Upwards movement was expected, but the target at 2,107 was too high.

Summary: Upwards movement may be over. A clear breach of the channel on the hourly chart would provide confidence. The next wave down would most likely make new lows. A new low below 2,020.13 would eliminate the idea that the S&P remains in a bull market and new all time highs will be seen soon.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see last analysis of weekly and monthly charts go here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

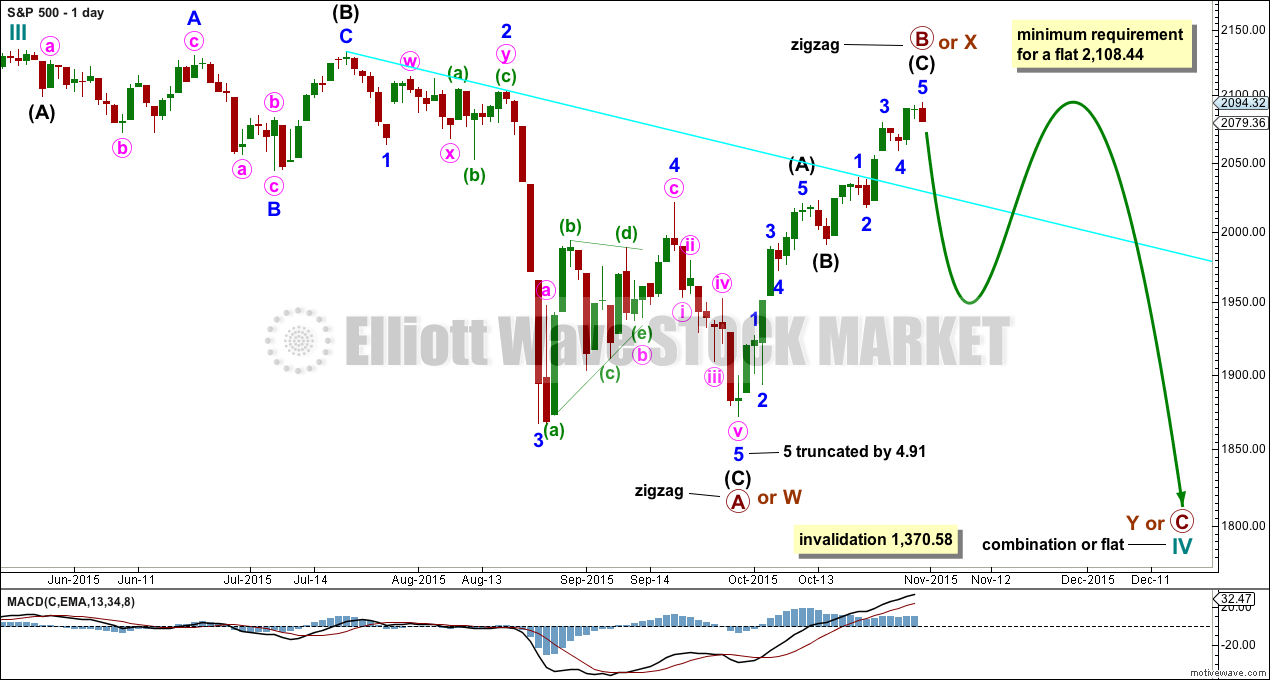

BULL ELLIOTT WAVE COUNT

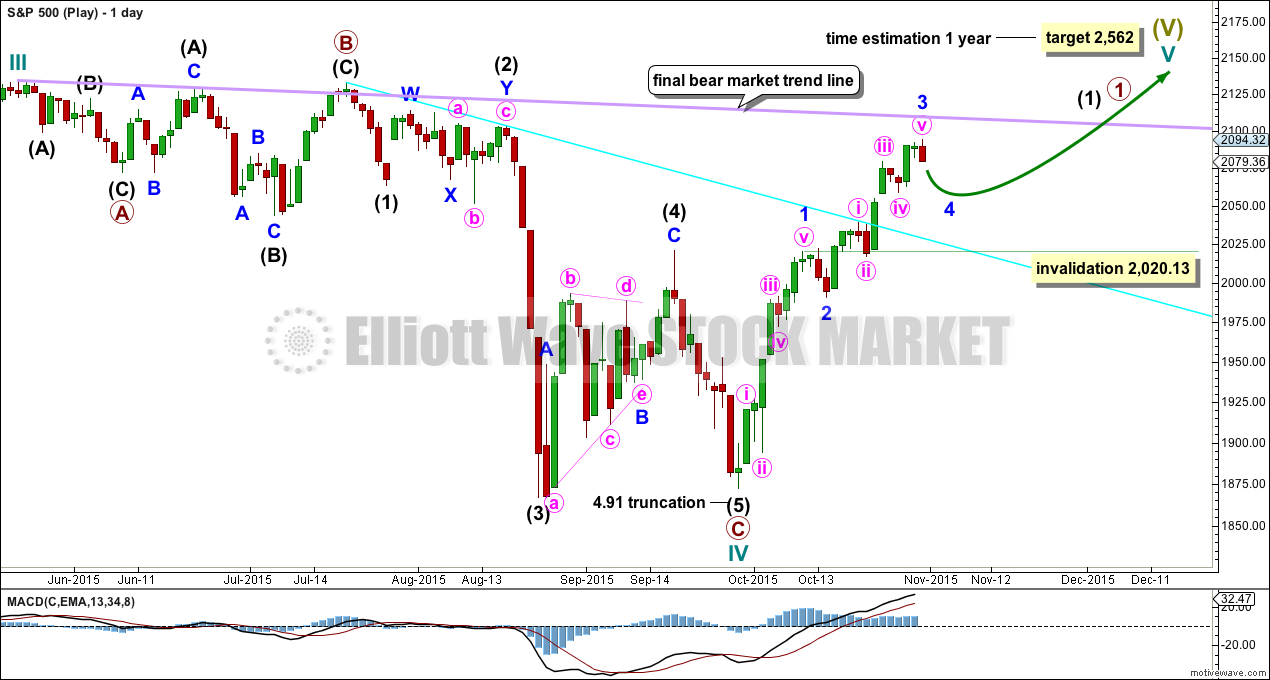

DAILY CHART – COMBINATION OR FLAT

Cycle wave IV should exhibit alternation to cycle wave II.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may end when price comes to touch the lower edge of the teal channel which is drawn about super cycle wave V using Elliott’s technique (see this channel on weekly and monthly charts).

Cycle wave IV is may end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

If a zigzag is complete at the last major low as labelled, then cycle wave IV may be unfolding as a flat, combination or triangle.

Primary wave B or X upwards is a single zigzag. If upwards movement reaches to 2,108.44 or above, then cycle wave IV may be unfolding as a flat correction. At that point, primary wave B would meet the minimum length of 90% the length of primary wave A. If upwards movement does not meet the minimum requirement for a flat correction, then cycle wave IV may be a combination or triangle.

Primary wave B within a flat correction may make a new high above the start of primary wave A at 2,134.72 as in an expanded flat. There is no upper invalidation point for this wave count for that reason. Likewise, X waves within combinations may also move beyond the start of the first structure labelled primary wave W. There is no minimum or maximum length for an X wave within a combination.

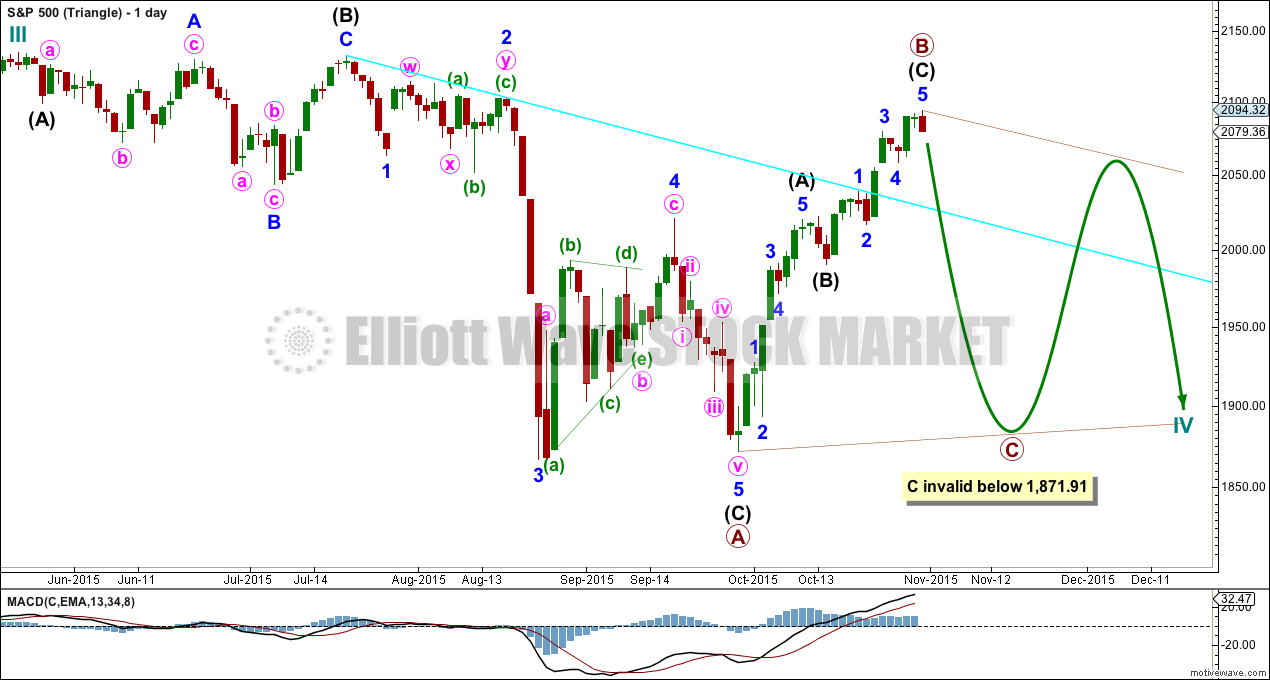

DAILY CHART – TRIANGLE

Cycle wave IV may unfold as a shallow triangle. This would provide alternation with the 0.41 zigzag of cycle wave II.

Primary wave B may be unfolding as a zigzag.

Primary wave B may move beyond the start of primary wave A at 2,134.72 as in a running triangle. There is no upper invalidation point for this wave count for that reason.

Primary wave C of a barrier or contracting triangle may not move beyond the end of primary wave A at 1,871.91.

The whole structure moves sideways in an ever decreasing range. The purpose of triangles is to take up time and move price sideways.

The hourly chart below works in exactly the same way for both of these daily charts, and so only one hourly chart for these two ideas will be presented today.

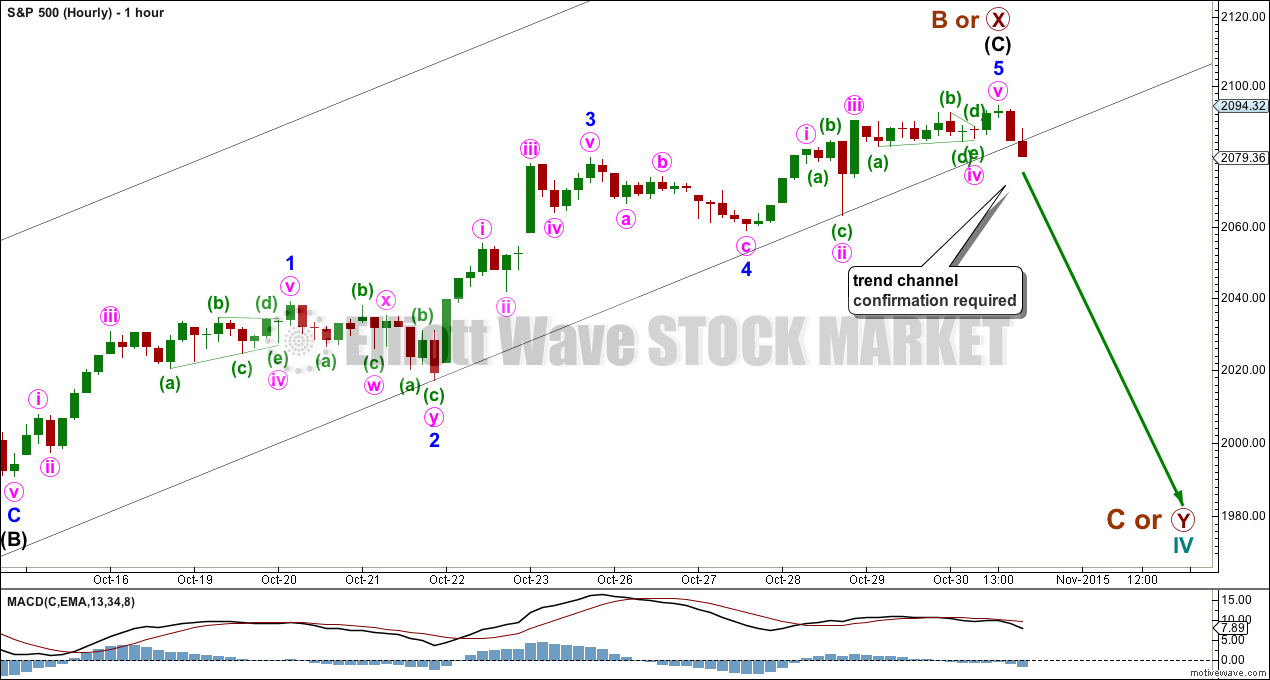

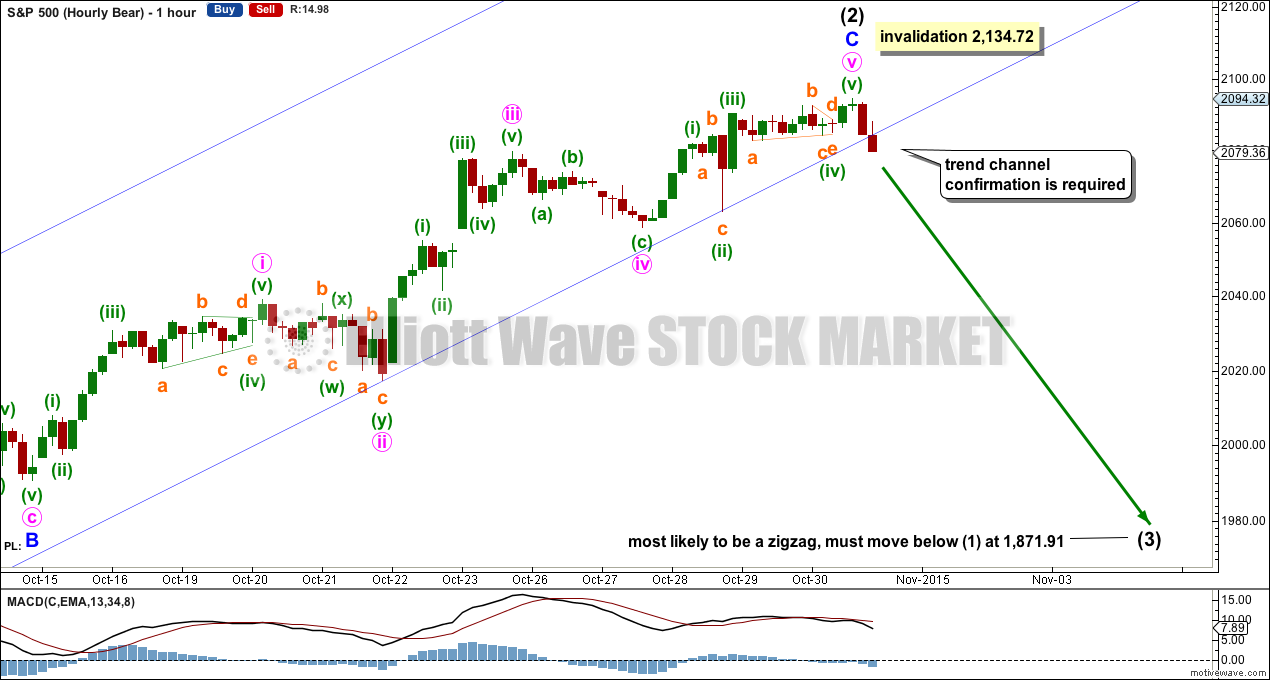

HOURLY CHART

The zigzag upwards for primary wave B or X is again a complete five wave structure. However, the channel about it has not been clearly breached, only overshot. When there is at least one full hourly candlestick below the lower edge of this channel and not touching it, then I would move the invalidation point down to the end of primary wave B or X and have confidence that the next wave down has begun.

After the lower edge of the channel is breached price may throwback to that line. When price behaves like that it offers confirmation of a trend change and an opportunity to join the trend with a low risk.

If primary wave B or X moves no higher, then a flat correction may be eliminated for cycle wave IV because the B wave within it would not have managed to retrace the minimum 90% of the A wave. Cycle wave IV would then be either a combination or triangle.

Both combinations and triangles are sideways moving structures. While there is no lower invalidation point for primary wave Y of a combination (other than the lower invalidation point for cycle wave IV as a whole at 1,370.58), it would most likely move sideways and end about the same level as primary wave W at 1,871.91. Primary wave Y would most likely be a flat correction. It must begin with a clear five down at the hourly chart level.

There is an evening doji star candlestick pattern at the high labelled primary wave B or X. This is further support for the idea that there may be a high in place.

ALTERNATE BULL ELLIOTT WAVE COUNT

DAILY CHART

It is possible to see cycle wave IV a completed flat correction. This would provide some structural alternation with the zigzag of cycle wave II.

This is a regular flat but does not have a normal regular flat look. Primary wave C is too long in relation to primary wave A. Primary wave C would be 3.84 short of 4.236 the length of primary wave A. While it is possible to also see cycle wave IV as a complete zigzag (the subdivisions for that idea would be labelled the same as the bear wave count below, daily chart) that would not provide structural alternation with the zigzag of cycle wave II, and so I am not considering it.

This idea requires not only a new high but that the new high must come with a clear five upwards, not a three.

At 2,562 cycle wave V would reach equality in length with cycle wave I. Cycle wave I was just over one year in duration so cycle wave V should be expected to also reach equality in duration.

I added a bear market trend line drawn using the approach outlined by Magee in “Technical Analysis of Stock Trends”. When this lilac line is clearly breached by upwards movement that shall confirm a trend change from bear to bull. The breach must be by a close of 3% or more of market value. If it comes with a clear five up, then this wave count would be further confirmed.

While price remains below the bear market trend line, we should assume the trend remains the same: downwards.

Minor wave 3 should be complete. Minor wave 4 may not move into minor wave 1 price territory below 2,020.13.

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count has a better fit at Grand Super Cycle degree and is better supported by regular technical analysis at the monthly chart level. But it is a huge call to make, so I present it second, after a more bullish wave count, and until all other options have been eliminated.

There are two ideas presented in this chart: a huge flat correction or a double flat / double combination. The huge flat is more likely. They more commonly have deep B waves than combinations have deep X waves (in my experience).

A huge flat correction would be labelled super cycle (a)-(b)-(c). It now expects a huge super cycle wave (c) to move substantially below the end of (a) at 666.79. C waves can behave like third waves. This idea expects a devastating bear market, and a huge crash to be much bigger than the last two bear markets on the monthly bear chart.

The second idea is a combination which would be labelled super cycle (w)-(x)-(y). The second structure for super cycle wave (y) would be a huge sideways repeat of super cycle wave (a) for a double flat, or a quicker zigzag for a double combination. It is also possible (least likely) that price could drift sideways in big movements for over 10 years for a huge triangle for super cycle wave (y).

The bear wave count sees a leading diagonal for a primary degree first wave unfolding. Within leading diagonals, the first, third and fifth waves are most commonly zigzags but sometimes may appear to be impulses. Here intermediate wave (1) is seen as a complete zigzag.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 2,134.72.

Intermediate wave (3) should unfold downwards when intermediate wave (2) is complete. It must move beyond the end of intermediate wave (1) and it would most likely be a zigzag.

HOURLY CHART

The zigzag upwards for intermediate wave (2) is seen in exactly the same way as the zigzag upwards for primary wave B or X for the first two wave counts. The degree of labelling for this idea is one degree lower.

Intermediate wave (3) is most likely to be a zigzag, if this is a third wave within a leading diagonal. It must move beyond the end of intermediate wave (1) at 1,871.91. It is likely to move reasonably below that point.

Actionary waves within diagonals do not normally exhibit Fibonacci ratios to each other. The best target calculation method for intermediate wave (3) would be to use the ratios of minor waves A and C within it. That can only be done when minor waves A and B are complete, so that the length of minor wave A is known and the start of minor wave C is known.

This wave count also comes with the strong caveat that there has still not been a clear breach of the channel about intermediate wave (2). Only when a full hourly candlestick is below the lower edge and not touching it may confidence be had that there has been a trend change.

At the end of intermediate wave (2) there is reasonably strong divergence with price and MACD. Upwards movement is weak; some downwards movement about here is a reasonable expectation.

TECHNICAL ANALYSIS

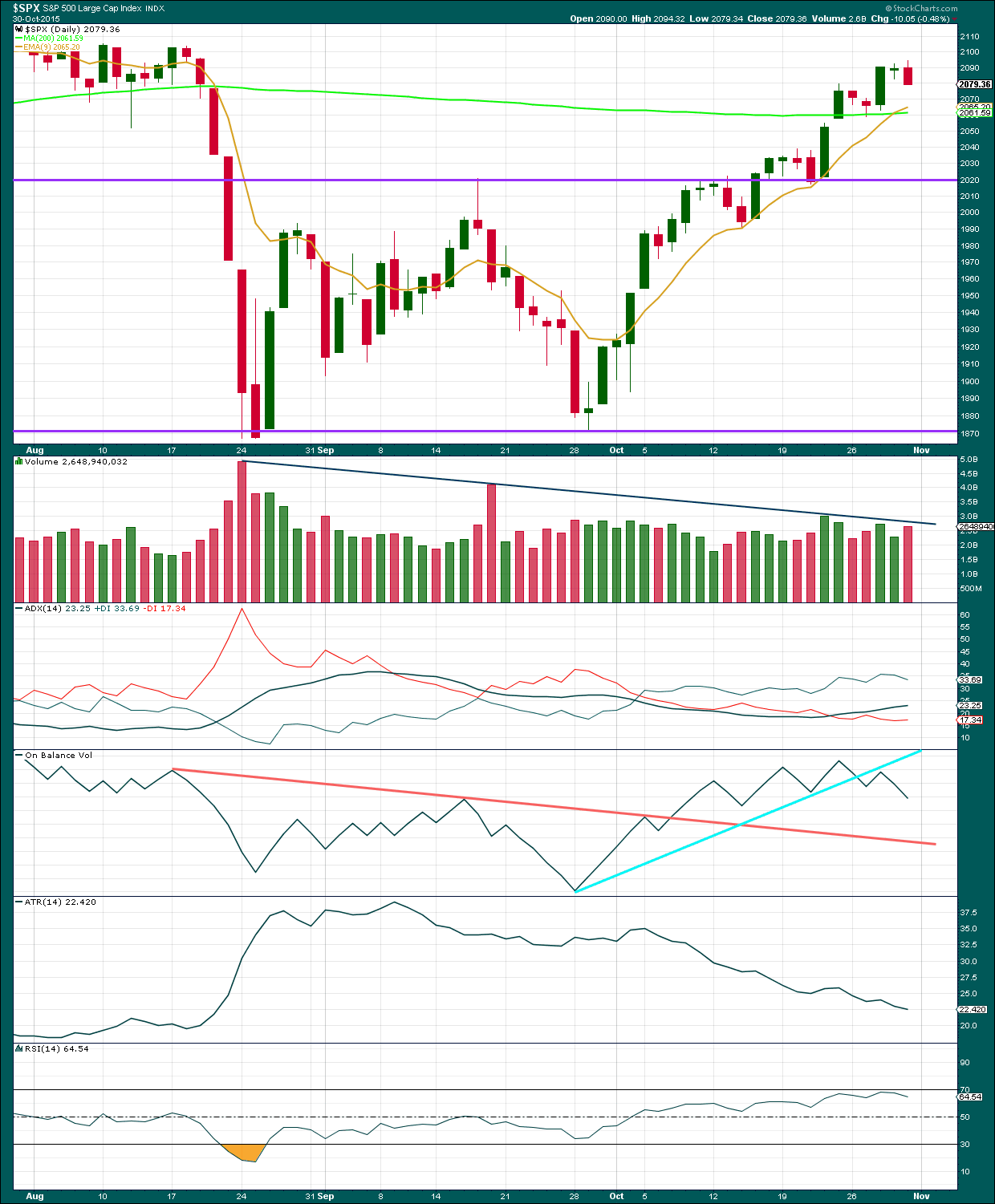

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily: A small increase in volume for an overall downwards day indicates that again a fall in price is supported by volume. The volume profile consistently is more bearish than bullish.

It still looks like the strong upwards day of 22nd October with increased volume was an upwards breakout of a prior consolidation. However, the rise in price is overall not supported by volume very well. If price returns back below the horizontal trend line and if it does that on an increase in volume, then I would expect the upwards breakout was false.

The potential upwards breakout and move above the 200 day SMA is the most bullish picture from the S&P 500 for months. It gives some concern to the bear wave count, but it is not enough to fully support the very bullish alternate wave count. The picture at the monthly chart level remains very bearish. We have not had technical confirmation of an end to the bear market yet.

This week price has found some support at the 200 day SMA. It may do so again when price comes down to touch it.

The black ADX line is now above 20 and rising indicating an upwards trend is in place.

I have changed the shorter Exponential Moving Average to 9 days. This is reasonably well showing now where price is finding support.

Average True Range still does not agree with ADX and the range price which has moving in has been declining overall since about 9th September. This is more typical of a consolidation period than a trend. Particularly since the 5th of October ATR is clearly declining. This indicates the rise in price is not a typical trend and may very well still be part of the prior consolidation. This supports the idea that the upwards breakout may have been false.

On Balance Volume has found resistance at the bright aqua blue trend line. It may now find support at the orange line.

RSI turned lower for Friday while price made a new high. Further divergence between price and RSI (small and weak though) supports the idea of at least a little downwards movement about here.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. So far the industrials and the transportation indices have made new major swing lows, but the S&P500 and Nasdaq have not.

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

To the upside, for Dow Theory, I am watching each index carefully. If any make new all time highs, that will be noted. If they all make new all time highs, then a continuation of a bull market would be confirmed. So far none have made new all time highs.

This analysis is published about 02:53 a.m. EST.

Lara,

Would you mind providing a quick update before after-hours closes at 8pm EST?

Thanks.

This is not always possible.

I am not able to look at both Gold and S&P in enough depth prior to market close in order to give a quick update.

I will when I can, but that’s not often.

Remember, my time zone is +13GMT.

I know that’s not what members want to hear, but this is a once a day analysis service, not a signal service and not an intraday service.

I understand. Thanks.

Thank you for your patience.

When I can, I will.

I notice momentum continues to be flat to declining. But now the structure is again incomplete and so a little more upwards movement needs to finish it.

The channel wasn’t properly breached. But the S&P just doesn’t work well always with channels. Still, this one needs to be breached before confidence may be had that upwards movement is over.

Perfect, thanks.

I did a bit of reading on the psychology of leading diagonals which apparently are rare. One comment was that they reflected hesitation in the kick-off to a strong move. This makes a lot of sense to me as “hesitation” could also result from countervailing forces (read banksters) desperately trying to work against the tide. Based on what happened with the markets in August, it would seem the same psychology applies to ending diagonals as well. If the bear wave count is correct, and I think it has quite a bit evidence to support it, primary wave two will in all likelihood be another ferocious and deep re-tracement, and will represent the banksters’ last stand. The end of intermediate one down for the bear count was tricky, showing a very strange divergence between VIX and UVXY, I expect the same for primary one.