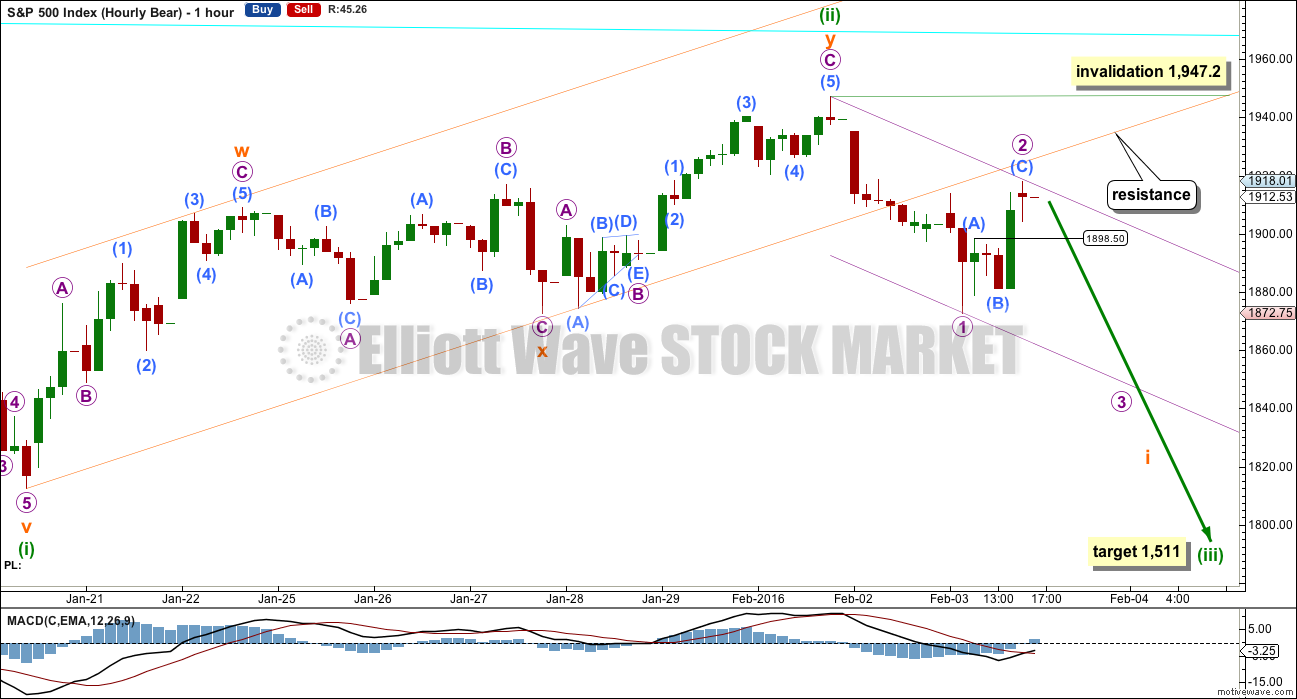

A new low below 1,872.7 provides more confidence in the hourly Elliott wave counts.

Summary: Final confidence in the resumption of the downwards trend would come with a breakout of the current consolidation, which has its lower limit about 1,870, on a downwards day with an increase in volume. At this stage, the downwards trend has likely resumed and the short term target is at 1,511. If this target is wrong, it may not be low enough. Look out for surprises to the downside; this could be the middle of a big strong third wave approaching.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see detail of the bull market from 2009 to the all time high on weekly charts, click here.

Last published monthly charts can be seen here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

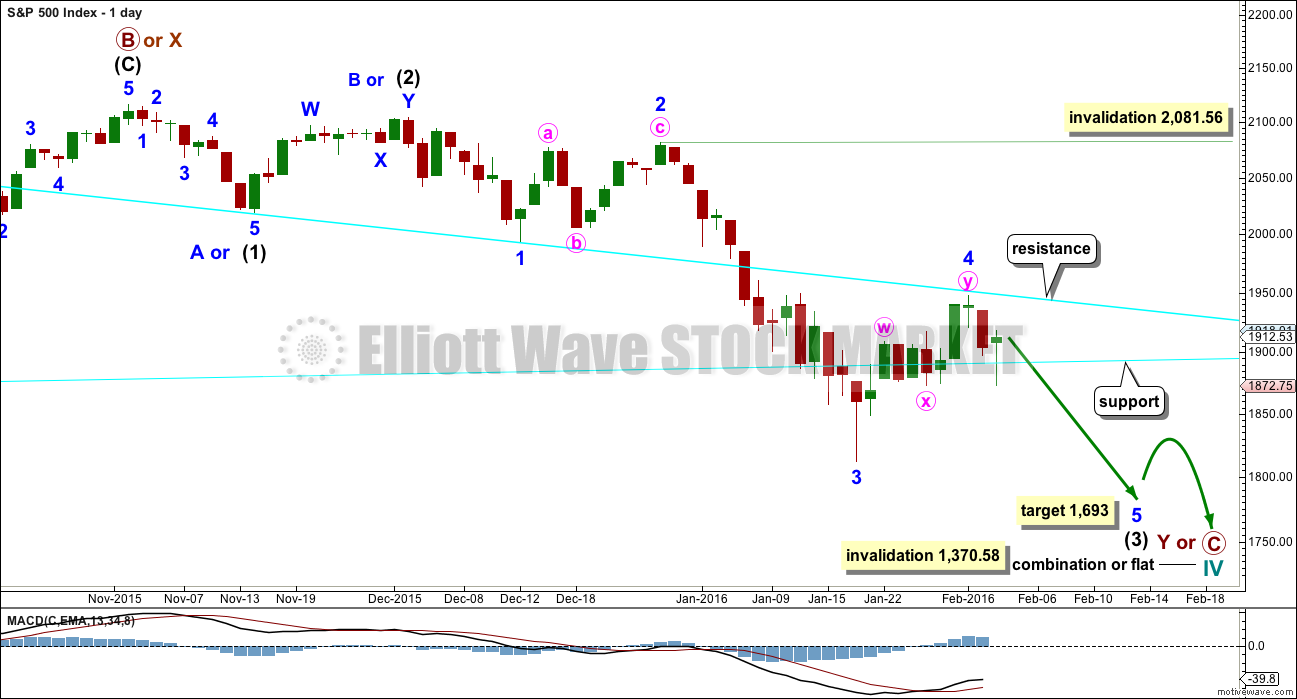

BULL ELLIOTT WAVE COUNT

DAILY CHART – COMBINATION OR FLAT

This wave count is bullish at Super Cycle degree.

Cycle wave IV may not move into cycle wave I price territory below 1,370.58. If this bull wave count is invalidated by downwards movement, then the bear wave count shall be fully confirmed.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may be a flat, or combination.

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

Primary wave C should subdivide as a five and primary wave Y should begin with a zigzag downwards. This downwards movement is either intermediate waves (1)-(2)-(3) of an impulse for primary wave C or minor waves A-B-C of a zigzag for intermediate wave (A). Both these ideas need to see a five down complete towards the target, so at this stage there is no divergence in expectations regarding targets or direction. When and if these two ideas diverge, I will separate them out into two separate charts. For now I will keep the number of charts to a minimum.

Primary wave A or W lasted three months. Primary wave C or Y may be expected to also last about three months. It is now in its second month at this stage and may not be able to complete in just one more. It may be longer in duration, perhaps a Fibonacci five months. That would still give a combination the right look at higher time frames.

Within the new downwards wave of primary wave C or Y, a first and second wave, or A and B wave, is now complete. Intermediate wave (2) or minor wave B lasted a Fibonacci 13 days exactly. At 1,693 intermediate wave (3) would reach 4.236 the length of intermediate wave (1).

This daily chart and the hourly chart below both label minor wave 3 as complete. It is also possible that the degree of labelling within minor wave 3 could be moved down one degree, because only minute wave i within it may be complete. The invalidation point reflects this. No second wave correction may move beyond its start above 2,081.56 within minor wave 3. If this bounce is minor wave 4, then it may not move into minor wave 1 price territory above 1,993.26.

Price has come up to find resistance at the upper cyan trend line. This line goes back to 20th July, 2015, (its first anchor) and is reasonably shallow, has been repeatedly tested, and has reasonable technical significance. It should be expected to offer reasonable resistance and this may end the upwards correction here.

Price found some support about the lower cyan trend line today, which is drawn across the lows from October 2014 to August 2015. Downwards momentum may show an increase once price breaks below support about this line.

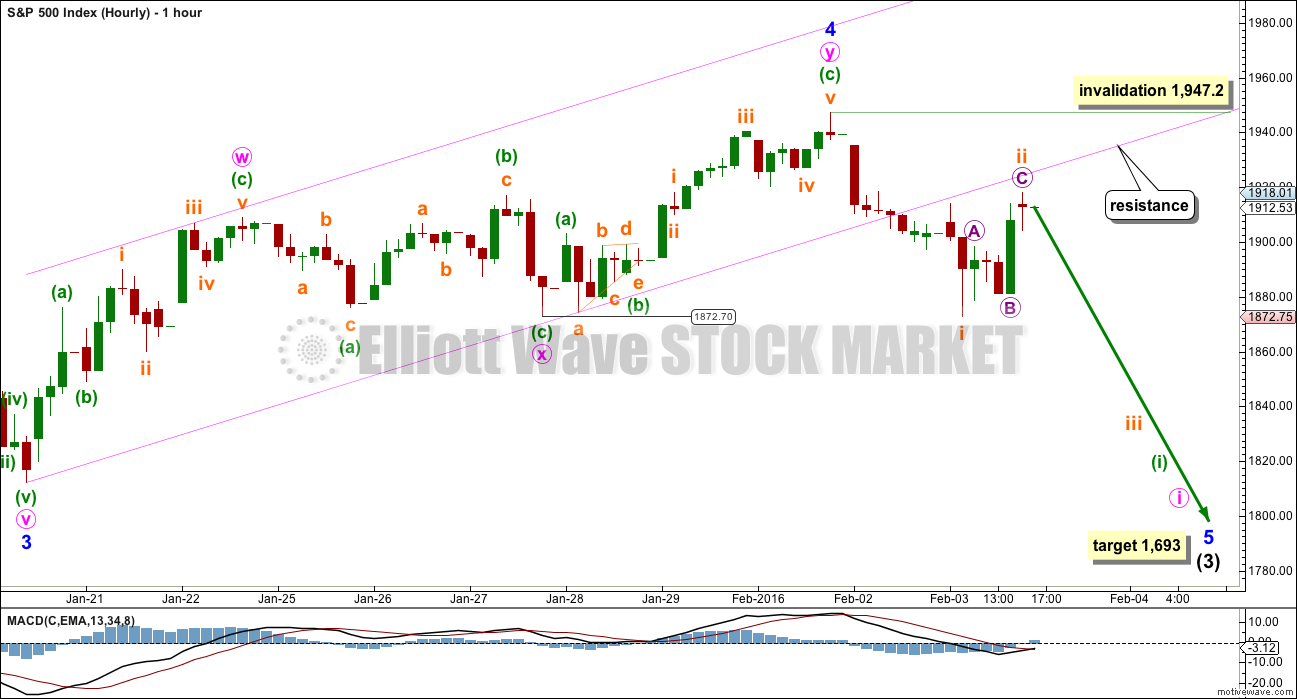

HOURLY CHART

At this stage, the corrective structure which has the best fit is a double zigzag. This movement now has a clear three wave look to it on the daily chart.

If this is a fourth wave correction, then the least likely structure for it would be a zigzag or zigzag multiple. That would not provide adequate alternation with the second wave zigzag.

However, alternation is a guideline, not a rule, and it is not always seen.

The probability that a fourth wave is unfolding has reduced. The probability that this bounce is a second wave has increased.

Because both bull and bear wave counts see this structure in the same way on the hourly chart, further comment will be with the bear wave count.

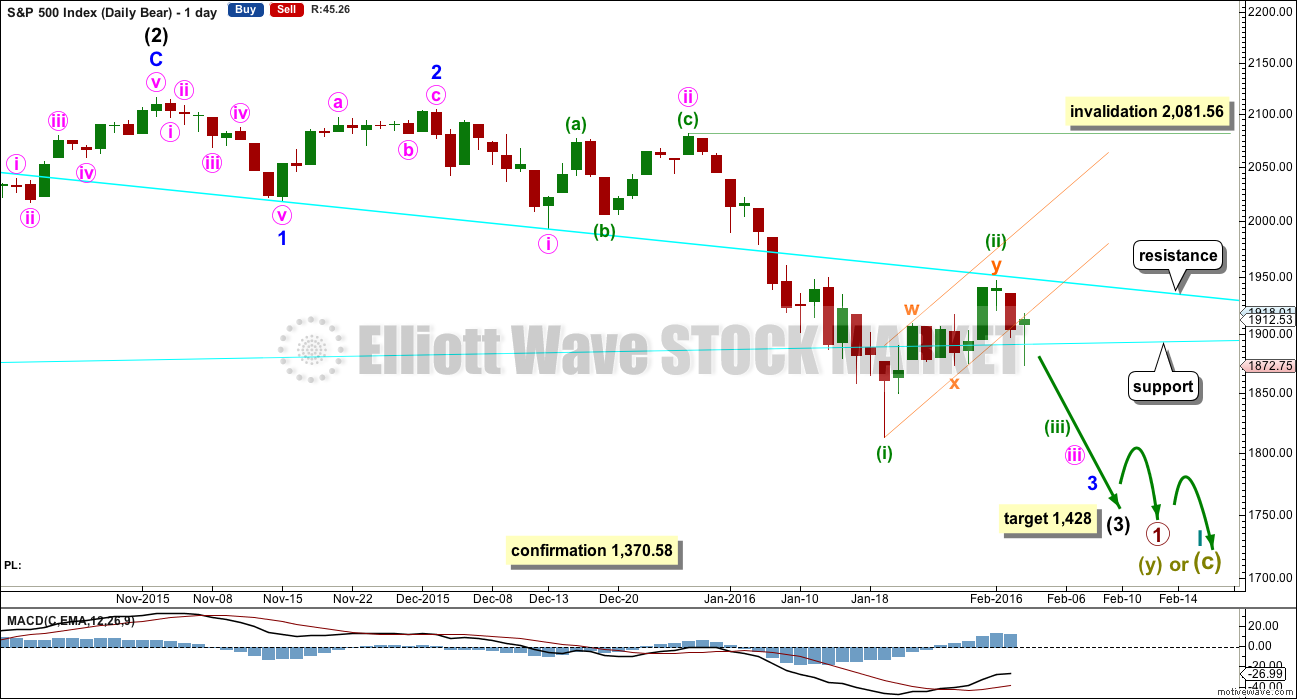

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count fits better than the bull with the even larger picture, super cycle analysis found here. It is also well supported by regular technical analysis at the monthly chart level.

Importantly, there is no lower invalidation point for this wave count. That means there is no lower limit to this bear market.

Downwards movement so far within January still looks like a third wave. This third wave for intermediate wave (3) still has a long way to go. It has to move far enough below the price territory of intermediate wave (1), which has its extreme at 1,867.01, to allow room for a following fourth wave correction to unfold which must remain below intermediate wave (1) price territory.

Intermediate wave (2) was a very deep 0.93 zigzag. Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428. If intermediate wave (3) ends below this target, then the degree of labelling within this downwards movement may be moved up one degree; this may be primary wave 3 now unfolding and in its early stages.

The correction for minuette wave (ii) may be over totalling a Fibonacci eight sessions and finding resistance at the upper cyan trend line. A small channel may now be drawn about this correction. This channel is now breached at the hourly chart level. The channel is still not clearly breached at the daily chart level. I define a breach as a full candlestick below the line and not touching it. It looks like price has moved higher at the end of Wednesday’s session for a classic throwback to the line.

Intermediate wave (2) lasted 25 sessions (no Fibonacci number), minor wave 2 lasted 11 sessions (no Fibonacci number), minute wave ii lasted 10 sessions (no Fibonacci number) and now minuette wave (ii) may have lasted a Fibonacci 8 sessions. Each successive second wave correction of a lower degree has a shorter duration which gives the wave count the right look, so far.

If minuette wave (ii) continues any higher, it may not move beyond the start of minuette wave (i) above 2,081.56. When the channel about minuette wave (ii) is breached by a full daily candlestick below it and not touching it, then the invalidation point may be moved lower at the daily chart also.

The degree of labelling within minute wave iii may also be moved up one degree. This correction may be minute wave iv. I will wait to see how momentum behaves for the next wave down to make a final decision on which degree of labelling is correct. For now I will leave the labelling as the most likely for a second wave due to the duration and the structure of a double zigzag.

If the next wave down shows a strong increase in momentum, then it would be the middle of a big third wave.

If the next wave down shows weaker momentum than minuette wave (i), then it would be a fifth wave to end minor wave 3.

HOURLY CHART

The structure of this correction fits neatly as a double zigzag.

The simplest method to confirm a trend change is a trend channel or trend line.

Although downwards movement from the high labelled minuette wave (ii) does not look perfect as a five at the hourly chart level, it will subdivide as a five on the five minute chart. What is clear so far is that upwards movement for Wednesday does fit best and looks clear as a three wave structure. In the short term, a new low below 1,898.50 would provide further confidence in this wave count at least at the hourly chart level. At that stage, downwards movement may not be a fourth wave correction within an impulse unfolding upwards because price would be back within what would be first wave price territory. At that stage, the upwards wave labelled micro wave 2 would be confirmed as a complete three.

It looks like after the breach of the orange channel that price has come back up to test the lower trend line for a typical throwback.

The violet channel is a base channel drawn about micro waves 1 and 2. If the next wave down is indeed a third wave as this wave count expects, then downwards movement should have the power to break through support at the lower edge of the base channel. Along the way down, upwards corrections should find resistance at the upper edge of the base channel. If micro wave 2 moves any higher, then redraw this base channel.

If micro wave 2 moves higher, then expect it to find strong resistance at the lower orange trend line.

Micro wave 2 may not move beyond the start of micro wave 1 above 1,947.2.

At 1,511 minuette wave (iii) would reach 1.618 the length of minuette wave (i). If this target is wrong, it may be too high. The next Fibonacci ratio in the sequence is 2.618 which gives a target at 1,242. That target looks too low.

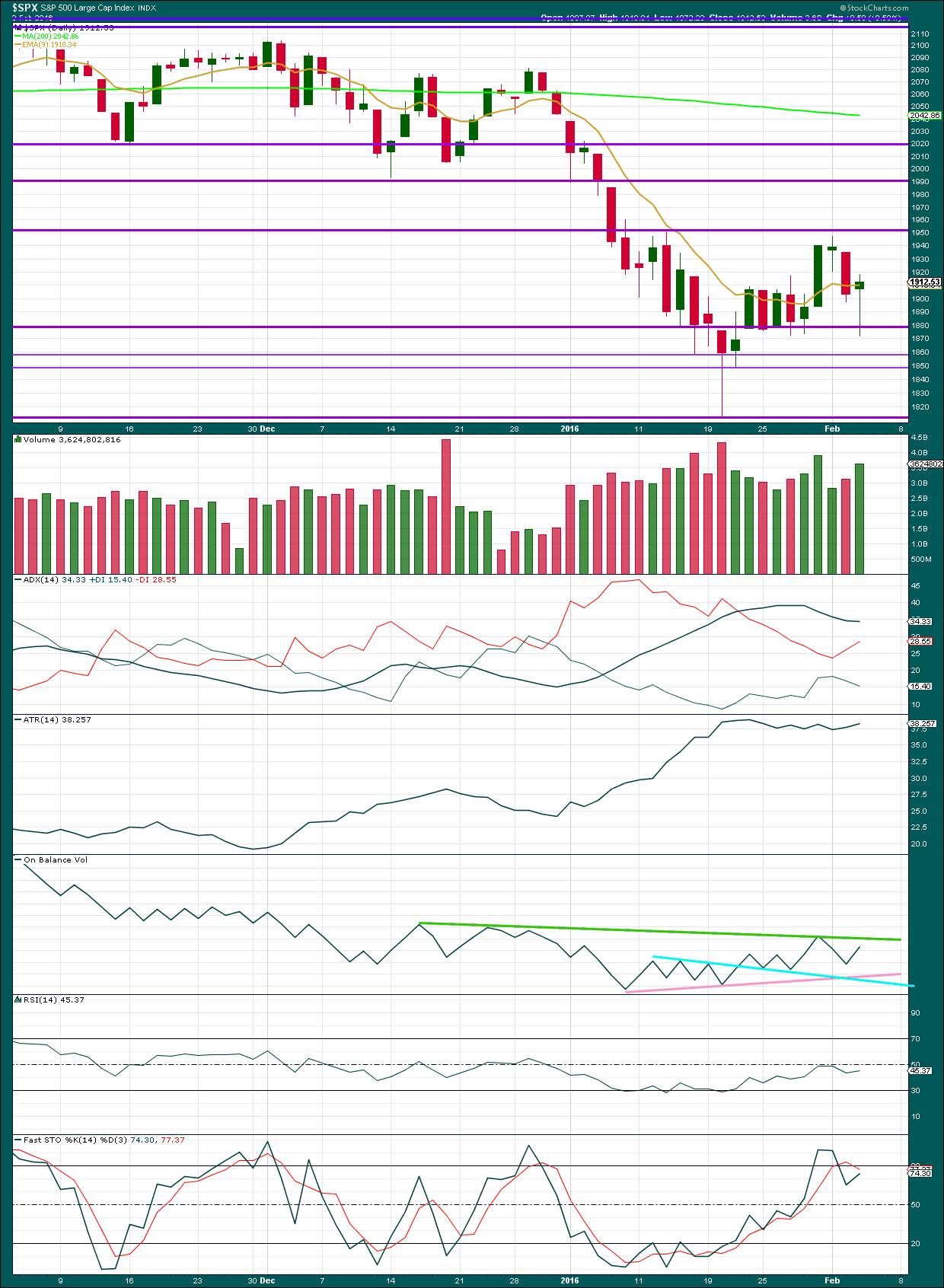

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

I added some more support lines at just below 1,860, at 1,850 and at 1,810. These go back to December 2013, and April / May 2014.

A green daily candlestick with a long lower shadow today comes with an increase in volume. However, price made a substantial new low. The bears were able to push price a lot lower today but could not keep it there. The bulls rallied to push price back up close to the day’s highs. The rise in price was supported by volume, so is not suspicious. This is a small cause for concern today for the bearish outlook for both Elliott wave counts. It is a small concern only due to the substantial new low for the day.

ADX is beginning to flatten off. If there is a trend about to develop, it would still be down as the -DX line remains above the +DX line. ADX still does not indicate there has been a trend change, only that there has been a consolidation period. ADX indicates that price is still within the consolidation (ADX is a lagging indicator). If price is still consolidating, then it is bound between roughly 1,950 and 1,870. A breakout below the lower edge of this zone on a day with increased volume would be a classic breakout. At that stage, more confidence in the Elliott wave counts would be reasonable. It is upwards days which have strongest volume during this consolidation. This indicates an upwards breakout would be more likely. This also gives a little cause for concern today.

ATR is beginning to show some increase. This may be the early stages of a trend.

On Balance Volume may still lead the way. OBV found strong resistance at the upper green line and bounced down from there. It is turning back up and should again be expected to find resistance at the green line, which may assist to hold down further upwards movement in price. If OBV breaks above the green line, that would be a fairly strong bullish indication. If OBV breaks below either of the pink or blue lines, that would be a reasonable bearish indication.

The rally has returned RSI from oversold. There is again plenty of room for this market to fall.

Stochastics is returning from overbought. With ADX still not indicating a trend, it should be expected that price will swing from resistance to support and back again, until a trend develops. At this stage, price is returning from resistance and Stochastics is returning from overbought. Price has found support but Stochastics is not yet oversold, so expect price to continue lower to the next line of support and to only stop when Stochastics reaches oversold at the same time.

DOW THEORY

For the bear wave count I am waiting for Dow Theory to confirm a market crash. I am choosing to use the S&P500, Dow Industrials, Dow Transportation, Nasdaq and I’ll add the Russell 2000 index. Major swing lows are noted below. So far the Industrials, Transportation and Russell 2000 have made new major swing lows. None of these indices have made new highs.

I am aware that this approach is extremely conservative. Original Dow Theory has already confirmed a major trend change as both the industrials and transportation indexes have made new major lows.

At this stage, if the S&P500 and Nasdaq also make new major swing lows, then Dow Theory would confirm a major new bear market. At that stage, my only wave count would be the bear wave count.

The lows below are from October 2014. These lows were the last secondary correction within the primary trend which was the bull market from 2009.

These lows must be breached by a daily close below each point. So far the S&P has made a new low below 1,821.61, but it has not closed below 1,821.61.

S&P500: 1,821.61

Nasdaq: 4,117.84

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

Russell 2000: 1,343.51 – this price point was breached.

This analysis is published @ 11:22 p.m. EST.

Hi

Lara

I remember a week or so back you had been looking for an explosive move to the downside.

I am naturally curios – What made you make that statement? I forgot was that before we hit 1812 or after ?

Is that still in the cards ?

Yes, I’m still expecting that.

Because this is a third wave.

But they have corrections along the way.

Hi

All

Is this a valid bear flag pattern anyone?

Notice what is going on with bollinger bands. I dont know but it looks weird to me…

Futures chart in both DJI and SPX show massive coiling. There is a huge break-out of some kind at hand I believe…futures often down huge overnight with little follow through at market open…those contracts are eventually going to have to be unwound…

I don’t know about now but I think what matters is tommorow morning 2 hours before the open

That’s just the problem. You cannot even rely on what futures are indicating or other markets are dong to provide some insight about US market action. Just as much market action has become divorced from economic reality, we are also starting to see fragmentation among markets and futures. This cannot last.

This what stinks about trading you wait wait then something small happens you change plans then the original plan plays out!

I’m just closing the screens for the next few weeks!

That’s why, for a big move… you have to position for the long haul. All cash… no margin.

The market is NOT going to allow you to see it and get in and ride it out. That’s what these crazy moves are all about. Trap as many Bulls as possible and Kick the Bears out of their shorts… right before all hell breaks loose!

The last time a saw crazy moves like this was in the few months leading up to the 1987 event.

A lot of the whiplash I think is indeed due to people trading on margin who cannot ride out counter-trend moves, and end up exacerbating them when they occur as they are forced to cover or exit their positions when the markets move against them. I never use margin and it is really frustrating to see these moves play out. The market will eventually devour all the margin traders and that I think, will be a good thing!

I don’t do margin either

The fundamental problem I have is we spent 14 days selling off 2080

To 1812

And now stuck from 1812 to 1947 and still at 1910ish area in 12 days

So the math seems confusing to me that we spent almost the same time on the 14 days sell off on a corrective wave upto 12 days.

I’m holding further judgement until tommorow and Monday!

This consolidation is storing energy for a massive move and all the evidence says it should be to the downside. The more I look at what has been happening, the more I am convinced that there is going to be one more all- in bankster cash dump that takes us hugely to the upside to wash out every last remaining short position trading on margin…and then, and only then, the real downside will materialize. I think the banksters are concerned about the size of current short positions. I am looking now for one final explosive upside move out of this triangle to end this period of consolidation. Margin traders beware…this is the way the banksters operate!

The charts don’t support the view for more significant upside

The 61.8 retracement is 1978

Unless the band’s open to the upside with a down trend it will throw off course of the down trend

So the consolidation is not at the apex that was last week

But we shall all find out tommorow and next week!

Chances are we could hit a brick wall and terminate!

For ES and YM on the daily chart with a 6 month view I see nicely drawn Head and Shoulder patterns with a nice balance on each side.

For each I also see a H&S on the weekly chart for ES and YM. It looks really nice if you run the daily and weekly for 5 years.

Futures down a little

If we go lower and into next couple weeks that is ideal

But I say but it all depends on this weeks candle IMO

Monday could be a wildly volatile day, just read an article on zerohedge stating that china will be reporting its fx reserves. BOA feels that it will be better than expected and unleash a vicious bear market rally, Goldman on the other hand thinks it will be worse than expected and result in a selloff. So we will see, announcement apparently Late Sunday. Chinas markets are closed all next week, so I guess its up to the rest of us. I cant imagine markets being closed for a full week. Hopefully we can finish this wave tomorrow and wait for Goldman to be right!

Monday would be fib 13 days, correct?

wow

Most interesting. They have burned up about a third of their reserves “defending” the currency. I suspect they felt they had to in order to respond to the short sellers but they are really probably not too unhappy about the advantage it gives their exports. Japan has virtually guaranteed their currency will be further devalued. I am not sure why the state of their FX reserves would necessarily affect market prices but one never knows. I have a sneaking suspicion that some sort of announcement is in the wings. I plan on going completely neutral short term at the close tomorrow. You just never know with these banksters… 🙂

I have never seen such an amazing string of back to back triangles in SPX! Somethin’ strange’s afoot…

Spx 2000 maybe?

We just moved the entire corrective wave back to 13 days.

I’m not so sure what the Macd is really saying but it sure doesn’t want lower prices at the moment.

Maybe 2-3 weeks of grind higher / sideways?

Does the dollar being crushed helped push equity higher ?

Face ripping rally tommorow ?

Something’s gotta give! 🙂

We’ve got another triangle so a face-ripping thrust is a distinct possibility…if it happens early enough tomorrow, we could get a reversal but I am not counting on it. Regardless of what happens (unless 1870 taken out) tomorrow, I am hitting the sidelines for the time being until we get some clarity…

Both VIX and UVXY printed green today despite markets’ positive close. This is generally bearish but this market is cagey. The only short term trade I feel confident about is grabbing UVXY short term calls under 40 and taking quick profits when it bounces. It looks like it is still being accumulated. If the market continues to meander tomorrow all my other very short term speculative trades (albeit small ones) are going kaput! 🙁

Nfp tommorow.

We either go sideways up up or down.

If the banksters are stalling, sideways is exactly what we are going to get and I would consider that a big red flag…

I don’t know although I’m bearish the setup keeps on changing

I want to see this all fall

Apart but the market doesn’t care about what I think

I think we have now entered a new Charted territory

No good volume today

It will be interesting to see the analysis today

I thought we had enough confirmation we had been going lower since we tagged 1872.21 but I don’t know anymore to be honest

I still think the very best trigger is a clean break of the round number pivots. I have learned from past experience that although it takes a lot of patience, it is worth waiting for that signal to trigger…maybe tomorrow??!!

Updated 5 minute chart.

I will have a new hourly alternate today for the bear. Minuette (ii) may continue higher, and so it is possible we shall see a new high above 1,947.2. Possible, but unlikely. The wave count there has a slight truncation, and a problem of proportion. And I think that cyan line on the daily chart will continue to provide resistance.

So the main hourly will be the same and preferred. And this is what may be happening very short term on the five minute chart.

When micro B triangle is complete if it does thrust upwards out of the triangle then I’ll wait to see a five up complete. If that happens and price remains below 1,947.2 then I’ll enter as close to 1,947.2 as I can, with a stop just above 1,947.2 and limit my risk.

That’s my strategy today anyway.

This chop is nuts! Taking profits on UVXY calls picked up yesterday. I know I am probably leaving some money on the table but I am not playing without a demolition of the 1900 level on close.

I’ve just done the same on that last pop lower – reduced exposure to about 25% short using just VIXY.

We should really go a bit lower to avoid truncation of this abc down from 1927 but it looks too sluggish to me – got tired of waiting.

Will be looking to get back in when things clear up a bit

It sure can be tiresome waiting for the inevitable! 🙂

Glad to see the move in Gold. I was a bit early in the miners but gave myself lots of time and positions have really exploded to the upside.

The best miners are ABX, NEM and GOLD

The best streamers (own rights to see mine production) are SLV, RGLD and FNV.

ETFs I have traded are NUGT (lousy spreads but can really pop), GDX, and GDXJ.

Of course the most widely traded is the old standby GLD.

It should be a good ride the next few months!

Oops! Streamer is not SLV (Silver ETF) but SLW, Silver Wheaton…

I now have Gold confirmed in a bull market

It may be that while the indices fall money shifts to a supposed safe haven of Gold

but I see Gold in a B wave up, to last one to several years (cycle degree) so eventually that will be fully retraced by the C wave down.

What is the best way to trade gold in your opinion? GLD, miners, other?

I trade the Gold spot market via CFD’s. My broker is CMC.

I am not necessarily recommending that, it’s just how I do it.

Hello Lara – Do you expect gold to retrace for a better entry?

Many analysts are looking at April for a low.

Appreciate your views

A

FWIW SafeWealth in Switzerland put out an alert to their clients yesterday, telling them to expect gold to go down so use this current rally as an opportunity to lighten gold holdings to about 20% (from 50% physical cash, 50% gold) unless you can handle the short term pain.

They are very conservative (they are wealth preservation specialists that use EW for preservation – they are very much against short term trading), and history shows that they *usually* get their calls correct.

I totally agree with all the reasons it is highly likely in a new bull but I’m not buying until price invalidates the final bear. Something still doesn’t quite smell right to me.

Interesting times indeed.

To clarify – by ‘go down’ I meant go down to new lows (800s / 900s)

Harry Dent thinks it is eventually going to 750.00. I think Lara is right and that the B wave is going a lot higher than most expect…a lot higher…

I have a conservative bear trend line which today is finally breached by a full daily candlestick.

When its breached by a full weekly candlestick I’ll have more confidence in this trend change, so maybe next week.

in lockstep with crude

Crude will go on to make new lows imo, I see it in the technicals and the fundamentals. Demand is weak and supply hasn’t been throttled yet

DOW 5 min rising wedge

pattern complete

Looks like chop will continue into tomorrow. I have no idea how to count the current price action. I do agree it does look as if it needs one more push higher. See ya’all later…

I’ll be expecting price to move higher overall today / tomorrow and I’m not clear right now if it could move above 1,947.2.

There is a clear five up now on the hourly chart. Price didn’t move below 1,898.5.

This is my five minute chart so far.

There are a few things I need to check out, but first see my reply to Peters comment below please.

thanks

and I’m out with a small profit

this market isn’t behaving as I expected today and the risk of more upwards movement exists

so I’ll take a small profit and wait to see what happens over the rest of this session

Such a drawing 5 min’ is very help, thank you very much

What a bonkers week this has been,wasn’t around 2007. Anybody who was, does the volatility mirror what happen then with what’s happening now?

Joseph

Quick question. What is your take on price so far today? Is it sloppy or more of a bearish tone now?

No opinion… Only that,

Looks Like H&S now forming on 5 min chart.

Look to hourly and daily chart…

good catch on hs/…..

Verne,

Anyways – I got to get some coffee – brb matey!

Joseph and Verne or Jack,

Shooting Star Reversal by the close on the daily?

Does that qualify since it is technically at a somewhat high level?

Once again, looking for conquest of 1900 pivot on close, a bearish engulfing candle would be conclusive imo…

a couple more weeks would probably do it to finally break 1900 – jk

Those would both be very encouraging. I think 1872 is still the crucial level. I will not be very confident until that happens. Right now with SPX coming off 1927 to 1906 I feel much better. But we are not out of the woods yet. Just my thoughts. BTW I got lucky two days in a row with the stops. Someone once told me, “Never push your luck.”

oh o.k

the higher risk the higher the reward!

i agree on luck!

especially getting out in the first 30 minutes with a short imo before they buy the dip…

Joseph

What is your take on SPX 1550 by end of month Feb?

I believe in the price… you never know the when.

I have found over the years that to get two targets right for one trade is extremely hard. I focus on price and not time when I make a decision to trade. That’s why I no longer use options. Except Leaps in the 18 month to 2 year+ range and when I buy those I buy well in the money Leaps.

oh o.k

Lots of stops no doubt run. Anybody here bought it? I doubt it…I was tempted to take profits on my UVXY calls this morning…glad I held on… 🙂

Very close for me. But no.

I am starting to get curious about this price action. I guess I should not be too surprised as the battle around the 2000 area lasted much longer. What I don’t get is why these folk don’t just let the waves play out their natural pattern and get it over with. I am starting to wonder if there is some serious stalling going on ahead of some sort of bankster announcement??!! 🙁

XLB–Materials Sector

XLI–Industrials Sector

XLF–Financials Sector

XLE–Energy Sector

All showing temporary strength!

Backtest of trendline? Kissing it right now on the hourly SPX chart.

Lara,

It looks like 5 waves up off of yesterday’s low, so I am thinking minuette wave ii is extending. Could what you have as the end of minute wave ii only be wave w of minuette ii? If that were the case, we may be close to finishing wave a of y of minuette ii. If I remember correctly, you held out the possibility of minuette wave ii lasting a 13 days, which would still allow for a few more days of sideways to upward movement. ending beyond 1947.

Also, volume looks reasonably strong for this upwards move today.

Thanks,

Peter

Yes, it does look like a clear five up. That is what it is.

Which means it’s going to go higher before it’s done.

It could be one of two things (degrees given for the bear hourly):

1. A deeper second wave for subminuette ii

2. Minuette (ii) is continuing higher.

I will favour neither, both are possible.

If it’s minuette (ii) continuing higher then that explains the three wave look to the downwards wave of Feb 2nd and 3rd.

But… the first wave up for minuette (ii) really fits best as a double zigzag. For it to extend at this point a triple zigzag should be the only option… and they are one of the rarest EW structures. So the probability must necessarily be very low.

Now if the upwards wave of minuette (ii) could be seen as a single zigzag then we may have an X wave down and now a second zigzag unfolding upwards.

I’ll spend some time checking out what that would look like.

SPX gap at around 1939 will probably get filled…

Rumor spiked oil which spiked stock prices… this rumor below is absolutely bogus! That will not ever happen. They are doing anything to support the Oil price… but it will fail.

Bogus Rumor:

Today it is talk of Turkey potentially invading Syria from the Russian defense minister…

It amazes me how people get away with this garbage and that people actually put their money at risk on this stuff.

Another week – another hammer?

If we close this week after tomorrows report up that would be 3 consecutive weeks of hammers…

I have to go back and check if I ever every saw 3 weeks of hammers ever in my life of trading.

I think you make too much of hammers. That do require confirmation IMO.

Looks to me like a head & shoulder pattern with a downward sloping neck line to me.

Correct I saw that head and shoulders back in oct last year and it sure is playing out slow motion.

It will be interesting to see how many more weekly hammers we need until this dies out.

It is comedy..

I think we can make a case that there are three H&S…

Oct to Sept

Sept to Feb and

One big one Oct to Feb

I just remember how everyone on twitter finance was so sure we would goto 1980 and 2000 before we would turn down to 1500’s

Mr. Market sure is always 5 steps ahead of the average crowd.

This potential +20 points could be a couple days – i sure hope not…

+20 I don’t think….

Oil already fading. That was a bogus rumor. All the Oil rumors are bogus the last several days. There will be no deals for production cuts until oil is materially lower in price… at that price way down there for more than 9 months+++++++++

Both Brent & WTI have now turned red.

great

Looks Like H&S now forming on 5 min chart.

The DOW has just got such strength. Not sure what to make of it. DOW and SPX leading but NASDAQ lagging. Not how things should be imo…

yep!

Yesterday SPX had a 33.6 point move up in the 2 to 3PM hour.

13.35 in 5 min from 2:20 to 2:25PM and

6.16 in the next 5 min from 2:25 to 2:30PM

Could get a like kind more the other way at any time.

The bollinger bands keep on compressing. Dropped about -20 points from the upper band yesterday now at 1954….

Once we get within 70-30 points it should resolve… no jinx – down, down and down!

The dis- connect between the huge cash dumps and the still elevated VIX suggests that the crowd is not buying it. The key to bankster efficacy is the ability to convince the crowd; failing that, they are blowing smoke…

An incredible amount of capital is being blown trying to fight the downward trend in these markets. While this could go on for a while, when it does break down its going to be very violent…

Those SDS calls are going to double (again!) today. Be sure to sell ’em or roll ’em to take advantage of the small volatility premium if you got some.

Round number pivots should be decisively taken out this morning with strong move past SPX 1870…we hope! Despite being jacked up overnight, DAX already down 1% 🙂

Strong SPX support shelf in the 1870 area (four bounces) and price needs to decisively slice through it to say goodbye to the 1900 pivot. It’s good to keep in mind during bear markets these sharp rallies are caused not only by short covering but also smart traders and algos that specifically target the likely stops of short positions. I started noticing a few months back how often price would “co-incidentally” move just past logical stops before reversing. For this reason I am a bit more flexible in my stops and occasionally prepared to be underwater in some short term positions as is presently the case. This current whiplash move is clearly designed to stop out as many shorts as possible ahead of the next decline. I suspect a break of 1870 on strong volume will signal its completion and will deploy the last of my ammunition at that time.

Good morning Vernecarty,

I am using two vehicles for this short position. The first is SQQQ. The other is TVIX. I used the 1915 point as what I thought was the limit up move. Then I placed my stops at an equivalent to just beyond that figuring they might try to run those stops. My SQQQ positions were comfortably safe in part because Nasdaq has been a bit lower than SPX. But the TVIX as I mentioned below moved more percentage wise than the SPX or QQQ so it came within 0.10% of being stopped out.

My question is this, do you find that the VIX and related vehicles are easier to be pushed by big traders / banksters further where they sort of disconnect from the markets for a time?

Thanks for all your comments etc.

I find that for me the VIX is very hard to trade. I always get hammered trying. So I gave up.

I find it’s easier to trade for longer term swings… the 3 X short or long ETF’s and Proshares are as good as any. Currently I am in SDOW & SPXS + in the money Leap options for them. The Leaps I positioned back in May when VIX was ~ 11-12. I don’t trade these options… or haven’t yet. Waiting for the big move for Leaps.

Another important thing about both VIX and UVXY is that for the vast majority of traders they are definitely NOT buy and hold instruments. Profits should be quickly taken in the 15-20% range for short term trades. That is 90% of trading them successfully imo.

They are definitely more volatile as it were, instruments. VIX option spreads tend to be lousy and you really have to get positioned well ahead of a big move to make it worthwhile. I like trading UVXY because although it is also very volatile, spreads are not too bad and it moves in a pretty consistent way. The key to trading it is once it begins an uptrend, look for support levels and just buy when it hit them or goes a little below. This has worked predictably for the last several months since its break-away gap up open. While I am sure these are as subject as other instruments so far as attempts to manipulate is concerned, it looks to me like the smart money has been accumulation long positions in volatility the last few months. Speaking of which, both market and VIX up today and we all know what that means 🙂

Thanks and I am now fully positioned. Yesterday’s correction is a gift.

I totally agree with this. Used to listen to an independent financial advisor who said don’t use stops for this reason. You will get whipsawed by the algorithms you mentioned and get bullied out of your position. Once something passes your “mental” stop price, sell out… don’t actually place a stop.

I agree. When I am able to watch closely I am using mental stops. But when I need to be away from my desk / computer, I can’t leave without setting stops especially early in a position / trade. Once I am well in the money / profit, it becomes much easier to manage. I know this makes my trading different than those who can be by their computer for the entirety of the market day every day. But it is what it is and I have to work within those parameters.

Thanks to both our you Ari & Joseph for taking the time to share your thoughts with me.

Sure hope I’m wrong but after falling lower on lighter volume today (compared to previous days of similar price) and then quickly accelerating up on higher volume … along with maintaining a perfect upward channel line on daily, incl a strong futures market, smells pretty bullish on short term.

Thanks Lara. I was gone most of the day. I have not been stopped out. But it was very close. One of my stops came within 0.10% (yes one tenth of one percent) of being stopped out. I guess I will move it a bit tomorrow to give it some breathing room. One of the most disappointing events for a trader is to be stopped out of a position by a few cents and then see the move they anticipated materialize while getting away from them. Been there done that.

IKR! Happens to me too, to all of us I expect. One of the most frustrating things about trading I think.

One of my risk management techniques is to move my stop to break even once my position becomes comfortably positive. I’ll do this even after just 24 hours if price goes my way.

What that means in practice is I’m often stopped out for no profit (or the tiniest profit if my stop is just beyond entry). But no loss either.

When that happens I reassess the situation and think of it this way. I’m offered a better entry point.

I don’t think of the lost profit. That way leads madness.

It means that for some of my longer trades it took a few entry attempts before the position “sticks”. And that’s okay. It suits my psychology. I don’t like risk.

That is exactly what I did yesterday. Before leaving for the day, I moved my stops to put me at a profit albeit small. Sometimes it is better to be lucky than good. But only sometimes. Thanks for all you do at this site. Surf’s up. Market’s down!

Thanks!

“The] volume of each transaction increases dramatically as the end of a trend is reached … while the time interval between each transaction drops… . In other words, as prices start to rise or fall, stock is sold more frequently and in larger chunks. Traders become tense and panic because they are scared of missing a trend switch.”

http://www.elliottwave.com/freeupdates/archives/2016/02/03/Gene-Stanley-is-The-Puzzle-Solver.aspx#axzz3zAIdghzW

Good point

This looks like a classic bull trap.

Friday is important this week!

$CPC is printing 0.85, which is somewhat bearish.

Not liking the Futures’ action though.

I would be comfortable seeing this volume profile for a commodity.

I see it less often for the S&P.

But then, the S&P does seem to be exhibiting some commodity like behaviours recently…

Lara, I am hearing about some massive budget cuts that are going on…kind of budget cuts that I remember seeing back in ’08…I think is just a matter of time, and I also think that is going to be worse than ’08.