Downwards movement was expected as most likely, which is what happened.

Summary: The probability that a Dead Cat Bounce is over is very high, but not fully confirmed. A clear breach of the upwards sloping aqua blue trend line on the daily charts would confirm it. Downwards movement is showing again an increase in volume. This next wave down is either a middle of a third wave to a target at 1,638, or a fifth wave to a target at 1,821. At this stage, I favour the third wave idea. Momentum will tell us which one is correct.

To see an outline of the bigger picture on monthly and weekly charts click here.

Changes to last analysis are bold.

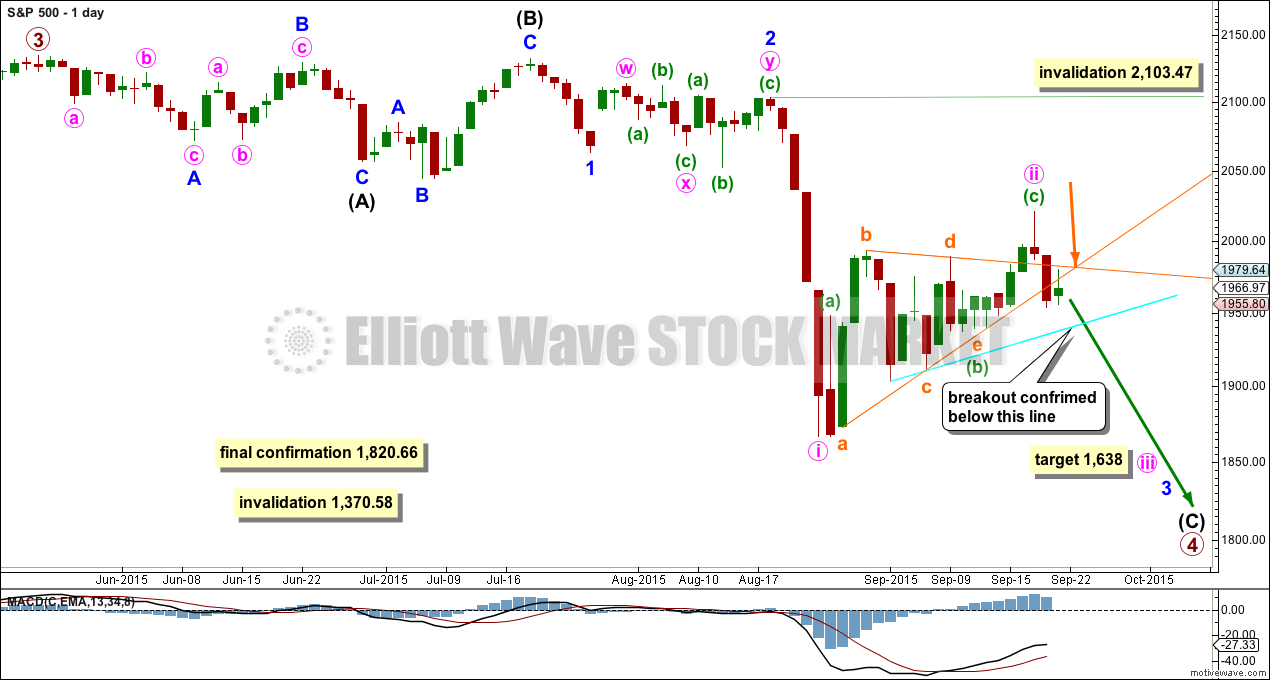

BULL ELLIOTT WAVE COUNT

DAILY CHART

Primary wave 4 may be longer lasting than primary wave 2 as these types of sideways corrective structures tend to be more time consuming than zigzags. Primary wave 4 may complete in a total Fibonacci 21 weeks. Primary wave 4 has started its 18th week, but it may not exhibit a Fibonacci duration because the S&P does not reliably do this. Time estimates may only be taken as a very rough guide.

Within primary wave 4, it may be that intermediate waves (A) and (B) are both complete as three wave structures indicating a flat may be unfolding. Intermediate wave (C) down must be a five wave structure; it looks like it is unfolding as an impulse. For now I will leave this degree as is, but depending on where intermediate wave (C) ends I may move it back down one degree. It is also possible that only minor wave A may be unfolding as a flat correction.

At the daily chart level, this wave count sees primary wave 4 as a possible regular flat correction: intermediate wave (B) is a 98% correction of intermediate wave (A). However, regular flats normally have C waves which are close to equality with their A waves, and they normally fit nicely within parallel channels. Here intermediate wave (C) is much longer than (A) and will still move lower as its structure is incomplete. When the five wave impulse down for intermediate wave (C) is complete, then I will revisit the structure of primary wave 4 which may not be a flat. The structure at the daily chart level so far fits for the very bearish wave count better than this wave count.

If this impulse does not bring price down to the lower edge of the big channel on the weekly chart, then it may only be intermediate wave (A) of a bigger flat for primary wave 4.

Full and final confirmation of a bear market (mid term) would come with:

1. A clear five down on the daily chart.

2. A new low below 1,820.66.

As each condition is met further confidence may be had in the bigger picture for this wave count.

Primary wave 4 may not move into primary wave 1 price territory below 1,370.58. Invalidation of this bull wave count (still bullish at cycle degree) would be confirmation of the bear wave count.

I am drawing the bright aqua blue trend line on all charts in exactly the same way. It is this line which I want to use to confirm the end of this correction and the resumption of the downwards trend. When there is a break below this line, and if it comes with higher volume, then I would have some confidence that the trend has resumed.

There was a triangle within this correction, and I expect it was as labelled here. Extend the triangle trend lines outwards. The point in time at which they cross over may see a trend change. This does not always work, but it works often enough to be a trick to look out for.

The Dead Cat Bounce which may have ended three trading days ago looks more like a second wave than a fourth wave. To see it as a fourth wave correction has inadequate alternation in depth and structure. This means that the next wave down is most likely to unfold as a third wave at least at two wave degrees, which should show an increase in downwards momentum beyond that seen for the first wave labelled minute wave i.

At 1,638 minute wave iii would reach 1.618 the length of minute wave i.

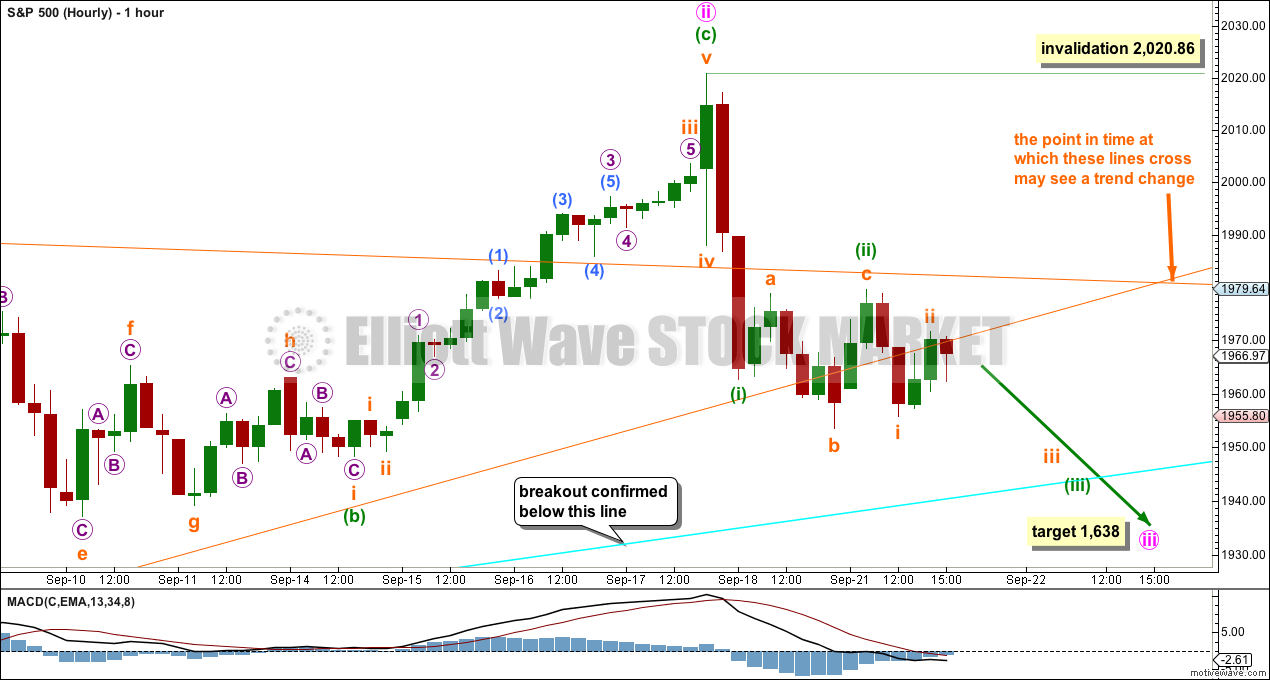

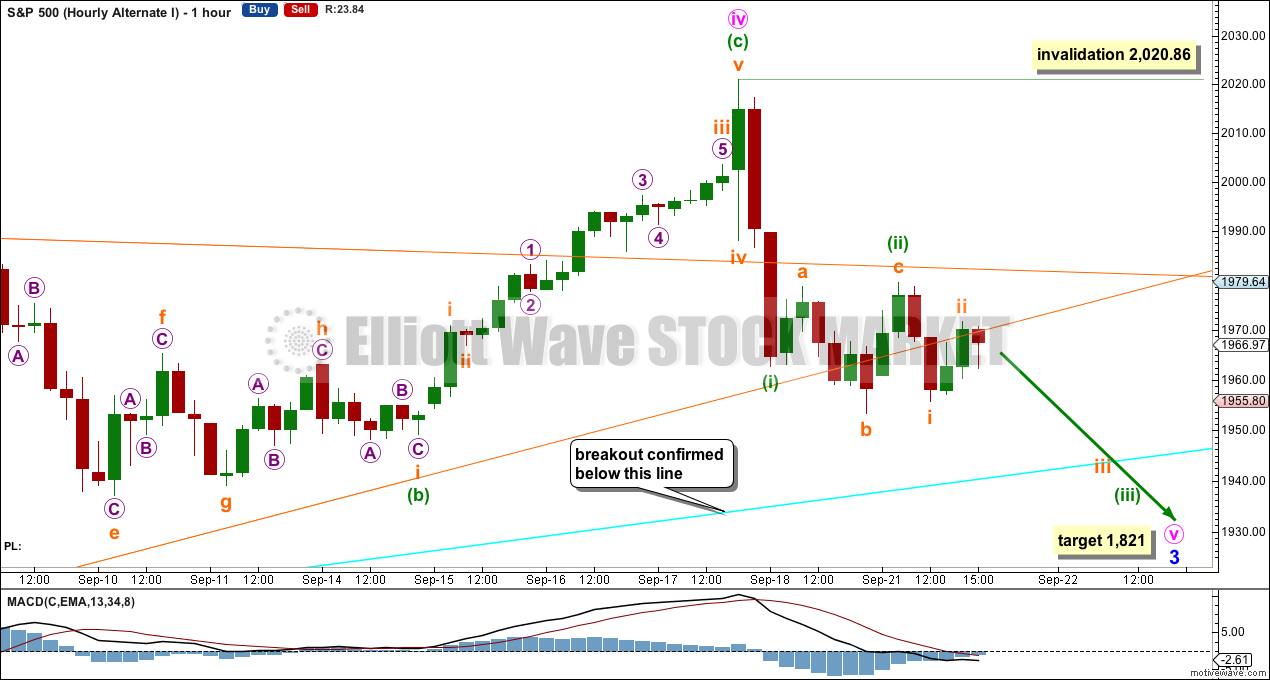

HOURLY CHART

Minor wave 2 was a double combination which lasted 15 days. Minute wave ii is a zigzag which lasted 18 days. Although minute wave ii is longer in duration than minor wave 2 one degree higher, the difference is not great and so is acceptable. The wave count has the right look at the daily chart level.

Minute wave ii is a complete zigzag, and within it minuette wave (b) subdivides perfectly as a nine wave triangle. Minute wave ii is deep, 0.65 the length of minute wave i.

I would still want to see price break below the aqua blue trend line which is a conservative support line. I would have confidence in a downwards breakout once that is breached.

Minute wave iii should show a strong increase in momentum beyond that seen for minute wave i.

So far, within minute wave iii, minuette wave (i) may be complete as labelled. Upwards movement for Monday shows on the daily chart and this may be minuette wave (ii). It is common for the S&P to show the subdivisions of its third waves at the daily chart level, so despite a small green candlestick for Monday’s session this wave count has a typical look.

Minuette wave (ii) may be over as labelled as an expanded flat correction, or it may yet continue sideways for another one to two days. It may continue as a double flat or combination. Minuette wave (ii) may not move beyond the start of minuette wave (i) above 2,020.86.

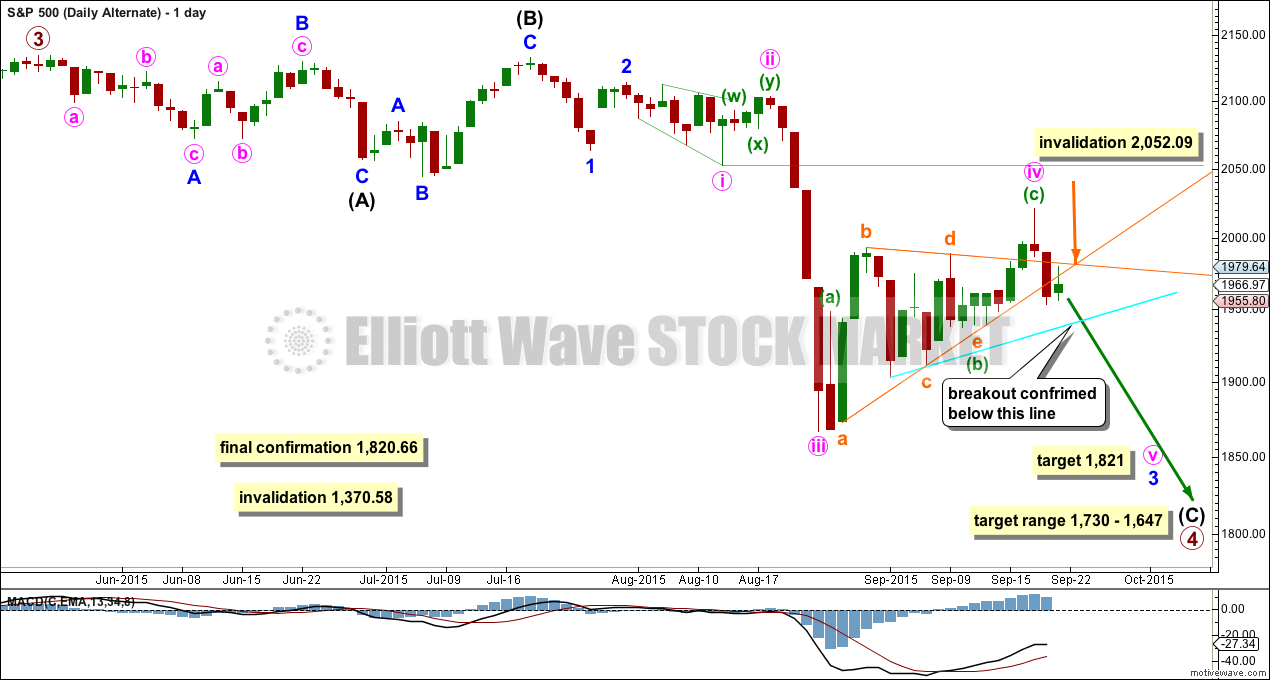

ALTERNATE BULL ELLIOTT WAVE COUNT

DAILY CHART

At this stage, I expect this idea has a lower probability, so it will be reduced to an alternate.

Minor wave 2 lasted just three days and is seen as over earlier. Minute wave ii is a double zigzag lasting four days.

If this current correction is minute wave iv, then there are three big problems.

1. It would be a single zigzag, so there would be inadequate alternation between the double zigzag of minute wave ii.

2. It would be deep at 0.65, so there would be inadequate alternation with the deep 0.83 correction of minute wave ii.

3. It would be much longer in duration, lasting 15 days, than minute wave ii which lasted only 4 days.

This idea is possible, but I would judge it to have a low probability. If the momentum of the next wave down does not show a strong increase, then this would be an explanation.

At 1,821 minor wave 3 would reach 4.236 the length of minor wave 1.

The final target for this idea for primary wave 4 is to see it end within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its range from 1,730 to 1,647.

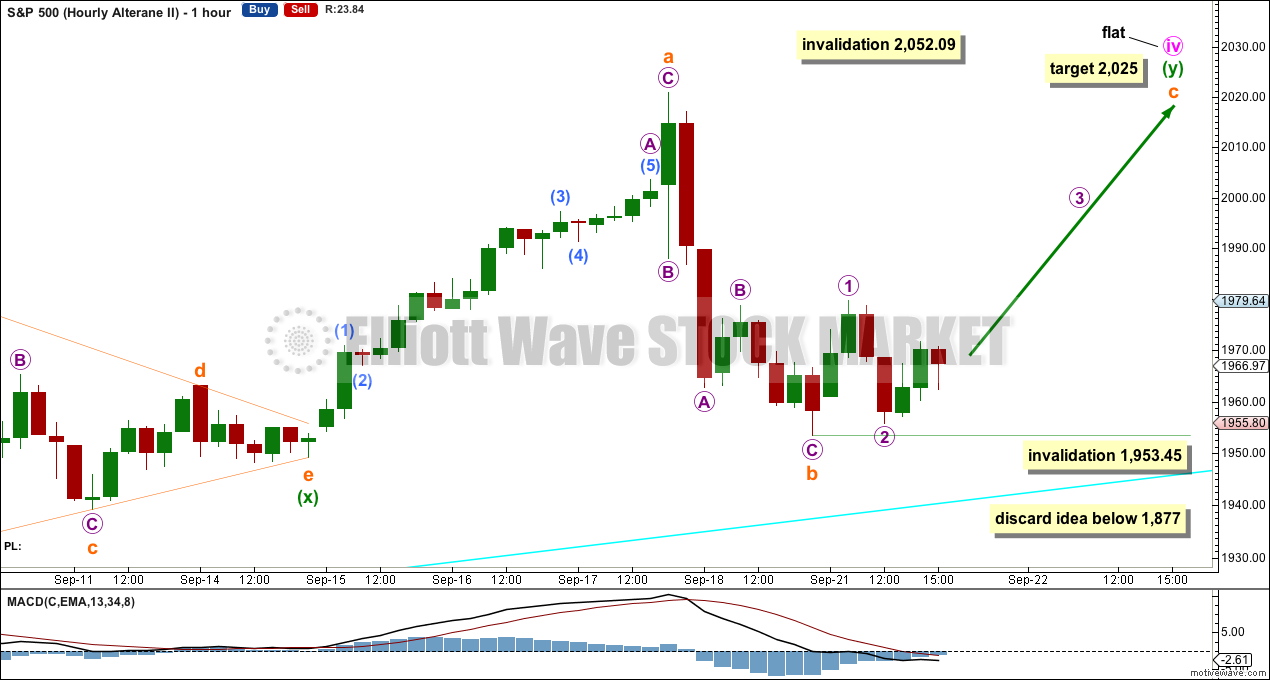

FIRST HOURLY CHART

Alternation is a guideline, not a rule, and is almost always seen to one degree or another and should be expected. However, it is not clear or perfect so all possibilities should be considered.

The subdivisions for the hourly chart are here exactly the same as for the main hourly chart. The only difference is the correction is seen as a fourth wave and not a second wave.

SECOND HOURLY ELLIOTT WAVE COUNT

This idea now has a lower probability. The purpose of combinations is to move price sideways, so they should have a sideways look and not a clear slope. This correction now has a clear upwards slope and does not look like a combination.

There was a triangle in recent sideways movement. The question is: what degree and what wave should it be labelled? All possibilities should be considered, even those which look unlikely.

Minute wave ii was a deep 0.83 double zigzag. Given the guideline of alternation minute wave iv may be expected to be more shallow and most likely a flat, combination or triangle.

Here minute wave iv may be seen as a double combination.

The first structure in the double is now seen as a zigzag. This means the second structure in the double is now seen as a flat correction for a double combination.

Within a possible flat for minuette wave (y), subminuette wave a must subdivide as a three and subminuette wave b must retrace a minimum 90% of subminuette wave a. Subminuette wave b has reached below 1,956 meeting the minimum requirement.

Subminuette wave b may make a new low below the start of subminuette wave a at 1,949.13 as in an expanded flat. There is no rule which places a limit on the length of subminuette wave b within the flat correction, but there is a convention within Elliott wave that when the B wave reaches twice the length of the A wave the probability of a flat unfolding is so low the idea should be discarded. Here that price point would be at 1,877. It is possible today that subminuette wave b could continue further.

If subminuette wave b is over as labelled, then within subminuette wave c micro wave 2 may not move beyond the start of micro wave 1 below 1,953.45.

At 2,025 subminuette wave c would reach equality in length with subminuette wave a.

Minute wave iv may not move into minute wave i price territory above 2,052.09.

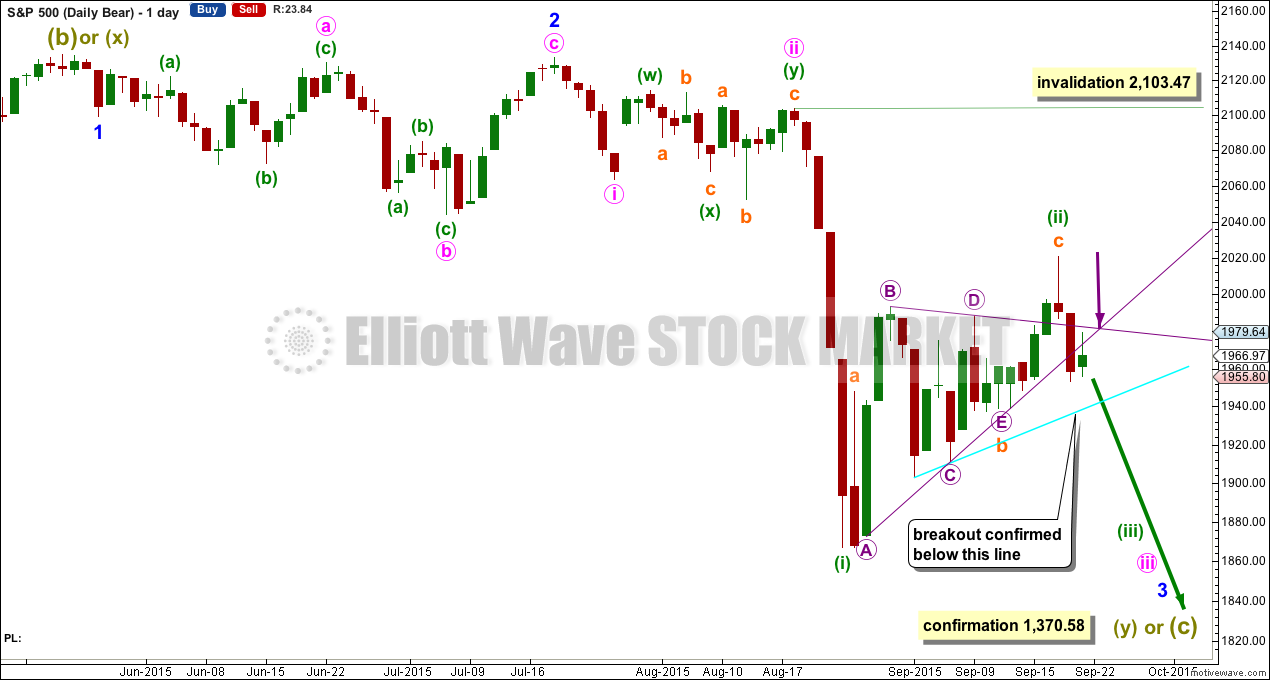

BEAR ELLIOTT WAVE COUNT

DAILY CHART

A big impulse down must begin, for this bear wave count, so a series of overlapping first and second waves should now be complete. The idea for the bull wave count (a flat correction unfolding downwards) does not work for this bear wave count.

A new low below 1,370.58 would invalidate the bull wave count confirming a huge market crash. Before that price point is passed though, structure should be a strong indication that this bear wave count would be correct. It is supported by regular technical analysis at the monthly chart level.

TECHNICAL ANALYSIS

DAILY CHART

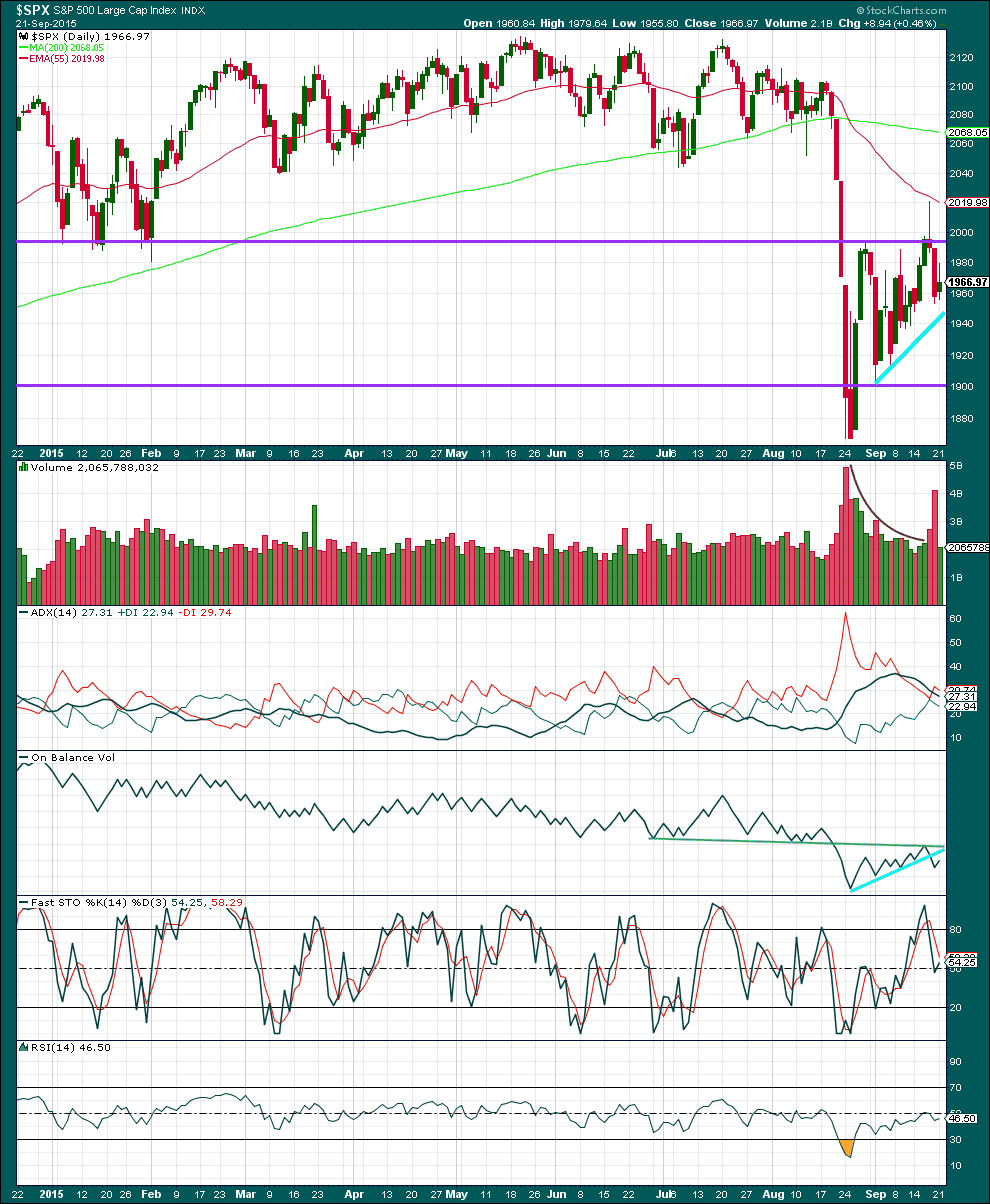

Click chart to enlarge. Chart courtesy of StockCharts.com.

Daily: A small green body with a long upper wick for Monday’s candlestick is bearish. It comes on much lighter volume than the prior downwards day, which is also bearish.

Kaufman’s Moving Average has provided resistance to upwards movement.

ADX is flat indicating the market is not currently trending. ADX does tend to be a lagging indicator.

The green trend line on On Balance Volume is very shallow, repeatedly tested, and reasonably technically significant. The trend line has shown perfectly when price would stop upwards movement, and it ended when OBV again touched that trend line. Resistance at that trend line is reinforced. OBV has now breached the short upwards sloping bright aqua blue line, another small bearish indicator.

Price has returned to below the horizontal line of resistance and moved lower. Resistance remains at that trend line.

Stochastics has returned from overbought. There is room for the market to rise or fall. A range bound system would be expecting a downwards swing to continue and to not end until Stochastics shows oversold and price finds support.

I am adding RSI again. I will use RSI on the daily chart to help indicate when the next downwards wave ends. When RSI shows oversold then downwards movement may end. RSI is currently well above oversold, so there is plenty of room for the market to fall.

A note on Dow Theory: for the bear wave count I would wait for Dow Theory to confirm a huge market crash. So far the industrials and the transportation indices have made new major swing lows, but the S&P500 and Nasdaq have not.

S&P500: 1,820.66

Nasdaq: 4,116.60

DJT: 7,700.49 – this price point was breached.

DJIA: 15,855.12 – this price point was breached.

This analysis is published about 08:27 p.m. EST.

Futures suggesting either the third or fifth wave down has arrived. If it is a third I would expect the VIX to quickly eclipse the August 24 high of 53.29 and UVXY should trade over 100 in very short order. UVXY did not trade as it does at the end of a third wave on August 24 and did not put in a spike high until September 1. Looks like another opportunity for a ten-bagger coming up at the next spike high, especially if it turns out to be minor three. Stay alert everybody…this is going to be fast and furious I think.

Vix didn’t gap down much this morning.

Why would you expect VIX to gap down on a market down day? Perhaps you meant gap up? I think Lara’s observation about the momentum in the third wave developing slowly and peaking towards the middle of the wave is really insightful. The deliberation with which this wave has been developing strongly suggests that it may be longer and deeper than expected. The so-far slow up-tick in the VIX is also an indication of quite a bit of residual optimism in the market. Lara also pointed out that RSI is nowhere oversold. I would buckle up and enjoy the ride…

Sorry, gap up. It seems like its’s catching up though. Let’s hope we have confirmation at the close.

The PPT is buying the decline at the close to make sure it continues in a somewhat orderly manner. VIX and UVXY not looking back though and staying near the highs of the day. Much more downside to come…in fact we are probably just getting underway

Vernecarthy–What is going to be a ten-bagger? Possibly I don’t understand your definition of the term–I see ten-bagger as 10X original price.

That’s right, ten times your entry price. Very few trades in the market give you this opportunity and UVXY is one of them that does so once or twice a year. A few weeks ago I bought UVXY September 50 calls for .77 and sold them for 29.00. Buying the puts is an even surer trade if you do it right as reversion to the mean is generally swift and predictable.

The very best strategy is to wait for the set up at the end of a third wave down when UVXY will spike AND close above the upper Bollinger bands. It is critical if you buy puts that you give yourself at least one month to expiration. I violated my own rule on this last time and paid for it as the first close above the Bollinger Bands in August was not a good shorting opportunity but the second one was and I missed it because I thought the third wave was already done. If you want more details about how I enter the trade send me an e-mail and I will tell you. It involves using a contingency order to enter your position. Hope that helps a bit.

wow that was an incredible trade. Those are the opportunities i dream of. I’m not having much success trading options on SPY. Even when i’m right (like this past few days), i’m not making much. I still need a panic move down asap to make such a return on my current position.

I’m fairly successful trading weekly puts and calls on GLD, but i tend to give back a lot my profits to SPY, which i haven’t come close to mastering yet. In addition to not timing it as perfectly as i can on GLD, the premiums are really getting in my way of having a good time. Perhaps i’m doing this all wrong

Eli: Its best to pay extra for additional time when trading (specially for options.) For example, all traders who had bought September expiration put options on S&P back in August most likely lost badly. But those that bought December/January options are sitting pretty right now… Just give yourself more time. I’ve learned that the hard way. Its tough to be right, but to have the wrong timing. Pay the extra up front for more time and you will have less stress and won’t get frustrated as much with the daily ups and downs. If you think something will haven in the next 4-6 weeks, buy options 3-4 months out for more piece of mind.

Ari is right. Everytime I get greedy and buy close to expiration options I get slammed. Even if you are right about direction and don’t give yourself enough time for the trade to work, you can still loose money since over the short term the market makers will destroy you.

Lara is very good about getting the trend right so if you are trading SPY, although it is really conter-intuitive, patiently wait for strong moves against the established trend and short those moves. Easy to say, hard to do but that is the key to consistently winning trades with SPY.

Thanks to all for your generous feedback. It is helpful. I still aim to recoup my past SPY losses. Not as revenge trades (those are very, very bad), but as calm, cool and collected winning trades. I will prevail, because I (as well as all of you) am still smarter then those dumb computer programs running all that dumb money 🙂

vernecarty

Thanks for reply, I did not understand you were trading UVXY options, that is a fascinating strategy. Yes I would certainly appreciate an email of details, is there someway on this forum to email you?

Email me at vernecarty@msn.com.

Looks like we have broken the Aqua Blue line with some momentum. What is the first target we are looking for?

Probably safe to expect August low of 1867.01 to be taken out if it’s a fifth wave, much lower if it is a third…

Hi Lara

Would you rule out a contracting leading diagonal on the daily chart for a B wave from the August low?

This guys analysis seems spot on lately

http://studyofcycles.blogspot.co.nz/2015/09/thinking-it-through-with-gratitude.html

Amr

That wave count does not make sense to me, using the rules in Frost and Prechter.

He has wave B labelled “flat” and it’s a triple. Triples are very rare. Triple combinations may only have one zigzag but this one has two. That is invalid.

If that wave count is seeing the A-B-C down as a three wave structure it is unclear if it’s a flat or zigzag because the A wave isn’t labelled as a three or a five. The problem is the A wave will not fit nicely as a five, it’s more likely a three. But the B wave is < 90% of A so the requirements for a flat aren't met. I do not think as it is labelled that this is a valid Elliott wave count.