There is only one Elliott Wave count for FTSE.

Summary: I have only a bear wave count for FTSE. The bull wave count was invalided. So far I have not been able to find other bull alternatives which fit. Of all the markets I currently analyse, FTSE is the clearest bear.

To see monthly and weekly charts and the bigger picture see last analysis here.

Changes to last analysis are bold.

Click charts to enlarge.

BEAR WAVE COUNT

Minor wave 4 may have completed as a small shallow zigzag, lasting 11 days and 0.39 of minor wave 3. This provides perfect alternation with the deep 0.82 expanded flat of minor wave 2.

At 5,471 minor wave 5 would reach 0.618 the length of minor wave 3.

Draw a channel about this downwards movement: draw the first trend line from the ends of minor waves 1 to 3, then push a parallel copy up to contain the whole movement. Minor wave 5 may end either midway within the channel, or about the lower edge.

Minor wave 5 has begun with two overlapping first and second waves. This may indicate an extended fifth wave to unfold, which fits with the target for minor wave 5 to reach equality in length with minor wave 3.

I have considered the possibility that this choppy movement is a continuation of minor wave 4. So far it would fit, but only if minor wave 4 would be incomplete. That would see minor wave 4 much longer in duration to minor wave 2 which lasted only 6 days. Because it is the proportion of second and fourth waves within an impulse that give the wave count the right look, I do not think this movement is a continuation of minor wave 4.

If my analysis is wrong this week, then the call that minor wave 4 is over would be what’s wrong. Within minor wave 5, no second wave correction may move beyond its start above 6,284.17. If price breaks above this invalidation point, then the labelling which sees minor wave 4 as complete would be wrong.

TECHNICAL ANALYSIS

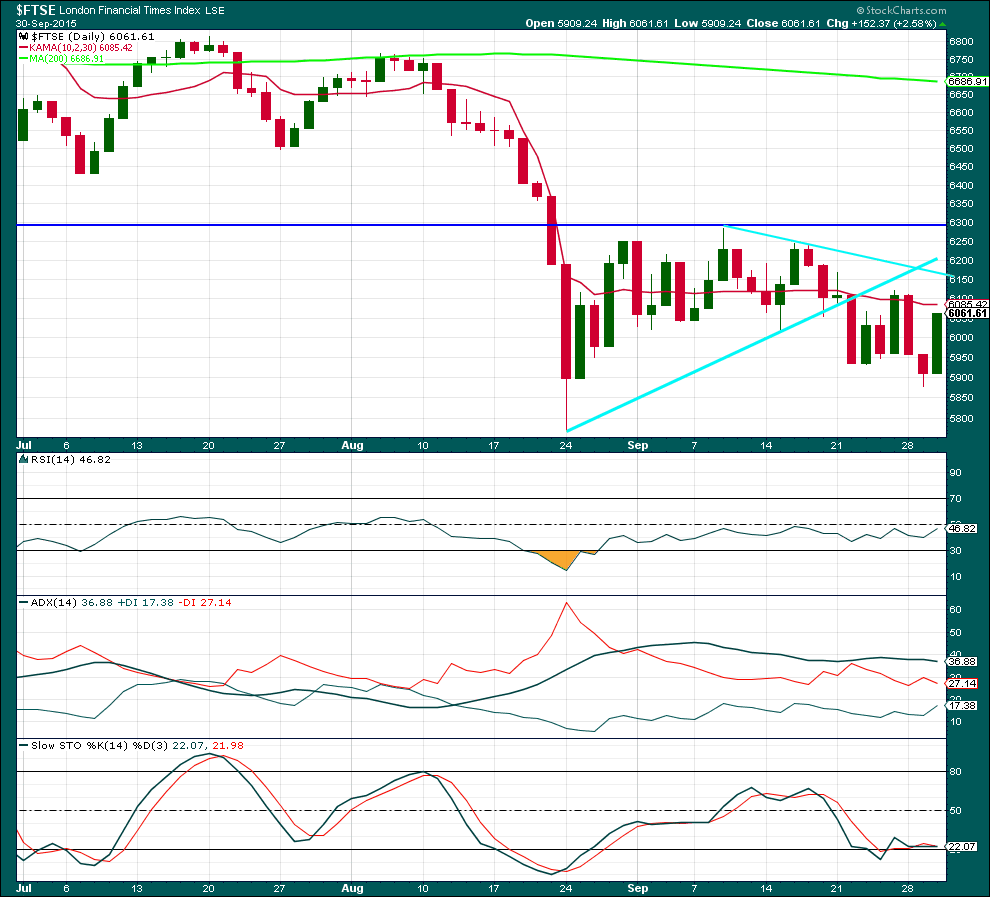

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is no volume data on either the FXCM feed or StockCharts. Volume analysis is done from Yahoo Finance data.

Price has essentially been moving sideways since the low of 24th August. During this time, the downwards day of 18th September has strongest volume which indicates a breakout from this sideways move is more likely to be downwards than upwards.

Overall, ADX remains mostly flat. The consolidation is maturing, the trend should resume soon, but for now the breakout may not have yet happened.

A new low below the low of 24th August and an increase in volume would add confidence that a downwards breakout is underway.

This analysis is published about 09:37 p.m. EST.

Hi Lara

With the invalidation point hit here, do you think it still has the right look for minor wave 4 still? I’m struggling to read this. To me it looks like minor wave 5 has finished and that there is a corrective phase which could run to resistance at 6415-6430?

Hello Lara,

Instead of FTSE could you analyze Nasdaq Biotech Index, NBI. Biotechnology Index looks like more fun + nobody is commenting on FTSE. So, I don’t know if anyone is reading.

Thank you,

I am reading!

I’ve just subscribed because of the Ftse

Thanks

FTSE is not part of the paid membership service. I will try to get it done at least once a month, and as often as once a week, but if I don’t have time it doesn’t get done. Or if members request something else that week I’ll do something else (this week it was Nasdaq).

So don’t subscribe because of FTSE. Its free content done whenever, not a regular part of the paid membership.