Downwards movement was again expected for Wednesday.

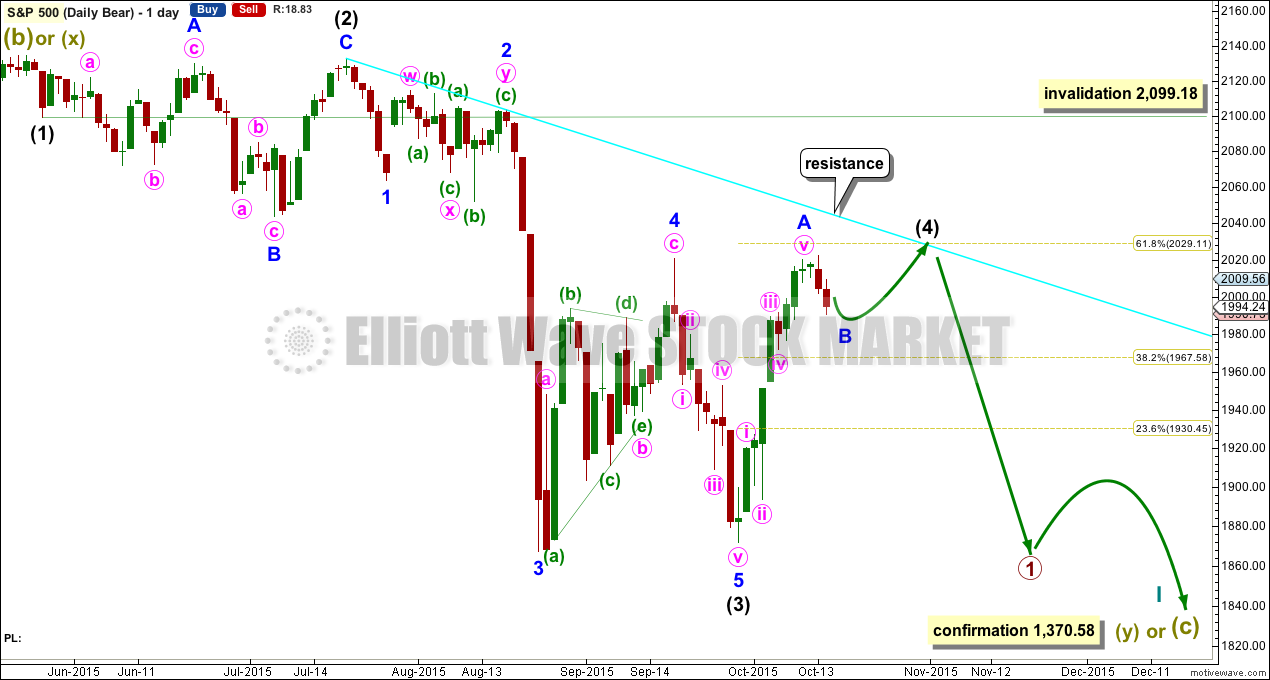

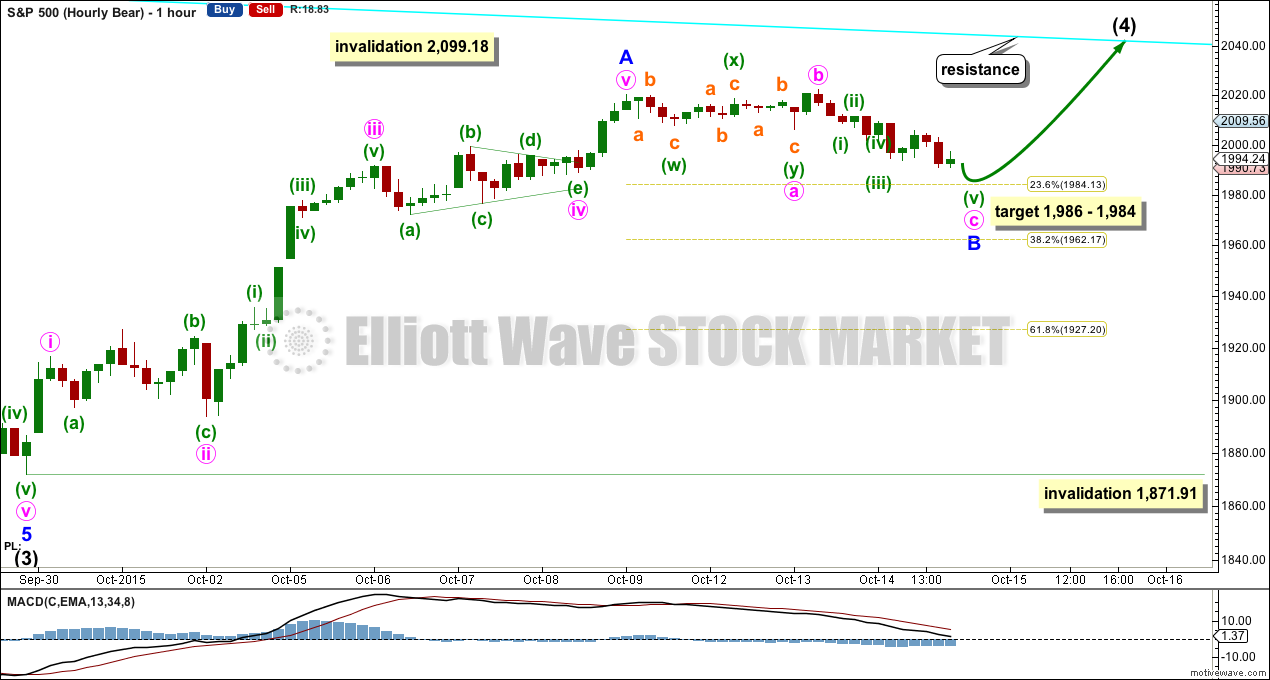

Summary: Short term this downwards movement may end tomorrow about 1,986 – 1,984. The next wave up is either a five wave structure for a C wave, or a B wave at three degrees. If the next wave up is a three, then the correction will be incomplete. If it is a five, then it may find resistance at the bright aqua blue line on the daily chart.

To see how each of the bull and bear wave counts fit within a larger time frame see the Grand Supercycle Analysis.

To see last analysis of weekly and monthly charts go here.

If I was asked to pick a winner (which I am reluctant to do) I would say the bear wave count has a higher probability. It is better supported by regular technical analysis at the monthly chart level, it fits the Grand Supercycle analysis better, and it has overall the “right look”.

New updates to this analysis are in bold.

BULL ELLIOTT WAVE COUNT

DAILY CHART

Cycle wave IV should exhibit alternation to cycle wave II. Cycle wave IV may find support at the teal channel on the weekly and monthly charts.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV should exhibit alternation in structure and maybe also alternation in depth. Cycle wave IV may end when price comes to touch the lower edge of the teal channel which is drawn about super cycle wave V using Elliott’s technique.

Cycle wave IV is likely to end within the price range of the fourth wave of one lesser degree. Because of the good Fibonacci ratio for primary wave 3 and the perfect subdivisions within it, I am confident that primary wave 4 has its range from 1,730 to 1,647.

If a zigzag is complete at the last major low as labelled, then cycle wave IV may be unfolding as a flat, combination or triangle.

If cycle wave IV is a flat correction, then within it primary wave B must subdivide as a corrective structure (a three or a triangle) and must end at least 90% the length of primary wave A at 2,108.44. Primary wave B of an expanded flat may make a new all time high above 2,134.72. There is no upper invalidation point for this idea.

If cycle wave IV is a combination, then it would be labelled primary waves W-X-Y. Primary wave X may be any corrective structure and it has no minimum requirement, unlike the B wave within a flat. X waves within combinations are most often deep corrections to achieve the purpose of a sideways movement. X waves may move beyond the start of W waves. There is no upper invalidation point for this idea either.

If cycle wave IV is a triangle, then primary wave B upwards has no minimum requirement, must subdivide as a three wave structure (most likely a zigzag), and may also make a new all time high as in a running triangle. There is no upper invalidation point for this idea either.

Of all Elliott waves it is B waves which exhibit the greatest variety in structure and form. They are extremely difficult to analyse. Often, it is only when they are complete that their structure can be determined.

At this stage, primary wave B looks like it may be unfolding as a zigzag. This may change though.

HOURLY CHART

Intermediate wave (B) may be over tomorrow. If the degree of labelling within minor wave A is moved up one degree, then it may be the whole of intermediate wave (B).

Or intermediate wave (B) may be as labelled, only one third complete. Minor wave A within it may be an almost complete expanded flat correction.

On the five minute chart, the structure of minuette wave (v) downwards is incomplete and needs a final fifth wave down. When that is done, most likely to a slight new low at least, then the next move upwards may be a B wave within a B wave within a B wave.

B waves are the most difficult of all Elliott wave structures, and B waves within B waves are worse. If the next movement is very choppy and overlapping, then this is what it may be.

Intermediate wave (B) may not move beyond its start below 1,871.91, because intermediate wave (A) is a five.

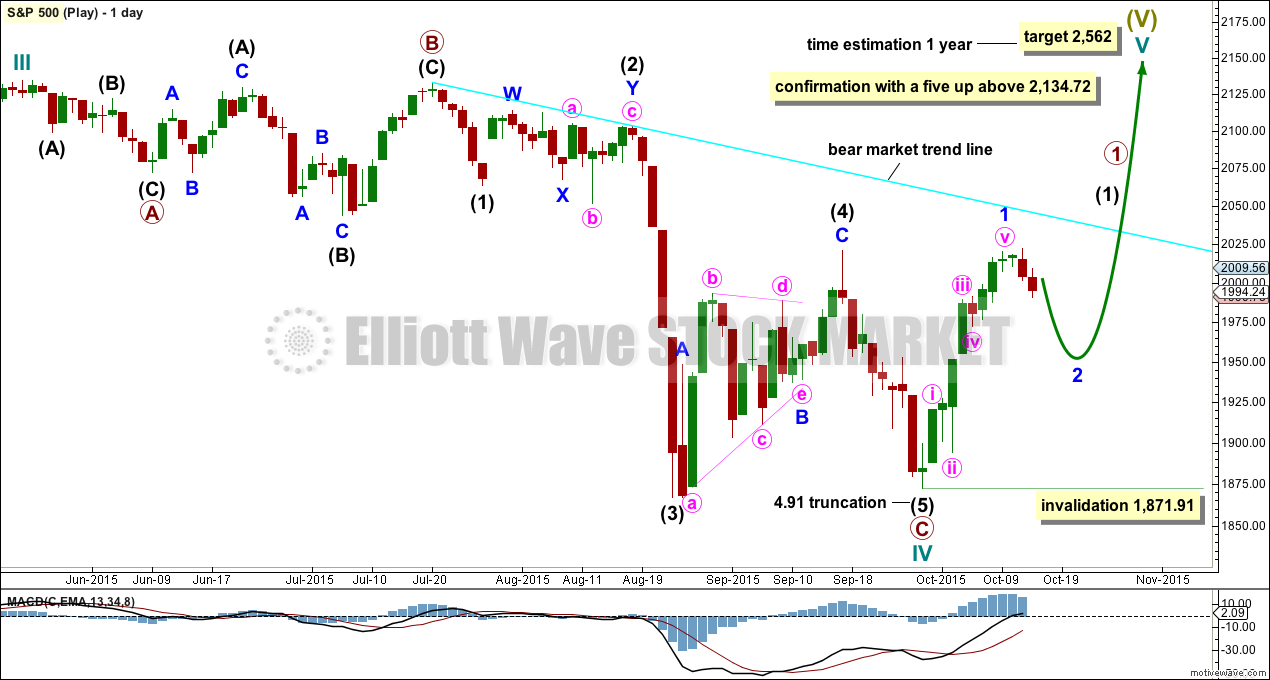

ALTERNATE BULL ELLIOTT WAVE COUNT

DAILY CHART

It is possible to see cycle wave IV a completed flat correction. This would provide some structural alternation with the zigzag of cycle wave II.

This is a regular flat but does not have a normal regular flat look. Primary wave C is too long in relation to primary wave A. Primary wave C would be 3.84 short of 4.236 the length of primary wave A. While it is possible to also see cycle wave IV as a complete zigzag (the subdivisions for that idea would be labelled the same as the bear wave count below, daily chart) that would not provide structural alternation with the zigzag of cycle wave II, and so I am not considering it.

This idea requires not only a new high but that the new high must come with a clear five upwards, not a three.

At 2,562 cycle wave V would reach equality in length with cycle wave I. Cycle wave I was just over one year in duration so cycle wave V should be expected to also reach equality in duration.

I added a bear market trend line drawn using the approach outlined by Magee in “Technical Analysis of Stock Trends”. When this lilac line is clearly breached by upwards movement that shall confirm a trend change from bear to bull. If it comes with a clear five up, then this wave count would be further confirmed.

While price remains below the bear market trend line, we should assume the trend remains the same: downwards.

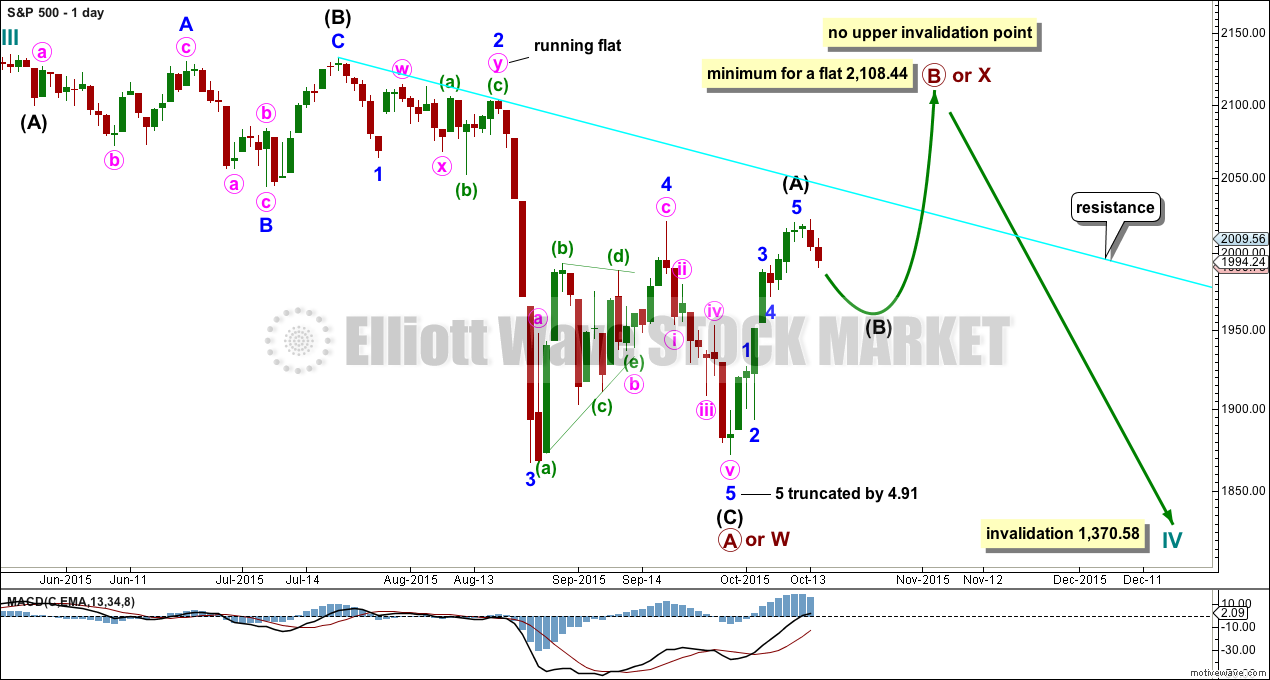

BEAR ELLIOTT WAVE COUNT

DAILY CHART

This bear wave count has a better fit at Grand Super Cycle degree and is better supported by regular technical analysis at the monthly chart level. But it is a huge call to make, so I present it second, after a more bullish wave count, and until all other options have been eliminated.

There are two ideas presented in this chart: a huge flat correction or a double flat / double combination. The huge flat is more likely. They more commonly have deep B waves than combinations have deep X waves (in my experience).

A huge flat correction would be labelled super cycle (a)-(b)-(c). It now expects a huge super cycle wave (c) to move substantially below the end of (a) at 666.79. C waves can behave like third waves. This idea expects a devastating bear market, and a huge crash to be much bigger than the last two bear markets on the monthly bear chart.

The second idea is a combination which would be labelled super cycle (w)-(x)-(y). The second structure for super cycle wave (y) would be a huge sideways repeat of super cycle wave (a) for a double flat, or a quicker zigzag for a double combination. It is also possible (least likely) that price could drift sideways in big movements for over 10 years for a huge triangle for super cycle wave (y).

I am now seeing a third wave complete at the last major low for intermediate wave (3). Intermediate wave (3) is 17.31 longer than 6.854 the length of intermediate wave (1).

Minor wave 5 is seen as complete and slightly truncated.

A channel drawn using Elliott’s technique no longer works. Sometimes fourth waves aren’t contained within such a channel, which is why Elliott developed a second technique to use when they breach the channel.

Intermediate wave (2) was a very deep 0.95 expanded flat lasting 38 sessions. Intermediate wave (4) should exhibit alternation, is most likely to be more shallow, and be a quicker zigzag or zigzag multiple. It may not move into intermediate wave (1) price territory above 2,099.18.

At this stage, it looks like intermediate wave (4) is unfolding as a zigzag.

Intermediate wave (4) is not over. It may end in a total Fibonacci 21 sessions which would see it continue now for a further 10 sessions. Alternatively, at this stage, it is also possible it may come to a quicker end: a further two sessions would see it complete in a total Fibonacci 13 sessions.

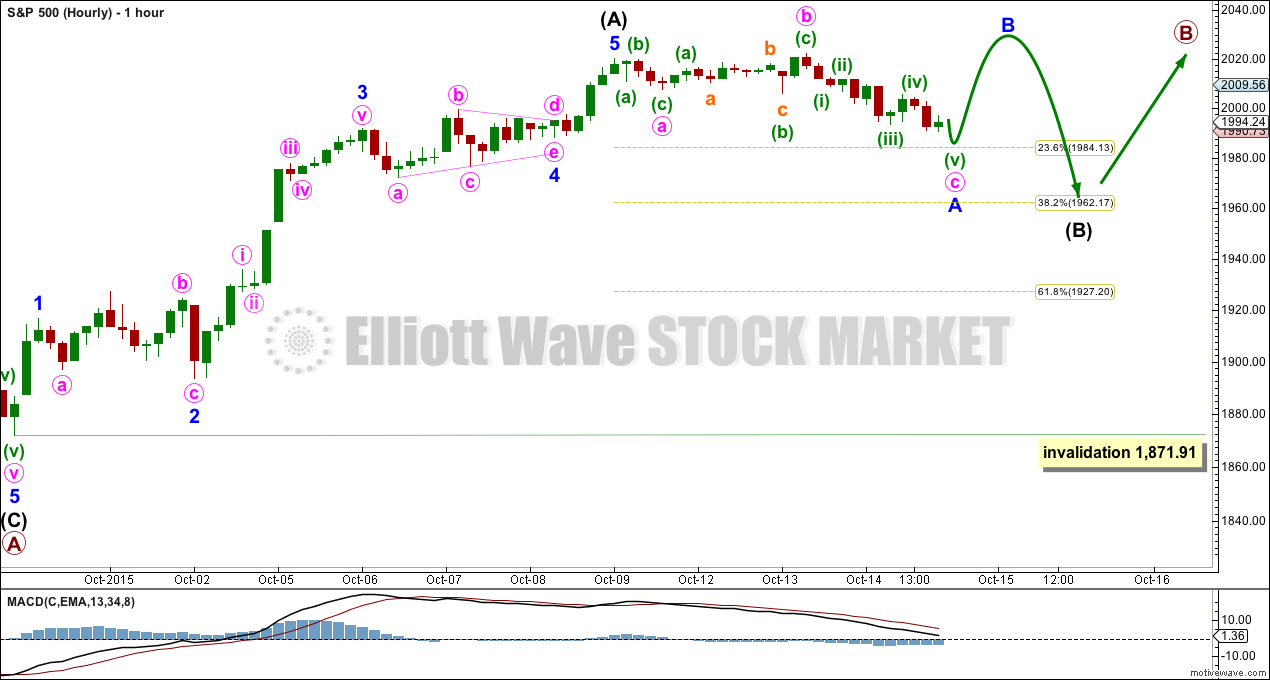

HOURLY CHART

Intermediate wave (4) for this bear wave count is seen as unfolding as a zigzag in exactly the same way as primary wave B for the first wave count.

Here I am considering an almost complete expanded flat correction for minor wave B. Minute wave b is seen differently, which illustrates the difficulty with B waves as they are the most complicated and difficult of all Elliott waves to analyse.

Here minute wave a is seen as a double zigzag which is termed a “three”. Minute wave b is a quick zigzag and a 1.16 length of minute wave a indicating an expanded flat. At 1,986 minute wave c would reach 1.618 the length of minute wave a, and at 1,984 minor wave B would end at the 0.236 Fibonacci ratio of minor wave A. This gives a 2 point target zone for a potential end to this correction.

If minor wave B ends tomorrow in one more session and minor wave C upwards lasts only one session, then intermediate wave (4) may end in a total Fibonacci 13 sessions, with a long A wave and a short C wave.

Alternatively, minor wave B may morph into a double flat, triangle or combination. That is not the only possibility although I am labelling it here as an almost complete expanded flat.

Minor wave B may not move beyond the start of minor wave A below 1,871.91.

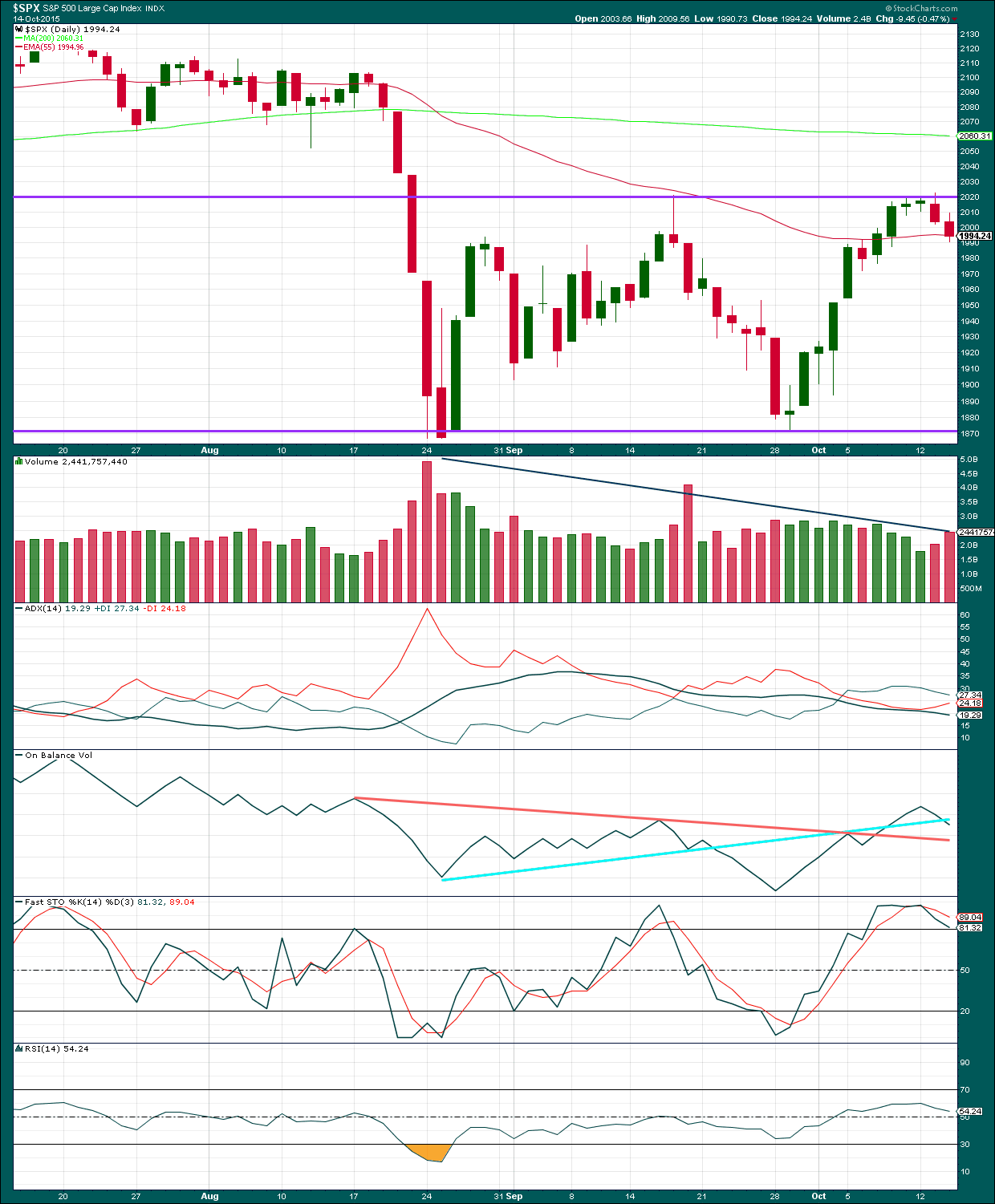

TECHNICAL ANALYSIS

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

I am pushing the horizontal lines of resistance and support outwards to contain all recent sideways movement. To reliably indicate a breakout one of these lines needs to be breached. If a breach comes on increased volume, then a breakout would be indicated.

Price has bounced down from the upper line of resistance. ADX continues to indicate the market is range bound. With Stochastics now starting to turn downwards, more downwards movement from price overall should be expected to continue until price finds support and Stochastics reaches oversold.

Downwards movement for Wednesday’s session comes on increased volume. Again, as price moves lower it is supported by volume while the last upwards movement in price was not supported by volume. The volume profile continues to be bearish.

The black ADX points slowly lower indicating the market is not trending. Overall volume is declining while price moves sideways. During this sideways consolidation contained within support and resistance lines it is a downwards day which shows clearly strongest volume. This indicates the breakout is most likely to be down. This trick does not always work, but it works often enough to be a good indicator of the breakout direction.

On Balance Volume has broken below the blue line and may find some support at the new orange line. Neither of these lines are highly technically significant though; they are too short and not often tested.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. So far the industrials and the transportation indices have made new major swing lows, but the S&P500 and Nasdaq have not.

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

This analysis is published about 12:22 a.m. EST.

Co-ordinated central bank buying across all the indices is a sign of panic and very bearish. I suspect we will see a sucker’s rally in the form of an opening pop tomorrow to temporarily re-take DJI 17000 followed by an intra-day reversal. The problem with persistent central bank intervention is that when the declines come they tend to be more violent. VIX futures suggest more downside in the intermediate term. The thousand point DJI decline in August is a harbinger of what’s in store for these manipulated markets.

Vernecarty,

How is it that you determine central banks are buying and manipulating the markets? Thanks for all your comments. They are interesting and helpful.

That is a question that would make for a very lengthy discussion but the short reply is that while official QE has ended, unofficially it continues and in spades and always will. If you know where to look, there is evidence that our own Central Bank has been giving…er…”swapping”, trillions with foreign markets. Audit the FED…are you kidding??

There are many metrics that give one a good idea of market participants (in addition to volume) and institutional investors have left the arena (very little block buying) which is why the continued rise, albeit on low volume is so remarkable. The creation of the Plunge Protection Team (PPT) to “stabalize” the US markets has been well reported on over the years and has been adopted in numerous other financial venues. We saw remarkable evidence of this in the Chinese attempts to halt the recent slide in their own markets. Margin account values peaked six months ago and have been declining steadily. More simply though, I think it is hard to miss if you have been observing market behavior the past few years…they have become fairly predictable.

VIX again may be a leading indicator. It started dropping towards end of trading today while S&P was still around the low end of the range. It may precede a turn up. I wouldn’t be surprised if the up turn already started tonight in ES or will be soon after open tomorrow.

Daily stochastic is overbought, volume is supporting downward movement but Europe/Asia is up, reserve bank buying is set in a feedback mode. Perhaps low volume price rises? Wouldn’t that be a shocker :-0

The weird thing is this kind of * buying is designed to shake out weak shorts but downside momentum clearly shows an absence of committed sellers. If the market cannot keep its head above water with few sellers in the game what does that portend…?

*Vernecarty: I have edited your comment slightly to remove a particular phrase.

Thanks, it was a poor choice of words.