get off my stream of consciousness commentary!

First of all, your stream of consciousness is beneficial for me.

Secondly, and I have not stated this here before, but I often take very large positions, percentage wise relative to the total portfolio. Some call it ‘swinging for the fences.’

Common wisdom is to risk a maximum of 4% of a portfolio on any one trade. Sometimes I violate that ‘big time’. In those cases, I must be very careful to limit the loss because it can mean a significant loss to the overall portfolio. So some limit risk by the size of the trade. I often limit risk by the size of the loss. That is why I can be up 29% in two months. It is a very dangerous thing to do so one must be disciplined. That was the case in my last two trades and account for why I nervously exited my profitable position a bit early last week and was so quick to exit yesterday.

I doubt yer on your own there Rodney

Not at all a “cubbie”, most certainly one of the biggest rules is stick to the plan.

Moving a stop loss is an amateur move. Holding fast to your stop loss is wise. This is managing risk.

Risk management is the one thing that separates the experienced from less experienced. It can turn even a poor trading strategy into a profitable strategy.

Do members feel the markets are being generally rigged by the Central banks who are terrified of any natural corrections/clean outs.

Does this reduce the efficacy of Elliott Wave which is meant to work in a free market?

Hi Nick – this is an interesting question that is asked quite alot (it is semi-covered in Laras FAQs).

Personally I think it does not make any difference to the overall wave count (the market is much more powerful than a CB imho), but it can cause distortions on a shorter timeframe. You usually find that CB actions kind of fall into the wave pattern rather than the other way round – probably because CBs are run by humans who are just as affected by social mood as anyone else. CBs are generally reactive rather than pro-active imo.

It’s one of the more tricky concepts of EW to come to terms with, but very powerful once you do (as it allows you to cut out most of the noise). Lara doesn’t have a TV so generally has no knowledge of what any CB is doing until well after the event.

Thanks Olga.

That’s very interesting about Lara not having a tv – helps cut out all the noise I guess.

LOL

And the advertising

I do watch movies, on my computer (we have a big iMac which gives nice pictures). Lots of foreign film too.

I read mostly local “news” of New Zealand happenings. I read the Guardian a little, Al Jazeera very occasionally for a different POV and lately Spiegel (English version). But I’m reading headlines and social issue stories, I’m not reading the “business” news. I’m trying to get a feel for social mood out there.

I almost never listen to radio and when I do it’s BBC world service probably for half an hour once a month.

My teenager thinks that living without television is normal 🙂

This final manic run to the upside should trap most bulls, cubbies, and dinasor bears gambling away their retirement money (of course no one here, I hope) and set the stage for an epic move to the downside. IMHO this is not a place to be thinking about going long :). This move up should be over soon.

Look for index to move a bit higher today as leveraged shorts are forced to cover above 1950. A move past 1975 would for me trigger additional upside hedges as I think it would signal a challenge to the 2000 pivot. We could see a reversal today or if not, an outside reversal day on Monday. Close back below 50 day MA could signal end of short covering. Beware the Ides of March! 🙂

Vern, I actually think by “leveraged” you actually mean “margin” shorts. As you know UVXY is a highly leveraged ETF and option utilization in itself is highly leveraged…It confuses me because I know you are a big fan of both UVXY and options so…are you trying to say you’re getting out at 1975? IMHO this thing is gonna head lower…

Quite right. Trading with anything but your own shekels! And of course, only what you can afford to loose…. 🙂

German Finance Minister pretty vocal

““Fiscal as well as monetary policies have reached their limits,” Schäuble told a gathering of bankers and officials hosted by the Washington, DC-based Institute of International Finance on the sidelines of the G-20 meeting in Shanghai. “If you want the real economy to grow, there are no shortcuts which avoid reforms.””

Ris, thank you for posting this info…

Its likely that the G-20 meeting is providing impetus to this rally. I think traders are hoping for more stimulus to be announced, many realizing that it was stimulus that fueled the multi-year rally. We may go higher today because most traders won’t want to be caught short into the weekend.

Here is Elliott Wave 60 – minute view of the Wilshire by another chartest – Daneric that I follow that provides another possibility of where this might be heading. I tend towards the bearish view myself but thought I would share.

http://danericselliottwaves.blogspot.com/

Lara,

I highly recommend you to have Ceaser sell your work in the place/website that are selling your unauthorized work. This tells me that there is a market (and demand) for your work someplace else as well which should be a good news. Please have Ceaser do it because we all depend on your great analysis.

Not cool… Not happy…

That’s okay, the membership here is healthy and growing. And I have a pretty good plan to grow it further with members who are more experienced and so may get more value from my work. More experienced members tend to understand it better and so stay longer.

I strongly suspect this person isn’t making much off my work. For a few reasons.

Lara this is not right and it should not stand…of course, I am not trying to get into your business, or tell you how you should run it…I can tell you, I feel as if we are here like a family, and breach of that trust is not cool. I will not write about this situation anymore (unless asked by you). I don’t want to be a distraction.

Please let me know if I can help…

I know, it’s not cool at all.

And it will be easy for me to stop. I’m in that process. It will be done.

I’m just not going to get upset or too worked up by it. He’s not making much off my work, it’s no great loss to me, and if I just keep calm about it all then I have more energy to focus on what matters.

I had a great surf today in challenging sized waves. So I’m happy 🙂

What a beautiful perspective. I really admire your composure in the face of this betrayal. A great reminder to the rest of us to keep in mind what is truly important in life! In the end, this individual will loose more than they ever took from you; of that I am confident! 🙂

Thank you Verne.

Karma. It has a nice habit of biting those people who are horrid in the a** eventually.

I am a great believer in karma.

Lara have you looked into a DMCA takedown complaint? I think it doesn’t matter where the site is hosted in the world. What I’m not sure about is if you must yourself be located in the U.S. or not. I know that the U.S. has copyright treaties with many countries so I don’t know if this extends to you or not. Just a thought…

Looking into it, yes.

I am here