Downwards movement was expected.

Summary: This does not look like the start of a third wave down because volume is too light. What looks likely is today was part of a correction which may end with some upwards movement to end tomorrow above 2,093.84 but not above 2,104.27. Thereafter, strong downwards movement for a third wave is expected to begin.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see last analysis of weekly and monthly charts click here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

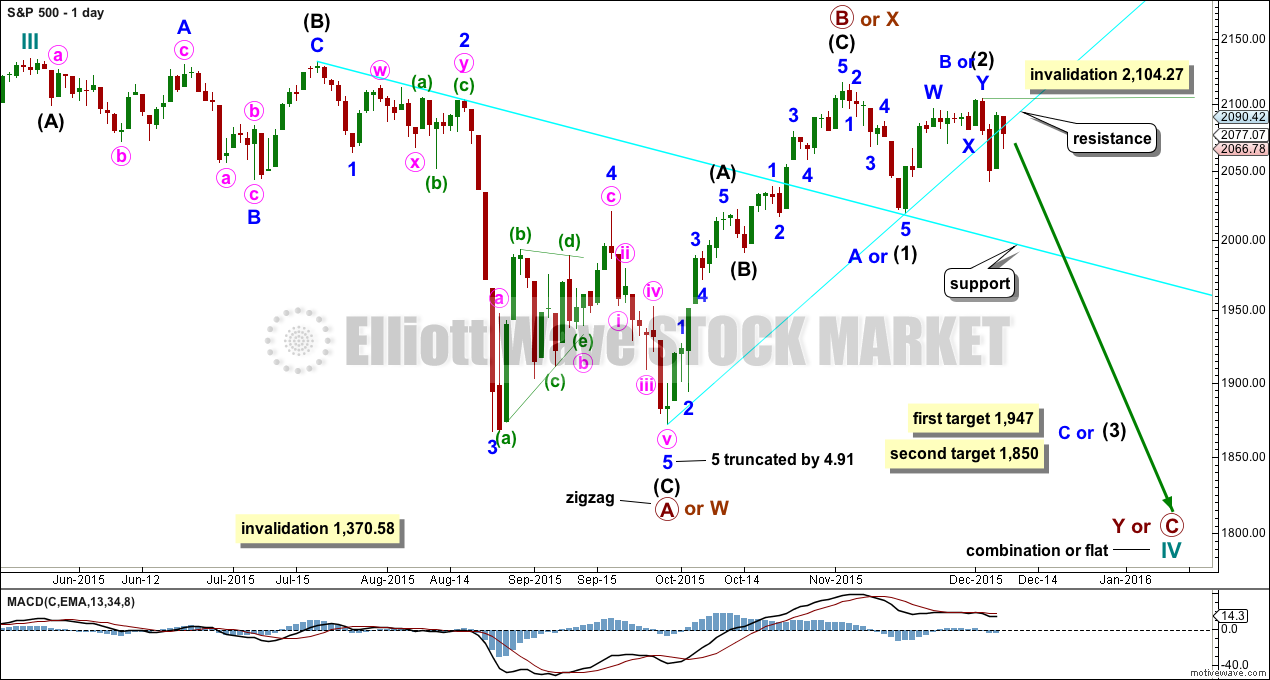

BULL ELLIOTT WAVE COUNT

DAILY CHART – COMBINATION OR FLAT

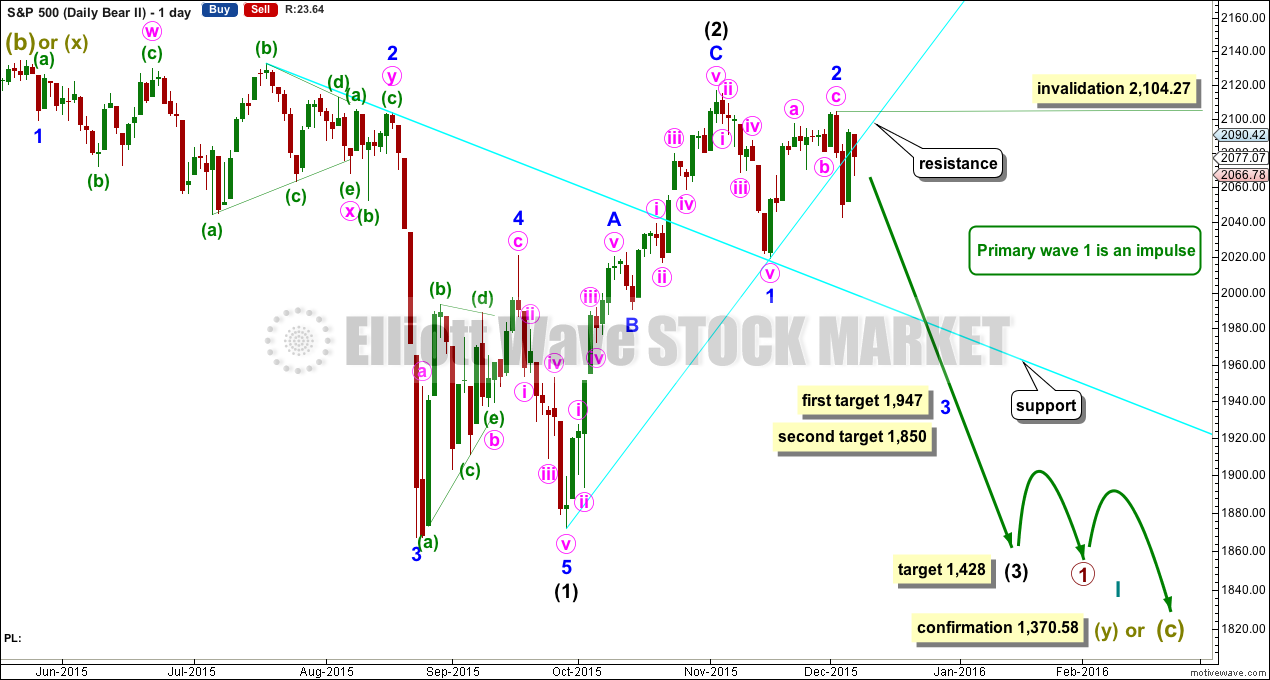

Cycle wave IV should exhibit alternation to cycle wave II.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may end when price comes to touch the lower edge of the teal channel which is drawn about super cycle wave V using Elliott’s technique (see this channel on weekly and monthly charts).

Cycle wave IV may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

If a zigzag is complete at the last major low as labelled, then cycle wave IV may be unfolding as a flat, combination or triangle.

The wave count is changed today to again see primary wave B or X as a zigzag completed earlier. Primary wave C should subdivide as a five and primary wave Y should begin with a zigzag downwards. This downwards movement is either intermediate waves (1)-(2)-(3) of an impulse for primary wave C or minor waves A-B-C of a zigzag for intermediate wave (A). Both these ideas need to see a five down complete towards the target, so at this stage there is no divergence in expectations regarding targets or direction.

Primary wave A or W lasted three months. Primary wave Y or C may be expected to also last about three months.

Within the new downwards wave of primary wave C or Y, a first and second wave, or A and B wave, is now complete. Intermediate wave (2) or minor wave B lasted a Fibonacci 13 days exactly. At 1,947 intermediate wave (3) or minor wave C would reach 1.618 the length of intermediate wave (1) or minor wave A. If price falls through this first target, or gets there and the structure is incomplete, then the next target would be at 1,850 where intermediate wave (3) or minor wave C would reach 2.618 the length of intermediate wave (1).

No second wave correction may move beyond the start above 2,104.27 within intermediate wave (3) or minor wave C.

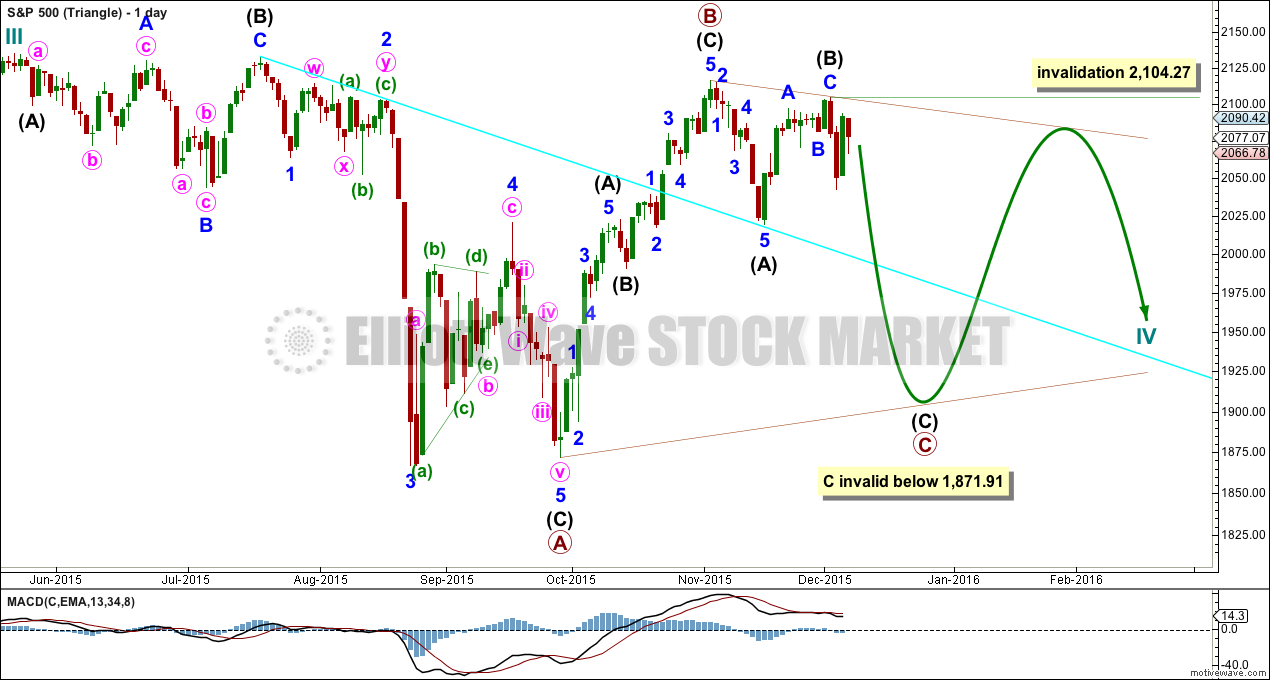

DAILY CHART – TRIANGLE

Cycle wave IV may unfold as a shallow triangle. This would provide alternation with the 0.41 zigzag of cycle wave II.

Primary wave B may be a complete zigzag. Primary wave C downwards may be underway and within it intermediate waves (A) and (B) are complete. No second wave correction may move beyond its start above 2,104.27 within intermediate wave (C).

The whole structure moves sideways in an ever decreasing range. The purpose of triangles is to take up time and move price sideways. A possible time expectation for this idea may be a total Fibonacci eight or thirteen months, with thirteen more likely. So far cycle wave IV has lasted six months.

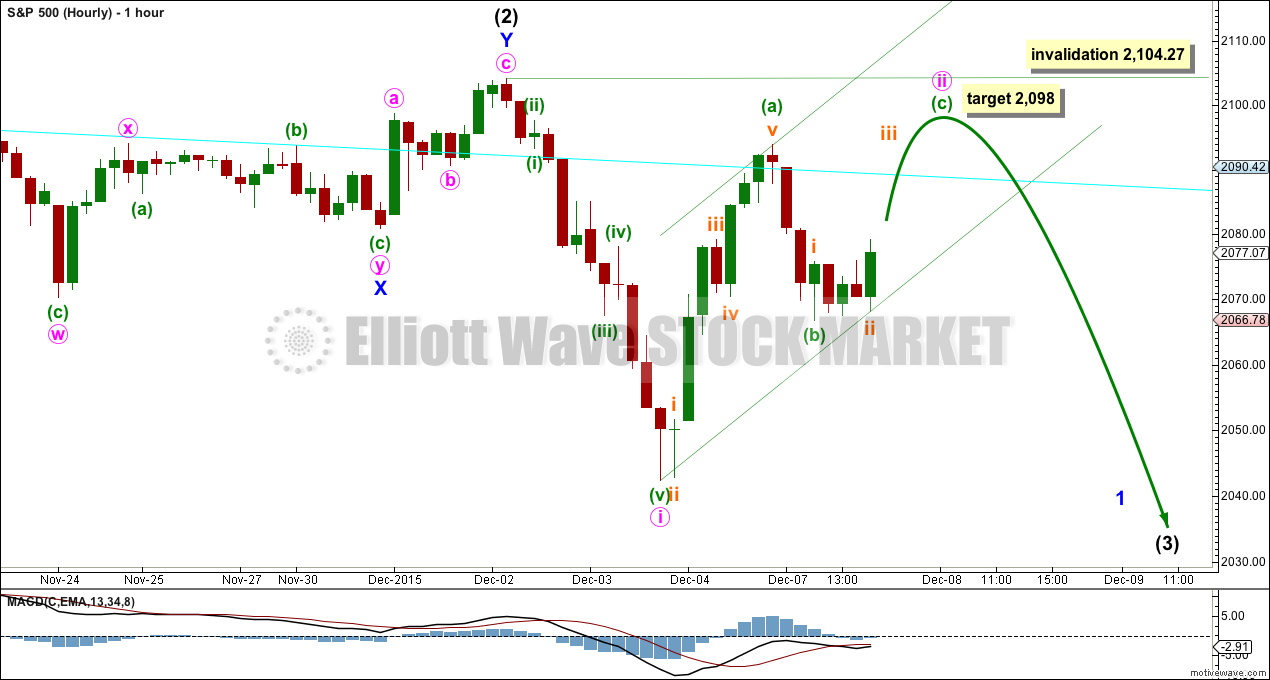

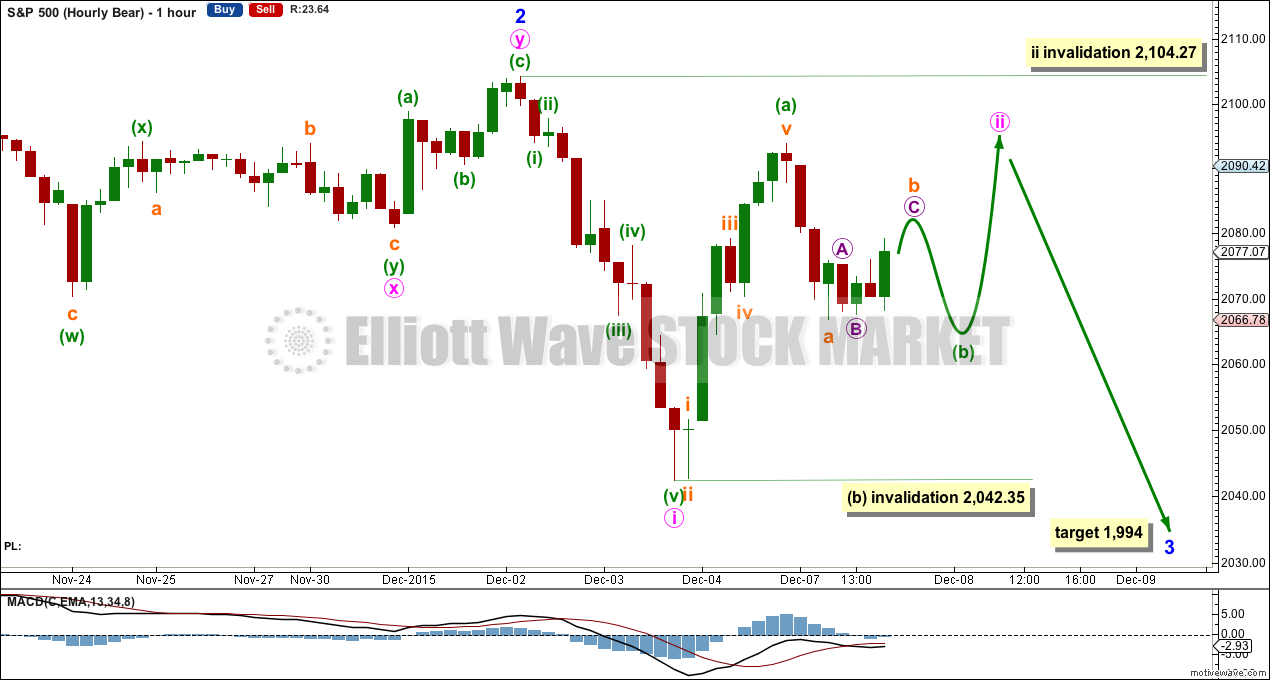

HOURLY CHART

There are at least two ways to see Monday’s price movement.

The two hourly wave counts will look at two different ways, and both work for bull and bear (the degree of labelling for this bull is one degree higher).

The difference between the two hourly charts today is how to view the choppy movement about the low for Monday. It may be a first wave up and a second wave correction, but this looks less likely as the upwards movement labelled here subminuette wave i subdivides best as a double zigzag, not an impulse, on lower time frames. The scenario presented for the hourly bear wave count fits better at the one minute chart level.

Minute wave ii may be continuing as a more time consuming and deeper zigzag. If it ends tomorrow with upwards movement, then it may total a Fibonacci three days.

At 2,098 minuette wave (c) would reach 0.618 the length of minuette wave (a).

ALTERNATE BULL ELLIOTT WAVE COUNT

DAILY CHART

It is possible to see cycle wave IV a completed flat correction. This would provide some structural alternation with the zigzag of cycle wave II.

This is a regular flat but does not have a normal regular flat look. Primary wave C is too long in relation to primary wave A. Primary wave C would be 3.84 short of 4.236 the length of primary wave A. While it is possible to also see cycle wave IV as a complete zigzag (the subdivisions for that idea would be labelled the same as the bear wave count below, daily chart) that would not provide structural alternation with the zigzag of cycle wave II, and so I am not considering it.

This idea requires not only a new high but that the new high must come with a clear five upwards, not a three.

At 2,562 cycle wave V would reach equality in length with cycle wave I. Cycle wave I was just over one year in duration so cycle wave V should be expected to also reach equality in duration. Cycle degree waves should be expected to last about one to several years, so this expectation is reasonable. It would be extremely unlikely for this idea that cycle wave V was close to completion, because it has not lasted nearly long enough for a cycle degree wave.

I added a bear market trend line drawn using the approach outlined by Magee in “Technical Analysis of Stock Trends”. When this lilac line is clearly breached by upwards movement that shall confirm a trend change from bear to bull. The breach must be by a close of 3% or more of market value. If it comes with a clear five up, then this wave count would be further confirmed.

While price remains below the bear market trend line, we should assume the trend remains the same: downwards.

Intermediate wave (1) is a complete five wave impulse and intermediate wave (2) is a complete three wave zigzag.

For this wave count, when the next five up is complete that would be intermediate wave (3). Within intermediate wave (3), no second wave correction may move beyond the start of its first wave below 2,019.39.

This wave count does not have support from regular technical analysis and it has a big problem of structure for Elliott wave analysis. I do not have confidence in this wave count. It is presented as a “what if?” to consider all possibilities.

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count has a better fit at Grand Super Cycle degree and is better supported by regular technical analysis at the monthly chart level. But it is a huge call to make, so I present it second, after a more bullish wave count, and until all other options have been eliminated.

There are two ideas presented in this chart: a huge flat correction or a double flat / double combination. The huge flat is more likely. They more commonly have deep B waves than combinations have deep X waves (in my experience).

A huge flat correction would be labelled super cycle (a)-(b)-(c). It now expects a huge super cycle wave (c) to move substantially below the end of (a) at 666.79. C waves can behave like third waves. This idea expects a devastating bear market, and a huge crash to be much bigger than the last two bear markets on the monthly bear chart.

The second idea is a combination which would be labelled super cycle (w)-(x)-(y). The second structure for super cycle wave (y) would be a huge sideways repeat of super cycle wave (a) for a double flat, or a quicker zigzag for a double combination. It is also possible (least likely) that price could drift sideways in big movements for over 10 years for a huge triangle for super cycle wave (y).

The downwards movement labelled intermediate wave (1) looks like a five. If minor wave 2 is seen as a double zigzag with a triangle for wave X within it, then the subdivisions all fit nicely.

Ratios within intermediate wave (1) are: minor wave 3 is 7.13 points short of 6.854 the length of minor wave 1, and minor wave 5 is just 2.81 points longer than 0.618 the length of minor wave 3. These excellent Fibonacci ratios add some support to this wave count.

Intermediate wave (2) was a very deep 0.93 zigzag (it will also subdivide as a double zigzag). Because intermediate wave (2) was so deep the best Fibonacci ratio to apply for the target of intermediate wave (3) is 2.618 which gives a target at 1,428.

Within intermediate wave (3), minor waves 1 and 2 are complete. The upwards movement for minor wave 2 does have a strong three wave look to it at the daily chart level. Minor wave 2 was another deep correction at 0.87 of minor wave 1. Targets for minor wave 3 are 1.618 and 2.618 the length of minor wave 1.

It is still possible (but still less likely) that primary wave 1 is unfolding as a leading diagonal. I will keep that chart up to date and will publish it if and when it begins to diverge from the idea presented here. For now I want to keep the number of charts published more manageable.

HOURLY CHART

The subdivisions within subminuette wave b fit perfectly at the one minute chart level. This may be an almost complete regular flat correction with only a small final fifth wave up to end micro wave C required.

Thereafter, downwards movement to end below 2,066.78 would complete a zigzag for minuette wave (b).

This may then be followed by upwards movement for minuette wave (c) to end above the end of minuette wave (a) at 2,093.84 avoiding a truncation.

Minute wave ii may not move beyond the start of minute wave i above 2,104.27.

Overall, this idea expects choppy overlapping sideways and upwards movement which may last another one to three days.

When minute wave ii is complete, then minute wave iii downwards may begin.

If this wave count is invalidated with a new high above 2,104.27, then the alternate below should be used.

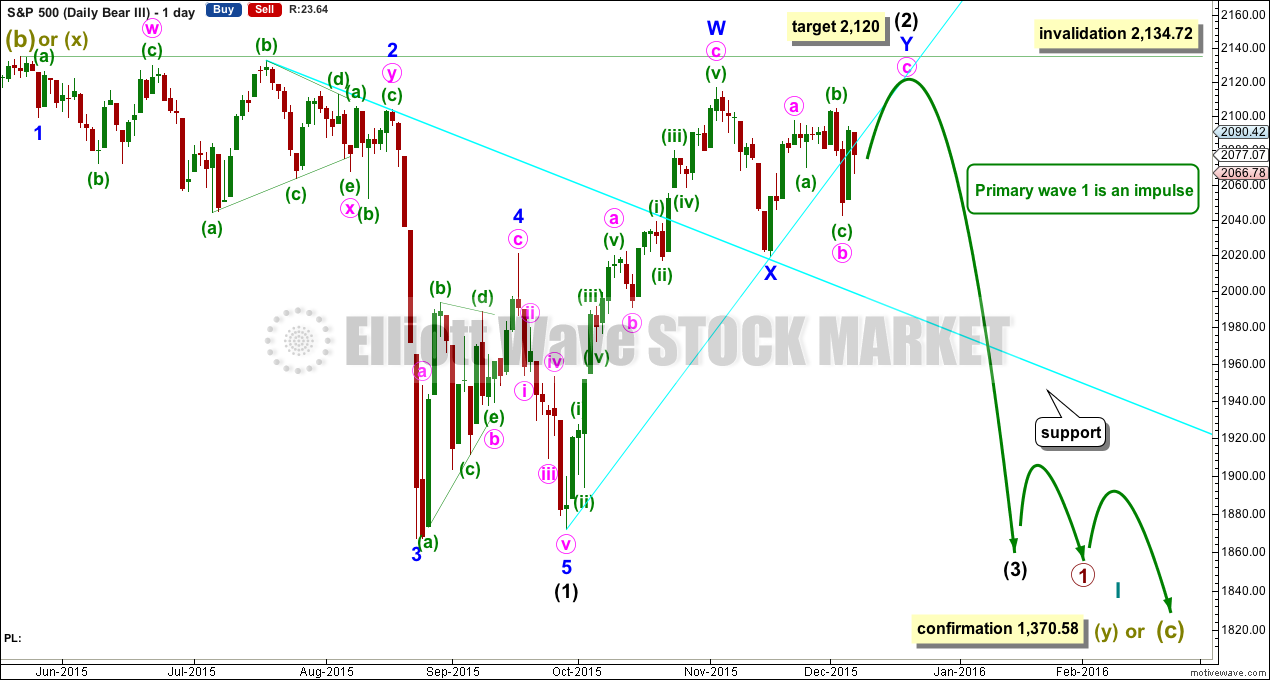

ALTERNATE BEAR ELLIOTT WAVE COUNT

DAILY CHART

What if we see a new high above 2,104.27?

It is possible that intermediate wave (2) could be continuing as a double zigzag. This cannot be a combination. The second structure in the double cannot be a flat correction because the b wave within it is less than 0.9 the length of the a wave.

Double zigzags exist to deepen a correction when the first zigzag in the double does not move price deep enough. In this instance, the first zigzag in the double is a 0.93 length of intermediate wave (1); it is very deep indeed. A second zigzag is not required because the first was very deep. This structure meets the rules but not the purpose of a double zigzag, so it does not have the right look.

This idea has a low probability. But it is technically possible. It should only be used if price moves above 2,101.27.

At that stage, a five up on the hourly chart would be required to complete. It should move above 2,116.48, so that the second zigzag in the double deepens the correction and meets its purpose. It may not move above 2,134.72.

At 2,120 minute wave c would reach equality in length with minute wave a.

TECHNICAL ANALYSIS

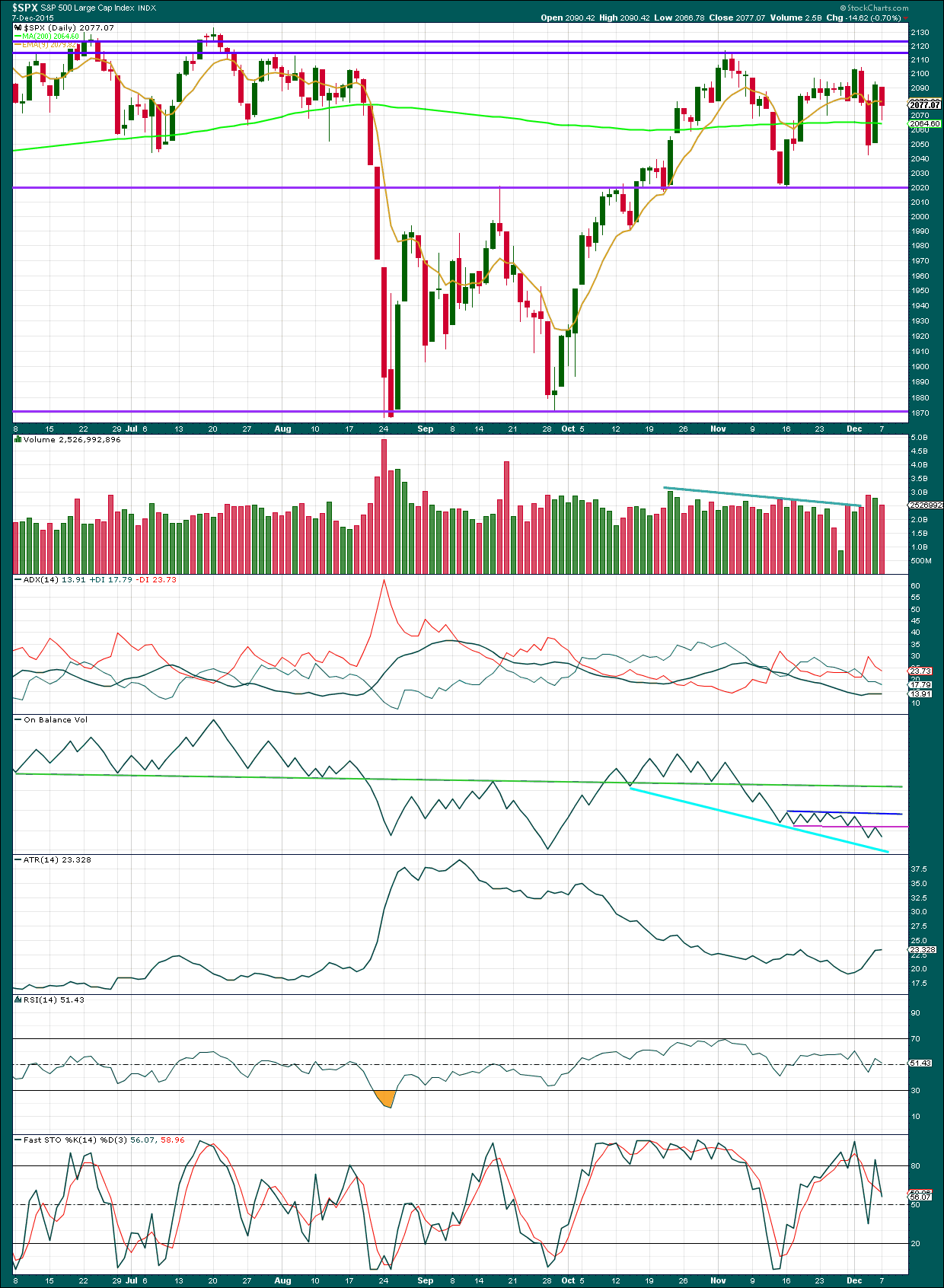

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily: Volume for Monday’s downwards movement is lighter than the two days prior, as price fell volume declined. This is suspicious and the reason for the hourly wave count being changed slightly. This downwards movement is more likely part of a correction than the beginning of a new trend. Price found support at the 200 day moving average on Monday.

ADX is flat and below 15. No clear trend is indicated. ATR overall looks like it may be slightly rising for the last few days. This may be the earliest stage of a new trend.

I have added a new trend line to On Balance Volume (pink). This line is almost horizontal, repeatedly tested but not long held, so it is reasonably technically significant. It has been breached and is now providing resistance. This is fairly bearish short term. If price turns higher tomorrow as expected, then OBV may lead the way to show when upwards movement ends. If OBV comes again to touch the pink line, upwards movement in price may end there.

Neither RSI nor Stochastics are oversold. There is plenty of room for this market to fall.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. So far the industrials and the transportation indices have made new major swing lows, but the S&P500 and Nasdaq have not.

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

To the upside, for Dow Theory, I am watching each index carefully. If any make new all time highs, that will be noted. If they all make new all time highs, then a continuation of a bull market would be confirmed. So far none have made new all time highs.

This analysis is published about 09:01 p.m. EST.

Since my comments below were published with charts I’ve spent more time looking at the structure for today on the one minute chart.

The upwards wave subdivides as a zigzag, it won’t fit as an impulse. That changes the probability of the two scenarios presented below to about even.

I’ll explain why in todays analysis.

Glad to see the zig zag option, that’s what I was counting. Looking forward to the update.

DJT had a sharp fall today.

Transports leading the way again possibly?

I thought about that but history doesn’t repeat itself but it sure does rhyme. I still emphasize that tech will hold this up to the end. It sure does look like TRAN is dumping but the problem to me is that it looks like its near the previous lows of the SPX. So, it could drag out a little more(1 week) possibly!

But what still looks more likely is the second wave is still unfolding and will be more time consuming than the idea in my first comment below.

Bless you my child! It’s sure good to have an expert eye give us some extra insight into this tricksy market. Thanks so much for the updates Lara!

Verne,

I truly think this is all about NDX going to 4816+*The year 2000 high in my early college days! and then the SHOW IS OVER!

Are you loading up on the Q’s?

I am hedging an upside break with a few bearish credit spreads…just in case.

Cashed out some of the exploding volatility calls this morning. I wish the market would make up its/our minds! I think Lara is right about one more pop before the party gets started, although of course we also had a long lower wick at yesterday’s close. I wish they would hurry up and fill a gap already! 😀 😀

i b b

i trade weekly options at times

its not for everyone…

😉

That stock CMG has been tanking for a while when you get a chance pull a chart. Probably that goes further down first if you are so hungry to short…

Another high beta way overpriced and over-hyped example of the stock bubble we are in. They are toast, and the E Coli is the least of their problems…

Probably CMG is but I like IBB. It is a leading index and it sure held up the NDX today. Works wonders. Look at that candle today 😉

Target is 349-359 in a couple days maybe! That is a big percentage point move potentially. This index has been leading for 6 years – chances are high imo it continues to the end of this run…

Good point!

Two ideas for the hourly chart today. This is a less likely idea. It’s possible we’re seeing another bunch of overlapping first and second waves, and the last second wave was actually a quick zigzag as I had originally labelled it.

So far price is behaving exactly as the hourly bear expected.

This could be a zigzag down, or the start of an impulse down.

At this stage a new high above 2,079.21 would indicate more upwards movement to reach above 2,093.84.

A new low below 2,042.35 would indicate the correction was actually over and an impulse down should be underway, a third wave.

Thanks Lara, incredibly useful info

ditto

hi

all

I am logging off. Nothing to see here.

bye

Playing at the R/S line dangerous chop going on

May doubling back to touch previous support….one of those gaps will be filled today…

Let the battle of the dueling gaps begin: 2049.62? or 2077.07?

Whichever one is filled first will tell volumes about this market’s destiny! 🙂

SPX daily has stopped just under the middle BB , I don’t know how significant it is …. today

all

The game is over maybe imo

Lara’s was right 🙂

laters…

Not necessarily…you should stay hedged…always!

oops a fake out maybe : /

You don’t expect the banksters to go quietly into the night now do you? They are going to do their best to fill that gap down. ( I suspect the bears are going to object)

I’m kidding – i called hammer time early on. Most likely the market will GO UP as I noted.

I have NO IDEA what this crazy manipulated market is going to do. Neither does any one else I suspect…not even the banksters…. I suspect I will have a better idea when one of those gaps get filled 😀

it is obvious to me the game that is being played in this triangle.

Those of you who are short or bought UVXY calls are probably smiling but be disciplined and take profits! Roll half your take into new positions for more downside. This market is very tricksy as Gollum would opine…. 🙂

All

It is Hammer Time!!

Don’t get excited too soon; Let’s see if the bears fill the 2049.62 gap from last Thursday’s close…if they are serious, they will today for certain…

yeah right matey!

to bearish

I think the outlook and playbook I posted last week and yesterday is in the mix!

Could be a good map – imo

trade at your own risk 😉

cheers

SPX HR sitting on support 1

Hmmmmmmmmm

Short term indicators getting over cooked

Until 2020 is taken out I am sticking with a 4th wave triangle. I imagine an interest rate hike is already factored in, so I wonder what the reaction would be if no rate hike next week?

Sweet spot of third down…

There will be a rate hike. It is virtually impossible for them not to raise rates. Just look at the bond market!

Heh! Heh! 🙂

Actually, the triangle makes perfect sense as we can expect the banksters to fight the decline tooth and nail and that is the likely wave form to develop as they try to buck the trend. The key is they have to convince the rest of the crowd that they can pull it off and the VIX will tell us if they are succeeding. If it goes above 20 they are toast….

Lara,

I talked about the 20-40 point range late last week and now here we are ~ -1-3% from the highs. So, it could play out in this range till we roll over possibly. My question is from an elliot wave count. Does it change the way you count the decline drastically if we keep on having steep moves within this potential triangle?

No. It doesn’t change the expectation of a sharp decline.

Third waves quite often begin with a series of overlapping first and second wave corrections.

Back in August I had that chop from the all time high analysed as a series of overlapping first and second waves. The third wave down did turn up eventually.

That’s what first and second waves do when they behave like that. They convince us that there can’t be a steep third wave, and they do it right before it turns up.

The annoying thing is…. the chop can go on for some time before the steep part turns up. That chop up to mid August lasted over three months. It was excruciating.

Many thanks Lara!

Futures stair-stepping lower which suggests the banksters are still buying in an attempt to “manage” the decline. If the market is falling under its own torpidity (as suggested by the relatively light volume so far), what happens when it starts to be aggressively sold…?

It looks like the Chinese data has forced the banksters to cry ‘Uncle” and they are no longer playing the phony inflation game with futures. Europe, including DAX down across the board. Look for VIX to clear 20 to usher in a third down. The persistent bullishness evidenced by the relative lack of fear in the market, especially in view of the downside risks, means things could get really interesting…really fast…

Lara, I thought over the weekend you had (a) labeled as wave ii, and we should be headed lower. Now you changed it to (a)? Could (a) still be ii, with your current labeling (a) to orange ‘a’ being a 1 down, with a small abc up for 2 almost complete?

I am surprised you don’t have an option like this today given the conviction ii being done last Friday.

Yes, I had labelled it as a complete zigzag.

The thing today which made me reconsider was volume.

If today’s downwards movement was the start of a third wave it would more likely have stronger volume.

Falling price on lighter volume is suspicious. I am suspicious that my prior wave count was wrong.

But then, I could be wrong.

If this wave count is invalidated early tomorrow with a new low below 2,042.35 then I’m wrong, and a third wave down is underway.

Ok thank. Seems like it could have been an alternate. Will let the Invalidation point guide me.

Verne,

Futures selling off -10.50. Not sure what the MIRACLE buyer of last resort will do before the cash open tommorow.

I think we are in the absolute final stages of the this move prior to the down thrust.

Volatility is sure picking up.

I also think price could fluctuate a little longer into FOMC maybe within this TRIANGLE area.

One thing I have noticed before a market dumps is price gets compressed. At this point Price is between 2113-2036. I think it needs to move 20 points more closer…

Thoughts?

There is sure a lot of coiling for a big move going on. Futures down probably in response to Chinese data. I am a bit doubtful about the onset of the much anticipated third wave to be honest. Volume and momentum just seemed too tepid. I have seen a few cases in which third waves stared very slowly with deceptive stair steps down and then picked up speed so who knows what may develop. We can also get some sort of external catalyst, such as the poor exports data out of China tonight. I expect another day of meandering… we won’t have a third wave down confirmed until VIX takes out last Thursday’s high of 19.35 so keeping some powder dry until then…

K that makes sense!